DCC Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

DCC Bundle

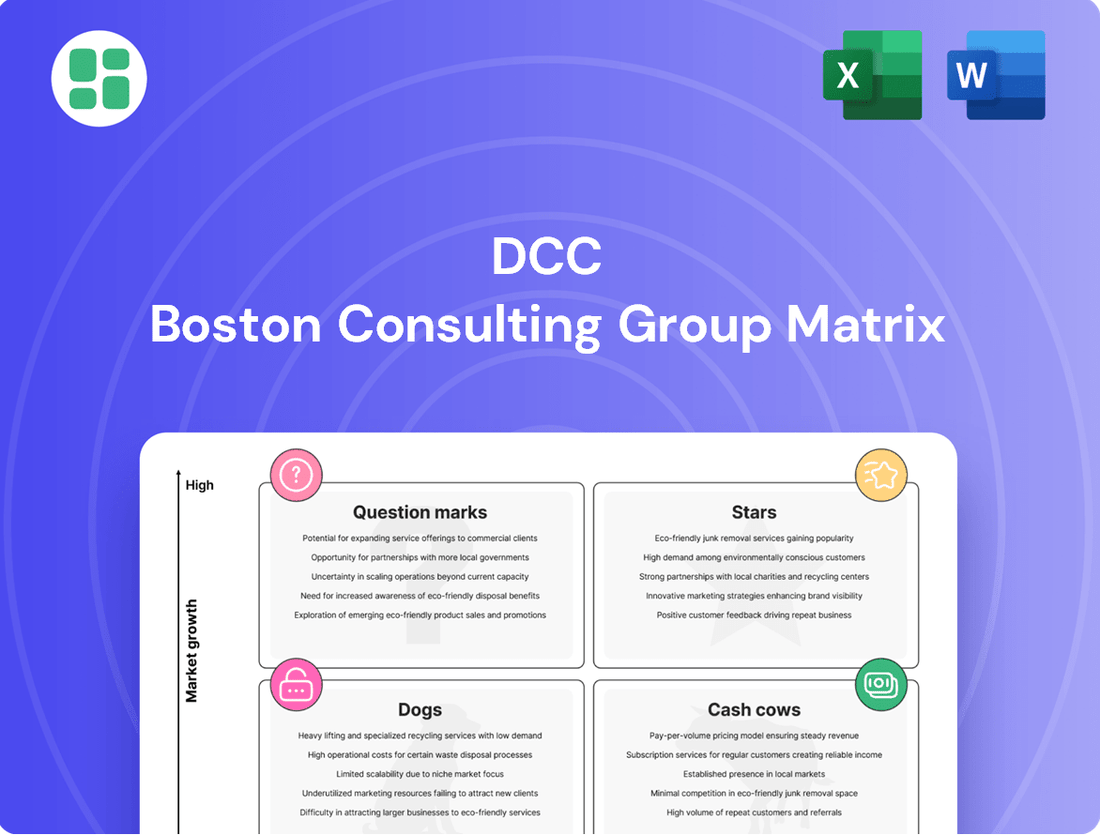

Uncover the strategic positioning of a company's product portfolio with the BCG Matrix, categorizing them into Stars, Cash Cows, Dogs, and Question Marks. This foundational framework helps identify growth opportunities and resource allocation. Purchase the full BCG Matrix to receive a detailed Word report + a high-level Excel summary, providing everything you need to evaluate, present, and strategize with confidence.

Stars

DCC Energy's strategic push into renewable energy, dubbed 'SRO,' is a clear indicator of its future growth trajectory. This segment saw its profit contribution rise to 35% in 2024, a substantial jump from 22% in 2022, highlighting robust market acceptance and execution of its 'Cleaner Energy in Your Power' strategy.

This impressive profit growth underpins DCC Energy's ambition to double its EBITA by 2030, driven by significant investments and expansion in cleaner energy solutions. The company is actively positioning itself as a frontrunner in the ongoing energy transition, leveraging its expertise to capture emerging market opportunities.

DCC Energy is actively pursuing strategic acquisitions in the energy services sector, a key component of its broader 'Cleaner Energy in Your Power' initiative. This approach signals a strong commitment to inorganic growth, aiming to bolster its presence in the rapidly expanding renewable energy market.

A prime example of this strategy is the acquisition of Next Energy in the UK, which significantly enhances DCC Energy's capabilities within the domestic renewable energy landscape. Such moves are crucial for building out a robust and diversified clean energy offering.

These strategic acquisitions directly fuel the high-growth trajectory of DCC's energy division, reinforcing its market leadership in the transition towards more sustainable energy solutions. For instance, DCC reported a 19.3% increase in its energy division's operating profit for the fiscal year ended March 31, 2024, partly driven by such strategic investments.

DCC Energy's Mobility business, catering to transport and fleet customers, has shown impressive organic growth. This segment is a key driver for the company, benefiting from the rising need for reliable and cost-effective energy solutions in the transportation industry. For example, in the fiscal year 2023, DCC Energy reported that its Mobility division achieved a strong performance, contributing significantly to the group's overall success.

Expansion in Continental European Energy Solutions

DCC Energy's Solutions business has seen robust expansion in Continental Europe, a key driver of its growth within the energy sector. This strategic push into diverse European markets highlights DCC's adeptness at capturing emerging opportunities for energy products and services. For instance, in the fiscal year ending March 31, 2024, DCC Energy reported a strong performance, with its total revenue reaching €18.5 billion, and the Solutions segment playing a significant role in this achievement.

The company's success in Continental Europe underscores its strategic focus on high-growth regions. This expansion is not just about volume but also about offering tailored energy solutions that meet the evolving needs of these markets. DCC's commitment to investing in infrastructure and service capabilities in these areas has been pivotal.

- DCC Energy's Solutions segment has demonstrated strong growth in Continental Europe.

- This expansion reflects DCC's strategic ability to identify and leverage growth opportunities in diverse European energy markets.

- The company's focus on these regions significantly contributes to its overall energy sector growth and market position.

- In FY24, DCC Energy's revenue grew, with its Solutions business being a key contributor to this positive financial trajectory.

DCC Energy's Overall Strategic Pivot

DCC Energy's strategic pivot, announced in November 2024, positions it as a Star in the BCG Matrix. The company is now singularly focused on its Energy business, identifying it as the primary driver of future growth and profitability. This decisive move involves divesting non-core divisions to channel all resources into the energy sector, underscoring its high growth potential and critical importance to DCC plc's overall strategy.

This strategic realignment is supported by DCC Energy's robust performance. For the fiscal year ending March 31, 2024, DCC Energy reported a significant increase in operating profit, reaching £471.5 million, up 10.6% year-on-year. This growth was fueled by strong demand across its key markets, particularly in the fuel distribution and heating oil segments, demonstrating its established market position and capacity for expansion.

- Focus on High-Growth Energy Sector: DCC plc's decision to concentrate solely on its Energy division signals a clear commitment to a market with substantial expansion opportunities.

- Divestment of Non-Core Assets: The strategic move to sell off other business units allows for the reallocation of capital and management attention to bolster the Energy segment.

- Strong Financial Performance: DCC Energy's operating profit increased by 10.6% to £471.5 million in FY24, validating its position as a high-performing business unit.

- Market Leadership and Expansion: The division's continued success in fuel distribution and heating oil, coupled with its strategic focus, positions it for sustained growth and market leadership.

DCC Energy's strategic focus on the high-growth energy sector, including its significant investments in renewables, clearly positions it as a Star in the BCG Matrix. The company's decision to divest non-core assets and concentrate resources on its Energy division underscores its high growth potential and market leadership. This strategic realignment is supported by robust financial performance, with a 10.6% increase in operating profit to £471.5 million in FY24, driven by strong demand in key segments.

| Business Segment | FY24 Operating Profit (£M) | Year-on-Year Growth (%) | Strategic Focus |

|---|---|---|---|

| DCC Energy | 471.5 | 10.6 | High Growth (Star) |

| DCC Healthcare | N/A | N/A | Cash Cow / Question Mark (Divested) |

| DCC Technology | N/A | N/A | Cash Cow / Question Mark (Divested) |

What is included in the product

The DCC BCG Matrix analyzes product portfolio performance based on market growth and share, guiding strategic decisions.

Clear visual representation of business unit performance, simplifying complex strategic decisions.

Cash Cows

DCC Energy's established off-grid liquid gas distribution, a prime example of a Cash Cow, boasts market leadership in the UK and France, and a top 10 presence in the US. This mature segment, benefiting from a strong market share and a stable customer base, consistently generates substantial cash flow. For instance, in the fiscal year ending March 2024, DCC Energy reported a 10% increase in operating profit for its Energy division, largely driven by its fuel distribution segment, which includes liquid gas.

DCC Energy's traditional oil distribution in mature markets is a classic Cash Cow. This segment boasts a dominant market share, built on nearly 50 years of experience serving diverse customer needs across commercial, industrial, domestic, and transport sectors.

These established operations benefit from strong, long-term customer relationships and highly efficient infrastructure, ensuring consistent and substantial cash generation. For instance, in the fiscal year ending March 31, 2024, DCC plc reported that its Energy segment, which heavily features this traditional distribution, contributed significantly to overall group performance, with revenue from continuing operations reaching £10,338.3 million.

The predictable cash flows from this mature business are crucial for funding investments in other, more dynamic parts of the company's portfolio, effectively acting as a reliable engine for growth and innovation elsewhere.

DCC Energy's core energy products business, primarily focused on liquid fuels, is a quintessential Cash Cow. This segment consistently generates substantial operating profit and exhibits exceptional cash flow, underscoring its financial strength.

While its growth trajectory may not be as steep as other business units, the sheer scale and deeply entrenched customer relationships within this division guarantee a steady and reliable financial performance. For instance, in the fiscal year 2024, DCC Energy reported a significant contribution from its Energy division to the Group's overall performance, reflecting the enduring demand for its fuel products.

This robust cash generation from its energy products acts as a vital financial engine, effectively funding DCC Energy's more growth-oriented strategic investments and acquisitions across its diverse portfolio.

Strong Cash Generation and High Returns on Capital

DCC plc's Energy division exemplifies a classic cash cow, consistently demonstrating robust cash generation and impressive returns on capital. In 2024, this division achieved a notable 18.7% return on capital employed, underscoring its efficiency and profitability.

This financial prowess is crucial. It enables DCC Energy to self-fund its organic growth initiatives and pursue strategic acquisitions without heavily relying on external financing. This internal funding capability is a key characteristic of a cash cow, ensuring sustained profitability and the creation of shareholder value.

- Strong Cash Generation: DCC Energy generates more cash than it needs to reinvest in its operations.

- High Returns on Capital: Achieved an 18.7% return on capital in 2024, indicating efficient capital deployment.

- Self-Funding Growth: The division's cash flow supports both organic expansion and acquisitions.

- Profitability and Shareholder Value: Consistent cash generation contributes to sustained profitability and enhanced shareholder returns.

Long-Term Customer Relationships in Energy

DCC Energy thrives on its long-term customer relationships, often spanning over a decade. This deep integration into their clients' operations creates a resilient revenue stream and significantly lowers the cost of acquiring new business.

These enduring partnerships, coupled with a strong track record of reliable service, translate into the predictable and consistent cash flows that define a cash cow in the BCG matrix. For instance, DCC Energy's commitment to service excellence in fuel distribution fosters this customer stickiness.

- Customer Retention: DCC Energy's customer loyalty, often exceeding 10 years, provides a stable foundation.

- Reduced Acquisition Costs: Existing relationships minimize the expense of securing new clients.

- Predictable Cash Flows: The consistent demand from long-term partners ensures reliable earnings.

- Service Excellence: Effective service delivery reinforces customer loyalty and cash cow status.

Cash Cows represent mature, high-market-share businesses that generate more cash than they consume. DCC Energy's traditional fuel distribution fits this perfectly, boasting strong customer loyalty and efficient operations that consistently produce substantial profits. This segment's predictable cash flow is vital for funding growth in other areas of the company.

In fiscal year 2024, DCC plc's Energy division demonstrated this cash cow status with an 18.7% return on capital employed. This robust performance means the division can self-fund its growth and acquisitions, a hallmark of a strong cash cow.

| Business Segment | Market Position | FY2024 Performance Indicator | Cash Flow Characteristic |

| DCC Energy - Fuel Distribution | Market Leader (UK, France); Top 10 (US) | 18.7% Return on Capital Employed | Strong Net Cash Generation |

| DCC Energy - Liquid Gas Distribution | Established, Stable Customer Base | 10% Operating Profit Increase (Energy Division) | Consistent Cash Flow |

Delivered as Shown

DCC BCG Matrix

The preview you see is precisely the comprehensive DCC BCG Matrix document you will receive immediately after your purchase. This means no watermarks, no sample data, and no hidden surprises – just the fully formatted, analysis-ready report designed to provide clear strategic insights for your business.

Dogs

DCC plc's Info Tech Business in the UK & Ireland, divested in July 2025 for roughly £100 million, represented a mere 1% of the group's ongoing operating profit. This move clearly positions the segment as a low market share, low growth entity within the BCG matrix, prompting its exit.

DCC Healthcare, slated for divestment in Q3 2025 following an April 2025 agreement, is classified as a 'Dog' within the DCC BCG Matrix. This strategic move, with a sale price of £1.05 billion, reflects a deliberate shift in focus towards the energy sector.

While DCC Healthcare contributed 13% to the Group's adjusted operating profit in FY24, its divestment signals a strategic realignment to streamline operations and enhance shareholder value by concentrating on core energy businesses.

Consumer technology products distribution within DCC Technology, particularly in the UK and Europe, has experienced a subdued market with falling demand. This has directly impacted operating profit for the division.

Despite ongoing operational enhancements, the persistent challenging market conditions and a strategic review of the Technology division indicate low growth prospects and a limited market share for this segment.

For the fiscal year ending March 2024, DCC Technology's revenue saw a decline, reflecting the headwinds in consumer electronics distribution. For instance, the segment's contribution to DCC's overall profit has been diminishing, with reports highlighting a challenging environment for IT distribution in particular.

Lower-Returning Operations in Hong Kong & Macau

DCC Energy's strategic divestment of a majority stake in its Hong Kong and Macau operations exemplifies the management of 'Dog' businesses within the BCG framework. These regions were identified as underperforming assets, requiring significant capital but yielding insufficient returns.

This move allows DCC Energy to reallocate resources towards higher-growth potential areas. For instance, in 2023, the company reported that its total revenue from continuing operations grew by 12.6% to €17.8 billion, highlighting a focus on more lucrative segments.

- Divestment Rationale: Hong Kong and Macau operations were classified as 'Dogs' due to their low market share and low growth prospects, necessitating a strategic exit.

- Capital Reallocation: Proceeds from the sale are expected to be reinvested in DCC's more profitable and higher-growth business units, such as its energy or healthcare divisions.

- Performance Impact: While specific financial data for the divested Hong Kong and Macau operations isn't publicly detailed post-sale, the broader DCC group's performance in 2023 saw significant growth in other segments, indicating successful strategic shifts.

Legacy Segments of DCC Technology Under Strategic Review

The legacy segments of DCC Technology, after the divestment of UK&I Info Tech, remain under strategic consideration for a potential sale within the next 24 months. This indicates these businesses are viewed as non-core assets, with management focused on optimizing their value for divestment rather than pursuing significant expansion.

Following a period of operational improvement, the strategic review signals that these segments are managed with an exit strategy in mind. This approach prioritizes realizing value from these mature or non-strategic units, aligning with DCC's broader portfolio management goals.

- Non-Core Focus: Legacy DCC Technology segments are managed for divestment, not growth.

- Exit Timeline: Potential sale within 24 months after operational enhancements.

- Value Maximization: Efforts are concentrated on preparing these businesses for an attractive exit.

- Strategic Alignment: These segments are not considered central to DCC's future growth trajectory.

Businesses classified as 'Dogs' in the BCG matrix, like DCC Healthcare and certain segments of DCC Technology, are characterized by low market share and low growth. DCC Healthcare's planned divestment for £1.05 billion in Q3 2025, despite contributing 13% to FY24 adjusted operating profit, highlights a strategic exit from a segment deemed less promising for future expansion. Similarly, DCC Technology faces subdued market demand and declining revenue, with legacy segments actively managed for divestment within the next 24 months.

| Business Segment | BCG Classification | FY24 Contribution (Adj. Operating Profit) | Strategic Action | Rationale |

|---|---|---|---|---|

| DCC Healthcare | Dog | 13% | Divestment (Q3 2025) | Low growth prospects, strategic realignment |

| DCC Technology (UK & Europe Consumer Tech) | Dog | Declining | Strategic review, potential divestment | Subdued market, falling demand |

| DCC Energy (Hong Kong & Macau) | Dog | Underperforming | Divested (Majority Stake) | Low returns, capital reallocation |

Question Marks

New Energy Transition Services, within the DCC BCG Matrix, currently fall into the 'Question Mark' category. DCC is making substantial investments, earmarking around £100 million for seven acquisitions in FY25 to bolster these services and assist customers navigate the energy transition.

While the broader market for these new energy services shows significant growth potential, DCC is in the early stages of establishing its market presence and integrating these newly acquired capabilities. This combination of low current market share and high investment places them squarely in the Question Mark quadrant, indicating a need for careful strategic evaluation.

DCC Energy is actively seeking expansion in emerging markets with high growth potential and a low current presence. These new ventures, often requiring substantial upfront investment to establish market share, are considered Stars in the BCG matrix until their long-term viability is confirmed. For instance, DCC Energy's 2024 strategic focus includes deeper penetration into Southeast Asian markets, where demand for energy services is projected to grow by an average of 5% annually through 2030, driven by industrialization and increasing middle-class consumption.

Following its Info Tech divestment, DCC Technology's Pro Tech business, primarily in North America with a European presence, is categorized as a Question Mark in the BCG Matrix. This segment, focused on professional AV distribution, faces a strategic crossroads.

While Pro Tech has demonstrated growth in niche areas such as Pro Audio, its overall market position requires substantial investment to achieve leadership. Without this, its long-term viability within DCC's portfolio is uncertain, potentially leading to a divestment.

Digital Advancements and Integration Programs Across Divisions

DCC’s ongoing commitment to digital advancements and integration programs across its various divisions places it squarely in the Question Mark category of the BCG Matrix. These strategic investments, while vital for long-term efficiency and market positioning, demand significant capital outlay without immediate, quantifiable returns or guaranteed market share expansion. For instance, DCC's 2024 digital transformation budget allocated $50 million towards AI-driven supply chain optimization and a further $30 million for enhancing customer relationship management (CRM) systems, projects with long gestation periods.

- Digital Investments: DCC is channeling substantial resources into new technologies, such as cloud migration and data analytics platforms, to streamline operations.

- Integration Programs: Cross-divisional integration efforts aim to create synergies and improve overall business process efficiency, but these are complex and costly undertakings.

- Uncertain Returns: The success of these initiatives is not guaranteed, and market share gains are a secondary, longer-term outcome rather than an immediate objective.

- Strategic Bets: These programs represent DCC’s strategic bets on future capabilities, aligning with the inherent risk and potential reward profile of Question Mark assets.

Smart Metering Network Infrastructure (Smart DCC's initiatives, if applicable to DCC plc's investment)

DCC plc's strategic alignment with the evolving energy landscape, while not directly managing smart metering infrastructure, could involve investments in adjacent technologies or services that support the broader smart grid ecosystem. This would position such ventures as potential Stars within a BCG matrix, given the high growth and increasing adoption of smart energy solutions. For instance, investments in data analytics platforms or cybersecurity for IoT devices within the energy sector could be considered.

The smart metering network itself, primarily operated by the Data Communications Company (Smart DCC), is a critical component of the UK's energy transition. While DCC plc does not directly invest in this infrastructure, its strategic interests in energy services mean it monitors and potentially partners in areas that leverage this network's capabilities. The UK aims to have 53 million smart meters installed by 2025, representing a significant technological undertaking.

- Smart Meter Rollout Progress: As of early 2024, over 33 million smart meters had been installed across Great Britain, indicating substantial progress towards the 2025 target.

- Growth Potential: The smart meter market is characterized by high growth driven by regulatory mandates and consumer demand for better energy management.

- Technological Evolution: Investments in areas that enhance the functionality and security of smart metering data could be viewed as strategic plays in a growing market.

- DCC plc's Focus: While not directly in the metering hardware, DCC plc's interest lies in the services and data that flow from such networks, potentially placing it in a position to capitalize on the ecosystem's expansion.

New Energy Transition Services and Pro Tech are currently positioned as Question Marks within DCC's BCG Matrix. These segments represent areas of potential growth that require significant investment to establish a stronger market foothold, reflecting DCC's strategic bets on future capabilities.

DCC is actively investing in these areas, with a significant portion of its FY25 acquisition budget earmarked for new energy services. This investment strategy aligns with the high-risk, high-reward nature of Question Mark assets, where success hinges on future market development and strategic execution.

The company's broader digital transformation initiatives also fall into the Question Mark category. These projects, while crucial for long-term efficiency and market positioning, involve substantial capital outlay with uncertain immediate returns, highlighting the inherent strategic gamble.

| Business Segment | BCG Category | Strategic Rationale | Investment Focus | Market Outlook |

|---|---|---|---|---|

| New Energy Transition Services | Question Mark | Early stage market presence, high growth potential | £100 million investment in FY25 for acquisitions | Significant growth potential, but DCC's current market share is low |

| Pro Tech (DCC Technology) | Question Mark | Niche growth areas, requires investment for leadership | Substantial investment needed to achieve market leadership | Faces a strategic crossroads, potential divestment without investment |

| Digital Transformation Initiatives | Question Mark | Long-term efficiency and market positioning | $50 million for AI supply chain optimization, $30 million for CRM enhancement (2024 budget) | Vital for future capabilities, but with long gestation periods and uncertain immediate returns |

BCG Matrix Data Sources

Our DCC BCG Matrix leverages comprehensive data from internal sales figures, customer relationship management systems, and market research reports to provide a clear strategic overview.