Deere Marketing Mix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Deere Bundle

Deere's success is built on a powerful 4Ps marketing mix, expertly balancing innovative products with strategic pricing and extensive distribution. Their robust promotional efforts further solidify their market leadership.

Go beyond the basics—get access to an in-depth, ready-made Marketing Mix Analysis covering Product, Price, Place, and Promotion strategies. Ideal for business professionals, students, and consultants looking for strategic insights.

Product

Deere & Company's comprehensive equipment portfolio, primarily under the John Deere brand, is a cornerstone of its marketing strategy, serving agriculture, construction, forestry, and turf care. This extensive range includes everything from high-horsepower tractors and fuel-efficient combines to excavators and specialized harvesters. For 2025, key additions like the autonomy-ready 9RX series tractors and the S7 series combines highlight Deere's commitment to innovation and meeting evolving industry needs.

John Deere's advanced precision agriculture technology, including See & Spray Premium, is a significant product differentiator. This technology leverages AI for precise weed detection and targeted spraying, reducing herbicide use by up to 77% according to Deere's own field trials. This directly translates to cost savings for farmers and improved environmental sustainability.

Deere's Financial Services and Support, primarily through John Deere Financial, are crucial to its marketing mix. Beyond just selling tractors and excavators, they offer robust financing solutions like loans, leases, and wholesale financing for dealers. This makes acquiring expensive machinery much more manageable for customers. In fiscal year 2023, John Deere Financial's net income was $974 million, demonstrating its significant contribution to the company's profitability and customer accessibility.

Parts and Aftermarket Services

John Deere's commitment to parts and aftermarket services is crucial for maintaining customer loyalty and maximizing equipment lifespan. They offer a comprehensive inventory of genuine parts, ensuring compatibility and performance. This focus on after-sales support is a key differentiator.

For the fiscal year 2023, Deere & Company reported that its Parts segment generated approximately $4.4 billion in net sales. This segment is vital, contributing significantly to the company's overall revenue and demonstrating the strong demand for their aftermarket offerings.

- Genuine Parts Availability: John Deere maintains extensive stock of original equipment manufacturer (OEM) parts, minimizing downtime for customers.

- Service Network: A vast network of dealerships provides expert maintenance, repair, and technical support.

- Fleet Management Solutions: Advanced telematics and data analytics help customers proactively manage their fleets and optimize service needs.

Continuous Innovation and Development

Deere's dedication to continuous innovation is a cornerstone of its marketing strategy, directly impacting its product offering. The company consistently invests heavily in research and development, a crucial element for staying ahead in a competitive agricultural and construction landscape. This commitment translates into a steady stream of new products and upgrades designed to meet the dynamic needs of its customer base.

A key driver for Deere's innovation is its focus on integrating advanced technologies and automation. This approach allows the company to address emerging market trends and customer demands, particularly in sectors like precision agriculture and the burgeoning field of autonomous machinery. For example, Deere has been a leader in developing solutions that enhance efficiency and sustainability on the farm.

Deere's R&D spending highlights its commitment. In fiscal year 2023, the company reported R&D expenses of approximately $2.2 billion, a significant figure underscoring its focus on future product development. This investment fuels the introduction of technologies like advanced GPS guidance, sensor technology, and data analytics, all aimed at improving operational outcomes for its users.

- Significant R&D Investment: Deere allocated roughly $2.2 billion to R&D in fiscal year 2023, demonstrating a strong commitment to innovation.

- Technological Integration: New product launches frequently feature cutting-edge technologies, including automation and precision farming solutions.

- Addressing Market Demands: Innovation efforts are directly tied to evolving customer needs, particularly in sustainable farming practices and autonomous operations.

- Product Lifecycle Enhancement: Continuous development ensures Deere's product portfolio remains competitive and relevant in a rapidly changing industry.

Deere's product strategy centers on a broad equipment portfolio, from large agricultural machinery to construction and forestry equipment, all under the trusted John Deere brand. For 2025, innovations like the autonomy-ready 9RX tractors and advanced S7 combines underscore their commitment to cutting-edge solutions. Furthermore, their See & Spray Premium technology, which uses AI to reduce herbicide use by up to 77%, highlights a focus on efficiency and sustainability.

| Product Category | Key Innovations (2025 Focus) | Key Differentiator |

|---|---|---|

| Agriculture | 9RX Series Tractors (Autonomy-Ready), S7 Series Combines | See & Spray Premium (AI-driven herbicide reduction) |

| Construction | Excavators, Loaders | Advanced hydraulic systems for efficiency |

| Forestry | Harvesters, Skidders | Enhanced durability and operator comfort |

What is included in the product

This analysis provides a comprehensive breakdown of John Deere's marketing mix, examining its product innovation, pricing strategies, distribution channels, and promotional activities.

It offers a deep dive into how Deere leverages its 4 Ps to maintain market leadership and effectively reach its agricultural and construction customer base.

This analysis simplifies Deere's 4Ps, offering a clear roadmap to address market challenges and boost customer satisfaction.

Place

Deere's extensive global dealership network, comprising over 2,000 independent dealers worldwide, is a cornerstone of its product distribution and customer engagement strategy. This vast reach ensures that customers in diverse agricultural and construction markets have convenient access to sales, parts, and expert service. For instance, in fiscal year 2023, John Deere reported that its dealers provided crucial support, with service being a significant driver of customer loyalty and repeat business.

Deere strategically places manufacturing and distribution centers worldwide, including key locations in Brazil and India, to optimize operations. This global footprint is designed to slash shipping expenses and accelerate delivery schedules, directly addressing regional market needs. For instance, Deere's investments in expanding its Indian manufacturing capabilities in 2024 aim to bolster its presence in the rapidly growing Asian agricultural sector, enhancing both efficiency and responsiveness.

John Deere leverages a robust online presence, with its official website serving as a central hub for product details, service information, and customer support. This digital infrastructure, while not always facilitating direct equipment purchases, significantly streamlines the sales journey and enhances customer engagement by providing readily accessible information and facilitating dealer connections.

In 2023, Deere's digital transformation efforts continued, with investments aimed at improving the customer experience online. While specific e-commerce sales figures for equipment are not directly disclosed, the company reported a 14% increase in net sales for its Agriculture and Turf segment in the first quarter of fiscal year 2024 compared to the same period in 2023, indicating strong overall demand supported by its digital outreach.

Direct Sales to Key Accounts

Direct sales to key accounts are crucial for John Deere, especially in markets where large enterprises, government bodies, and major agricultural operations are significant buyers. This strategy allows for highly customized solutions and fosters deeper relationships with these high-volume customers, ensuring their specific needs are met. For instance, in fiscal year 2023, John Deere reported net sales and revenues of $61.1 billion, a testament to the scale of its operations, with a significant portion likely driven by these direct, large-scale transactions.

This direct engagement model enables John Deere to offer specialized support, including tailored financing options, dedicated technical assistance, and optimized product configurations. This focus on key accounts is particularly evident in sectors like large-scale farming and construction, where the upfront investment and ongoing operational requirements necessitate a more hands-on approach from the manufacturer. The company’s commitment to innovation is also showcased through these relationships, allowing for direct feedback that informs future product development.

- Targeted Approach: Focuses on high-value customers like large agricultural enterprises and government agencies.

- Relationship Management: Builds strong, long-term partnerships through personalized service.

- Customization: Offers tailored solutions and product configurations to meet specific client needs.

- Market Penetration: Secures significant market share by directly addressing the demands of major players.

Integrated Supply Chain Management

Integrated Supply Chain Management is a cornerstone for Deere, ensuring its vast product lines reach customers efficiently. Effective inventory management and a well-coordinated supply chain are critical given the size and complexity of its agricultural and construction equipment. Deere focuses on optimizing inventory levels and aligning production with retail demand to maintain product availability amidst market shifts.

Deere's commitment to supply chain excellence is evident in its efforts to reduce lead times and enhance responsiveness. For instance, in fiscal year 2023, the company reported a net income of $10.07 billion, underscoring the operational efficiencies that a robust supply chain enables.

- Inventory Optimization: Deere continually refines its inventory strategies to balance carrying costs with the need for product availability.

- Demand Alignment: The company works to synchronize production schedules with real-time sales data and market forecasts.

- Logistics Network: Deere leverages a sophisticated logistics network to manage the movement of raw materials and finished goods globally.

- Supplier Collaboration: Strong partnerships with suppliers are crucial for ensuring the timely delivery of high-quality components.

Deere's place strategy centers on its extensive global dealership network, providing customers with accessible sales, parts, and service. This network, exceeding 2,000 dealers, ensures broad market coverage. The company also strategically positions manufacturing and distribution hubs globally, including in emerging markets like India, to reduce costs and improve delivery times, directly addressing regional demands.

Deere enhances its place strategy through a strong digital presence, offering product information and customer support online, which streamlines the customer journey. Direct sales to large accounts are also vital, allowing for customized solutions and fostering deep relationships with major buyers in agriculture and construction. This multifaceted approach ensures product availability and customer satisfaction across diverse markets.

| Distribution Channel | Key Features | Fiscal Year 2023/2024 Data |

| Global Dealership Network | Over 2,000 independent dealers worldwide, providing sales, parts, and service. | Dealers provided crucial support; service is a significant driver of customer loyalty. |

| Manufacturing & Distribution Centers | Strategic global locations (e.g., Brazil, India) to optimize operations and reduce shipping costs. | Investments in expanding Indian manufacturing capabilities in 2024 to bolster Asian presence. |

| Online Presence | Website as a hub for product details, service, and customer support, facilitating dealer connections. | Continued investments in digital transformation to improve customer experience online. |

| Direct Sales to Key Accounts | Tailored solutions and dedicated support for large enterprises, government bodies, and major operations. | Net sales and revenues of $61.1 billion in FY2023, with significant contribution from large-scale transactions. |

What You See Is What You Get

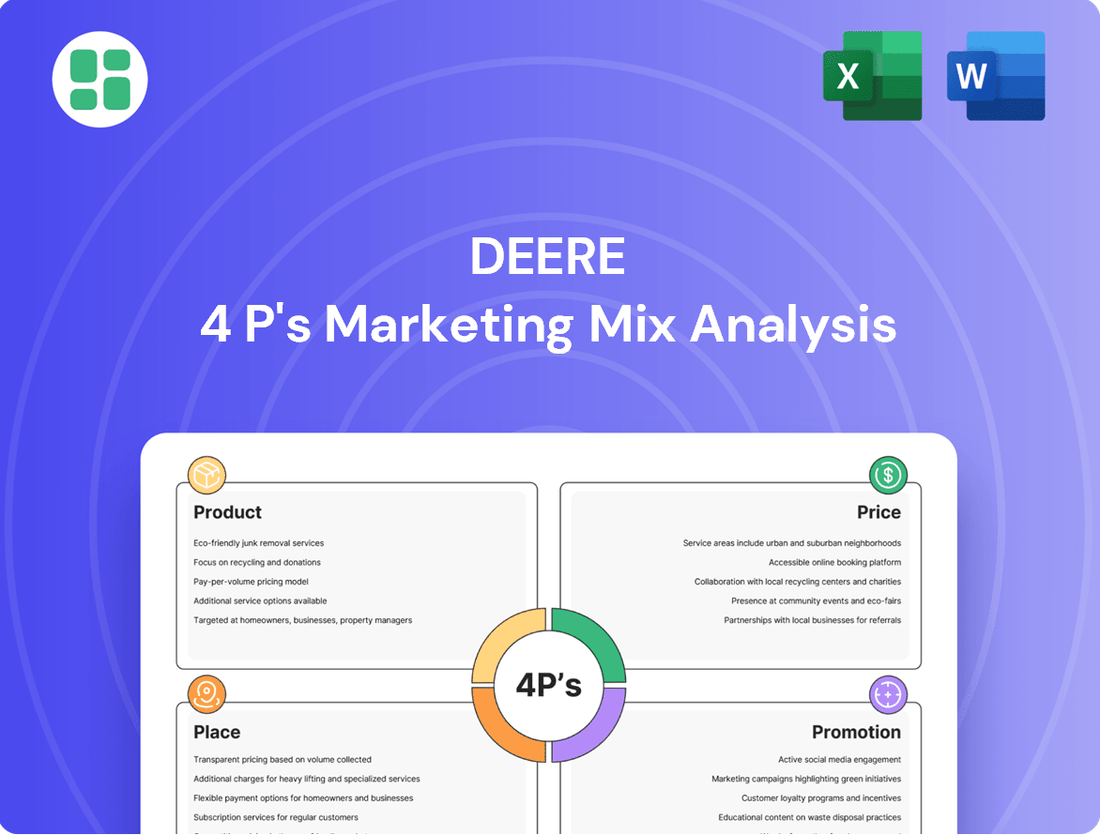

Deere 4P's Marketing Mix Analysis

The preview you see here is the exact, fully completed Deere 4P's Marketing Mix Analysis you'll receive instantly after purchase. This comprehensive document details product, price, place, and promotion strategies for Deere, offering valuable insights without any surprises. You're viewing the actual content, ready for immediate application and strategic planning.

Promotion

John Deere masterfully weaves together traditional advertising, digital marketing, and public relations to amplify its brand message and product appeal. This integrated approach ensures a unified voice across all touchpoints, effectively reaching a broad and varied customer base.

For instance, in 2024, John Deere's digital marketing efforts saw significant investment, with a focus on social media engagement and targeted online campaigns. Their commitment to consistent messaging across platforms like YouTube, showcasing new technology and customer success stories, reinforces their brand as an innovator in agriculture and construction.

John Deere masterfully leverages its deep brand heritage, instantly recognizable by its iconic green and yellow color scheme, to foster powerful visual storytelling. This strategy goes beyond mere aesthetics, weaving compelling narratives that highlight the real-world performance and unwavering dependability of its agricultural and construction equipment.

Through captivating imagery and authentic customer stories, John Deere connects with its audience on an emotional level, reinforcing the trust built over generations. For instance, during fiscal year 2023, John Deere reported net sales and revenues of $61.2 billion, a testament to the enduring appeal and customer loyalty driven by such consistent brand messaging.

Deere maintains a robust digital engagement strategy, leveraging platforms like YouTube and various social media channels to connect with its audience. This approach allows for the consistent delivery of valuable content, including product demonstrations and industry insights, effectively broadening their reach and deepening customer relationships.

Trade Shows, Demos, and Educational Initiatives

John Deere actively engages in prominent trade shows and industrial fairs, providing hands-on product trials and free demonstrations to highlight their cutting-edge tools and equipment. This direct engagement allows potential customers to experience the innovation firsthand. For example, at Farm Progress Show 2024, Deere showcased advancements in precision agriculture, drawing significant crowds eager to see autonomous and connected solutions in action.

Educational initiatives are a cornerstone of Deere's strategy, equipping farmers and industry professionals with essential knowledge about emerging technologies and their practical advantages. These programs aim to foster adoption of new equipment and practices. In 2024, Deere expanded its online learning modules, which saw a 15% increase in user engagement compared to the previous year, focusing on topics like AI-driven crop management.

- Trade Show Presence: John Deere's participation in major events like World Ag Expo and Agritechnica provides direct customer interaction and product showcases.

- Demonstration Value: Free product trials and live demonstrations effectively communicate the benefits of new technologies and equipment.

- Educational Outreach: Initiatives like webinars and training sessions in 2024 focused on smart farming technologies, enhancing user understanding and adoption.

- Innovation Showcase: These platforms are crucial for displaying advancements in areas such as autonomous machinery and data analytics, reinforcing Deere's market leadership.

Customer Loyalty Programs and After-Sales Support

Deere's promotional efforts go beyond initial sales, focusing on building lasting customer connections. They achieve this through well-structured loyalty programs and a strong emphasis on after-sales support, ensuring customers feel valued long after their purchase.

This commitment to customer retention is evident in their community involvement and comprehensive value proposition. For instance, Deere's John Deere Rewards program offers exclusive benefits and early access to new technologies, fostering a sense of belonging and encouraging repeat business. In 2024, agricultural equipment dealers reported that 75% of their customers participated in loyalty or rewards programs, indicating a significant impact on customer retention.

- Customer Retention: Loyalty programs aim to keep customers engaged and encourage repeat purchases, a key strategy for sustained revenue.

- After-Sales Value: Robust support services, including maintenance and technical assistance, enhance the overall customer experience and product lifespan.

- Community Building: Initiatives like customer advisory boards and regional events strengthen brand loyalty and provide valuable feedback for product development.

John Deere's promotional strategy is a multi-faceted approach that blends digital engagement, direct customer interaction, and educational outreach. They leverage their iconic brand heritage to create compelling narratives that resonate with their audience, fostering trust and loyalty. This is further supported by robust loyalty programs and strong after-sales service, ensuring continued customer satisfaction and repeat business.

In 2024, Deere's investment in digital marketing, particularly social media and targeted online campaigns, aimed to broaden their reach. Their presence at key industry events like the Farm Progress Show in 2024 allowed for direct engagement, showcasing innovations in precision agriculture and autonomous solutions. Educational initiatives, including expanded online learning modules in 2024, saw a 15% increase in user engagement, focusing on smart farming technologies.

The company's commitment to customer retention is underscored by programs like John Deere Rewards, which provide exclusive benefits and early access to new technologies. In 2024, dealers noted that 75% of their customers participated in loyalty or rewards programs, highlighting the effectiveness of these initiatives in fostering repeat business and a strong customer base.

| Promotional Tactic | 2024/2025 Focus | Impact/Data Point |

|---|---|---|

| Digital Marketing & Social Media | Targeted campaigns, YouTube content | Increased engagement, brand amplification |

| Trade Shows & Demonstrations | Farm Progress Show 2024 | Showcased autonomous and connected solutions |

| Educational Initiatives | Online learning modules | 15% increase in user engagement (2024) |

| Loyalty Programs | John Deere Rewards | 75% customer participation (2024) |

Price

John Deere strategically employs a value-based pricing approach, aligning its prices with the significant benefits customers derive from its equipment. This means pricing isn't just about cost, but about the perceived worth of durability, cutting-edge technology, and exceptional performance that translate into long-term operational efficiency and profitability for farmers and construction professionals.

This strategy allows Deere to position its products as premium investments, justifying higher price points. For instance, the advanced precision agriculture technology integrated into their 2024 model tractors, such as the 8RX series, offers substantial fuel savings and yield improvements, demonstrating a clear return on investment that supports the premium pricing.

John Deere strategically prices its equipment by recognizing that different customers have vastly different needs and budgets. For instance, a small family farm might look for a more affordable, versatile tractor, while a large commercial operation could invest in a high-tech, specialized harvester. This approach ensures their product offerings, and their associated prices, appeal to a broad spectrum of the market.

This segmentation allows Deere to capture value across various customer tiers. In 2023, John Deere reported net income of $10.17 billion, reflecting strong demand across its diverse product lines and customer segments. By offering a range of models, from entry-level compact tractors to advanced autonomous solutions, they cater to everything from hobby farms to massive agricultural enterprises, each with a distinct price sensitivity.

John Deere understands that acquiring its high-value equipment requires significant capital. To address this, John Deere Financial provides a robust suite of financing options, including loans and leases, designed to make purchasing more accessible for a broad customer base. These tailored solutions are crucial for enabling farmers and construction professionals to invest in the machinery they need to operate efficiently.

For the 2024 fiscal year, John Deere Financial reported a net income of $1.15 billion, underscoring the significant role financing plays in the company's overall performance and customer support. This financial arm actively works to offer competitive credit terms, thereby lowering barriers to entry and fostering long-term customer relationships by ensuring equipment affordability.

Competitive Positioning and Market Dynamics

John Deere maintains its premium brand image by strategically pricing its equipment, ensuring it reflects superior quality and innovation. While this premium positioning is key, the company actively analyzes competitor pricing to remain competitive, particularly in a market influenced by fluctuating commodity prices and economic uncertainty. For instance, during 2024, the agricultural sector experienced varied demand, impacting equipment sales and prompting Deere to adjust its pricing strategies to balance value and market share.

The company’s pricing decisions are also heavily influenced by broader economic factors and market demand. In 2024, global economic conditions, including inflation and interest rates, played a significant role in customer purchasing power and the overall demand for agricultural machinery. Deere's approach involves a careful calibration of price points to reflect these external pressures while upholding the perceived value of its advanced technology and durable products.

- Premium Pricing Strategy: John Deere leverages its reputation for quality and advanced technology to justify premium pricing.

- Competitive Benchmarking: The company continuously monitors competitor pricing to ensure its products offer compelling value.

- Economic Sensitivity: Pricing is adjusted based on market demand, commodity prices, and overall economic conditions, as seen in 2024's varied agricultural market.

- Value Proposition: Deere aims to balance its premium pricing with a strong value proposition, emphasizing long-term reliability and operational efficiency.

Dynamic Pricing for Parts and Technology Licenses

John Deere employs dynamic pricing for its extensive parts inventory, a strategy that allows adjustments based on real-time market demand and the current availability of specific components. This approach ensures competitive pricing, especially critical for agricultural machinery where downtime can be costly.

The company's pivot to a recurring licensing model for its advanced precision technology solutions, such as those integrated into its 2024 model year tractors and combines, offers customers greater financial flexibility. This shift from upfront capital expenditure to predictable operational expenses is designed to lower adoption barriers and encourage wider utilization of John Deere's cutting-edge agronomic tools.

- Dynamic Pricing Factors: Market demand, parts availability, and seasonal agricultural needs influence pricing for John Deere parts.

- Technology Licensing Shift: Precision Ag solutions moved from one-time purchase to subscription-based licenses, enhancing accessibility.

- Financial Flexibility: The licensing model provides customers with predictable costs and easier budget management for technology upgrades.

- Adoption Encouragement: Lower initial financial hurdles through licensing aim to increase the uptake of John Deere's precision farming technologies.

John Deere's pricing strategy is multifaceted, aiming to capture value while remaining competitive. They employ value-based pricing, aligning costs with the perceived benefits of durability and technology, as seen with their 2024 8RX tractors offering fuel savings. This premium positioning is supported by a diverse product range catering to different customer needs and budgets, contributing to their strong financial performance, with a net income of $10.17 billion in 2023.

Furthermore, John Deere offers flexible financing through John Deere Financial, which reported $1.15 billion in net income for fiscal year 2024, making their high-value equipment more accessible. They also utilize dynamic pricing for parts and a shift to recurring licensing models for precision technology, enhancing customer financial flexibility and encouraging adoption of their advanced agronomic tools.

| Pricing Strategy Element | Description | 2023/2024 Data/Example |

|---|---|---|

| Value-Based Pricing | Prices reflect perceived customer benefits (durability, technology). | 2024 8RX tractors offer fuel savings and yield improvements. |

| Segmentation | Catering to diverse customer needs and budgets. | Net income of $10.17 billion in 2023 reflects broad market appeal. |

| Financing Options | John Deere Financial supports equipment accessibility. | Fiscal 2024 net income for John Deere Financial was $1.15 billion. |

| Dynamic/Licensing Pricing | Adjustments for parts; shift to recurring licenses for technology. | Licensing models for precision Ag tools lower adoption barriers. |

4P's Marketing Mix Analysis Data Sources

Our Deere 4P's Marketing Mix Analysis is grounded in comprehensive data, including official company reports, investor relations materials, and detailed product specifications. We also incorporate insights from industry publications and market research to provide a holistic view of Deere's strategies.