Delek Logistics PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Delek Logistics Bundle

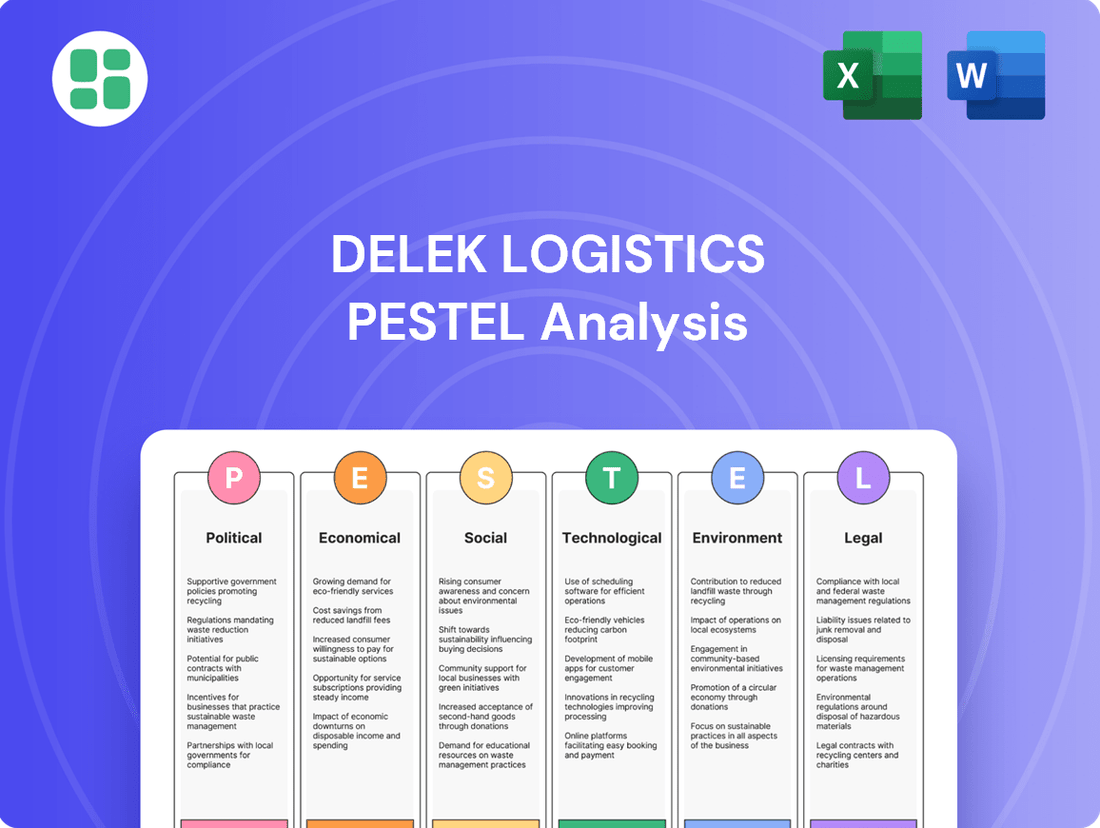

Delek Logistics operates within a dynamic external environment shaped by political, economic, social, technological, legal, and environmental factors. Understanding these forces is crucial for strategic planning and risk mitigation. Our comprehensive PESTLE analysis delves into these critical areas, providing you with actionable intelligence.

Gain a competitive edge by understanding how regulatory changes, economic volatility, and evolving consumer preferences impact Delek Logistics. Our expertly crafted PESTLE analysis offers deep-dive insights into these crucial external trends. Download the full version now to unlock strategic advantages and inform your decision-making.

Political factors

Government energy policies at federal, state, and local levels significantly shape Delek Logistics' operational landscape. Policies impacting fossil fuel production, consumption, and infrastructure development, such as those influencing oil and gas extraction or midstream asset incentives, directly affect the company's growth and compliance. For instance, the Biden administration's focus on transitioning to renewable energy, coupled with potential restrictions on new oil and gas leases, could influence investment in traditional infrastructure.

Delek Logistics' operations are heavily influenced by regulatory stability, particularly concerning its pipeline and terminal infrastructure. The predictability of permitting processes and environmental reviews directly impacts project timelines and costs. For instance, in 2024, the energy sector continued to navigate evolving environmental regulations, with some projects facing extended review periods, potentially delaying expansion plans and increasing capital expenditures.

Geopolitical tensions and evolving trade policies significantly impact Delek Logistics by influencing global crude oil and refined product markets. Disruptions in supply chains, such as those seen with ongoing conflicts in Eastern Europe, can lead to price volatility and affect the volume of products flowing through Delek's transportation and storage assets. Trade disputes, for instance, between major economies could alter demand patterns for refined fuels, indirectly affecting Delek's operational throughput.

The stability of energy demand across international markets is a crucial consideration. For example, economic slowdowns in key importing regions, potentially exacerbated by political instability, can reduce the need for refined products, thereby impacting the utilization rates of Delek's infrastructure. As of early 2025, the International Energy Agency (IEA) projects global oil demand growth to moderate, influenced by these complex geopolitical and trade dynamics.

Taxation and Fiscal Policies

Changes in corporate taxation and fiscal policies directly influence Delek Logistics' profitability and investment appeal. For instance, shifts in the tax treatment of Master Limited Partnerships (MLPs), such as potential changes to pass-through status or the imposition of new federal taxes on MLPs, could significantly impact its distributable cash flow and ability to return capital to unitholders.

Tax reforms affecting infrastructure depreciation schedules or investment tax credits for midstream assets would also play a crucial role. If depreciation allowances are reduced, it could lower taxable income but also decrease reported earnings. Conversely, enhanced incentives for infrastructure development could boost capital investment and future growth prospects.

Delek Logistics' financial performance is also subject to state-level tax policies in its primary operating regions. For example, variations in state corporate income tax rates or specific excise taxes on fuel transportation could affect operating margins and overall financial health.

- Federal Tax Reforms: Potential changes to MLP taxation, such as the introduction of a corporate-level tax on MLP income, could reduce net cash available for distributions.

- Depreciation Allowances: The ability to deduct depreciation on midstream infrastructure impacts taxable income; changes to these rules, like those seen in discussions around tax code updates, are critical.

- State Tax Environment: Operating in states like Texas, Arkansas, and Louisiana means Delek Logistics must navigate varying state income tax rates and potentially specific industry-related taxes, influencing its effective tax rate.

Political Stability in Operating Regions

Political stability in Delek Logistics' key operating regions, particularly the Permian Basin and U.S. Gulf Coast, is crucial for its infrastructure investments. Shifts in local or state leadership, influenced by elections or evolving public sentiment towards industrial activities, can impact project approvals and community relations. For instance, the 2024 U.S. general election cycle may bring policy changes affecting energy infrastructure development, requiring Delek to adapt its strategies to maintain a predictable operational environment.

The company's ability to navigate varying political landscapes is essential for securing permits and maintaining social license to operate. Changes in state-level regulations, driven by political mandates or public opinion, could directly affect pipeline construction timelines and operational compliance costs. Maintaining strong relationships with local and state government officials across Texas and the Gulf Coast states remains a priority for Delek Logistics.

Government policies directly influence Delek Logistics' operations, from federal energy mandates impacting fossil fuels to state-level regulations on infrastructure. The Biden administration's push for renewable energy, for example, could affect investment in traditional midstream assets. In 2024, the sector continued to grapple with evolving environmental regulations, with some projects facing extended review periods, potentially delaying expansion and increasing costs.

Geopolitical events and trade dynamics significantly impact Delek Logistics by affecting global oil and refined product markets. Disruptions, such as those from ongoing conflicts, can lead to price volatility and alter product flows through Delek's assets. As of early 2025, the IEA projects moderated global oil demand growth, influenced by these complex geopolitical and trade factors.

Changes in corporate taxation and fiscal policies, including potential reforms affecting Master Limited Partnerships (MLPs), directly influence Delek Logistics' profitability and investment appeal. For instance, shifts in the tax treatment of MLPs could impact distributable cash flow. State-level tax policies in key operating regions like Texas also affect operating margins.

Political stability in Delek Logistics' core operating regions, such as the Permian Basin, is vital for infrastructure investments. The 2024 U.S. general election cycle, for example, could introduce policy shifts impacting energy infrastructure development, requiring Delek to adapt its strategies for a predictable operational environment.

What is included in the product

This PESTLE analysis examines the external macro-environmental factors impacting Delek Logistics across Political, Economic, Social, Technological, Environmental, and Legal dimensions, offering actionable insights for strategic decision-making.

A PESTLE analysis for Delek Logistics offers a structured approach to identify and mitigate external risks, thereby relieving the pain point of navigating complex and unpredictable market dynamics.

Economic factors

Fluctuations in crude oil and refined product prices directly impact Delek Logistics' transported and stored volumes. While many midstream contracts are fee-based, extreme price swings can affect producer drilling activity and refinery utilization, ultimately influencing throughput demand.

For instance, sustained low oil prices, as seen at various points in 2023 and early 2024, can lead to reduced drilling, impacting the supply of crude oil to pipelines. Conversely, high prices might incentivize more production, increasing volumes. Delek Logistics' 2024 guidance anticipates stable throughput, but significant deviations from expected price trends could alter this outlook.

Hedging strategies can offer some protection against price volatility. By securing prices for a portion of their volumes or related inputs, companies like Delek Logistics can mitigate the impact of sharp market movements on their financial performance and operational planning.

Overall economic growth significantly impacts Delek Logistics' business by driving demand for energy products. A healthy economy, marked by robust GDP expansion and strong industrial activity, typically translates to increased consumption of transportation fuels and raw materials for manufacturing. This heightened demand directly benefits Delek Logistics by boosting the utilization of its pipeline and terminal infrastructure.

For instance, in 2024, projections for US GDP growth, estimated around 2.5% by various economic forecasters, suggest a continued need for efficient energy logistics. Similarly, industrial production indices, which saw fluctuations throughout 2023, are expected to stabilize or grow, further supporting the throughput volumes for Delek's assets. A strong industrial sector means more feedstock moving through pipelines and more refined products being stored and distributed via terminals.

Conversely, economic slowdowns or recessions can have a detrimental effect. Reduced consumer spending and business investment lead to lower energy consumption, directly impacting Delek Logistics' revenue streams. During economic downturns, companies often scale back operations, resulting in decreased demand for the transportation and storage services that Delek provides, leading to lower utilization rates for its assets.

The prevailing interest rate environment significantly influences Delek Logistics Partners (DLGP) capital costs. As of mid-2024, the Federal Reserve has maintained a hawkish stance, with benchmark rates hovering around 5.25%-5.50%. This elevated rate environment directly increases the cost of borrowing for DLGP, making new debt issuance or refinancing existing obligations more expensive. Consequently, capital expansion projects, such as pipeline construction or terminal upgrades, become less economically attractive as higher interest expenses erode potential returns.

Higher interest rates also impact investor sentiment towards Master Limited Partnerships (MLPs) like DLGP. With increased yields available from less risky fixed-income investments, investors may demand higher distributions from MLPs to compensate for the perceived risk, potentially pressuring unit prices. For instance, if DLGP’s cost of debt rises by 1%, it could translate to a substantial increase in annual interest payments, impacting distributable cash flow available to unitholders.

Inflationary Pressures on Operational Expenses

Inflationary pressures directly impact Delek Logistics' operational expenses, particularly for labor, raw materials, and energy. For instance, the U.S. Producer Price Index (PPI) for refined petroleum products saw a significant increase in late 2023 and early 2024, impacting input costs. While Delek Logistics may pass some of these rising costs to customers through contractual agreements, sustained inflation can still squeeze profit margins if cost recovery mechanisms are insufficient.

Persistent inflation can also affect the company's profitability by eroding the real value of its long-term assets and potentially increasing the cost of capital for future investments.

- Rising Labor Costs: Wage inflation, driven by a competitive job market, increases Delek Logistics' payroll expenses.

- Material and Maintenance Expenses: Higher costs for steel, equipment, and spare parts directly impact maintenance budgets and capital expenditure.

- Energy Price Volatility: Fluctuations in diesel and natural gas prices, critical for transportation and facility operations, add to operational cost uncertainty.

- Contractual Pass-Through Limitations: While some contracts allow for cost adjustments, not all expenses are fully recoverable, potentially impacting margin stability.

Supply and Demand Dynamics in Key Basins

Supply and demand dynamics within Delek Logistics' core operating regions, particularly the Permian Basin and the Gulf Coast, are critical. Changes in crude oil and natural gas production levels directly impact the need for Delek's pipeline and terminal services. For instance, increased production in the Permian necessitates greater takeaway capacity, boosting demand for Delek's infrastructure.

Refinery capacity and local consumption patterns also play a significant role. Higher refinery utilization on the Gulf Coast, for example, translates to increased demand for crude oil transportation, benefiting Delek. Conversely, slowdowns in refinery operations can dampen demand for logistics services.

Factors influencing supply and demand include drilling efficiency and well productivity. In 2024, the Permian Basin continued to see robust production growth, with some analysts projecting output to reach over 6 million barrels per day by year-end. However, takeaway capacity constraints remain a persistent challenge, creating opportunities for midstream providers like Delek.

- Permian Basin Production: Exceeding 5.8 million barrels per day in early 2024, driving demand for transportation.

- Gulf Coast Refinery Utilization: Averaged around 90% in Q1 2024, supporting strong demand for crude input.

- Natural Gas Output: Continued to rise in key basins, increasing the need for gas gathering and processing logistics.

- Takeaway Capacity: Ongoing expansion projects are addressing constraints, but bottlenecks still influence spot rates for logistics.

Economic growth directly fuels demand for Delek Logistics' services. With U.S. GDP projected to grow around 2.5% in 2024, this expansion supports increased energy consumption and industrial activity, benefiting pipeline throughput. Conversely, economic slowdowns would reduce demand, impacting revenue.

Interest rates, hovering around 5.25%-5.50% in mid-2024, increase Delek's borrowing costs, making expansion projects more expensive. Higher rates also pressure MLP unit prices as investors seek higher yields elsewhere.

Inflation impacts operational costs for labor and materials, with PPI for refined products showing increases in late 2023/early 2024. While some costs can be passed on, persistent inflation can still affect profit margins.

Crude oil and refined product price volatility affects Delek's volumes, though fee-based contracts offer some stability. Sustained low prices can reduce drilling, impacting supply, while high prices can incentivize production.

Preview the Actual Deliverable

Delek Logistics PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive PESTLE analysis of Delek Logistics delves into the Political, Economic, Social, Technological, Legal, and Environmental factors impacting the company's operations and strategic decisions.

This is a real screenshot of the product you’re buying—delivered exactly as shown, no surprises. It provides a detailed examination of how external forces shape Delek Logistics' business landscape, offering valuable insights for stakeholders.

Sociological factors

Public perception of fossil fuel infrastructure significantly influences Delek Logistics. Growing environmental awareness and concerns about climate change are leading to increased scrutiny of pipelines and terminals. For instance, a 2024 Pew Research Center survey indicated that 62% of U.S. adults believe the government should prioritize developing renewable energy sources over fossil fuels, a sentiment that can translate into opposition for new fossil fuel projects.

Negative public perception can translate into tangible challenges for Delek Logistics, including heightened regulatory hurdles, project delays, and reputational damage. Companies that fail to address these concerns risk facing organized opposition, which can impact their ability to expand or maintain operations. Delek's community engagement and transparent communication strategies are therefore crucial in mitigating these risks and fostering public acceptance.

Delek Logistics places significant emphasis on its community relations to secure a social license to operate. This involves fostering trust and ensuring mutual benefit with communities surrounding its infrastructure, which is vital for uninterrupted operations and obtaining necessary project approvals. In 2023, Delek Logistics reported investments in various community initiatives, though specific figures for local employment impact are not publicly detailed, the company's commitment to addressing local concerns remains a key operational tenet.

The aging workforce and potential shortages of specialized talent in the energy and logistics sectors pose a significant challenge for Delek Logistics. For instance, the U.S. Bureau of Labor Statistics projected that in 2024, the demand for truck drivers, a critical role in logistics, would continue to outpace supply. This scarcity can drive up labor costs and create operational hurdles, impacting efficiency.

To counter these trends, Delek Logistics must focus on robust talent attraction and retention strategies. This includes competitive compensation, comprehensive benefits, and investing in workforce development programs to upskill existing employees and attract new talent. Proactive recruitment and training initiatives are essential to ensure a steady supply of skilled workers for its operations through 2025 and beyond.

Consumer Demand Shifts for Energy

Societal trends are significantly reshaping energy consumption. Growing environmental consciousness and the rapid adoption of electric vehicles (EVs) are leading to a noticeable shift away from traditional refined petroleum products. For instance, by the end of 2024, it's projected that over 30% of new vehicle sales in some major markets could be electric, directly impacting gasoline demand.

Delek Logistics, while primarily focused on transporting crude oil and refined products, must consider these evolving consumer preferences. A sustained and substantial move towards EVs and alternative energy sources could eventually decrease the overall volume of hydrocarbons requiring transportation and storage services. The pace of this transition is a critical variable, with projections for 2025 indicating continued strong growth in EV market share, though the exact scale of impact on refined product volumes remains a subject of ongoing analysis.

Key considerations for Delek Logistics include:

- Shifting Consumer Preferences: Increasing demand for EVs and renewable energy sources directly correlates with a potential long-term decline in demand for refined petroleum products.

- Impact on Transportation Volumes: A significant reduction in refined product consumption will inevitably affect the volume of materials Delek Logistics transports and stores.

- Pace of Transition: The speed at which consumers adopt EVs and alternative energy will determine the immediacy and scale of the impact on Delek's core business.

- Market Adaptability: Delek's ability to adapt its infrastructure and services to accommodate changing energy landscapes will be crucial for future resilience.

Stakeholder Activism and ESG Expectations

Stakeholder activism is increasingly shaping the energy sector, with a significant focus on Environmental, Social, and Governance (ESG) performance. Investors, advocacy groups, and even consumers are demanding greater transparency and accountability from companies like Delek Logistics regarding their environmental impact and social responsibility. This pressure can directly influence operational changes, reporting frameworks, and investment strategies, pushing companies towards more sustainable practices.

The growing ESG movement has led to a notable shift in investment priorities. For instance, a significant portion of global assets under management is now guided by ESG principles. In 2024, reports indicated that ESG-focused funds continued to attract substantial inflows, even amidst market volatility. This trend suggests that companies failing to demonstrate robust ESG credentials may face challenges in accessing capital and could become targets for activist campaigns, particularly those centered on fossil fuel infrastructure.

- Investor Pressure: In 2024, many large institutional investors publicly committed to increasing their engagement on ESG issues, with a focus on climate-related risks and opportunities.

- Advocacy Group Campaigns: Environmental organizations have intensified their campaigns against fossil fuel infrastructure, often using shareholder resolutions to pressure companies like Delek Logistics.

- Reporting Standards: There's a growing demand for standardized ESG reporting, with frameworks like SASB and TCFD gaining traction, requiring more detailed disclosures from companies.

- Activist Targets: Fossil fuel midstream companies are increasingly scrutinized for their role in the energy transition, making their infrastructure assets potential targets for activist campaigns aimed at accelerating decarbonization.

Societal shifts toward sustainability and evolving consumer preferences are key influences on Delek Logistics. Increased environmental awareness and the growing adoption of electric vehicles (EVs) are gradually reducing demand for refined petroleum products. By the end of 2024, projections indicated that EVs could represent over 30% of new vehicle sales in some major markets, directly impacting gasoline consumption. This trend necessitates that Delek Logistics adapt to a potential long-term decrease in hydrocarbon transportation volumes, with continued strong EV market share growth anticipated through 2025.

Technological factors

Technological advancements are significantly reshaping pipeline integrity and monitoring. Innovations like advanced sensor technologies and drone inspections are becoming standard for identifying potential issues early. For instance, the adoption of AI-powered predictive maintenance is projected to reduce pipeline failures by up to 30% in the coming years, a critical factor for companies like Delek Logistics managing extensive networks.

Delek Logistics can leverage these technologies to enhance safety and operational efficiency. Real-time monitoring systems, coupled with AI analytics, allow for immediate detection of anomalies, minimizing leak risks and environmental impact. This proactive approach not only safeguards operations but also contributes to substantial savings by reducing unplanned downtime and costly emergency repairs, potentially lowering maintenance expenditures by 15-20% annually.

Investing in these cutting-edge solutions provides Delek Logistics with a distinct competitive advantage. By ensuring a higher degree of pipeline reliability and safety, the company can operate more cost-effectively and with greater environmental stewardship. This technological leadership can attract investors and partners who prioritize robust infrastructure and sustainable practices in the energy sector.

Delek Logistics is heavily influenced by the automation and digitalization of its operations. Technologies such as automated loading and unloading systems at its terminals, coupled with digital inventory management, are crucial for optimizing throughput. For instance, the company's investment in advanced control systems aims to minimize human error and boost overall efficiency across its storage facilities and logistics networks.

The integration of these digital tools allows for real-time tracking and management of assets, leading to more precise inventory control and reduced operational downtime. Furthermore, Delek Logistics leverages data analytics to gain insights into operational performance, enabling more informed decision-making for continuous improvement and cost optimization.

Delek Logistics faces escalating cybersecurity risks impacting both operational technology (OT) and information technology (IT) systems. The threat of cyberattacks on critical infrastructure, such as pipelines and terminals, can lead to significant operational disruptions, data breaches, and severe financial losses. For instance, the Colonial Pipeline incident in 2021, which halted fuel supply for days, underscores the potential impact, costing the company an estimated $4.4 million in ransom and extensive recovery efforts.

Protecting these interconnected systems requires continuous and substantial investment in advanced cybersecurity defenses and robust incident response capabilities. The increasing sophistication of cyber threats necessitates proactive measures, including regular vulnerability assessments and employee training. By prioritizing infrastructure protection, Delek Logistics can mitigate the risk of operational downtime and safeguard sensitive data, ensuring business continuity and maintaining stakeholder trust amidst evolving digital threats.

Emerging Energy Technologies and Infrastructure Adaptation

Emerging energy technologies like green hydrogen production and advanced biofuels are gradually gaining traction, potentially reshaping the energy landscape. While these technologies are still in their early stages, they represent a long-term shift that could impact traditional crude oil and refined products logistics. Delek Logistics may need to consider how its existing infrastructure, such as pipelines and storage terminals, can be adapted to handle new energy commodities.

The company has an opportunity to evolve its asset base to support these burgeoning sectors. For instance, adapting existing pipeline networks for hydrogen transport or developing new terminal capabilities for biofuel blending could open up new service lines. This strategic adaptation is crucial for maintaining relevance and capturing future growth opportunities in a diversifying energy market.

The International Energy Agency (IEA) reported in its 2024 Outlook that investments in clean energy technologies are projected to reach $2 trillion globally in 2024, a significant increase from previous years. This trend underscores the growing importance of these sectors. Delek Logistics' ability to pivot and integrate these emerging technologies into its operational model will be a key determinant of its long-term success and competitive positioning.

- Infrastructure Adaptation: Delek Logistics can explore repurposing existing pipeline and terminal assets for the transport and storage of hydrogen or advanced biofuels, aligning with the projected growth in these sectors.

- New Service Lines: The company may develop new service offerings, such as dedicated hydrogen logistics or biofuel blending facilities, to capitalize on the evolving energy demand.

- Long-Term Investment: Strategic investments in adapting infrastructure for emerging energy technologies are essential for Delek Logistics to remain competitive and capture future market share in a decarbonizing economy.

Innovation in Storage and Terminal Operations

Technological advancements are significantly reshaping storage and terminal operations for companies like Delek Logistics. Innovations such as advanced tank gauging systems, for instance, offer real-time, highly accurate inventory management, reducing potential losses and improving operational efficiency. These systems are crucial for optimizing product flow and ensuring precise accounting, a key concern in the logistics sector.

Furthermore, the implementation of sophisticated vapor recovery units (VRUs) and optimized blending technologies directly addresses environmental performance and product quality. VRUs capture volatile organic compounds (VOCs) that would otherwise be released into the atmosphere, helping companies meet increasingly stringent environmental regulations. Optimized blending allows for the precise mixing of different product streams to meet specific market demands, enhancing value and reducing waste.

The role of technology in meeting evolving regulatory requirements for storage is paramount. For example, the U.S. Environmental Protection Agency (EPA) continues to update regulations concerning emissions from storage tanks. Companies investing in technologies that demonstrably reduce emissions, such as advanced VRUs, are better positioned to comply and avoid potential penalties. In 2024, the focus on ESG (Environmental, Social, and Governance) factors means that technological adoption for environmental stewardship is not just a compliance issue but a strategic imperative.

- Advanced Tank Gauging: Improves inventory accuracy, reducing losses and streamlining reconciliation processes.

- Vapor Recovery Units (VRUs): Capture VOC emissions, aiding compliance with environmental regulations and improving air quality.

- Optimized Blending Technologies: Enhance product quality and value by allowing precise mixing of different product streams.

- Digitalization of Operations: Facilitates real-time monitoring, predictive maintenance, and enhanced safety protocols within terminals.

Technological advancements are significantly reshaping pipeline integrity and monitoring, with innovations like AI-powered predictive maintenance projected to reduce pipeline failures by up to 30% in the coming years. Delek Logistics can leverage these technologies to enhance safety and operational efficiency, potentially lowering maintenance expenditures by 15-20% annually through proactive anomaly detection.

The automation and digitalization of operations, including advanced control systems and digital inventory management, are crucial for optimizing throughput and minimizing human error. Real-time asset tracking and data analytics enable more informed decision-making for continuous improvement and cost optimization across Delek Logistics' networks.

The company faces escalating cybersecurity risks, as highlighted by the Colonial Pipeline incident in 2021, underscoring the need for substantial investment in advanced defenses and incident response capabilities to mitigate operational disruptions and financial losses.

Emerging energy technologies like green hydrogen and advanced biofuels represent a long-term shift, with global clean energy investments projected to reach $2 trillion in 2024, necessitating Delek Logistics' adaptation of existing infrastructure to remain competitive.

Legal factors

Delek Logistics operates within a stringent environmental regulatory framework. Compliance with laws governing air emissions, water discharge, hazardous waste, and spill prevention is paramount. For instance, the EPA's 2024 initiatives continue to focus on reducing greenhouse gas emissions from industrial sources, potentially impacting Delek's transportation and storage operations.

Meeting these environmental standards necessitates significant investment in technology and operational adjustments, contributing to compliance costs. Failure to adhere to these regulations, which are enforced at federal, state, and local levels, can result in substantial fines and legal repercussions.

The company must also remain agile, adapting to evolving environmental standards. For example, upcoming state-level regulations in 2025 concerning methane emissions from pipeline infrastructure could require additional capital expenditures and operational changes to ensure continued compliance.

Delek Logistics faces significant regulatory burdens concerning pipeline and terminal safety and security. Agencies like the Pipeline and Hazardous Materials Safety Administration (PHMSA) and the Occupational Safety and Health Administration (OSHA) mandate strict adherence to standards for pipeline integrity management, emergency response, and personnel training. For instance, PHMSA's regulations require comprehensive integrity management programs, including regular inspections and risk assessments, directly impacting operational costs and protocols.

Delek Logistics operates within a stringent legal landscape governing land use, particularly for its extensive pipeline infrastructure. Navigating eminent domain laws, which allow for the compulsory acquisition of private land for public use, is a critical and often contentious aspect of securing rights-of-way for new projects or expansions. In 2024, the average compensation awarded in eminent domain cases can vary significantly by state, impacting project budgets.

Zoning regulations and local permitting processes add further layers of complexity, often requiring extensive environmental reviews and community consultations. Delays in obtaining these permits, which can stretch for months or even years, directly translate into increased project costs and can postpone revenue generation. For instance, a significant pipeline project could see its budget increase by several percentage points due to permit-related delays alone.

Contract Law and Commercial Agreements

Delek Logistics relies heavily on its commercial agreements, particularly long-term contracts for transportation, terminalling, and storage services with Delek US Holdings and various third-party customers. These contracts are the bedrock of its stable revenue streams. Ensuring robust contract terms, clear dispute resolution processes, and strict adherence to commercial law are paramount for managing these critical business relationships effectively.

The company's operations are also subject to regulatory oversight concerning its common carrier obligations. This means Delek Logistics must adhere to specific legal requirements regarding the transportation of goods, ensuring fair and non-discriminatory access to its services. For instance, in 2024, Delek Logistics reported that approximately 80% of its revenue was derived from fee-based contracts, underscoring the importance of these legal frameworks.

- Contractual Stability: Delek Logistics' revenue is largely secured through long-term agreements, with a significant portion, around 80% in 2024, coming from fee-based contracts.

- Commercial Law Adherence: Compliance with commercial law is essential for maintaining the integrity and enforceability of these agreements.

- Dispute Resolution: Effective mechanisms for resolving contract disputes are vital to prevent disruptions to operations and revenue.

- Common Carrier Regulations: Adherence to regulations governing common carriers ensures equitable access to Delek Logistics' infrastructure and services.

Master Limited Partnership (MLP) Specific Regulations

Delek Logistics' structure as a Master Limited Partnership (MLP) subjects it to a unique set of legal and tax regulations. These rules, primarily governed by the Internal Revenue Service (IRS), mandate that MLPs derive at least 90% of their income from qualifying sources, such as the transportation and storage of natural resources. Failure to meet this threshold can result in the MLP being taxed as a corporation, significantly altering its financial structure and investor appeal.

Maintaining these qualifying income requirements and adhering to distribution mandates are critical for Delek Logistics' operational and financial health. The partnership must distribute a substantial portion of its available cash flow to unitholders, impacting its ability to retain earnings for reinvestment. For instance, in 2023, Delek Logistics reported a distributable cash flow of $547 million, with a significant portion allocated to distributions.

Potential legislative changes to MLP tax treatment pose a significant risk. Any shifts in tax policy, such as the elimination or modification of pass-through taxation for MLPs, could directly affect Delek Logistics' valuation and its attractiveness to investors. For example, proposals discussed in late 2024 regarding potential corporate tax rate changes could indirectly influence the comparative advantage of MLP structures.

- Qualifying Income: MLPs like Delek Logistics must ensure at least 90% of their revenue comes from qualifying sources, such as pipeline transportation and storage fees.

- Distribution Requirements: A significant portion of MLP cash flow, typically over 90%, must be distributed to unitholders annually.

- IRS Scrutiny: MLPs face ongoing IRS oversight to ensure compliance with partnership tax rules, with penalties for non-compliance.

- Legislative Risk: Changes in tax laws, such as modifications to pass-through taxation or corporate tax rates, could materially impact MLP valuations and investor demand.

Delek Logistics must navigate a complex web of legal requirements related to its operations and corporate structure. The company's status as a Master Limited Partnership (MLP) dictates specific tax regulations, including the crucial 90% qualifying income rule enforced by the IRS. For instance, in 2023, Delek Logistics reported $2.1 billion in revenue, with a substantial portion derived from its pipeline and terminalling businesses, which are considered qualifying income sources.

Furthermore, adherence to common carrier regulations ensures fair access to its infrastructure, a critical aspect given that approximately 80% of Delek Logistics' revenue in 2024 stemmed from fee-based contracts. The company's reliance on these long-term commercial agreements underscores the importance of robust contract law compliance and effective dispute resolution mechanisms to maintain stable revenue streams.

Potential legislative shifts in MLP taxation present a notable risk, as any changes to pass-through taxation could impact investor appeal and valuation. For example, discussions in late 2024 regarding corporate tax adjustments could indirectly influence the comparative advantage of MLP structures.

| Legal Factor | Description | Relevance to Delek Logistics | 2023/2024 Data Point |

|---|---|---|---|

| MLP Tax Regulations | IRS rules requiring at least 90% of income from qualifying sources. | Ensures tax benefits and MLP status. | $2.1 billion in 2023 revenue, largely from qualifying sources. |

| Common Carrier Obligations | Legal requirements for non-discriminatory service provision. | Maintains access to infrastructure for customers. | ~80% of 2024 revenue from fee-based contracts. |

| Contract Law | Governs commercial agreements and dispute resolution. | Secures revenue streams and manages business relationships. | Reliance on long-term contracts with Delek US Holdings and third parties. |

| Legislative Risk (MLP Taxation) | Potential changes to tax policies affecting MLPs. | Could alter valuation and investor attractiveness. | Discussions in late 2024 on corporate tax rate changes. |

Environmental factors

Stricter climate change policies, including potential carbon taxes and emissions reduction targets, directly impact Delek Logistics' core business. For instance, if governments mandate a significant shift away from fossil fuels, demand for transporting crude oil and refined products could decline, posing a risk to existing infrastructure. In 2024, many nations are strengthening their Nationally Determined Contributions (NDCs) under the Paris Agreement, which could accelerate this transition and create stranded asset risks for companies heavily invested in fossil fuel infrastructure.

These evolving regulations also present opportunities for diversification. Delek Logistics could explore expanding its services to include the transportation of lower-carbon fuels like hydrogen or biofuels, or invest in infrastructure supporting renewable energy projects. The company's commitment to measuring and reducing its own operational emissions, as reported in its 2023 sustainability report, is a step towards adapting to these policy shifts, though specific quantitative targets for emission reductions in the near term (2024-2025) are crucial for assessing its preparedness.

Delek Logistics faces inherent environmental risks due to its operations with crude oil and refined products, including the potential for spills and leaks. Such incidents can lead to substantial financial penalties, extensive cleanup expenses, and significant damage to the company's reputation. For instance, in 2023, the U.S. Environmental Protection Agency (EPA) reported that accidental releases from pipelines accounted for a notable portion of all oil spills, underscoring the persistent nature of this risk across the industry.

The company mitigates these risks through robust preventative measures and emergency response protocols. These include regular inspections, advanced leak detection systems, and comprehensive training for personnel. Delek Logistics’ commitment to environmental stewardship is crucial, as demonstrated by industry trends where companies investing in proactive environmental management often see lower incident rates and improved public perception.

Delek Logistics' operations, particularly those in water-scarce areas like the Permian Basin, face significant environmental considerations regarding water management. Responsible sourcing, efficient wastewater treatment, and strict adherence to water quality regulations are paramount to ensure operational continuity and maintain positive community relations.

Water scarcity poses a direct threat to the energy sector's infrastructure and production capabilities. For instance, in 2023, the Permian Basin experienced periods of drought, increasing the demand for water management solutions and potentially impacting drilling and completion activities for companies like Delek Logistics.

Biodiversity and Habitat Protection

Delek Logistics' operations, particularly in pipeline construction and maintenance, necessitate careful consideration of biodiversity and habitat protection. Environmental impact assessments are crucial for identifying and mitigating potential harm to ecosystems during planning and construction phases. For instance, in 2024, the company's projects would need to align with evolving regulations concerning endangered species and protected habitats, potentially impacting project timelines and costs.

Compliance with wildlife protection laws, such as the Endangered Species Act in the United States, is paramount. This involves avoiding sensitive ecosystems and implementing mitigation strategies, like wildlife crossings or habitat restoration, to minimize ecological footprints. Failure to comply can result in significant fines and project delays, as seen in past industry incidents where environmental non-compliance led to substantial financial penalties.

- Environmental Impact Assessments: Mandatory for all new infrastructure projects to evaluate potential effects on biodiversity.

- Habitat Protection: Strategies to avoid or minimize disruption to sensitive ecosystems and wildlife corridors.

- Mitigation Measures: Implementation of measures like habitat restoration or wildlife crossings to offset unavoidable impacts.

- Regulatory Compliance: Adherence to federal and state wildlife protection laws and regulations.

Waste Management and Pollution Prevention

Delek Logistics faces ongoing challenges in managing waste and preventing pollution across its extensive pipeline and terminal operations. The company must ensure the proper disposal of both hazardous materials, such as used oil and contaminated soil, and non-hazardous waste generated from maintenance and administrative activities. Adherence to stringent air and water pollution control standards, including those set by the Environmental Protection Agency (EPA), is paramount to avoid penalties and maintain operational integrity.

The company's commitment to environmental stewardship is demonstrated through various initiatives aimed at minimizing its ecological footprint. This includes investing in technologies to reduce emissions and prevent spills, as well as implementing robust waste reduction and recycling programs. For instance, in 2023, Delek Logistics reported a focus on improving leak detection and repair programs to prevent hydrocarbon releases into the environment.

- Waste Reduction: Implementing strategies to decrease the volume of waste generated at operational sites.

- Recycling Initiatives: Expanding programs for recycling materials like metal, plastic, and paper.

- Pollution Prevention: Investing in advanced technologies and best practices to minimize air and water discharges.

- Hazardous Waste Management: Ensuring compliant and safe handling and disposal of all hazardous substances.

Stricter climate policies, including potential carbon taxes and emissions reduction targets, directly impact Delek Logistics' core business. For instance, if governments mandate a significant shift away from fossil fuels, demand for transporting crude oil and refined products could decline, posing a risk to existing infrastructure. In 2024, many nations are strengthening their Nationally Determined Contributions (NDCs) under the Paris Agreement, which could accelerate this transition and create stranded asset risks for companies heavily invested in fossil fuel infrastructure.

These evolving regulations also present opportunities for diversification. Delek Logistics could explore expanding its services to include the transportation of lower-carbon fuels like hydrogen or biofuels, or invest in infrastructure supporting renewable energy projects. The company's commitment to measuring and reducing its own operational emissions, as reported in its 2023 sustainability report, is a step towards adapting to these policy shifts, though specific quantitative targets for emission reductions in the near term (2024-2025) are crucial for assessing its preparedness.

Delek Logistics faces inherent environmental risks due to its operations with crude oil and refined products, including the potential for spills and leaks. Such incidents can lead to substantial financial penalties, extensive cleanup expenses, and significant damage to the company's reputation. For instance, in 2023, the U.S. Environmental Protection Agency (EPA) reported that accidental releases from pipelines accounted for a notable portion of all oil spills, underscoring the persistent nature of this risk across the industry.

The company mitigates these risks through robust preventative measures and emergency response protocols. These include regular inspections, advanced leak detection systems, and comprehensive training for personnel. Delek Logistics’ commitment to environmental stewardship is crucial, as demonstrated by industry trends where companies investing in proactive environmental management often see lower incident rates and improved public perception.

Delek Logistics' operations, particularly those in water-scarce areas like the Permian Basin, face significant environmental considerations regarding water management. Responsible sourcing, efficient wastewater treatment, and strict adherence to water quality regulations are paramount to ensure operational continuity and maintain positive community relations.

Water scarcity poses a direct threat to the energy sector's infrastructure and production capabilities. For instance, in 2023, the Permian Basin experienced periods of drought, increasing the demand for water management solutions and potentially impacting drilling and completion activities for companies like Delek Logistics.

Delek Logistics' operations, particularly in pipeline construction and maintenance, necessitate careful consideration of biodiversity and habitat protection. Environmental impact assessments are crucial for identifying and mitigating potential harm to ecosystems during planning and construction phases. For instance, in 2024, the company's projects would need to align with evolving regulations concerning endangered species and protected habitats, potentially impacting project timelines and costs.

Compliance with wildlife protection laws, such as the Endangered Species Act in the United States, is paramount. This involves avoiding sensitive ecosystems and implementing mitigation strategies, like wildlife crossings or habitat restoration, to minimize ecological footprints. Failure to comply can result in significant fines and project delays, as seen in past industry incidents where environmental non-compliance led to substantial financial penalties.

- Environmental Impact Assessments: Mandatory for all new infrastructure projects to evaluate potential effects on biodiversity.

- Habitat Protection: Strategies to avoid or minimize disruption to sensitive ecosystems and wildlife corridors.

- Mitigation Measures: Implementation of measures like habitat restoration or wildlife crossings to offset unavoidable impacts.

- Regulatory Compliance: Adherence to federal and state wildlife protection laws and regulations.

Delek Logistics faces ongoing challenges in managing waste and preventing pollution across its extensive pipeline and terminal operations. The company must ensure the proper disposal of both hazardous materials, such as used oil and contaminated soil, and non-hazardous waste generated from maintenance and administrative activities. Adherence to stringent air and water pollution control standards, including those set by the Environmental Protection Agency (EPA), is paramount to avoid penalties and maintain operational integrity.

The company's commitment to environmental stewardship is demonstrated through various initiatives aimed at minimizing its ecological footprint. This includes investing in technologies to reduce emissions and prevent spills, as well as implementing robust waste reduction and recycling programs. For instance, in 2023, Delek Logistics reported a focus on improving leak detection and repair programs to prevent hydrocarbon releases into the environment.

- Waste Reduction: Implementing strategies to decrease the volume of waste generated at operational sites.

- Recycling Initiatives: Expanding programs for recycling materials like metal, plastic, and paper.

- Pollution Prevention: Investing in advanced technologies and best practices to minimize air and water discharges.

- Hazardous Waste Management: Ensuring compliant and safe handling and disposal of all hazardous substances.

Delek Logistics' environmental performance is subject to increasing scrutiny and regulatory oversight. For example, in 2023, the U.S. Environmental Protection Agency (EPA) continued to enforce stringent regulations on emissions and waste disposal, with potential fines for non-compliance. The company's ability to adapt to evolving environmental standards, particularly concerning greenhouse gas emissions and water usage, will be critical for its long-term operational sustainability and financial health.

| Environmental Factor | Impact on Delek Logistics | Key Considerations / Actions | 2023/2024 Data/Trends |

|---|---|---|---|

| Climate Change Policies | Reduced demand for fossil fuels, stranded asset risk | Diversification into lower-carbon fuels, emission reduction targets | Strengthening of NDCs under Paris Agreement in 2024 |

| Operational Risks (Spills/Leaks) | Financial penalties, reputational damage | Preventative measures, leak detection, emergency response | EPA data in 2023 highlighted pipeline releases as a significant source of spills |

| Water Management | Operational continuity, community relations | Responsible sourcing, wastewater treatment, regulatory adherence | Droughts in Permian Basin in 2023 increased water management demand |

| Biodiversity & Habitat | Project timelines, costs, regulatory compliance | Environmental impact assessments, habitat protection, mitigation | Evolving regulations on endangered species in 2024 impacting projects |

| Waste & Pollution | Compliance, operational integrity | Waste reduction, recycling, pollution prevention, hazardous waste management | Focus on improved leak detection and repair programs in 2023 |

PESTLE Analysis Data Sources

Our PESTLE Analysis for Delek Logistics is meticulously constructed using data from official government publications, reputable financial news outlets, and industry-specific market research reports. This ensures a comprehensive understanding of regulatory, economic, and technological influences impacting the energy logistics sector.