Deere PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Deere Bundle

Deere operates within a dynamic global environment, influenced by political stability, economic fluctuations, and evolving social trends. Understanding these external forces is crucial for anticipating challenges and capitalizing on opportunities. Our comprehensive PESTLE analysis delves into these critical factors, offering actionable intelligence to inform your strategic decisions.

Unlock a deeper understanding of how political shifts, economic downturns, technological advancements, environmental regulations, and social preferences are shaping Deere's future. This meticulously researched PESTLE analysis provides the clarity and foresight you need to navigate the complexities of the agricultural and construction machinery markets. Download the full version now and gain a significant competitive advantage.

Political factors

Global trade tensions, especially between the US and China, significantly influence Deere's export strategies for agricultural machinery. For instance, in 2023, the value of U.S. agricultural exports to China saw a notable fluctuation, highlighting the sensitivity of these markets to geopolitical shifts.

The prospect of European counter-tariffs on U.S. agricultural machinery presents another challenge, potentially impacting Deere's market access and product pricing in key regions. This could lead to increased costs for European farmers relying on imported equipment.

These ongoing geopolitical dynamics compel Deere to strategically adjust its supply chains and market focus, aiming to buffer against potential financial disruptions and maintain competitive pricing.

Government agricultural subsidies, like the US Farm Bill, are a significant driver of farmer purchasing power for new machinery. For instance, the 2023 Farm Bill, with its proposed funding, continues to offer support through crop insurance and conservation programs, directly impacting the demand for equipment from manufacturers like Deere.

These government programs, including incentives for adopting sustainable farming practices or direct support for equipment upgrades, can substantially boost sales volumes for agricultural machinery. A well-funded Farm Bill can create a more stable market, encouraging farmers to invest in advanced technology and efficiency-enhancing tools.

Conversely, shifts in subsidy allocations or reductions in program funding can lead to volatility in Deere's sales. Changes in policy, particularly concerning direct payments or equipment purchase incentives, directly affect the financial capacity of farmers to acquire new tractors, combines, and other heavy machinery.

Large-scale government infrastructure projects, such as the US Infrastructure Investment and Jobs Act, directly stimulate demand for the heavy machinery that Deere & Company manufactures. This legislation, with its significant funding allocated to roads, bridges, and other public works, translates into increased orders for Deere's construction and forestry equipment, including excavators and loaders.

Deere's construction and forestry divisions are poised to benefit considerably from these public spending initiatives. For instance, the Infrastructure Investment and Jobs Act is projected to support trillions of dollars in construction activity over the coming decade, creating a sustained need for the types of equipment Deere specializes in. The ongoing nature and substantial scope of these government plans are therefore a critical determinant of the long-term performance and growth prospects for this key segment of Deere's business.

Right-to-Repair Legislation and Lawsuits

Deere & Company is navigating a complex landscape of right-to-repair legislation and related lawsuits. The Federal Trade Commission (FTC) and various U.S. states have initiated legal actions, citing antitrust concerns over Deere's alleged restrictions on independent repair services and access to crucial diagnostic software. These challenges could necessitate significant adjustments to Deere's established service and maintenance models.

The outcomes of these ongoing legal disputes, alongside the increasing adoption of right-to-repair laws at the state level, such as the one enacted in Colorado, are poised to reshape the equipment servicing sector. Potential impacts include changes in how machinery is maintained and repaired, which could affect Deere's profitability and its relationships with customers and third-party service providers.

- FTC and State Lawsuits: Allegations of antitrust violations stem from Deere's alleged monopolistic practices in repair services.

- Diagnostic Software Access: A key point of contention involves independent technicians' ability to access diagnostic tools and software necessary for repairs.

- Impact on Service Model: Potential mandates to provide broader access to parts, tools, and software could alter Deere's current revenue streams from authorized service centers.

- State-Level Legislation: The growing trend of state-level right-to-repair laws, like Colorado's, creates a patchwork of regulations Deere must comply with.

Political Stability in Key Markets

Deere & Company's extensive global footprint means its operations and sales are directly impacted by the political stability of its key markets. For instance, in 2024, regions experiencing geopolitical tensions or significant policy shifts in agriculture could affect Deere's access to raw materials and the purchasing power of its customers.

Unforeseen policy changes or regulatory shifts in major agricultural economies, such as the European Union or Brazil, can disrupt Deere's supply chains and influence demand for its machinery. For example, changes in trade tariffs or environmental regulations can create unpredictable market conditions.

Deere's ability to adapt to evolving political landscapes is crucial for its sustained global performance. In 2024, the company is likely focusing on risk mitigation strategies in markets with heightened political uncertainty, ensuring operational resilience.

- Geopolitical Risk Monitoring: Deere actively monitors geopolitical developments in over 100 countries, with particular attention to major agricultural markets in North America, South America, and Europe.

- Trade Policy Impact: Changes in trade agreements and tariffs, such as those affecting agricultural exports from the US to China, can directly influence Deere's sales volumes and profitability in those regions.

- Regulatory Environment Shifts: Evolving environmental regulations in countries like Germany or France regarding agricultural practices can necessitate adjustments in Deere's product offerings and technology development.

Government agricultural policies, including subsidies and trade agreements, significantly shape the demand for Deere's machinery. For example, the 2023 U.S. Farm Bill's continued support for crop insurance and conservation programs underpins farmer purchasing power. Furthermore, shifts in global trade dynamics, such as potential European counter-tariffs on U.S. agricultural equipment, necessitate strategic adjustments in Deere's market approach and supply chain management.

Infrastructure spending, like the U.S. Infrastructure Investment and Jobs Act, directly boosts demand for Deere's construction and forestry equipment. This legislation, projected to support trillions in construction activity, creates a sustained need for excavators and loaders. Deere's ability to adapt to evolving political landscapes and monitor geopolitical risks in its key markets is crucial for sustained global performance.

Regulatory challenges, particularly regarding right-to-repair legislation and access to diagnostic software, could force Deere to alter its service and maintenance models. Ongoing legal actions by the FTC and various states highlight concerns over alleged monopolistic practices in repair services, potentially impacting Deere's revenue streams from authorized service centers.

| Political Factor | Impact on Deere | Example/Data (2023-2025) |

| Trade Tensions (US-China) | Affects export strategies and market access | Fluctuations in U.S. agricultural exports to China in 2023 |

| Agricultural Subsidies (e.g., US Farm Bill) | Drives farmer purchasing power for new machinery | 2023 Farm Bill funding supports crop insurance and conservation programs |

| Infrastructure Spending (e.g., IIJA) | Stimulates demand for construction and forestry equipment | IIJA projected to support trillions in construction activity over the next decade |

| Right-to-Repair Legislation | Could alter service and maintenance models | FTC actions and state laws (e.g., Colorado) challenging repair restrictions |

| Geopolitical Stability | Impacts operations and customer purchasing power | Deere monitors political developments in over 100 countries |

What is included in the product

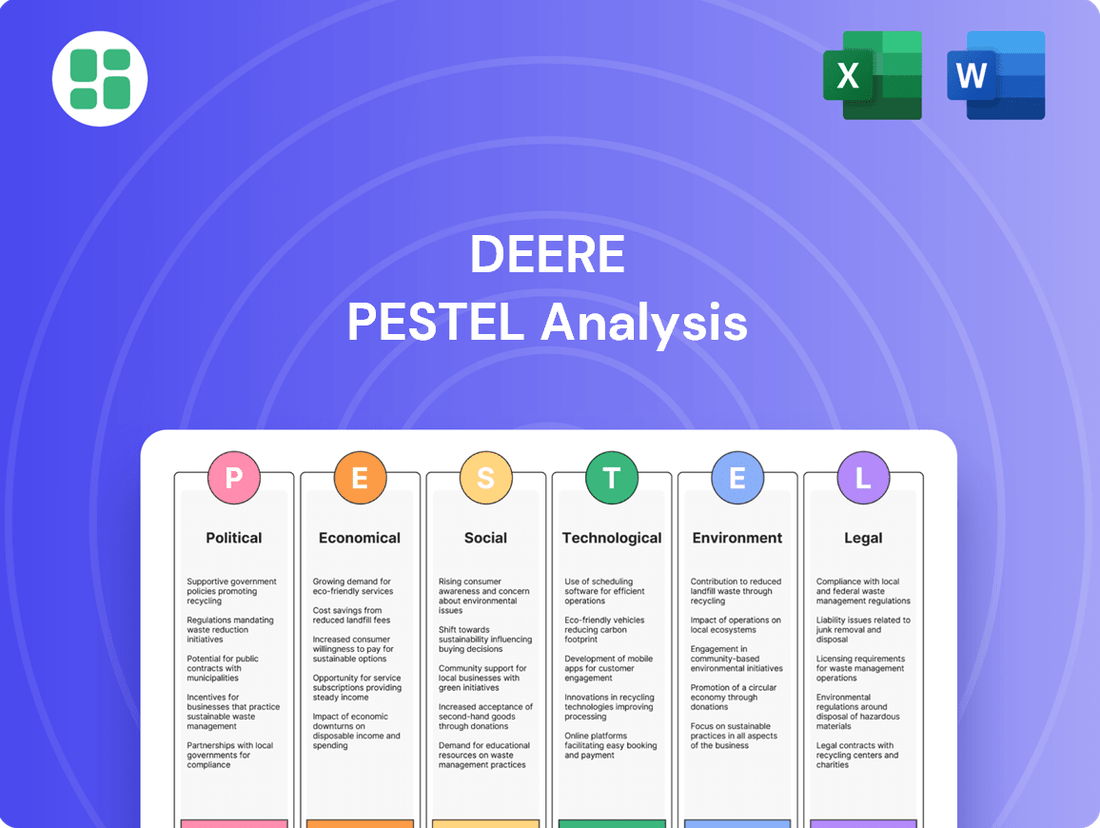

This PESTLE analysis examines the external macro-environmental factors impacting Deere & Company across Political, Economic, Social, Technological, Environmental, and Legal dimensions.

It provides actionable insights and forward-looking strategies to navigate market dynamics and capitalize on emerging opportunities.

A clear and concise Deere PESTLE analysis provides a readily digestible overview of external factors, alleviating the pain of sifting through complex data for strategic decision-making.

By offering a structured framework to understand political, economic, social, technological, environmental, and legal influences, the Deere PESTLE analysis simplifies the identification of potential opportunities and threats.

Economic factors

Declining commodity prices are a significant headwind for the agricultural sector, directly impacting farm income and, consequently, the demand for agricultural machinery. As crop and livestock prices soften, farmers face tighter budgets, leading to increased caution regarding large capital expenditures like new equipment.

Projections for net farm income in the United States indicate a downturn, with forecasts suggesting a decline in 2024 and continuing into 2025. For instance, the USDA's Economic Research Service has projected a decrease in net farm income for 2024 compared to previous years, a trend that is expected to persist.

This economic pressure on the farming community translates directly into reduced demand for new agricultural equipment from manufacturers like Deere. Farmers are likely to postpone or scale back purchases of high-value machinery, opting to maintain existing equipment or seek used alternatives to manage costs.

Elevated interest rates significantly increase the cost of borrowing for Deere's core customer base, farmers and contractors. This makes financing new equipment purchases more expensive, potentially delaying or deterring investment in machinery. For instance, the Federal Reserve's benchmark interest rate, which influences many lending rates, remained elevated throughout much of 2024, impacting affordability.

Deere's own financial services division, a crucial component of its business, is also directly exposed to these rate shifts. Higher borrowing costs for Deere's financial arm can translate into less favorable lending terms for customers, further dampening equipment demand. This sensitivity means that even with strong underlying demand for agricultural and construction products, financing costs can act as a significant headwind.

The broader economic environment characterized by higher interest rates contributes to a slowdown in the equipment market. As capital becomes more expensive, businesses and individuals tend to be more cautious with large expenditures like farm machinery or construction vehicles. This trend was observable in 2024, with some analysts noting a moderation in order backlogs for heavy equipment due to these financing challenges.

Deere anticipates a challenging 2025, projecting a continued contraction in its agricultural, construction, and forestry markets. Notably, North American large agricultural equipment sales are expected to see significant declines, reflecting broader economic headwinds.

Adding to this pressure is a substantial oversupply of equipment across various sectors. This surplus creates a buyer's market, intensifying downward pressure on pricing for new and used machinery. For instance, industry reports from late 2024 indicated elevated inventory levels for tractors and combines compared to historical averages.

In this environment, Deere's ability to effectively manage its inventory levels is paramount. Efficiently moving existing stock while carefully calibrating production to match anticipated demand will be key to navigating the pricing challenges and maintaining profitability.

Inflationary Pressures on Input Costs

Farmers are grappling with significantly higher costs for essential inputs like fertilizers. For instance, urea prices, a key nitrogen fertilizer, saw substantial increases in 2023 and early 2024, impacting agricultural operations globally. This surge in fertilizer costs directly squeezes farmer profitability, potentially dampening their appetite for new equipment purchases.

These elevated input expenses for farmers, coupled with Deere's own potential increases in raw material and manufacturing costs, create a dual challenge. It can affect demand for Deere's products and put pressure on the company's profit margins. Managing production expenses effectively, especially if sales volumes decrease, becomes a critical strategy for Deere.

- Fertilizer Cost Surge: Urea prices, a benchmark fertilizer, experienced notable volatility and upward trends throughout 2023 and into early 2024, impacting farm operating budgets.

- Profitability Squeeze: Higher fertilizer costs reduce the net income available to farmers, potentially lowering their capacity for capital expenditures like new machinery.

- Deere's Margin Pressure: Rising material and production costs for Deere, alongside potentially softer farmer demand, could compress the company's operational margins.

- Cost Management Imperative: Deere's ability to control its own production costs will be crucial for maintaining profitability, particularly if agricultural equipment sales volumes face headwinds.

Currency Fluctuations

Currency exchange rate volatility significantly impacts Deere's global operations. Fluctuations can affect the cost of imported components and the revenue generated from international sales when translated back into U.S. dollars. For instance, a stronger U.S. dollar can make Deere's equipment more expensive for overseas buyers, potentially dampening demand.

In 2024, the U.S. dollar experienced periods of strength against various major currencies. This trend can directly influence Deere's reported earnings. For example, if the Euro weakens against the dollar, European sales translate into fewer dollars, impacting the company's top-line figures from that region.

Deere actively manages these currency risks through various hedging strategies. However, the inherent unpredictability of global currency markets remains a persistent challenge for companies with extensive international sales and manufacturing footprints. The company's ability to navigate these fluctuations is crucial for maintaining stable international profitability.

- Impact on Sales: A stronger USD can increase the price of Deere's machinery for international customers, potentially reducing sales volume in key markets.

- Profitability Translation: Fluctuations affect how profits earned in foreign currencies are converted into U.S. dollars, influencing reported net income.

- Competitive Landscape: Currency shifts can alter the relative price competitiveness of Deere's products compared to local manufacturers or competitors based in countries with weaker currencies.

- Hedging Costs: While essential, currency hedging strategies involve costs that can also impact profit margins.

The agricultural sector is facing significant economic headwinds, with declining commodity prices directly impacting farm incomes and, consequently, the demand for new machinery. Projections for U.S. net farm income in 2024 and 2025 indicate a downturn, forcing farmers to be more cautious with large capital expenditures.

Elevated interest rates, exemplified by the Federal Reserve's sustained benchmark rate in 2024, increase borrowing costs for farmers and Deere's financial services division, making equipment financing more expensive and potentially deterring investment. This environment, coupled with substantial equipment oversupply noted in late 2024, creates a buyer's market and intensifies pricing pressure.

Farmers are also grappling with surging input costs, such as fertilizer prices, which saw notable increases through early 2024, further squeezing profitability and reducing the capacity for new equipment purchases. Deere faces a dual challenge of potentially softer demand and its own rising material and production costs, necessitating careful cost management.

Currency exchange rate volatility, particularly the strength of the U.S. dollar observed in 2024, affects Deere's global operations by making its products more expensive for overseas buyers and impacting the translation of foreign earnings. While hedging strategies are employed, market unpredictability remains a persistent challenge.

| Economic Factor | 2024/2025 Outlook | Impact on Deere | Key Data Points |

| Commodity Prices | Declining | Reduced farm income, lower demand for machinery | USDA forecasts lower net farm income for 2024/2025 |

| Interest Rates | Elevated | Higher financing costs for customers, reduced affordability | Federal Reserve benchmark rate remained high through 2024 |

| Input Costs (Fertilizer) | Rising | Reduced farmer profitability, potential delay in equipment purchases | Urea prices saw notable increases in 2023-early 2024 |

| Currency Exchange Rates | Volatile (USD Strength) | Impacts international sales and reported earnings | Stronger USD makes exports more expensive |

| Equipment Inventory | Oversupply | Intensified pricing pressure, buyer's market | Elevated inventory levels noted in late 2024 |

Same Document Delivered

Deere PESTLE Analysis

The preview shown here is the exact Deere PESTLE analysis document you’ll receive after purchase—fully formatted and ready to use.

This is a real screenshot of the product you’re buying—delivered exactly as shown, no surprises. It provides a comprehensive overview of the Political, Economic, Social, Technological, Legal, and Environmental factors impacting Deere.

The content and structure shown in the preview is the same Deere PESTLE analysis document you’ll download after payment, offering actionable insights for strategic planning.

Sociological factors

Deere's core markets—agriculture, construction, and commercial landscaping—are grappling with a pronounced shortage of skilled workers. This isn't a minor inconvenience; it's a fundamental challenge impacting productivity and growth across these vital sectors.

The U.S. Bureau of Labor Statistics projects a need for over 1.4 million new agriculture, food, and natural resources occupations by 2030, yet the available skilled workforce is not keeping pace. Similarly, the construction industry faced a deficit of over 400,000 workers in 2023, according to Associated Builders and Contractors. This societal shift directly fuels demand for advanced machinery that can compensate for the lack of human operators.

Deere's strategic focus on developing autonomous and automated equipment is a direct response to this pressing need. By investing heavily in AI and robotics, Deere is providing solutions that allow customers to perform complex tasks with reduced reliance on specialized labor, thereby enhancing efficiency and output in an increasingly challenging labor environment.

The average age of farmers in the United States reached 57.5 years in 2022, highlighting a significant demographic shift. This aging population often leads to farm consolidation as older farmers retire without immediate successors, creating larger operations that may demand more sophisticated, technology-driven machinery from companies like Deere.

This trend also means a growing need for equipment that is intuitive and easier to operate, potentially appealing to a new generation of farmers who may be less familiar with traditional farming methods but are more receptive to digital integration and precision agriculture solutions. Deere's strategy must balance supporting experienced operators with attracting and enabling newer, tech-savvy entrants into the agricultural sector.

Consumers increasingly prioritize food grown with environmentally sound practices, driving demand for sustainably produced goods. This societal shift directly impacts agricultural methods, encouraging farmers to adopt greener approaches.

Deere is well-positioned to capitalize on this trend by offering precision agriculture solutions that optimize resource use, such as reducing herbicide and fuel consumption. For instance, Deere's See & Spray™ technology demonstrated a 77% reduction in herbicide use in field trials in 2023, directly addressing this demand.

The company's commitment to sustainability, including its goal to reduce greenhouse gas emissions across its value chain by 35% by 2030, resonates with this growing consumer preference. This alignment strengthens Deere's brand image and market appeal among environmentally conscious farmers and consumers.

Rural Connectivity and Digital Divide

The adoption of precision agriculture, a core offering for Deere, is significantly impacted by rural connectivity. Many farming communities still grapple with unreliable or absent broadband internet, creating a digital divide that limits access to Deere's advanced connected technologies. This gap can prevent some farmers from fully leveraging the benefits of data-driven farming, such as real-time equipment monitoring and optimized resource management.

For instance, a 2024 report indicated that approximately 25% of U.S. rural households still lack access to reliable high-speed internet. This lack of infrastructure directly affects Deere's ability to deploy its full suite of connected solutions, potentially slowing adoption rates in these areas. Deere must explore strategies, possibly through partnerships with internet providers or government initiatives, to bridge this digital divide and ensure equitable access to its innovations for all its customers.

- Digital Divide Impact: Approximately 25% of U.S. rural households lacked reliable high-speed internet access in 2024, hindering precision agriculture adoption.

- Connectivity Dependency: Deere's connected technologies, crucial for precision farming, require robust internet access for optimal functionality.

- Strategic Imperative: Deere needs to consider partnerships and solutions to ensure its digital offerings are accessible across all customer segments, regardless of their location's connectivity infrastructure.

Workforce Diversity and Inclusion

Societal expectations and Deere's own commitments to diversity, equity, and inclusion (DE&I) significantly shape its corporate governance and how it attracts talent. These expectations are increasingly driving how companies operate and report their progress.

Shareholder activism underscores the importance of DE&I, with proposals often pushing for more transparent reporting on initiatives aimed at fostering a meritocratic and inclusive environment. For instance, in 2024, several major corporations faced shareholder votes on DE&I metrics, reflecting a broader trend.

A diverse workforce is not just a social imperative; it's a strategic advantage. Companies like Deere recognize that a variety of perspectives is crucial for understanding and meeting the needs of an evolving global customer base, while also fueling innovation and creativity.

- Societal Pressure: Growing public and investor emphasis on DE&I influences corporate strategy and public perception.

- Shareholder Engagement: DE&I policies are increasingly subject to shareholder scrutiny and proposals, demanding greater transparency and accountability.

- Talent Acquisition: A strong DE&I commitment is vital for attracting and retaining top talent in a competitive global market.

- Innovation Driver: Diverse teams are linked to enhanced problem-solving capabilities and the development of more innovative products and services.

Societal shifts, particularly the aging farmer demographic and the scarcity of skilled labor in agriculture and construction, are driving demand for advanced, automated machinery. This trend is further amplified by consumer preferences for sustainably grown food, pushing farmers towards precision agriculture solutions that optimize resource usage.

The digital divide remains a significant hurdle, with a notable percentage of rural households still lacking reliable broadband, which impacts the adoption of Deere's connected technologies. Concurrently, increasing societal and investor focus on diversity, equity, and inclusion (DE&I) is shaping corporate governance and talent acquisition strategies, with diverse teams being recognized as a key driver of innovation.

| Societal Factor | Impact on Deere | Supporting Data/Trend |

|---|---|---|

| Labor Shortages | Increased demand for automation and autonomous equipment. | U.S. agriculture needs 1.4M+ workers by 2030; construction faced a 400K+ worker deficit in 2023. |

| Demographic Shifts (Aging Farmers) | Demand for intuitive, technology-driven machinery; potential for farm consolidation. | Average farmer age in U.S. was 57.5 in 2022. |

| Sustainability Concerns | Growth in precision agriculture adoption and demand for resource-optimizing tech. | Deere's See & Spray™ reduced herbicide use by 77% in 2023 field trials. |

| Digital Divide | Hindrance to full adoption of connected technologies in rural areas. | ~25% of U.S. rural households lacked reliable broadband in 2024. |

| DE&I Expectations | Influence on corporate strategy, governance, and talent attraction. | Increased shareholder focus on DE&I metrics in 2024. |

Technological factors

Deere's leadership in precision agriculture, incorporating GPS, IoT, and data analytics, is revolutionizing farming efficiency. Technologies like See & Spray™ are demonstrably reducing herbicide usage, with Deere reporting a 70% reduction in herbicide applied in certain trials, thereby boosting both economic and environmental outcomes for farmers.

This technological integration is rapidly transforming farming practices, with the adoption of precision agriculture solutions moving from a competitive advantage to a fundamental necessity for farmers aiming to remain profitable and sustainable in the 2024-2025 period.

Deere is significantly investing in automation and AI, showcasing new autonomous machines like the 9RX Tractor and orchard tractors at CES 2025. These advancements directly tackle skilled labor shortages and aim to lower operational expenses while increasing output by allowing machines to handle intricate jobs independently.

The company's second-generation autonomy kits and retrofit solutions are crucial for broadening the accessibility of these advanced technologies, making autonomous capabilities available to a wider range of customers and equipment.

Deere is making significant strides in electrification, aiming for a fully-electric option in every Turf product family. This commitment extends to their Construction & Forestry divisions, with plans to introduce over 20 electric and hybrid models by 2026. This strategic shift is driven by a desire to offer customers more sustainable and efficient equipment, aligning with global efforts to reduce carbon emissions.

Digital Platforms and Data Analytics

Deere's investment in digital platforms like the John Deere Operations Center and its accompanying mobile apps is a significant technological advantage. These cloud-based tools allow customers to manage their equipment, track jobsite performance, and gain valuable data-driven insights, fostering more informed operational and agronomic decisions. This digital ecosystem is central to optimizing productivity and creating seamless workflows for users.

The continuous evolution of these digital tools directly translates to enhanced customer value and efficiency. For instance, in fiscal year 2023, Deere reported that its Agriculture and Turf segment’s net sales increased by 13%, with a significant portion of this growth attributed to the adoption of its precision technology and digital solutions. These platforms are not just about data; they are about actionable intelligence.

- Operations Center: A cloud-based platform for fleet management and jobsite monitoring.

- Mobile Apps: Provide on-the-go access to machine data and performance insights.

- Data-Driven Decisions: Empowering customers with analytics for better agronomic and operational choices.

- Customer Value: Continuous enhancements aim to boost customer efficiency and profitability.

R&D Investment and Innovation Pipeline

Deere & Company is demonstrating a strong commitment to R&D, dedicating substantial resources to foster innovation within the agricultural sector. For fiscal year 2023, the company reported R&D expenses of $2.15 billion, a notable increase from $1.94 billion in fiscal year 2022, underscoring its focus on future technologies.

This investment fuels a robust innovation pipeline, encompassing the development of advanced machinery, precision agriculture solutions, and autonomous farming capabilities. Deere's strategic focus on these areas aims to enhance efficiency and sustainability for its customers globally. For instance, their investment is directed towards technologies like AI-powered crop monitoring and advanced robotics.

Key areas of R&D focus for Deere include:

- Precision Agriculture Technologies: Enhancing data analytics and connectivity for optimized farm management.

- Autonomous and Electric Solutions: Developing self-driving equipment and electrified machinery to reduce operational costs and environmental impact.

- Advanced Manufacturing: Investing in new production techniques to improve product quality and manufacturing efficiency.

Deere's technological advancements are reshaping agriculture, with precision farming tools like See & Spray™ reducing herbicide use by up to 70% in trials, enhancing both cost-efficiency and environmental stewardship for farmers.

The company's push into automation and AI is evident in new autonomous tractors showcased in 2025, addressing labor shortages and improving operational efficiency by enabling machines to perform complex tasks independently.

Deere's commitment to electrification is substantial, with plans for electric options across all Turf product lines and over 20 electric/hybrid models in Construction & Forestry by 2026, aligning with sustainability goals.

The John Deere Operations Center and mobile apps provide a crucial digital ecosystem, empowering users with data analytics for optimized farm and jobsite management, directly contributing to increased productivity and informed decision-making.

| Technological Factor | Deere's Action/Investment | Impact/Data (2023-2025) |

| Precision Agriculture | See & Spray™ technology, IoT, GPS | Up to 70% herbicide reduction in trials; Agriculture & Turf net sales up 13% in FY23 due to precision tech adoption. |

| Automation & AI | Autonomous tractors (e.g., 9RX), autonomy kits | Addressing skilled labor shortages; enhancing operational efficiency. |

| Electrification | Electric Turf products, 20+ electric/hybrid models by 2026 | Reducing carbon emissions; offering sustainable equipment options. |

| Digital Platforms | Operations Center, mobile apps | Data-driven insights for farm/jobsite management; improved customer value and efficiency. |

| R&D Investment | $2.15 billion in FY23 | Fuels innovation in advanced machinery, precision ag, and autonomous solutions. |

Legal factors

Deere is navigating significant legal challenges related to right-to-repair, including federal antitrust lawsuits and state legislative actions. These legal battles, which gained momentum in 2023 and continue into 2024, center on allegations that Deere's restrictions on repair software and diagnostic tools hinder farmers' ability to service their own equipment or seek independent repair services.

The Federal Trade Commission (FTC) and various state attorneys general have voiced concerns, citing potential monopolistic practices. For instance, by late 2023, several states, including New York and California, had introduced or passed right-to-repair legislation impacting agricultural equipment.

The resolution of these lawsuits and legislative efforts in 2024 and 2025 could compel Deere to provide broader access to repair manuals, diagnostic tools, and parts. Such changes would directly affect Deere's substantial after-sales service and parts revenue, which represented a significant portion of its overall earnings in recent fiscal years, potentially forcing a recalibration of its service business model.

As Deere & Company (DE) pushes further into precision agriculture, collecting extensive farm data through its connected solutions, data privacy and security laws are becoming paramount. Ensuring farmers’ data is protected and handled securely is a significant legal challenge, especially with the increasing volume of sensitive information being gathered. For instance, the General Data Protection Regulation (GDPR) in Europe and similar legislation in other key markets impose strict requirements on data handling, with potential fines for non-compliance. Deere’s ability to navigate these evolving global regulations is crucial for maintaining farmer trust and avoiding costly legal repercussions.

Deere's global operations mean it must navigate a complex web of product liability laws and safety standards. For instance, in 2023, the U.S. Consumer Product Safety Commission (CPSC) reported over 200,000 product-related injuries treated in emergency rooms, highlighting the importance of robust safety protocols for heavy machinery.

Failure to meet these rigorous standards, which vary significantly by region, can lead to costly lawsuits and damage Deere's hard-earned reputation for reliability. The company's commitment to safety is therefore not just a regulatory necessity but a core business imperative.

Deere invests heavily in research and development, ensuring that its continuous product innovation is always accompanied by exhaustive testing and strict adherence to evolving safety regulations worldwide, a strategy vital for maintaining market trust and minimizing legal exposure.

Intellectual Property Rights

Deere's significant investments in precision agriculture, automation, and AI necessitate robust intellectual property (IP) protection to maintain its competitive advantage. This includes safeguarding patents for new technologies, proprietary software algorithms, and unique equipment designs. For instance, in 2023, Deere reported substantial R&D spending, underscoring the value placed on innovation and its IP.

Legal battles concerning IP, especially regarding software access for independent repair of its sophisticated machinery, represent a critical challenge. These disputes highlight the tension between manufacturers' IP rights and the right-to-repair movement, which could impact Deere's service revenue and customer loyalty. The company actively monitors and engages in legal frameworks governing these areas to protect its innovations.

- Patent Portfolio: Deere holds thousands of patents globally, a testament to its commitment to innovation in areas like autonomous operations and data analytics.

- Software Licensing: The legal landscape surrounding software licensing and access for third-party repairs is a dynamic area impacting Deere's business model.

- Trade Secrets: Protecting trade secrets related to manufacturing processes and proprietary data management systems is crucial for maintaining market leadership.

Antitrust and Competition Laws

Deere navigates a complex web of global antitrust and competition laws, extending beyond the current right-to-repair debates. These regulations scrutinize market dominance, mergers, and overall competitive conduct. The Federal Trade Commission's (FTC) ongoing lawsuit alleging repair monopolization underscores the intense oversight large manufacturers like Deere face to maintain fair market practices.

Failure to comply with these stringent antitrust regulations can result in significant financial penalties and force costly operational overhauls. For instance, in 2023, the European Commission fined major companies billions for anti-competitive practices, demonstrating the severe consequences of non-adherence.

- Regulatory Scrutiny: Deere operates under global antitrust laws that govern market concentration and competitive behavior.

- FTC Lawsuit: The ongoing FTC action highlights concerns about monopolistic repair practices.

- Compliance Imperative: Adherence is vital to prevent substantial fines and mandated business adjustments.

Deere faces significant legal challenges, particularly concerning the right-to-repair movement, with ongoing federal antitrust lawsuits and state legislative actions. These legal battles, active through 2023 and into 2024, focus on Deere's alleged restrictions on repair software and diagnostic tools, impacting farmers' ability to service their equipment independently.

The company's extensive use of connected solutions in precision agriculture also brings data privacy and security laws to the forefront. Navigating global regulations like GDPR is crucial to protect sensitive farmer data and avoid substantial penalties, a challenge that will continue to evolve through 2025.

Deere's commitment to product safety is paramount, requiring adherence to varying global standards to mitigate risks of costly lawsuits and reputational damage. The company's robust R&D and adherence to safety regulations are vital for maintaining market trust and minimizing legal exposure.

Intellectual property protection is another critical legal area, with Deere actively safeguarding patents and trade secrets for its advanced technologies. Legal disputes over software access for repairs highlight the ongoing tension between IP rights and the right-to-repair, a dynamic that will shape Deere's service model and revenue streams through 2025.

Environmental factors

Climate change significantly impacts agriculture, with altered weather patterns and resource availability directly affecting crop yields and, consequently, farmer profitability. This volatility creates a direct link to the demand for agricultural machinery, as farmers seek to optimize operations. For instance, more frequent extreme weather events, like droughts and floods, can lead to reduced harvests, impacting the purchasing power for new equipment.

Deere & Company is actively addressing these challenges by focusing on solutions that boost resource efficiency and promote sustainable farming practices. This strategic alignment helps farmers adapt to the unpredictable environmental conditions, ensuring greater resilience. The company's investment in precision agriculture technology, for example, allows farmers to use resources like water and fertilizer more effectively, a critical advantage in a changing climate.

The global shift towards a low-carbon economy presents a substantial strategic opportunity for Deere. As regulations and consumer preferences increasingly favor sustainable production, the demand for advanced agricultural equipment that supports these goals is expected to grow. Deere's commitment to innovation in areas like alternative fuels and electric machinery positions it to capitalize on this transition, aligning with both environmental imperatives and market demand.

Deere has set ambitious 'Leap Ambitions' targeting a 20% reduction in Scope 1 and 2 greenhouse gas (GHG) emissions by the end of fiscal year 2025. This includes a significant aim to reduce the environmental impact, specifically CO2e emissions, of 90% of its new product offerings.

To achieve these goals, Deere is actively increasing its reliance on renewable electricity sources and implementing energy efficiency improvements across its global operations. These initiatives are directly responsive to growing global demands for enhanced corporate environmental stewardship.

Deere is actively pursuing sustainable manufacturing, with a goal to implement best water management practices at all its water-scarce factory locations. This commitment extends to increasing their recycling rate to 85% of total waste generated by their operations.

These environmental initiatives are designed to significantly reduce the ecological impact of Deere's production. For instance, by focusing on sustainable materials and boosting sales of remanufactured and rebuilt products, Deere is actively contributing to a more circular economy, minimizing resource depletion.

Electrification of Equipment and Reduced Emissions

Deere is making significant strides in electrifying its equipment, a crucial step in reducing environmental impact. For instance, the company has introduced electric Gator utility vehicles and is actively developing battery-electric tractors, showcasing a commitment to a cleaner future. This electrification strategy directly addresses growing environmental concerns and stringent regulatory demands for reduced emissions from machinery.

The drive towards electrification is not just about compliance; it's a core component of Deere's product sustainability. By eliminating tailpipe emissions and lowering fuel consumption, these electric and hybrid alternatives offer substantial benefits. For example, battery-electric tractors are projected to offer lower operating costs due to reduced energy and maintenance expenses compared to traditional diesel engines.

- Electric & Hybrid Development: Deere is expanding its portfolio with electric Gator utility vehicles and battery-electric tractors.

- Emission Reduction: These advancements aim to eliminate tailpipe emissions, contributing to cleaner air.

- Fuel Efficiency: Electrification significantly reduces reliance on fossil fuels and lowers overall fuel consumption.

- Noise Reduction: Electric machinery operates more quietly, addressing noise pollution concerns in various environments.

Promotion of Sustainable Farming Practices

Deere’s commitment to sustainable farming is evident in its precision agriculture technologies designed to minimize environmental impact. Solutions like See & Spray™ and those supporting conservation tillage directly aid farmers in reducing chemical usage, lowering fuel consumption, and decreasing soil disturbance. These innovations are crucial for promoting environmentally responsible agriculture.

The company actively monitors its contribution to sustainability through metrics such as 'sustainably engaged acres'. This metric quantifies the adoption of two or more John Deere technology solutions or sustainable practices by customers. By focusing on these areas, Deere empowers its customers to achieve superior agricultural results while optimizing resource utilization.

- Reduced Chemical Input: Precision application technologies minimize the need for herbicides and pesticides.

- Fuel Efficiency: Optimized machinery operation and reduced tillage lower fuel consumption.

- Soil Health: Conservation tillage practices help preserve soil structure and reduce erosion.

Climate change poses significant risks to agriculture, impacting crop yields and farmer profitability, which in turn affects demand for machinery. Deere is actively developing solutions to enhance resource efficiency and promote sustainable farming, helping farmers adapt to environmental volatility. The company's commitment to reducing its environmental footprint is underscored by its ambitious 'Leap Ambitions,' targeting a 20% reduction in Scope 1 and 2 GHG emissions by fiscal year 2025.

Deere is investing heavily in electrification, with new electric Gator utility vehicles and developing battery-electric tractors to reduce tailpipe emissions and fuel consumption. Their precision agriculture technologies, like See & Spray™, aim to minimize chemical usage, lower fuel consumption, and improve soil health, directly supporting environmentally responsible farming practices.

The company's sustainability efforts include increasing reliance on renewable electricity and improving energy efficiency across operations, alongside implementing best water management practices at water-scarce factory locations and aiming for an 85% waste recycling rate.

Deere's progress towards its environmental goals includes a focus on sustainable materials and increasing sales of remanufactured and rebuilt products, fostering a circular economy. The company tracks customer adoption of sustainable practices through metrics like 'sustainably engaged acres'.

| Environmental Goal | Target | Status/Progress | Year |

|---|---|---|---|

| Scope 1 & 2 GHG Emissions Reduction | 20% | Progressing towards target | FY2025 |

| CO2e Emissions Reduction in New Products | 90% of new product offerings | Ongoing development | FY2025 |

| Waste Recycling Rate | 85% | Ongoing implementation | Ongoing |

| Water Management Practices | Best practices at water-scarce locations | Implementation underway | Ongoing |

PESTLE Analysis Data Sources

Our Deere PESTLE Analysis is grounded in comprehensive data from agricultural industry reports, government economic indicators, and global environmental policy updates. We incorporate insights from leading market research firms and technological trend forecasts to ensure a holistic view.