Delek US Holdings Marketing Mix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Delek US Holdings Bundle

Delek US Holdings strategically leverages its diverse product portfolio, competitive pricing, extensive distribution network, and targeted promotional efforts to maintain its market position. From refining its product offerings to optimizing its supply chain, every element of their 4Ps is meticulously designed for impact.

Unlock the full potential of Delek US Holdings' marketing strategy. Gain instant access to a comprehensive, editable 4Ps analysis, complete with actionable insights and real-world examples, perfect for business professionals and students alike.

Product

Delek US Holdings refines crude oil into vital transportation fuels like gasoline, diesel, and jet fuel. These products are indispensable for powering industries and everyday life, ensuring mobility and facilitating trade.

In 2023, Delek US Holdings processed an average of 278,000 barrels per day across its refining assets, highlighting its significant production capacity. These refined fuels are crucial for sectors ranging from logistics and agriculture to aviation and personal transportation.

The company's refining facilities are strategically positioned to efficiently serve major consumer markets, optimizing distribution and reducing transportation costs. This geographic advantage is key to their competitive market presence.

Delek US Holdings' product strategy extends beyond traditional fuels to include asphalt, a critical material for infrastructure projects. This diversification highlights their commitment to serving a broader market, particularly in construction and road maintenance.

The company's operation of multiple asphalt terminals underscores a strategic focus on this segment. For instance, Delek US reported in its 2023 annual report that its asphalt segment contributed to its overall diversified business, with specific volumes and sales figures demonstrating its importance in their portfolio.

Delek US Holdings, through its subsidiary Delek Logistics Partners, LP, provides a robust suite of logistics services critical to the energy sector. These services encompass gathering, pipeline transportation, storage, wholesale marketing, and terminalling for crude oil, refined products, and natural gas.

The company's offerings also extend to essential water disposal and recycling services, demonstrating a comprehensive approach to midstream operations. In 2023, Delek Logistics Partners reported approximately 1,500 miles of pipeline and significant storage capacity, highlighting its extensive infrastructure network.

Convenience Store Offerings

While Delek US Holdings divested its company-operated retail fuel and convenience store assets in late 2024, its history with the MAPCO brand demonstrates a robust understanding of convenience retailing. This segment historically focused on delivering essential fuel alongside a curated selection of convenience merchandise to meet immediate consumer needs.

The MAPCO brand, even post-divestiture, continues to represent a familiar touchpoint for consumers seeking quick-service offerings. Key elements of its convenience store strategy included providing:

- Grab-and-go meals: Offering prepared foods for immediate consumption, catering to busy lifestyles.

- Fresh coffee: A staple convenience item, often a primary draw for morning commuters.

- Loyalty programs: Designed to foster repeat business and customer retention through rewards and discounts.

This historical focus highlights Delek's past engagement in a high-volume, low-margin retail environment where operational efficiency and customer convenience were paramount. The strategic sale of these assets in 2024 allowed Delek to streamline its operations and concentrate on its core refining and logistics businesses.

Renewable Fuels Initiatives

Delek US Holdings is actively pursuing renewable fuels initiatives as part of its evolving marketing strategy. This includes exploring and developing low-carbon solutions that align with the global energy transition. For instance, in 2023, Delek announced plans to invest in renewable diesel production, aiming to capitalize on growing demand for sustainable transportation fuels.

This strategic move diversifies Delek's product offerings beyond traditional petroleum-based fuels. It signals a commitment to sustainability and adapting to changing market dynamics. The company's participation in the renewable fuels sector is a key component of its long-term vision for a more resilient and environmentally conscious business model.

Key aspects of Delek's renewable fuels focus include:

- Investment in Renewable Diesel: Delek is exploring opportunities to produce and market renewable diesel, a biofuel that can be used as a direct substitute for petroleum diesel.

- Alignment with Energy Transition: These initiatives position Delek to benefit from government incentives and increasing consumer preference for cleaner energy sources.

- Portfolio Diversification: By venturing into renewable fuels, Delek aims to reduce its reliance on fossil fuels and create new revenue streams.

- Sustainability Commitment: The company's engagement in renewable fuels underscores its dedication to environmental stewardship and contributing to a lower-carbon future.

Delek US Holdings offers a diverse product portfolio, primarily focused on refined transportation fuels like gasoline and diesel, alongside asphalt for infrastructure. In 2023, their refining operations processed approximately 278,000 barrels per day, underscoring their substantial output capacity. The company is also strategically expanding into renewable fuels, with plans announced in 2023 to invest in renewable diesel production, signaling adaptation to the energy transition.

| Product Category | Key Offerings | 2023 Operational Highlight | Strategic Focus |

|---|---|---|---|

| Refined Fuels | Gasoline, Diesel, Jet Fuel | 278,000 bpd processed | Serving major consumer markets |

| Asphalt | Materials for infrastructure | Multiple asphalt terminals operated | Diversification into construction |

| Renewable Fuels | Renewable Diesel | Investment plans announced | Energy transition alignment |

What is included in the product

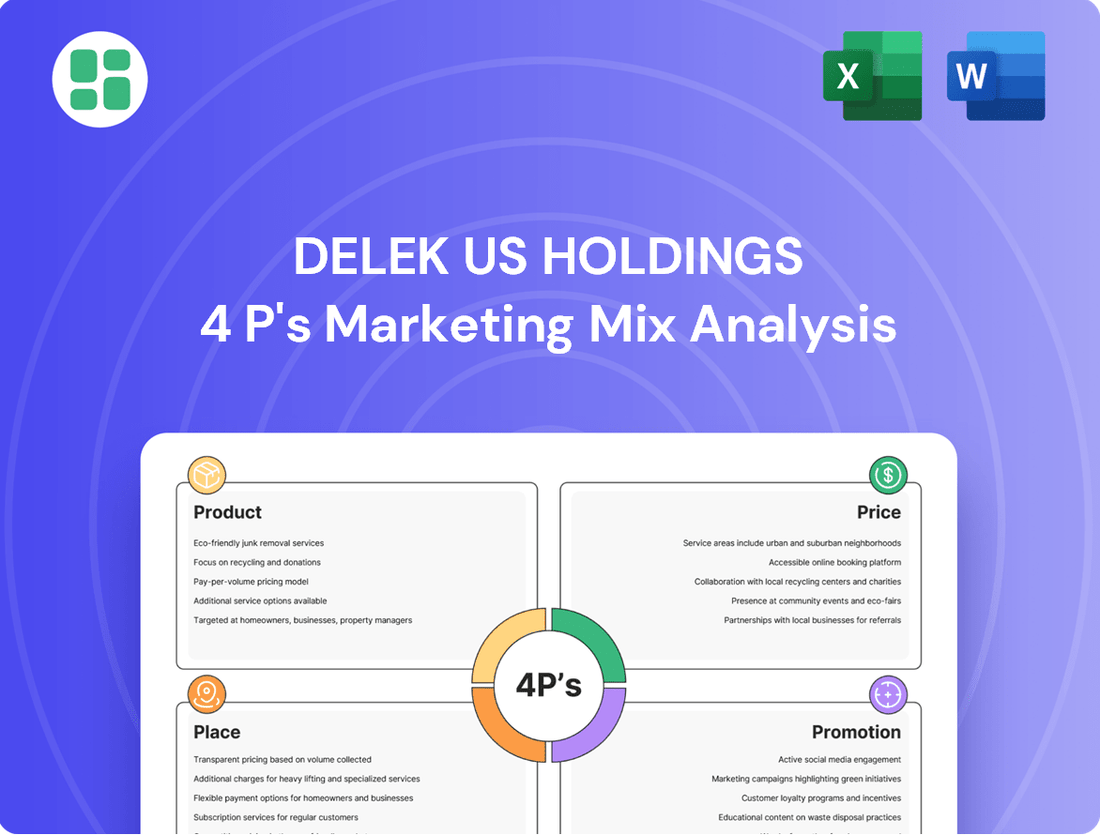

This analysis offers a comprehensive examination of Delek US Holdings' marketing mix, detailing their strategies for Product, Price, Place, and Promotion to inform strategic decision-making.

This analysis clarifies Delek US Holdings' strategic approach to Product, Price, Place, and Promotion, effectively addressing the pain point of understanding their market positioning and competitive advantage.

Place

Delek US Holdings' refinery network is a cornerstone of its marketing mix, strategically positioned to serve key regional markets. With facilities in Tyler and Big Spring, Texas, El Dorado, Arkansas, and Krotz Springs, Louisiana, the company ensures efficient crude oil processing and product distribution. These locations are vital for meeting demand in the Gulf Coast and Mid-Continent regions.

Delek US Holdings, through its Delek Logistics segment, boasts an extensive logistics infrastructure crucial for its marketing mix. This network comprises pipelines, gathering systems, and terminals strategically located in key energy-producing regions like the Permian and Delaware Basins, as well as along the Gulf Coast. This robust infrastructure ensures efficient transportation and storage of crude oil and refined products, directly supporting Delek's market reach and product delivery capabilities.

Delek US Holdings strategically operates four asphalt terminals, including a key facility in Bakersfield, California. These locations are vital for efficiently distributing asphalt to support the nation's infrastructure needs. In 2023, Delek US reported significant asphalt sales volumes, underscoring the importance of these terminal networks in meeting market demand.

Wholesale and Direct Sales Channels

Delek US Holdings predominantly leverages wholesale channels to distribute its refined petroleum products and asphalt. This approach targets a broad base of commercial and industrial clients, ensuring wide market penetration.

The company's logistics segment plays a crucial role, offering direct services to other energy firms. This business-to-business (B2B) distribution model highlights Delek's integrated approach to the energy market.

In 2023, Delek's wholesale segment remained a cornerstone of its sales strategy, with refined product sales volume reaching approximately 276,500 barrels per day. The logistics segment, including its pipeline and terminal operations, generated significant revenue, contributing to the overall B2B focus.

- Wholesale Dominance: Primarily serves commercial and industrial customers with refined products and asphalt.

- Logistics Services: Offers direct distribution and logistics solutions to other energy companies.

- B2B Focus: Emphasizes a business-to-business model across its sales and service operations.

- 2023 Performance: Refined product sales averaged around 276,500 bpd, showcasing the scale of wholesale operations.

Retail Convenience Store Presence (MAPCO)

Although Delek US Holdings divested its direct ownership of MAPCO retail stores in late 2024, the MAPCO brand remains a significant player in the convenience store sector. MAPCO operates hundreds of locations, primarily concentrated in the Southeastern United States, but has recently expanded its footprint into states like Ohio, Indiana, and Pennsylvania, extending its reach to a broader consumer base.

This extensive network directly serves consumers by offering both fuel and a variety of convenience items. The strategic placement of these stores ensures accessibility for everyday needs.

- Brand Presence: MAPCO continues to operate over 300 convenience stores across multiple states.

- Geographic Reach: Expansion into Ohio, Indiana, and Pennsylvania in 2024 signifies a strategic growth initiative.

- Consumer Interaction: The stores serve as direct points of sale for fuel and convenience goods.

Delek US Holdings' strategic placement of refineries and asphalt terminals is a key element of its market approach. The company's facilities in Texas, Arkansas, and Louisiana are positioned to efficiently serve the Gulf Coast and Mid-Continent markets. Furthermore, its asphalt terminals, including the one in Bakersfield, California, are crucial for supplying infrastructure projects across the nation, with significant asphalt sales volumes reported in 2023.

| Asset Type | Key Locations | 2023 Data/Significance |

|---|---|---|

| Refineries | Tyler, TX; Big Spring, TX; El Dorado, AR; Krotz Springs, LA | Serve Gulf Coast and Mid-Continent markets |

| Asphalt Terminals | Bakersfield, CA; others | Support national infrastructure needs; significant sales volumes in 2023 |

Preview the Actual Deliverable

Delek US Holdings 4P's Marketing Mix Analysis

The preview shown here is the actual document you’ll receive instantly after purchase—no surprises. This comprehensive analysis of Delek US Holdings' 4P's Marketing Mix is fully complete and ready for your immediate use.

Promotion

Delek US Holdings prioritizes transparent investor relations and financial communications. This is evident through their dedicated investor relations website, quarterly earnings calls, and detailed financial reports, all designed to foster confidence and attract capital. For instance, in their Q1 2024 earnings report, Delek US Holdings highlighted a significant improvement in adjusted EBITDA, reaching $150 million, underscoring their commitment to communicating strong financial performance.

The company's strategy focuses on clearly articulating its financial results, strategic advancements, and future projections to a broad audience including investors, analysts, and the media. This proactive approach aims to build trust and demonstrate the company's value proposition. Their investor day in late 2023 provided a comprehensive overview of their refining segment's strategic advantages and capital allocation plans, reinforcing their forward-looking narrative.

For Delek US Holdings, business-to-business (B2B) promotion centers on nurturing robust connections within its refining, asphalt, and logistics sectors. This involves dedicated direct sales teams actively engaging industrial clients, key distributors, and fellow energy enterprises.

Key promotional activities include meticulous contract negotiations and a steadfast commitment to dependable supply chains and exceptional service delivery. In 2023, Delek US reported approximately $10.8 billion in total revenue, underscoring the significant scale of these B2B relationships in driving its financial performance.

MAPCO's promotional strategy, particularly within its retail convenience store segment historically linked to Delek US Holdings, heavily emphasizes customer loyalty and an elevated in-store experience. The MY Reward$ program is central to this, aiming to foster repeat business through tangible benefits and personalized offers.

This focus on loyalty is crucial for driving customer retention in a competitive market. For instance, in 2023, convenience store loyalty programs saw significant engagement, with many customers citing rewards as a primary reason for choosing a particular brand. MAPCO's efforts to integrate quality fuel, fresh food, and a welcoming atmosphere alongside its loyalty program are designed to capture and maintain this customer engagement.

Public Relations and Corporate Profile

Delek US Holdings actively manages its corporate image through public relations, emphasizing its role as a diversified downstream energy company. This strategy aims to communicate operational strengths, robust safety protocols, and its commitment to energy security and sustainable practices.

The company's public relations efforts highlight its contributions to the energy sector, including its refining capacity and logistics infrastructure. For instance, in the first quarter of 2024, Delek US reported a total refining throughput of 269,000 barrels per day, showcasing its operational scale.

- Operational Excellence: Delek US consistently communicates its efficient refining processes and logistical network.

- Safety and Sustainability: The company emphasizes its strong safety records and initiatives towards environmental responsibility.

- Energy Security: Public relations efforts underscore Delek's role in providing reliable energy supplies.

- Financial Performance: Communication often includes key financial metrics, such as their reported adjusted EBITDA of $160 million for Q1 2024, demonstrating financial health.

Industry Engagement and Conferences

Delek US Holdings actively participates in key industry events and associations, demonstrating its commitment to staying at the forefront of the refining and marketing sectors. This engagement allows the company to share its expertise, build relationships with peers and potential partners, and gain valuable insights into emerging market trends and regulatory landscapes. For instance, Delek's presence at major conferences like the Independent Petroleum Association of America (IPAA) meetings and industry-specific refining forums in 2024 and early 2025 provides a platform for strategic discussions and business development.

These industry engagements are crucial for fostering Delek's recognition as a thought leader and for identifying potential collaborations that can drive future growth. By actively participating, Delek US not only stays informed but also positions itself as a reliable and knowledgeable player in the energy market. This proactive approach to industry interaction is a vital component of its marketing strategy, supporting its overall business objectives.

- Industry Presence: Delek US regularly attends and often presents at major industry conferences, such as the American Fuel & Petrochemical Manufacturers (AFPM) Annual Meeting and the National Association of Convenience Stores (NACS) Show, providing direct exposure to stakeholders.

- Networking Opportunities: Participation facilitates crucial networking with suppliers, customers, investors, and regulatory bodies, fostering stronger business relationships and identifying new partnership avenues.

- Market Intelligence: Conferences offer direct access to the latest market trends, technological advancements, and competitive intelligence, enabling Delek US to adapt its strategies effectively.

- Brand Visibility: Showcasing expertise through presentations and sponsorships at these events enhances Delek US's brand visibility and reinforces its position within the industry.

Delek US Holdings' promotional efforts are multi-faceted, targeting both business-to-business relationships and broader corporate image building. For its core refining and logistics operations, direct engagement with industrial clients and distributors, supported by dependable supply chains, is paramount. This B2B focus is reflected in their substantial revenue figures, with 2023 total revenue reaching approximately $10.8 billion, highlighting the scale of these crucial relationships.

In the retail sector, exemplified by MAPCO, promotion centers on customer loyalty programs like MY Reward$ to drive repeat business. This strategy aims to enhance customer retention by offering tangible benefits and a superior in-store experience, combining quality fuel and food offerings. The success of such programs is evident in the high engagement seen across the convenience store industry in 2023.

Broader corporate promotion involves public relations that emphasize operational strengths, safety, and energy security, reinforcing Delek's position as a diversified downstream energy company. Their Q1 2024 reported refining throughput of 269,000 barrels per day underscores their significant operational scale and reliability.

Furthermore, active participation in industry events and associations, such as the AFPM Annual Meeting and NACS Show, enhances brand visibility and fosters strategic relationships. These engagements in 2024 and early 2025 provide platforms for sharing expertise and gaining market intelligence.

| Promotional Focus | Key Activities | Supporting Data/Examples |

|---|---|---|

| B2B Relationships (Refining, Logistics) | Direct sales, contract negotiation, dependable supply chains | 2023 Total Revenue: $10.8 billion |

| Retail (MAPCO) | Customer loyalty programs (MY Reward$), enhanced in-store experience | High engagement in loyalty programs in 2023 |

| Corporate Image | Public relations, emphasizing safety, operational scale, energy security | Q1 2024 Refining Throughput: 269,000 bpd |

| Industry Engagement | Participation in conferences (AFPM, NACS) | Active presence in 2024-2025 industry events |

Price

Delek US Holdings prices its refined products like gasoline, diesel, and jet fuel based on commodity markets. This means global crude oil prices and regional crack spreads, which represent the difference between crude oil cost and refined product prices, heavily dictate their pricing. For instance, in early 2024, West Texas Intermediate (WTI) crude oil prices fluctuated between $70 and $80 per barrel, directly impacting Delek's product costs and selling prices.

The company's refining margins, a key indicator of profitability, are directly tied to these market benchmarks. A widening crack spread generally leads to higher refining margins for Delek, while a narrowing spread compresses profitability. This commodity-based approach makes Delek's financial performance highly sensitive to the often volatile energy markets.

Delek US Holdings historically approached pricing for its former retail operations, like MAPCO, with a strong focus on local market competitiveness. This meant fuel prices were regularly adjusted to align with or beat nearby competitors, ensuring they remained attractive to consumers.

Beyond just matching prices, Delek US utilized loyalty programs as a key strategy to provide added value and incentivize repeat business. These programs allowed them to offer discounts or rewards, effectively lowering the perceived cost for loyal customers and fostering a stronger customer base in a highly competitive retail fuel and convenience sector.

Delek Logistics Partners (DKL) often secures its revenue through long-term, fee-based contracts for services like pipeline transportation and gathering. This contractual pricing model offers a predictable and stable income stream, which is a key advantage in the often-volatile energy sector. For instance, in 2023, Delek US Holdings reported that its logistics segment, which includes DKL, generated a significant portion of its earnings from these stable, fee-based arrangements, providing a solid foundation against fluctuating commodity prices.

Market-Driven Asphalt Pricing

Delek US Holdings' asphalt product pricing is intrinsically tied to fluctuating market forces. Key drivers include the cost of crude oil, which directly impacts asphalt production expenses, and regional demand, particularly from the construction sector. Competitive supply levels also play a significant role in shaping pricing strategies.

Delek US actively monitors and adjusts its asphalt prices to reflect these evolving market dynamics. This ensures their pricing remains competitive and aligned with prevailing economic conditions.

- Crude Oil Costs: Fluctuations in crude oil prices directly influence the cost of producing asphalt. For instance, West Texas Intermediate (WTI) crude oil prices averaged around $78 per barrel in early 2024, a factor Delek considers.

- Regional Demand: Construction activity, especially road building and infrastructure projects, dictates regional demand for asphalt. Increased government spending on infrastructure in 2024 is a positive indicator for demand.

- Competitive Landscape: The number of asphalt suppliers in a given region affects pricing power. Delek analyzes competitor pricing and market share to set its own rates.

- Supply Chain Efficiency: Delek's ability to efficiently transport and deliver asphalt also factors into its pricing, impacting overall cost-effectiveness for customers.

Strategic Capital Allocation and Shareholder Returns

Delek US Holdings' financial strategy directly impacts its shareholder returns and stock valuation. The company actively manages its debt levels, utilizes share buybacks to reduce outstanding shares and boost earnings per share, and makes dividend payments to reward investors. These capital allocation decisions are crucial indicators of the company's financial strength and its commitment to returning value to shareholders.

For instance, in the first quarter of 2024, Delek US reported a net income of $176 million, or $2.04 per diluted share. The company's commitment to capital discipline is evident in its ongoing share repurchase program. As of March 31, 2024, Delek US had approximately $230 million remaining under its authorized share repurchase program, demonstrating a proactive approach to enhancing shareholder value.

- Debt Management: Delek US focuses on maintaining a healthy balance sheet, which influences investor confidence and the cost of capital.

- Share Buybacks: The company's share repurchase program directly reduces the number of shares outstanding, potentially increasing earnings per share and stock price.

- Dividend Payments: While not always consistent, dividend payments signal financial stability and a direct return of profits to investors.

- Financial Health Indicator: These capital allocation strategies collectively serve as key metrics for assessing Delek US's financial performance and its attractiveness to investors.

Delek US Holdings' pricing for refined products like gasoline and diesel is intrinsically linked to global commodity markets, specifically crude oil prices and regional crack spreads. This means that when crude oil costs, such as West Texas Intermediate (WTI) which averaged around $78 per barrel in early 2024, go up or down, Delek's selling prices and refining margins tend to follow suit. Their asphalt pricing also mirrors market forces, influenced by crude oil costs, construction sector demand, and competitive supply levels, with increased infrastructure spending in 2024 supporting demand.

| Product Segment | Pricing Driver | 2024 Data Point Example |

|---|---|---|

| Refined Products (Gasoline, Diesel) | Crude Oil Prices & Crack Spreads | WTI Crude Oil: ~$78/barrel (early 2024 average) |

| Asphalt | Crude Oil Costs & Regional Construction Demand | Increased infrastructure spending in 2024 |

| Logistics (DKL) | Long-term, Fee-Based Contracts | Stable, predictable revenue streams reported in 2023 |

4P's Marketing Mix Analysis Data Sources

Our Delek US Holdings 4P analysis is grounded in a comprehensive review of public financial disclosures, including SEC filings and annual reports. We also incorporate insights from investor presentations, press releases, and industry-specific market data to capture their strategic marketing efforts.