Delta Galil Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Delta Galil Bundle

Delta Galil faces moderate bargaining power from its buyers, especially large retailers, due to readily available alternatives in the apparel manufacturing sector. The threat of new entrants is also significant, as the industry has relatively low barriers to entry, potentially impacting pricing and market share.

The complete report reveals the real forces shaping Delta Galil’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

When there are only a few suppliers offering unique or specialized sustainable fabrics and components, they gain considerable bargaining power. This means companies like Delta Galil might have limited options if these suppliers decide to increase their prices or change their contract terms. The demand for sustainable textiles is expected to grow significantly, which further strengthens the position of these particular suppliers.

Suppliers that are well-regarded and provide certified sustainable materials can often charge higher prices. This can directly affect Delta Galil's production costs, as these premium materials become a larger part of their expenses. For instance, the global sustainable textile market was valued at approximately USD 10.5 billion in 2023 and is projected to grow substantially in the coming years, highlighting the increasing importance and potential pricing power of these specialized suppliers.

Global supply chains are facing significant strain in 2025, impacting everything from raw material availability to shipping costs. This makes it harder for companies like Delta Galil to secure necessary inputs, thereby strengthening the bargaining power of their suppliers. For instance, the cost of cotton, a key raw material for apparel, saw a notable increase in early 2025 due to adverse weather conditions in major producing regions.

Shifting trade policies and geopolitical tensions are also playing a critical role. New tariffs on goods imported from China, a traditional manufacturing hub for the fashion industry, directly increase sourcing expenses for apparel makers. This uncertainty necessitates strategic adjustments in sourcing locations to manage costs and ensure a stable supply of finished goods.

Delta Galil is actively addressing these challenges by diversifying its manufacturing base. The company is strategically moving production away from China and increasing its reliance on facilities in countries like Egypt, which benefit from favorable trade agreements and lower tariff rates. This proactive approach aims to mitigate the financial impact of global disruptions and maintain competitive pricing.

The apparel industry, including companies like Delta Galil, is feeling the pinch from rising raw material costs, particularly for essential inputs like cotton. These increased expenses for suppliers are inevitably passed down, directly impacting Delta Galil's cost of goods sold.

Elevated freight costs have also become a significant factor, adding another layer of pressure. For instance, these increased transport expenses notably affected Delta Galil's gross margin in the first quarter of 2025, clearly illustrating the suppliers' leverage in dictating input prices.

Labor conditions and ethical sourcing demands

Increasing global awareness and regulatory pressure, such as the Uyghur Forced Labor Prevention Act (UFLPA) enacted in 2022, significantly impact labor conditions and ethical sourcing demands. This heightened scrutiny can bolster the bargaining power of suppliers who demonstrably adhere to robust ethical and labor compliance standards, as companies like Delta Galil must prioritize these partners to mitigate reputational and legal risks.

Delta Galil, operating within a complex global manufacturing landscape, faces a narrowing supplier pool when prioritizing ethical sourcing. Suppliers capable of proving transparency and adherence to fair labor practices, including fair wages and safe working environments, gain leverage. For instance, a 2024 report indicated that 75% of consumers are willing to pay more for sustainable products, underscoring the market demand for ethically sourced goods.

- Supplier Leverage: Suppliers meeting stringent ethical and labor standards gain increased bargaining power.

- Regulatory Impact: Legislation like the UFLPA reinforces the need for supply chain transparency.

- Consumer Demand: A significant portion of consumers (e.g., 75% in 2024 surveys) prefer and will pay more for ethically sourced products.

- Delta Galil's Challenge: The company must align with these demands, potentially limiting supplier options to those with proven ethical practices.

Delta Galil's diversified manufacturing and vertical integration

Delta Galil's extensive international network of production facilities and strategic partnerships, coupled with its ongoing pursuit of vertical integration, serves as a significant countermeasure against the bargaining power of suppliers. This approach allows the company to exert greater control over its supply chain.

By internalizing more production stages and cultivating a diverse global sourcing base, Delta Galil diminishes its dependence on any single supplier group. This diversification strengthens its negotiating leverage.

For instance, in 2023, Delta Galil reported that its vertical integration efforts contributed to improved cost management and supply chain resilience. The company operates numerous wholly-owned or majority-owned manufacturing sites across various continents, enabling it to absorb more of the value chain and reduce reliance on external providers for key components or processes.

- Diversified Sourcing: Delta Galil maintains relationships with a wide array of suppliers across different regions, preventing any single supplier from dominating its material needs.

- Vertical Integration: By controlling key manufacturing processes, the company reduces its exposure to external supplier price hikes and availability issues.

- Global Footprint: With production facilities in countries like Israel, Egypt, Turkey, and Vietnam, Delta Galil can shift production or sourcing to mitigate localized supply disruptions or unfavorable supplier terms.

- Partnerships: Long-term relationships with key suppliers, built on mutual benefit, can also temper individual supplier bargaining power.

Suppliers of specialized sustainable materials and components hold significant leverage over Delta Galil, especially as demand for eco-friendly textiles grows. This power is amplified when these suppliers are few and offer unique products, potentially leading to price increases that impact Delta Galil's costs. The global sustainable textile market, valued at approximately USD 10.5 billion in 2023, is projected for substantial growth, indicating a strengthening position for these key suppliers.

The increasing cost of raw materials, such as cotton, and elevated freight expenses in 2025 directly translate to higher input prices for Delta Galil. For example, adverse weather in early 2025 caused cotton prices to rise, impacting production costs. These rising supplier expenses, coupled with global supply chain strains, empower suppliers to dictate terms more effectively.

Regulatory pressures, like the Uyghur Forced Labor Prevention Act, also bolster the bargaining power of suppliers who can demonstrate robust ethical and labor compliance. Companies like Delta Galil must prioritize these partners, limiting their supplier options and increasing the leverage of those who meet these stringent standards. Consumer demand for ethically sourced products, with 75% of consumers willing to pay more in 2024, further solidifies this trend.

| Factor | Impact on Delta Galil | Supplier Leverage |

| Sustainable Material Demand | Increased cost of key inputs | High |

| Raw Material Price Volatility (e.g., Cotton) | Higher Cost of Goods Sold | Moderate to High |

| Elevated Freight Costs | Reduced Gross Margin | Moderate |

| Ethical Sourcing Compliance | Limited supplier options, increased cost for compliant suppliers | High |

What is included in the product

Uncovers key drivers of competition, customer influence, and market entry risks tailored to Delta Galil's position in the global apparel industry.

Quickly pinpoint competitive threats and opportunities within the apparel industry, enabling Delta Galil to proactively address potential market disruptions.

Customers Bargaining Power

Consumers in the apparel industry, including those who purchase Delta Galil's products, often display significant price sensitivity. This means they are highly influenced by price when making purchasing decisions. In 2024, the global apparel market continued to be a highly competitive space, with consumers having access to an unprecedented number of brands and retailers both online and in physical stores.

The sheer volume of product availability, from fast fashion to premium brands, empowers customers. They can easily compare prices across various platforms, seeking out promotions and discounts. This wide availability means that if one retailer or brand is perceived as too expensive, customers can readily switch to a competitor offering similar products at a lower price point.

Delta Galil, operating in both branded and private label segments, must acknowledge this dynamic. For instance, in the private label sector, where Delta Galil often supplies retailers, the retailer's ability to source from multiple manufacturers intensifies customer leverage. This necessitates a constant focus on cost management and competitive pricing strategies to maintain market share and customer loyalty.

The increasing prevalence of online sales channels and direct-to-consumer (DTC) models significantly bolsters customer bargaining power. This shift allows consumers to easily compare prices and product offerings across a wider array of brands, thereby reducing their loyalty to any single provider and lowering the costs associated with switching.

Delta Galil Industries has experienced robust expansion in its online sales, especially for its proprietary brands. For instance, in 2023, the company reported a substantial increase in its e-commerce revenue, highlighting the critical need for a strong digital footprint to cater to evolving consumer preferences and to capitalize on the potentially higher profit margins offered by DTC sales.

Consumers are increasingly prioritizing sustainability and ethical production when buying clothes. A 2023 report indicated that 70% of consumers consider sustainability when making a purchase, and a growing number are willing to switch brands if their values aren't met. This growing demand for eco-friendly and ethically sourced apparel significantly boosts customer bargaining power.

Influence of private label and brand partnerships

Delta Galil's dual strategy of producing both its own brands and private label goods for retailers significantly amplifies the bargaining power of its customers. These large retail chains, acting as direct clients, leverage their substantial order volumes and extensive market presence to negotiate favorable terms. This dynamic positions major retailers to exert considerable influence over pricing, delivery schedules, and product customization requirements.

The considerable purchasing power of these retail giants means they can often dictate terms, impacting Delta Galil's margins and operational flexibility. For instance, a single major retailer could represent a significant portion of Delta Galil's revenue, making it difficult to refuse their demands. In 2023, for example, major retailers continued to push for lower costs amidst inflationary pressures, directly affecting manufacturers like Delta Galil.

- Retailer Dependence: Major retailers often consolidate their supplier base, increasing their leverage over individual manufacturers.

- Volume Discounts: The sheer volume of goods purchased by these clients allows them to demand substantial price reductions.

- Brand Partnerships: Retailers who partner with Delta Galil for private label development also gain insight into production costs, further strengthening their negotiating position.

Impact of tariffs on retail prices and consumer purchasing power

The ongoing unpredictability of tariffs, particularly U.S. import tariffs, could lead to increased retail prices for apparel in the second half of 2025. This rise in prices may reduce consumer purchasing power, making customers more selective and potentially increasing their bargaining power as they seek value. Delta Galil is actively working to manage this by distributing cost implications with vendors and customers.

For instance, in 2024, the apparel industry has already seen shifts in sourcing strategies due to trade tensions, with companies exploring nearshoring or diversifying supplier bases to mitigate tariff impacts. This strategic adjustment aims to absorb some cost increases, but a significant portion may still be passed on to consumers.

- Tariff Uncertainty: Continued volatility in tariff policies creates an unstable cost environment for apparel retailers.

- Reduced Purchasing Power: Higher retail prices directly impact consumers' ability to afford goods, leading to more price-sensitive purchasing decisions.

- Increased Customer Selectivity: As prices rise, consumers become more discerning, favoring brands that offer better value for money, thus amplifying their bargaining power.

- Delta Galil's Mitigation Strategy: The company is proactively managing cost increases by sharing the burden with both suppliers and end consumers.

Customers possess considerable bargaining power in the apparel sector due to widespread product availability and price sensitivity, a trend evident throughout 2024. This power is amplified by the rise of e-commerce and direct-to-consumer models, allowing consumers to easily compare prices and switch brands, thereby reducing loyalty. Delta Galil's strategy of serving both proprietary brands and private labels for large retailers means these clients, with their significant order volumes, can negotiate heavily on terms, impacting margins and operational flexibility.

| Factor | Impact on Delta Galil | 2024 Data/Trend |

|---|---|---|

| Price Sensitivity | High, forcing competitive pricing | Global apparel market remains highly competitive with numerous brands. |

| Switching Costs | Low due to abundant alternatives | Easy online price comparison across platforms. |

| Retailer Leverage | Significant for private label clients | Large retailers demand lower costs amidst inflationary pressures. |

| Sustainability Demand | Growing influence on brand choice | 70% of consumers consider sustainability in 2023 purchasing decisions. |

What You See Is What You Get

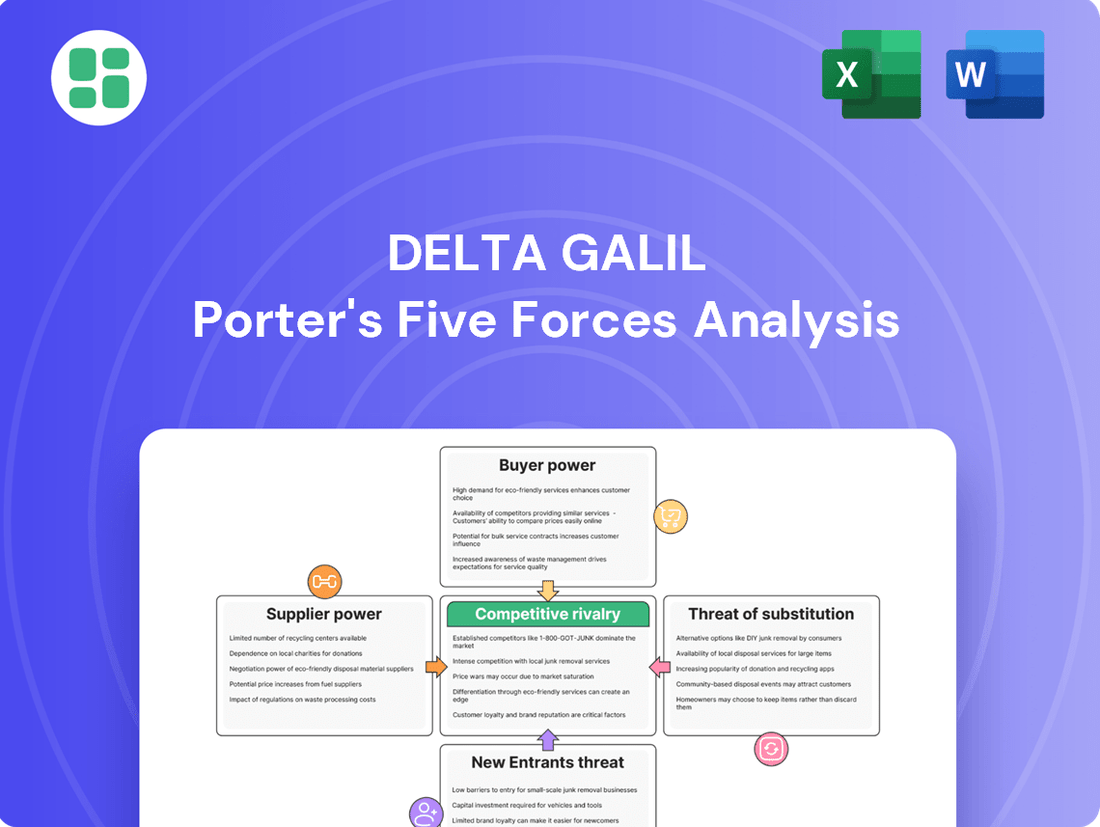

Delta Galil Porter's Five Forces Analysis

This preview shows the exact Delta Galil Porter's Five Forces Analysis you'll receive immediately after purchase, offering a comprehensive breakdown of competitive forces within the textile and apparel industry. You'll gain insights into the bargaining power of buyers and suppliers, the threat of new entrants and substitutes, and the intensity of rivalry among existing competitors, all presented in a professionally formatted and ready-to-use document.

Rivalry Among Competitors

The apparel industry is intensely competitive, featuring a vast array of global and regional companies, from niche designers to massive conglomerates. Delta Galil navigates this crowded landscape, producing and selling a wide spectrum of apparel, including intimate wear, activewear, and sleepwear, for both established brands and private labels.

In 2023, the global apparel market was valued at an estimated $1.7 trillion, with numerous companies vying for market share across various segments. This high level of competition means that companies like Delta Galil must constantly innovate and manage costs effectively to maintain their position.

Competition is particularly fierce in apparel segments where Delta Galil holds a leading global position, such as intimates and activewear. This intense rivalry necessitates continuous adaptation and strategic maneuvering to maintain market share and profitability.

Emerging 'challenger' brands are making significant inroads, especially in the sportswear category, by rapidly gaining market share. This trend pressures established players like Delta Galil to prioritize innovation and agility to stay ahead.

Delta Galil's strategic response involves leveraging global licenses and introducing new brands to drive sales growth and enhance profitability. For instance, in 2023, the company reported a revenue increase, demonstrating the effectiveness of its brand expansion strategy amidst a competitive landscape.

The fashion industry's relentless pace, with new trends emerging almost weekly, intensifies competition as brands race to capture consumer attention with fresh designs. Delta Galil actively counters this by focusing on its innovation and design prowess, developing cutting-edge products to maintain a competitive edge in this rapidly evolving market.

Impact of direct-to-consumer (DTC) and online sales growth

The surge in e-commerce and direct-to-consumer (DTC) sales has dramatically amplified competitive rivalry. Brands can now bypass traditional retail gatekeepers, reaching consumers directly and lowering barriers to entry. This shift means more players are vying for customer attention online, intensifying price competition and the need for strong digital marketing capabilities.

Delta Galil has actively embraced this trend, reporting substantial growth in its online sales. This focus on digital channels highlights the company's adaptation to the evolving retail landscape and its commitment to optimizing these direct customer relationships. For instance, in 2023, Delta Galil's online segment continued to be a key growth driver, reflecting the broader industry shift towards digital engagement.

- Increased Digital Competition: DTC models allow smaller, agile brands to enter the market and compete directly with established players like Delta Galil, often with lower overheads.

- Channel Conflict: The growth of DTC can create tension with traditional wholesale partners who may feel undercut or bypassed.

- Customer Acquisition Costs: While DTC offers direct access, acquiring customers online can be expensive due to the need for digital advertising and sophisticated CRM systems.

- Delta Galil's Online Performance: The company's own online sales growth, a significant portion of its revenue, demonstrates its participation and success within this intensified digital rivalry.

Strategic responses to market shifts and cost pressures

Delta Galil, like many apparel companies, is contending with significant macroeconomic headwinds and persistent supply chain disruptions. These factors, coupled with escalating operational costs, intensify the competitive rivalry as firms strive to protect margins and market share.

To counter these pressures, Delta Galil is actively pursuing strategic realignments. These include enhancing factory efficiency, a critical move given the industry's sensitivity to operational costs. For instance, in 2023, the company reported a focus on optimizing production processes to mitigate rising labor and material expenses.

Furthermore, Delta Galil is proactively developing new product categories in collaboration with its key clients. This strategy aims to foster deeper customer relationships and capture new revenue streams, thereby diversifying its offerings and reducing reliance on existing product lines. Expediting cost-reduction initiatives across the board is also a core component of its response, ensuring agility and resilience in a dynamic market.

- Navigating Macroeconomic Uncertainty: Apparel firms face challenges from inflation and shifting consumer spending patterns.

- Supply Chain Resilience: Ongoing disruptions necessitate robust strategies to ensure timely delivery and manage inventory costs.

- Cost Optimization: Delta Galil's focus on factory efficiency and cost reduction directly addresses rising input prices.

- Customer-Centric Innovation: Developing new categories with main customers aims to strengthen partnerships and drive sales growth.

Competitive rivalry in the apparel sector is intense, with numerous global and regional players. Delta Galil operates within this crowded market, facing pressure from established brands and emerging DTC companies. The company's strategy involves leveraging global licenses and innovating new product categories to maintain its competitive edge amidst rapid fashion cycles and evolving consumer preferences.

The surge in e-commerce has intensified this rivalry, lowering barriers to entry and increasing customer acquisition costs. Delta Galil’s own online sales growth in 2023 demonstrates its adaptation to this digital shift, highlighting the need for strong digital marketing and customer relationship management.

Macroeconomic headwinds, including inflation and supply chain disruptions, further exacerbate competitive pressures, forcing companies like Delta Galil to focus on operational efficiency and cost reduction. The company's efforts to enhance factory efficiency and develop new product categories with key clients are crucial responses to these challenges.

| Metric | 2023 Value | Significance |

|---|---|---|

| Global Apparel Market Value | ~$1.7 Trillion | Indicates a large, competitive market |

| Delta Galil Revenue Growth | Reported Increase | Shows effectiveness of strategies amidst competition |

| Online Sales Growth | Key Growth Driver | Reflects adaptation to digital competition |

SSubstitutes Threaten

The rise of fast fashion presents a significant threat of substitution for companies like Delta Galil. These brands offer highly trend-driven apparel at remarkably low price points, directly influencing consumer purchasing decisions. For instance, the global fast fashion market was valued at approximately $39.5 billion in 2023 and is projected to grow substantially, indicating a strong consumer preference for accessible, on-trend clothing.

The expanding second-hand and resale market poses a significant threat to traditional apparel manufacturers like Delta Galil. Thrift shopping's popularity is surging, with the global secondhand apparel market projected to reach $350 billion by 2027, according to ThredUp’s 2024 Resale Report. This growth is fueled by environmentally conscious consumers actively seeking sustainable and unique clothing options, directly diverting demand from new apparel.

The increasing popularity of athleisure and hybrid apparel presents a significant threat of substitutes for Delta Galil. Consumers are increasingly choosing versatile garments that can serve multiple purposes, potentially reducing demand for specialized intimates, activewear, or leisurewear. For instance, the global athleisure market was valued at approximately $320 billion in 2023 and is projected to grow substantially in the coming years, indicating a clear shift in consumer behavior towards multi-functional clothing.

DIY and custom apparel alternatives

While a smaller segment, the increasing accessibility of materials and tools for DIY clothing or the rise of custom apparel services can represent a niche substitute threat for Delta Galil. Consumers seeking unique, personalized, or highly specific garments might bypass mass-produced options, impacting demand for Delta Galil's core offerings. For instance, platforms like Etsy saw a significant increase in handmade and custom sales, with reports indicating growth in the custom apparel sector throughout 2023 and into early 2024, though specific figures for Delta Galil's direct impact are not publicly detailed.

These alternatives cater to a desire for individuality and can be particularly appealing for special occasions or niche fashion trends. The cost-effectiveness of some DIY approaches, combined with the growing availability of online tutorials and affordable crafting supplies, lowers the barrier to entry for consumers wanting to create their own apparel. This trend, while not replacing the scale of mass-market apparel, does siphon off a segment of consumers who might otherwise purchase ready-made garments.

- DIY and custom apparel offer unique personalization, appealing to consumers seeking individuality.

- Increased accessibility of materials and online tutorials lowers the barrier to entry for DIY clothing creation.

- Platforms like Etsy have seen growth in custom apparel sales, indicating a niche market shift.

Shifting consumer spending priorities

Economic pressures and evolving lifestyle priorities significantly influence consumer spending, potentially diverting funds away from apparel. For instance, in 2024, many consumers are facing persistent inflation, which could lead them to cut back on discretionary purchases like clothing to cover essential expenses.

When consumers choose to prioritize other goods or experiences, such as travel or home improvements, over clothing, the overall demand for apparel, including Delta Galil's offerings, can be affected. This represents a broader substitution of spending where consumers are opting for alternatives to traditional fashion purchases.

- Consumer spending shifts: Rising costs for essentials like food and energy in 2024 mean less disposable income for non-essential items such as apparel.

- Prioritization of experiences: Post-pandemic trends continue to show a strong consumer preference for experiences (e.g., travel, dining) over material goods.

- Impact on apparel demand: A reallocation of discretionary spending away from clothing directly reduces the market size for companies like Delta Galil.

The threat of substitutes for Delta Galil is multifaceted, encompassing fast fashion, the burgeoning resale market, and the rise of athleisure. These alternatives directly compete for consumer spending by offering lower prices, trend relevance, sustainability, or versatility. For example, the global athleisure market was valued at approximately $320 billion in 2023, highlighting a significant consumer shift towards multi-functional apparel.

Furthermore, economic pressures in 2024, such as persistent inflation, are forcing consumers to re-evaluate discretionary spending, potentially diverting funds away from apparel towards essential goods or experiences like travel. This broadens the scope of substitution beyond direct fashion alternatives.

| Substitute Category | Key Drivers | Market Data (Approximate) |

|---|---|---|

| Fast Fashion | Low price, trend-driven | Global market valued at $39.5 billion in 2023 |

| Second-hand/Resale | Sustainability, affordability, uniqueness | Projected to reach $350 billion by 2027 (ThredUp 2024 Report) |

| Athleisure | Versatility, comfort, multi-purpose use | Global market valued at $320 billion in 2023 |

| DIY/Custom Apparel | Individuality, personalization, niche trends | Growth observed on platforms like Etsy through 2023-2024 |

| Alternative Spending | Economic pressures, lifestyle priorities | Inflation impacting discretionary income in 2024 |

Entrants Threaten

Starting a comprehensive apparel manufacturing and distribution business, particularly on a global scale akin to Delta Galil, demands substantial capital. This includes investments in state-of-the-art factories, advanced machinery, extensive inventory, and robust logistics networks. For instance, establishing a modern textile manufacturing facility can easily cost tens of millions of dollars, with global supply chain operations requiring even more significant upfront funding.

These considerable capital requirements serve as a formidable barrier, deterring many potential new entrants from entering the competitive apparel market. The sheer scale of investment needed to compete effectively means only well-capitalized companies can realistically consider challenging established players like Delta Galil.

Delta Galil Industries leverages strong brand recognition, both through its proprietary labels like 7 For All Mankind and Schiesser, and its prestigious licensing agreements with globally recognized names such as adidas, Tommy Hilfiger, and Polo Ralph Lauren. This deep-rooted brand equity and established customer loyalty present a formidable hurdle for any potential newcomers aiming to penetrate the market.

New companies face significant hurdles due to the intricate nature of global supply chains. Sourcing raw materials, managing manufacturing across different countries, and ensuring timely distribution requires substantial investment and expertise, which startups often lack.

Navigating the web of international trade regulations, tariffs, and labor laws, such as the Uyghur Forced Labor Prevention Act (UFLPA) which impacts textile sourcing, adds considerable complexity and cost. This regulatory landscape can deter potential new entrants by increasing the barriers to entry and the cost of compliance.

Access to distribution channels and retail partnerships

Delta Galil's established global manufacturing footprint and extensive network of relationships with retailers and brands worldwide present a significant barrier to new entrants. These deeply ingrained partnerships grant Delta Galil privileged access to critical distribution channels that are difficult for newcomers to replicate. For instance, in 2023, Delta Galil reported a substantial portion of its revenue derived from its key retail partners, underscoring the importance of these established relationships.

New companies entering the textile and apparel industry would face immense challenges in securing comparable shelf space and forging significant partnerships with major retailers. The time and investment required to build such networks are considerable, making it an uphill battle for nascent businesses to gain traction against established players like Delta Galil.

- Established Global Reach: Delta Galil's ability to serve a vast array of retailers and brands across the globe is a testament to its developed distribution networks.

- Barriers to Entry: New entrants would find it exceptionally difficult to replicate Delta Galil's extensive relationships and secure the necessary retail partnerships.

- Competitive Advantage: The company's existing access to distribution channels provides a significant competitive advantage, limiting the threat from potential new market participants.

Innovation and technological expertise as entry barriers

Delta Galil's positioning as a high-tech apparel company presents a significant threat of new entrants, primarily due to the substantial barriers erected by innovation and technological expertise. The company's focus on creating next-generation products through advanced R&D, sophisticated design capabilities, and proprietary manufacturing processes, such as seamless apparel technology, demands considerable upfront investment and specialized knowledge. This high barrier to entry means that potential competitors must possess not only substantial capital but also a deep well of technical skill and a commitment to continuous innovation to even begin to compete effectively.

The financial commitment required for cutting-edge research and development in apparel technology is a critical deterrent. For instance, companies investing heavily in areas like advanced material science, smart textiles, or automated production lines, as Delta Galil likely does, face years of development before seeing a return. This investment can easily run into millions of dollars, a figure that can be prohibitive for many aspiring market entrants.

Furthermore, the intangible asset of accumulated expertise is a powerful barrier. Delta Galil's years of experience in developing and refining its innovative processes, from intricate design software to complex manufacturing machinery, create a knowledge gap that new players must bridge. This expertise is not easily replicated and often involves a highly skilled workforce, making it difficult for newcomers to match the quality and efficiency of established, technologically advanced firms.

- High R&D Investment: Companies like Delta Galil invest millions annually in research and development to maintain their technological edge, deterring new entrants who lack similar financial capacity.

- Proprietary Technologies: The development of unique manufacturing processes, such as advanced seamless apparel production, creates intellectual property and operational advantages that are difficult and costly for competitors to replicate.

- Skilled Workforce Requirement: Operating at the forefront of apparel technology necessitates a highly skilled workforce with expertise in areas like material science, industrial engineering, and advanced manufacturing, which is a challenge for new entrants to assemble quickly.

- Continuous Innovation Cycle: The need for constant innovation to stay competitive in the tech-apparel sector requires ongoing investment and adaptation, creating a dynamic environment where only well-resourced and agile companies can thrive.

The threat of new entrants for Delta Galil is significantly mitigated by the substantial capital required to establish a global apparel manufacturing and distribution operation. Investments in advanced factories, machinery, and logistics networks, potentially costing tens of millions, create a high barrier. Furthermore, the complexity of global supply chains and navigating international trade regulations, including acts like the UFLPA, adds considerable cost and complexity, deterring many potential newcomers.

Porter's Five Forces Analysis Data Sources

Our Porter's Five Forces analysis for Delta Galil is built upon a foundation of robust data, including the company's annual reports, investor presentations, and SEC filings. We supplement this with industry-specific market research reports and analyses from reputable financial news outlets.