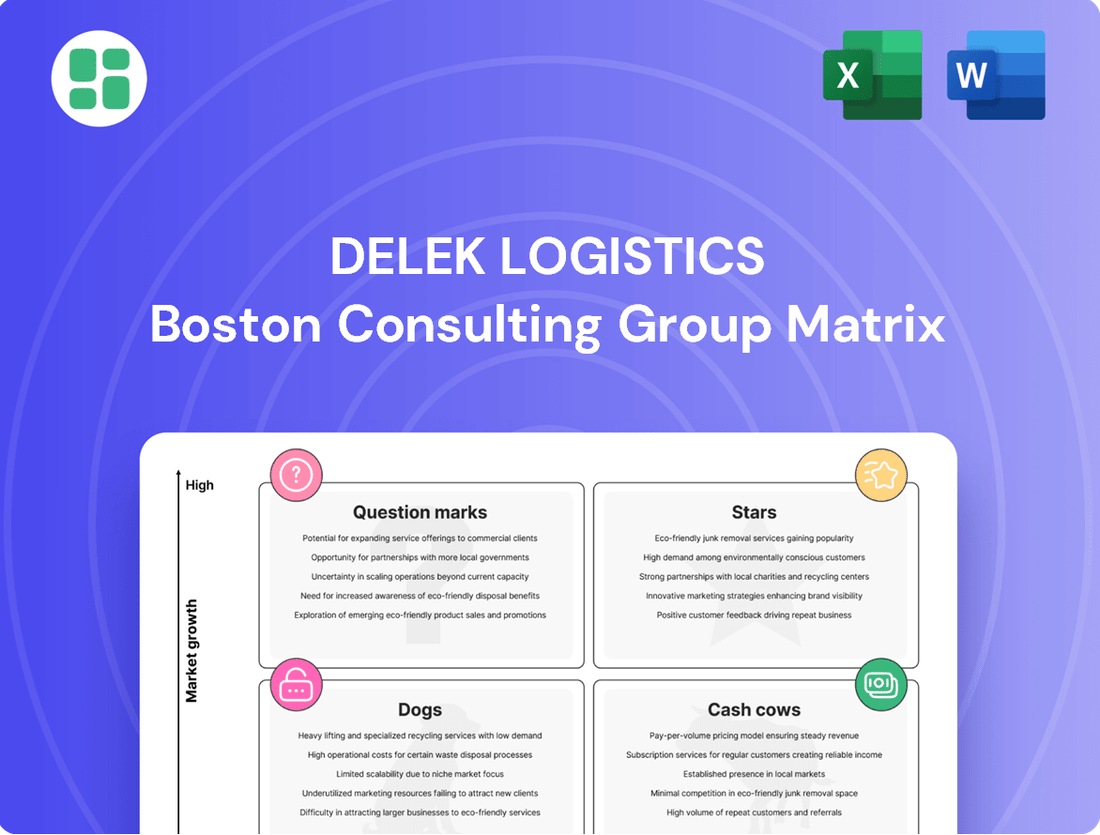

Delek Logistics Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Delek Logistics Bundle

Uncover the strategic positioning of Delek Logistics' diverse portfolio with our comprehensive BCG Matrix analysis. See which segments are fueling growth and which require careful consideration.

This preview offers a glimpse into Delek Logistics' market dynamics, but for a complete understanding and actionable insights, the full BCG Matrix report is essential. Gain clarity on Stars, Cash Cows, Dogs, and Question Marks to make informed decisions.

Don't miss out on the detailed quadrant placements and data-backed recommendations that will empower your strategic planning. Purchase the full BCG Matrix today to unlock a roadmap for optimizing Delek Logistics' investments and product development.

Stars

Delek Logistics Partners (DKL) is significantly expanding its midstream footprint in the Permian Basin, targeting both the Midland and Delaware sub-basins. This strategic push aligns with the region's projected sustained growth in oil and gas production, expected to continue through 2025.

DKL's investments are designed to capture a substantial market share within this expanding sector, driven by the increasing need for efficient logistics solutions to transport growing production volumes.

The Libby 2 Gas Processing Plant, a key growth driver for Delek Logistics, successfully completed commissioning in Lea County, New Mexico. This facility significantly boosts natural gas processing capabilities in the Delaware Basin.

The plant is projected to reach full operational capacity by the second half of 2025. This positions it as a high-growth asset within the natural gas midstream sector, demonstrating a rapidly expanding market presence.

Delek Logistics Partners (DKL) has strategically bolstered its water midstream segment through significant acquisitions, notably H2O Midstream and Gravity Water Midstream. These moves are pivotal, as they not only add to DKL's Adjusted EBITDA but also substantially broaden its operational reach in water disposal and recycling services.

The demand for these water services is particularly robust within active Permian Basin drilling regions. This high demand underscores DKL's strong market position in a niche yet expanding part of the midstream industry. For instance, in 2023, DKL reported that its water solutions segment generated approximately $161 million in revenue, a notable increase driven by these strategic acquisitions and the underlying market growth.

Wink to Webster Pipeline Joint Venture

Delek Logistics' (DKL) acquisition of Delek US Holdings' stake in the Wink to Webster (W2W) pipeline significantly boosted its equity income from pipeline joint ventures. This strategic move positions DKL within a high-demand crude oil transportation corridor.

The W2W pipeline, a critical artery connecting the Permian Basin to the Gulf Coast, is a key asset for DKL. This expansion solidifies its market presence in a region experiencing substantial growth in crude oil production and demand.

- W2W Pipeline: Connects Permian Basin to Gulf Coast, a vital crude oil artery.

- Market Position: DKL benefits from a strong presence in a high-growth crude transportation corridor.

- Financial Impact: Acquisition enhances DKL's equity income from pipeline joint ventures.

Increasing Third-Party Revenue Contribution

Delek Logistics is strategically increasing the proportion of its earnings derived from third-party customers. This move is designed to foster greater financial independence from its sponsor, Delek US Holdings. By diversifying its revenue streams, Delek Logistics is demonstrating its ability to compete effectively in the wider midstream sector.

This expansion beyond affiliate business signifies a successful broadening of its customer base and service offerings. In 2024, Delek Logistics reported that third-party revenue contributed significantly to its overall financial performance, reflecting this ongoing strategic initiative.

- Third-Party Revenue Growth: Delek Logistics' focus on third-party customers is a key driver for its growth.

- Economic Separation: The company aims to reduce its reliance on Delek US Holdings, enhancing its financial flexibility.

- Market Expansion: This strategy allows Delek Logistics to capture a larger share of the competitive midstream market.

- Diversified Service Offerings: The expansion highlights the company's ability to provide services to a broader range of clients.

Delek Logistics' (DKL) water midstream segment, bolstered by acquisitions like H2O Midstream and Gravity Water Midstream, is a prime example of a Star. This segment is experiencing robust demand, particularly in the Permian Basin, and generated approximately $161 million in revenue in 2023. Its strong market position and rapid growth in a key niche sector align perfectly with the characteristics of a Star in the BCG matrix.

What is included in the product

Delek Logistics' BCG Matrix analysis highlights strategic opportunities and challenges across its diverse portfolio.

It categorizes business units to guide investment, divestment, and growth strategies.

A clear Delek Logistics BCG Matrix overview, placing each business unit, relieves the pain of strategic uncertainty.

Cash Cows

Delek Logistics' established Permian Basin gathering systems are clear cash cows. These mature assets, boasting high market share, continue to benefit from ongoing Permian activity. They generate consistent, fee-based throughput, providing stable and predictable cash flows that are vital to Delek's financial stability.

Delek Logistics' long-term fee-based contracts are a prime example of a cash cow. Approximately 92% of their contract portfolio is built on these agreements, which typically span 7 to 10 years.

This structure provides highly predictable revenue and strong profit margins. Because these contracts require very little additional investment to maintain, they generate consistent cash flow for the company.

Delek Logistics demonstrates a robust history of consistent quarterly cash distribution growth. As of the second quarter of 2025, the company achieved its 50th consecutive increase in these distributions.

This ongoing dividend expansion is a strong signal of the company's mature and stable assets. These assets are effectively generating substantial free cash flow, which is then passed on to unitholders.

Gulf Coast Refined Products Terminals

Delek Logistics' Gulf Coast refined products terminals and storage facilities are prime examples of cash cows within its BCG Matrix. These assets operate in a mature segment characterized by stable demand, where Delek holds a significant market share. Their efficiency in generating consistent cash flow with minimal investment in promotion or placement underscores their cash cow status.

In 2023, Delek Logistics reported that its refined products segment, which includes these terminals, contributed substantially to its overall financial performance. The company's strategic focus on optimizing these existing assets allows for robust cash generation, supporting other areas of the business. For instance, Delek's 2024 guidance anticipates continued strong performance from its logistics and marketing segments, largely driven by these mature, high-performing assets.

- Mature Market Dominance: The Gulf Coast refined products market is well-established, with consistent demand for storage and distribution services.

- High Market Share: Delek Logistics maintains a strong position in this low-growth but stable market segment.

- Efficient Cash Generation: These terminals generate significant, reliable cash flow with relatively low ongoing investment requirements.

- Strategic Importance: The cash generated by these assets helps fund growth initiatives and other business segments within Delek Logistics.

Tyler and El Dorado Refinery Support Assets

The Tyler and El Dorado Refinery Support Assets for Delek Logistics are firmly positioned as Cash Cows within the BCG Matrix. These assets are mature and integrated, playing a crucial role in the crude oil and refined products supply chain for Delek US Holdings' refineries in Tyler, Texas, and El Dorado, Arkansas.

Their critical function ensures consistent volumes and stable revenues, making them reliable generators of cash for the company. For instance, in 2024, Delek Logistics reported that its Pipeline and Terminaling segment, which includes these support assets, generated significant and consistent operating income, underscoring their cash-generating capabilities.

- Mature and Integrated Operations: These assets are well-established and integral to the refining process, minimizing the need for significant new investment.

- Consistent Revenue Streams: Their vital role in supporting refinery operations guarantees steady throughput and, consequently, predictable revenue generation.

- High Market Share in Niche: Within their specific operational context supporting Delek US Holdings, these assets hold a dominant position, ensuring continued demand.

- Strong Cash Generation: The stability and critical nature of these assets translate into substantial and reliable cash flow for Delek Logistics.

Delek Logistics' Permian Basin gathering systems are textbook cash cows, benefiting from consistent Permian activity and generating stable, fee-based throughput. Their long-term, fee-based contracts, covering approximately 92% of their portfolio with terms of 7 to 10 years, ensure predictable revenue and strong profit margins with minimal reinvestment. This stability is reflected in their consistent quarterly cash distribution growth, with 50 consecutive increases as of Q2 2025, signaling robust free cash flow generation from mature, stable assets.

| Asset Type | Key Characteristic | Cash Flow Driver | Recent Performance Indicator (2024/2025) |

| Permian Basin Gathering Systems | Mature, high market share | Fee-based throughput | Continued benefit from Permian activity |

| Long-Term Fee-Based Contracts | 92% of portfolio, 7-10 year terms | Predictable revenue, low reinvestment | Stable profit margins |

| Gulf Coast Refined Products Terminals | Mature segment, stable demand | Efficient cash generation | Substantial contribution to financial performance (2023) |

| Refinery Support Assets (Tyler & El Dorado) | Integrated, critical to refining | Consistent volumes, stable revenues | Significant operating income from Pipeline & Terminaling (2024) |

What You See Is What You Get

Delek Logistics BCG Matrix

The Delek Logistics BCG Matrix preview you are viewing is the exact, fully formatted document you will receive upon purchase. This means no watermarks, no demo content, and no hidden surprises – just a comprehensive, analysis-ready report designed for immediate strategic application. You can trust that the insights and structure presented here are precisely what you'll be able to leverage for your business planning and decision-making. This is your final, professional-grade BCG Matrix analysis, ready to be integrated into your workflow without delay.

Dogs

Legacy pipeline or storage assets in regions with dwindling production or significantly reduced throughput due to shifts in drilling or market demand can be categorized as dogs in Delek Logistics' BCG Matrix. These assets likely possess a low market share and minimal growth potential, often operating at the breakeven point.

For instance, if a legacy crude oil pipeline in a mature basin, like parts of the Permian Basin experiencing a shift towards natural gas, sees its throughput decline by 15% year-over-year, it would fit this description. Such an asset would struggle to generate substantial returns, given its limited operational capacity and the lack of anticipated market expansion.

The Wholesale Marketing and Terminalling segment of Delek Logistics has experienced a dip in its Adjusted EBITDA in recent quarters. This decline is partly attributed to the assignment of the Big Spring refinery marketing agreement to Delek Holdings.

This shift suggests a potential loss of market share or reduced profitability within certain marketing operations. Consequently, this segment might be characterized as a low-growth, low-share area within the BCG matrix, warranting a strategic review.

Delek Logistics' 'Dogs' are assets that require substantial maintenance capital but offer little return, particularly those with a small market share in slow-growing sectors. These could include older, less efficient pipeline segments or storage facilities that are costly to keep operational. For instance, if a particular pipeline segment generated only $5 million in operating cash flow in 2024 but required $4 million in sustaining capital expenditures, it would be a prime candidate for this category.

Highly Leveraged or Unprofitable Joint Ventures

Highly Leveraged or Unprofitable Joint Ventures within Delek Logistics' portfolio would be classified as Dogs in the BCG Matrix. These are investments, often in pipeline joint ventures, that are not performing well. They might be generating very little income or even operating at a loss. This situation is particularly concerning when they are situated in a market that isn't experiencing significant growth.

These ventures act as cash traps, meaning they require ongoing financial resources and management attention but fail to deliver substantial returns or contribute positively to the company's overall profitability. For instance, if a joint venture pipeline project had a debt-to-equity ratio exceeding 70% in 2024 and failed to meet its projected EBITDA margins by more than 15%, it would likely fall into this category.

- Underperforming Assets: Joint ventures with consistently low revenue growth, potentially below 2% annually, and negative or near-zero operating margins.

- High Debt Burden: Investments where the leverage ratio is significantly higher than industry averages, increasing financial risk without commensurate returns.

- Market Stagnation: Ventures operating in mature or declining markets where expansion and increased profitability are unlikely in the near future.

- Resource Drain: Projects that consume capital for maintenance or operational support without generating sufficient cash flow to cover their costs.

Non-Strategic Assets Identified for Divestiture

In the context of Delek Logistics Partners (DKL) and its strategic positioning, assets that fall into the 'Dog' quadrant of the Boston Consulting Group (BCG) matrix are typically those with low market share and low growth potential. While specific divestiture candidates haven't been explicitly named in recent public filings up to July 2025, DKL's stated focus on its Permian Basin operations suggests that non-core assets not contributing significantly to this strategy would be considered for divestiture.

These underperforming assets might include pipelines or storage facilities in regions outside the Permian, or those with declining throughput and limited prospects for expansion or improved profitability. For instance, if an asset generated less than $5 million in annual EBITDA and had a negative growth outlook, it could be a candidate. The goal is to streamline operations and allocate capital towards higher-growth, strategic areas.

- Underperforming Assets: Those with low profitability and minimal contribution to overall cash flow.

- Non-Core Operations: Assets that do not align with DKL's strategic focus, particularly its Permian Basin expansion.

- Limited Growth Potential: Infrastructure or services facing declining demand or lacking opportunities for significant market share increase.

- Strategic Alignment: Divestiture candidates would be those that, if sold, would allow for greater capital allocation to the Permian-centric growth strategy.

Dogs in Delek Logistics' BCG Matrix represent assets with low market share and low growth prospects, often requiring significant capital for maintenance with minimal returns. These could be legacy pipeline or storage assets in mature, declining regions or underperforming joint ventures with high debt. For example, a pipeline segment generating only $5 million in 2024 operating cash flow while needing $4 million in sustaining capital expenditures would be a dog.

The Wholesale Marketing and Terminalling segment, experiencing a dip in Adjusted EBITDA due to factors like the Big Spring refinery marketing agreement assignment, may also be classified as a dog. This indicates a potential loss of market share or reduced profitability in a low-growth area, necessitating a strategic review.

Delek Logistics' focus on Permian Basin operations implies that non-core assets, such as pipelines or storage outside this region with declining throughput and limited expansion potential, are candidates for divestiture. An asset generating less than $5 million in annual EBITDA with a negative growth outlook exemplifies such a dog.

| Asset Type | Market Share | Growth Potential | 2024 EBITDA (Est.) | 2024 Sustaining CapEx (Est.) |

|---|---|---|---|---|

| Legacy Pipeline (Mature Basin) | Low | Low | $5M | $4M |

| Underperforming JV | Low | Low | $2M | $3M |

| Non-Core Storage Facility | Low | Low | $1M | $1.5M |

Question Marks

Delek Logistics has recently secured new acreage dedications in undeveloped areas, primarily within the Permian Basin's crude oil sector. This strategic move aims to capture nascent market share in a high-growth region.

These newly dedicated areas are characterized by a lack of established infrastructure, necessitating substantial capital investment to build out the necessary facilities. This positions them as potential question marks within Delek's BCG Matrix, requiring significant resources to mature into stars.

The Permian Basin saw significant activity in 2024, with production continuing to rise. For Delek, successfully developing these new dedications will be key to converting these question marks into future revenue streams.

Delek Logistics' expansion of acid gas injection (AGI) and sour gas treating at the Libby Complex positions them to capitalize on the burgeoning demand for enhanced natural gas processing. This strategic move taps into a high-growth segment of the energy market, driven by increasing volumes of sour gas that require specialized treatment.

Currently, these new service offerings represent a nascent market share for Delek Logistics. The significant capital investment required to build out these capabilities means that while the potential for growth is substantial, the immediate market penetration is limited, classifying them as question marks within the BCG matrix.

Diversifying into new third-party customer segments for Delek Logistics (DKL) represents a classic Stars category in the BCG Matrix. This strategy involves entering growing markets where DKL currently has a small presence, requiring substantial investment in marketing and infrastructure to capture market share.

For instance, if DKL were to target the rapidly expanding renewable energy logistics sector, it would fit this profile. The U.S. market for renewable energy infrastructure is projected to see significant growth, with investments in wind and solar power infrastructure expected to reach hundreds of billions by 2025. DKL's expansion into such a segment would be a strategic move to capitalize on this burgeoning demand.

Early-Stage Crude and Water Gathering Projects

Delek Logistics' early-stage crude and water gathering projects, such as those alongside the Libby 2 plant in the Permian Basin, are positioned in high-growth regions. These ventures are currently in their ramp-up phases, meaning they are building operational capacity and market presence. This stage necessitates significant capital investment and ongoing operational support to achieve their full potential and secure market share.

- Growth Potential: These projects are situated in the Permian, a prolific oil and gas producing region, indicating strong underlying demand for gathering services.

- Capital Intensity: Early-stage infrastructure development requires substantial upfront capital expenditure, impacting immediate profitability but setting the stage for future revenue.

- Operational Ramp-Up: Volumes and market share are still developing, which is typical for new projects, requiring focused execution and management to gain traction.

- Strategic Importance: These gathering systems are crucial for Delek Logistics' integrated strategy, providing essential midstream services to upstream production.

Unspecified 'Accretive Growth Projects'

Delek Logistics' unspecified 'accretive growth projects' in areas like the Delaware Basin can be viewed through the lens of the BCG Matrix. These investments are directed towards markets with high growth potential, but where Delek's current market share is relatively low. This positions them as potential Stars or Dogs, depending on their future performance and market penetration.

For instance, in 2024, Delek Logistics continued to invest in infrastructure projects aimed at capturing growth in key energy-producing regions. The Delaware Basin, in particular, has seen significant activity. While specific project details remain undisclosed, the allocation of capital to these ventures signifies a strategic bet on future market expansion.

- Potential Stars: Investments in high-growth areas like the Delaware Basin, where Delek aims to increase its market share.

- Uncertain Outcome: The success of these projects is not yet guaranteed, placing them in a state of flux within the BCG matrix.

- Capital Allocation: Delek's commitment to these unspecified projects highlights a forward-looking strategy to capitalize on emerging opportunities.

- Market Dynamics: The company's focus on regions with strong growth trajectories suggests an effort to diversify and expand its operational footprint.

Delek Logistics' new acreage dedications in undeveloped Permian Basin areas represent classic question marks. These ventures require significant capital to build infrastructure, aiming to capture future market share in a high-growth sector.

The company's expansion of acid gas injection and sour gas treating services also falls into this category, demanding substantial investment for limited initial market penetration.

These early-stage gathering projects, like those near the Libby 2 plant, are in high-growth regions but still ramping up operations and market presence, necessitating ongoing investment.

These question mark initiatives are crucial for Delek Logistics' long-term strategy, aiming to transform nascent opportunities into stable revenue streams.

BCG Matrix Data Sources

Our Delek Logistics BCG Matrix is constructed using comprehensive market data, encompassing financial reports, industry analysis, and operational performance metrics to provide a clear strategic overview.