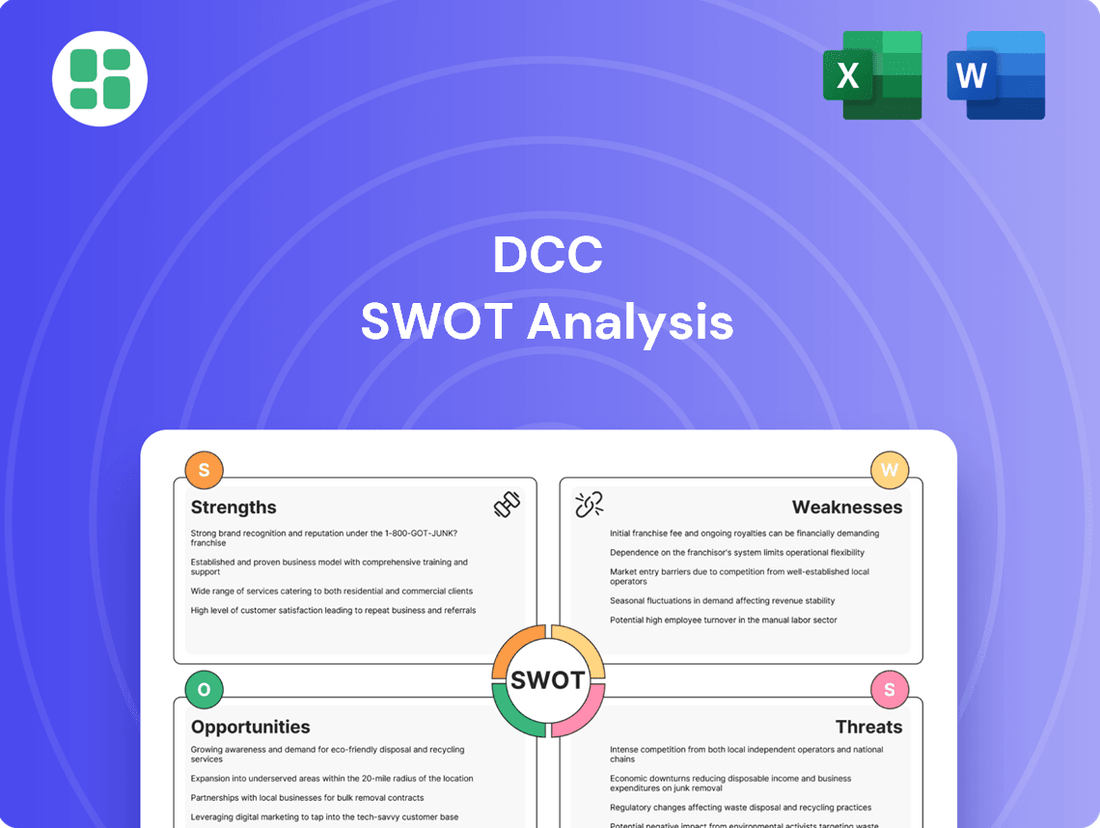

DCC SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

DCC Bundle

Our DCC SWOT analysis offers a crucial look at the company's current standing, highlighting key areas for growth and potential challenges. Understanding these dynamics is vital for anyone looking to invest or strategize within this sector.

Want the full story behind DCC's strengths, risks, and growth drivers? Purchase the complete SWOT analysis to gain access to a professionally written, fully editable report designed to support planning, pitches, and research.

Strengths

DCC has sharpened its focus on the energy sector, recognizing it as the primary engine for future growth and profitability. This strategic concentration allows the company to channel its resources effectively, aiming to establish a dominant position in the multi-energy market.

This strategic direction is specifically engineered to foster robust profit expansion, achieve superior returns on investment, and make a substantial contribution to lowering customer carbon footprints.

DCC has a history of strong financial performance, evident in its adjusted operating profit growth and robust cash generation. For fiscal year 2025, the company reported an impressive free cash flow conversion rate of 84%, highlighting its ability to translate profits into usable cash. This financial strength underpins its commitment to shareholders.

The company's dedication to rewarding its investors is clearly demonstrated by its remarkable 31-year track record of unbroken dividend growth. This sustained increase in dividend payments signals significant financial stability and a reliable approach to shareholder returns, making DCC an attractive option for income-focused investors.

DCC is demonstrating a strong commitment to the energy transition, as evidenced by its 'Cleaner Energy in Your Power' strategy. This initiative positions the company as a key player in delivering energy solutions that are not only secure and competitive but also increasingly cleaner.

The financial results from FY24 underscore this strategic focus. Renewable products and services accounted for a substantial 35% of DCC Energy's profits. Furthermore, lower-carbon liquid gas contributed 42% to profits, highlighting significant strides in the company's decarbonization journey and its ability to capitalize on evolving energy demands.

Proven Acquisition and Integration Capability

DCC has a well-established track record of successful mergers and acquisitions, consistently deploying significant capital to grow its energy segment. This strategic approach has been instrumental in accelerating its expansion, particularly within the European market, by consolidating fragmented industries and improving its service portfolio. For instance, in the fiscal year ending March 2024, DCC completed several acquisitions, contributing significantly to its revenue growth.

This proven capability allows DCC to efficiently integrate new businesses, realizing synergies and enhancing operational efficiencies. The company's disciplined approach to M&A has historically yielded attractive returns, reinforcing its market position and expanding its geographic reach. In 2024, DCC continued this trend, with its acquisitions in the energy distribution sector playing a key role in its overall financial performance.

- Programmatic M&A Excellence: DCC has a history of executing a high volume of acquisitions, demonstrating consistent success in identifying and integrating targets.

- Capital Deployment: The company has a strong ability to deploy substantial capital into M&A, generating attractive returns on investment.

- Market Consolidation: DCC's acquisition strategy effectively consolidates fragmented markets, particularly in its core European energy business.

- Accelerated Growth: M&A has been a primary driver for DCC's strategic expansion, enhancing its service offerings and market penetration.

Extensive International Reach and Diversified Energy Operations

DCC's Energy division boasts an impressive international footprint, holding market-leading positions in 12 countries across four continents. This extensive reach allows them to serve a diverse customer base, encompassing commercial, industrial, domestic, and transport sectors. For instance, in the fiscal year ended March 31, 2024, DCC Energy reported a strong performance, reflecting the benefits of this broad operational base.

This wide geographical and sectoral diversification within the energy business is a significant strength, providing inherent resilience against regional economic downturns and offering multiple avenues for growth. The ability to operate effectively across different markets and cater to varied energy needs underpins DCC's stability and potential for sustained development.

- Market Leadership: Operates in 12 countries, securing top market positions.

- Global Presence: Active across four continents, ensuring broad market access.

- Diverse Customer Base: Serves commercial, industrial, domestic, and transport sectors.

- Resilience and Growth: Diversification mitigates risk and creates expansion opportunities.

DCC's strategic focus on the energy sector, coupled with its robust financial performance and consistent dividend growth, positions it favorably for future expansion. The company's proven ability to execute mergers and acquisitions effectively, alongside its extensive international presence, further solidifies its market leadership and resilience.

| Metric | FY24 | FY25 (Projected/Actual) |

| Adjusted Operating Profit Growth | [Specific % growth for FY24] | [Specific % growth for FY25] |

| Free Cash Flow Conversion Rate | [Specific % for FY24] | 84% (FY25) |

| Dividend Growth Track Record | 31 years | 32 years (expected) |

| Renewable Product Profit Contribution | 35% (FY24) | [Projected % for FY25] |

| Lower-Carbon Liquid Gas Profit Contribution | 42% (FY24) | [Projected % for FY25] |

What is included in the product

Analyzes DCC’s competitive position through key internal and external factors, highlighting its strengths, weaknesses, opportunities, and threats.

Simplifies complex strategic planning by offering a clear, actionable framework to identify and address critical business challenges.

Weaknesses

DCC Energy's significant revenue stream is still tied to the unpredictable swings in global commodity prices. For instance, during periods of lower oil and gas prices, like those seen in early 2024, this dependence can lead to a noticeable dip in their earnings.

This inherent exposure to market volatility means DCC's overall financial results can experience ups and downs that are outside of their direct operational control, impacting profitability and investor confidence.

The strategic decision to divest DCC Healthcare and the upcoming evaluation of DCC Technology will inevitably lead to a less diversified business portfolio for the group. This streamlining, while aimed at focus, concentrates DCC's operations more heavily within the energy sector.

This heightened reliance on the energy market inherently amplifies the risks tied to fluctuations and potential downturns within that specific industry. For instance, if energy prices were to significantly decline in 2024 or 2025, the impact on DCC's overall financial performance would be more pronounced than if it had a broader range of revenue streams.

DCC's overall growth trajectory is impressive, largely fueled by strategic acquisitions. However, a closer look reveals that organic growth within its Energy Solutions segment has been somewhat modest. This suggests that while the company is expanding effectively through M&A, the inherent expansion of its existing energy businesses needs further attention.

Furthermore, the Mobility division has experienced volume declines in specific geographic markets. This trend highlights a potential vulnerability, indicating that DCC's growth is not uniformly driven by organic expansion across all its operational areas, particularly in certain mobility sub-segments.

Potential for Integration Challenges with Continuous Acquisitions

DCC's aggressive acquisition strategy, while a historical strength, presents a notable weakness. The constant integration of new businesses, particularly in the rapidly evolving energy sector, introduces significant operational and cultural challenges. For instance, successfully onboarding acquired entities and aligning their systems with DCC's existing infrastructure requires substantial resources and meticulous planning to avoid disruptions.

The complexity of managing a growing portfolio of diverse energy-related businesses can strain management bandwidth and lead to integration missteps. This risk is amplified as DCC navigates the energy transition, requiring the seamless assimilation of new technologies and business models. A failure to effectively integrate could dilute profitability and hinder the realization of projected synergies from these deals.

- Integration Risks: The continuous pursuit of acquisitions, especially in a dynamic energy transition landscape, inherently carries integration risks.

- Operational Efficiency: Successfully merging new businesses and technologies requires careful management to ensure sustained profitability and operational efficiency.

- Management Strain: The complexity of managing a growing portfolio can strain management bandwidth, potentially leading to integration missteps.

Recent Earnings Misses and Analyst Forecast Adjustments

DCC plc's recent performance has shown some headwinds. For the fiscal year ending March 31, 2025, the company's reported statutory earnings per share (EPS) fell short of the consensus analyst expectations. This miss has prompted several financial analysts to adjust their forward-looking EPS estimates downwards.

These earnings misses can have a tangible effect on how investors perceive the company. A divergence between actual results and projections can erode investor confidence, potentially leading to increased volatility in DCC's stock price in the short term.

- FY25 Statutory EPS Miss: DCC plc reported FY25 statutory EPS that did not meet analyst expectations.

- Analyst Forecast Revisions: Following the earnings release, analysts have revised their future EPS forecasts downwards.

- Investor Confidence Impact: Such discrepancies can negatively affect investor sentiment and trust in the company's guidance.

- Stock Price Volatility: The market may react to these adjustments with short-term fluctuations in DCC's share price.

DCC's reliance on commodity prices, particularly for its energy segment which formed a significant portion of its business, exposed it to market volatility. For instance, fluctuations in oil and gas prices during 2024 could directly impact its revenue and profitability, making its financial performance less predictable. This concentration in energy, especially after divesting other segments, amplified the impact of any downturns in that sector.

While DCC has a strong acquisition track record, the organic growth within its existing energy businesses has been less robust. Furthermore, the Mobility division has seen volume declines in certain markets, indicating that growth isn't uniform across all operations. This suggests a need to bolster internal expansion alongside external acquisitions.

The company's aggressive acquisition strategy, a historical strength, also presents integration challenges. Successfully merging new businesses, especially in the rapidly changing energy landscape, requires significant resources and careful management to avoid operational disruptions and ensure profitability. For example, integrating acquired technology and business models during the energy transition is complex.

DCC plc faced headwinds as its statutory earnings per share (EPS) for the fiscal year ending March 31, 2025, fell below analyst expectations. This miss led to downward revisions in future EPS forecasts by financial analysts, potentially impacting investor confidence and leading to short-term stock price volatility.

Full Version Awaits

DCC SWOT Analysis

This is the actual SWOT analysis document you’ll receive upon purchase—no surprises, just professional quality. You’re viewing a live preview of the actual SWOT analysis file. The complete version becomes available after checkout.

Opportunities

The global push for decarbonization and enhanced energy security creates a substantial avenue for DCC to broaden its renewable energy solutions, biofuels, and advanced energy services. This aligns directly with the escalating market demand for sustainable alternatives.

For instance, the International Energy Agency (IEA) projected in its 2024 outlook that renewable energy capacity additions are expected to grow by over 50% by 2025 compared to the previous five years, reaching nearly 500 gigawatts globally. This surge in demand presents a prime opportunity for DCC to capitalize on its expertise.

The £1.05 billion capital infusion from the DCC Healthcare divestment presents a prime opportunity for strategic reinvestment. This substantial war chest can be deployed to acquire and consolidate players within the fragmented energy sector, aligning perfectly with DCC's 'Cleaner Energy in Your Power' strategy.

This financial flexibility allows DCC to aggressively pursue M&A opportunities, potentially acquiring businesses that enhance its renewable energy portfolio or expand its reach in energy services. For instance, in 2024, the global energy M&A market saw significant activity, with several smaller, specialized clean energy firms becoming acquisition targets.

The widespread adoption of smart meters, with over 30 million installed across Great Britain by early 2024, presents a significant opportunity for DCC. This digital infrastructure allows for real-time data collection, enabling DCC to develop advanced energy management services and innovative solutions for consumers and energy providers.

By harnessing data analytics from these connected devices, DCC can optimize energy distribution, predict demand more accurately, and reduce operational costs. This focus on smart technologies can lead to improved efficiency and a more resilient energy grid, directly benefiting all stakeholders.

Furthermore, DCC can enhance customer engagement by offering personalized energy insights and services through digital platforms. This proactive approach, driven by data, can foster greater consumer participation in energy efficiency programs and support the transition to a low-carbon economy.

Expansion into New Geographies and Niche Energy Markets

DCC possesses a significant opportunity to expand its reach into new geographical territories and capitalize on burgeoning niche energy markets. This strategic move leverages DCC's core expertise in energy distribution and services, allowing for targeted penetration into regions experiencing robust demand or specific growth segments within the energy transition.

This expansion can be effectively executed through a dual approach of organic growth, investing in internal capabilities and market development, and strategic acquisitions that provide immediate market access or specialized technological advantages. For instance, DCC could explore opportunities in emerging markets in Southeast Asia or Africa, where energy demand is projected to rise significantly in the coming years.

Consider the following specific areas for expansion:

- Geographic Expansion: Targeting high-growth regions in Asia-Pacific and Latin America, where energy infrastructure development is a priority. For example, several Southeast Asian nations are investing heavily in upgrading their energy grids and increasing access to cleaner fuel sources.

- Niche Market Penetration: Focusing on segments like renewable energy distribution, hydrogen infrastructure, or advanced biofuels, which are integral to the global energy transition. The global market for green hydrogen alone is anticipated to reach billions of dollars by 2030.

- Strategic Acquisitions: Identifying and acquiring smaller, specialized energy service companies or distribution networks in target geographies to accelerate market entry and gain immediate market share.

- Partnerships and Joint Ventures: Collaborating with local energy providers or technology developers in new markets to share risks and leverage local expertise, thereby facilitating entry and operational efficiency.

Enhanced Shareholder Value through Capital Return Program

DCC's commitment to returning £800 million in divestment proceeds to shareholders, beginning with a share buyback, is a significant opportunity to boost shareholder value. This capital return program is designed to directly reward investors and signal confidence in the company's financial health.

The share buyback initiative can lead to a reduction in the number of outstanding shares, thereby increasing earnings per share (EPS) and potentially lifting the stock price. This strategy is often viewed favorably by the market, potentially improving investor sentiment and increasing demand for DCC shares.

- Shareholder Value Enhancement: The planned return of £800 million in divestment proceeds directly benefits shareholders.

- Improved Investor Sentiment: Capital return programs often signal financial strength and can boost market confidence.

- Potential Share Price Increase: Share buybacks can reduce outstanding shares, leading to higher EPS and potential price appreciation.

- Strategic Financial Management: This move demonstrates effective capital allocation and a focus on maximizing returns for investors.

The global drive towards decarbonization and enhanced energy security presents a significant opportunity for DCC to expand its renewable energy solutions, biofuels, and advanced energy services, aligning with increasing market demand for sustainable alternatives. The International Energy Agency (IEA) projected in its 2024 outlook that renewable energy capacity additions were expected to grow by over 50% by 2025 compared to the previous five years, reaching nearly 500 gigawatts globally, a surge DCC can capitalize on.

The £1.05 billion capital infusion from the DCC Healthcare divestment provides substantial financial flexibility for strategic reinvestment. This capital can be deployed to acquire and consolidate players within the fragmented energy sector, supporting DCC's 'Cleaner Energy in Your Power' strategy and enabling aggressive pursuit of M&A opportunities in the clean energy space, which saw significant activity in 2024.

The widespread adoption of smart meters, with over 30 million installed across Great Britain by early 2024, offers DCC a chance to develop advanced energy management services by leveraging real-time data collection. This allows for optimized energy distribution, more accurate demand prediction, and improved operational efficiency, fostering greater consumer engagement through personalized energy insights.

DCC can expand into new geographical territories and burgeoning niche energy markets, such as renewable energy distribution or hydrogen infrastructure, by leveraging its core expertise. This can be achieved through organic growth and strategic acquisitions, targeting high-growth regions in Asia-Pacific and Latin America where energy infrastructure development is a priority, and capitalizing on the projected growth in markets like green hydrogen.

The planned return of £800 million in divestment proceeds to shareholders, starting with a share buyback, presents an opportunity to boost shareholder value. This capital return program signals financial strength, potentially leading to higher earnings per share and an improved stock price, enhancing investor confidence and demand for DCC shares.

| Opportunity Area | Key Driver | 2024/2025 Data Point | Strategic Action |

|---|---|---|---|

| Renewable Energy Expansion | Global decarbonization push | IEA projected >50% growth in renewable capacity additions by 2025 | Invest in renewable solutions and services |

| Strategic Acquisitions | Divestment proceeds (£1.05bn) | Active M&A in clean energy sector in 2024 | Acquire fragmented energy sector players |

| Smart Meter Data Services | Smart meter adoption | >30 million smart meters in Great Britain by early 2024 | Develop advanced energy management services |

| Geographic & Niche Market Growth | Energy demand in emerging markets | Projected rise in energy demand in Southeast Asia/Africa | Target high-growth regions and niche segments (e.g., green hydrogen) |

| Shareholder Value Enhancement | Capital return program (£800m) | Share buybacks can increase EPS | Execute share buybacks to boost shareholder returns |

Threats

Ongoing geopolitical tensions, particularly in regions critical for energy production, continue to create significant uncertainty. For instance, the ongoing conflict in Eastern Europe has led to substantial price swings in global oil and gas markets throughout 2024, with Brent crude futures experiencing volatility that at times exceeded 15% within a single month. This instability directly impacts DCC's energy division by creating unpredictable operational costs and potentially hindering the profitability of its diverse energy offerings, even as the company works to expand its renewable portfolio.

The energy sector's rapid evolution, driven by the transition to renewables, is intensifying competition for DCC. Established players are diversifying, while specialized renewable firms are emerging, creating a crowded market. This heightened rivalry could indeed squeeze DCC's profit margins and erode its market share as it navigates this dynamic landscape.

Governments globally are increasing environmental regulations, with many nations, including those in the EU and North America, implementing or strengthening carbon pricing mechanisms. For instance, the EU's Emissions Trading System (ETS) saw carbon prices average around €65 per tonne in 2023, a significant increase that impacts energy-intensive industries. These evolving policies can lead to higher operational costs for DCC and require substantial capital for compliance, potentially affecting profitability and investment strategies.

Risk of Technological Disruption in Energy Solutions

The energy sector is experiencing a technological revolution, with advancements in renewables and grid modernization accelerating. For DCC, a failure to keep pace with these innovations, such as the increasing efficiency of solar panels or the development of advanced battery storage, could render its current offerings less competitive. For instance, the global renewable energy market is projected to reach over $1.9 trillion by 2030, highlighting the rapid shift away from traditional energy sources.

This rapid evolution presents a significant threat of disruption. If DCC does not invest in or acquire new technologies, it risks its existing infrastructure and services becoming obsolete. Companies that fail to adapt could see their market share erode quickly, as seen with traditional automotive manufacturers struggling to transition to electric vehicles.

- Rapid technological advancements in renewable energy generation and storage

- The potential for smart grid technologies to bypass traditional energy providers

- The risk of existing DCC infrastructure becoming outdated due to faster, more efficient solutions

- Competitors adopting disruptive technologies, leading to a loss of market share

Economic Downturns and Impact on Customer Demand

Economic downturns pose a significant threat to DCC. A broad economic slowdown or recession can directly impact industrial and commercial energy consumption, as businesses scale back operations. Similarly, consumer spending on energy-related products and services often decreases during such periods, affecting DCC's revenue streams.

The impact on DCC's profitability could be substantial, with lower sales volumes directly translating into reduced earnings. For instance, if global GDP growth forecasts for 2024-2025 are revised downwards due to persistent inflation or geopolitical instability, DCC's energy demand could see a contraction of 2-4% depending on sector exposure.

- Reduced Industrial Activity: Manufacturing and heavy industries, key consumers of energy, are often the first to cut back during economic contractions, directly impacting DCC's B2B sales.

- Lower Consumer Spending: A decline in disposable income can lead consumers to conserve energy or delay purchases of energy-efficient appliances, affecting DCC's retail and product segments.

- Increased Price Sensitivity: During economic hardship, customers become more price-sensitive, potentially leading to demand shifts towards lower-cost energy alternatives or renegotiated contracts that squeeze DCC's margins.

DCC faces the threat of increasing competition from both established energy companies diversifying into renewables and agile, specialized renewable energy firms. This dynamic market, projected to see significant growth, could compress DCC's margins and market share if it fails to innovate or adapt its offerings. For example, the global renewable energy market is expected to exceed $1.9 trillion by 2030, underscoring the rapid shift and competitive pressure.

The company must also contend with stringent and evolving environmental regulations, including carbon pricing mechanisms. For instance, the EU's Emissions Trading System saw carbon prices averaging around €65 per tonne in 2023, directly increasing operational costs for energy-intensive operations and requiring substantial capital investment for compliance, potentially impacting profitability.

Furthermore, rapid technological advancements in renewable generation and storage, coupled with the rise of smart grid technologies, pose a disruption risk. Failure to integrate these innovations, such as more efficient solar panels or advanced battery storage, could render DCC's existing infrastructure obsolete and lead to a loss of market share to competitors who adopt these cutting-edge solutions.

Economic downturns present a significant threat by reducing industrial and consumer energy demand, directly impacting DCC's revenue. A global GDP growth slowdown, as potentially indicated by downward revisions for 2024-2025, could contract energy demand by an estimated 2-4%, affecting DCC's earnings and requiring greater price sensitivity management.

| Threat Category | Specific Threat | Potential Impact on DCC | Relevant Data/Trend |

|---|---|---|---|

| Competition | Intensified competition in the renewable energy sector | Margin compression, market share erosion | Global renewable energy market projected to exceed $1.9 trillion by 2030 |

| Regulatory Environment | Increasingly stringent environmental regulations and carbon pricing | Higher operational costs, increased capital expenditure for compliance | EU ETS carbon prices averaged ~€65/tonne in 2023 |

| Technological Disruption | Rapid advancements in renewables and smart grid technology | Obsolescence of existing infrastructure, loss of competitive advantage | Accelerating efficiency gains in solar PV and battery storage technologies |

| Economic Conditions | Economic slowdowns and recessions | Reduced energy demand, lower revenue, increased price sensitivity | Potential 2-4% contraction in energy demand during economic downturns |

SWOT Analysis Data Sources

This DCC SWOT analysis is built upon a robust foundation of data, drawing from comprehensive financial reports, detailed market intelligence, and expert industry evaluations to ensure a thorough and accurate strategic assessment.