Delek Logistics Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Delek Logistics Bundle

Delek Logistics faces moderate bargaining power from its suppliers due to the specialized nature of pipeline and terminal services, but this is somewhat offset by the essentiality of their infrastructure.

The threat of new entrants is relatively low, given the significant capital investment and regulatory hurdles required to build competing midstream assets.

However, the threat of substitutes, while not immediate, could emerge from alternative transportation methods or shifts in energy consumption patterns.

The complete report reveals the real forces shaping Delek Logistics’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

The concentration of suppliers for critical inputs significantly impacts Delek Logistics' bargaining power. If only a few specialized providers offer essential components like advanced pipeline coatings or specific drilling equipment, these suppliers gain considerable leverage. For instance, a scarcity of certified technicians for maintaining complex pumping stations could mean Delek Logistics faces higher costs and less favorable terms.

The uniqueness of inputs for Delek Logistics significantly influences supplier bargaining power. If the specialized components or services required for its pipeline operations, terminal services, or wholesale fuel distribution are not readily available from multiple sources, suppliers can command higher prices or more favorable terms.

Delek Logistics faces significant switching costs if it were to change its primary suppliers for refined products and crude oil. These costs can include the financial expense of reconfiguring or replacing existing pipeline connections, storage facilities, and transportation equipment to accommodate different product specifications or supplier logistics. For instance, if a new supplier requires specialized handling or different terminal infrastructure, Delek would need to invest in upgrades, impacting operational efficiency and incurring substantial capital expenditure.

Operational disruptions are a major component of switching costs. Re-training personnel on new supplier protocols, quality control procedures, and safety standards can lead to temporary dips in productivity. Furthermore, the process of re-certifying new materials or product grades to meet Delek's stringent operational requirements can be time-consuming and complex. In 2023, the energy infrastructure sector saw capital expenditures for upgrades and maintenance averaging around 5-7% of revenue for companies of Delek's size, highlighting the potential financial impact of such changes.

The bargaining power of suppliers is amplified when these switching costs are high for Delek Logistics. If suppliers know that Delek would face considerable financial and operational hurdles to switch, they can leverage this to negotiate more favorable terms, potentially including higher prices or less flexible contract conditions. Conversely, if Delek can demonstrate that its infrastructure is largely standardized and adaptable across multiple potential suppliers, it strengthens its own negotiating position, allowing for better pricing and contract flexibility.

Threat of Forward Integration by Suppliers

The threat of suppliers integrating forward into Delek Logistics' midstream operations is a significant factor in assessing supplier bargaining power. If suppliers, such as oil and gas producers, could credibly enter the logistics business, they would gain substantial leverage in pricing and contract negotiations. This would essentially turn them into direct competitors, potentially disrupting Delek's market position.

When considering this threat, it's crucial to evaluate the feasibility and strategic incentives for these suppliers. For instance, in 2024, many upstream producers are focused on optimizing their existing operations and capital discipline. However, persistent volatility in commodity prices or a desire for greater control over their supply chain could incentivize some to explore forward integration. The capital investment required for midstream infrastructure, such as pipelines and terminals, is substantial, which can be a deterrent. Yet, if the potential returns and strategic benefits of controlling transportation and storage outweigh the costs, the threat becomes more credible.

- Feasibility Assessment: The capital intensity of midstream assets is a primary barrier. For example, constructing a new pipeline can cost hundreds of millions to billions of dollars.

- Strategic Incentives: Producers might integrate forward to secure reliable transportation, capture additional margin, and gain greater control over product delivery, especially during periods of tight capacity.

- Competitive Landscape: The presence of established midstream players like Delek Logistics, with existing infrastructure and expertise, makes direct competition challenging for new entrants.

- Market Dynamics: A sustained period of high crude oil prices or significant differentials between production basins and refining centers could increase the attractiveness of forward integration for upstream companies.

Importance of Delek Logistics to Suppliers

The significance of Delek Logistics to its suppliers is a key factor in assessing bargaining power. If Delek Logistics constitutes a substantial portion of a supplier's overall sales, that supplier is likely to be more accommodating with pricing and terms. Conversely, if Delek Logistics is a small customer for a supplier, the supplier has less motivation to negotiate favorably.

For instance, in 2023, Delek Logistics' capital expenditures were approximately $230 million, indicating significant procurement activity. The extent to which individual suppliers contribute to this figure directly influences their leverage. A supplier whose business with Delek Logistics represents, say, 20% of their annual revenue will naturally have a different negotiation stance compared to one where Delek Logistics accounts for only 1%.

- Supplier Dependence: Delek Logistics' revenue contribution to its suppliers directly impacts supplier willingness to offer favorable terms.

- Revenue Concentration: Suppliers with a high percentage of revenue derived from Delek Logistics are more susceptible to Delek's demands.

- Market Position of Suppliers: The bargaining power of suppliers also depends on their own market position and the availability of alternative buyers for their products or services.

The bargaining power of suppliers for Delek Logistics is influenced by the concentration and uniqueness of critical inputs. If few specialized providers exist for essential components like pipeline coatings or specific technical services, these suppliers gain leverage, potentially leading to higher costs for Delek. For example, in 2024, the scarcity of specialized technicians for maintaining complex energy infrastructure could increase operational expenses.

Switching costs for Delek Logistics, encompassing financial and operational hurdles in changing suppliers for refined products or crude oil, significantly empower suppliers. These costs can include reconfiguring infrastructure or retraining personnel. In 2023, capital expenditures for infrastructure upgrades in the energy sector averaged 5-7% of revenue for companies of Delek's scale, underscoring the financial impact of supplier changes.

The threat of suppliers integrating forward into Delek Logistics' midstream operations also amplifies supplier bargaining power. While capital-intensive, upstream producers might pursue this to secure transportation and capture margins, especially if market conditions, like sustained high crude prices in 2024, make it strategically attractive.

Delek Logistics' significance to its suppliers directly impacts their negotiation stance. Suppliers heavily reliant on Delek's business, which represented a substantial portion of their revenue in 2023, are more likely to offer favorable terms compared to those with minimal dependence.

| Factor | Impact on Supplier Bargaining Power | Supporting Data/Example |

| Supplier Concentration/Uniqueness of Inputs | High | Scarcity of specialized technicians or components increases supplier leverage. |

| Switching Costs | High | Financial and operational disruptions associated with changing suppliers can be substantial. 2023 energy sector upgrades averaged 5-7% of revenue. |

| Threat of Forward Integration | Moderate to High | Upstream producers may integrate to control supply chain, influenced by 2024 market conditions. |

| Delek's Importance to Suppliers | Variable | Suppliers with higher revenue dependence on Delek have less bargaining power. |

What is included in the product

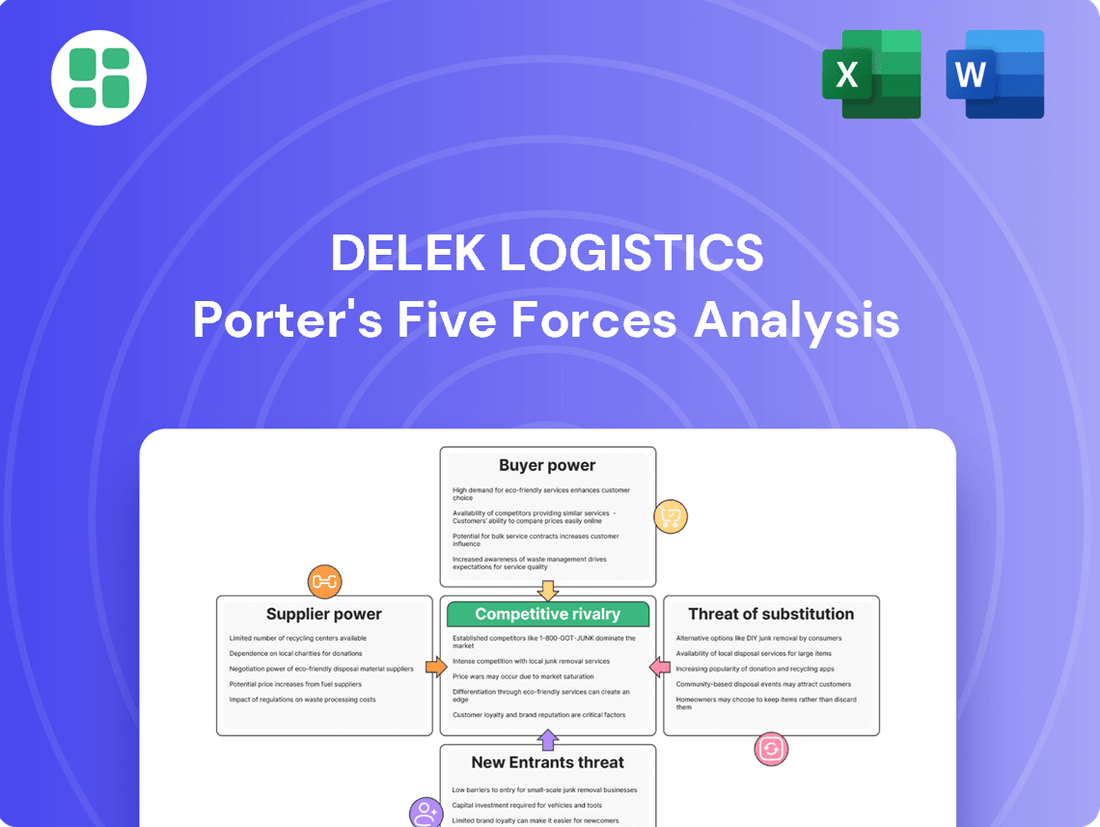

This analysis dissects the competitive forces impacting Delek Logistics, revealing the intensity of rivalry, buyer and supplier power, threat of new entrants, and the potential for substitutes.

Delek Logistics' Five Forces analysis provides a clear, one-sheet summary of all competitive pressures—perfect for quick, informed strategic decisions.

Customers Bargaining Power

The concentration of Delek Logistics' customers is a key factor in their bargaining power. Delek US Holdings, Inc. stands out as a particularly significant customer, representing a substantial portion of Delek Logistics' revenue. This reliance on a few large customers, especially Delek US Holdings, means these entities can exert considerable influence over pricing and terms.

In 2023, Delek US Holdings represented approximately 30% of Delek Logistics' total revenue, highlighting the concentrated nature of its customer base. A more fragmented customer landscape, with many smaller, independent clients, would dilute the bargaining power of any single customer. Instead, the current structure allows major clients to negotiate more favorable conditions, potentially impacting Delek Logistics' profitability.

Switching costs for customers of Delek Logistics can significantly influence their bargaining power. If customers face substantial expenses or operational disruptions when moving to a competitor, their ability to demand lower prices or better terms from Delek is diminished.

These costs can include the need to reconfigure existing infrastructure, such as pipelines or storage facilities, to accommodate a new provider's specifications. For instance, in 2024, midstream infrastructure projects often involve specialized equipment and integration, making a switch a complex and costly undertaking. Renegotiating intricate, long-term contracts, which are common in the industry, also represents a significant barrier.

Conversely, if switching is relatively seamless, with minimal investment required and easily transferable contracts, customers gain more leverage. This ease of transition would empower them to negotiate more aggressively, potentially impacting Delek Logistics' profitability and market position.

The availability of substitute services significantly impacts Delek Logistics' customer bargaining power. Customers transporting crude oil and refined products have various alternatives to Delek's pipeline and storage services. These include other pipeline operators, as well as rail, truck, and marine transport options.

In the Permian Basin and along the Gulf Coast, where Delek Logistics operates, these alternative transportation and storage methods provide customers with choices. For instance, in 2024, the Permian Basin continued to see substantial investment in both pipeline capacity expansion and alternative logistics solutions, including increased rail loading capacity, which directly offers producers an alternative to pipeline commitments.

This competitive landscape, with multiple viable transport and storage options, empowers customers. They can leverage these substitutes to negotiate better rates and terms with Delek Logistics, as the cost and availability of alternatives directly influence their willingness to commit to Delek's services.

Price Sensitivity of Customers

Delek Logistics' customers exhibit varying degrees of price sensitivity. For instance, smaller refiners or independent fuel distributors, whose profit margins are often tighter, may be more inclined to seek the lowest possible logistics costs. Conversely, larger, integrated energy companies might prioritize reliability and service over marginal price differences, especially if logistics represent a smaller fraction of their overall operating expenses.

The cost of Delek Logistics' services as a percentage of a customer's total costs is a significant determinant of price sensitivity. If transportation and storage fees constitute a substantial portion of a customer's expenditures, they will naturally be more attuned to pricing fluctuations. This is particularly true in highly competitive downstream markets where even small cost advantages can translate into market share gains.

The intensity of competition within Delek Logistics' customers' own industries directly impacts their price sensitivity. In commoditized markets, where differentiation is minimal, customers are more likely to exert pressure on all input costs, including logistics, to remain competitive. For example, in 2023, the average operating margin for independent petroleum refiners in the U.S. hovered around 4-6%, making them highly sensitive to any increase in their cost structure.

- Customer Profitability: Customers with lower profit margins, such as independent gasoline retailers, are more sensitive to Delek Logistics' pricing.

- Logistics Cost Share: If transportation and storage represent a significant portion of a customer's total costs, they will have greater bargaining power due to price sensitivity.

- Market Competition: Customers operating in highly competitive markets, where price is a key differentiator, are less tolerant of higher logistics costs.

- Availability of Alternatives: The presence of alternative logistics providers or modes of transport directly influences how sensitive customers are to Delek Logistics' prices.

Threat of Backward Integration by Customers

Customers of Delek Logistics, particularly large refiners or producers, possess significant bargaining power if they can credibly integrate backward into logistics operations. This means they could potentially build their own pipelines, terminals, or transportation fleets.

The threat of backward integration is heightened when logistics represent a substantial cost or a critical bottleneck for these customers. For instance, if a major refiner finds Delek's transportation fees are impacting their profitability, they might explore developing their own infrastructure to gain cost control and operational efficiency. This potential for self-sufficiency directly strengthens their negotiating position.

In 2024, the energy logistics sector continues to see consolidation and strategic investments. Companies like Marathon Petroleum (MPC) and Phillips 66 (PSX) operate integrated midstream assets alongside their refining operations, demonstrating the feasibility of backward integration for large players. This competitive landscape means Delek Logistics must remain competitive on pricing and service to mitigate this customer leverage.

The bargaining power of customers is further amplified by:

- High Capital Requirements for Logistics Assets: While integration is possible, the significant upfront investment needed for pipelines and terminals can deter some customers, thus limiting the immediate threat.

- Operational Expertise: Running specialized logistics operations requires specific expertise, which some customers may lack or find costly to develop internally.

- Regulatory Hurdles: Navigating the complex regulatory environment for transportation infrastructure can also act as a barrier to backward integration.

Delek Logistics' customers, particularly large refiners, possess significant bargaining power if they can credibly integrate backward into logistics operations, potentially building their own infrastructure. This threat is heightened when logistics represent a substantial cost or critical bottleneck, encouraging customers to seek cost control and operational efficiency. For instance, in 2024, major energy companies continue to invest in integrated midstream assets, demonstrating the feasibility of this strategy for large players.

| Factor | Impact on Customer Bargaining Power | Example/Data (2023-2024) |

|---|---|---|

| Customer Concentration | High | Delek US Holdings represented ~30% of Delek Logistics' revenue in 2023. |

| Switching Costs | Moderate to High | Reconfiguring specialized midstream infrastructure in 2024 is complex and costly. |

| Availability of Substitutes | Moderate | Rail and truck transport offer alternatives to pipelines in key operating regions. |

| Price Sensitivity | Varies (High for low-margin customers) | Independent refiners had ~4-6% operating margins in 2023, making them price sensitive. |

| Threat of Backward Integration | Moderate | Large players like MPC and PSX operate integrated midstream assets. |

Same Document Delivered

Delek Logistics Porter's Five Forces Analysis

This preview shows the exact document you'll receive immediately after purchase—no surprises, no placeholders. The comprehensive Delek Logistics Porter's Five Forces Analysis meticulously details the competitive landscape, including the bargaining power of buyers and suppliers, the threat of new entrants and substitutes, and the intensity of rivalry within the midstream energy sector.

Rivalry Among Competitors

Delek Logistics Partners (DKL) operates in a sector with a notable number of competitors, particularly in the Permian Basin and Gulf Coast regions. While specific market share data can fluctuate, the landscape includes both large, established midstream companies and smaller, more specialized players.

The presence of numerous competitors, many of comparable size, suggests a highly competitive environment. For instance, companies like Enterprise Products Partners, Magellan Midstream Partners, and Plains All American Pipeline are significant players in the broader crude oil and refined products logistics market, often overlapping with Delek's operational areas.

This density of competition can lead to price pressures and a constant need for efficiency and strategic asset development to maintain or grow market share. In 2024, the ongoing expansion and optimization of infrastructure in key production basins like the Permian continue to fuel this rivalry as companies vie for producer business and transportation volumes.

The midstream logistics industry is experiencing robust growth, driven by increasing domestic energy production. This expansion allows companies to grow by capturing new opportunities rather than directly confronting competitors for existing market share, which generally tempers rivalry.

For instance, the U.S. Energy Information Administration projected that crude oil production would reach an average of 13.1 million barrels per day in 2024, an increase from 2023. Such expansionary conditions typically lead to less aggressive competitive dynamics as the pie is getting bigger for everyone involved.

Delek Logistics' core services, including pipeline transportation, terminal operations, and storage, are largely considered commoditized within the midstream energy sector. This means that, for many customers, the basic function of moving or storing hydrocarbons is similar across providers, leading to a greater emphasis on price. For instance, in 2024, the market continued to see intense competition among midstream companies for long-term transportation contracts, often driven by tariff rates.

However, Delek Logistics can achieve differentiation through strategic asset locations, such as proximity to key production basins or refining centers, and by offering specialized storage solutions tailored to specific customer needs. Their extensive network of pipelines and terminals, particularly in the Permian Basin and Haynesville Shale, provides a competitive edge by offering integrated logistics solutions that reduce handling costs and improve efficiency for producers and refiners. This integration can mitigate pure price competition.

Exit Barriers

Exit barriers in the midstream logistics sector, particularly for companies like Delek Logistics, are substantial. These barriers make it difficult and costly for firms to leave the market. Specialized assets, such as pipelines and storage terminals, often have very limited alternative uses, meaning they cannot be easily repurposed or sold for a significant value if a company decides to exit.

Furthermore, significant regulatory obligations and long-term contractual commitments with shippers and producers further anchor companies to their operations. These commitments can include take-or-pay contracts, which require payment for capacity regardless of actual usage, creating ongoing financial liabilities even if a company wishes to cease operations. Such factors can compel companies to remain active competitors, even when market conditions are unfavorable.

For instance, in 2024, the energy infrastructure sector continued to see significant investment, but the specialized nature of midstream assets means that selling off a pipeline system, for example, is not as straightforward as selling a more generic piece of equipment. The capital intensity and the long lead times for developing new infrastructure also contribute to high exit costs, as companies have already sunk considerable funds into their existing networks.

- Specialized Assets: Midstream infrastructure like pipelines and storage tanks are built for specific purposes and lack broad marketability, leading to low salvage value upon exit.

- Contractual Commitments: Long-term agreements with shippers, often structured as take-or-pay contracts, create ongoing financial obligations that are difficult to terminate without penalty.

- Regulatory Hurdles: Navigating environmental regulations and obtaining permits for decommissioning or selling assets can be complex and time-consuming, adding to exit costs.

- High Capital Investment: The substantial upfront investment in midstream infrastructure means that companies often cannot recoup their initial capital outlay if they exit prematurely.

Cost Structure and Capacity Utilization

Delek Logistics' (DKL) cost structure, particularly its high fixed costs in pipeline and terminal operations, significantly influences competitive rivalry. When capacity utilization dips, the pressure to cover these fixed expenses intensifies.

During periods of overcapacity in the midstream sector, companies like DKL may resort to aggressive pricing to fill idle assets. This can trigger price wars, eroding profit margins across the industry. For instance, in 2024, reports indicated that certain pipeline segments experienced lower utilization rates due to shifts in crude oil production and refining demand, creating a more competitive pricing environment.

- High Fixed Costs: Pipeline infrastructure and terminal facilities represent substantial upfront investments, leading to significant fixed operating expenses for Delek Logistics.

- Capacity Utilization Impact: Profitability is heavily tied to how much of this infrastructure is actively being used. Lower utilization means fixed costs are spread over fewer revenue-generating units.

- Overcapacity and Price Wars: When the industry has more capacity than needed, companies often lower prices to secure business, leading to intense competition and reduced profitability for all.

- 2024 Market Dynamics: Shifts in energy production and consumption patterns in 2024 contributed to varying capacity utilization levels across different midstream assets, directly impacting pricing strategies and competitive intensity.

Competitive rivalry within Delek Logistics' (DKL) midstream sector is characterized by a substantial number of players, including large, established entities and smaller, specialized firms, particularly in key regions like the Permian Basin and Gulf Coast. While the overall market growth in 2024, with projected crude oil production reaching 13.1 million barrels per day, generally tempers direct confrontation, the commoditized nature of services like pipeline transportation and storage still fosters intense competition on price for contracts.

Delek Logistics' ability to differentiate through strategic asset locations and integrated solutions helps mitigate pure price competition. However, the industry's high fixed costs and the impact of capacity utilization on profitability mean that periods of overcapacity can lead to aggressive pricing strategies and reduced margins for all participants. The specialized nature of midstream assets also creates significant exit barriers, keeping companies engaged in the competitive landscape.

| Competitor Type | Examples | Impact on Rivalry |

| Large Established Midstream | Enterprise Products Partners, Magellan Midstream Partners, Plains All American Pipeline | Intensify rivalry through scale, extensive networks, and market influence. |

| Smaller Specialized Players | Various regional operators | Compete on niche services, specific geographic advantages, or specialized asset types. |

| New Entrants (less common in established infrastructure) | Companies with new infrastructure projects | Can increase rivalry if they capture significant market share or introduce innovative solutions. |

SSubstitutes Threaten

Crude oil and refined products can be transported via rail, trucking, and marine vessels, offering alternatives to Delek Logistics' pipeline network. In 2024, rail transport capacity for crude oil saw continued investment, though pipeline efficiency often remains superior for large volumes and long distances.

The efficiency and cost-effectiveness of these substitutes are critical. While trucking offers flexibility for smaller, localized movements, it's generally more expensive per barrel than pipelines for long-haul transport. Marine vessels are efficient for coastal or international movements but are limited by port infrastructure and waterway access.

The threat of substitutes is amplified when these alternatives can match or undercut pipeline pricing and delivery times. For instance, fluctuations in rail freight rates or expanded trucking capabilities could divert significant volumes from Delek's pipelines, impacting their utilization and profitability.

Pipelines generally provide the most cost-effective method for moving crude oil and refined products over long distances, often costing less than $5 per barrel for long-haul transport. This low cost is a significant advantage for Delek Logistics. However, if advancements in rail or truck technology significantly improve their efficiency and reduce their per-barrel cost, or if pipeline tariffs increase substantially, the economic advantage of pipelines could diminish, making substitutes more appealing.

Delek Logistics customers, primarily energy producers and refiners, exhibit a low propensity to substitute away from pipeline transportation. This is largely due to the significant switching costs associated with establishing new infrastructure or adapting existing facilities for alternative methods like rail or trucking.

The specialized nature of pipeline transport for crude oil and refined products means that most customers are locked into existing systems. For instance, in 2024, the vast majority of crude oil moved via pipeline in the US, underscoring the entrenched position of this mode for bulk liquid transport, with rail and truck serving more niche or last-mile delivery roles.

While customers are aware of alternatives, the economic and operational efficiencies of pipelines for large volumes make them the preferred choice. The perceived benefits of pipeline reliability and cost-effectiveness for their core operations outweigh the perceived advantages of more flexible but less efficient substitute methods.

Changes in Energy Demand and Consumption

Broader trends in energy demand, particularly the accelerating shift towards alternative energy sources like solar, wind, and electric vehicles, pose a significant threat to Delek Logistics. This transition away from traditional fossil fuels could fundamentally alter the market for crude oil and refined products.

Long-term declines in the consumption of these core products, driven by global energy transition initiatives and government policies, directly reduce the overall need for Delek Logistics' pipeline, terminal, and transportation services. For instance, projections indicate a substantial increase in electric vehicle adoption, with the International Energy Agency (IEA) forecasting that electric cars could account for over 40% of all new car sales globally by 2030, up from around 14% in 2022. This shift directly impacts demand for refined gasoline and diesel fuel.

- Shifting Energy Mix: The increasing global investment in renewable energy infrastructure, projected to reach trillions of dollars in the coming decade, directly competes with fossil fuel-based energy systems that Delek Logistics supports.

- EV Adoption Rates: Rapid growth in electric vehicle sales, with global sales exceeding 10 million units in 2022, signals a long-term reduction in demand for gasoline and diesel, key products transported by Delek.

- Policy and Regulation: Government mandates and incentives promoting energy efficiency and carbon reduction, such as the US Inflation Reduction Act, accelerate the transition away from fossil fuels, impacting the volume of products Delek handles.

- Technological Advancements: Innovations in energy storage and grid modernization further enable the integration of renewables, potentially diminishing reliance on traditional fuel transportation networks.

Regulatory and Environmental Shifts

Regulatory and environmental shifts significantly influence the threat of substitutes for pipeline transportation. For instance, increased scrutiny and new regulations on pipeline safety and environmental impact, such as those enacted by the Pipeline and Hazardous Materials Safety Administration (PHMSA) in the U.S., can escalate operational costs for pipeline companies. These rising costs can make alternative transportation methods, like rail or truck, more economically competitive, thereby increasing the threat of substitution.

Conversely, government policies can also bolster pipelines against substitutes. For example, if environmental regulations become more stringent for trucking or rail, particularly concerning emissions or carbon footprints, pipelines might become a relatively more attractive option. In 2024, the ongoing debate around energy infrastructure and environmental sustainability continues to shape these dynamics, with potential for new legislation impacting the cost-effectiveness of various transport modes.

- Stricter pipeline safety regulations can increase operational expenses, making alternatives like rail more appealing.

- Environmental policies favoring lower-emission transport could reduce the attractiveness of trucking and rail compared to pipelines.

- The U.S. Department of Transportation's continued focus on pipeline integrity management in 2024 directly impacts compliance costs for operators.

While pipelines are generally the most cost-effective for bulk transport, the threat of substitutes like rail and trucking is real, especially if their costs decrease or pipeline costs rise. In 2024, rail transport capacity continued to see investment, though pipelines still hold an advantage for large volumes and long distances. The ultimate impact hinges on the relative pricing and efficiency gains of these alternatives.

Entrants Threaten

Entering the midstream logistics sector, like that of Delek Logistics, demands immense capital. Building essential infrastructure such as pipelines, expansive terminals, and significant storage facilities requires hundreds of millions, if not billions, of dollars. For instance, major pipeline projects often exceed $1 billion in initial investment.

This exceptionally high upfront financial commitment serves as a formidable barrier, effectively deterring many potential new competitors from entering the market. Consequently, the number of viable new entrants capable of meeting these substantial capital requirements is significantly limited.

New entrants face substantial regulatory hurdles and lengthy permitting processes, including rigorous environmental assessments and complex land acquisition procedures. For instance, infrastructure projects in the midstream energy sector, similar to Delek Logistics' operations, can experience approval timelines stretching over several years, significantly increasing upfront investment and delaying revenue generation.

Newcomers face significant hurdles in securing essential rights-of-way for pipeline construction and prime locations for terminals. Delek Logistics, as an established player, benefits from existing networks and long-standing relationships, creating a formidable barrier for emerging competitors trying to build comparable infrastructure.

Economies of Scale and Experience Curve

Delek Logistics benefits significantly from established economies of scale and the experience curve. Its extensive network of pipelines and terminals, developed over years of operation, allows for lower per-unit operating costs compared to potential new entrants. For instance, in 2024, Delek Logistics reported operating 6,300 miles of pipeline, a substantial infrastructure advantage that would be costly and time-consuming for a newcomer to replicate.

New entrants would struggle to match Delek Logistics’ cost efficiencies. The learning curve in managing complex logistics operations, optimizing throughput, and navigating regulatory landscapes provides incumbents with a distinct advantage. Without comparable scale, new players would likely face higher initial capital expenditures and operational expenses, creating a significant barrier to entry in terms of pricing competitiveness.

- Economies of Scale: Delek Logistics' vast infrastructure network leads to lower per-unit costs.

- Experience Curve: Years of operational expertise translate into efficiency gains and cost savings.

- High Initial Capital: New entrants require substantial investment to build comparable infrastructure.

- Competitive Pricing Challenge: Newcomers face difficulty competing on price due to higher initial costs.

Brand Loyalty and Switching Costs for Customers

Existing customers often remain with current logistics providers due to significant switching costs, rather than pure brand loyalty. These costs can stem from long-term contracts, the expense of integrating new systems, or the perceived risk associated with disrupting established supply chains. For instance, in 2024, many large industrial clients were locked into multi-year agreements with established pipeline operators like Delek Logistics, making a transition to a new provider prohibitively complex and costly.

The inertia created by these switching costs acts as a substantial barrier. New entrants would need to offer not just competitive pricing but also a seamless transition and proven reliability to overcome the ingrained customer relationships and operational dependencies. This makes it challenging for newcomers to gain immediate traction against incumbents who have already invested in building these customer ties and integrated infrastructure.

- Customer Retention: Delek Logistics benefits from high customer retention rates, often exceeding 90% for key contracts, due to the inherent switching costs.

- Contractual Lock-ins: A significant portion of Delek's revenue is secured through contracts with terms ranging from 5 to 15 years, effectively deterring customers from seeking alternatives.

- Operational Integration: Clients often have their systems deeply integrated with Delek's infrastructure, making the cost and complexity of switching to a new provider substantial in 2024.

The threat of new entrants into the midstream logistics sector, where Delek Logistics operates, is generally low. This is primarily due to the massive capital investment required to build comparable infrastructure, such as pipelines and terminals, which often runs into hundreds of millions or even billions of dollars. For example, major pipeline projects frequently surpass $1 billion in initial outlays. Furthermore, new companies face significant regulatory hurdles and lengthy permitting processes, which can add years and substantial costs to project development. Delek Logistics' established network, economies of scale, and existing customer relationships, often secured by long-term contracts, present formidable barriers that make it difficult for newcomers to compete effectively on price or service in 2024.

| Barrier Type | Description | Impact on New Entrants | Delek Logistics Advantage (2024 Data) |

|---|---|---|---|

| Capital Requirements | Building pipelines, terminals, and storage requires billions. Major pipeline projects can exceed $1 billion. | Extremely high, deterring most potential entrants. | Established infrastructure base reduces need for new large-scale capital deployment for existing operations. |

| Regulatory & Permitting | Lengthy processes including environmental reviews and land acquisition. Projects can take years to approve. | Increases upfront costs and delays revenue generation. | Experience navigating complex regulatory landscapes and existing permits. |

| Economies of Scale & Experience | Lower per-unit costs from extensive operations and years of expertise. Delek operated 6,300 miles of pipeline in 2024. | Difficulty matching cost efficiencies and operational optimization. | Significant cost advantage due to scale and operational learning curve. |

| Customer Switching Costs | High costs associated with changing providers due to contracts, system integration, and supply chain disruption. Many clients had multi-year agreements in 2024. | Requires new entrants to offer substantial incentives and prove reliability. | High customer retention rates (often over 90%) due to integrated systems and long-term contracts (5-15 years). |

Porter's Five Forces Analysis Data Sources

Our Delek Logistics Porter's Five Forces analysis is built upon a foundation of publicly available information, including Delek Logistics' SEC filings, investor presentations, and annual reports. We supplement this with insights from reputable industry research firms and financial news outlets to provide a comprehensive view of the competitive landscape.