Delek US Holdings Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Delek US Holdings Bundle

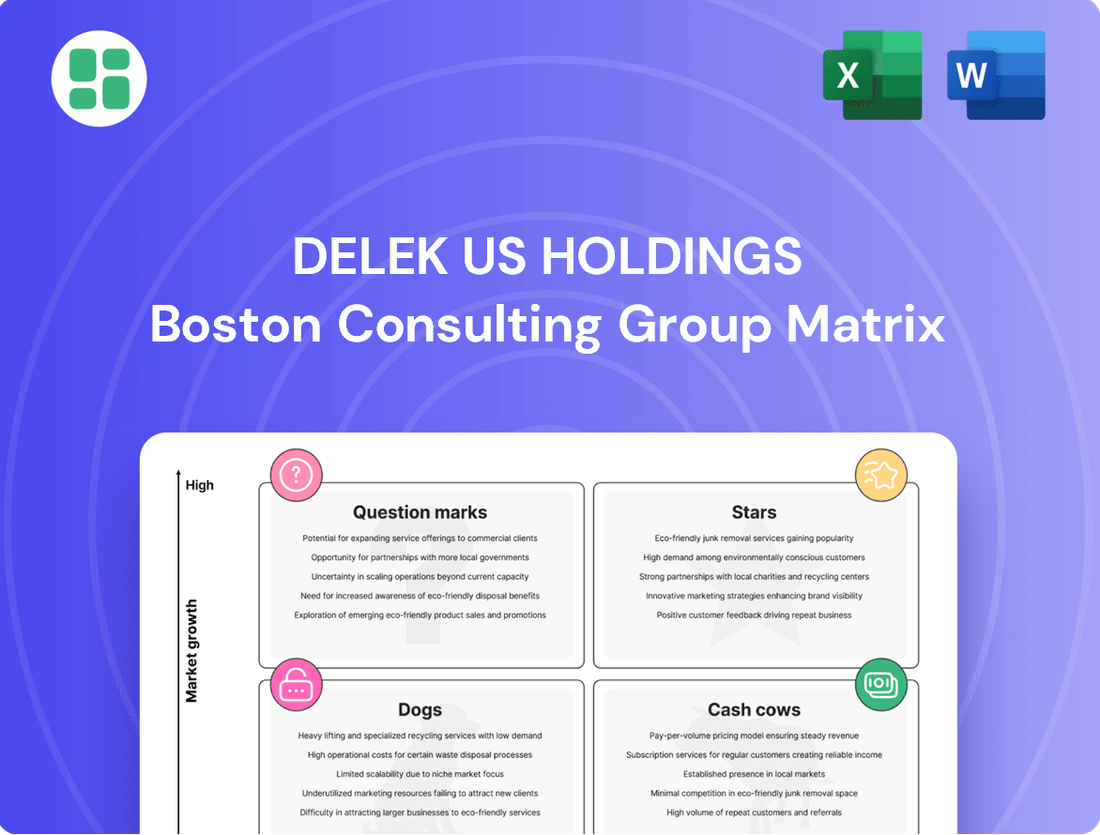

Curious about Delek US Holdings' strategic positioning? Our BCG Matrix preview offers a glimpse into their product portfolio, highlighting potential Stars, Cash Cows, Dogs, and Question Marks. Understand where their strengths lie and where challenges may emerge.

Unlock the full potential of this analysis by purchasing the complete Delek US Holdings BCG Matrix. Gain detailed quadrant placements, actionable insights, and a clear roadmap to optimize their business strategy and investment decisions.

Stars

Delek Logistics Partners (DKL) is poised to capitalize on the Permian Basin's expanding oil and gas output, with projections indicating production could hit around 6.52 million barrels per day by the close of 2025. This robust growth in the Permian offers a substantial advantage for DKL's gathering and processing operations.

DKL's strategic infrastructure enhancements, including the new Libby 2 gas plant, directly address the escalating demand in this vital region. These investments reinforce DKL's strong position within critical transportation and processing routes.

Delek US Holdings (DKL) strategically bolstered its midstream capabilities through acquisitions like Gravity Water Midstream and H2O Midstream in late 2024 and early 2025. These moves significantly expanded its asset base and boosted third-party cash flows, demonstrating a commitment to growth in this sector.

These acquisitions are key to DKL's strategy of broadening its service portfolio and extending its geographic presence within the expanding midstream market. The integration of these new assets positions DKL to better compete and capture a greater market share.

Delek Logistics has significantly enhanced its independence from Delek US Holdings by increasing third-party revenue. By the end of 2023, third-party EBITDA contributed around 80% of the total, a substantial rise from previous periods. This strong third-party focus demonstrates a diversified customer base and a reduced dependence on its sponsor, signaling a more resilient and growth-oriented business model.

Robust Adjusted EBITDA Growth in Logistics

Delek Logistics has demonstrated robust financial performance, achieving record Adjusted EBITDA. In the fourth quarter of 2024, the company reported $107.2 million in Adjusted EBITDA, followed by an even stronger $117 million in the first quarter of 2025. This represents a significant 15% year-over-year increase for the first quarter of 2025.

This sustained growth highlights Delek Logistics' strong position within the expanding logistics market. The company's operational efficiency and strategic expansion initiatives are clearly paying off, translating into impressive financial gains. Such consistent EBITDA increases signal a market-leading business unit that is a significant value generator.

- Record Adjusted EBITDA: $107.2 million in Q4 2024 and $117 million in Q1 2025.

- Year-over-Year Growth: 15% increase in Adjusted EBITDA for Q1 2025.

- Market Position: Demonstrates leadership and effective management in a growing sector.

- Value Generation: Sustained EBITDA growth indicates strong financial performance and strategic success.

Positioning for Hydrocarbon Export Growth

The U.S. midstream sector is poised for significant expansion, fueled by increasing hydrocarbon exports, especially natural gas and Natural Gas Liquids (NGLs). New pipeline projects and enhanced export terminals are in development to address existing capacity constraints.

Delek Logistics (DKL), with its strategically located assets and ongoing expansions, particularly within the Permian Basin, is well-positioned to capitalize on this industry-wide growth trend.

This strategic alignment with the nation's energy export objectives presents a substantial high-growth opportunity for DKL's midstream services.

- U.S. Natural Gas Exports: In 2024, U.S. LNG export capacity is projected to reach approximately 17.2 billion cubic feet per day (Bcfd), a substantial increase from previous years, highlighting robust demand for American natural gas.

- Permian Basin Production: The Permian Basin continues to be a powerhouse, with production consistently exceeding 6 million barrels of oil per day in early 2024, driving demand for associated NGLs and the midstream infrastructure to transport them.

- Delek Logistics' Position: DKL's extensive pipeline network and terminal operations in key producing regions, including the Permian, provide critical infrastructure for moving these growing export volumes.

- Export Infrastructure Growth: Significant investments are underway to expand U.S. export terminals, with several new facilities expected to come online by late 2024 and into 2025, further supporting the export growth narrative.

Delek Logistics Partners (DKL) is clearly a Star in the Delek US Holdings BCG Matrix. Its strong performance, evidenced by record Adjusted EBITDA of $117 million in Q1 2025, and a 15% year-over-year growth in Q1 2025, points to a high-growth, high-market-share business segment. The company's strategic acquisitions in late 2024 and early 2025, such as Gravity Water Midstream and H2O Midstream, have significantly expanded its asset base and third-party cash flows, solidifying its dominant position in the midstream sector.

| Metric | Q4 2024 | Q1 2025 | YoY Growth (Q1 2025) |

|---|---|---|---|

| Adjusted EBITDA | $107.2 million | $117 million | 15% |

| Third-Party Revenue Contribution | ~80% (as of end 2023) | N/A | N/A |

| Permian Basin Production | >6 million bpd (early 2024) | Projected ~6.52 million bpd (end 2025) | N/A |

What is included in the product

This BCG Matrix overview for Delek US Holdings identifies which business units are Stars, Cash Cows, Question Marks, or Dogs.

It highlights strategic recommendations for investment, holding, or divestment based on market share and growth.

A clear BCG Matrix visualizes Delek US Holdings' portfolio, easing the pain of strategic uncertainty by highlighting growth opportunities and areas needing divestment.

Cash Cows

Delek Logistics Partners' core fee-based logistics assets, primarily its pipeline and storage infrastructure, operate as established cash cows within Delek US Holdings' portfolio. These mature assets generate highly stable and predictable cash flows, largely due to long-term contracts that insulate them from commodity price volatility. For instance, Delek Logistics reported that its logistics segment generated $170 million in Adjusted EBITDA for the full year 2023, demonstrating its consistent profitability.

The capital expenditure required to maintain these existing infrastructure components is relatively low once they are operational. This efficiency in ongoing investment allows these assets to convert a significant portion of their revenue into free cash flow, reinforcing their status as reliable cash generators. This consistent financial contribution is crucial for Delek US Holdings' overall financial health and its ability to fund other strategic initiatives.

Delek US Holdings boasts established refining infrastructure with a combined crude throughput capacity of 302,000 barrels per day across its Tyler, Big Spring, El Dorado, and Krotz Springs facilities. While the refining sector is considered mature, these long-standing assets, representing substantial prior investments, are capable of generating significant cash flow when running optimally. Their history and crucial position within Delek's operations strongly suggest they fit the profile of a cash cow – a business unit with a high market share in a low-growth industry.

Delek US Holdings is actively pursuing operational efficiency through its Enterprise Optimization Plan (EOP) and Zero-Based Budgeting (ZBB). These programs are designed to unlock significant cash flow, targeting a run-rate improvement of $100 million to $120 million by the latter half of 2025. This strategic focus on cost reduction and efficiency gains within its established refining and logistics operations is characteristic of managing cash cow assets, ensuring maximum profitability from mature business segments.

Stable Distribution Payouts from DKL

Delek Logistics Partners (DKL) operates as a cash cow within Delek US Holdings' portfolio, characterized by its consistent policy of increasing quarterly cash distributions. This upward trend in payouts directly reflects the partnership's robust ability to generate reliable distributable cash flow, a hallmark of mature and efficient operations. The stability of these returns to unitholders signals a business segment that consistently produces more cash than it requires for its ongoing operations and investments.

The cash-generating power of DKL's core assets, primarily its logistics and refining infrastructure, underpins the stability of these distributions. For instance, in the first quarter of 2024, Delek US Holdings reported that Delek Logistics Partners generated significant distributable cash flow, enabling continued distributions. This consistent return to investors highlights DKL's mature business model and its capacity to convert operational success into tangible shareholder value.

- Consistent Distribution Growth: DKL has a history of increasing its quarterly cash distributions, demonstrating predictable cash generation.

- Mature Business Segment: The stability of payouts indicates a well-established business that generates surplus cash.

- Strong Cash Flow Generation: DKL's core operations consistently produce more cash than is needed for reinvestment.

- Reliable Unitholder Returns: The predictable nature of distributions provides a dependable income stream for investors.

Reliable Product Supply Chains

Delek US Holdings' integrated operations, spanning from crude oil supply to refining and then to logistics and wholesale distribution, form a robust supply chain. This integration, especially prominent in the mid-continent and Gulf Coast areas, offers a significant competitive edge by guaranteeing a steady flow of products and consistent market access.

The reliability of these supply chains directly supports stable revenue generation, a hallmark of a cash cow business. For instance, Delek's 2024 performance, as reported in their Q1 2024 earnings, highlighted the resilience of their refining segment, which benefited from strong operational uptime and favorable crack spreads, underscoring the value of their integrated model.

- Integrated Model: Delek's operations connect crude oil sourcing, refining, and distribution, ensuring consistent product availability.

- Regional Strength: Focus on mid-continent and Gulf Coast regions provides market access and operational efficiencies.

- Revenue Stability: Reliable supply chains contribute to predictable and stable revenue streams, characteristic of a cash cow.

Delek Logistics Partners (DKL) consistently demonstrates its cash cow status through its reliable distributable cash flow generation, enabling steady increases in quarterly cash distributions to unitholders. This predictable financial performance, a key indicator of mature and efficient operations, means DKL generates more cash than it needs for reinvestment, providing a dependable income stream. For example, DKL's first quarter 2024 results showed strong performance supporting these distributions, underscoring its role as a stable cash generator within Delek US Holdings.

| Metric | 2023 (Full Year) | Q1 2024 |

|---|---|---|

| DKL Adjusted EBITDA | $170 million | $45 million |

| Distributable Cash Flow (DKL) | Not explicitly stated for full year, but consistent distributions imply strong generation. | Sufficient to support quarterly distributions. |

What You See Is What You Get

Delek US Holdings BCG Matrix

The Delek US Holdings BCG Matrix you are currently previewing is the identical, fully formatted report you will receive immediately after purchase. This means no watermarks, no demo content, and no surprises – just a comprehensive strategic analysis ready for your immediate business planning needs.

Rest assured, the Delek US Holdings BCG Matrix you see here is the precise document that will be delivered to you upon completing your purchase. This professionally crafted report offers in-depth insights into Delek's business units, allowing for informed strategic decision-making without any need for further editing or revisions.

What you are reviewing is the actual, final Delek US Holdings BCG Matrix file that will be yours once you complete the purchase. This analysis-ready document is instantly downloadable, enabling you to seamlessly integrate it into your strategic presentations or internal discussions.

Dogs

Delek US Holdings' refining segment is currently navigating a challenging landscape marked by volatile and depressed refining margins. Crack spreads, a key indicator of refinery profitability, have seen significant declines throughout 2024 and into early 2025. This weak margin environment directly squeezes the profitability of Delek's refining operations, impacting cash generation.

The external pressures on these margins make it difficult for Delek's refining assets to consistently generate positive contributions to the company's overall financial performance. For instance, in the first quarter of 2024, Delek reported adjusted EBITDA from its refining segment that was notably lower year-over-year, reflecting these margin headwinds.

Delek US Holdings faced significant financial headwinds in its refining segment. The company reported a net loss of $173 million in the first quarter of 2025, following a substantial net loss of $413.8 million in the fourth quarter of 2024.

The refining operations were particularly challenging, contributing negatively to Adjusted EBITDA in the fourth quarter of 2024. This indicates that the segment's expenses outweighed its revenue generation, effectively consuming more cash than it produced.

Such a performance, where a business unit is a net drain on company resources, strongly aligns with the characteristics of a 'Dog' in a BCG Matrix analysis. These units typically have low market share and operate in slow-growing markets, often requiring significant investment without generating substantial returns.

Refineries, like those operated by Delek US Holdings, demand significant capital for essential maintenance and periodic turnarounds to maintain safe and efficient operations. These investments are crucial for long-term viability and regulatory compliance.

Delek US Holdings, for example, undertook a major five-year turnaround at its Krotz Springs refinery in 2024. Such extensive projects tie up substantial funds and can negatively impact immediate profitability, a characteristic often seen in Dogs within a BCG Matrix.

The high, unavoidable capital expenditures for these turnarounds can severely strain a company's cash flow, especially when operating in a low-margin industry. This financial pressure reinforces the Dog classification, as it represents a business segment requiring significant investment without generating commensurate returns.

Exposure to Geopolitical and Regulatory Risks

Delek US Holdings, like many in the refining sector, faces significant exposure to geopolitical and regulatory risks. Events such as the ongoing conflict between Russia and Ukraine can disrupt global energy supply chains, leading to price volatility and impacting feedstock costs. For instance, in early 2024, crude oil prices continued to be influenced by these geopolitical tensions, affecting refinery margins.

Regulatory changes also present a substantial challenge. The Renewable Fuel Standard (RFS) obligations, for example, require refiners to blend biofuels or purchase credits, adding to operating expenses. In 2024, the Environmental Protection Agency's (EPA) final RFS rule for 2023-2025 continued to shape compliance costs for companies like Delek. Additionally, the potential for tariffs on imported refined products or crude oil can further complicate market access and profitability.

- Geopolitical Impact: The refining industry's profitability is directly tied to global energy security and supply disruptions, with events like the Russia-Ukraine war creating significant price volatility for crude oil and refined products throughout 2024.

- Regulatory Burden: Compliance with mandates like the Renewable Fuel Standard (RFS) imposes direct costs on refiners. For 2024, the EPA's RFS rules dictated significant credit purchase obligations for companies.

- Tariff Uncertainty: The possibility of new tariffs on imported fuels or feedstocks introduces an unpredictable cost element, potentially impacting Delek US Holdings' competitive positioning and operational planning.

Slowing Global Fuel Demand Growth

Slowing global fuel demand growth, projected around 1% for 2025, presents a significant challenge. This slowdown is driven by factors such as the increasing adoption of electric vehicles and the development of alternative fuel sources.

This deceleration in market expansion, coupled with an anticipated increase in global refining capacity, is creating an oversupply situation. Such conditions put considerable pressure on existing refining operations.

Operating within a market that is either stagnant or contracting, and facing heightened competition, makes it difficult for refiners to increase or even sustain their market share profitably.

- Projected global petroleum product demand growth: ~1% in 2025

- Key demand influencers: EV adoption, alternative fuels

- Market dynamic: Oversupply due to demand slowdown and rising refining capacity

- Impact on refiners: Difficulty in gaining/maintaining profitable market share

Delek US Holdings' refining segment fits the 'Dog' profile due to its low market share in a mature, low-growth industry and persistent profitability challenges. The segment experienced substantial net losses, reporting a $173 million loss in Q1 2025 and a $413.8 million loss in Q4 2024, indicating it consumes more resources than it generates. This financial drain, coupled with the need for significant capital for essential maintenance like the 2024 Krotz Springs refinery turnaround, solidifies its 'Dog' classification.

The refining market itself is characterized by slowing demand growth, projected at around 1% for 2025, and increasing global capacity, leading to oversupply. This environment makes it difficult for companies like Delek to maintain or grow profitable market share. Geopolitical instability and regulatory burdens, such as Renewable Fuel Standard obligations, further exacerbate these challenges, adding cost pressures and market uncertainty.

| Metric | 2024 (Q4) | 2025 (Q1) | Significance for 'Dog' Classification |

|---|---|---|---|

| Refining Segment Net Loss | $413.8 million | $173 million | Demonstrates consistent negative profitability, a hallmark of Dogs. |

| Capital Expenditure (Example) | Major Turnaround at Krotz Springs | Ongoing | High, unavoidable investments in mature assets without commensurate returns. |

| Market Growth Projection (Global) | ~1% for 2025 | ~1% for 2025 | Indicates a low-growth or stagnant market, typical for Dogs. |

| Regulatory Costs (Example) | RFS Compliance | RFS Compliance | Adds to operational expenses in a low-margin environment. |

Question Marks

Delek US Holdings' asphalt business operates within a sector poised for significant expansion. The U.S. asphalt market is anticipated to grow at a compound annual growth rate of 5.1% between 2024 and 2032, largely fueled by substantial government investment in infrastructure projects. This robust market growth presents a clear opportunity.

Despite the favorable market conditions, Delek's specific market share within the asphalt segment isn't characterized as a leading position. This suggests that while the industry is expanding, Delek needs to strategically invest to strengthen its competitive standing and capitalize on the increasing demand.

Consequently, Delek's asphalt business can be viewed as a Question Mark in the BCG Matrix. It's a segment operating in a high-growth industry, but it requires careful consideration and targeted investment to potentially increase its market share and transition into a stronger market position.

Delek US Holdings' Enterprise Optimization Plan (EOP) is a critical initiative designed to boost profitability by $100 million to $120 million in run-rate cash flow by the latter half of 2025. This plan focuses heavily on enhancing the performance of existing assets, especially its refining segment, which has shown weaker results. The successful implementation of EOP is a key factor in determining the future financial health and strategic direction of these underperforming refining operations.

Delek US Holdings views renewable fuels as a diversified asset, placing it in a sector experiencing rapid growth and evolving demand. This segment aligns with the Question Mark category in the BCG Matrix due to its high growth potential coupled with uncertain future returns.

The global renewable fuels market is projected to reach over $200 billion by 2028, driven by increasing environmental regulations and a push for decarbonization. Delek's involvement here signifies an investment in a future-oriented energy source, though its specific market penetration and project success remain to be seen.

New Technology Adoption in Refining

To stay ahead in the demanding refining sector, Delek US Holdings, like its peers, needs to embrace new technologies for enhanced efficiency, lower emissions, and broader product portfolios. While specific new product lines aren't highlighted, Delek's ongoing initiatives, such as the El Dorado Refinery's (EOP) optimization efforts, suggest a strategic adoption of advanced operational methods. The true impact of these technological investments on gaining a competitive advantage and increasing market share within this established industry represents a significant question mark.

- Efficiency Gains: Investments in technologies like advanced process control (APC) can lead to significant operational improvements. For instance, APC systems have been shown to reduce energy consumption by 2-5% in refineries, directly impacting profitability.

- Emission Reduction: The refining industry faces increasing pressure to reduce its environmental footprint. Technologies focused on sulfur removal or CO2 capture, while costly, are becoming essential for regulatory compliance and long-term sustainability.

- Market Share Impact: Delek's ability to translate technological advancements into tangible market share gains depends on successful implementation and the competitive responses of other refiners. The ROI on these investments is critical for their classification as stars or question marks.

- 2024 Outlook: In 2024, the refining sector saw continued focus on operational excellence and debottlenecking projects, often incorporating digital solutions and automation to improve yields and reduce costs. Delek's specific investments in these areas will determine their position.

Future Strategic Investments Post-Divestiture

Delek US Holdings' divestiture of its MAPCO convenience store business in 2024 for $390 million marks a pivotal moment, shifting its strategic focus squarely onto its refining and logistics operations. This move positions the company at a crossroads, with the allocation of these substantial proceeds representing a classic 'Question Mark' in its BCG Matrix analysis. The company must now identify and execute new investments that have the potential for high growth but currently hold a smaller market share within their respective industries.

- Strategic Shift: The $390 million sale of MAPCO signals Delek's commitment to core refining and logistics.

- Investment Uncertainty: Redeploying these funds into new growth areas creates a 'Question Mark' in the portfolio.

- Future Growth Drivers: Success hinges on identifying and capitalizing on high-growth, lower-market-share opportunities.

- Value Creation: Strategic investments are crucial for long-term shareholder value post-divestiture.

Delek's asphalt business is in a high-growth industry, but its market share needs improvement, making it a Question Mark. Similarly, its renewable fuels segment shows promise due to market expansion, yet its current market penetration makes it a Question Mark. The company's refining operations, while core, face challenges requiring technological investment to secure market share, also classifying them as Question Marks.

The $390 million divestiture of MAPCO in 2024 provides capital for new ventures, but the success of these future investments remains uncertain, solidifying their Question Mark status. Delek's strategic allocation of these funds will be crucial for future growth.

| Business Segment | Industry Growth | Market Share | BCG Classification |

|---|---|---|---|

| Asphalt | High (5.1% CAGR 2024-2032) | Moderate | Question Mark |

| Renewable Fuels | High (>$200B by 2028) | Low/Emerging | Question Mark |

| Refining | Moderate/Mature | Established, needs improvement | Question Mark |

| Post-MAPCO Investments | Varies (depends on new ventures) | Low/New | Question Mark |

BCG Matrix Data Sources

Our BCG Matrix is built on verified market intelligence, combining financial data, industry research, official reports, and expert commentary to ensure reliable, high-impact insights.