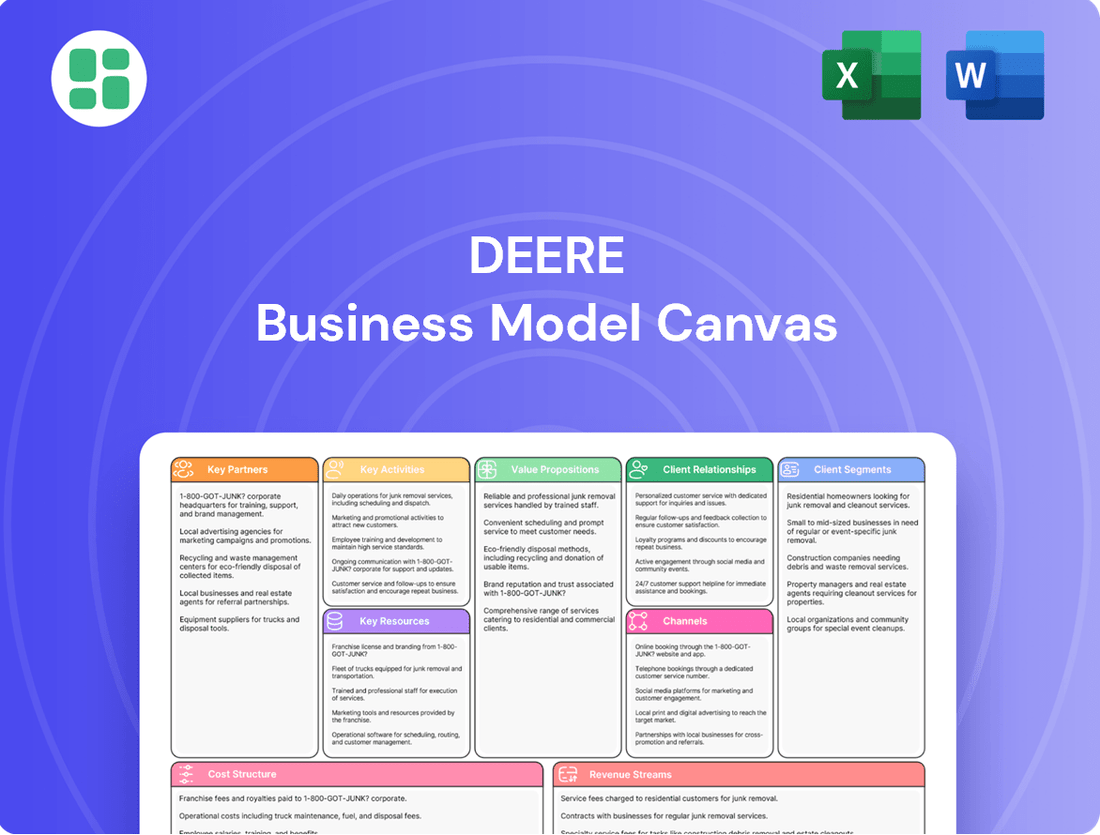

Deere Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Deere Bundle

Explore the intricate workings of Deere's business model with our comprehensive Business Model Canvas. This detailed breakdown reveals how they connect with customers, deliver value, and generate revenue in the agricultural and construction sectors. Download the full version to gain a strategic advantage.

Partnerships

Deere & Company actively cultivates strategic alliances with leading technology companies to bolster its precision agriculture solutions. These collaborations are crucial for integrating cutting-edge innovations into their equipment and services.

A prime example is the January 2024 partnership with SpaceX. This alliance integrates SpaceX's Starlink satellite internet service directly into Deere's John Deere Operations Center. This move aims to provide reliable, high-speed connectivity for farmers, even in the most remote rural locations, directly addressing a significant operational hurdle.

The SpaceX collaboration is designed to unlock the full potential of advanced agricultural technologies. By ensuring consistent data flow, it facilitates critical functions such as autonomous operations, real-time data analytics, and seamless remote diagnostics, ultimately enhancing farm productivity and promoting sustainable farming practices.

Deere's Startup Collaborator program, initiated in 2019, is a key component of its innovation strategy. This program actively seeks out and partners with emerging companies to integrate advanced technologies into its offerings.

In 2024, Deere's Startup Collaborator program featured six companies. These collaborators are working on diverse fields such as land surface temperature measurement, artificial intelligence, quantum sensing, V2X charging, logistics, and production management software.

The objective of these collaborations is to discover novel methods for enhancing value for Deere's agricultural and construction clients. By incorporating these cutting-edge solutions, Deere aims to stay at the forefront of technological advancements in its industries.

Deere strategically forms joint ventures to broaden its financial services, especially in burgeoning markets. A prime example is the 50:50 partnership with Banco Bradesco in Brazil, unveiled in August 2024. This collaboration is designed to offer superior financing solutions tailored for John Deere customers and their dealers.

This alliance significantly bolsters Deere's capacity to deliver competitive and attractive financial packages. By leveraging the strengths of both entities, the joint venture aims to make purchasing John Deere equipment more accessible and financially viable for its customer base.

Global Supplier Network

Deere & Company's operational backbone is its extensive global supplier network, providing critical components, raw materials, and specialized services. This interconnected web is fundamental to maintaining Deere's manufacturing prowess and overall efficiency. For instance, in April 2025, KellyOCG achieved Partner-level status within John Deere's Achieving Excellence Program, highlighting the caliber of suppliers Deere engages with for managed services and recruitment outsourcing.

This strategic supplier engagement ensures a consistently robust and high-quality supply chain, which is vital for Deere's product development and delivery. The Achieving Excellence Program, in particular, signifies Deere's commitment to fostering strong, collaborative relationships with its top-performing partners, driving mutual growth and operational excellence.

- Global Reach: Deere sources a diverse range of inputs from suppliers across the globe, ensuring access to specialized materials and competitive pricing.

- Supplier Recognition: Programs like the John Deere Achieving Excellence Program identify and reward top-tier suppliers, fostering a culture of quality and continuous improvement.

- Strategic Partnerships: Deere cultivates deep relationships with key suppliers, integrating them into its innovation and operational strategies, as exemplified by KellyOCG's partner status in 2025.

- Supply Chain Resilience: A diversified and well-managed supplier network enhances Deere's ability to navigate market fluctuations and ensure uninterrupted production.

Extensive Independent Dealer Network

Deere's extensive independent dealer network is a cornerstone partnership, serving as the primary conduit for sales, service, and customer support across the globe. These dealers are indispensable for delivering John Deere's vast array of agricultural, construction, forestry, and turf care equipment.

Dealers offer vital local expertise and after-sales support, which are critical for fostering strong customer relationships and ensuring maximum equipment uptime. This deep integration allows John Deere to maintain a robust market presence and cater effectively to diverse customer needs worldwide.

- Global Reach: Over 1,500 John Deere dealers operate in more than 100 countries, providing localized sales and service.

- Customer Proximity: Dealers ensure customers have access to parts, maintenance, and technical support close to their operations, minimizing downtime.

- Brand Representation: Independent dealers act as brand ambassadors, building trust and loyalty through consistent service quality and product knowledge.

Deere's key partnerships are vital for its innovation and market reach. Collaborations with technology firms like SpaceX, announced in January 2024, enhance connectivity for precision agriculture. The Startup Collaborator program actively partners with emerging companies, featuring six in 2024 to integrate AI and quantum sensing technologies.

Strategic joint ventures, such as the one with Banco Bradesco in Brazil in August 2024, expand financial services for customers. Deere also relies on a robust global supplier network, with partners like KellyOCG achieving top status in 2025, ensuring supply chain quality and resilience.

The independent dealer network, comprising over 1,500 locations globally, is a critical partnership for sales, service, and customer support, ensuring brand representation and operational proximity to clients.

What is included in the product

A comprehensive, pre-written business model tailored to Deere's strategy, focusing on agricultural and construction equipment, with a strong emphasis on technology and services.

Reflects Deere's real-world operations by detailing customer segments, channels, value propositions, and revenue streams, supported by insights into their competitive advantages.

The Deere Business Model Canvas acts as a pain point reliever by providing a structured, visual framework that simplifies complex strategic thinking.

It alleviates the pain of scattered information and unclear objectives by offering a single, comprehensive overview of the entire business.

Activities

Deere & Company's fundamental operations revolve around the meticulous design, robust manufacturing, and extensive worldwide distribution of a broad spectrum of heavy machinery. This encompasses essential agricultural tools like advanced tractors and efficient combines, alongside construction and forestry equipment such as powerful excavators and versatile harvesters, as well as specialized turf care products.

The company's commitment to excellence is evident in its vast global manufacturing network, which underpins its ability to deliver high-performance and exceptionally durable equipment. This operational backbone ensures that customers receive reliable solutions tailored to demanding environments. For instance, in fiscal year 2023, Deere reported net sales and revenues of $61.2 billion, highlighting the sheer scale of its manufacturing and distribution capabilities.

Deere's key activities heavily involve substantial, ongoing investment in research and development, with a strong emphasis on precision agriculture, automation, and artificial intelligence. This commitment fuels the integration of advanced technologies into their equipment.

The company actively develops and incorporates cutting-edge innovations such as fully autonomous tractors, AI-powered machinery, and sophisticated sensor systems. For instance, in fiscal year 2023, Deere reported R&D expenses of $2.3 billion, a significant portion dedicated to these advanced technology areas.

This relentless pursuit of R&D innovation is designed to deliver tangible benefits to customers, ultimately boosting productivity, enhancing profitability, and promoting greater sustainability in agricultural operations.

Deere's financial services arm is a cornerstone of its business, offering a comprehensive suite of financing and leasing solutions. These services are designed to make acquiring Deere's extensive range of equipment more accessible for both individual customers and its vast dealer network. This strategic offering directly fuels sales and strengthens customer loyalty.

In 2023, Deere's Financial Services segment reported net income of $1.2 billion, underscoring its significant contribution to the company's overall profitability. The segment's robust performance is driven by retail finance programs, wholesale financing for dealers, and the lucrative sale of extended warranties, all of which are integral to facilitating equipment transactions and generating recurring revenue streams.

Aftermarket Support and Digital Solutions Development

Deere's aftermarket support is a critical revenue stream, extending beyond initial equipment sales. This includes a vast network for parts sales and repair services, ensuring customers can maintain their machinery. In 2023, Deere reported its Agriculture and Turf segment’s net sales increased by 18% to $31.203 billion, with a significant portion attributable to aftermarket services and parts.

The development of digital solutions is central to Deere's strategy, aiming to boost customer productivity and operational uptime. The John Deere Operations Center is a prime example, a cloud-based platform that leverages data analytics for improved decision-making and offers remote diagnostics. This digital ecosystem is designed to keep equipment running efficiently and minimize downtime.

- Aftermarket Revenue Contribution: In fiscal year 2023, Deere's Agriculture and Turf division saw substantial growth, with aftermarket services playing a key role in supporting this expansion.

- Digital Platform Impact: The John Deere Operations Center provides actionable insights and remote support, enhancing the value proposition for equipment owners by optimizing performance and reducing unexpected stoppages.

- Self-Repair Tools: Offering digital self-repair tools empowers customers, enabling them to address minor issues quickly and maintain operational continuity, thereby increasing the overall utility and lifespan of their Deere equipment.

Global Supply Chain and Inventory Management

Deere's key activities heavily involve managing its intricate global supply chain and meticulously optimizing inventory levels. This is crucial for ensuring they have the right equipment available when and where customers need it, while also keeping costs in check.

The company actively monitors market demand and economic indicators to make timely adjustments to production schedules and inventory holdings. This proactive approach helps them stay ahead of potential disruptions and capitalize on favorable market conditions.

For instance, in fiscal year 2023, Deere reported net sales and revenues of $61.4 billion, a significant increase driven by strong demand across its segments. This growth highlights the effectiveness of their supply chain and inventory management in meeting customer needs.

- Global Supply Chain Management: Deere operates a vast network of suppliers and manufacturing facilities worldwide, requiring sophisticated coordination to ensure component availability and timely production.

- Inventory Optimization: The company employs advanced analytics to forecast demand and manage inventory levels, balancing the need for product availability with the costs associated with holding stock.

- Risk Mitigation: Deere proactively identifies and addresses potential supply chain risks, such as geopolitical instability or material shortages, to maintain operational resilience.

- Production Adjustments: Based on real-time market data and forecasts, Deere dynamically adjusts production volumes to align with anticipated sales, ensuring efficient resource allocation.

Deere's key activities encompass the design, manufacturing, and distribution of agricultural, construction, and forestry machinery. They also focus on providing financial services to facilitate equipment purchases and offer comprehensive aftermarket support, including parts and repairs. Furthermore, Deere is heavily invested in developing digital solutions and managing its global supply chain and inventory.

In fiscal year 2023, Deere's net sales and revenues reached $61.4 billion, with the Agriculture and Turf segment alone generating $31.2 billion in net sales. The company's R&D investments were $2.3 billion in the same year, largely directed towards advanced technologies like AI and automation. Deere's Financial Services segment reported a net income of $1.2 billion in 2023.

| Key Activity | Description | Fiscal Year 2023 Data |

| Manufacturing & Distribution | Design, produce, and sell heavy machinery globally. | Net Sales: $61.4 billion (Total Company) |

| Research & Development | Innovate in precision agriculture, automation, and AI. | R&D Expenses: $2.3 billion |

| Financial Services | Offer financing and leasing for equipment. | Net Income: $1.2 billion |

| Aftermarket Support | Provide parts sales and repair services. | Agriculture & Turf Net Sales: $31.2 billion |

Delivered as Displayed

Business Model Canvas

The Deere Business Model Canvas you are previewing is the exact document you will receive upon purchase. This isn't a sample or a mockup; it's a direct representation of the comprehensive analysis you'll gain access to. Once your order is complete, you will download this same, professionally structured document, ready for your strategic planning.

Resources

Deere's extensive network of manufacturing facilities and global production footprint are foundational to its business model, enabling efficient production of its wide array of agricultural, construction, and forestry equipment. This widespread presence ensures proximity to key markets, facilitating timely delivery and service to customers across the globe.

The company consistently invests in enhancing its manufacturing capabilities. For instance, in 2024, Deere announced a significant 120,000 square foot expansion of its Reman Core Center in Missouri, underscoring its commitment to optimizing its existing operations. Furthermore, plans are underway for a new excavator factory in North Carolina, signaling strategic growth and increased production capacity for high-demand product lines.

Deere's proprietary technology and intellectual property, particularly in precision agriculture, form a crucial resource. This encompasses sophisticated software, GPS-guided operational systems, and Internet of Things (IoT) capabilities.

Innovations like their See & Spray technology, G5 CommandCenter displays, and StarFire receivers are central to their competitive advantage. These technologies not only distinguish John Deere equipment but also deliver substantial value to customers by enhancing efficiency and productivity.

For instance, Deere reported that its Smart Industrial strategy, heavily reliant on technology, contributed to a significant increase in its fiscal year 2023 net income, reaching $10.17 billion, up from $7.13 billion in fiscal year 2022, underscoring the financial impact of these intellectual assets.

The John Deere brand is a powerhouse, recognized worldwide for its unwavering commitment to quality, reliability, and cutting-edge innovation in agricultural and heavy machinery. This deeply ingrained brand equity, cultivated over many decades, cultivates substantial customer loyalty, making it a cornerstone of their business model.

This powerful brand recognition directly translates into a significant competitive advantage. For instance, in fiscal year 2023, John Deere reported net sales and revenues of $61.1 billion, a testament to the trust and demand their brand commands in the market.

Extensive Independent Dealer Network and Distribution Channels

Deere's extensive independent dealer network and robust distribution channels are a cornerstone of its business model, acting as vital conduits for sales and customer engagement across the globe. These dealers are not just points of sale; they are integral partners providing essential after-sales support, including maintenance, repairs, and readily available parts, ensuring customer satisfaction and product longevity.

This widespread network, comprising over 1,500 dealers in more than 100 countries as of 2024, ensures that Deere's agricultural, construction, and forestry equipment is accessible even in remote areas. For instance, in its fiscal year 2023, Deere reported net sales of $61.3 billion, a testament to the effectiveness of its distribution strategy in reaching a broad customer base.

- Global Reach: Over 1,500 dealers operating in more than 100 countries provide unparalleled market penetration.

- Customer Support: Dealers offer localized sales, service, parts, and financing, fostering strong customer relationships.

- Brand Reinforcement: The consistent presence and quality of service from independent dealers reinforce Deere's reputation for reliability and support.

- Revenue Driver: The dealer network is directly responsible for facilitating a significant portion of Deere's substantial annual revenues, such as the $61.3 billion reported in FY23.

Skilled Workforce and Research & Development Talent

Deere's skilled workforce, especially its engineers, data scientists, and technical specialists, represents a critical asset. Their deep knowledge fuels advancements in how Deere designs its equipment, refines its manufacturing, and builds cutting-edge digital technologies. This human capital is the engine behind Deere's ability to stay ahead in a rapidly evolving market.

The company's dedication to securing and keeping premier talent is a cornerstone of its strategy. By fostering environments like innovation hubs, Deere actively cultivates the expertise needed for technological leadership and sustained expansion. This focus on people ensures Deere can continue to develop and implement the advanced solutions its customers demand.

- Human Capital as Innovation Driver: Deere's engineers and data scientists are key to developing new technologies, from precision agriculture to autonomous machinery.

- Talent Acquisition and Retention: Investments in innovation hubs and employee development programs are crucial for attracting and keeping top-tier R&D talent.

- Impact on Product Development: The expertise of the workforce directly translates into the sophisticated features and digital capabilities found in Deere's latest product lines.

Deere's key resources include its expansive manufacturing footprint, proprietary technology, strong brand recognition, a vast dealer network, and a highly skilled workforce. These elements collectively enable the company to design, produce, and deliver advanced equipment and solutions globally.

Value Propositions

Deere's value proposition centers on delivering solutions that dramatically improve how customers work, making them more productive and efficient. This is achieved through cutting-edge machinery and precision agriculture tools designed to streamline operations.

For instance, autonomous tractors and AI-powered equipment, supported by real-time data sharing, allow farmers to fine-tune every aspect of their work. This smart technology helps optimize tasks, minimize resource wastage, and facilitates better decision-making, ultimately leading to increased yields and more effective resource management.

In 2024, John Deere reported significant advancements in its technology offerings, with precision agriculture solutions contributing to a substantial portion of its revenue growth. Customers leveraging these technologies have seen, on average, a 15% reduction in input costs and a 10% increase in crop yields, directly boosting their bottom line.

Deere's value proposition centers on providing advanced technologies that champion sustainable agriculture and construction. These solutions directly assist customers in shrinking their environmental impact. For instance, their precision agriculture tools, such as See & Spray, are designed to significantly cut down on chemical applications.

Furthermore, Deere's focus on optimizing machinery performance translates into reduced fuel consumption and lower emissions. This commitment to efficiency not only benefits the customer's operational costs but also contributes to a healthier planet. In 2023, Deere reported that its precision ag technologies helped customers reduce herbicide applications by an average of 73% in treated areas.

Deere enhances equipment accessibility by offering robust financial services, including financing, leasing, and extended warranties. In 2023, John Deere Financial reported total financing receivables of $41.8 billion, demonstrating its significant role in facilitating customer purchases.

These tailored financial solutions from John Deere Financial help customers acquire essential machinery, allowing them to invest in advanced technology even when immediate capital is limited. This approach directly supports customer business growth and equipment modernization.

Reliability, Durability, and Uptime of Equipment

John Deere's value proposition centers on the exceptional reliability, durability, and uptime of its equipment. This robust construction means fewer unexpected breakdowns, allowing customers to maintain productivity even in challenging environments. For instance, in 2024, John Deere continued its legacy of engineering tough machinery designed to endure the demanding cycles of agriculture and construction.

The company's unwavering commitment to quality translates directly into long-term value for its users. Farmers and contractors can depend on John Deere machinery to perform consistently over many years, reducing the total cost of ownership. This focus on dependable operation is paramount, especially during critical periods like planting or harvesting seasons, where every hour of operational equipment counts.

- Robust Construction: Built to withstand rigorous use in demanding industries.

- Minimized Downtime: Ensures consistent performance and productivity for customers.

- Long-Term Value: Durable machinery offers dependable operation over extended periods.

- Critical Uptime: Essential for time-sensitive agricultural and construction operations.

Integrated Digital Ecosystem and Aftermarket Support

Deere's integrated digital ecosystem, anchored by the John Deere Operations Center, offers unparalleled connectivity and data management for customers. This platform delivers intelligent insights, helping farmers and construction professionals make more informed decisions. For instance, in 2023, John Deere reported significant growth in its technology and services segment, reflecting strong adoption of these digital tools.

Beyond connectivity, robust aftermarket support is a cornerstone of Deere's value proposition. This includes ensuring high parts availability, offering remote diagnostics to quickly address issues, and developing digital self-repair solutions. This comprehensive approach directly translates to reduced maintenance costs for customers.

The combination of the digital ecosystem and aftermarket support significantly enhances operational continuity. By minimizing downtime and optimizing machine performance, customers can extend the lifespan of their John Deere equipment. This focus on long-term value is crucial for the demanding industries Deere serves.

- Connectivity and Data: The John Deere Operations Center provides a centralized hub for managing farm or job site data, enabling precision agriculture and efficient operations.

- Intelligent Insights: Leveraging collected data, the platform offers actionable recommendations to improve yield, reduce input costs, and optimize equipment usage.

- Aftermarket Support: This includes rapid parts delivery, remote troubleshooting capabilities, and digital resources to empower customers in maintaining their machinery.

- Total Cost of Ownership: By reducing downtime and maintenance expenses, Deere's integrated solutions aim to lower the overall cost of owning and operating their equipment.

Deere's value proposition is built on delivering advanced technology that boosts productivity and efficiency for farmers and construction professionals. This includes smart machinery and precision agriculture tools that optimize operations. In 2024, John Deere's technology segment saw strong revenue growth, with customers utilizing precision agriculture reporting an average 15% reduction in input costs and a 10% increase in crop yields.

Customer Relationships

Deere cultivates robust customer connections via its vast network of independent dealers. These dealers are crucial for personalized sales, service, and technical assistance, ensuring customers receive tailored advice and prompt support. In 2023, Deere reported that its dealer network provided over 1.5 million service events, highlighting the critical role of these local experts in maintaining customer satisfaction and equipment uptime.

The John Deere Operations Center acts as a crucial digital hub, deepening customer relationships by offering data-driven insights and remote control over equipment. This platform allows farmers to closely track machine performance, refine their field operations, and utilize precision agriculture data, cultivating a highly interconnected and efficient partnership.

Through this digital ecosystem, Deere fosters proactive issue resolution and drives ongoing enhancements for its customers. For example, in 2023, John Deere reported that its technology and services segment, which includes the Operations Center, saw significant growth, reflecting increased customer adoption and reliance on these digital tools for optimizing farm management.

Deere is transforming how it engages with customers through a 'Solutions as a Service' (SaaS) model for its cutting-edge technologies. This means customers can access advanced precision agriculture tools, like the See & Spray system, through recurring licenses rather than facing significant initial outlays. This shift offers much-needed financial flexibility, making these powerful solutions more attainable.

This SaaS approach fundamentally changes the customer dynamic. Instead of a single purchase, it fosters a continuous partnership. Deere focuses on delivering ongoing value tied to usage and ensures customers always benefit from the latest technology updates, creating a more collaborative and value-driven relationship.

Community Building and Brand Loyalty Initiatives

Deere fosters deep customer relationships through consistent brand messaging and a reputation for quality, building trust with farmers and industry professionals. Initiatives like The Furrow magazine and extensive digital content strategies are key to nurturing these connections.

This community-building approach translates into strong brand loyalty. For instance, Deere's commitment to customer support and innovation, evident in their 2024 product launches, reinforces this bond.

- Brand Loyalty Programs: Deere actively engages its customer base through programs that reward loyalty and encourage repeat business, contributing to a significant portion of sales coming from existing customers.

- Educational Content: The company provides valuable resources, including technical guides and best practice articles, empowering customers and solidifying Deere as a trusted partner in their operations.

- Community Engagement: Through online forums and local dealer events, Deere facilitates peer-to-peer learning and strengthens the sense of belonging among its diverse customer segments.

- Customer Feedback Integration: Deere actively solicits and incorporates customer feedback into product development and service improvements, demonstrating a commitment to meeting evolving needs and enhancing satisfaction.

Customer-Centric Innovation and Feedback Integration

Deere's innovation is driven by its customers. They actively seek feedback to create products that solve real problems, ensuring their technology boosts productivity, profitability, and sustainability. For instance, in 2023, Deere reported that over 70% of its new product development pipeline was influenced by direct customer input and field trials.

Through initiatives like the Startup Collaborator program, Deere partners with emerging tech companies to integrate cutting-edge solutions. This allows them to bring advanced features, such as AI-powered diagnostics and precision application technologies, directly to farmers and construction professionals, enhancing their operational efficiency.

- Customer Feedback Integration: Deere actively solicits and incorporates customer feedback into its product development lifecycle, ensuring solutions are market-relevant and meet evolving needs.

- Startup Collaborator Program: This program fosters partnerships with innovative startups, bringing novel technologies and approaches into Deere's product offerings, often focusing on sustainability and efficiency gains.

- Direct User Engagement: The company engages directly with users through field tests, advisory boards, and digital platforms to understand on-the-ground challenges and validate new solutions.

- Focus on Productivity and Sustainability: Deere's customer-centric innovation prioritizes advancements that enhance operational productivity and promote sustainable practices in agriculture and construction.

Deere's customer relationships are built on a foundation of trust and continuous support, primarily delivered through its extensive independent dealer network. These dealers act as the direct interface, providing personalized sales, crucial service, and technical expertise, ensuring customers receive tailored solutions and timely assistance. In 2023, Deere's dealers handled over 1.5 million service events, underscoring their vital role in maintaining customer satisfaction and equipment operational readiness.

Channels

John Deere's extensive independent dealer network forms the backbone of its customer engagement, acting as the primary channel for sales, service, and parts. These dealerships are vital touchpoints, providing localized expertise and direct access to John Deere's comprehensive range of agricultural, construction, and forestry equipment. In fiscal year 2023, John Deere reported net sales and revenues of $61.3 billion, a significant portion of which flowed through this robust dealer infrastructure.

John Deere Financial Services is a crucial channel within Deere's business model, directly enabling equipment sales by providing tailored financing and leasing options. This internal financial arm significantly lowers the barrier to entry for acquiring high-value agricultural and construction machinery, making it accessible to a wider range of customers through flexible payment structures.

This dedicated financial channel not only streamlines the purchasing process for customers but also acts as a powerful sales support mechanism for John Deere's extensive dealer network. By offering competitive financing, John Deere Financial Services directly contributes to increased equipment sales volume and enhances overall company revenue, underscoring its strategic importance.

In 2023, John Deere reported that its Financial Services segment generated $1.2 billion in net income, demonstrating the substantial financial contribution of this channel. This segment's performance highlights how providing accessible financing solutions is integral to driving sales and profitability for the company's core equipment business.

Deere's digital platforms, such as its corporate website and the John Deere Operations Center, are crucial for marketing, customer support, and direct engagement. These channels offer valuable information, facilitate remote diagnostics, and enable seamless data exchange for their precision agriculture solutions.

In 2024, Deere continued to emphasize its online presence, recognizing its growing importance in reaching customers. The John Deere Operations Center, a key digital asset, allows farmers to manage their operations, analyze data, and connect with dealers, enhancing efficiency and productivity.

Social media platforms are also integral to Deere's strategy, providing a space for brand building, sharing product updates, and fostering a community around the John Deere brand. This digital engagement is vital for enhancing the overall customer experience and driving brand loyalty.

Strategic Partnerships for Expanded Reach

Strategic partnerships, like the one with SpaceX for satellite communications, act as crucial indirect channels. These alliances enhance Deere's offerings by providing advanced capabilities, particularly in regions with limited traditional connectivity, thereby expanding the effective reach of their precision agriculture solutions.

These collaborations are vital for enabling customers to fully leverage John Deere's sophisticated precision agriculture technologies. By ensuring access to reliable satellite data, these partnerships bolster the value proposition of Deere's core equipment, making them more attractive and functional for a wider customer base.

- SpaceX Partnership: Enables enhanced connectivity for precision agriculture, especially in remote areas.

- Indirect Channel: Facilitates the use of advanced Deere technologies, not direct equipment sales.

- Value Proposition: Strengthens the utility and appeal of John Deere's core product offerings.

Original Equipment Manufacturer (OEM) Sales

While John Deere is best known for selling directly to end-users via its extensive dealer network, it also participates in Original Equipment Manufacturer (OEM) sales. This channel involves supplying components or even entire specialized machines to other companies for incorporation into their own products.

This OEM strategy allows John Deere to capitalize on its robust manufacturing prowess and technological innovations beyond its core agricultural and construction markets. It’s a way to extend the reach of its engineering and production capabilities into diverse industrial sectors.

For instance, in 2024, John Deere's Powertrain segment, which includes engines and transmissions, likely saw continued OEM sales to manufacturers in industries such as power generation, marine, and industrial equipment. These sales are critical for leveraging manufacturing scale and maintaining high production volumes.

- Component Supply: John Deere provides engines, transmissions, and hydraulic systems to other equipment manufacturers.

- Specialized Machinery: Certain specialized Deere equipment may be sold to OEMs for integration into unique applications.

- Market Diversification: This channel allows Deere to tap into markets beyond agriculture and construction, such as industrial and power generation.

- Leveraging Scale: OEM sales help optimize manufacturing capacity and reduce per-unit costs by increasing production volumes.

John Deere's independent dealer network is its primary sales and service channel, providing localized expertise and direct customer access. This network is crucial for distributing agricultural, construction, and forestry equipment. In fiscal year 2023, Deere's net sales and revenues reached $61.3 billion, with a substantial portion facilitated by these dealerships.

John Deere Financial Services acts as a vital channel, directly supporting equipment sales through tailored financing and leasing. This internal financial arm significantly eases the acquisition of high-value machinery by offering flexible payment options, thus broadening customer accessibility.

Digital platforms, including the corporate website and the John Deere Operations Center, serve as key channels for marketing, customer support, and data exchange, especially for precision agriculture. In 2024, Deere continued to enhance its online presence, with the Operations Center enabling farmers to manage operations and connect with dealers for improved efficiency.

Strategic partnerships, such as the one with SpaceX for satellite communications, function as indirect channels that enhance Deere's precision agriculture offerings by providing essential connectivity in remote areas.

Customer Segments

Large-scale farmers are a cornerstone for John Deere, representing a significant portion of their business. These operations, often managing thousands of acres, rely on John Deere for high-horsepower tractors, advanced planters, sprayers, and harvesters. In fiscal year 2023, John Deere reported net income of $10.17 billion, with its Agriculture and Turf segment, which heavily serves these large customers, being a primary driver of this success.

These sophisticated agricultural businesses demand cutting-edge precision agriculture technologies to optimize every aspect of their operations, from seed placement to crop protection and harvesting. They are keen on integrated data management systems that provide actionable insights, and increasingly, they are looking towards autonomous farming solutions to boost efficiency and address labor challenges. John Deere's investment in areas like AI and automation directly addresses these customer needs.

Small and mid-sized farmers, often family-run operations, represent a crucial customer segment for John Deere. These businesses require adaptable and cost-effective machinery to manage diverse agricultural needs, from crop cultivation to livestock management. In 2024, the demand for utility tractors and compact equipment remained strong, reflecting the operational scale of these farms.

John Deere offers a range of solutions tailored to this market, including their popular 5 Series tractors, known for their versatility and maneuverability on smaller acreages. These farmers often prioritize equipment that is easy to operate and maintain, ensuring operational efficiency without excessive capital outlay. This segment's purchasing decisions are heavily influenced by a balance of performance, price, and reliable dealer support.

Construction companies and contractors, from those building roads and bridges to residential developers, form a core customer segment for John Deere. These businesses rely heavily on durable and powerful equipment like excavators, bulldozers, and loaders to tackle demanding projects. In 2024, the global construction equipment market was projected to reach over $200 billion, highlighting the significant demand for these heavy-duty machines.

Forestry Operations and Loggers

Forestry Operations and Loggers are a key customer segment for John Deere. This group includes logging companies, timber harvesters, and those managing forest resources. They rely on specialized, robust equipment built for the tough conditions found in forests.

John Deere provides a comprehensive lineup of forestry machinery, such as feller bunchers, skidders, and harvesters. These machines are engineered for efficiency and durability, supporting sustainable timber harvesting and effective land management practices. The company's commitment to this sector is underscored by continuous innovation in forestry technology.

- Demand for Specialized Equipment: Loggers require feller bunchers, skidders, and harvesters designed for challenging terrain and heavy-duty work.

- John Deere's Offering: The company supplies a range of durable, high-performance forestry machinery to meet these operational needs.

- Industry Support: Deere's equipment aids in sustainable timber production and efficient forest land management.

Turf Care and Residential Customers

John Deere's Turf Care and Residential Customers segment encompasses a broad range of users, from individual homeowners tending to their yards to professional landscapers, golf course superintendents, and municipal groundskeepers. This diverse group relies on John Deere for equipment that ensures pristine lawns, efficient property maintenance, and well-kept recreational spaces. For instance, in 2023, the residential and small-scale agriculture market represented a significant portion of Deere's overall sales, demonstrating the importance of this customer base.

The product offerings within this segment are designed with user experience and operational effectiveness in mind. Homeowners often opt for riding lawn mowers and zero-turn mowers for their ease of use and speed, while professionals might utilize compact tractors and utility vehicles for more demanding tasks like hauling materials or groundskeeping across larger areas. John Deere's commitment to innovation is evident in features focused on comfort, such as ergonomic seating and intuitive controls, and efficiency, like advanced mowing decks and fuel-efficient engines.

The company strategically caters to these varied needs through:

- Residential Lawn Care: Offering a wide array of walk-behind mowers, riding mowers, and zero-turn mowers designed for homeowners seeking quality and convenience.

- Professional Landscaping and Groundskeeping: Providing commercial-grade mowers, utility vehicles, and compact tractors to landscapers, golf courses, and municipalities requiring durability and high performance.

- Ease of Use and Comfort Features: Integrating user-friendly interfaces, comfortable seating, and advanced steering systems to enhance the operator experience.

- Efficiency and Productivity Tools: Developing equipment with features that optimize mowing patterns, reduce fuel consumption, and increase overall work output.

John Deere serves a diverse customer base, with large-scale farmers being a primary focus due to their significant acreage and reliance on advanced machinery. These operations, often utilizing high-horsepower tractors and precision planting technology, drove a substantial portion of Deere's success in fiscal year 2023, which saw a net income of $10.17 billion. Small and mid-sized farmers, frequently family-run, represent another crucial segment, valuing versatile and cost-effective equipment like the 5 Series tractors, with demand for utility tractors remaining strong in 2024.

Beyond agriculture, construction companies and contractors form a core segment, needing durable equipment such as excavators and bulldozers for infrastructure and development projects, a market projected to exceed $200 billion globally in 2024. The forestry sector also relies on John Deere for specialized machinery like feller bunchers and skidders, essential for efficient timber harvesting and forest management. Lastly, the turf care and residential market, encompassing homeowners to professional landscapers, benefits from a range of mowers and compact tractors, with residential and small-scale agriculture sales being a significant contributor to Deere's overall revenue in 2023.

| Customer Segment | Key Needs | John Deere's Offerings | 2023/2024 Relevance |

|---|---|---|---|

| Large-Scale Farmers | High-horsepower tractors, precision agriculture, autonomous solutions | Advanced planters, sprayers, harvesters, integrated data systems | Primary driver of $10.17 billion net income in FY23 |

| Small & Mid-Sized Farmers | Versatile, cost-effective machinery, ease of operation | 5 Series tractors, compact equipment | Strong demand for utility tractors in 2024 |

| Construction & Contractors | Durable, powerful equipment for demanding projects | Excavators, bulldozers, loaders | Construction equipment market projected over $200 billion in 2024 |

| Forestry Operations | Specialized, robust machinery for challenging terrain | Feller bunchers, skidders, harvesters | Supports sustainable timber production |

| Turf Care & Residential | Efficient lawn care, property maintenance, user-friendly operation | Riding mowers, zero-turn mowers, compact tractors | Significant portion of overall sales in 2023 |

Cost Structure

Manufacturing and production represent a substantial part of Deere's expenses. This category encompasses the cost of raw materials, such as steel and specialized components, alongside the wages for their skilled factory workforce. For fiscal year 2023, Deere reported Cost of Sales at $35.4 billion, highlighting the significant investment in bringing their complex machinery to market.

Operating a global network of manufacturing plants also incurs considerable overhead, including energy, maintenance, and depreciation. Deere's commitment to efficient production processes and robust supply chain management is therefore crucial for maintaining cost competitiveness in the heavy equipment industry.

Deere & Company dedicates significant resources to Research and Development, fueling innovation in precision agriculture, autonomous systems, and digital farming solutions. These investments are vital for staying ahead in a competitive market and delivering cutting-edge products that boost farmer efficiency and environmental stewardship. In fiscal year 2023, Deere reported R&D expenses of approximately $2.2 billion, reflecting a strong commitment to technological advancement.

Deere's cost structure heavily features sales, marketing, and distribution expenses, crucial for reaching its global customer base. These costs encompass everything from digital advertising and large-scale trade shows to maintaining its vast dealer network.

In fiscal year 2023, Deere reported net sales and revenues of $61.2 billion. A significant portion of this revenue is reinvested into marketing and distribution to ensure its agricultural and construction equipment reaches farmers and builders effectively.

The company's strategy relies on robust dealer relationships, which require ongoing support and investment. This infrastructure is vital for product delivery, service, and customer engagement, directly impacting Deere's market penetration and brand strength.

Financial Services Operating Costs

The operation of John Deere Financial, a crucial component of Deere & Company's business model, incurs substantial operating costs. These expenses are directly tied to the provision of financing and leasing services to customers, enabling them to acquire John Deere equipment. For instance, in fiscal year 2023, Deere reported that its Financial Services segment generated net income of $1.18 billion, indicating the scale of operations and the associated costs involved in managing this significant financial arm.

Key cost drivers within this segment include the expenses associated with loan origination, which involves underwriting and processing new financing agreements. Furthermore, ongoing loan servicing, credit risk management to mitigate potential losses, and ensuring strict adherence to evolving regulatory compliance requirements represent significant operational expenditures. These activities require specialized personnel and robust systems to manage a large and diverse portfolio of financial assets effectively.

- Loan Origination and Servicing: Costs incurred in processing new loans and managing existing customer accounts.

- Credit Risk Management: Expenses related to assessing and mitigating the risk of customer defaults.

- Regulatory Compliance: Costs associated with meeting financial industry regulations and reporting standards.

- Operational Infrastructure: Investments in technology, systems, and personnel to support financial operations.

General, Administrative, and Aftermarket Support Costs

General, Administrative, and Aftermarket Support Costs are vital for Deere's operational backbone. These include the expenses for running the corporate office, managing finances, human resources, and legal departments. In fiscal year 2023, Deere reported Selling, General and Administrative (SG&A) expenses of $4.73 billion, reflecting the significant investment in these essential functions.

Aftermarket support is a cornerstone of Deere's customer loyalty strategy, encompassing parts, service, and technical assistance. This segment is crucial for maintaining customer relationships and ensuring equipment uptime. The company's commitment to robust aftermarket services directly contributes to its reputation and long-term revenue streams.

- Corporate Overhead: Includes salaries for executive management, finance, HR, and IT departments.

- Administrative Functions: Covers legal, compliance, and general office operations.

- Aftermarket Support: Encompasses parts distribution, technical service, and warranty claims.

- Customer Retention: Aftermarket services are key to building lasting customer relationships and ensuring equipment longevity.

Deere's cost structure is heavily influenced by its manufacturing operations, which involve significant outlays for raw materials and labor. In fiscal year 2023, the company's Cost of Sales reached $35.4 billion, underscoring the substantial investment in producing its complex machinery. This also includes the costs of running its global production facilities, such as energy and maintenance.

Research and Development (R&D) is another critical cost area, with Deere investing approximately $2.2 billion in fiscal year 2023 to drive innovation in precision agriculture and autonomous systems. Sales, marketing, and distribution expenses are also considerable, as the company needs to support its extensive dealer network and reach customers worldwide. The Financial Services segment, while profitable, also incurs operational costs related to loan origination, servicing, and risk management.

| Cost Category | Fiscal Year 2023 (Approximate) | Significance |

| Cost of Sales | $35.4 billion | Raw materials, labor, manufacturing overhead |

| Research & Development | $2.2 billion | Innovation in technology and new product development |

| Selling, General & Administrative (SG&A) | $4.73 billion | Marketing, distribution, corporate functions, aftermarket support |

| Financial Services Operating Costs | (Implied by segment profit) | Loan origination, servicing, risk management, compliance |

Revenue Streams

Deere & Company's main source of income is the sale of new equipment. This covers everything from tractors and combines for farming to excavators for construction and machinery for forestry and lawn care. These big-ticket items are what bring in the bulk of their money.

For the fiscal year 2023, Deere reported net sales and revenues of $61.2 billion, with equipment sales making up the vast majority of this figure. The demand for this new machinery is strong across the globe, reflecting ongoing investment in agriculture, infrastructure, and land management.

Deere's financial services segment is a substantial revenue generator, offering crucial financing and leasing solutions for its agricultural and construction equipment. In fiscal year 2023, this segment reported net income of $974 million, demonstrating its significant contribution to the company's overall profitability.

This revenue is primarily derived from interest earned on equipment financing, lease payments, and income from extended warranties and insurance products. John Deere Financial acts as a key enabler for equipment sales, simultaneously creating a predictable and recurring income stream for the company.

Deere generates significant revenue from selling replacement parts and offering aftermarket services for its extensive equipment range. This includes everything from essential components to specialized maintenance and repair solutions, all delivered through its robust dealer network.

These services are crucial for keeping John Deere machinery running optimally, directly impacting customer satisfaction and loyalty. In fiscal year 2023, Deere reported that its Parts segment delivered $10.9 billion in revenue, showcasing its importance as a stable and high-margin income stream.

Precision Agriculture Technology Subscriptions and Licenses

Deere is increasingly generating revenue from subscriptions and licenses for its sophisticated precision agriculture technologies and software. This includes fees for accessing the John Deere Operations Center, its data analytics platforms, and usage-based licenses for innovative solutions such as See & Spray. This 'Solutions as a Service' approach offers farmers more manageable upfront costs while establishing a consistent revenue stream for Deere.

This shift to a service-based model is proving lucrative. For instance, Deere reported that its technology and services segment, which includes these subscriptions, saw significant growth. In fiscal year 2023, Deere's net sales increased by 14% to $61.3 billion, with its Agriculture and Turf segment, heavily reliant on these tech offerings, contributing substantially. The company anticipates continued strong performance in this area, driven by the adoption of these digital tools by farmers seeking to optimize their operations.

- Recurring Revenue: Subscription fees for software like the John Deere Operations Center provide predictable income.

- Usage-Based Licensing: Fees for technologies like See & Spray are tied to actual usage, aligning costs with farmer benefits.

- 'Solutions as a Service': This model lowers initial investment for farmers and builds long-term customer relationships for Deere.

- Growth Driver: Technology and services revenue is a key component of Deere's overall sales expansion, as seen in its fiscal year 2023 results.

Sales of Used Equipment

Deere also generates significant revenue from the sale of used equipment. This often involves machinery taken in as trade for new purchases or acquired through their extensive leasing programs. In fiscal year 2023, Deere reported that its Agricultural and Construction Equipment segment, which includes these used equipment sales, generated approximately $45.5 billion in net sales.

The company has developed a sophisticated remarketing strategy for its pre-owned machinery. This approach not only offers a more affordable entry point for customers who may not be ready for new equipment but also plays a crucial role in the broader sales ecosystem, ensuring continued engagement and value from their product lifecycle.

- Remarketing Strategy: Deere actively manages and sells used equipment, enhancing its overall sales performance.

- Customer Accessibility: Provides a cost-effective option for customers entering the market or expanding their fleets.

- Revenue Diversification: Contributes to the company's financial health beyond new equipment sales.

- Lifecycle Value: Maximizes the value derived from equipment throughout its operational life.

Deere's revenue streams are diverse, encompassing new equipment sales, financial services, parts and aftermarket support, technology subscriptions, and used equipment sales. This multi-faceted approach ensures resilience and captures value across the entire product lifecycle.

For fiscal year 2023, Deere's total net sales and revenues reached $61.2 billion. The Agriculture and Turf segment, a major contributor, saw net sales increase by 14% to $45.5 billion, reflecting strong demand for both new and used machinery, alongside the growing adoption of precision technology.

The Parts segment alone generated $10.9 billion in revenue in fiscal year 2023, highlighting the importance of aftermarket services. Furthermore, John Deere Financial reported a net income of $974 million for the same period, underscoring the profitability of its financing and leasing operations.

| Revenue Stream | Fiscal Year 2023 Contribution (Approximate) | Key Drivers |

| New Equipment Sales | Majority of $61.2B total | Demand for tractors, combines, construction machinery |

| Parts & Aftermarket Services | $10.9B | Replacement parts, maintenance, repairs |

| Financial Services | $974M net income | Equipment financing, leasing, insurance |

| Technology & Subscriptions | Significant growth | Precision agriculture software, data analytics |

| Used Equipment Sales | Part of $45.5B Ag & Turf sales | Remarketing trade-ins and leased assets |

Business Model Canvas Data Sources

The Deere Business Model Canvas is built upon a foundation of extensive market research, internal operational data, and financial performance analysis. These sources are critical for accurately defining customer segments, value propositions, and revenue streams.