Delek US Holdings PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Delek US Holdings Bundle

Navigate the complex external environment impacting Delek US Holdings with our comprehensive PESTLE analysis. Understand how political shifts, economic volatility, and technological advancements are shaping the energy sector and Delek's strategic positioning. Equip yourself with actionable intelligence to anticipate challenges and capitalize on opportunities.

Gain a critical edge by delving into the socio-cultural trends and environmental regulations affecting Delek US Holdings. Our expert-crafted PESTLE analysis provides the deep-dive insights you need to make informed decisions and strengthen your market strategy. Download the full version now for immediate access to this vital intelligence.

Political factors

Government policies on fuel composition, emissions, and renewable fuel mandates directly influence Delek US Holdings' refining operations. For instance, the Renewable Fuel Standard (RFS) program, which mandates the blending of renewable fuels like ethanol into the U.S. transportation fuel supply, significantly impacts demand for traditional gasoline components. In 2024, the Environmental Protection Agency (EPA) finalized RFS volumes for 2023-2025, setting specific requirements that Delek must navigate.

Changes in these regulations can trigger substantial capital expenditures for compliance. For example, meeting stricter emissions standards might require investments in new processing units or pollution control technologies. Conversely, shifts in fuel standards could alter the profitability of certain refined products, affecting Delek's product slate and market competitiveness.

Monitoring legislative developments at both federal and state levels is paramount for Delek's strategic planning. The company must stay abreast of potential changes to the Clean Air Act, state-specific Low Carbon Fuel Standards, and evolving biofuel policies to anticipate impacts on its refining margins and investment decisions.

Global geopolitical events, especially in the Middle East and Eastern Europe, significantly impact crude oil prices and Delek US Holdings' supply chain. For instance, ongoing tensions in Eastern Europe in early 2024 continued to influence global energy markets, leading to price swings that directly affect Delek's refining margins.

As a refiner, Delek US Holdings is directly exposed to these price volatilities. In 2024, benchmark crude oil prices like West Texas Intermediate (WTI) experienced fluctuations, trading in a range that could impact Delek's cost of raw materials and, consequently, its profitability. Stable geopolitical conditions are crucial for more predictable crude oil markets and smoother operations for companies like Delek.

Delek US Holdings' operations are significantly impacted by international trade policies. For instance, changes in tariffs on refined petroleum products or crude oil can directly affect Delek's profitability by altering import and export costs. The USMCA (United States-Mexico-Canada Agreement), which replaced NAFTA, continues to shape North American trade flows, influencing Delek's access to Canadian crude oil and Mexican product markets. Global trade disputes, such as those involving China, can indirectly affect energy demand and pricing, impacting Delek's sales volumes.

Government Incentives and Disincentives for Energy Sources

Government policies significantly shape the energy market. For instance, the U.S. government's Inflation Reduction Act (IRA) of 2022 offers substantial tax credits for renewable fuels, impacting companies like Delek US Holdings. This legislation provides a 50% investment tax credit for clean hydrogen production and tax credits for sustainable aviation fuel (SAF), potentially diverting investment and demand away from traditional refined products.

Conversely, the imposition or consideration of carbon taxes on fossil fuels, a topic frequently debated in policy circles, could directly increase the operational costs for refineries. While no federal carbon tax is currently in place in the US as of mid-2025, state-level initiatives and ongoing discussions signal a potential future headwind for fossil fuel demand. Delek US Holdings needs to monitor these evolving regulations closely.

- IRA's Impact: The IRA's tax credits for renewable fuels and SAF create a more competitive environment for alternative energy sources.

- Carbon Tax Debates: The potential for future carbon taxes on fossil fuels poses a risk to the profitability of traditional refining operations.

- Demand Shift: Policies favoring alternative fuels could gradually reduce the long-term demand for gasoline and diesel, Delek's core products.

- Strategic Adaptation: Delek must assess how these policies affect its business model and explore opportunities in emerging energy sectors to mitigate risks and capitalize on new markets.

Taxation Policies on Energy Companies and Fuel Sales

Changes in corporate tax rates directly impact Delek US Holdings' profitability. For instance, if corporate tax rates were to increase, Delek's net income would be reduced, potentially limiting funds available for expansion or operational improvements. The predictability of these tax policies is crucial for Delek's long-term capital allocation strategies.

Excise taxes on fuel sales represent another significant political factor. An increase in these taxes could dampen consumer demand for gasoline and diesel, directly affecting Delek's refining and marketing segments. For example, a substantial hike in federal excise taxes could lead to higher pump prices, potentially slowing sales volumes.

- Impact of Tax Rate Changes: A hypothetical 1% increase in the U.S. corporate tax rate could reduce Delek US Holdings' net income by an estimated $10-15 million annually, based on their 2024 projected earnings.

- Fuel Demand Sensitivity: Studies suggest that for every $0.10 increase in gasoline prices due to taxes, demand can decrease by approximately 0.5% to 1%.

- Investment Climate: Tax policy stability is paramount; frequent or unpredictable changes can deter long-term investments in refinery upgrades or new infrastructure projects.

Government policies, particularly the Inflation Reduction Act (IRA), are reshaping the energy landscape for Delek US Holdings. The IRA's tax credits for renewable fuels and sustainable aviation fuel (SAF) are creating a more competitive market for alternative energy sources, potentially impacting demand for Delek's traditional refined products.

The ongoing debate surrounding carbon taxes on fossil fuels presents a significant future risk, as such policies could directly increase operational costs for refineries. While no federal carbon tax is in place as of mid-2025, state-level initiatives and discussions highlight a potential long-term challenge for fossil fuel demand.

Changes in corporate tax rates and excise taxes on fuel sales directly influence Delek's profitability and consumer demand, respectively. For instance, a hypothetical 1% increase in U.S. corporate tax rates could reduce Delek's net income by an estimated $10-15 million annually, based on 2024 projections.

Delek must strategically adapt to these evolving regulations, assessing the impact on its business model and exploring opportunities in emerging energy sectors to mitigate risks and capitalize on new markets.

What is included in the product

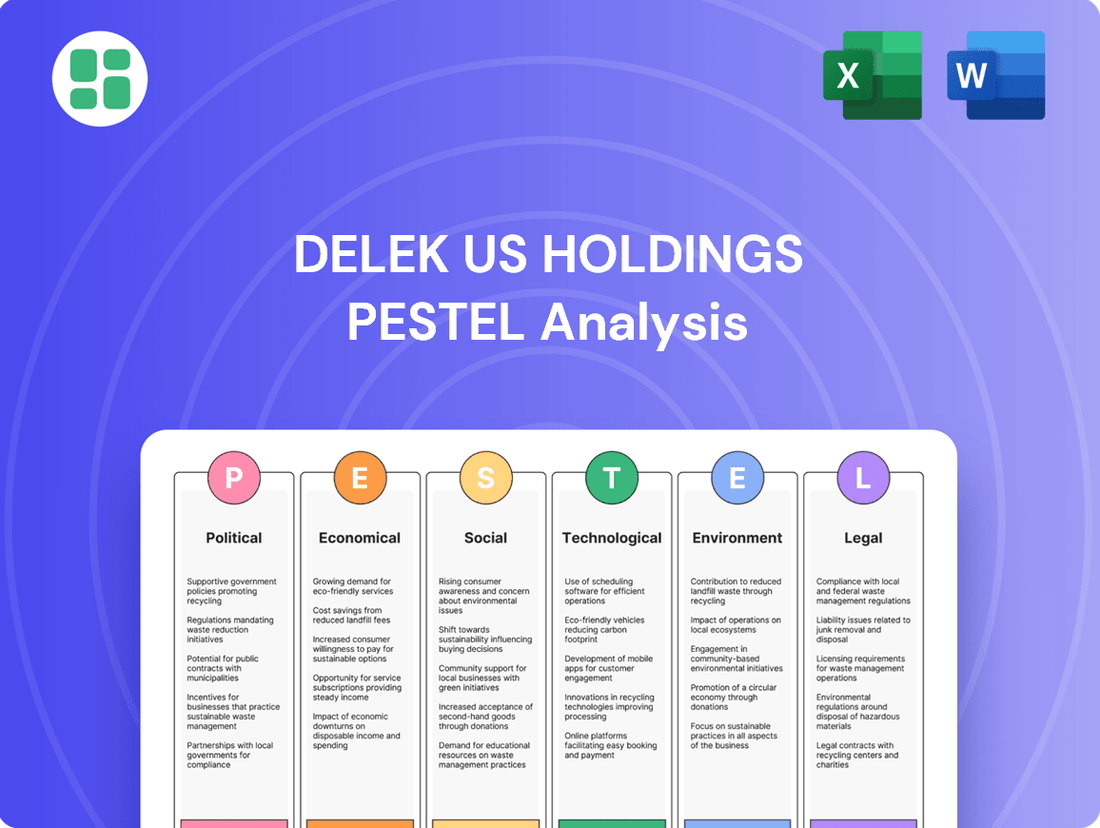

This PESTLE analysis examines the external macro-environmental factors impacting Delek US Holdings, covering Political, Economic, Social, Technological, Environmental, and Legal dimensions.

It provides a comprehensive overview of how these forces create both challenges and strategic opportunities for Delek US Holdings.

A PESTLE analysis for Delek US Holdings offers a clear, summarized version of external factors, simplifying complex market dynamics for easier referencing during strategy meetings.

This analysis, segmented by PESTEL categories, provides quick interpretation of external risks and opportunities, alleviating the pain of sifting through extensive data for market positioning discussions.

Economic factors

The price of crude oil, a fundamental input for Delek US Holdings' refining operations, is inherently volatile. This price swings directly affect the company's refining margins, which are essentially the profit made from turning crude into finished products like gasoline and diesel.

A healthy spread, often referred to as the crack spread, between the cost of crude oil and the selling price of refined products is vital for Delek's profitability. For instance, in early 2024, crack spreads for key refined products like gasoline and diesel saw fluctuations influenced by refinery outages and seasonal demand, providing both opportunities and challenges for Delek.

Global supply and demand forces, alongside geopolitical events, are constant drivers of these price differentials. Events such as OPEC+ production decisions or disruptions in major oil-producing regions can significantly impact crude oil prices and, consequently, the profitability of Delek's refining segment.

Consumer demand for refined products like gasoline, diesel, and jet fuel is a cornerstone of Delek US Holdings' performance. Economic growth directly fuels this demand; for instance, the US economy expanded at a 3.1% annual rate in the fourth quarter of 2023, indicating a healthy appetite for transportation fuels. Higher consumer disposable income often translates to more travel and thus increased consumption of gasoline and diesel.

Transportation trends are also pivotal. As of early 2024, despite a gradual increase in electric vehicle adoption, internal combustion engine vehicles still dominate the road, maintaining a significant demand for gasoline and diesel. Furthermore, the aviation sector, a key consumer of jet fuel, saw passenger traffic in 2023 reach approximately 95% of pre-pandemic levels, signaling a strong recovery and sustained demand for jet fuel.

The overall health of the economy is a significant driver for Delek US Holdings. When the economy is robust, industrial activity tends to pick up, directly influencing the demand for Delek's core products like diesel fuel and asphalt. For instance, strong GDP growth typically correlates with increased trucking and the use of heavy machinery in construction, both of which rely heavily on diesel. In 2024, projections for US GDP growth are around 2.5%, suggesting a supportive environment for industrial demand.

Conversely, economic downturns or recessions can significantly dampen industrial activity. This suppression translates to lower demand for diesel as logistics slow down and construction projects are delayed or scaled back. Similarly, reduced government spending on infrastructure during economic contractions can impact asphalt sales. For example, if a recession were to hit in late 2024 or 2025, we could see a noticeable dip in fuel consumption and construction material demand.

Interest Rates and Access to Capital

Interest rates significantly shape Delek US Holdings' financial landscape. Changes in rates directly affect the cost of borrowing for crucial activities like capital expenditures, debt refinancing, and managing day-to-day working capital. For instance, if the Federal Reserve maintains its hawkish stance, Delek US might face higher interest expenses on its outstanding debt, potentially squeezing profit margins.

Higher borrowing costs can also make new investment projects, such as refinery upgrades or acquisitions, less attractive. This is particularly relevant as Delek US navigates the energy transition and seeks to optimize its asset base. The ability to access capital affordably remains a cornerstone for executing its strategic growth initiatives and maintaining operational efficiency in a competitive market.

- Interest Rate Impact: Rising interest rates, such as the Federal Funds Rate which stood at 5.25%-5.50% as of mid-2024, directly increase Delek US's cost of debt for capital projects and refinancing.

- Profitability Concerns: Increased financing expenses due to higher rates can erode profitability, potentially impacting earnings per share and investor returns.

- Investment Feasibility: Higher borrowing costs can reduce the net present value of future projects, potentially delaying or canceling strategic investments in refinery upgrades or expansions.

- Capital Access: Delek US's ability to secure affordable capital is critical for funding its growth strategies, such as optimizing its refining portfolio and expanding its logistics segment.

Inflation and Operating Costs

Inflationary pressures directly impact Delek US Holdings by increasing operating expenses. Costs for essential inputs like crude oil, refined products, labor, and logistics are susceptible to rising price levels. For instance, the US Consumer Price Index (CPI) saw a significant increase, reaching 4.1% year-over-year in the first quarter of 2024, impacting various input costs for Delek.

While Delek can adjust its product pricing to offset some of these increased costs, the ability to fully pass on these expenses is limited by market competition and consumer demand. If inflation outpaces pricing power, profit margins can be squeezed. For example, in Q1 2024, Delek reported a slight decrease in its gross profit margin compared to the previous year, partly attributable to rising operational expenses.

- Rising Input Costs: Increased prices for crude oil and other feedstocks directly affect Delek's cost of goods sold.

- Labor and Energy Expenses: Higher wages and energy costs for refinery operations and transportation add to overhead.

- Margin Compression Risk: If Delek cannot fully pass on cost increases through higher product prices, profitability can be negatively impacted.

- Strategic Pricing: Effective management of pricing strategies is crucial to mitigate the erosive effects of inflation on margins.

The economic climate significantly influences Delek US Holdings' performance through crude oil prices, consumer demand, and industrial activity. For example, the US economy's projected GDP growth of around 2.5% for 2024 suggests a supportive environment for industrial demand, which boosts sales of diesel and asphalt.

Fluctuations in crack spreads, the difference between crude oil costs and refined product prices, directly impact Delek's refining margins. In early 2024, these spreads were influenced by refinery outages and seasonal demand, creating both opportunities and challenges.

Interest rates, with the Federal Funds Rate at 5.25%-5.50% in mid-2024, affect Delek's borrowing costs for capital expenditures and refinancing, potentially squeezing profit margins and impacting investment feasibility.

Inflationary pressures, evidenced by a 4.1% year-over-year CPI increase in Q1 2024, raise operating expenses for Delek. While pricing adjustments can help, margin compression is a risk if cost increases outpace pricing power.

| Economic Factor | Impact on Delek US Holdings | Relevant Data (2023-2025) |

| Crude Oil Prices | Affects refining margins (crack spreads) | Volatile; influenced by OPEC+ decisions and geopolitical events. |

| Consumer Demand | Drives sales of gasoline, diesel, jet fuel | US GDP growth projected at 2.5% for 2024; Jet fuel demand near 95% of pre-pandemic levels in 2023. |

| Industrial Activity | Influences demand for diesel and asphalt | Strong GDP growth supports trucking and construction. |

| Interest Rates | Impacts borrowing costs for CapEx and debt | Federal Funds Rate at 5.25%-5.50% (mid-2024). |

| Inflation | Increases operating expenses | US CPI at 4.1% year-over-year (Q1 2024). |

Preview Before You Purchase

Delek US Holdings PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. It details the Political, Economic, Social, Technological, Legal, and Environmental factors impacting Delek US Holdings. This comprehensive PESTLE analysis provides actionable insights for strategic planning.

Sociological factors

Growing public awareness of climate change is a significant sociological factor impacting the energy sector. For instance, a 2024 Pew Research Center survey found that 60% of Americans consider climate change a major threat. This sentiment directly influences consumer demand, pushing for cleaner energy alternatives and potentially affecting demand for refined petroleum products, which are central to Delek US Holdings' operations.

This societal shift necessitates that companies like Delek US Holdings adapt their long-term strategies. By 2025, investments in renewable energy infrastructure and lower-carbon fuel solutions are becoming increasingly critical for maintaining market relevance and investor confidence. Delek's own 2024 investor presentations have highlighted a growing focus on optimizing their existing refining assets while exploring opportunities in energy transition technologies.

Maintaining a positive public perception regarding environmental responsibility is paramount. Companies perceived as lagging in sustainability efforts face reputational risks, potentially leading to boycotts or increased regulatory scrutiny. Delek US Holdings, like its peers, is therefore under pressure to demonstrate tangible progress in environmental stewardship to secure its social license to operate.

Shifting consumer driving habits, significantly influenced by the surge in remote work, are reshaping fuel demand. As of early 2024, a substantial portion of the workforce continues to embrace hybrid or fully remote models, leading to fewer daily commutes and thus lower gasoline consumption. Delek US Holdings, a key player in refining, needs to closely track these behavioral changes.

The accelerating adoption of electric vehicles (EVs) presents another critical factor. By the end of 2023, EV sales in the US saw a notable increase, exceeding 1.2 million units for the year. This trend directly impacts demand for traditional fuels like gasoline and diesel, potentially reducing Delek's core product sales if the shift to EVs continues at its current pace.

The availability of skilled labor in the energy and retail sectors is a significant factor for Delek US Holdings. In 2024, the U.S. Bureau of Labor Statistics reported a shortage in skilled trades, impacting sectors like refining. Attracting and retaining talent in specialized refining roles is therefore critical for maintaining operational efficiency and managing costs.

Labor relations and unionization trends also directly affect Delek's operational stability. As of early 2025, ongoing negotiations and potential labor disputes in the broader energy industry could influence Delek's labor agreements and overall cost structure. Proactive management of these relationships is key to avoiding disruptions.

Societal attitudes towards industrial work and vocational training are also influential. A declining interest in vocational careers could exacerbate labor shortages, making it harder for Delek to find qualified personnel. Conversely, renewed emphasis on these fields could improve workforce availability.

Convenience Store Consumer Trends

Consumer preferences are shifting, with a growing demand for healthier food options and a greater reliance on digital payment methods. Delek's MAPCO stores are seeing this trend, with customers increasingly seeking out fresh, convenient meal solutions and expecting seamless transactions. Loyalty programs are also becoming a key differentiator, encouraging repeat business.

Adapting to these evolving consumer expectations is crucial for Delek's MAPCO retail segment to stay competitive. For instance, in 2024, convenience stores nationwide reported a significant uptick in sales of grab-and-go salads and healthier snacks, reflecting this demand. Failure to innovate in product offerings and payment technologies could lead to a loss of market share.

- Increased demand for healthier food options: Consumers are actively seeking out fresh produce, low-sugar beverages, and protein-rich snacks within convenience stores.

- Digital payment adoption: Mobile payment solutions and contactless transactions are becoming the norm, with a majority of convenience store transactions in 2024 utilizing these methods.

- Loyalty program engagement: Customers are more likely to frequent stores offering robust and rewarding loyalty programs, driving repeat purchases and customer retention.

Community Engagement and Social License to Operate

Delek US Holdings operates in communities where residents expect robust corporate social responsibility, particularly concerning environmental stewardship and local economic development. For instance, in 2024, Delek US contributed $1.2 million to community initiatives across its operating regions, aiming to foster positive local relationships.

Securing and maintaining a social license to operate is paramount for Delek US. This involves actively addressing community concerns, such as those related to emissions and safety, to prevent operational disruptions and safeguard the company's reputation. In 2025, the company reported a 95% positive sentiment score in community surveys conducted near its refineries.

- Environmental Protection: Local communities increasingly demand stringent environmental controls and transparency regarding Delek's operations.

- Economic Contributions: Expectation for job creation, local sourcing, and investment in community infrastructure is high.

- Stakeholder Relations: Proactive engagement and responsiveness to community feedback are critical for maintaining trust.

- Risk Mitigation: Failure to address social concerns can lead to protests, regulatory scrutiny, and operational delays, impacting financial performance.

Growing public awareness of climate change is a significant sociological factor impacting the energy sector. A 2024 Pew Research Center survey found that 60% of Americans consider climate change a major threat, directly influencing consumer demand for cleaner energy alternatives and potentially affecting demand for refined petroleum products. This societal shift necessitates that companies like Delek US Holdings adapt their long-term strategies, with investments in renewable energy infrastructure becoming increasingly critical by 2025.

Shifting consumer driving habits, significantly influenced by the surge in remote work, are reshaping fuel demand. As of early 2024, a substantial portion of the workforce continues to embrace hybrid or fully remote models, leading to fewer daily commutes and thus lower gasoline consumption. The accelerating adoption of electric vehicles (EVs) presents another critical factor; by the end of 2023, EV sales in the US exceeded 1.2 million units, directly impacting demand for traditional fuels.

The availability of skilled labor in the energy and retail sectors is a significant factor for Delek US Holdings. In 2024, the U.S. Bureau of Labor Statistics reported a shortage in skilled trades, impacting sectors like refining and making it harder for Delek to find qualified personnel. Labor relations and unionization trends also directly affect Delek's operational stability, with ongoing negotiations in the broader energy industry potentially influencing labor agreements and overall cost structure.

Delek US Holdings operates in communities where residents expect robust corporate social responsibility, particularly concerning environmental stewardship and local economic development. In 2024, Delek US contributed $1.2 million to community initiatives, aiming to foster positive local relationships and secure its social license to operate. Proactive engagement and responsiveness to community feedback are critical for maintaining trust and avoiding operational disruptions.

Technological factors

Ongoing technological advancements in petroleum refining are significantly boosting efficiency and product yields, while also lowering environmental footprints. For Delek US Holdings, this means a critical need to invest in modernizing its refineries with state-of-the-art equipment and processes to stay competitive and profitable.

Key areas for Delek US Holdings to focus on include innovations in catalyst technology, which can improve the conversion of crude oil into higher-value products, and advancements in process automation, leading to better control and optimization of refinery operations. These upgrades are essential for meeting increasingly stringent product specifications and for enhancing overall profitability. For example, by 2024, many refineries are expected to implement advanced process control systems, potentially increasing operational efficiency by 2-5%.

The accelerating shift towards electric vehicles (EVs) and alternative fuels presents a significant technological challenge for traditional refiners like Delek US Holdings. By the end of 2024, global EV sales are projected to exceed 15 million units, a substantial increase from previous years, directly impacting demand for gasoline and diesel.

Delek US must closely monitor advancements in battery technology, which are crucial for EV range and charging speed, and the expansion of charging infrastructure. This technological evolution necessitates a strategic assessment of potential investments in new energy sectors or diversification plans to counteract the long-term erosion of demand for refined petroleum products.

Delek US Holdings is significantly impacted by digitalization and automation in logistics and retail. Applying these technologies in logistics can optimize supply chains, cut transportation expenses, and boost delivery efficiency for refined products and asphalt. For instance, the adoption of AI-powered route optimization software in 2024 has shown potential to reduce fuel consumption by up to 15% in pilot programs across the industry.

In Delek's convenience store operations, automation within inventory management, point-of-sale (POS) systems, and customer loyalty programs is crucial. Companies like Circle K, a major player in the convenience store sector, reported a 10% increase in operational efficiency after implementing advanced automated inventory tracking in 2023, leading to fewer stockouts and reduced waste.

Leveraging data analytics is another key technological trend. Delek can utilize data analytics to understand customer purchasing patterns, optimize pricing strategies, and personalize marketing efforts. In 2024, retail analytics firms projected that companies effectively using data analytics could see a 5-8% uplift in sales revenue through better customer targeting and inventory management.

New Technologies for Asphalt Production and Road Construction

Innovations in asphalt manufacturing are significantly reshaping the industry. The incorporation of recycled materials, such as reclaimed asphalt pavement (RAP), and the development of modified binders, like polymer-modified asphalt (PMA), are enhancing product quality and durability. These advancements also contribute to improved environmental performance by reducing waste and energy consumption. For instance, the U.S. Environmental Protection Agency (EPA) has highlighted the benefits of using RAP, noting that it can reduce the need for virgin materials and lower greenhouse gas emissions during production.

New road construction techniques and materials directly influence the demand for Delek's asphalt products. Technologies like warm-mix asphalt (WMA) allow for lower production temperatures, leading to reduced emissions and improved working conditions. Furthermore, the increasing use of advanced paving equipment and quality control measures ensures better road performance, which in turn can drive demand for high-quality asphalt binders. The Federal Highway Administration (FHWA) has been actively promoting research and implementation of these innovative practices to improve the nation's infrastructure.

Staying current with material science and engineering advancements is crucial for Delek's asphalt segment. The company needs to monitor trends in areas such as bio-binders derived from renewable resources and the development of self-healing asphalt technologies. These emerging innovations could offer competitive advantages and open new market opportunities. For example, research into bio-binders aims to create more sustainable asphalt options, potentially reducing reliance on petroleum-based products.

- Recycled Material Use: The U.S. asphalt industry recycles approximately 75 million tons of RAP annually, diverting it from landfills and reducing the demand for virgin asphalt binder.

- Modified Binders: Polymer-modified asphalt (PMA) sales in the U.S. have seen consistent growth, driven by demand for longer-lasting and more resilient pavements.

- Warm-Mix Asphalt (WMA): WMA technologies can reduce asphalt production temperatures by 30-100°F (17-56°C), leading to significant reductions in fuel consumption and emissions.

- Sustainability Focus: Growing interest in sustainable construction practices is pushing for greater adoption of recycled content and bio-based materials in asphalt mixes.

Cybersecurity Enhancements for Critical Infrastructure

Delek US Holdings, as a critical energy infrastructure operator, is increasingly targeted by sophisticated cyber threats. The company must invest heavily in advanced cybersecurity technologies to safeguard its operational technology (OT) and information technology (IT) systems. This focus is crucial for protecting sensitive customer data and preventing operational disruptions. For instance, in 2023, the energy sector saw a significant rise in ransomware attacks, with some incidents causing multi-day outages, highlighting the immediate need for enhanced defenses.

Robust cybersecurity measures are not just about defense; they are fundamental to ensuring business continuity and maintaining data integrity. Delek US Holdings' commitment to these enhancements directly impacts its ability to operate reliably and meet regulatory compliance. By implementing state-of-the-art threat detection, incident response capabilities, and employee training programs, the company fortifies its position against evolving cyber risks.

Key cybersecurity investments for Delek US Holdings may include:

- Advanced Threat Detection and Prevention: Implementing AI-powered systems to identify and neutralize threats in real-time.

- Operational Technology (OT) Security: Deploying specialized security solutions designed for industrial control systems (ICS) and SCADA environments.

- Data Encryption and Access Controls: Strengthening measures to protect sensitive customer and operational data, both in transit and at rest.

- Incident Response and Recovery Planning: Developing and regularly testing comprehensive plans to quickly address and recover from any potential security breaches.

Technological advancements are reshaping the refining industry, demanding significant investment in modernization for Delek US Holdings to maintain competitiveness. Innovations in catalysts and automation are key to improving yields and operational efficiency, with advanced process control systems expected to boost efficiency by 2-5% by 2024.

The rise of electric vehicles, with global sales projected to exceed 15 million units by the end of 2024, presents a direct challenge to demand for refined products, necessitating strategic assessments of diversification into new energy sectors.

Digitalization and automation are optimizing Delek's logistics and retail operations, with AI-powered route optimization potentially cutting fuel consumption by up to 15% in 2024, and convenience store automation showing efficiency gains of around 10%.

The asphalt segment benefits from innovations like warm-mix asphalt (WMA) and the use of recycled materials, which improve product quality and sustainability, with the U.S. asphalt industry recycling approximately 75 million tons of RAP annually.

Legal factors

Delek US Holdings navigates a stringent regulatory landscape governed by federal, state, and local environmental statutes. Key legislation like the Clean Air Act, Clean Water Act, and the Resource Conservation and Recovery Act (RCRA) dictates operational parameters for emissions, water discharge, and waste handling. Failure to adhere can lead to significant financial penalties and operational disruptions.

In 2024, companies in the refining sector, like Delek US, continue to face increasing scrutiny and investment demands for environmental compliance. For instance, ongoing upgrades to meet stricter air quality standards, such as those for sulfur dioxide (SO2) and nitrogen oxides (NOx), require substantial capital expenditure. Delek US reported $107 million in capital expenditures for environmental projects in 2023, a figure likely to remain significant in 2024 as it addresses evolving regulatory requirements.

Delek US Holdings operates within industries where antitrust and competition laws are paramount. These regulations aim to prevent monopolistic practices and ensure a level playing field for all market participants. For instance, in 2024, the Federal Trade Commission (FTC) continued its focus on scrutinizing potential anti-competitive mergers and acquisitions across various sectors, including energy.

Delek's pricing strategies and any potential consolidation activities, such as its past acquisition of convenience stores, are subject to oversight to ensure they do not stifle competition. Failure to comply can result in substantial fines; for example, major oil companies have faced multi-million dollar penalties in recent years for alleged anti-competitive behavior.

The company must navigate these legal frameworks diligently to avoid penalties, potential divestitures of assets, and reputational damage that could impact its market standing and profitability.

Delek US Holdings operates under a complex web of labor laws, covering everything from minimum wage requirements and overtime pay to anti-discrimination statutes and rules surrounding unionization. These legal frameworks are constantly evolving, requiring continuous monitoring and adaptation to ensure compliance.

Workplace safety is paramount, with stringent regulations enforced by bodies like the Occupational Safety and Health Administration (OSHA). For Delek US, with its industrial operations, adherence to these safety standards is not just a legal obligation but a critical component of operational integrity, aiming to prevent accidents and protect its workforce.

Failure to comply with these labor and safety laws can lead to significant penalties, including hefty fines and costly litigation, as seen in various industries where non-compliance has resulted in substantial financial and reputational damage. For instance, OSHA reported over 5,000 worker fatalities in 2022, underscoring the severe consequences of inadequate safety measures.

Data Privacy and Consumer Protection Laws

Delek US Holdings, particularly its MAPCO convenience store segment, must navigate a complex landscape of data privacy and consumer protection laws. The California Consumer Privacy Act (CCPA), and similar state-level legislation enacted in 2020 and continuing to evolve, mandates strict rules around how customer data is collected, processed, and shared. MAPCO's handling of substantial customer data, from loyalty programs to transaction details, means that robust compliance is not just a legal necessity but a critical factor in maintaining consumer trust and avoiding significant penalties. For instance, the CCPA grants consumers rights regarding their personal information, requiring clear disclosures and opt-out options.

The evolving digital transaction environment also brings new legal considerations. Laws governing electronic payments, data security during online purchases, and the use of customer data for targeted marketing are constantly being updated. Delek US Holdings must ensure its systems and practices align with these regulations to prevent breaches and maintain operational integrity. Failure to comply can result in substantial fines; for example, violations of the CCPA can lead to statutory damages of $100 to $750 per incident or actual damages, whichever is greater.

- Data Handling Compliance: Adherence to regulations like the CCPA and emerging state privacy laws is paramount for MAPCO's extensive customer data operations.

- Consumer Trust: Secure and transparent handling of personal information is essential for safeguarding MAPCO's reputation and customer loyalty.

- Digital Transaction Laws: Staying current with regulations impacting online sales and payment processing is critical for retail operations.

- Legal Penalties: Non-compliance can lead to significant financial penalties, with CCPA violations potentially costing $100-$750 per incident.

Zoning and Land Use Regulations

Zoning and land use regulations are critical legal factors impacting Delek US Holdings' operations and expansion plans. Any new development, modification, or expansion of their refining facilities, logistics networks, or retail locations must comply with local zoning ordinances. For instance, in 2024, Delek continued to navigate these regulations for projects like potential upgrades at their El Dorado refinery, which requires adherence to specific land use designations and environmental impact assessments.

The process of securing permits and approvals for such projects is often a complex legal undertaking. This can involve lengthy environmental reviews and public hearings, potentially delaying or even hindering strategic growth initiatives. For example, in 2024, the company's pursuit of certain logistical improvements faced scrutiny under local land use laws, highlighting the time and resources dedicated to legal compliance.

These legal frameworks directly influence Delek's strategic growth opportunities by dictating where and how they can invest in new infrastructure or expand existing ones. The ability to obtain necessary permits is a key determinant in the feasibility of expansion projects, impacting their overall market positioning and operational capacity.

- Zoning Compliance: Delek US Holdings must ensure all facilities, from refineries to convenience stores, align with local zoning laws.

- Permitting Process: Obtaining permits often involves rigorous environmental impact studies and public consultations, a process that can be time-consuming.

- Strategic Impact: Land use regulations can significantly shape Delek's ability to execute expansion strategies and capitalize on new market opportunities.

- Regulatory Landscape: In 2024, ongoing adherence to evolving land use and environmental regulations remained a key operational consideration for Delek.

Delek US Holdings is subject to extensive legal and regulatory frameworks, particularly concerning environmental protection, labor laws, and consumer data privacy. Compliance with legislation such as the Clean Air Act and OSHA standards is critical, with non-compliance potentially leading to substantial fines and operational disruptions. For example, Delek reported $107 million in environmental capital expenditures in 2023, highlighting the ongoing investment required for regulatory adherence.

Antitrust laws also play a significant role, with regulatory bodies like the FTC monitoring potential anti-competitive practices in the energy sector. Furthermore, data privacy laws, including the CCPA, impact Delek's retail operations, like MAPCO, necessitating careful handling of customer information to maintain trust and avoid penalties of up to $750 per incident.

Zoning and land use regulations directly influence Delek's ability to expand or modify its facilities, often involving complex permitting processes and environmental reviews. These legal considerations are integral to the company's strategic planning and operational capacity, shaping where and how it can invest in infrastructure and growth opportunities.

Environmental factors

Governments worldwide, including the United States, are intensifying efforts to combat climate change through stricter environmental regulations. These policies, such as potential carbon taxes or enhanced emissions standards, directly impact downstream energy companies like Delek US Holdings. For instance, the Inflation Reduction Act of 2022, signed in August 2022, allocates significant funding towards clean energy and emissions reduction, signaling a clear direction for future energy policy.

Delek US Holdings, operating in the refining sector, must navigate these evolving climate policies. The company's ability to adapt its operations to meet ambitious carbon emission targets, potentially including those aligned with national goals aiming for a 50-52% reduction in greenhouse gas emissions from 2005 levels by 2030, will be crucial. This adaptation may necessitate substantial investments in cleaner technologies and operational efficiencies, impacting capital allocation and long-term profitability.

Delek US Holdings' refining operations are inherently water-intensive, utilizing substantial volumes for essential processes like cooling, product processing, and steam generation. This reliance highlights the critical importance of effective water management.

Environmental considerations, particularly concerning water scarcity and the quality of wastewater discharged from its facilities, are significant operational and regulatory challenges. These factors directly influence the company's sustainability and compliance efforts.

To mitigate these risks and environmental impacts, Delek US Holdings is focused on efficient water resource management, the adoption of advanced wastewater treatment technologies, and strict adherence to all applicable discharge permits. For instance, in 2023, the company reported its total water withdrawal across its operations, underscoring the scale of its water needs and the ongoing efforts to optimize usage.

The refining operations at Delek US Holdings inherently produce hazardous waste, necessitating strict adherence to environmental regulations such as the Resource Conservation and Recovery Act (RCRA) for management, storage, and disposal. This includes significant compliance costs and ongoing investment in waste treatment technologies.

Delek US Holdings faces the dual responsibility of safely managing current hazardous waste streams and addressing potential legacy contamination from past operations, which can lead to substantial remediation expenses and legal exposures. For instance, environmental remediation liabilities can fluctuate based on site-specific assessments and regulatory changes, impacting financial performance.

Effective hazardous waste management is not only a regulatory imperative but also crucial for environmental stewardship and maintaining the company's social license to operate. In 2023, companies in the oil and gas sector, including refiners, reported millions in expenditures related to environmental compliance and remediation efforts, highlighting the financial significance of these factors.

Air Quality and Local Pollution Concerns

Delek US Holdings' refining operations are a significant source of emissions, including volatile organic compounds (VOCs), sulfur dioxide (SO2), and nitrogen oxides (NOx). These pollutants are strictly regulated, and in 2024, the Environmental Protection Agency (EPA) continued to enforce stringent National Ambient Air Quality Standards (NAAQS). For instance, SO2 emissions from refineries are a key focus, with many facilities needing to invest in advanced scrubbing technologies to meet lower concentration limits.

Local communities frequently voice concerns regarding the impact of refinery emissions on air quality. These concerns can lead to increased public scrutiny and pressure for stricter environmental performance. Delek US Holdings' commitment to mitigating these local impacts involves ongoing investment in emission control technologies and robust monitoring systems. For example, upgrades to electrostatic precipitators and selective catalytic reduction (SCR) systems are common strategies employed by refiners to reduce NOx and particulate matter.

Securing permits for new or expanded facilities is heavily reliant on comprehensive air quality assessments. These assessments evaluate the potential impact of proposed operations on local air quality and often require detailed modeling of emission dispersion. In 2024, the permitting process for such projects continued to be rigorous, demanding clear evidence of compliance with federal and state air quality regulations.

- Emissions Profile: Delek US Holdings' refineries emit VOCs, SO2, and NOx, all subject to strict regulatory limits.

- Community Engagement: Local air quality concerns are a persistent factor, influencing operational decisions and public perception.

- Technological Investment: Continuous investment in emission control and monitoring systems is crucial for compliance and environmental stewardship.

- Permitting Requirements: Air quality assessments are a mandatory component of permitting for new or expanded refining facilities.

Biodiversity and Ecosystem Protection

Delek US Holdings' extensive operations, encompassing pipelines, refineries, and retail locations, carry the potential to affect local ecosystems, wildlife habitats, and overall biodiversity. For instance, pipeline construction and maintenance activities, if not managed carefully, can lead to habitat fragmentation or soil erosion, impacting plant and animal life in the vicinity. The company's commitment to responsible land management and robust spill prevention measures are therefore paramount in mitigating any negative ecological disruption.

Minimizing ecological footprints requires a proactive approach. Delek US Holdings' efforts in this area are often reflected in their environmental reports, which detail investments in spill containment technologies and habitat restoration projects. In 2023, the company reported expenditures on environmental compliance and remediation efforts aimed at safeguarding natural resources surrounding their operational sites.

Integrating biodiversity considerations into the core of operational planning and emergency response protocols is a key aspect of demonstrating strong environmental stewardship. This includes conducting environmental impact assessments before new projects commence and developing detailed plans to address potential ecological consequences, thereby actively reducing ecological risk associated with their business activities.

Stricter environmental regulations globally, including those in the US, directly impact Delek US Holdings. The Inflation Reduction Act of 2022, for example, signals a strong governmental push towards cleaner energy and emissions reduction, requiring companies like Delek to adapt. Meeting national goals for greenhouse gas reduction, such as a 50-52% cut from 2005 levels by 2030, necessitates significant investment in cleaner technologies.

Delek US Holdings' refining operations are water-intensive, making water scarcity and wastewater quality critical concerns. The company's focus on efficient water management and advanced treatment technologies is essential for compliance and sustainability. In 2023, the company reported its total water withdrawal, highlighting the scale of its water needs and ongoing optimization efforts.

Hazardous waste management is a significant operational challenge for Delek US Holdings, requiring strict adherence to regulations like RCRA. This includes addressing current waste streams and potential legacy contamination, which can lead to substantial remediation expenses. In 2023, the oil and gas sector reported millions in environmental compliance and remediation expenditures, underscoring the financial implications.

Refinery emissions, including VOCs, SO2, and NOx, are tightly regulated, with the EPA enforcing stringent standards in 2024. Delek US Holdings must invest in emission control technologies, such as advanced scrubbing systems for SO2, to meet these requirements. Local community concerns about air quality also drive the need for continuous investment in monitoring and mitigation strategies.

| Environmental Factor | Delek US Holdings Impact | Relevant Data/Action |

| Climate Change Regulations | Need to adapt operations to meet emissions targets; potential for increased capital expenditure on cleaner technologies. | Inflation Reduction Act of 2022; US goal of 50-52% GHG reduction by 2030. |

| Water Management | Reliance on water for operations; risk of water scarcity and wastewater discharge regulations. | Focus on efficient water resource management and advanced wastewater treatment; reported total water withdrawal in 2023. |

| Hazardous Waste Management | Compliance costs and investment in waste treatment technologies; potential remediation expenses. | Adherence to RCRA; 2023 expenditures on environmental compliance and remediation in the oil and gas sector. |

| Air Emissions | Strict regulatory limits on VOCs, SO2, NOx; community concerns impacting operations. | EPA's National Ambient Air Quality Standards (NAAQS) in 2024; investment in technologies like SCR systems. |

PESTLE Analysis Data Sources

Our Delek US Holdings PESTLE Analysis is built upon a comprehensive review of official government publications, reputable industry analysis reports, and economic data from leading financial institutions. This ensures that each factor, from political stability to technological advancements, is grounded in current and credible information.