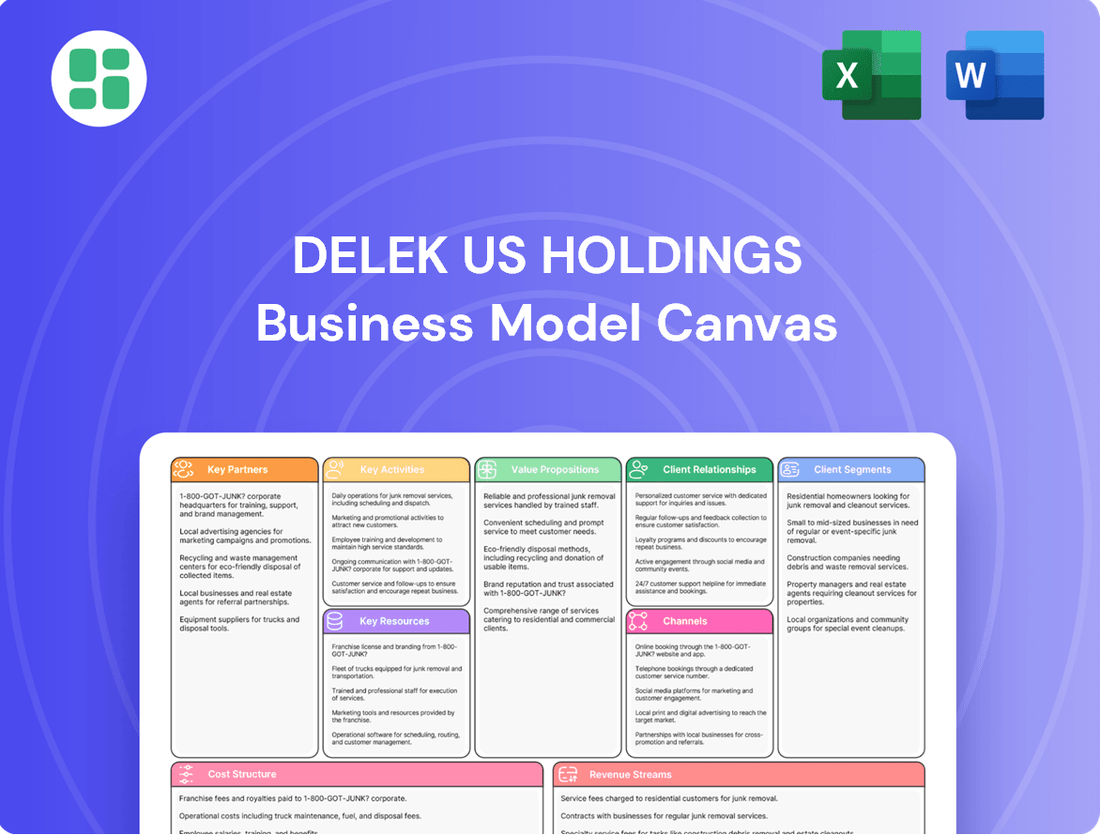

Delek US Holdings Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Delek US Holdings Bundle

Unlock the strategic blueprint behind Delek US Holdings's business model. This comprehensive Business Model Canvas reveals their key partners, value propositions, and revenue streams, offering a clear view of their operational success.

Dive deeper into Delek US Holdings’s real-world strategy with the complete Business Model Canvas. From customer relationships to cost structure, this downloadable file offers a clear, professionally written snapshot of what makes this company thrive—and where its opportunities lie.

See how the pieces fit together in Delek US Holdings’s business model. This detailed, editable canvas highlights the company’s customer segments, key partnerships, revenue strategies, and more. Download the full version to accelerate your own business thinking.

Partnerships

Delek US Holdings cultivates key partnerships with crude oil suppliers to ensure a steady flow of feedstock for its refineries. These relationships are vital for maintaining operational efficiency and managing costs. For instance, in 2023, Delek US's refined product sales volume averaged 271,300 barrels per day, underscoring the need for consistent crude oil procurement.

Delek US Holdings relies heavily on a network of logistics and transportation providers to keep its operations running smoothly. This includes partnerships with pipeline operators to bring crude oil to their refineries and shipping companies and trucking firms to move refined products and asphalt to market. For example, in 2024, Delek US continued to leverage these relationships to ensure timely delivery of its diverse product portfolio.

Delek US Holdings relies on key partnerships with technology and equipment vendors to maintain its competitive edge in the refining and retail sectors. These collaborations are crucial for modernizing operations, which demand sophisticated technology and specialized machinery. For instance, in 2024, Delek continued to invest in refinery upgrades, process optimization, and environmental compliance technologies, often through strategic alliances with leading tech providers.

These partnerships extend to equipment manufacturers, ensuring access to reliable components for both routine maintenance and new installations. Such relationships are vital for operational efficiency, upholding stringent safety protocols, and meeting evolving industry standards. Delek's commitment to these vendor relationships underscores its focus on long-term operational excellence and regulatory adherence.

Asphalt Distributors and Construction Companies

Delek US Holdings cultivates vital relationships with major asphalt distributors and a wide array of construction firms, particularly those engaged in road construction and broader infrastructure development. These partnerships are fundamental to ensuring their asphalt products reach a diverse customer base and for securing significant contracts for large-scale projects. This network directly translates into consistent demand for Delek's asphalt output.

These collaborations are not merely transactional; they represent strategic alliances that underpin Delek's asphalt segment. For instance, in 2024, infrastructure spending in the United States has shown robust growth, with the Bipartisan Infrastructure Law continuing to drive project opportunities. Delek's ability to leverage its partnerships with construction companies allows it to tap into this expanding market effectively.

- Distribution Network: Partnerships with asphalt distributors are key to reaching numerous end-users across various geographic regions.

- Project Access: Collaborations with construction companies provide Delek with access to large-volume, long-term projects, ensuring predictable sales.

- Market Stability: These relationships help stabilize demand for Delek's asphalt products, even amidst fluctuating market conditions.

- Infrastructure Focus: Delek's asphalt business is closely tied to infrastructure spending trends, making these partnerships critical for growth.

MAPCO Product and Service Vendors

MAPCO, Delek US Holdings' convenience store segment, relies on a broad network of product and service vendors to stock its shelves and operate efficiently. These partnerships are crucial for providing the diverse merchandise, fresh food, and beverages that customers expect. For instance, in 2024, MAPCO continued to solidify relationships with major packaged goods suppliers, ensuring a consistent flow of popular brands.

Beyond basic merchandise, MAPCO's vendor relationships extend to critical operational areas. This includes securing agreements with fresh food suppliers to offer ready-to-eat meals and snacks, as well as coffee providers to maintain a robust beverage program. Furthermore, technology vendors are vital for implementing and upgrading point-of-sale systems and customer loyalty platforms, directly impacting the in-store experience and driving repeat business.

- Merchandise Suppliers: Partnerships with national and regional distributors for packaged goods, snacks, and beverages.

- Food Service Vendors: Collaborations with suppliers for fresh ingredients, prepared foods, and proprietary menu items.

- Beverage Partners: Agreements with coffee, fountain drink, and bottled beverage companies.

- Technology Providers: Engagement with companies offering point-of-sale (POS) systems, payment processing, and customer relationship management (CRM) software.

Delek US Holdings’ key partnerships are foundational to its operational success, particularly in securing crude oil and distributing refined products. These relationships ensure a consistent supply chain and market access, vital for maintaining profitability. In 2023, Delek US reported refined product sales volume of 271,300 barrels per day, highlighting the scale of these critical collaborations.

The company also leverages strategic alliances with technology and equipment vendors to enhance refinery efficiency and competitiveness. These partnerships are crucial for modernization and compliance efforts. In 2024, Delek continued to invest in process optimization and environmental technologies, often through these vital vendor relationships.

Furthermore, Delek's asphalt segment thrives on strong ties with asphalt distributors and construction firms. These collaborations grant access to major infrastructure projects, such as those bolstered by the Bipartisan Infrastructure Law in 2024, ensuring robust demand for their asphalt products.

| Key Partnership Area | Description | Impact/Example |

| Crude Oil Suppliers | Securing feedstock for refineries | Ensures operational efficiency and cost management; 271,300 bpd refined product sales in 2023 |

| Logistics & Transportation | Pipeline operators, shipping, trucking | Facilitates movement of crude oil and refined products; crucial for timely delivery in 2024 |

| Technology & Equipment Vendors | Modernization and process optimization | Drives competitive edge and compliance; investments in upgrades in 2024 |

| Asphalt Distributors & Construction Firms | Market access and project acquisition | Secures large-volume contracts; taps into infrastructure spending growth in 2024 |

What is included in the product

This Delek US Holdings Business Model Canvas provides a strategic overview of their operations, focusing on refining, marketing, and transportation of petroleum products, and highlights key partnerships and cost structures.

It delves into customer segments like retail consumers and industrial clients, outlining value propositions such as reliable fuel supply and efficient logistics, all within a framework designed for investor clarity.

Delek US Holdings' Business Model Canvas acts as a pain point reliever by providing a clear, one-page snapshot of their integrated refining, logistics, and retail operations, simplifying complex industry dynamics for stakeholders.

It offers a digestible format to quickly identify how Delek US alleviates pain points in the energy sector through efficient resource management and market access.

Activities

Delek US Holdings' core activity is the intricate process of transforming crude oil into essential refined products like gasoline, diesel, and jet fuel. This operation spans its strategically located refineries in Texas, Arkansas, and Louisiana, forming the backbone of its business.

Managing these complex refining processes requires a constant focus on optimizing yields to maximize output and ensuring that all products meet stringent quality standards and environmental regulations. Operational efficiency and an unwavering commitment to safety are paramount throughout these activities.

In 2024, Delek US Holdings processed approximately 300,000 barrels of crude oil per day across its refining system. The company reported that its refining segment generated a refining margin of $10.50 per barrel in the first quarter of 2024, demonstrating strong operational performance.

Delek US Holdings actively procures and trades crude oil, a critical activity for its refining operations. This involves sophisticated market analysis to identify advantageous purchasing opportunities and manage price volatility. In 2023, Delek US processed approximately 283,000 barrels of crude oil per day across its refineries, highlighting the scale of its acquisition needs.

The company’s trading strategy focuses on securing reliable feedstock at competitive prices, often through long-term supply contracts. This strategic procurement is essential for maintaining efficient refinery operations and managing inventory levels effectively. Delek US aims to optimize its crude oil slate to maximize profitability and respond to changing market dynamics.

Delek US Holdings, through its master limited partnership Delek Logistics Partners (DKL), actively manages a robust network of pipelines, terminals, and transportation assets. This infrastructure is crucial for gathering crude oil, moving it, storing it, and finally delivering refined products and natural gas liquids to market.

These operations are central to Delek's integrated value chain, ensuring efficient movement of resources. In 2023, Delek Logistics reported total revenues of $1.02 billion, with its logistics segment contributing significantly to the company's overall financial performance by generating steady, fee-based cash flows from third-party customers.

Asphalt Production and Sales

Delek US Holdings actively engages in the production and sale of asphalt, a critical material for the construction and maintenance of roads and other infrastructure. This core activity leverages their refining capabilities to transform crude oil into high-quality asphalt products.

The company manages intricate manufacturing processes within its refineries to ensure consistent asphalt quality, meeting stringent industry standards. Simultaneously, Delek US cultivates robust distribution networks to effectively reach a wide array of customers, encompassing government agencies and private construction companies undertaking significant projects.

In 2023, Delek US reported that its Asphalt business segment generated approximately $686 million in revenue, showcasing its significant contribution to the company's overall financial performance. This segment's success is tied to the demand for infrastructure development and repair, which remained a priority in many regions.

- Asphalt Production: Delek US operates specialized refining units to produce various grades of asphalt, essential for paving and construction.

- Sales and Distribution: The company distributes asphalt through terminals and direct sales to government entities and private construction firms, ensuring timely delivery for projects.

- Market Demand: Asphalt sales are closely linked to infrastructure spending and seasonal construction activity, with demand typically increasing during warmer months.

- Revenue Contribution: In 2023, the Asphalt segment was a notable revenue generator for Delek US, highlighting its importance within the company's portfolio.

Convenience Store Retailing

Delek US Holdings' convenience store retailing, primarily through its MAPCO brand, focuses on the day-to-day management of over 300 locations. This involves ensuring efficient inventory turnover, particularly for high-demand items like fuel and fresh food, and optimizing the in-store experience. Key activities include strategic merchandising to maximize sales per square foot and the continuous enhancement of customer service to foster loyalty.

The operational scope encompasses managing fuel sales, which are a significant revenue driver, alongside a diverse range of convenience items. This requires robust supply chain management and adherence to quality standards. Delek US Holdings also actively engages in marketing initiatives and the development of loyalty programs to attract and retain customers. In 2024, Delek US Holdings reported that its retail segment, which includes MAPCO convenience stores, generated approximately $1.5 billion in revenue, highlighting the segment's substantial contribution to the company's overall performance.

- Fuel Sales Management: Overseeing the procurement, pricing, and dispensing of motor fuels across the MAPCO network.

- Merchandising and Inventory: Strategically stocking and displaying a wide array of products, from snacks and beverages to essential household items, while managing stock levels to minimize waste and maximize availability.

- Customer Experience Enhancement: Implementing customer service standards, loyalty programs, and in-store promotions to drive repeat business and positive brand perception.

- Network Operations: Maintaining and optimizing the physical footprint of convenience stores, ensuring accessibility and operational efficiency for consumers.

Delek US Holdings' primary activities revolve around refining crude oil into valuable products, managing a logistics network, producing and selling asphalt, and operating convenience stores. These operations are interconnected, supporting an integrated value chain.

The company's refining segment processed approximately 300,000 barrels of crude oil per day in 2024, achieving a refining margin of $10.50 per barrel in Q1 2024. Its logistics segment, managed through Delek Logistics Partners, generated $1.02 billion in revenue in 2023, providing essential infrastructure services.

The asphalt business contributed significantly, with revenues of approximately $686 million in 2023, driven by infrastructure demand. Furthermore, the retail segment, primarily MAPCO convenience stores, reported around $1.5 billion in revenue in 2024, underscoring its substantial market presence.

| Activity | Key Operations | 2023/2024 Data Points |

|---|---|---|

| Refining | Crude oil processing, yield optimization, product quality | ~300,000 bpd processed (2024); $10.50/bbl refining margin (Q1 2024) |

| Logistics | Pipeline, terminal, and transportation asset management | $1.02 billion in revenue (2023) |

| Asphalt Production & Sales | Manufacturing and distribution of asphalt products | ~$686 million in revenue (2023) |

| Convenience Retailing (MAPCO) | Fuel sales, merchandise, customer service | ~$1.5 billion in revenue (2024) |

Full Version Awaits

Business Model Canvas

The Delek US Holdings Business Model Canvas preview you are viewing is the exact document you will receive upon purchase. This means you're seeing a direct representation of the comprehensive analysis that details Delek's core business operations, customer segments, value propositions, revenue streams, and key resources. Upon completing your purchase, you will gain full access to this entire, ready-to-use Business Model Canvas, ensuring no surprises and immediate utility for your strategic planning.

Resources

Delek US Holdings' refining infrastructure comprises four strategically located refineries: Tyler and Big Spring in Texas, El Dorado in Arkansas, and Krotz Springs in Louisiana. These facilities are the backbone of its petroleum refining operations.

Collectively, these refineries possess a crude oil throughput capacity of 302,000 barrels per day. This physical asset base is crucial for transforming crude oil into a range of refined petroleum products, forming the core of Delek's business.

Delek US Holdings' key resources in logistics and midstream assets are primarily managed through Delek Logistics Partners. These include a robust network of pipelines, crude oil gathering systems, and storage terminals that are crucial for the efficient movement of crude oil and refined products.

These physical assets, such as their extensive pipeline network and strategically located storage terminals, enable Delek US to transport and store significant volumes of hydrocarbons. For instance, as of the end of 2023, Delek Logistics Partners operated approximately 1,200 miles of pipelines and 6.7 million barrels of storage capacity, showcasing the scale of these essential resources.

The transportation fleets further enhance the company's ability to serve both its internal refining operations and a diverse base of third-party customers. This integrated infrastructure is vital for maintaining competitive advantage and ensuring reliable supply chain operations in the energy sector.

The MAPCO convenience store network, a cornerstone of Delek US Holdings, functions as a vital direct-to-consumer channel. This extensive network, predominantly located in the Southeastern United States, facilitates robust sales of both fuel and a diverse range of merchandise. As of the first quarter of 2024, Delek US Holdings operated approximately 330 MAPCO convenience stores, highlighting its significant retail presence.

Skilled Workforce and Management Expertise

Delek US Holdings relies heavily on its human capital, encompassing experienced engineers, skilled refinery operators, logistics specialists, and adept trading professionals. This expertise is fundamental to achieving operational excellence and making sound strategic decisions across its diverse business segments.

The company's management teams, particularly within its retail operations, are vital for driving efficiency and customer satisfaction. Their collective knowledge fuels continuous improvement initiatives throughout the organization.

- Human Capital: Delek US Holdings employs a workforce with deep industry knowledge, including specialized roles in refining, logistics, and retail management.

- Operational Excellence: The expertise of its engineers and operators directly impacts the efficiency and reliability of its refining and logistics operations.

- Strategic Decision-Making: Experienced management and trading teams are crucial for navigating market volatility and making profitable strategic choices.

- Continuous Improvement: The collective know-how of its employees fosters a culture of ongoing enhancement in all business areas.

Financial Capital and Market Access

Delek US Holdings leverages its robust financial capital and market access to fuel its operations and growth. This includes maintaining significant cash reserves, securing diverse credit facilities, and demonstrating a consistent ability to raise capital in the financial markets. For instance, as of the first quarter of 2024, Delek US reported total liquidity of approximately $1.4 billion, comprising cash and cash equivalents along with available borrowing capacity under its credit facilities. This financial strength is crucial for funding planned capital expenditures, which in 2024 were projected to be between $300 million and $350 million, primarily focused on sustaining and growth projects.

The company's access to financial markets enables it to pursue strategic investments and effectively manage its liquidity, even amidst market volatility. This capability is vital for acquisitions and for ensuring operational continuity. Delek US’s strong balance sheet and proven track record in capital markets provide the foundation for these strategic maneuvers, allowing for agile responses to market opportunities and challenges.

- Access to Financial Markets Delek US maintains strong relationships with financial institutions, facilitating access to credit facilities and capital raising opportunities.

- Cash Reserves and Liquidity The company prioritizes maintaining healthy cash reserves and liquidity to ensure operational flexibility and meet short-term obligations. As of Q1 2024, total liquidity stood at approximately $1.4 billion.

- Funding Operations and Capital Expenditures Financial capital is essential for funding day-to-day operations and significant capital expenditures, such as the projected $300-350 million in 2024 for sustaining and growth projects.

- Strategic Investments and Market Volatility A strong financial position enables Delek US to make strategic investments and navigate periods of market volatility, ensuring long-term stability and growth.

Delek US Holdings' key resources are its physical refining assets, including four refineries with a combined crude oil throughput capacity of 302,000 barrels per day. Its logistics and midstream operations, managed through Delek Logistics Partners, feature approximately 1,200 miles of pipelines and 6.7 million barrels of storage capacity as of year-end 2023. The company also operates a retail network of about 330 MAPCO convenience stores as of Q1 2024. This extensive infrastructure is supported by skilled human capital and robust financial resources, including approximately $1.4 billion in total liquidity as of Q1 2024, enabling capital expenditures projected between $300 million and $350 million for 2024.

| Key Resource | Description | Capacity/Scale (as of latest available data) | Strategic Importance |

| Refining Infrastructure | Four refineries: Tyler & Big Spring (TX), El Dorado (AR), Krotz Springs (LA) | 302,000 bpd crude oil throughput | Core operations for transforming crude oil into refined products. |

| Logistics & Midstream | Pipelines, gathering systems, storage terminals (via Delek Logistics Partners) | ~1,200 miles of pipelines, 6.7 million bbls storage (end 2023) | Efficient movement and storage of crude oil and refined products, serving internal and third-party needs. |

| Retail Network | MAPCO convenience stores | ~330 stores (Q1 2024) | Direct-to-consumer channel for fuel and merchandise sales, enhancing market reach. |

| Human Capital | Skilled workforce in refining, logistics, and retail | N/A | Drives operational excellence, strategic decision-making, and continuous improvement. |

| Financial Capital | Cash reserves, credit facilities, market access | ~$1.4 billion total liquidity (Q1 2024) | Funds operations, capital expenditures (FY24 est. $300-350M), and strategic investments. |

Value Propositions

Delek US Holdings ensures a steady and dependable flow of refined fuels, including gasoline, diesel, and jet fuel, to a wide array of markets. This consistent supply is absolutely vital for sectors like transportation, industry, and commerce, all of which rely on uninterrupted access to energy resources to maintain operations.

In 2024, Delek US demonstrated this reliability through its robust refining operations. For instance, its El Dorado refinery typically processes around 75,000 barrels per day, contributing significantly to the regional supply of these essential products.

Delek US Holdings provides premium asphalt, a critical component for building and maintaining our nation's roads and infrastructure. This ensures projects are built to last.

Governmental bodies and construction firms rely on Delek's asphalt for its durability and consistent quality. For instance, in 2023, Delek's asphalt segment played a crucial role in numerous infrastructure projects across the United States, contributing to the repair and construction of thousands of miles of roadways.

Delek US Holdings, through its MAPCO brand, offers convenient fuel and retail access, providing customers with a one-stop shop for their immediate needs. In 2024, MAPCO's extensive network of locations across the southeastern United States ensures high accessibility for both travelers and local residents.

This convenience translates into a 'Better Break' experience, allowing consumers to quickly refuel their vehicles and purchase a wide array of products, including fresh food and beverages. This focus on immediate gratification and time-saving solutions is a key driver of customer loyalty and repeat business.

Integrated Energy Solutions

Delek US Holdings offers integrated energy solutions by combining refining, logistics, and retail operations. This synergy allows for efficient crude oil processing and product distribution, creating a streamlined value chain.

This integrated model enhances operational efficiency and provides a more cohesive experience for their commercial clients. For instance, Delek's logistics segment, primarily through its ownership in Delek Logistics Partners (DKL), plays a crucial role in transporting crude oil to its refineries and finished products to market.

In 2024, Delek US continued to leverage this integration. The company’s refining segment processed approximately 310,000 barrels per day on average during the first quarter of 2024, showcasing the scale of their operations. This integrated approach aims to capture value across the entire energy supply chain.

The benefits of this integrated approach are evident in:

- Supply Chain Optimization: Connecting refining, transportation, and marketing reduces bottlenecks and improves overall throughput.

- Enhanced Efficiency: Internal logistics support for refineries lowers transportation costs and ensures reliable feedstock supply.

- Customer Value: Large commercial clients benefit from a single, reliable partner managing multiple stages of the energy product lifecycle.

- Market Responsiveness: The integrated model allows for quicker adaptation to market demands and price fluctuations.

Operational Efficiency and Cost Management

Delek US Holdings prioritizes operational efficiency and cost management to benefit both its business-to-business clients and its internal operations. This focus allows for more competitive pricing and a stronger bottom line.

The company's strategic initiatives, such as the Enterprise Optimization Plan, are designed to yield substantial cash flow enhancements by streamlining processes across all its business segments. For instance, in 2023, Delek US reported significant progress in its operational efficiency, contributing to improved financial performance.

- Optimized Refining Processes: Delek US continually refines its refining operations to maximize yield and minimize waste, directly impacting cost structures.

- Supply Chain Enhancements: Improvements in logistics and procurement reduce input costs and ensure reliable feedstock supply.

- Technological Integration: Adoption of advanced technologies aids in process control and predictive maintenance, lowering operational expenditures.

- Synergies from Acquisitions: Integrating acquired assets effectively unlocks cost-saving opportunities and operational efficiencies.

Delek US Holdings provides essential refined fuels and asphalt, underpinning critical sectors like transportation and infrastructure development. Its MAPCO brand offers convenient retail fuel and convenience store access, serving daily consumer needs. The company's integrated model, combining refining, logistics, and retail, optimizes the energy value chain for efficiency and market responsiveness.

Delek US Holdings delivers operational efficiency and cost management, translating into competitive pricing and enhanced value for its diverse customer base. This focus on streamlining processes across refining, logistics, and retail ensures reliable product delivery and cost-effective operations.

In 2024, Delek US continued to demonstrate its value proposition through consistent operational performance and strategic integration. The company's commitment to optimizing its refining processes and supply chain enhancements directly contributes to its ability to offer competitive pricing and maintain strong financial performance.

| Value Proposition | Description | 2024 Relevance |

|---|---|---|

| Reliable Fuel & Asphalt Supply | Consistent provision of gasoline, diesel, jet fuel, and premium asphalt for transportation, industry, and infrastructure. | El Dorado refinery processing ~75,000 bpd; asphalt used in numerous infrastructure projects. |

| Convenient Retail Access | MAPCO brand offers accessible fuel and a wide range of convenience products, providing a one-stop shop. | Extensive MAPCO network across the southeastern US ensures high accessibility for consumers. |

| Integrated Energy Solutions | Synergy across refining, logistics (DKL), and retail creates a streamlined value chain for efficient operations. | Average refining throughput of ~310,000 bpd in Q1 2024 highlights operational scale. |

| Operational Efficiency & Cost Management | Focus on process optimization and cost reduction benefits clients through competitive pricing and strengthens the company's financial standing. | Enterprise Optimization Plan yielding cash flow enhancements; significant progress in operational efficiency reported in 2023. |

Customer Relationships

For MAPCO convenience store customers, relationships are primarily transactional and self-service, emphasizing quick and convenient experiences at the pump and within the store. This approach caters to the on-the-go nature of their customer base, prioritizing efficiency.

Delek US Holdings enhances customer engagement through its MYReward$ loyalty program. This program offers tangible benefits such as discounts and tailored promotions, effectively driving repeat business and fostering a stronger connection with their retail customers.

In 2023, Delek US Holdings reported that its retail segment, which includes MAPCO, saw a significant increase in fuel gallons sold, indicating robust customer traffic and a positive reception to their convenience offerings. The MYReward$ program is a key driver in this growth, with a substantial percentage of fuel transactions attributed to loyalty members.

Delek US Holdings provides dedicated account management for its large wholesale customers of refined products and asphalt. This ensures personalized service and builds strong, trust-based relationships.

These relationships are often solidified through long-term contracts, offering stability and predictability for both Delek and its wholesale partners. For example, in 2024, Delek continued to focus on securing these types of agreements to support its refining segment.

The account management teams work closely with customers to understand their specific volume and delivery needs. This customized approach is key to meeting the diverse operational requirements of the wholesale market, fostering loyalty and repeat business.

Delek US Holdings prioritizes strong community ties, particularly through its MAPCO retail brand. This commitment is evident in their local involvement and dedication to responsible business operations within the communities they serve. For instance, in 2024, MAPCO continued its focus on supporting local initiatives, which directly contributes to building brand loyalty and strengthening its appeal in those areas.

Supplier and Partner Collaboration

Delek US Holdings (DK) prioritizes robust supplier and partner collaboration, recognizing its critical role in operational stability. In 2024, maintaining these relationships is paramount, especially with crude oil suppliers and logistics providers, ensuring a consistent flow of raw materials and efficient product distribution. These collaborations are typically long-term, built on mutual trust and a shared objective of optimizing the supply chain.

These partnerships extend to technology vendors, crucial for adopting and integrating advanced systems that enhance refinery efficiency and safety. For instance, Delek’s commitment to operational excellence in 2024 involves working closely with partners to implement cutting-edge process control software and predictive maintenance solutions. This collaborative approach fosters innovation and problem-solving, directly impacting cost management and throughput.

- Supplier Reliability: Delek US Holdings relies on a diverse base of crude oil suppliers to mitigate supply disruptions and secure favorable pricing.

- Logistics Efficiency: Strong relationships with pipeline operators, trucking companies, and marine transporters are essential for cost-effective and timely movement of crude oil and refined products.

- Technology Integration: Collaboration with technology providers ensures Delek stays at the forefront of refinery optimization, safety enhancements, and environmental compliance.

- Strategic Alignment: These partnerships are often structured around shared goals, such as improving yield, reducing emissions, and enhancing overall market responsiveness.

Investor Relations and Transparency

Delek US Holdings prioritizes a strong connection with its varied investor community, encompassing both large institutions and individual shareholders. This is achieved through consistent financial updates, quarterly earnings calls, and detailed investor presentations. Transparency in communicating financial results and outlining strategic plans is a cornerstone of their approach.

In 2024, Delek US continued to emphasize open communication. For instance, their investor relations efforts included regular webcasts of earnings calls, providing direct access to management for questions. They also published comprehensive annual and quarterly reports detailing operational performance and financial health.

- Investor Outreach: Delek US engages with institutional investors, mutual funds, and individual shareholders through various channels.

- Financial Reporting: Regular dissemination of financial statements, earnings releases, and investor-specific presentations.

- Strategic Transparency: Clear communication of the company's business strategy, operational updates, and outlook.

- Accessibility: Making management available through earnings calls and investor conferences to address stakeholder inquiries.

Delek US Holdings cultivates distinct customer relationships across its business segments. For its retail customers via MAPCO, relationships are largely self-service and transactional, enhanced by the MYReward$ loyalty program which drives repeat purchases through discounts and promotions. In 2023, MAPCO saw increased fuel gallons sold, with loyalty members contributing significantly to this growth. For wholesale customers of refined products and asphalt, Delek provides dedicated account management, building trust through personalized service and long-term contracts. This tailored approach ensures specific volume and delivery needs are met, fostering strong partnerships.

| Customer Segment | Relationship Type | Key Engagement Strategies | 2023/2024 Data Point |

|---|---|---|---|

| MAPCO Retail Customers | Transactional, Self-Service, Loyalty Program | MYReward$ loyalty program, convenience, promotions | Increased fuel gallons sold in 2023; loyalty members a significant driver. |

| Wholesale Customers (Refined Products, Asphalt) | Dedicated Account Management, Long-Term Contracts | Personalized service, understanding specific needs, reliability | Focus on securing long-term agreements in 2024 for segment stability. |

Channels

Delek US Holdings relies on a robust wholesale distribution network to move its refined petroleum products. This channel serves a broad customer base, including large distributors, airlines, and other entities that purchase in bulk. In 2024, Delek US continued to leverage its extensive logistics infrastructure, including pipelines and terminals, to efficiently deliver gasoline, diesel, and jet fuel to these wholesale clients.

MAPCO branded convenience stores serve as Delek US Holdings' primary retail channel, offering direct access to consumers for gasoline, diesel, and a diverse range of merchandise. In 2024, Delek US Holdings continued to leverage this extensive network, which is crucial for capturing end-consumer demand and driving significant retail fuel volumes.

Delek US Holdings directly sells its asphalt products to key clients, including construction firms, government entities, and road-building contractors. This direct approach facilitates customized solutions and allows for price negotiation on substantial projects.

In 2023, Delek’s refining segment, which includes asphalt production, generated approximately $1.2 billion in revenue, showcasing the significance of these direct sales channels for large-scale infrastructure development.

Pipelines and Terminals (Delek Logistics)

Delek Logistics Partners' pipelines and terminals are essential for moving and storing crude oil and refined products, benefiting both Delek US and other companies. This network is key for a smooth supply chain. In 2024, Delek Logistics reported significant volumes, with its Delaware Basin assets alone handling substantial throughput, underscoring the operational scale of these channels.

The infrastructure provides reliable and cost-effective transportation solutions, directly impacting the profitability of refined product sales and crude oil sourcing. These assets are crucial for Delek US's refining operations, ensuring consistent feedstock delivery and product distribution. For instance, the company's ownership in various pipeline systems and terminal facilities across key regions supports its integrated business model.

- Critical Infrastructure: Pipelines and terminals facilitate the movement and storage of crude oil and refined products.

- Supply Chain Backbone: This network ensures efficient and reliable logistics for Delek US and third-party clients.

- Operational Scale: In 2024, Delek Logistics managed significant throughput volumes across its extensive network.

- Economic Impact: These assets contribute to cost-effectiveness and profitability by ensuring feedstock supply and product distribution.

Digital Platforms and Online Presence

Delek US Holdings utilizes digital platforms to enhance its investor relations and corporate communications. Their website and dedicated investor portals act as crucial hubs for sharing financial reports, press releases, and other essential company information with stakeholders.

Beyond investor outreach, Delek US may employ these digital channels for business-to-business interactions. This could include facilitating B2B order management, providing access to product information, or streamlining communication with their commercial partners.

- Website Functionality: Delek US's corporate website serves as a primary digital touchpoint, offering comprehensive information on their operations, financial performance, and strategic initiatives.

- Investor Relations Portal: A dedicated investor portal provides easy access to SEC filings, earnings call transcripts, and investor presentations, facilitating transparency and engagement.

- Digital Communication Strategy: The company leverages digital platforms to disseminate news and updates efficiently, ensuring stakeholders are informed about key developments.

Delek US Holdings utilizes a multi-faceted channel strategy, encompassing wholesale distribution, its MAPCO retail network, direct asphalt sales, and extensive logistics infrastructure managed by Delek Logistics Partners. Digital platforms also play a key role in investor relations and potential B2B interactions.

The wholesale channel moves refined products to large distributors and other bulk purchasers, leveraging Delek's logistics. MAPCO stores provide direct consumer access for fuel and merchandise. Direct sales of asphalt target construction and government clients, with 2023 asphalt revenue reaching approximately $1.2 billion.

Delek Logistics Partners' pipelines and terminals are vital for crude oil and refined product movement and storage, supporting both Delek US and third parties. In 2024, these assets handled substantial throughput, underscoring their operational importance for cost-effective supply chain management.

| Channel | Description | Key 2024/2023 Data Points |

| Wholesale Distribution | Bulk sales of refined products (gasoline, diesel, jet fuel) to distributors, airlines, etc. | Leveraging extensive logistics infrastructure (pipelines, terminals) for efficient delivery. |

| MAPCO Retail | Direct sales to consumers at branded convenience stores, offering fuel and merchandise. | Crucial for capturing end-consumer demand and driving retail fuel volumes. |

| Direct Asphalt Sales | Selling asphalt products directly to construction firms, government entities, and contractors. | In 2023, the refining segment, including asphalt, generated ~$1.2 billion in revenue. |

| Delek Logistics Partners (Pipelines & Terminals) | Infrastructure for moving and storing crude oil and refined products for Delek US and third parties. | Managed significant throughput volumes in 2024; ensures feedstock delivery and product distribution. |

| Digital Platforms | Investor relations (website, portals) and potential B2B interactions (order management, partner communication). | Primary digital touchpoint for financial reports, press releases, and stakeholder engagement. |

Customer Segments

Wholesale fuel distributors and marketers are a cornerstone customer segment for Delek US Holdings. These are substantial entities that acquire refined fuels in large quantities directly from Delek, acting as intermediaries to supply a wide array of end-users. Their operational needs are centered on securing a steady and predictable flow of products, alongside pricing that allows them to remain competitive in their own markets.

Reliability in logistics is paramount for these distributors, as any disruption in supply can significantly impact their downstream customer relationships and profitability. In 2024, Delek US continued to leverage its integrated refining and logistics network to meet the demands of this segment, ensuring timely deliveries and consistent product availability across its operational footprint.

Airlines and large trucking companies are crucial customers for Delek US Holdings, primarily purchasing jet fuel and diesel. These sectors represent high-volume demand, with airlines alone consuming a significant portion of global aviation fuel. For instance, in 2023, global airline passenger traffic reached approximately 94% of pre-pandemic levels, indicating a substantial and recovering need for jet fuel.

The consistent and reliable supply of these fuels is paramount for transportation providers to maintain operational efficiency. Delek's ability to ensure uninterrupted delivery of jet fuel to airports and diesel to trucking depots directly impacts their ability to serve their own customer bases. This reliability is a key factor in securing long-term contracts within this segment.

Construction and infrastructure companies are key customers for Delek US Holdings, primarily purchasing asphalt products. These materials are essential for a wide range of projects, from building new roads and highways to maintaining existing infrastructure and undertaking specialized paving work. Their demand is driven by government spending on infrastructure and private development initiatives.

These clients prioritize consistent quality and dependable delivery to ensure their construction projects stay on schedule and within budget. For example, in 2024, infrastructure spending in the US saw continued growth, fueled by initiatives like the Bipartisan Infrastructure Law, creating a robust market for asphalt suppliers like Delek.

General Consumers (MAPCO Customers)

General consumers, primarily visiting MAPCO convenience stores, form a substantial and varied customer segment for Delek US Holdings. These individuals seek quick access to fuel, snacks, beverages, and various convenience products for their daily needs. Their purchasing decisions are heavily influenced by the availability of these items, competitive pricing, and the overall shopping environment.

In 2024, MAPCO stores continued to serve millions of customers seeking convenience. For instance, convenience stores nationwide reported average transaction values that reflect the everyday purchases of this segment. These consumers rely on MAPCO for immediate needs, making the store's location and product variety crucial to their loyalty.

- Convenience-Driven Purchases: Customers primarily visit MAPCO for immediate needs like fuel, snacks, and drinks, valuing speed and accessibility.

- Price Sensitivity: Competitive pricing on everyday items and fuel is a significant factor influencing consumer choices at MAPCO locations.

- Broad Demographic Appeal: MAPCO caters to a wide range of individuals, from commuters to local residents, all seeking a convenient retail experience.

- Impulse Buys: The store layout and product placement encourage impulse purchases of snacks, beverages, and other non-essential items.

Industrial and Commercial End-Users

Delek US Holdings serves a critical customer segment comprising industrial and commercial end-users. These businesses rely on specific refined fuels and lubricants to keep their operations running smoothly. Think of manufacturing plants needing specialized fuels for machinery, or agricultural operations requiring high-quality lubricants for tractors and harvesting equipment. Power generation facilities also fall into this category, often needing specific fuel grades for turbines and generators.

The demand from these sectors is substantial. For instance, in 2024, the industrial sector's energy consumption remained a significant driver for refined product demand. Agricultural businesses, particularly in the US, continued to require consistent supplies of diesel and other fuels for their extensive fleets. Power generation, especially with the ongoing need for reliable energy sources, also represents a stable demand base for refined products.

- Manufacturing: Requires fuels for production processes and lubricants for heavy machinery.

- Agriculture: Needs diesel fuel for farm equipment and specialized lubricants for optimal performance.

- Power Generation: Utilizes refined fuels as a primary energy source for electricity production.

Delek US Holdings serves a diverse customer base, including wholesale fuel distributors and marketers who are vital intermediaries for a broad range of end-users. Airlines and large trucking companies represent significant demand for jet fuel and diesel, respectively, with aviation fuel demand showing strong recovery in 2023, reaching 94% of pre-pandemic levels. Construction and infrastructure firms are key purchasers of asphalt products, with US infrastructure spending growth in 2024 bolstering this segment.

The company also caters to general consumers through its MAPCO convenience stores, offering fuel, snacks, and beverages, with millions of customers relying on these locations for everyday needs. Additionally, industrial and commercial end-users, such as manufacturing plants, agricultural operations, and power generation facilities, depend on Delek for specific refined fuels and lubricants to maintain their operations. The industrial sector's energy consumption remained a key demand driver in 2024.

| Customer Segment | Primary Products | Key Needs | 2023/2024 Relevance |

|---|---|---|---|

| Wholesale Distributors | Refined Fuels | Steady supply, competitive pricing | Core segment leveraging integrated logistics |

| Airlines & Trucking | Jet Fuel, Diesel | Reliable, uninterrupted delivery | Aviation fuel demand recovered significantly in 2023 |

| Construction | Asphalt | Consistent quality, on-time delivery | Infrastructure spending growth supported demand in 2024 |

| General Consumers (MAPCO) | Fuel, Convenience Items | Accessibility, variety, competitive pricing | Millions of customers served daily in 2024 |

| Industrial/Commercial | Specialty Fuels, Lubricants | Specific grades, operational reliability | Industrial sector energy consumption a key demand driver in 2024 |

Cost Structure

The most substantial expense for Delek US Holdings is the acquisition of crude oil and other essential feedstocks for its refining processes. These costs are inherently tied to the unpredictable nature of global energy markets, directly influencing the company's bottom line.

For instance, in the first quarter of 2024, Delek US reported that crude oil and refined product costs represented a significant portion of its cost of goods sold, highlighting the direct correlation between feedstock prices and operational expenses.

Delek US Holdings' operating expenses are heavily influenced by the costs of running its refineries. These include significant outlays for energy, such as natural gas and electricity, which are critical for powering the refining processes. In 2023, energy costs represented a substantial portion of their operational expenditures.

Chemicals and catalysts are also key cost drivers, essential for the chemical reactions that transform crude oil into refined products. Maintenance expenses, covering both routine upkeep and necessary repairs, are vital for ensuring refinery safety and efficiency. Labor costs for skilled refinery personnel form another significant component of these operating expenses.

Delek US Holdings actively pursues operational efficiency initiatives to mitigate these costs. For instance, in the first quarter of 2024, the company reported a focus on optimizing energy consumption and improving turnaround efficiency to manage its refining operating expenses more effectively.

Delek US Holdings' cost structure is significantly impacted by logistics and transportation expenses. These include the operational and maintenance costs for their pipelines, terminals, and transportation fleets. For instance, in 2023, Delek US reported that their cost of sales, which includes transportation and logistics, represented a substantial portion of their overall expenses.

These costs are further broken down into elements like fuel for their transportation assets, wages for drivers and operators, and the ongoing upkeep of their extensive infrastructure. Third-party logistics services also contribute to this category, adding to the overall financial commitment in moving their refined products and crude oil.

Convenience Store Inventory and Operations

The MAPCO segment of Delek US Holdings incurs significant costs related to its convenience store operations. These include the direct purchase of merchandise and food items, which form the core of its revenue stream. In 2024, Delek US Holdings reported that its retail segment, which includes MAPCO, generated approximately $4.5 billion in revenue, highlighting the substantial cost associated with acquiring this inventory.

Beyond inventory, operational expenses are substantial. This encompasses costs associated with store rental or ownership, ensuring the physical presence of its retail outlets. Utilities, such as electricity and water, are ongoing necessities for maintaining store functionality. Labor costs for store employees, covering wages and benefits, represent another major expenditure. For instance, in 2024, the average hourly wage for convenience store workers in the US was around $14-$16, a key factor in Delek's operational expenses.

- Merchandise and Food Purchases: The primary cost driver, directly tied to sales volume and product mix.

- Store Occupancy Costs: Includes rent or mortgage payments and property taxes for retail locations.

- Utilities: Essential services like electricity, gas, water, and waste disposal for store operations.

- Labor Expenses: Wages, salaries, and benefits for store staff, including cashiers, managers, and maintenance personnel.

- Marketing and Advertising: Costs incurred to attract customers and promote specific products or store initiatives.

- Facility Maintenance: Expenses for upkeep, repairs, and improvements to ensure a safe and appealing retail environment.

Capital Expenditures and Maintenance

Delek US Holdings (DK) faces substantial capital expenditures, particularly for refinery turnarounds, which are crucial for maintaining operational efficiency and safety. These planned maintenance events, along with upgrades and expansion projects, represent significant investments necessary for long-term reliability and growth. In 2024, the company continued to invest in these areas to ensure its assets remain competitive and compliant with evolving environmental standards.

The integrity of Delek's logistics infrastructure, including pipelines and terminals, also demands ongoing capital investment. Furthermore, maintaining and enhancing its retail store network requires consistent funding to support customer experience and operational performance. These expenditures are fundamental to Delek's strategy of operational excellence and market positioning.

- Refinery Turnarounds: Essential for safety, compliance, and efficiency, these are major capital outlays.

- Infrastructure Upgrades: Investments in logistics assets ensure reliable product movement and storage.

- Retail Network Investment: Capital allocated to retail stores aims to improve customer experience and drive sales.

- Growth Projects: Funding for expansion initiatives supports long-term strategic objectives.

Delek US Holdings' cost structure is dominated by the purchase of crude oil and other feedstocks, a variable expense directly tied to market fluctuations. Operating expenses for its refineries, including energy, chemicals, catalysts, labor, and maintenance, represent another significant cost category. Additionally, logistics and transportation costs for moving crude oil and refined products, along with the costs of merchandise and store operations for its MAPCO segment, are substantial components.

| Cost Category | Description | 2024 Data/Trend |

|---|---|---|

| Feedstocks | Acquisition of crude oil and other raw materials. | Primary cost driver, highly sensitive to global energy prices. Q1 2024 results showed this as a major part of cost of goods sold. |

| Refinery Operations | Energy, chemicals, catalysts, labor, maintenance. | Energy costs were substantial in 2023. Focus on energy efficiency in Q1 2024 to manage these expenses. |

| Logistics & Transportation | Pipeline, terminal, fleet operations, fuel, labor. | Significant portion of overall expenses in 2023. Includes fuel, wages, and infrastructure upkeep. |

| Retail Operations (MAPCO) | Merchandise, food, store occupancy, utilities, labor. | Retail segment revenue was approx. $4.5 billion in 2024. Average US convenience store worker wage around $14-$16/hour in 2024. |

Revenue Streams

Delek US Holdings' primary revenue stream is generated through the wholesale and retail sales of refined petroleum products. This includes gasoline, diesel fuel, and jet fuel, which are the direct outputs of their refining operations.

In 2024, Delek US Holdings reported that its refining segment, which encompasses these product sales, was a significant driver of its financial performance. For instance, during the first quarter of 2024, the company's refining segment generated substantial revenue, reflecting strong demand for these essential fuels.

Delek US Holdings generates revenue through the sale of asphalt products, catering to construction companies and infrastructure development. This specialized segment provides a distinct income source within their broader operations.

In 2023, Delek US Holdings reported total asphalt sales volumes of approximately 2.3 million tons. The company's focus on this niche market allows for targeted revenue generation, supporting its overall financial performance.

Delek US Holdings generates a significant portion of its retail income from selling fuel at its MAPCO convenience stores. This revenue stream encompasses both gasoline and diesel sold directly to individual customers.

In 2024, Delek US Holdings continued to see strong performance in its retail segment, with fuel sales forming the backbone of its convenience store operations. The company's strategic focus on optimizing fuel pricing and enhancing the customer experience at MAPCO locations directly contributed to robust sales volumes throughout the year.

Convenience Store Merchandise Sales

Beyond fuel, Delek US Holdings' MAPCO convenience stores generate substantial revenue from merchandise, food, and beverages. This diversification is crucial for bolstering retail segment earnings and providing a more stable income base.

In 2024, the convenience store segment is expected to continue its growth trajectory, with merchandise sales playing a vital role. This segment offers a consistent revenue stream that complements the more volatile fuel market.

- Merchandise Sales: Sales of snacks, drinks, tobacco, and general merchandise within MAPCO locations are a key component of revenue.

- Food and Beverage Offerings: The expansion of fresh food options and diverse beverage choices further drives customer spending.

- Revenue Diversification: This focus on non-fuel items helps insulate Delek US from fluctuations in gasoline and diesel prices, contributing to more predictable financial performance.

Logistics Services Fees

Delek Logistics Partners, a key component of Delek US Holdings' operations, generates revenue through a fee-based model for its logistics services. These services include the gathering, transportation, and storage of crude oil. This structure provides a degree of stability and predictability to its revenue streams, as fees are typically tied to volume and service utilization rather than commodity price fluctuations.

The fee-based nature of these logistics services is a significant advantage. It insulates a portion of Delek's revenue from the volatility inherent in the oil and gas markets. This allows for more consistent cash flow, which is crucial for operational planning and investment decisions.

- Fee-Based Revenue: Primarily generated from crude oil gathering, transportation, and storage services.

- Customer Base: Services provided to both Delek US and external third-party customers.

- Revenue Stability: The fee structure offers predictable income, less susceptible to commodity price swings.

- Operational Focus: Supports Delek US's refining and marketing operations by ensuring efficient movement and storage of crude oil.

Delek US Holdings' revenue streams are diverse, anchored by the wholesale and retail sale of refined petroleum products like gasoline and diesel. Their refining segment, a major revenue driver, saw strong performance in early 2024 due to robust fuel demand.

Additionally, Delek US generates income from asphalt sales, serving the construction industry, with approximately 2.3 million tons sold in 2023. The MAPCO convenience store chain contributes significantly through both fuel sales and a growing non-fuel segment, including merchandise, food, and beverages, which provides a more stable income base.

Delek Logistics Partners, operating on a fee-based model for crude oil gathering, transportation, and storage, offers a predictable revenue stream insulated from commodity price volatility.

| Revenue Stream | Description | 2024 Data/Context |

|---|---|---|

| Refined Product Sales | Wholesale & retail sale of gasoline, diesel, jet fuel. | Significant driver of financial performance; strong demand in Q1 2024. |

| Asphalt Sales | Sales to construction and infrastructure sectors. | Approx. 2.3 million tons sold in 2023. |

| Retail Fuel Sales (MAPCO) | Direct sale of gasoline and diesel at convenience stores. | Robust sales volumes in 2024 due to optimized pricing and customer experience. |

| Retail Non-Fuel Sales (MAPCO) | Merchandise, food, and beverages at convenience stores. | Expected continued growth in 2024; vital for segment earnings. |

| Logistics Services (Delek Logistics Partners) | Fee-based gathering, transportation, storage of crude oil. | Provides stable, predictable income insulated from commodity price swings. |

Business Model Canvas Data Sources

The Delek US Holdings Business Model Canvas is informed by a blend of financial disclosures, industry analysis, and operational data. This ensures a robust understanding of revenue streams, cost structures, and key activities.