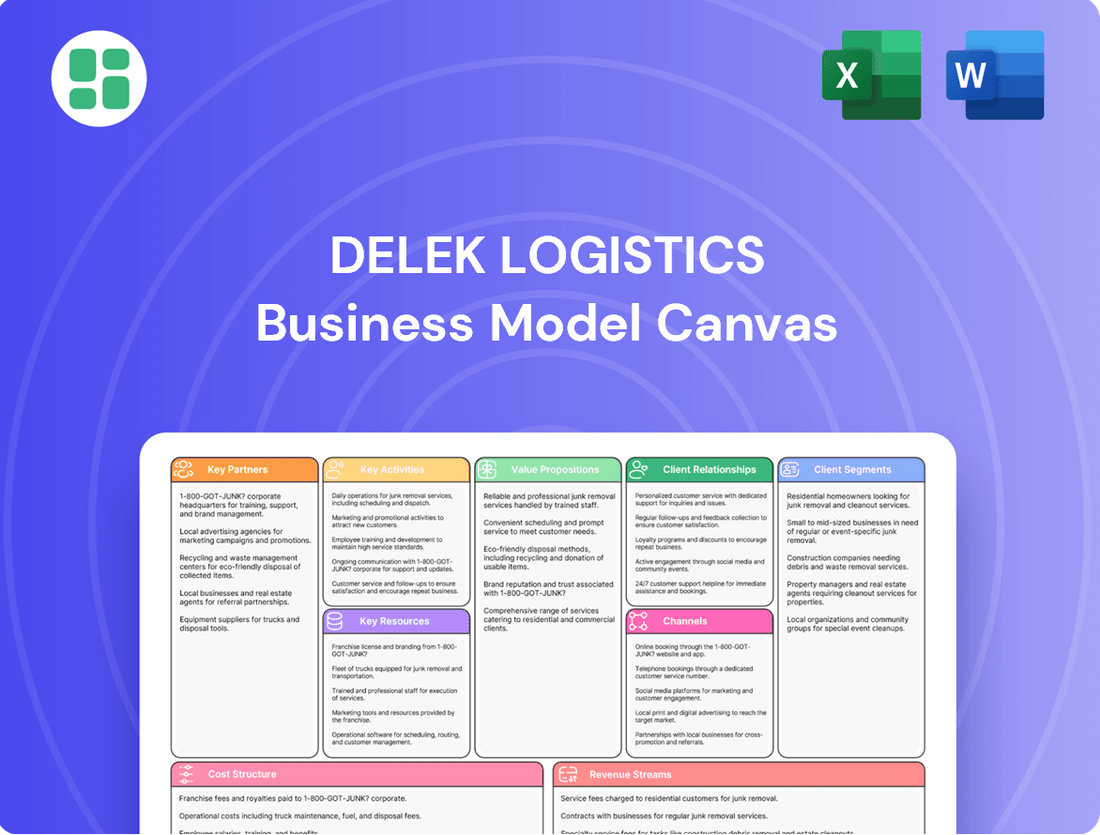

Delek Logistics Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Delek Logistics Bundle

Unlock the strategic blueprint behind Delek Logistics's success with our comprehensive Business Model Canvas. This detailed analysis reveals how they leverage their infrastructure and customer relationships to generate consistent revenue. Ideal for anyone seeking to understand the core drivers of a thriving midstream energy company.

Partnerships

Delek Logistics Partners' (DKL) primary strategic alliance is with Delek US Holdings, Inc. (DK). DK owns the general partner interest and a majority of the limited partner interest in DKL, creating a strong alignment of interests.

This relationship is vital because Delek US Holdings is a significant customer, relying on DKL's midstream and logistics services for its crude oil and refined products operations. In 2024, Delek US Holdings' refining segment processed an average of 272,000 barrels per day, directly benefiting DKL's infrastructure.

This symbiotic relationship ensures a consistent base of business for Delek Logistics and supports its strategic growth initiatives by providing a reliable demand for its services.

Delek Logistics actively collaborates with numerous independent crude oil producers, especially those operating within the prolific Permian Basin. These alliances are crucial for broadening Delek's customer portfolio beyond its affiliated entity, Delek US Holdings, and for solidifying its presence in strategically important oil-producing areas.

These producer partnerships are vital for Delek Logistics' growth strategy, allowing it to secure a consistent flow of crude oil for its gathering and transportation infrastructure. For instance, in 2023, Delek Logistics reported that third-party customers represented a significant portion of its crude oil gathering revenue, demonstrating the importance of these relationships.

The company's strategic acquisitions, such as H2O Midstream and Gravity Water Midstream, further bolster these producer relationships by providing essential integrated water handling solutions, including disposal and recycling services. This comprehensive offering enhances the value proposition for producers, making Delek Logistics a more attractive midstream partner.

Delek Logistics actively partners with other refiners and distributors, forming a crucial network for its transportation, terminalling, and wholesale marketing operations. These collaborations are vital for extending Delek's market presence in refined products, utilizing its extensive terminal and pipeline infrastructure to serve a wider array of customers.

These strategic alliances are often solidified through long-term contractual agreements, which are instrumental in securing predictable and stable revenue streams for Delek Logistics. For instance, in 2023, Delek Logistics reported that approximately 90% of its revenues were derived from fee-based contracts, underscoring the importance of such partnerships.

Other Midstream Energy Companies (Joint Ventures)

Delek Logistics actively partners with other prominent midstream energy companies through joint ventures. These strategic alliances, including collaborations with entities like Enterprise Products Partners LP and Magellan Midstream Partners, are crucial for expanding their infrastructure footprint. Such partnerships enable Delek Logistics to share the significant capital outlay and operational burdens associated with developing and maintaining large-scale pipeline and storage assets.

These joint ventures are instrumental in facilitating growth and access to new markets. For instance, Delek Logistics' participation in projects like the Wink to Webster pipeline exemplifies how these collaborations enhance network reach and capacity. By pooling resources and expertise, Delek Logistics can undertake projects that might be too large or complex to manage independently, thereby increasing its overall market presence and operational efficiency.

The benefits of these key partnerships extend to risk mitigation and operational synergy. Working with established players like Plains All American Pipeline allows for the sharing of best practices and the leveraging of existing infrastructure. This collaborative approach not only diversifies investment risk but also streamlines operations, leading to more efficient project execution and a stronger competitive position in the midstream sector.

- Strategic Alliances: Delek Logistics forms joint ventures with major midstream operators like Enterprise Products Partners, Magellan Midstream Partners, and Plains All American Pipeline.

- Infrastructure Expansion: These partnerships facilitate the expansion of pipeline networks and storage capacity, sharing investment and operational responsibilities for large-scale projects.

- Project Examples: Key collaborations include investments in significant infrastructure like the Wink to Webster pipeline.

- Risk and Synergy: Joint ventures help mitigate investment risk and foster operational synergies by leveraging the expertise and assets of multiple energy companies.

Equipment and Technology Suppliers

Delek Logistics’ (DKL) operations are heavily reliant on its relationships with equipment and technology suppliers. These partnerships are crucial for the ongoing maintenance and necessary upgrades to its vast network of infrastructure, which includes pipelines, terminals, and processing facilities. For instance, securing advanced pumping technology or state-of-the-art monitoring systems from these suppliers directly impacts operational efficiency and the overall reliability of DKL's assets.

These collaborations ensure DKL has access to cutting-edge technologies that are essential for maintaining high standards in operational efficiency, safety protocols, and environmental compliance. This continuous access to innovation allows for the improvement and expansion of key assets, such as the Libby gas processing plant, ensuring it operates at peak performance and meets evolving regulatory requirements. In 2024, Delek Logistics continued to invest in technology upgrades across its midstream assets to enhance throughput and reduce operational costs.

- Pipeline Integrity Technology: Partnerships with suppliers providing advanced inspection and monitoring tools, like inline inspection (ILI) pigs, are vital for ensuring the safe and efficient operation of DKL's extensive pipeline network.

- Terminal Automation Systems: Collaborations with technology providers offering sophisticated terminal automation and control systems improve loading/unloading efficiency and inventory management at DKL's storage facilities.

- Processing Plant Equipment: Securing specialized equipment and catalysts from leading manufacturers is essential for the optimal performance and expansion of DKL's gas processing plants, such as the Libby facility.

- Digitalization and Data Analytics: Working with technology firms to implement digital solutions and data analytics platforms enhances operational visibility, predictive maintenance capabilities, and overall asset management.

Delek Logistics' key partnerships are foundational to its operational success and strategic growth. The primary alliance with Delek US Holdings (DK) ensures a stable customer base, with DK's refining operations processing significant volumes, benefiting DKL's infrastructure. Independent crude oil producers, particularly in the Permian Basin, are crucial for diversifying DKL's customer portfolio and securing consistent feedstock for its gathering and transportation assets, with third-party customers representing a substantial revenue source.

Collaborations with other refiners and distributors extend DKL's market reach for refined products, leveraging its terminal and pipeline network. Joint ventures with major midstream operators like Enterprise Products Partners and Magellan Midstream Partners are vital for expanding infrastructure, sharing capital costs, and accessing new markets, as seen in projects like the Wink to Webster pipeline. These alliances also bolster risk mitigation and operational synergies through shared expertise and assets.

Furthermore, partnerships with equipment and technology suppliers are critical for maintaining and upgrading DKL's infrastructure, ensuring operational efficiency, safety, and environmental compliance. Investments in advanced technologies, such as pipeline integrity tools and terminal automation systems, are ongoing, with DKL focusing on digitalization and data analytics to enhance asset management and predictive maintenance capabilities. In 2024, Delek Logistics continued to invest in technology upgrades to improve throughput and reduce operational costs.

What is included in the product

This Delek Logistics Business Model Canvas provides a strategic overview of their operations, focusing on the midstream energy infrastructure and services they offer. It details their key partners, activities, and resources, along with their revenue streams and cost structure.

Delek Logistics' Business Model Canvas acts as a pain point reliever by providing a clear, one-page snapshot of their complex operations, simplifying understanding and identifying areas for efficiency gains.

Activities

Operating and maintaining midstream assets is the heart of Delek Logistics' operations. This includes the day-to-day running and upkeep of their vast network of pipelines, terminals, and storage for crude oil and refined products.

Ensuring these assets function safely, reliably, and efficiently is crucial for delivering value. For instance, Delek Logistics reported approximately 6,400 miles of pipeline in operation as of year-end 2023, highlighting the scale of their maintenance efforts.

Regular inspections, necessary repairs, and proactive preventative maintenance are key to minimizing disruptions and guaranteeing system integrity. This focus on operational excellence is vital for consistent product flow and operational uptime.

Delek Logistics' core activity involves gathering crude oil from numerous production sites, with a significant focus on the Permian Basin. They then transport this oil using a network of pipelines and trucks to refineries and key market centers. This ensures a steady supply chain for their operations and for external clients.

This gathering and transportation segment is crucial for Delek Logistics, serving as a vital link for their affiliate, Delek US Holdings, as well as other independent oil producers. In 2024, the company continued to invest in expanding its gathering infrastructure and boosting its transportation capacity to meet growing demand.

Delek Logistics actively markets and handles refined products like gasoline and diesel through its terminalling operations. This key activity involves managing inventory at terminals and ensuring smooth product flow for customers, contributing substantially to their overall revenue.

In 2024, Delek Logistics' refined products and terminalling segment demonstrated robust performance, generating approximately $1.3 billion in revenue. This highlights the critical role these services play in the company’s financial success and market presence.

Strategic Acquisitions and Organic Growth Projects

Delek Logistics actively pursues strategic acquisitions to bolster its midstream portfolio, focusing on assets that complement its existing infrastructure and service capabilities. This includes significant investments like the 2022 acquisition of H2O Midstream and Gravity Water Midstream for approximately $110 million, expanding its water logistics operations.

Simultaneously, the company drives organic growth through projects such as the construction of new processing plants. A prime example is the Libby 2 gas processing plant, which commenced operations in 2023, adding substantial natural gas processing capacity and enhancing Delek Logistics' market position.

- Strategic acquisitions, like H2O Midstream and Gravity Water Midstream, enhance water logistics capabilities.

- Organic growth projects, such as the Libby 2 gas processing plant, expand processing capacity.

- These activities are crucial for strengthening competitive advantages and ensuring sustained long-term growth.

Financial Management and Investor Relations

Delek Logistics actively manages its financial health through strategic debt offerings and careful capital allocation, ensuring robust liquidity. For instance, in Q1 2024, Delek Logistics reported total debt of $2.2 billion, demonstrating its use of leverage to fund operations and growth.

Investor relations are a cornerstone, with transparent financial reporting and regular earnings calls. The company's commitment to consistent distribution growth, such as the $0.37 per unit distribution declared for Q1 2024, aims to attract and retain a stable investor base.

- Financial Health Management: Includes managing debt offerings and capital allocation to maintain strong liquidity.

- Investor Relations: Focuses on transparent financial reporting and earnings calls.

- Distribution Growth: A key strategy to attract and retain investors, exemplified by consistent quarterly distributions.

Delek Logistics' key activities revolve around operating and expanding its midstream infrastructure, which includes pipelines, terminals, and storage facilities for crude oil and refined products. They also engage in gathering crude oil and marketing refined products, ensuring efficient movement and handling of these commodities.

Strategic acquisitions and organic growth projects are central to their business model, aimed at enhancing their service offerings and market reach. Financial management and investor relations are also critical, focusing on maintaining liquidity and providing consistent returns to stakeholders.

| Key Activity | Description | 2023/2024 Data Point |

|---|---|---|

| Midstream Operations | Operating and maintaining pipelines, terminals, and storage. | ~6,400 miles of pipeline in operation (end of 2023). |

| Gathering & Transportation | Collecting crude oil from production sites and transporting it. | Continued investment in infrastructure expansion in 2024. |

| Refined Products & Terminals | Marketing and handling refined products like gasoline and diesel. | Approx. $1.3 billion in revenue from this segment in 2024. |

| Growth & Development | Strategic acquisitions and organic projects. | Libby 2 gas processing plant commenced operations in 2023. |

| Financial Management | Managing debt, capital allocation, and investor relations. | $0.37 per unit distribution declared for Q1 2024. |

What You See Is What You Get

Business Model Canvas

The Business Model Canvas for Delek Logistics that you are previewing is the exact document you will receive upon purchase. This comprehensive overview details all nine essential building blocks of their business strategy, offering a clear and actionable roadmap. You'll gain immediate access to this same professionally structured and informative canvas, ready for your analysis and application.

Resources

Delek Logistics Partners (DKL) boasts an extensive pipeline infrastructure, a critical asset for its operations. This network comprises a significant mileage of crude oil and refined products pipelines, forming the core of its transportation solutions.

This robust infrastructure facilitates the efficient and economical transport of substantial quantities of petroleum products. Key operational areas include the Permian Basin and the Gulf Coast, vital energy hubs.

As of early 2024, Delek Logistics continues to invest in expanding and enhancing its pipeline network, aiming to optimize capacity and reach. For instance, the company has been actively involved in projects designed to increase takeaway capacity from prolific producing regions.

Delek Logistics operates a robust network of strategically positioned terminals and storage facilities, crucial for handling crude oil and refined products. These assets are key to their ability to efficiently receive, store, and distribute these vital commodities.

In 2024, Delek Logistics continued to leverage this infrastructure, which provides significant logistical flexibility. This allows them to cater to a broad range of customer demands and adeptly navigate fluctuations within the supply chain, ensuring reliable service delivery.

Delek Logistics relies heavily on its highly skilled workforce, encompassing engineers, operators, and maintenance specialists. This team's deep understanding of complex midstream assets, from pipelines to processing plants, is fundamental to safe and efficient operations.

Their expertise ensures adherence to rigorous safety standards, a critical factor in maintaining operational excellence and reliability across Delek Logistics' infrastructure. For instance, in 2023, Delek Logistics reported a strong safety record, a testament to their operational expertise.

Access to Capital and Financial Strength

Delek Logistics Partners, LP (DKL) leverages its access to capital markets and robust financial strength to fuel its operations, maintain its infrastructure, and pursue expansion. This financial foundation is critical for funding everything from routine upkeep to ambitious new projects.

Securing debt offerings and maintaining a strong balance sheet are cornerstones of DKL's strategy. This financial health directly supports the acquisition of new assets and the execution of significant capital expenditure projects, ensuring the company can grow and adapt.

- Debt Offerings: Delek Logistics has utilized debt markets to finance its growth. For instance, in 2023, the company completed a $500 million senior notes offering.

- Balance Sheet Health: Maintaining a healthy balance sheet allows DKL to manage its leverage ratios effectively, making it an attractive borrower and partner.

- Capital Expenditures: Access to capital is vital for DKL's planned capital expenditures, which in 2024 were projected to be between $170 million and $190 million, supporting growth projects and asset integrity.

- Financial Strength: A strong financial position enables DKL to pursue strategic acquisitions and investments, enhancing its competitive advantage in the midstream energy sector.

Long-Term Contracts and Customer Relationships

Delek Logistics' long-term contractual agreements are a cornerstone of its business model, providing a reliable foundation for operations. These agreements, particularly with Delek US Holdings and other major energy players, are crucial for revenue stability.

These contracts ensure predictable cash flows, which are vital for Delek Logistics' financial health and its ability to pursue expansion opportunities. For instance, in 2023, Delek Logistics reported that approximately 90% of its revenue was generated from fee-based contracts, highlighting the significance of these relationships.

- Long-Term Contracts: Agreements with key customers, including Delek US Holdings, provide a stable revenue base.

- Customer Relationships: Strong ties with energy companies ensure ongoing business and predictable demand for services.

- Revenue Stability: Approximately 90% of Delek Logistics' revenue in 2023 stemmed from fee-based contracts, demonstrating the reliability of these relationships.

- Financial Predictability: These contracts underpin the partnership's financial stability and support its growth strategies.

Delek Logistics' key resources are its extensive pipeline network and strategically located terminals, vital for transporting and storing crude oil and refined products. These physical assets are complemented by a highly skilled workforce adept at managing complex midstream operations and ensuring safety. Furthermore, access to capital markets and a healthy balance sheet enable the company to fund its growth and maintain its infrastructure.

The partnership's financial strength, demonstrated by its utilization of debt markets and focus on balance sheet health, directly supports its capital expenditure plans. For example, in 2023, Delek Logistics completed a $500 million senior notes offering, and projected 2024 capital expenditures were between $170 million and $190 million. This financial backing is crucial for acquiring new assets and executing expansion projects.

Long-term contractual agreements, particularly with Delek US Holdings, form a significant portion of Delek Logistics' key resources, ensuring predictable cash flows. In 2023, approximately 90% of its revenue was derived from these fee-based contracts, highlighting the stability and reliability they provide for financial planning and strategic growth.

| Key Resource | Description | 2023/2024 Data Point |

| Infrastructure | Pipeline network, terminals, and storage facilities | Approx. 90% revenue from fee-based contracts (2023) |

| Human Capital | Skilled engineers, operators, and maintenance specialists | Strong safety record reported (2023) |

| Financial Strength | Access to capital markets and healthy balance sheet | $500 million senior notes offering (2023); $170-$190 million projected CAPEX (2024) |

| Contractual Agreements | Long-term contracts with key customers | ~90% revenue from fee-based contracts (2023) |

Value Propositions

Delek Logistics offers dependable and streamlined transportation and storage for crude oil and refined products, guaranteeing secure and punctual deliveries. This is essential for clients who require consistent supply chains to keep their businesses running smoothly.

The company's extensive network of pipelines, terminals, and transportation assets, including a significant presence in the Permian Basin, underpins this reliability. In 2023, Delek Logistics reported approximately 5,700 miles of pipeline and 12.5 million barrels of storage capacity, demonstrating its substantial infrastructure.

Their operational acumen, honed through years of experience in the energy logistics sector, further solidifies this value proposition. This expertise allows them to manage complex logistics challenges efficiently, ensuring that customer needs are met with precision and care.

Delek Logistics provides crucial access to prolific oil and gas regions like the Permian and Delaware Basins, along with vital market centers on the Gulf Coast. This strategic positioning is a core value proposition, enabling efficient product movement.

This robust connectivity allows producers to reach high-demand markets and refiners to secure necessary feedstocks, thereby streamlining operations and expanding their market influence. In 2024, Delek Logistics reported significant throughput volumes, underscoring the vital role its infrastructure plays in connecting supply and demand centers.

Delek Logistics offers a complete package of midstream services, from getting crude oil and natural gas from the wellhead (gathering) to moving it through pipes (pipeline transportation), storing it, and getting it to buyers (wholesale marketing). This integrated approach simplifies the entire process for energy producers.

By providing everything from gathering to water disposal, Delek Logistics acts as a one-stop shop, streamlining complex energy supply chains for its customers. This comprehensive offering helps clients manage their logistics more efficiently.

In 2024, Delek Logistics continued to leverage its integrated model, which is crucial for optimizing the flow of hydrocarbons. The company's extensive network of assets supports efficient operations across various segments of the midstream value chain.

Operational Scale and Flexibility

Delek Logistics leverages its extensive network of pipelines, terminals, and storage facilities to provide substantial operational scale and flexibility. This infrastructure allows the company to efficiently manage diverse product types and fluctuating volumes, ensuring reliable service for its customers.

This adaptability is crucial for clients facing evolving market conditions. Delek Logistics' capacity to scale operations supports their customers' growth initiatives and helps them navigate operational adjustments smoothly, making them a valuable partner.

- Extensive Infrastructure: Operates a significant network of pipelines, terminals, and storage assets across key regions.

- Volume Handling: Capable of managing varying volumes of crude oil and refined products, demonstrating robust capacity.

- Product Versatility: Handles a range of product types, offering flexibility to meet diverse customer needs.

- Scalable Solutions: Provides adaptable services that can grow or contract with customer demand, facilitating their operational agility.

Enhanced Capital Efficiency for Customers

Delek Logistics offers customers a significant advantage by allowing them to bypass the substantial capital outlays typically required for constructing and maintaining their own logistics infrastructure. This strategic outsourcing frees up customer capital, enabling its redirection towards core business operations like production or refining.

By leveraging Delek Logistics' specialized assets and proven operational efficiencies, clients can achieve their goals without the burden of direct investment in logistics facilities. This approach enhances capital efficiency, allowing businesses to remain agile and focused on their primary revenue-generating activities.

For example, in 2024, many energy companies are prioritizing operational flexibility. By utilizing Delek Logistics' existing pipeline and terminal networks, they can avoid the multi-year development cycles and immense upfront costs associated with building new midstream assets, which can easily run into hundreds of millions or even billions of dollars.

- Avoids Capital Expenditures: Customers sidestep the need to invest in pipelines, storage tanks, and terminals.

- Focus on Core Business: Capital is freed up to be reinvested in production, refining, or other primary business functions.

- Leverages Specialized Assets: Access to Delek Logistics' efficient and specialized infrastructure without direct ownership costs.

- Operational Efficiency Gains: Benefit from Delek Logistics' expertise in managing and operating logistics assets, leading to cost savings and improved performance.

Delek Logistics provides essential, integrated midstream services, connecting energy producers to markets through its extensive pipeline, terminal, and storage network.

The company's value lies in its ability to offer customers a complete logistics solution, from gathering at the wellhead to wholesale marketing, thereby simplifying complex supply chains.

By leveraging Delek Logistics' infrastructure, clients avoid significant capital expenditures on their own logistics assets, freeing up capital for core business activities and enhancing operational flexibility.

This strategic partnership allows businesses to benefit from Delek Logistics' operational scale, product versatility, and scalable solutions, ensuring reliable and efficient product movement in a dynamic market.

| Value Proposition | Description | Key Benefit | Supporting Fact (2023/2024) |

|---|---|---|---|

| Integrated Midstream Services | Comprehensive solutions from gathering to wholesale marketing. | Streamlined supply chains for energy producers. | Operated ~5,700 miles of pipeline in 2023. |

| Infrastructure Access & Reliability | Extensive network of pipelines, terminals, and storage. | Secure and punctual delivery of crude oil and refined products. | 12.5 million barrels of storage capacity in 2023. |

| Capital Expenditure Avoidance | Outsourcing logistics infrastructure development and maintenance. | Frees up customer capital for core business operations. | Customers avoid multi-year development cycles and massive upfront costs. |

| Operational Scale & Flexibility | Adaptable services to manage diverse product types and fluctuating volumes. | Supports customer growth and navigates market changes. | Significant throughput volumes reported in 2024, indicating robust capacity utilization. |

Customer Relationships

Delek Logistics primarily secures its customer relationships through long-term contractual agreements. These agreements are the bedrock of their business, offering a predictable revenue stream and fostering deep, enduring partnerships with their clients.

These contracts often feature minimum volume commitments or fixed fees, providing Delek Logistics with a stable financial foundation. For instance, in 2023, the company reported that a significant portion of its revenue was derived from these long-term contracts, highlighting their critical role in financial stability and operational planning.

Delek Logistics Partners LP prioritizes strong customer connections through dedicated account management and comprehensive operational support. This ensures that the specific logistical requirements of their key clients are consistently met with efficiency and precision.

In 2024, Delek Logistics continued to foster these relationships by engaging in regular communication, proactively addressing any operational challenges, and customizing service delivery. This focus on tailored solutions is crucial for maintaining elevated customer satisfaction and ensuring seamless operational alignment with their partners.

Delek Logistics' relationship with Delek US Holdings is fundamentally characterized by deep strategic alignment, underscored by Delek US's substantial ownership stake and its position as a primary customer. This symbiotic connection drives collaborative efforts across operational planning, infrastructure expansion, and market strategy development.

This close partnership ensures that both entities mutually benefit from their interconnected crude oil and refined products businesses. For instance, Delek Logistics' assets, such as pipelines and terminals, are crucial for transporting and storing products generated by Delek US's refineries, creating a stable revenue stream for the logistics arm.

In 2024, Delek US Holdings remained a significant contributor to Delek Logistics' revenue, with a substantial portion of its throughput volumes originating from Delek US's refining operations. This ongoing reliance highlights the critical nature of their aligned strategies in supporting each other's growth and operational efficiency within the energy sector.

Performance-Based Trust and Reliability

Delek Logistics’ customer relationships are deeply rooted in performance-based trust and unwavering reliability. This means consistently delivering products safely and on time, which is paramount in the midstream energy sector. For instance, in 2024, Delek Logistics continued to emphasize operational excellence across its pipeline and terminal network, aiming to minimize any service interruptions that could impact customer supply chains.

Fostering long-term confidence and repeat business hinges on demonstrating consistent operational performance and strict adherence to quality standards. By minimizing disruptions, Delek Logistics reinforces its reputation as a dependable partner. This commitment is crucial for maintaining strong relationships in a highly competitive market where reliability directly translates to customer satisfaction and continued engagement.

- Consistent Delivery: Delek Logistics prioritizes on-time and safe product delivery, a critical factor for customer trust.

- Operational Excellence: Maintaining high standards in pipeline and terminal operations minimizes service disruptions.

- Quality Assurance: Adherence to stringent quality standards builds confidence in the integrity of delivered products.

- Long-Term Partnerships: Demonstrated reliability fosters repeat business and strengthens customer loyalty in the midstream sector.

Partnerships for Growth and Expansion

Delek Logistics actively cultivates strategic partnerships to fuel its expansion and enhance service offerings. These collaborations go beyond mere transactional relationships, focusing on mutual growth opportunities like joint ventures for new pipeline infrastructure or co-developing services that directly address evolving customer demands.

This proactive strategy solidifies customer loyalty by showcasing a dedication to their success. For instance, in 2024, Delek Logistics continued to leverage its existing network to facilitate the integration of new production sources for its partners, thereby increasing throughput and revenue for all parties involved.

- Strategic Alliances: Delek Logistics forms partnerships to expand its reach and service capabilities.

- Joint Ventures: Collaborations on new pipeline projects and infrastructure development are key to growth.

- Customer-Centric Expansion: Service offerings are adapted and expanded in direct response to identified customer needs and market opportunities.

- Mutual Benefit: These partnerships aim to enhance efficiency and drive growth for both Delek Logistics and its partners.

Delek Logistics' customer relationships are built on long-term contracts, providing revenue stability and fostering deep client partnerships. These agreements often include minimum volume commitments, ensuring a predictable financial foundation for the company, as evidenced by a significant portion of their 2023 revenue stemming from these arrangements.

Dedicated account management and operational support are key to meeting specific client needs efficiently, with 2024 efforts focusing on proactive communication and customized service delivery to maintain high customer satisfaction and operational alignment.

The strategic alignment with Delek US Holdings, a primary customer and significant owner, drives collaborative efforts in operational planning and infrastructure development, creating a symbiotic relationship where Delek Logistics' assets support Delek US's refining operations.

In 2024, Delek US Holdings remained a crucial revenue contributor, with its throughput volumes directly supporting Delek Logistics' growth and operational efficiency within the energy sector.

| Customer Relationship Aspect | Key Strategy | 2024 Focus/Impact |

|---|---|---|

| Contractual Agreements | Long-term contracts with minimum volume commitments | Ensures predictable revenue and stable financial foundation. |

| Client Support | Dedicated account management and operational support | Proactive communication and customized service delivery to meet specific needs. |

| Strategic Alignment | Partnership with Delek US Holdings | Synergistic operations supporting mutual growth and efficiency. |

| Reliability and Performance | On-time, safe delivery and operational excellence | Minimizing service interruptions and adhering to quality standards to build trust. |

Channels

Delek Logistics employs a robust direct sales and business development team. This team actively seeks to secure new long-term contracts and broaden existing service agreements with customers. Their efforts are crucial for driving growth and expanding Delek's midstream footprint.

In 2024, this team's focus on understanding specific client requirements allows them to offer customized midstream solutions. This client-centric approach is key to fostering strong, enduring relationships and ensuring Delek Logistics remains a preferred partner.

Delek Logistics' existing infrastructure network, comprising pipelines, terminals, and storage facilities, serves as its core channel, directly linking its services to customer operations. This physical network is crucial for the efficient transportation and storage of refined products and crude oil.

Strategic interconnections with other pipeline systems and major production or consumption hubs are vital. For instance, in 2023, Delek Logistics reported that its Delaware Basin gathering system connected to Permian Basin crude oil infrastructure, enabling broad market access.

These interconnections allow for seamless product movement across different regions and modes of transportation, enhancing the value proposition for Delek Logistics' customers by providing reliable and integrated supply chain solutions.

Delek Logistics heavily relies on its deep-seated industry relationships and a robust referral network to drive growth. These established connections within the energy sector, built on trust and consistent performance, are crucial for identifying new project opportunities and securing lucrative contracts. For instance, in 2024, a significant portion of new business secured by Delek Logistics stemmed directly from these trusted partnerships and positive word-of-mouth from existing clients, underscoring the value of a strong reputation for reliability and efficiency.

Investor Relations and Public Communication

Delek Logistics' investor relations website, financial reports, and earnings calls are crucial channels. While geared towards investors, these platforms also effectively communicate the company's operational strengths, strategic vision, and performance to a wider audience, including potential business partners and customers. This transparency fosters trust and can lead to new business opportunities.

For instance, Delek Logistics Partners LP (DKL) reported in their Q1 2024 earnings that their investor relations website saw significant traffic, highlighting the broad reach of their communications. The company's commitment to clear financial reporting, including detailed breakdowns of segment performance, further solidifies its image as a reliable and forward-thinking entity in the midstream sector.

- Investor Relations Website: Serves as a primary hub for financial data, presentations, and news, reaching a global investor base.

- Financial Reports (10-K, 10-Q): Provide in-depth operational and financial performance, offering transparency on capabilities and strategic execution.

- Earnings Calls and Webcasts: Direct engagement with analysts and investors, allowing for real-time communication of strategy and performance metrics.

- Press Releases: Announce significant operational updates, expansions, or strategic partnerships, reaching both financial and industry-specific media.

Strategic Acquisitions and Joint Ventures

Strategic acquisitions and joint ventures are key channels for Delek Logistics to quickly enter new markets and expand its operations. These moves allow for immediate access to established customer bases and new geographic territories, accelerating growth. For instance, in 2024, Delek Logistics continued to evaluate strategic opportunities that align with its growth objectives, building on its existing infrastructure and market position.

By integrating the assets and capabilities of acquired companies or partners, Delek Logistics can swiftly broaden its service offerings and geographical reach. This strategy was evident in past expansions, enabling the company to offer a more comprehensive suite of logistics solutions. The company's financial reports for 2024 highlight ongoing investments in infrastructure and strategic partnerships designed to enhance its competitive advantage.

- Rapid Market Entry: Acquisitions and joint ventures bypass the lengthy process of organic market development.

- Expanded Customer Base: Gaining immediate access to the customer networks of acquired entities.

- Geographic Diversification: Quickly establishing a presence in new regions and territories.

- Synergistic Growth: Integrating new assets to enhance service offerings and operational efficiency.

Delek Logistics' channels are multifaceted, encompassing direct sales, strategic partnerships, and robust communication platforms. The direct sales team actively secures new contracts, while industry relationships and referrals drive significant new business, as evidenced by a substantial portion of 2024 new business stemming from these trusted connections.

The company's existing infrastructure, including pipelines and terminals, acts as a primary channel, directly connecting services to customer operations. Strategic interconnections with other systems, like the Permian Basin crude oil infrastructure, further enhance market access and product movement, as highlighted by 2023 operational reports.

Furthermore, Delek Logistics leverages its investor relations website and financial reports as key communication channels, fostering transparency and building trust that can translate into new business opportunities. For example, Q1 2024 earnings reports showed significant traffic to their investor relations site.

Strategic acquisitions and joint ventures also serve as critical channels for rapid market entry and operational expansion, allowing for immediate access to new customer bases and territories, a strategy actively pursued in 2024.

Customer Segments

Delek US Holdings, Inc. represents the cornerstone customer segment for Delek Logistics. As the parent company, Delek US Holdings is a principal consumer of the logistics services provided, particularly for crude oil and refined products transportation and storage. This symbiotic relationship is critical, as Delek Logistics' infrastructure is largely purpose-built to facilitate Delek US Holdings' refining operations.

The strategic alignment is evident in the geographical concentration of Delek Logistics' assets, which are integral to supporting Delek US Holdings' key refinery locations in Texas and Arkansas. For instance, in 2024, Delek US Holdings operated refineries in El Dorado, Arkansas, and Tyler, Texas, with Delek Logistics providing essential pipeline and terminal services to these facilities, ensuring efficient feedstock supply and product offtake.

Delek Logistics serves independent and major crude oil producers in the prolific Permian Basin, encompassing both the Midland and Delaware Basins, as well as those along the vital Gulf Coast. These producers rely on Delek's infrastructure for the essential gathering, transportation, and processing of their crude oil and associated natural gas and water. For instance, in 2024, the Permian Basin continued to be a powerhouse, with production often exceeding 6 million barrels per day, underscoring the critical need for robust midstream services like those offered by Delek.

Refined Product Marketers and Distributors are key customers for Delek Logistics. These companies focus on getting refined petroleum products, like gasoline and diesel, to everyone who needs them. Delek Logistics helps them by providing essential services such as storing these products in terminals and facilitating their wholesale movement. This ensures a smooth and efficient supply chain for these vital businesses.

Other Midstream Energy Companies

This customer segment encompasses other midstream energy companies that leverage Delek Logistics' existing infrastructure. These entities might require interconnections to their own pipelines, utilize Delek's throughput capacity, or seek storage solutions. Such relationships are typically formalized through joint ventures or specific contractual agreements, aiming to enhance logistical efficiency for all participants.

These collaborations are crucial for optimizing the broader energy supply chain. For instance, in 2024, Delek Logistics reported that its pipeline throughput volumes were significantly influenced by these types of strategic partnerships, contributing to a stable revenue stream. The company’s ability to offer integrated solutions makes it an attractive partner for other midstream operators looking to expand their reach or improve operational flow.

- Interconnections: Facilitating the seamless transfer of crude oil and refined products between Delek's and other companies' assets.

- Throughput Agreements: Providing capacity on Delek's pipelines for third-party transportation needs.

- Storage Services: Offering storage solutions at key terminal locations for inventory management and market access.

- Joint Ventures: Participating in collaborative projects to develop new midstream infrastructure, sharing risks and rewards.

Industrial and Commercial End-Users

While not their primary focus, Delek Logistics' infrastructure can serve industrial and large commercial operations needing significant volumes of crude oil or refined products. These end-users might require specialized handling or storage, leveraging Delek's extensive pipeline and terminal network. For instance, a large manufacturing plant or a power generation facility could be a customer requiring reliable, bulk delivery of feedstocks or fuels.

In 2024, the energy sector continued to see robust demand for reliable logistics. Delek Logistics' focus on essential energy infrastructure positions it well to serve these larger commercial entities. Their ability to provide integrated solutions, from transportation to storage, makes them a valuable partner for businesses with substantial energy needs.

- Bulk Delivery Capabilities: Facilitating large-scale transportation of crude oil and refined products.

- Specialized Storage Solutions: Offering dedicated storage capacity for industrial clients.

- Network Integration: Providing access to Delek's extensive pipeline and terminal infrastructure.

- Reliability for Operations: Ensuring consistent supply for critical industrial processes and power generation.

Delek Logistics' customer base is diverse, primarily centered around the energy sector. Its parent company, Delek US Holdings, is a foundational client, relying on Delek Logistics for critical transportation and storage of crude oil and refined products. This ensures the smooth operation of Delek US Holdings' refining assets, such as those in Texas and Arkansas, which were operational and supported by Delek Logistics in 2024.

Independent crude oil producers, especially those in the Permian Basin, represent another significant segment. These producers depend on Delek's midstream infrastructure for gathering, transporting, and processing their oil and gas. The Permian Basin’s substantial production, often exceeding 6 million barrels per day in 2024, highlights the critical need for these services.

Refined product marketers and distributors are also key customers, utilizing Delek Logistics' terminals for storage and wholesale movement of products like gasoline and diesel. Additionally, other midstream companies engage with Delek Logistics through interconnections, throughput agreements, and joint ventures to optimize their own logistical operations, as evidenced by Delek's 2024 throughput volumes influenced by these partnerships.

Cost Structure

Operating and maintenance expenses are the backbone of Delek Logistics' ongoing operations, representing substantial recurring costs. These cover everything from paying the people who keep the pipelines running smoothly to the electricity powering the terminals and the parts needed for routine upkeep. For instance, in 2023, Delek Logistics reported operating expenses of approximately $717 million, highlighting the significant investment required to maintain its extensive network of assets.

These costs are critical for ensuring the safety and efficiency of Delek Logistics' infrastructure, which includes pipelines, storage terminals, and other crucial logistics assets. This category encompasses essential elements like employee wages, energy consumption for operations, the procurement of necessary supplies, and regular repair work. Furthermore, environmental compliance costs are a vital component, ensuring adherence to regulations and responsible asset management.

Delek Logistics Partners (DKL) faces significant capital expenditures, split between maintaining its current assets and funding growth initiatives. In 2024, the company projected capital expenditures to be between $275 million and $325 million, reflecting ongoing investments in infrastructure and strategic expansion projects.

These expenditures are vital for DKL's operational efficiency and market position. For instance, investments in projects like the Libby 2 processing plant are designed to enhance capacity and revenue generation, directly impacting the Cost Structure by increasing the asset base and associated depreciation.

As a master limited partnership, Delek Logistics Partners (DKL) relies on debt financing for its infrastructure projects and expansion. This means a significant portion of its operating expenses is dedicated to servicing this debt, primarily through interest payments. For instance, in the first quarter of 2024, Delek Logistics reported interest expense of $39 million, reflecting the ongoing cost of its leverage.

Effectively managing these debt service costs is crucial for DKL's profitability and financial health. The partnership actively works to optimize its financing terms and maintain a manageable debt-to-EBITDA ratio, which stood at approximately 4.2x as of the end of Q1 2024. This focus ensures that interest expenses do not unduly burden its cash flows.

Acquisition-Related Costs

Delek Logistics' cost structure includes significant acquisition-related expenses. These costs arise from the process of finding, negotiating, and integrating new businesses, such as the acquisitions of H2O Midstream and Gravity Water Midstream. These expenses are particularly notable during periods of active mergers and acquisitions (M&A) activity.

These acquisition-related costs encompass a range of expenditures. They include fees for legal counsel, costs associated with thorough due diligence to assess potential targets, and the expenses involved in integrating acquired operations into Delek Logistics' existing framework. These are material components of their overall spending.

- Legal Fees: Costs incurred for legal advice and services during acquisition negotiations and closing.

- Due Diligence Expenses: Funds spent on investigating the financial, operational, and legal aspects of target companies.

- Integration Costs: Expenditures required to merge new acquisitions into Delek Logistics' systems, processes, and personnel.

General, Administrative, and Regulatory Compliance Costs

General, administrative, and regulatory compliance costs form a crucial part of Delek Logistics' operational expenses. These overheads encompass salaries for essential administrative personnel, day-to-day office expenditures, and professional services like legal and accounting. For 2024, companies in the energy sector, like Delek Logistics, face substantial outlays for navigating complex regulatory landscapes.

The energy industry, particularly in areas like environmental protection, worker safety, and transportation of hazardous materials, demands rigorous adherence to a multitude of regulations. These compliance efforts are not a one-time event but a continuous and significant financial commitment. For instance, in 2023, the U.S. Environmental Protection Agency (EPA) continued to enforce stringent standards impacting pipeline operations and emissions, directly affecting the cost structure of midstream companies.

- Salaries for administrative staff

- Office rent and utilities

- Legal and accounting fees

- Environmental, safety, and transportation regulatory compliance

Delek Logistics' cost structure is multifaceted, encompassing operational expenses, capital expenditures, debt servicing, acquisition-related outlays, and general administrative costs. These elements are essential for maintaining and growing its midstream energy infrastructure business.

Key cost drivers include maintaining its extensive network of pipelines and terminals, investing in new projects, managing its debt obligations, and ensuring regulatory compliance. For example, in Q1 2024, interest expense was $39 million, illustrating the impact of debt financing.

The company's commitment to growth is evident in its capital expenditure projections. For 2024, Delek Logistics anticipated capital expenditures between $275 million and $325 million, funding both maintenance and expansion initiatives.

| Cost Category | 2023 Actuals/2024 Projections | Significance |

|---|---|---|

| Operating Expenses | ~$717 million (2023) | Covers day-to-day running of assets. |

| Capital Expenditures | $275-$325 million (2024 Projection) | Investments in infrastructure and growth. |

| Interest Expense | $39 million (Q1 2024) | Cost of debt financing. |

Revenue Streams

Delek Logistics' main income comes from charging fees for moving crude oil, refined products, and natural gas via its pipelines. These fees are usually tied to how much is moved and how far, with contracts often guaranteeing a minimum volume over extended periods.

In 2024, Delek Logistics reported that its logistics segment, which includes these transportation fees, generated a significant portion of its overall revenue. Specifically, the company's pipeline operations are designed to provide stable, fee-based income, insulating it somewhat from volatile commodity prices.

Delek Logistics generates revenue through storage and terminalling fees, offering capacity for crude oil and refined products at its extensive network of terminals and storage facilities. These fees are typically structured based on the volume of capacity utilized or the length of time a customer stores their products.

This model provides a dependable income stream, as it is not directly tied to the fluctuating volumes of product being transported. For instance, in the first quarter of 2024, Delek Logistics reported that its Logistics Segment, which includes these services, contributed significantly to its overall financial performance, highlighting the stability offered by these recurring fees.

Delek Logistics generates revenue through wholesale marketing of refined products, capturing the difference between what they pay for these products and what they sell them for. This margin-based income stream is a key component of their business, contributing to overall profitability.

For instance, in the first quarter of 2024, Delek Logistics reported that its wholesale marketing segment contributed significantly to its earnings, demonstrating the importance of this revenue stream even amidst market volatility.

Gathering and Processing Fees

Delek Logistics generates revenue through gathering and processing fees, especially in the vital Permian Basin. These fees are earned by collecting crude oil, natural gas, and water, and for the crucial processing of natural gas. The company's strategic investments in expanding its infrastructure, such as the Libby plant, directly bolster this income stream.

This segment's performance is closely tied to production volumes and the company's capacity to handle those volumes efficiently. For instance, in 2024, Delek Logistics continued to see robust activity in its Permian gathering and processing operations, contributing significantly to its overall financial results.

- Gathering Fees: Revenue earned from collecting crude oil, natural gas, and water from producers.

- Processing Fees: Income generated from processing natural gas to meet pipeline quality specifications.

- Facility Expansion Impact: Investments in facilities like the Libby plant directly increase the capacity and thus the potential revenue from these services.

- Permian Basin Focus: A significant portion of these fees is derived from operations within the high-activity Permian Basin.

Joint Venture Distributions and Equity Income

Delek Logistics Partners (DKL) generates revenue through distributions and equity income from its participation in pipeline joint ventures. These income streams are essentially DKL's share of the profits earned by these jointly owned and operated pipeline assets.

For instance, in the first quarter of 2024, Delek Logistics reported that its equity income from joint ventures, primarily related to its stake in the DCP Midstream joint venture, contributed significantly to its overall financial performance. This income reflects the operational success and profitability of these critical midstream infrastructure assets.

- Joint Venture Distributions: DKL receives cash distributions from its ownership stakes in various pipeline joint ventures.

- Equity Income: This represents DKL's proportionate share of the net income generated by its joint venture investments.

- Contribution to Performance: These income sources directly bolster DKL's overall financial results and cash flow.

- Q1 2024 Impact: Equity income from joint ventures was a notable component of DKL's reported earnings in early 2024.

Delek Logistics' revenue streams are primarily fee-based, ensuring stability by charging for services rather than directly profiting from commodity price fluctuations. These include transportation fees for moving crude oil, refined products, and natural gas, as well as storage and terminalling fees for utilizing their extensive infrastructure.

Furthermore, the company generates income through wholesale marketing of refined products, capturing margins on sales, and gathering and processing fees, particularly in the active Permian Basin. These diverse revenue sources are bolstered by equity income and distributions from pipeline joint ventures, providing a well-rounded financial model.

| Revenue Stream | Description | 2024 Relevance |

|---|---|---|

| Transportation Fees | Charging for moving oil, refined products, and natural gas via pipelines. | Core revenue driver, often with minimum volume commitments. |

| Storage & Terminalling Fees | Fees for using capacity at terminals and storage facilities. | Provides stable, recurring income independent of throughput volumes. |

| Wholesale Marketing | Profiting from the margin on refined product sales. | Key contributor to profitability, even with market volatility. |

| Gathering & Processing Fees | Revenue from collecting and processing crude oil, natural gas, and water. | Significant in Permian Basin, boosted by infrastructure investments like the Libby plant. |

| Joint Venture Income | Distributions and equity income from pipeline partnerships. | Notable contribution to overall financial performance, as seen in Q1 2024 results from DCP Midstream stake. |

Business Model Canvas Data Sources

The Delek Logistics Business Model Canvas is built upon a foundation of financial reports, operational data, and industry-specific market research. These sources provide the necessary insights into revenue streams, cost structures, and key activities.