Delek US Holdings Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Delek US Holdings Bundle

Delek US Holdings navigates a complex landscape shaped by intense rivalry, significant buyer power, and the looming threat of substitutes. Understanding the delicate balance of these forces is crucial for any stakeholder looking to grasp Delek's competitive positioning.

The complete report reveals the real forces shaping Delek US Holdings’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

Delek US Holdings, as a petroleum refiner, relies heavily on crude oil, its essential raw material. The bargaining power of crude oil suppliers is a critical factor in Delek's operational costs and profitability.

The global crude oil market is largely dominated by a few major producing countries and blocs like OPEC+. These entities wield significant influence over global supply and, consequently, pricing. For instance, in 2024, OPEC+ has continued to manage production levels, directly impacting the availability and cost of crude oil for refiners like Delek.

Geopolitical tensions and deliberate production adjustments by these key suppliers can trigger substantial price volatility. When supply is restricted or perceived to be at risk, suppliers gain considerable leverage, forcing refiners to accept higher prices for their essential feedstock, thereby squeezing profit margins.

Delek US Holdings' capacity to refine a variety of crude oil types, from light and sweet to heavy and sour, significantly dampens supplier leverage. This processing flexibility allows Delek to switch between different crude sources based on availability and price, preventing any single supplier from dictating terms. For instance, in 2024, Delek's refineries were designed to handle a diverse crude slate, enhancing their procurement options.

The cost of switching crude oil suppliers presents a significant factor in the bargaining power of suppliers for Delek US Holdings. These switching costs aren't just financial; they encompass logistical hurdles and potential compatibility issues with existing refinery setups. For instance, adapting infrastructure to handle different crude grades can be a complex and expensive undertaking, making a sudden shift from established suppliers difficult.

Delek's reliance on long-term contracts and specialized infrastructure for particular crude oil types further solidifies this supplier stickiness. These existing arrangements can make it less appealing and more costly to explore alternative sourcing options, thereby strengthening the suppliers' position.

However, Delek US Holdings is actively working to mitigate this by expanding its logistics segment, Delek Logistics. By focusing on increasing third-party cash flows and enhancing service offerings, particularly in the Permian Basin, Delek aims to broaden its crude sourcing capabilities. This strategic move could potentially diversify its supplier base and reduce its dependence on any single provider, thereby lessening supplier bargaining power in the future.

Integration of Logistics Suppliers

Delek US Holdings' ownership of Delek Logistics Partners, LP (DKL) partially integrates its supply chain, particularly in logistics. This integration lessens the bargaining power of external transportation suppliers for a portion of crude oil and refined product movements. DKL's operations include pipelines and terminals, which are crucial for Delek US's refining and marketing segments.

This vertical integration within logistics provides Delek US with greater control over a significant part of its transportation needs. For the fiscal year 2023, Delek Logistics Partners reported total revenues of $1.3 billion, with a growing portion of this revenue coming from third-party customers, indicating an expanding operational footprint beyond Delek US itself.

- Reduced Reliance: Delek US's internal logistics capabilities, managed through DKL, decrease its dependence on third-party pipeline and trucking services for a segment of its operations.

- Cost Control: Owning and operating logistics assets can offer more predictable and potentially lower transportation costs compared to relying solely on external providers who may have pricing power.

- Strategic Advantage: The growing third-party revenue for DKL ($582 million in 2023) demonstrates the segment's strength and ability to generate income independently, further solidifying its position within Delek US's overall strategy and potentially increasing its negotiation leverage with external partners.

Specialized Equipment and Technology Suppliers

Suppliers of specialized equipment, catalysts, and advanced refining technologies hold significant bargaining power. This is due to the proprietary nature of their products and the substantial investment required for these critical refinery components. Delek US Holdings relies on these suppliers for essential upgrades and ongoing maintenance, making these relationships vital for operational continuity and efficiency.

The high cost associated with these specialized inputs means Delek has limited alternatives, thus strengthening supplier leverage. For instance, the cost of advanced catalysts can be a considerable portion of refinery operating expenses. In 2024, the demand for advanced refining technologies was robust, driven by regulatory changes and the push for greater efficiency, further empowering these suppliers.

- Proprietary Technology: Suppliers offering unique or patented refining processes and catalysts can command higher prices due to a lack of direct substitutes.

- High Switching Costs: The expense and time involved in qualifying and integrating new specialized equipment or catalyst suppliers are substantial deterrents for Delek to switch.

- Criticality of Inputs: The performance and uptime of Delek's refineries are directly tied to the quality and reliability of these specialized supplies, giving suppliers considerable influence.

The bargaining power of crude oil suppliers remains a significant factor for Delek US Holdings, primarily due to the concentrated nature of global oil production. In 2024, geopolitical events and production decisions by entities like OPEC+ continued to influence crude availability and pricing, directly impacting Delek's feedstock costs.

Delek's ability to process a diverse range of crude oil grades provides a degree of flexibility, allowing it to shift sourcing based on market conditions and mitigate the impact of any single supplier's leverage. However, the costs and complexities associated with changing crude suppliers, including infrastructure compatibility, can still create stickiness.

The company's strategic expansion of its logistics segment, Delek Logistics Partners (DKL), aims to enhance its control over the supply chain and diversify sourcing options. This vertical integration in logistics, which saw DKL generate $1.3 billion in revenue in 2023, can reduce reliance on external transportation providers and potentially improve cost predictability.

Suppliers of specialized refining equipment and catalysts also hold considerable power due to the proprietary nature of their products and the high costs associated with switching. Delek's dependence on these critical inputs for operational efficiency and technological advancement underscores the influence these suppliers wield in 2024, a year marked by strong demand for advanced refining solutions.

| Factor | Impact on Delek US Holdings | 2024 Context/Data |

| Crude Oil Supply Concentration | High leverage for major producers, impacting feedstock costs. | OPEC+ production management continues to influence global supply and pricing. |

| Crude Oil Processing Flexibility | Mitigates supplier power by allowing shifts in crude sourcing. | Delek's refineries are designed to handle a diverse crude slate. |

| Logistics Integration (DKL) | Reduces reliance on external transportation, potentially lowering costs. | DKL reported $1.3 billion in revenue for 2023, with growing third-party business. |

| Specialized Equipment/Catalyst Suppliers | Significant power due to proprietary technology and high switching costs. | Demand for advanced refining technologies was robust in 2024, empowering suppliers. |

What is included in the product

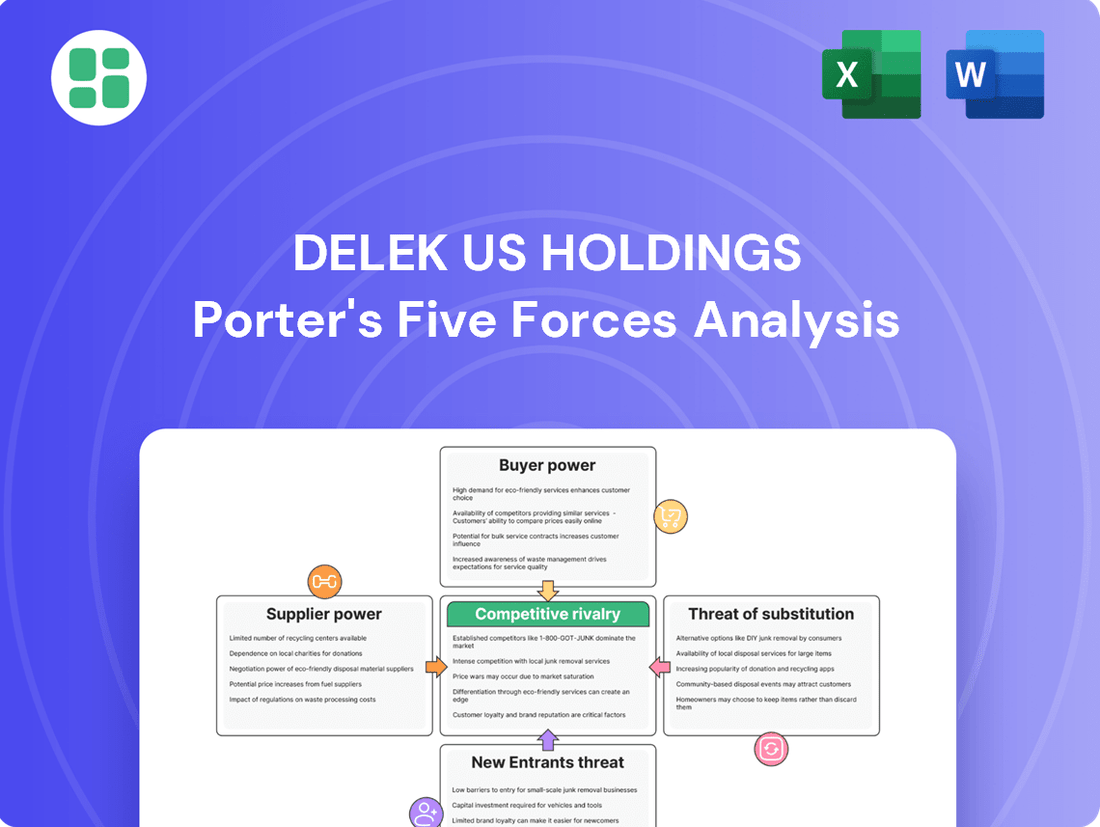

This analysis unpacks the competitive forces impacting Delek US Holdings, revealing the intensity of rivalry, buyer and supplier power, threat of new entrants, and the impact of substitutes on its refining and retail operations.

Effortlessly identify and mitigate competitive threats with a visual breakdown of Delek US Holdings' Porter's Five Forces, allowing for proactive strategy adjustments.

Customers Bargaining Power

Customers for refined products such as gasoline, diesel, and jet fuel, particularly wholesale distributors and major industrial consumers, exhibit significant price sensitivity. This is largely due to the commodity nature of these fuels, meaning buyers can easily switch suppliers if prices are not competitive. For instance, Delek US Holdings' margins are directly influenced by refining crack spreads, which saw fluctuations impacting pricing power in Q1 2025.

The broader refining market experienced challenging conditions towards the end of 2024 and into early 2025, marked by lower crack spreads. This market environment further amplifies customer leverage, as buyers can more readily negotiate favorable terms when supply generally outpaces demand or when refining margins are compressed.

Delek US Holdings (DK) benefits from serving a diversified customer base across its refining, logistics, asphalt, and convenience store operations. This broad reach across different market segments, including wholesale and retail, naturally spreads out customer influence.

While large wholesale buyers in the refining segment might possess some volume-driven bargaining power, this is counterbalanced by the fragmented nature of its retail operations. The MAPCO convenience store segment, for instance, deals with a vast number of individual consumers, each with minimal individual purchasing power.

In 2023, Delek US Holdings reported total revenues of approximately $11.6 billion, with its refining segment being a significant contributor. This revenue diversification across various customer types and industries helps to mitigate the concentrated power of any single customer group.

Customers for refined products, such as gasoline and diesel, have a significant number of choices. They can source these products from numerous domestic refiners and international importers, which naturally amplifies their bargaining power. This wide array of suppliers means customers aren't tied to a single source.

The U.S. refining sector is characterized by robust competition. Consequently, customers possess the flexibility to readily switch between suppliers based on critical factors like price competitiveness, product quality specifications, and the reliability of delivery. This dynamic environment directly impacts Delek US Holdings.

This competitive market structure inherently places considerable pressure on Delek US Holdings. The company must consistently strive to maintain competitive pricing strategies and ensure high levels of operational efficiency to retain its customer base and market share.

Evolving Consumer Preferences in Convenience Stores

Customer preferences in the convenience store sector, particularly for Delek's MAPCO brand, are undergoing a significant transformation. By 2025, consumers are increasingly seeking healthier food options, robust food service offerings, and seamless technology integration such as self-checkout and personalized loyalty programs. This shift directly impacts Delek's ability to retain and attract customers, influencing their purchasing power.

The bargaining power of customers is amplified as convenience stores evolve from mere fuel stops to comprehensive retail destinations. Food service, for instance, is emerging as a critical differentiator and revenue stream. In 2024, the convenience store industry saw continued growth in prepared food sales, with many chains reporting double-digit increases in this category, underscoring its importance in capturing customer spending.

- Shifting Demand: Consumers are prioritizing healthier snacks and meals, moving away from traditional high-sugar and high-fat convenience items.

- Food Service Growth: The demand for fresh, ready-to-eat meals and expanded foodservice menus is a key driver of customer loyalty and increased basket size.

- Technological Expectations: Customers expect efficient, technology-enabled experiences, including mobile ordering, contactless payment, and engaging loyalty programs.

- Value Perception: Customers are more discerning about value, weighing price against the quality of products, the convenience of the experience, and the overall brand offering.

Logistics Segment Customer Power

For Delek Logistics Partners (DKL), customers are primarily other energy companies that rely on its midstream infrastructure for transporting and storing crude oil and refined products. The bargaining power of these customers is influenced by the availability of competing pipeline networks and the sheer volume of product they need to move. In 2023, Delek Logistics reported that approximately 75% of its logistics segment revenue was derived from fee-based contracts, which generally offer more stable cash flows and reduce direct commodity price exposure, thereby mitigating some customer price pressure.

Delek Logistics actively works to strengthen its customer relationships and value proposition. By focusing on increasing third-party cash flows, which reached $315 million in 2023, and strategically expanding its presence in high-growth basins like the Permian, the company aims to become an indispensable partner for producers and refiners. This expansion strategy can lead to more integrated service offerings and potentially lock in customers with less reliance on alternative infrastructure.

- Customer Dependence: Delek Logistics' customers are typically large energy companies requiring extensive midstream services, making their need for DKL's infrastructure significant.

- Alternative Infrastructure: The presence and cost-effectiveness of alternative pipeline, rail, or truck transportation options directly impact customer bargaining power.

- Contractual Agreements: The majority of Delek Logistics' revenue in 2023 came from fee-based contracts, providing a degree of protection against direct customer price negotiations compared to commodity-linked pricing.

- Strategic Growth: Expansion into key production areas like the Permian Basin enhances DKL's network reach and can solidify its position with existing and potential customers.

Customers for Delek US Holdings' refined products, like gasoline and diesel, have considerable bargaining power due to the commodity nature of these fuels and the availability of numerous suppliers. This allows them to easily switch for better pricing, especially when refining margins are tight, as seen with fluctuating crack spreads impacting Delek's pricing power throughout 2024 and into early 2025.

While Delek's diversified customer base, including its MAPCO convenience stores, dilutes individual customer power, the refining segment's large wholesale buyers can still exert influence. However, the company's broad revenue streams, totaling approximately $11.6 billion in 2023, help mitigate the impact of any single customer group's leverage.

In the convenience store sector, customer preferences are shifting towards healthier options and better technology, influencing their purchasing decisions and bargaining power. The growth in prepared food sales in 2024 highlights this trend, making these offerings a key differentiator for customer retention.

For Delek Logistics Partners (DKL), customers are primarily large energy companies. Their bargaining power is tempered by DKL's extensive midstream infrastructure, particularly in growth areas like the Permian Basin. The majority of DKL's 2023 revenue, $315 million in third-party cash flows, came from fee-based contracts, offering some insulation from direct price negotiations.

| Customer Type | Key Influencing Factors | Impact on Delek US Holdings |

| Wholesale Refined Products Buyers | Price sensitivity, availability of alternative suppliers, crack spreads | Significant price pressure, need for competitive pricing strategies |

| Retail Convenience Store Customers (MAPCO) | Product variety (healthier options, food service), technology integration, loyalty programs | Need for evolving offerings, impact on sales volume and customer loyalty |

| Delek Logistics Customers (Energy Companies) | Availability of competing infrastructure, volume of product, contractual agreements | Mitigated by fee-based contracts and strategic network expansion |

What You See Is What You Get

Delek US Holdings Porter's Five Forces Analysis

This preview showcases the complete Porter's Five Forces analysis for Delek US Holdings, detailing the competitive landscape and strategic positioning within the refining and marketing industry. You are looking at the actual document, which includes in-depth insights into buyer power, supplier power, threat of new entrants, threat of substitutes, and competitive rivalry. The document displayed here is the part of the full version you’ll get—ready for download and use the moment you buy.

Rivalry Among Competitors

The U.S. refining sector is a mature market with a concentrated number of large, established competitors. Major players such as Valero, Marathon Petroleum, and Phillips 66 dominate the landscape, alongside significant regional refiners like Delek US Holdings.

Despite anticipated refinery closures in 2025, the industry's overall capacity remains robust, fueling a highly competitive environment. Delek US Holdings itself operates with a combined crude throughput capacity of 302,000 barrels per day, highlighting its position within this dynamic market.

Delek US Holdings operates in a refining sector characterized by substantial fixed costs. This necessitates high capacity utilization to spread these costs and achieve profitability through economies of scale.

During periods of market weakness, like the lower refining crack spreads Delek faced in the first quarter of 2025, insufficient utilization rates can lead to operating losses. For instance, if Delek's refineries ran at a lower percentage than their break-even point, the fixed costs alone would generate negative earnings.

The downstream energy sector faces a dynamic landscape. While global oil demand growth is projected to moderate in 2025, influenced by the ongoing energy transition and increasing electric vehicle adoption, U.S. fuel demand is anticipated to see continued, albeit potentially slower, growth. This divergence sets a competitive stage where companies like Delek US Holdings must strategically position themselves to capture market share amidst evolving consumption patterns for traditional fuels.

Competition in the Convenience Store Sector

The convenience store sector is intensely competitive, characterized by a fragmented landscape featuring national brands, regional operators, and independent businesses. Delek's MAPCO brand navigates this environment by focusing on key differentiators such as prime locations, competitive fuel pricing, and appealing in-store product selections, particularly its food service offerings. Enhancing the customer experience through loyalty programs and advanced technology integration is also crucial for success in this crowded market.

As of 2025, the United States is home to over 152,000 convenience stores, underscoring the sheer density of competition. This high number means that differentiation is paramount for brands like MAPCO to capture and retain market share.

- Market Fragmentation: The convenience store industry is highly fragmented, with a vast number of players.

- Competitive Factors: Key battlegrounds include location, fuel prices, food service, and customer experience.

- Industry Size: Over 152,000 convenience stores operated in the US by 2025.

- Differentiation Strategy: MAPCO competes through its store offerings, loyalty programs, and technology.

Product Differentiation and Innovation

Delek US Holdings operates in a sector where differentiating refined products is inherently challenging because they are largely commodities. This means that competition often centers on price rather than unique product features.

However, within its convenience store segment, Delek can achieve differentiation. This is done by focusing on improved food and beverage selections, offering healthier choices, and leveraging technology to create better customer experiences. These elements are key to gaining a competitive edge.

Delek's strategic focus on its Enterprise Optimization Plan (EOP) is designed to boost overall profitability. By implementing operational improvements, the company aims to strengthen its competitive standing in the market.

- Limited Product Differentiation: Refined products are largely commodities, leading to price-based competition.

- Convenience Store Differentiation: Focus on food/beverage offerings, healthier options, and technology enhances competitiveness.

- Enterprise Optimization Plan (EOP): Aims to improve operational efficiency and profitability, bolstering Delek's market position.

The U.S. refining industry is highly competitive, with major players like Valero and Marathon Petroleum setting a vigorous pace. Delek US Holdings, operating with a significant throughput capacity, actively competes within this mature market where economies of scale are paramount for profitability.

High fixed costs in refining necessitate high utilization rates. When crack spreads are low, as experienced in early 2025, Delek US Holdings can face operating losses if utilization falls below its break-even point, intensifying competitive pressures.

While global oil demand growth is moderating by 2025, U.S. fuel demand is still growing, albeit at a slower pace. This creates a competitive environment where companies like Delek must secure market share amidst evolving energy consumption trends.

In the convenience store sector, where over 152,000 U.S. locations exist by 2025, MAPCO competes through location, fuel pricing, and its food service offerings. Differentiation via loyalty programs and technology is key to standing out.

| Competitor | Approximate Refining Capacity (kbpd) - 2024 | Key Differentiators (Convenience Stores) |

| Valero Energy | ~3,100 | Extensive branded network, strong retail presence |

| Marathon Petroleum | ~2,900 | Integrated refining and midstream operations |

| Phillips 66 | ~2,200 | Focus on specialty products, strong midstream assets |

| Delek US Holdings | ~302 | Enterprise Optimization Plan, MAPCO convenience stores |

SSubstitutes Threaten

The growing popularity of electric vehicles (EVs) presents a substantial long-term challenge to the demand for gasoline and diesel, which are Delek's core refined products. While U.S. gasoline demand is anticipated to see a modest increase in 2025, the global surge in EV sales, especially in key markets like China and the United States, is projected to reduce oil demand by millions of barrels daily by 2030.

Biofuels and renewable diesel are increasingly viable alternatives to traditional petroleum fuels, spurred by environmental mandates and a growing demand for greener options. This trend poses a significant threat to Delek US Holdings' core business, as a substantial market shift could diminish demand for its conventional refined products.

While Delek is investing in renewable diesel capacity, a rapid acceleration in the adoption of these alternatives could still pressure its existing refining assets. For instance, the U.S. renewable diesel market saw significant growth, with production reaching approximately 5.5 billion gallons in 2023, indicating a tangible shift that could affect traditional fuel demand.

The increasing adoption of public transportation and the rapid expansion of ride-sharing platforms represent a significant threat of substitutes for Delek US Holdings. As more individuals opt for these alternatives, the demand for gasoline, a core product for Delek, naturally diminishes. For instance, in 2024, major metropolitan areas continued to see robust growth in ride-sharing usage, with services like Uber and Lyft reporting significant increases in passenger trips compared to pre-pandemic levels, directly impacting individual vehicle miles traveled.

Alternative Materials for Asphalt

While asphalt remains the dominant material for road construction, the threat of substitutes for Delek US Holdings' asphalt business does exist. Alternative materials like concrete are well-established and frequently used, especially for heavy-duty applications or where specific durability characteristics are paramount. In 2024, the U.S. construction market continued to see significant investment in infrastructure, with both asphalt and concrete vying for project share.

Emerging technologies and environmental pressures could also foster the development and adoption of novel substitutes. For instance, recycled plastics and other composite materials are being explored for road paving, although their widespread commercial viability and cost-effectiveness for large-scale infrastructure projects are still developing. The cost of asphalt versus concrete is a key factor influencing material choice; for example, while asphalt often offers lower initial installation costs, concrete can sometimes provide longer lifespans and reduced maintenance needs, impacting the total cost of ownership.

- Concrete's established presence in heavy-duty applications poses a direct substitute threat to asphalt.

- Emerging materials like recycled plastics are gaining traction for specific paving needs, though not yet mainstream.

- Cost competitiveness between asphalt and concrete remains a critical driver for material selection in infrastructure projects.

Shift in Convenience Store Consumption Habits

Consumers increasingly turn to supermarkets and online grocery delivery services for their food and beverage needs, presenting a significant threat of substitution for convenience stores. For instance, in 2024, online grocery sales continued their upward trajectory, capturing a larger share of the overall food retail market, directly impacting convenience store foot traffic for these essential purchases.

Furthermore, the rise of quick-service restaurants (QSRs) offering convenient meal solutions also siphons off potential convenience store customers. Many QSRs have expanded their breakfast and snack menus, directly competing with convenience store offerings. This shift in consumption habits means convenience stores must innovate to maintain relevance.

- Supermarket and Online Grocery Competition: Consumers are opting for broader selections and competitive pricing found at supermarkets and through the convenience of online grocery platforms.

- Quick-Service Restaurant (QSR) Alternatives: QSRs are increasingly providing grab-and-go meal and snack options that directly substitute convenience store purchases.

- Convenience Store Adaptation Strategies: To counter these threats, convenience stores are enhancing their food service programs and introducing healthier product lines.

- Evolving Consumer Preferences: The overall trend indicates a consumer base seeking greater variety, value, and healthier choices, which traditional convenience store formats may not always satisfy.

The threat of substitutes for Delek US Holdings is multifaceted, impacting both its refining and retail segments. The accelerating adoption of electric vehicles (EVs) and the growing market for biofuels directly challenge demand for gasoline and diesel. For instance, in 2024, EV sales continued to climb, with projections indicating a significant reduction in oil demand by the end of the decade.

In the retail sector, convenience stores face substitution from supermarkets and online grocery services, as well as quick-service restaurants (QSRs) offering convenient meal solutions. This shift in consumer behavior, driven by a desire for variety and value, pressures convenience store sales. For example, online grocery sales saw continued growth in 2024, capturing a larger market share.

| Substitute Category | Specific Substitute | Impact on Delek | 2024 Trend/Data Point |

|---|---|---|---|

| Transportation Fuels | Electric Vehicles (EVs) | Reduced demand for gasoline/diesel | Continued strong growth in EV sales |

| Transportation Fuels | Biofuels/Renewable Diesel | Competition for traditional fuels | U.S. renewable diesel production reached approx. 5.5 billion gallons in 2023 |

| Retail Purchases | Supermarkets/Online Grocery | Decreased convenience store foot traffic for essentials | Online grocery sales increased market share |

| Retail Purchases | Quick-Service Restaurants (QSRs) | Competition for grab-and-go meals/snacks | QSRs expanded menus, directly competing with convenience store offerings |

Entrants Threaten

The refining sector presents a significant hurdle for newcomers due to its exceptionally high capital requirements. Building a state-of-the-art refinery can easily cost billions of dollars, a sum that deters most potential entrants.

For instance, major refinery projects announced in recent years, such as those involving upgrades or new builds, often have price tags exceeding $5 billion. This massive upfront investment, coupled with the need for specialized technology and skilled labor, creates a substantial barrier.

New companies looking to enter the oil refining industry, like Delek US Holdings operates within, face a daunting regulatory maze. Obtaining the necessary environmental permits, adhering to strict safety standards, and managing ongoing compliance is a significant hurdle. For instance, the U.S. Environmental Protection Agency (EPA) oversees numerous regulations that refineries must follow, impacting operational costs and requiring substantial investment in pollution control technologies.

Established refiners like Delek US Holdings leverage extensive crude oil supply networks and refined product distribution channels, including those managed by Delek Logistics. This existing infrastructure represents a substantial hurdle for any potential new entrant seeking to establish a comparable operational footprint.

Brand Loyalty and Market Share in Retail

While the capital investment for convenience store operations is less demanding than for refining, building strong brand loyalty and securing substantial market share, as Delek has achieved with its MAPCO brand, necessitates significant marketing investment and astute site selection. The U.S. convenience store landscape is highly competitive, boasting over 152,000 locations as of 2024, making it an uphill battle for newcomers to carve out a meaningful presence.

New entrants face the challenge of overcoming established brands with loyal customer bases.

- Brand Recognition: Delek's MAPCO brand benefits from years of marketing and customer engagement, creating a hurdle for new, unproven brands.

- Market Saturation: With over 152,000 convenience stores in the U.S. in 2024, the sheer volume of existing players limits opportunities for new entrants to gain visibility.

- Capital for Marketing: Significant capital is required for effective advertising and promotional campaigns to compete with established brands.

- Strategic Location: Prime real estate is crucial, and securing desirable locations can be difficult and costly for new businesses.

Technological Expertise and Operational Complexity

The energy sector, particularly refining and logistics, demands significant technological know-how. Delek US Holdings, for instance, operates complex refining facilities that require specialized knowledge in chemical processes and equipment maintenance. This high barrier to entry means new companies must invest heavily in technology and skilled personnel to even begin competing.

Operational complexity further deters new entrants. Managing a diverse portfolio of assets, from refineries to pipelines and retail stations, involves intricate supply chain management and regulatory compliance. For example, Delek's 2023 annual report highlights ongoing capital expenditures for refinery upgrades and efficiency improvements, underscoring the continuous technological investment needed.

- High Capital Investment: Establishing modern refining capacity and logistics infrastructure requires billions of dollars.

- Skilled Workforce Demands: Operating complex energy infrastructure necessitates a highly trained and specialized workforce.

- Regulatory Hurdles: Navigating stringent environmental and safety regulations adds significant complexity and cost for new players.

- Technological Obsolescence Risk: Continuous investment in upgrading and maintaining advanced technology is crucial to remain competitive.

The threat of new entrants for Delek US Holdings is relatively low, primarily due to the immense capital required to build and operate refineries, a sector where Delek primarily operates. The sheer scale of investment, often in the billions, acts as a formidable barrier, deterring most potential newcomers from entering the market. Furthermore, established players benefit from existing supply chains and distribution networks, making it difficult for new entrants to achieve comparable operational efficiency and market reach.

| Barrier to Entry | Description | Impact on New Entrants |

|---|---|---|

| Capital Intensity | Refinery construction and upgrades cost billions. Delek's 2023 capital expenditures highlight ongoing investment needs. | Extremely high financial hurdle, limiting the number of potential entrants. |

| Regulatory Environment | Strict environmental and safety regulations require significant compliance investment. The EPA oversees numerous standards. | Adds substantial cost and complexity, requiring specialized expertise. |

| Established Infrastructure | Delek possesses established crude oil supply and product distribution networks, including through Delek Logistics. | New entrants struggle to match the logistical advantages and cost efficiencies of established firms. |

| Technological Expertise | Operating complex refining processes demands specialized knowledge and continuous technological upgrades. | Requires significant investment in R&D, technology, and skilled personnel. |

Porter's Five Forces Analysis Data Sources

Our Porter's Five Forces analysis for Delek US Holdings is built upon a foundation of publicly available information. This includes Delek's annual and quarterly reports (10-K and 10-Q filings), investor presentations, and press releases. We also incorporate data from industry-specific publications and market research reports to gain a comprehensive understanding of the refining and marketing sector.