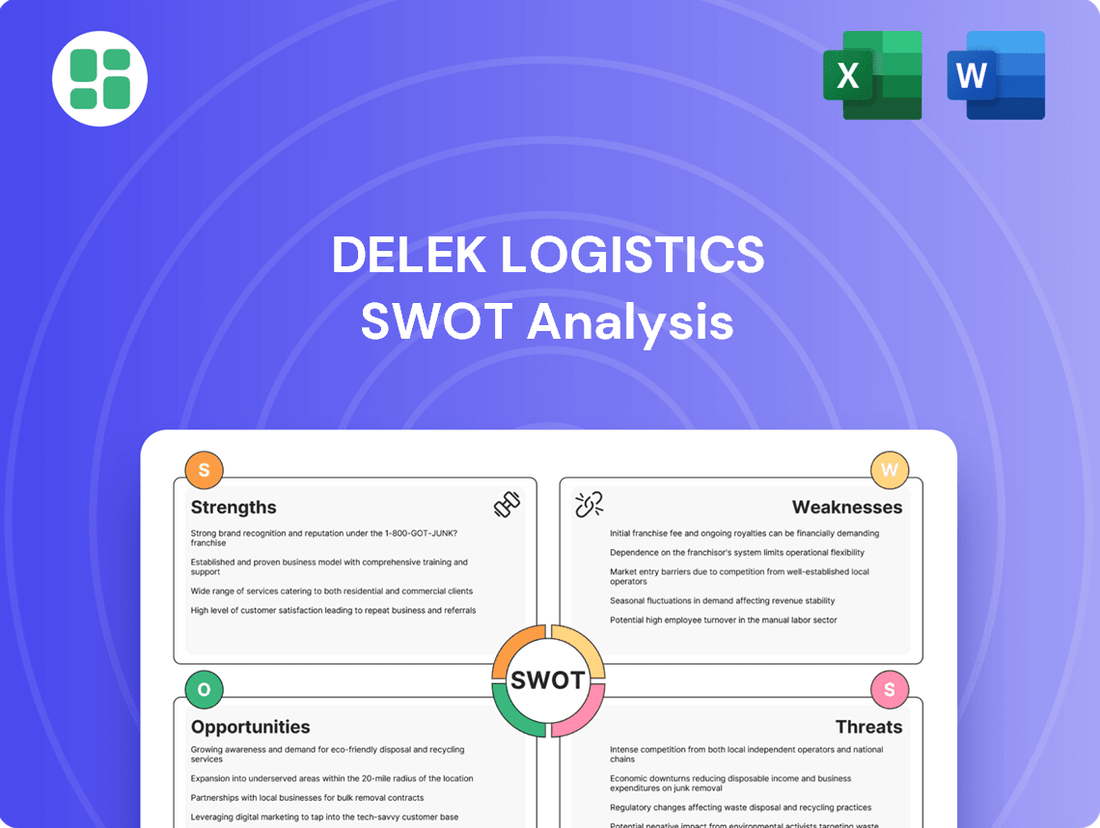

Delek Logistics SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Delek Logistics Bundle

Delek Logistics' strengths lie in its integrated midstream infrastructure and stable, fee-based revenue streams, providing a solid foundation for growth. However, potential threats from fluctuating commodity prices and regulatory changes could impact its operations.

Want the full story behind Delek Logistics' strengths, risks, and growth drivers? Purchase the complete SWOT analysis to gain access to a professionally written, fully editable report designed to support planning, pitches, and research.

Strengths

Delek Logistics Partners, LP (DKL) boasts a robust collection of crude oil and refined products logistics assets, encompassing pipelines, terminals, and storage. These are strategically positioned within the prolific Permian Basin and along the vital Gulf Coast, areas central to U.S. energy output and refining.

This advantageous geographic placement enables DKL to effectively connect significant supply and demand hubs, thereby securing consistent utilization of its infrastructure. For instance, as of the first quarter of 2024, DKL reported that its Permian Basin assets contributed significantly to its overall performance, benefiting from the region's high production levels.

Delek Logistics Partners (DKL) is making strides towards greater economic separation from its parent, Delek US Holdings, Inc. This strategic move is designed to bolster its position as a more independent midstream player.

A key indicator of this progress is the significant increase in third-party cash flow. By the first quarter of 2025, approximately 80% of DKL's cash flow was being generated from third-party customers. This substantial reliance on external business diversifies revenue streams and substantially reduces customer concentration risk.

Delek Logistics has showcased exceptional financial strength, achieving record adjusted EBITDA in both the first and second quarters of 2025. This consistent performance highlights the company's operational effectiveness and its ability to generate stable cash flows, even amidst fluctuating market conditions.

The partnership has also solidified its commitment to unitholder value, marking its 50th consecutive quarterly distribution increase in Q2 2025. This sustained growth in distributions offers investors an attractive yield, reflecting the company's confidence in its long-term earnings potential and its dedication to rewarding its stakeholders.

Integrated Service Provider in Permian

Delek Logistics Partners (DKL) has significantly bolstered its position in the Permian Basin by evolving into an integrated service provider. This strategic shift, notably marked by the acquisitions of H2O Midstream in September 2024 and Gravity Water Midstream in January 2025, has expanded DKL's service portfolio to encompass crude oil, natural gas, and water gathering and processing. This comprehensive offering allows DKL to cater to a broader spectrum of producer requirements, enhancing its competitive edge.

The integration of these acquisitions has transformed DKL into a full-suite midstream solutions provider, a critical advantage in the highly competitive Permian market. This expansion directly addresses the growing demand for efficient and reliable midstream infrastructure, particularly for water management, a key bottleneck for many Permian operators. By offering a consolidated service package, DKL can streamline operations for its customers, potentially leading to increased throughput and stronger contractual relationships.

- Expanded Service Offering: DKL now provides crude oil, natural gas, and water gathering and processing, a significant enhancement from its previous capabilities.

- Strategic Acquisitions: The successful integration of H2O Midstream (Sept 2024) and Gravity Water Midstream (Jan 2025) underpins this transformation.

- Competitive Advantage: The integrated model allows DKL to meet more producer needs, strengthening its market position in the Permian Basin.

- Operational Synergies: Offering a full suite of services can lead to greater operational efficiencies and cost savings for both DKL and its customers.

Successful Capital Projects and Debt Management

Delek Logistics has demonstrated strength in executing major capital projects, notably the expansion of its Libby 2 gas processing plant in the Permian Basin. This expansion is anticipated to significantly increase operational capacity and contribute positively to EBITDA, reinforcing its growth trajectory.

The company has also proactively managed its financial structure, evidenced by a successful $700 million debt issuance with a maturity in 2033. This strategic move extends the company's debt maturity profile, bolstering its financial flexibility and overall liquidity for future endeavors.

- Successful Libby 2 Gas Processing Plant Expansion: Boosts operational capacity and EBITDA.

- Proactive Debt Management: $700 million debt issuance in 2033 extends maturity and enhances liquidity.

Delek Logistics Partners (DKL) benefits from a strong, diversified revenue base, with approximately 80% of its cash flow generated from third-party customers by Q1 2025. This significantly reduces reliance on its parent company and mitigates customer concentration risk.

The company achieved record adjusted EBITDA in both Q1 and Q2 2025, underscoring its operational efficiency and ability to generate consistent cash flows. Furthermore, DKL has a proven track record of rewarding unitholders, marking its 50th consecutive quarterly distribution increase in Q2 2025.

What is included in the product

Delivers a strategic overview of Delek Logistics’s internal and external business factors, highlighting its operational strengths, market opportunities, and potential threats.

Offers a clear, actionable framework to identify and address Delek Logistics' key challenges and opportunities.

Weaknesses

Delek Logistics carries a significant debt burden, with a leverage ratio hovering around 4.32x as of June 30, 2025, and total debt approximating $2.2 billion. This financial structure, while managed by the company, could restrict its capacity to fund substantial organic growth initiatives or pursue new acquisitions without increasing borrowing expenses.

The company's credit rating, situated below investment grade, further highlights the potential constraints imposed by its high leverage. This could make future financing more costly and potentially limit access to capital compared to higher-rated competitors.

Delek Logistics Partners (DKL) has historically shown a strong dependence on its parent, Delek US Holdings (DK). While DKL has been actively growing its third-party revenue streams, a significant portion of its business has been tied to DK. This concentration, even with increased third-party contributions, can still represent a vulnerability.

For instance, in 2023, Delek US Holdings accounted for approximately 70% of DKL's total revenues. This deep integration means that any operational disruptions or financial strains experienced by Delek US could directly impact DKL's financial performance and stability, despite efforts to diversify its customer base.

Delek Logistics Partners (DKL) faces a significant weakness in its sensitivity to commodity price fluctuations. Even as a midstream operator, DKL's throughput volumes and profit margins can be indirectly impacted by swings in crude oil and natural gas prices. For instance, if oil prices were to fall sharply, as they did in early 2020, upstream producers might scale back operations, leading to lower demand for DKL's services.

Capital Intensive Nature of Operations

The capital-intensive nature of Delek Logistics' operations presents a significant weakness. Owning and operating essential infrastructure like pipelines, terminals, and processing plants demands continuous, substantial capital outlays. These expenditures are necessary for routine maintenance, ensuring regulatory compliance, and expanding operational capacity to meet market demands.

This ongoing need for investment directly impacts financial flexibility. For instance, Delek Logistics has projected capital investments in the range of $220 million to $250 million for 2025. Such significant outlays can strain distributable cash flow, potentially affecting distributions to unitholders and overall financial returns.

- High Capital Requirements: Infrastructure ownership necessitates consistent, large-scale capital spending.

- Maintenance and Compliance Costs: Ongoing expenses for upkeep and regulatory adherence are substantial.

- Expansion Investments: Capacity growth requires significant upfront capital, impacting cash flow.

- 2025 Capital Projection: Delek Logistics anticipates $220-$250 million in capital expenditures for 2025.

Volatility in Wholesale Marketing and Terminalling Segment

Delek Logistics Partners (DKL) faces challenges in its Wholesale Marketing and Terminalling segment due to inherent quarterly volatility. This segment's earnings can fluctuate significantly based on market conditions, as seen with the decrease in Adjusted EBITDA in Q1 2025. Factors like seasonal weather patterns and compressed wholesale margins directly impact its profitability.

The performance of this segment is more sensitive to short-term market swings and competitive intensity than DKL's more stable, fee-based logistics operations. This makes forecasting and maintaining consistent performance within this area a notable weakness.

- Quarterly Earnings Fluctuations: The Wholesale Marketing and Terminalling segment has demonstrated a tendency for inconsistent quarterly performance.

- Impact of Market Conditions: Adjusted EBITDA in Q1 2025 declined, illustrating the segment's susceptibility to seasonal weather and reduced wholesale margins.

- Competitive Pressures: This segment is more exposed to short-term market dynamics and competitive pressures compared to DKL's fee-based logistics assets.

Delek Logistics' substantial debt, around $2.2 billion with a leverage ratio of 4.32x as of June 30, 2025, limits its financial flexibility for growth and acquisitions. Its below-investment-grade credit rating further increases borrowing costs and potentially restricts capital access compared to peers.

The company's dependence on its parent, Delek US Holdings (DK), remains a vulnerability. Despite efforts to diversify, DK accounted for approximately 70% of DKL's revenues in 2023, meaning any issues at DK directly impact DKL.

DKL's operations are sensitive to commodity price volatility. Declines in oil and gas prices can reduce upstream activity, leading to lower demand for DKL's midstream services.

The capital-intensive nature of its business requires significant ongoing investment. Delek Logistics projected capital expenditures between $220 million and $250 million for 2025, which can strain distributable cash flow and impact unitholder distributions.

| Financial Metric | Value (as of June 30, 2025) | Impact |

|---|---|---|

| Total Debt | ~$2.2 billion | Limits financial flexibility for growth and acquisitions. |

| Leverage Ratio | 4.32x | Indicates significant financial risk and potential for higher borrowing costs. |

| Credit Rating | Below Investment Grade | Increases cost of capital and may limit access to funding. |

| Delek US Holdings Revenue Share (2023) | ~70% | Highlights concentration risk and dependence on parent company performance. |

| Projected 2025 Capital Expenditures | $220 - $250 million | Strains distributable cash flow and may affect unitholder distributions. |

Same Document Delivered

Delek Logistics SWOT Analysis

This is the actual Delek Logistics SWOT analysis document you’ll receive upon purchase—no surprises, just professional quality. It provides a comprehensive overview of the company's Strengths, Weaknesses, Opportunities, and Threats, offering valuable insights for strategic decision-making.

Opportunities

The Permian Basin remains a powerhouse for oil and gas production, presenting significant avenues for Delek Logistics (DKL) to broaden its midstream network for crude oil, natural gas, and water services. Producers are doubling down on acreage and increasing drilling in both the Midland and Delaware Basins, directly translating to higher volumes for DKL's infrastructure.

Delek Logistics Partners (DKL) has a history of successfully integrating acquisitions, as seen with the H2O Midstream and Gravity Water Midstream deals, which boosted its service capabilities and reach. These moves highlight a strategic focus on growth through targeted purchases.

Looking ahead, DKL can leverage this proven acquisition strategy to further solidify its market standing. Pursuing additional strategic acquisitions or forming joint ventures presents a clear opportunity to expand its asset base and enhance its service offerings, ultimately driving greater value for its unitholders.

Delek Logistics Partners (DKL) has a significant opportunity to broaden its customer base beyond its parent company, Delek US Holdings. As DKL gains more economic independence, it can actively pursue new clients in diverse markets, thereby mitigating the risk associated with over-reliance on a single entity.

This strategic shift allows DKL to explore offering additional value-added services, potentially venturing into areas outside its current core operations. For instance, in 2024, the energy infrastructure sector saw increased investment in midstream services for natural gas and NGLs, a segment DKL could potentially tap into.

Expanding its service offerings and customer portfolio not only reduces concentration risk but also opens up new avenues for revenue generation. This diversification is crucial for enhancing DKL's long-term financial stability and resilience in a dynamic energy market.

Leveraging Energy Transition for New Infrastructure

The global shift towards cleaner energy sources offers Delek Logistics a significant avenue for growth by adapting its existing midstream infrastructure or building new assets. This transition is not just about renewables; it includes crucial support for emerging technologies. For instance, infrastructure for carbon capture, utilization, and storage (CCUS) and hydrogen transportation are becoming increasingly vital. Delek's parent company, Delek US Holdings, is actively exploring carbon capture technologies, making this a natural strategic alignment.

This strategic pivot allows midstream companies like Delek Logistics to capitalize on the evolving energy landscape. The demand for infrastructure to support initiatives like renewable natural gas (RNG) is on the rise. As of early 2024, the global CCUS market is projected to grow substantially, with significant investments anticipated in new capture facilities and transportation networks. This presents a tangible opportunity for Delek to diversify its revenue streams and secure long-term contracts in these developing sectors.

- Infrastructure Adaptation: Repurposing or upgrading existing pipelines and storage facilities to handle new energy carriers like hydrogen or CO2.

- New Asset Development: Investing in the construction of dedicated infrastructure for CCUS, hydrogen, and RNG projects.

- Strategic Alignment: Leveraging parent company's (Delek US Holdings) investments and expertise in carbon capture technologies to create synergistic opportunities.

- Market Growth: Capitalizing on the expanding market for low-carbon energy solutions, driven by regulatory support and corporate sustainability goals.

Optimizing Existing Assets and Operational Efficiencies

Delek Logistics Partners (DKL) can unlock significant value by focusing on optimizing its current assets and driving operational efficiencies. Continuous investment in technology and process improvements is key to achieving this, leading to lower operating costs and better utilization of existing infrastructure. For instance, DKL's strategic move to add acid gas injection and sour gas treating capabilities at its Libby Complex demonstrates a clear path to enhancing service offerings and maximizing returns from its current asset base.

These enhancements are not just about incremental gains; they represent a fundamental shift towards maximizing the potential of existing infrastructure. By embracing technological advancements and refining operational processes, DKL can solidify its competitive position and improve profitability. This focus on efficiency is crucial in a dynamic energy market, allowing the company to adapt and thrive.

Key opportunities in optimizing existing assets include:

- Enhanced Throughput: Implementing advanced process controls and minor debottlenecking projects can increase the volume of products handled through existing pipelines and terminals.

- Cost Reduction Initiatives: Focusing on energy efficiency, predictive maintenance, and optimized logistics can significantly lower operating expenses per barrel or unit of throughput.

- Service Diversification: As seen with the Libby Complex example, adding new capabilities to existing facilities can create new revenue streams and attract a broader customer base.

- Digital Transformation: Leveraging data analytics and automation can improve asset monitoring, forecasting, and operational decision-making, leading to greater efficiency and reliability.

Delek Logistics (DKL) can capitalize on the growing Permian Basin production by expanding its midstream network for crude oil, natural gas, and water services, directly benefiting from increased producer activity. The company's proven track record of successful acquisitions, like the H2O Midstream and Gravity Water Midstream deals, provides a solid foundation for future growth through strategic purchases or joint ventures, enhancing its asset base and service offerings.

DKL has a clear opportunity to diversify its customer base beyond Delek US Holdings, actively pursuing new clients in various markets to reduce concentration risk and potentially explore new value-added services, such as those for natural gas and NGLs, a segment that saw increased investment in 2024.

The global energy transition presents a significant growth avenue for DKL, enabling it to adapt existing infrastructure or build new assets for emerging technologies like carbon capture, utilization, and storage (CCUS) and hydrogen transportation, aligning with Delek US Holdings' exploration of carbon capture technologies.

Optimizing existing assets through technological advancements and process improvements, such as adding acid gas injection and sour gas treating capabilities at the Libby Complex, offers a path to lower operating costs, enhance service offerings, and maximize returns from its current infrastructure.

Threats

Delek Logistics faces significant threats from evolving regulatory and environmental policies. For instance, stricter emissions standards, like those being considered for the transportation sector in 2024 and 2025, could force substantial capital expenditures for fleet upgrades or operational adjustments, directly impacting profitability.

Changes in environmental regulations, such as those concerning pipeline safety or spill prevention, can also lead to increased compliance costs and potential fines. The Pipeline and Hazardous Materials Safety Administration (PHMSA) continues to refine safety standards, and any new mandates in 2024-2025 could require costly retrofits or operational changes, affecting Delek Logistics' infrastructure investments.

A significant drop in crude oil and natural gas output from key regions like the Permian Basin or the Gulf Coast presents a substantial threat to Delek Logistics Partners (DKL). This decline, driven by shifts in global demand, geopolitical instability, or altered investment strategies by energy producers, directly impacts DKL's operational capacity.

Reduced production volumes translate to lower throughput across DKL's extensive network of pipelines and processing facilities. For instance, if a major shale play experiences a production slump, the volume of crude oil or natural gas flowing through DKL's assets would diminish, directly impacting the company's fee-based revenue streams.

In 2024, the energy market has seen volatility. While production in some areas has remained robust, concerns about future investment and potential supply disruptions persist. Any sustained downturn in the volumes DKL transports or processes would lead to a direct negative impact on its financial performance, particularly its distributable cash flow.

Delek Logistics Partners (DKL) faces a highly competitive midstream environment. Numerous established companies and emerging players are vying for market share, which can suppress pricing for services. In 2024, this intensified competition could lead to reduced contract rates for DKL, impacting its ability to secure new business and retain its current customer base.

Economic Downturns and Reduced Energy Demand

Broader economic downturns, like the potential slowdowns anticipated in late 2024 and into 2025, can significantly curb energy consumption. This directly impacts demand for refined products and crude oil, which are the core business for Delek Logistics Partners (DKL).

Such economic contractions would likely translate to lower transportation volumes and reduced storage needs for DKL. This could lead to underutilization of their extensive pipeline and terminal assets, negatively affecting revenue and profitability.

- Economic Slowdown Impact: A projected global GDP growth of around 2.7% for 2024, with potential moderations in 2025, could signal reduced industrial activity and consumer spending, thereby lowering energy demand.

- Commodity Price Volatility: Recessions often coincide with volatile energy prices, which can further complicate demand forecasting and impact the profitability of transporting and storing these commodities.

- Asset Utilization Risk: Lower demand directly threatens DKL's ability to maintain high utilization rates across its network, potentially impacting its fee-based revenue structure.

Operational Risks and Infrastructure Integrity

Delek Logistics Partners (DKL) operates a vast network of pipelines and processing facilities, which inherently exposes it to operational risks. Accidental leaks, spills, or equipment malfunctions are constant threats that could lead to significant financial repercussions, including hefty fines and environmental remediation costs.

These operational disruptions can severely impact DKL's ability to provide services, directly affecting its revenue streams and overall profitability. For instance, a major pipeline outage in 2023, though not specific to DKL, highlighted the industry's vulnerability to such events, with some incidents leading to weeks of service suspension and substantial repair expenses.

The consequences extend beyond immediate financial losses. Environmental damage can trigger extensive regulatory scrutiny and legal liabilities, while reputational harm can erode customer trust and investor confidence. These factors collectively threaten DKL's long-term operational continuity and financial stability.

- Potential for significant financial penalties due to environmental incidents.

- Risk of prolonged service interruptions impacting revenue generation.

- Damage to brand reputation leading to loss of customer and investor trust.

- Costs associated with equipment maintenance and potential failure.

Intensified competition in the midstream sector poses a threat by potentially suppressing service pricing. In 2024, this competitive landscape could lead to reduced contract rates for Delek Logistics Partners (DKL), hindering its ability to secure new business and retain existing customers.

The risk of economic slowdowns, particularly those anticipated for late 2024 and into 2025, could significantly curb energy consumption. This directly impacts demand for refined products and crude oil, the core of DKL's business, leading to lower transportation volumes and reduced asset utilization.

Operational risks, such as accidental leaks or equipment malfunctions, present a continuous threat. Incidents can result in substantial financial penalties, environmental remediation costs, and prolonged service interruptions, impacting DKL's revenue and reputation.

Furthermore, evolving regulatory and environmental policies, including stricter emissions standards and pipeline safety regulations, could necessitate significant capital expenditures for compliance, directly affecting profitability and operational flexibility through 2025.

SWOT Analysis Data Sources

This Delek Logistics SWOT analysis is built upon a robust foundation of data, including their official financial statements, comprehensive market research reports, and expert industry commentary to ensure a thorough and insightful assessment.