Deere SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Deere Bundle

Deere's robust brand recognition and extensive dealer network are significant strengths, but the company faces challenges from increasing competition and supply chain disruptions. Understanding these dynamics is crucial for anyone looking to invest or strategize in the agricultural and construction sectors.

Want the full story behind Deere's market position, its opportunities for innovation, and the threats it faces? Purchase the complete SWOT analysis to gain access to a professionally written, fully editable report designed to support your strategic planning and investment decisions.

Strengths

Deere & Company's John Deere brand is a powerhouse, universally recognized for its quality and dependability across agriculture, construction, and forestry. This strong brand recognition translates directly into customer trust and preference.

The company boasts an impressive dealer network, with over 2,000 locations in North America alone and a presence in more than 100 countries. This vast reach allows for deep market penetration and exceptional customer support.

This extensive network is crucial for providing localized service and parts, which in turn cultivates strong customer relationships and drives repeat business, solidifying brand loyalty.

Deere's technological leadership in precision agriculture, exemplified by innovations like See & Spray, is a core strength. This technology allows for precise application of herbicides, reducing chemical usage by up to 77% in field trials, a significant cost and environmental benefit for farmers. The integration of AI-driven navigation and autonomous capabilities further enhances operational efficiency and data utilization.

John Deere Financial is a major strength, offering both retail financing for customers buying machinery and wholesale financing for dealers. This segment is crucial as it directly supports equipment sales by making purchases more manageable for buyers.

In 2023, John Deere Financial reported net income of $1.06 billion, demonstrating its significant contribution to the company's overall profitability. This financial services arm provides a stable revenue stream, proving resilient even when equipment sales face challenges.

Diversified Product Portfolio

Deere & Company boasts a robust and diversified product portfolio, encompassing equipment for agriculture, construction, forestry, and turf care. This broad offering shields the company from the volatility of any single industry, ensuring a more consistent revenue stream. For instance, in fiscal year 2023, Deere reported net sales and revenues of $61.1 billion, a testament to the strength derived from its varied market presence.

The company's ability to serve a wide array of professional sectors globally contributes significantly to its market resilience. This diversification strategy allows Deere to capitalize on growth opportunities across different economic cycles. As of the first quarter of 2024, Deere's Construction and Forestry segment saw a 10% increase in net sales, complementing the continued strength in its Agriculture and Turf division.

- Broad Market Reach: Serves agriculture, construction, forestry, and turf care sectors.

- Risk Mitigation: Diversification reduces dependence on any single market's performance.

- Revenue Stability: A wider product range contributes to more predictable financial results.

- Global Presence: Caters to diverse professional needs worldwide, enhancing resilience.

Commitment to Sustainability and Innovation

Deere's dedication to sustainability is a significant strength, with substantial investments in reducing its environmental footprint. For instance, the company is actively developing electric and alternative fuel powertrains, aiming to offer low and no-carbon solutions for its equipment, a crucial move given the increasing global demand for greener agricultural and construction machinery.

This strategic direction is further reinforced by Deere's commitment to increasing the use of sustainable materials in its manufacturing processes and expanding its remanufactured and rebuild sales. This not only appeals to environmentally conscious customers but also taps into a growing circular economy trend, potentially boosting profitability and brand reputation.

The company's proactive stance on sustainability aligns perfectly with evolving global environmental regulations and the growing preference among investors for ESG (Environmental, Social, and Governance) compliant companies. This positions Deere favorably for long-term growth and resilience in a market increasingly shaped by climate concerns.

- Investment in Green Technology: Deere is channeling significant resources into developing electric and alternative power solutions to meet the growing demand for sustainable equipment.

- Circular Economy Focus: The company is prioritizing the use of sustainable materials and growing its remanufactured and rebuild sales, reflecting a commitment to resource efficiency.

- Regulatory and Investor Alignment: Deere's sustainability initiatives are strategically aligned with global environmental trends and increasing investor focus on ESG factors, ensuring long-term viability.

Deere's technological prowess, especially in precision agriculture, is a standout strength. Innovations like See & Spray, which can reduce herbicide use by up to 77% in field trials, showcase their commitment to efficiency and sustainability. This focus on smart farming solutions positions them as a leader in a rapidly evolving industry.

The company's financial services arm, John Deere Financial, is a significant contributor to profitability, reporting $1.06 billion in net income in 2023. This segment not only supports equipment sales by offering financing options but also provides a stable revenue stream, demonstrating resilience.

Deere's broad product portfolio, spanning agriculture, construction, and forestry, offers considerable market diversification. This strategy helps mitigate risks associated with any single sector's downturn, contributing to overall revenue stability. For example, in Q1 2024, their Construction and Forestry segment saw a 10% net sales increase, balancing the agricultural market.

Their commitment to sustainability is increasingly vital, with investments in electric and alternative fuel powertrains. This aligns with global environmental regulations and growing investor interest in ESG factors, positioning Deere for long-term success.

| Strength | Description | Supporting Data/Fact |

|---|---|---|

| Technological Leadership | Pioneering precision agriculture and smart farming solutions. | See & Spray technology reduced herbicide use by up to 77% in field trials. |

| Financial Services | Robust financing arm supporting sales and providing stable revenue. | John Deere Financial reported $1.06 billion in net income in 2023. |

| Product Diversification | Wide range of equipment across agriculture, construction, and forestry. | Q1 2024 Construction & Forestry net sales increased by 10%. |

| Sustainability Focus | Investment in green technology and sustainable practices. | Developing electric and alternative fuel powertrains for equipment. |

What is included in the product

Delivers a strategic overview of Deere’s internal and external business factors, highlighting its strong brand and market leadership while acknowledging potential impacts from technological shifts and economic downturns.

Simplifies complex market dynamics by clearly identifying Deere's competitive advantages and potential threats.

Weaknesses

Deere's performance is deeply tied to the ups and downs of agricultural markets and the wider economy. When commodity prices fall or interest rates climb, farm incomes tend to shrink, directly impacting sales and profits. For instance, in the first quarter of fiscal year 2024, Deere reported a net income of $1.75 billion, a decrease from $1.96 billion in the same period of the previous year, reflecting these challenging market conditions.

This sensitivity to cycles means that demand for Deere's equipment can be quite unpredictable. High interest rates, such as those experienced throughout 2023 and into early 2024, make financing new machinery more expensive for farmers, leading them to delay or cancel purchases. This directly translates into volatile revenue streams for Deere, making long-term financial planning more complex.

Deere & Company has experienced a significant downturn in its financial results. For fiscal year 2024, net sales and revenues decreased by 4% to $45.2 billion, and net income fell by 12% to $7.7 billion. This trend continued into the first half of fiscal year 2025, with net sales down 6% and net income dropping 15% compared to the prior year period.

These declining sales and earnings reflect a softening in agricultural equipment demand, particularly in North America, and ongoing supply chain disruptions that impacted production. The reduced financial performance directly affects investor sentiment, as evidenced by a 10% dip in Deere's stock price in early 2025 following these reports.

The financial constraints stemming from lower earnings could hinder Deere's capacity for crucial investments in research and development, particularly in areas like precision agriculture technology and autonomous solutions. This could put the company at a disadvantage against competitors who maintain stronger investment pipelines.

Deere's commitment to market leadership and ongoing innovation necessitates significant capital expenditures. In fiscal year 2023, for instance, capital expenditures for property and equipment totaled $1.48 billion, reflecting substantial investments in R&D and manufacturing capabilities to stay ahead in a competitive landscape.

The company has recently faced challenges with declining demand, particularly in North America's agricultural sector. This led to aggressive production adjustments, including cuts, to manage inventory levels. For example, in Q1 2024, Deere reported a 10% decrease in net sales for the Agriculture and Turf segment compared to the prior year, directly linked to these production and demand shifts.

These production adjustments, while necessary, can create operational inefficiencies and impact workforce stability. Managing fluctuating output levels can strain supply chains, potentially leading to temporary workforce reductions or altered staffing needs, which in turn can affect overall operational rhythm and cost management.

Supply Chain Vulnerabilities and Rising Input Costs

Deere is susceptible to increasing operational and manufacturing expenses, particularly with the potential imposition of new U.S. steel and aluminum tariffs. These higher raw material costs could compress profit margins if Deere cannot fully pass them on to customers through price increases. For instance, in Q2 2024, Deere reported a 6% increase in cost of goods sold, partly attributed to material costs.

These supply chain vulnerabilities can lead to production disruptions and impact overall profitability. Deere's reliance on global sourcing means that geopolitical events or trade disputes can create significant headwinds. For example, a 2023 report indicated that agricultural equipment manufacturers faced an average 15% increase in steel prices year-over-year, directly affecting production costs.

- Rising Input Costs: Deere faces pressure from escalating prices for raw materials like steel and aluminum.

- Tariff Impact: Potential new U.S. tariffs on steel and aluminum could further inflate costs.

- Margin Squeeze: Difficulty in passing increased costs to consumers can reduce profit margins.

- Production Disruptions: Supply chain vulnerabilities pose a risk to consistent manufacturing output.

Workforce Layoffs and Production Relocation Concerns

Deere & Company has faced significant backlash following recent announcements of workforce reductions. In late 2023 and early 2024, the company confirmed layoffs affecting thousands of employees across several U.S. manufacturing facilities. This move, coupled with plans to relocate certain production lines to Mexico, has fueled employee anxiety and public scrutiny.

These decisions have been interpreted by some as prioritizing cost-cutting over domestic labor, potentially impacting employee morale and the company's reputation. For instance, reports indicated that the production of certain tractor components was slated for a move to Mexico, raising concerns about job security for the existing U.S. workforce. This perception can strain the company's relationship with its employees and the communities where its plants are located.

- Workforce Reduction: Thousands of U.S. jobs impacted by layoffs in late 2023 and early 2024.

- Production Relocation: Plans to shift some manufacturing operations to Mexico.

- Employee Morale: Concerns about job security and perceived prioritization of cost savings over domestic workforce.

- Public Image: Potential damage to company reputation due to workforce decisions.

Deere's reliance on the agricultural sector makes it vulnerable to cyclical downturns. When commodity prices or farm incomes decline, demand for its equipment can drop significantly. For example, in Q1 fiscal 2024, Deere's net income was $1.75 billion, down from $1.96 billion in Q1 fiscal 2023, indicating sensitivity to market conditions.

The company's financial performance is also impacted by interest rate fluctuations. Higher rates in 2023 and early 2024 made financing more expensive for farmers, leading to delayed purchases and volatile revenue for Deere. This sensitivity complicates long-term financial planning.

Deere faces challenges with rising input costs, particularly for steel and aluminum, which increased by 6% in cost of goods sold in Q2 2024. Potential new U.S. tariffs could further inflate these expenses, potentially squeezing profit margins if costs cannot be fully passed on to customers.

The company's recent workforce reductions and plans to relocate some production to Mexico have led to employee anxiety and public scrutiny, potentially affecting morale and the company's reputation. Thousands of U.S. jobs were impacted by layoffs in late 2023 and early 2024.

| Metric | Q1 FY24 | Q1 FY23 | Change |

| Net Income (Billions USD) | 1.75 | 1.96 | -10.7% |

| Agriculture & Turf Net Sales (Billions USD) | 9.0 | 10.0 | -10.0% |

| Cost of Goods Sold (Billions USD) | 7.0 | 6.6 | +6.1% |

What You See Is What You Get

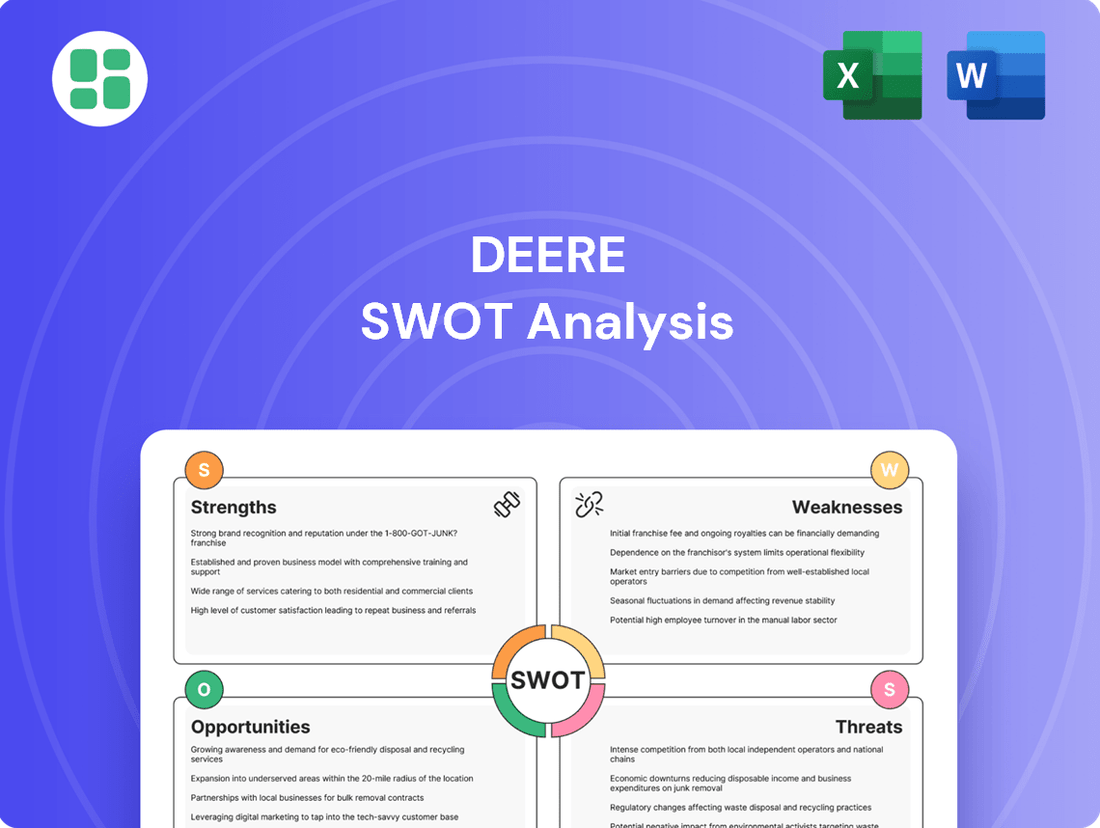

Deere SWOT Analysis

The preview you see is the actual Deere SWOT analysis document you’ll receive upon purchase—no surprises, just professional quality and comprehensive insights.

This is a real excerpt from the complete Deere SWOT analysis. Once purchased, you’ll receive the full, editable version, providing a thorough strategic overview.

You’re viewing a live preview of the actual Deere SWOT analysis file. The complete version, packed with detailed information, becomes available after checkout.

Opportunities

The global agricultural sector is seeing a significant uptake in precision farming and automation, with the precision agriculture market projected to reach $15.6 billion by 2025, growing at a CAGR of 12.8% from 2020. Deere's established leadership in AI-powered navigation, autonomous machinery, and advanced data analytics places it in a prime position to benefit from this expanding market. This technological evolution opens doors for Deere to introduce innovative product lines and cultivate recurring revenue streams via software and service subscriptions, reinforcing its market dominance.

Deere sees a substantial growth avenue in emerging markets, where the push for agricultural mechanization and infrastructure upgrades is accelerating. This presents a prime opportunity as these regions often have lower equipment penetration rates compared to developed nations.

With global food demand projected to climb, Deere’s established international footprint positions it well to capitalize on this trend. For instance, by 2050, the world population is expected to reach nearly 10 billion, necessitating increased agricultural output.

Strategic investments in these burgeoning economies, such as establishing local manufacturing or distribution networks, can cultivate new customer segments and bolster Deere's market share. This proactive approach is crucial for long-term expansion and revenue diversification.

Deere is actively pursuing a 'Solutions as a Service' strategy, projecting connectivity for 1.5 million machines by 2026. This focus on data and connectivity is designed to build a robust recurring revenue stream, targeting 10% of enterprise revenue from these services by 2030.

This shift involves licensing advanced software and offering technology subscriptions, leveraging the wealth of data generated by its connected equipment. Such a model offers a more consistent and predictable income, smoothing out the traditional seasonality inherent in heavy equipment sales.

Development of Sustainable and Electric Equipment

Deere's commitment to developing sustainable and electric equipment aligns perfectly with the global shift towards environmental responsibility and a reduced carbon footprint. This presents a substantial growth avenue.

The company is actively investing in electric and hybrid powertrains, with a stated goal of showcasing practical low or zero-carbon power solutions by 2026. This forward-thinking approach positions Deere to capture market share among customers prioritizing eco-friendly machinery.

- Market Leadership: Early adoption and innovation in electric equipment can solidify Deere's position as an industry leader, attracting environmentally conscious buyers.

- Regulatory Tailwinds: Increasing government regulations and incentives favoring lower-emission machinery create a favorable market environment for these developments.

- Customer Demand: A growing segment of agricultural and construction customers are actively seeking out and willing to pay a premium for sustainable equipment options.

Infrastructure Development and Construction Sector Recovery

Despite some current softness, the long-term global outlook for infrastructure development and urbanization remains robust, presenting a significant opportunity for a rebound in demand for construction and forestry equipment. This trend is particularly relevant as many developed nations are looking to upgrade aging infrastructure, and developing economies continue to urbanize, requiring new construction projects.

A recovery in both residential and non-residential construction activity, especially in key markets like North America and Europe, would directly translate into increased sales for Deere's construction and forestry segments. For instance, in 2024, the U.S. construction sector saw project starts increase, signaling potential for renewed equipment demand.

- Infrastructure Spending Growth: Global infrastructure spending is projected to reach trillions of dollars in the coming decade, driven by government initiatives and private investment.

- Urbanization Trends: Continued global urbanization necessitates significant investment in new housing, commercial buildings, and public works, all requiring construction machinery.

- Equipment Replacement Cycles: As older equipment reaches the end of its lifecycle, there will be a natural demand for new, more efficient machines, benefiting manufacturers like Deere.

Deere's strategic focus on precision agriculture and automation is well-aligned with a market projected to reach $15.6 billion by 2025, offering significant growth. The company's expansion into emerging markets, where agricultural mechanization is a priority, taps into a vast, underserved customer base. With global food demand rising, Deere's international presence is a key advantage.

The company's "Solutions as a Service" model, aiming for 10% of enterprise revenue from services by 2030, creates a stable, recurring revenue stream. Deere's investment in electric and hybrid powertrains addresses growing customer demand for sustainable equipment and aligns with environmental regulations. Finally, a rebound in global infrastructure development and urbanization will boost demand for Deere's construction and forestry equipment.

| Opportunity Area | Key Data Point/Projection | Deere's Position |

|---|---|---|

| Precision Agriculture | Market projected to reach $15.6B by 2025 (12.8% CAGR) | Leader in AI, automation, data analytics |

| Emerging Markets | Lower equipment penetration, accelerating mechanization | Established international footprint |

| Global Food Demand | World population to reach ~10B by 2050 | Well-positioned to increase agricultural output |

| Solutions as a Service | Targeting 10% enterprise revenue from services by 2030 | Connectivity for 1.5M machines by 2026 |

| Sustainable Equipment | Showcasing low/zero-carbon power by 2026 | Investing in electric/hybrid powertrains |

| Infrastructure Development | Global infrastructure spending in trillions over next decade | Strong construction and forestry equipment portfolio |

Threats

Deere's reliance on the agricultural and construction sectors makes it highly vulnerable to market volatility and economic downturns. Fluctuations in commodity prices, interest rates, and overall economic stability directly influence customer purchasing power and investment decisions.

Persistent high interest rates, as seen throughout much of 2024 and anticipated to continue into 2025, increase the cost of financing for farmers and construction companies, thereby dampening demand for new equipment. This economic headwind is a significant concern for Deere's revenue streams.

The company itself has acknowledged these challenges, forecasting continued market contraction for its core segments in 2025. This projected slowdown underscores the direct threat posed by a challenging macroeconomic environment to Deere's sales volumes and profitability.

The agricultural and construction equipment sectors are intensely competitive, with a multitude of global and local players fighting for market share. This fierce competition often translates into price wars and aggressive sales promotions, forcing companies like Deere to invest heavily in research and development to stay ahead.

For instance, in 2023, the global agricultural machinery market was valued at approximately $110 billion, with significant contributions from competitors like CNH Industrial and AGCO. Deere's ability to maintain its leadership position hinges on its capacity to innovate and offer superior technology, a challenge amplified by the constant pressure to differentiate its product lines in a crowded marketplace.

Deere & Company faces significant threats from escalating trade tariffs and ongoing geopolitical instability. Renewed trade wars could lead to increased import duties on essential raw materials like steel and aluminum, directly impacting Deere's manufacturing expenses and potentially raising product prices for consumers. For instance, the U.S. imposed tariffs on steel and aluminum imports in 2018, a move that affected numerous industries, including agriculture and construction equipment manufacturing, by increasing input costs.

Furthermore, global geopolitical conflicts and trade tensions create substantial disruptions to Deere's intricate international supply chains. These disruptions can lead to production delays, higher logistics costs, and reduced access to key overseas markets, thereby impacting the company's international earnings. The ongoing conflict in Eastern Europe, for example, has already demonstrated the fragility of global supply networks and the potential for significant economic fallout across multiple sectors.

Stringent Regulatory and Environmental Compliance

Deere faces significant hurdles from increasingly strict environmental regulations, particularly concerning emissions and the broader issue of climate change. These evolving standards necessitate continuous and substantial investment in research and development for new products, as well as in refining manufacturing operations to ensure compliance. For instance, in fiscal year 2023, Deere reported significant investments in R&D, a portion of which is directly tied to developing more sustainable technologies and meeting stricter emissions mandates for its agricultural and construction equipment.

Failure to adhere to these ever-changing regulatory frameworks carries substantial risks. These can manifest as hefty fines, costly legal battles, and potentially even restrictions on the ability to sell certain product lines in specific markets, impacting Deere's global reach and revenue streams. The company's commitment to sustainability, as highlighted in its 2024 outlook, directly addresses these threats by prioritizing the development of lower-emission engines and alternative fuel solutions.

- Emissions Standards: Deere must adapt its engine technologies to meet tightening global emissions regulations, such as those from the EPA and EU.

- Climate Change Policies: Government policies aimed at mitigating climate change could impact the demand for traditional equipment and accelerate the need for electric or alternative-powered solutions.

- Supply Chain Scrutiny: Environmental compliance extends to the supply chain, requiring Deere to ensure its suppliers also meet sustainability and ethical standards.

- Investment in Green Tech: A significant portion of R&D spending, which reached billions in recent years, is allocated to developing environmentally friendly technologies to preemptively address future regulations.

Technological Disruptions and Cybersecurity Risks

Deere faces the dual threat of technological disruption and cybersecurity risks. While a pioneer in precision agriculture and connected equipment, the pace of innovation means competitors could emerge with even more advanced solutions, potentially eroding Deere's market lead. This rapid evolution necessitates continuous investment in R&D to stay ahead.

Deere's increasing integration of connected machinery and digital services significantly amplifies its vulnerability to cybersecurity threats. A breach could compromise sensitive operational data, disrupt customer operations, and severely damage the company's reputation and customer trust. For instance, the automotive industry, a related sector, saw significant financial impact from cyber incidents in 2023, highlighting the potential scale of such risks.

- Technological Disruption: Competitors might introduce superior innovations, challenging Deere's market position.

- Cybersecurity Exposure: Connected machinery and digital platforms increase susceptibility to data breaches and IT risks.

- Operational Impact: IT risks can disrupt Deere's manufacturing, supply chain, and customer service operations.

- Reputational Damage: Security incidents can erode customer confidence and brand loyalty.

Deere's significant exposure to economic cycles, particularly in agriculture and construction, poses a substantial threat. High interest rates, a persistent concern through 2024 and into 2025, directly impact customer financing and demand for new equipment. This macroeconomic pressure is compounded by intense competition, forcing continuous investment in R&D to maintain market leadership, as seen in the highly competitive global agricultural machinery market valued at approximately $110 billion in 2023.

Geopolitical instability and trade tensions present another major threat, potentially increasing raw material costs through tariffs and disrupting Deere's complex global supply chains, leading to production delays and increased logistics expenses. Furthermore, increasingly stringent environmental regulations necessitate ongoing, substantial R&D and operational adjustments to ensure compliance, with failure risking fines and market access restrictions.

Deere also faces the dual threat of technological disruption and cybersecurity risks. Rapid innovation by competitors could challenge its market lead, while the increasing integration of connected machinery and digital services heightens vulnerability to data breaches, operational disruptions, and reputational damage. The company's substantial R&D investments, a significant portion of which is allocated to sustainable technologies, aim to mitigate these evolving regulatory and competitive pressures.

SWOT Analysis Data Sources

This SWOT analysis is built upon a robust foundation of data, incorporating Deere's official financial statements, comprehensive market research reports, and expert industry analyses to provide a well-rounded and insightful assessment.