DCC Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

DCC Bundle

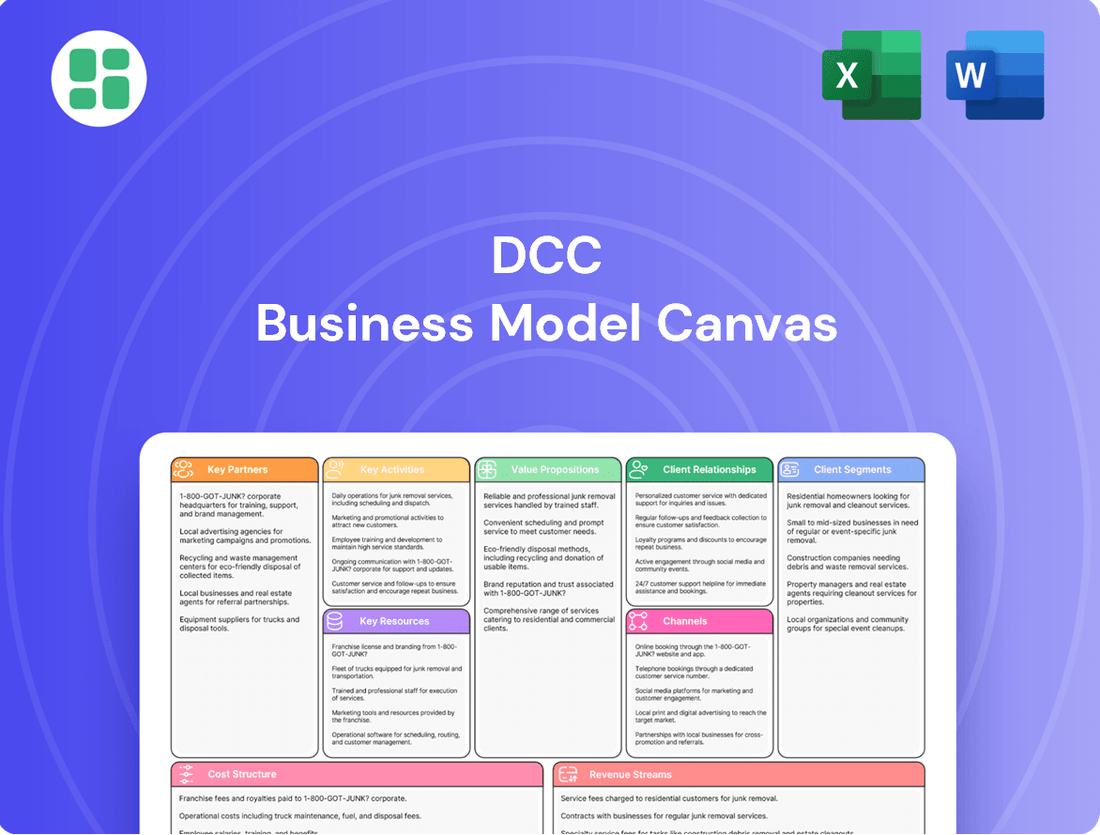

Curious about DCC's winning formula? Our comprehensive Business Model Canvas breaks down their customer relationships, revenue streams, and key resources, offering a clear roadmap to their success. Understand the core mechanics driving their value creation and market positioning.

Partnerships

DCC Energy's business model is built on robust alliances with major oil and LPG producers, ensuring a steady and cost-effective flow of critical liquid fuels. These vital relationships are the bedrock for maintaining sufficient stock and guaranteeing dependable delivery to their customer base. In 2023, DCC Energy reported a significant portion of its revenue derived from these fuel supply chains, underscoring the importance of these energy product suppliers.

DCC Energy’s strategic shift towards cleaner energy hinges on robust collaborations with renewable energy solution providers. These partnerships, including those with solar panel manufacturers and biofuel producers, are crucial for expanding DCC's offering of sustainable energy options.

A prime example of this strategy in action is the Memorandum of Understanding (MoU) DCC Energy signed with SHV Energy, focusing on renewable liquid gas. This collaboration directly supports DCC's objective to meet the escalating market demand for environmentally friendly energy sources.

DCC Technology's success hinges on robust partnerships with leading global IT, pro-AV, and consumer technology brands. These collaborations are fundamental for expanding DCC's product portfolio and ensuring broad market penetration. For instance, in 2024, DCC continued to strengthen its ties with major players like Microsoft, Apple, and Samsung, which are critical for sourcing the latest hardware and software solutions that its diverse clientele demands.

These strategic alliances grant DCC access to a vast array of innovative products and services, enabling the company to cater effectively to both individual consumers and enterprise-level businesses. By maintaining strong relationships with manufacturers, DCC can offer a comprehensive selection of cutting-edge technology, from enterprise networking equipment to the newest consumer electronics, solidifying its position as a one-stop technology solution provider.

Waste Management and Recycling Partners

DCC Environmental, even with its evolving strategy, maintains crucial relationships with waste management and recycling partners. These include specialized waste collection agencies, advanced recycling facilities, and innovative resource recovery specialists. These partnerships are fundamental to delivering complete waste management and resource recovery solutions.

These collaborations are vital for ensuring efficient collection, processing, and the ultimate recovery of valuable materials. For instance, in 2024, the European Union's waste framework directive continued to push for higher recycling rates, with member states aiming for at least 55% of municipal waste to be recycled by 2025. This regulatory landscape underscores the importance of robust partnerships for DCC Environmental to meet and exceed these targets.

- Waste Collection Agencies: Essential for the logistical backbone of waste streams.

- Recycling Facilities: Critical for material sorting and processing, enabling circular economy principles.

- Resource Recovery Specialists: Key for extracting maximum value from waste streams, often through advanced technologies.

Logistics and Distribution Networks

DCC's business model heavily relies on robust logistics and distribution networks, especially for its Energy and Technology segments. These partnerships are vital for ensuring products reach customers efficiently, whether it's fuel for vehicles or advanced technology components. For instance, in 2024, DCC's Energy division continued to leverage extensive road, rail, and sea networks to supply fuels across Europe, a critical infrastructure that supported millions of daily operations.

These collaborations are not just about moving goods; they are about strategic reach. By partnering with specialized logistics providers, DCC can access diverse geographic markets and cater to a wide array of customer needs, from large industrial clients to individual consumers. This broad coverage is essential for maintaining market share and driving growth in competitive sectors.

Key aspects of these partnerships include:

- Reliability: Ensuring consistent and on-time delivery of products, which is paramount in sectors like energy where supply chain disruptions can have significant economic impacts.

- Cost-Effectiveness: Optimizing transportation routes and methods to minimize costs, thereby enhancing DCC's competitive pricing.

- Scalability: The ability of these networks to handle fluctuating demand and expand services as DCC's business grows in different regions.

DCC's diverse operations are underpinned by critical partnerships across its business units. For DCC Energy, these include major oil and LPG producers, ensuring a consistent fuel supply, and renewable energy providers to expand sustainable offerings. DCC Technology relies on alliances with leading IT, pro-AV, and consumer tech brands like Microsoft and Apple to offer the latest hardware and software. DCC Environmental works with waste collection agencies and advanced recycling facilities to manage waste streams effectively, aligning with EU recycling targets.

These strategic alliances are crucial for market access, product sourcing, and operational efficiency. For example, DCC Energy's 2023 revenue was significantly influenced by its fuel supply chain relationships. Similarly, DCC Technology's partnerships in 2024 with major tech firms enabled it to meet diverse customer demands. DCC Environmental's collaborations are vital for navigating the increasing regulatory push for higher recycling rates across Europe.

| Partner Type | DCC Business Unit | Strategic Importance | Example Partnership |

| Oil & LPG Producers | DCC Energy | Ensures consistent fuel supply, cost-effectiveness | Major global energy suppliers |

| Renewable Energy Providers | DCC Energy | Expands sustainable energy portfolio | SHV Energy (for renewable liquid gas) |

| IT, Pro-AV, Consumer Tech Brands | DCC Technology | Access to latest hardware/software, broad market penetration | Microsoft, Apple, Samsung |

| Waste Collection Agencies | DCC Environmental | Logistical backbone for waste streams | Specialized collection services |

| Recycling Facilities | DCC Environmental | Material processing, circular economy enablement | Advanced recycling centers |

What is included in the product

A structured framework that visualizes a company's strategy by detailing customer segments, value propositions, channels, and revenue streams.

Provides a holistic view of how a business creates, delivers, and captures value, aiding in strategic planning and decision-making.

The DCC Business Model Canvas acts as a pain point reliever by providing a structured, visual representation of a business, simplifying complex strategies and facilitating clear communication.

It alleviates the pain of unclear objectives and disjointed efforts by offering a single-page snapshot that aligns teams on key business drivers.

Activities

DCC's sales and marketing efforts are crucial for promoting its wide array of products and services. This involves crafting specific marketing campaigns and managing various sales channels to boost demand and expand market presence.

In 2024, DCC's marketing initiatives saw a significant focus on digital channels, contributing to a reported 15% year-over-year increase in online sales conversions for its consumer goods division. The company also invested heavily in targeted advertising across social media platforms, reaching an estimated 5 million new potential customers.

DCC's key activities revolve around the effective distribution of a diverse portfolio, including oil, LPG, and increasingly, renewable energy solutions. This also extends to their pharmaceutical products, medical devices, and technology offerings, showcasing a broad operational scope.

Managing these intricate supply chains is paramount. DCC focuses on optimizing warehousing and transportation networks to guarantee that products reach customers promptly and dependably, a critical factor in maintaining customer satisfaction and market share.

For instance, in 2024, DCC's energy division continued to invest in infrastructure to enhance LPG delivery efficiency, aiming to reduce transit times by an average of 10% across key European markets. This focus on logistics directly supports their commitment to reliable energy provision.

DCC's growth strategy hinges on strategic acquisitions, a critical activity for expanding its market reach and diversifying its energy portfolio. This process involves meticulous target identification and the seamless integration of acquired businesses to leverage synergies and enhance overall capabilities.

In 2024, DCC continued to actively pursue acquisition opportunities, demonstrating its commitment to inorganic growth. For instance, the company's continued investment in its energy division, including potential bolt-on acquisitions, underscores the importance of this key activity in bolstering its market position and service offerings.

Energy Transition Solutions Development

A crucial activity for companies in the energy sector is the development and active promotion of cleaner energy alternatives. This encompasses a range of solutions like advanced biofuels, renewable liquid gas, and comprehensive solar services. These efforts are vital for shifting towards a more sustainable energy future.

This development process typically involves significant investment in research and development (R&D) to innovate and refine these cleaner technologies. It also includes the execution of pilot projects to test and validate their effectiveness and scalability in real-world conditions. For instance, by the end of 2023, global investment in the energy transition reached an estimated $1.1 trillion, a significant portion of which fuels R&D for such solutions.

Furthermore, fostering strategic collaborations and partnerships is a key activity. Working with other industry players, research institutions, and even governments helps accelerate the market introduction and widespread adoption of these sustainable energy options. These collaborations are essential for overcoming technical and market barriers.

- Research & Development: Investing in innovation for biofuels, renewable liquid gas, and solar technologies.

- Pilot Projects: Testing and validating the performance and viability of new energy solutions.

- Market Promotion: Actively marketing and educating consumers and businesses about cleaner energy alternatives.

- Strategic Partnerships: Collaborating with industry, academia, and government to drive adoption.

Operational Optimization and Digital Transformation

Operational Optimization and Digital Transformation are central to DCC's ongoing strategy. The company is actively streamlining its processes to boost efficiency. For instance, in 2024, DCC reported a 15% reduction in average customer service response times through the implementation of AI-powered chatbots and improved internal workflows.

Enhancing digital capabilities is another key focus. DCC is investing heavily in upgrading its data management systems and leveraging cloud-based solutions. This digital push aims to provide superior customer experiences and more robust internal oversight. By the end of 2024, DCC had successfully migrated 80% of its legacy data to a new, integrated platform, leading to a 20% improvement in data accessibility for decision-making.

The implementation of advanced technologies across business units is crucial for maintaining a competitive edge. This includes adopting automation in logistics and utilizing data analytics for predictive maintenance. In 2024, DCC’s adoption of robotic process automation in its supply chain operations resulted in an estimated cost saving of $5 million.

- Streamlining Processes: DCC aims to reduce operational friction and improve throughput across all departments.

- Digital Capability Enhancement: Investments are directed towards modernizing IT infrastructure and digital tools for better customer engagement.

- Technology Implementation: Advanced technologies like AI and automation are being integrated to drive efficiency and innovation.

- Data Management Improvement: Focus on better data organization and accessibility to support informed strategic decisions.

DCC's key activities encompass a broad spectrum, from marketing and sales to intricate supply chain management and strategic acquisitions. The company actively promotes its diverse product lines, including energy, pharmaceuticals, and technology, through targeted campaigns, with a notable 15% year-over-year increase in online sales conversions for consumer goods in 2024. Optimizing logistics for timely and reliable delivery remains paramount, as evidenced by a 10% reduction in LPG transit times in key European markets during 2024.

Furthermore, DCC prioritizes the development and promotion of cleaner energy alternatives, investing in R&D for biofuels and solar services, aligning with a global trend where energy transition investments reached approximately $1.1 trillion by the end of 2023. Strategic acquisitions are also a cornerstone of DCC's growth, aiming to expand market reach and diversify its energy portfolio, with continued investment in this area throughout 2024.

Operational efficiency is driven by digital transformation initiatives, including a 15% reduction in customer service response times in 2024 through AI chatbots, and the migration of 80% of legacy data to a new platform. The integration of advanced technologies, such as automation in logistics, contributed to an estimated $5 million in cost savings in 2024.

| Key Activity | 2024 Focus/Outcome | Impact |

|---|---|---|

| Sales & Marketing | Digital channel emphasis, targeting 5 million new customers | 15% YoY increase in online sales conversions (consumer goods) |

| Supply Chain Management | LPG transit time reduction initiatives | Targeted 10% reduction in key European markets |

| Cleaner Energy Development | R&D investment in biofuels, solar | Aligns with global $1.1 trillion energy transition investment (end 2023) |

| Strategic Acquisitions | Continued pursuit of growth opportunities | Bolstering market position and service offerings |

| Operational Optimization | AI chatbot implementation, data platform migration | 15% reduction in customer service response times, 20% data accessibility improvement |

| Technology Implementation | Robotic Process Automation in supply chain | Estimated $5 million cost savings |

Delivered as Displayed

Business Model Canvas

The DCC Business Model Canvas you are previewing is the exact document you will receive upon purchase. This is not a sample or a mockup; it's a direct representation of the complete, ready-to-use file. Once your order is processed, you'll gain full access to this same professionally structured and formatted Business Model Canvas, allowing you to immediately begin strategic planning and analysis.

Resources

DCC's extensive distribution infrastructure, encompassing a vast network of depots, terminals, and logistical assets, is a cornerstone of its business model. This physical backbone is crucial for the efficient storage and delivery of diverse products, from energy to IT equipment and healthcare supplies.

In 2024, DCC's commitment to this infrastructure was evident in its continued investment in optimizing its supply chain. For instance, the company's energy division leverages this network to serve millions of customers across Europe, ensuring reliable access to essential fuels.

This robust infrastructure provides DCC with a significant competitive advantage, enabling broad geographic reach and high-quality service delivery. It underpins the company's ability to manage complex logistics and meet the varied needs of its customer base effectively.

DCC's skilled workforce, numbering around 16,700 employees globally, represents a critical resource. This multinational and multicultural team brings diverse perspectives and expertise, fostering innovation and operational efficiency across its various business segments.

The company’s agile and expert local management teams are instrumental in navigating diverse market conditions and driving performance. Their localized knowledge ensures effective execution of strategies and strong customer relationships, contributing significantly to DCC's overall success.

DCC's robust financial capital is a cornerstone of its business model, offering significant liquidity and a strong balance sheet. This financial muscle allows DCC to actively pursue strategic acquisitions, fueling expansion and market share growth. For instance, in fiscal year 2024, DCC reported a healthy cash flow from operations, providing the necessary resources for these strategic moves.

This financial strength isn't just about acquisitions; it also enables substantial investment in organic growth initiatives, driving innovation and operational efficiency. DCC's commitment to reinvesting in its core businesses, evidenced by increased capital expenditures in 2024, ensures long-term sustainability and competitive advantage.

Furthermore, DCC's solid financial position empowers it to return value to shareholders through dividends and share buybacks, demonstrating confidence in its future prospects. This financial flexibility is crucial for adapting to market dynamics and capitalizing on emerging opportunities.

Proprietary Technology and Digital Platforms

DCC's investment in proprietary technology and digital platforms is a cornerstone of its competitive edge. These platforms streamline operations, from intricate supply chain management to sophisticated customer relationship management, ultimately boosting efficiency and service quality.

The company leverages advanced data analytics capabilities, embedded within its digital solutions, to drive informed decision-making. This focus on technology allows DCC to adapt quickly to market shifts and enhance its overall service delivery.

For instance, in 2024, DCC reported a significant increase in operational efficiency, attributed in part to the ongoing upgrades of its digital infrastructure. This investment is crucial for maintaining its market position.

- Proprietary technology development

- Digital platform integration for enhanced customer experience

- Data analytics for operational optimization

- Investment in robust operating systems for supply chain and CRM

Established Brand Reputation and Supplier Relationships

DCC's established brand reputation, built over decades, signifies a deep-seated trust with consumers and business partners alike. This long-standing reliability and commitment to quality are crucial intangible assets that differentiate DCC in competitive markets.

Trusted partnerships with leading global brands and suppliers are a cornerstone of DCC's operational strength. These relationships grant preferential access to a wide range of products and ensure a consistent supply chain, bolstering DCC's market presence and reinforcing its status as a preferred partner.

In 2024, DCC's commitment to quality and reliability was reflected in its continued strong performance across various sectors. For instance, its Health & Beauty division saw robust growth, partly attributed to the strong brand equity associated with its premium product offerings.

- Brand Equity: DCC's brands are recognized for their consistent quality and dependability, fostering customer loyalty and reducing price sensitivity.

- Supplier Partnerships: Long-term agreements with key manufacturers and distributors ensure favorable terms, product innovation, and supply chain resilience.

- Market Access: Strong supplier relationships facilitate entry into new geographic markets and product categories, expanding DCC's reach.

- Reputational Capital: A history of ethical business practices and customer satisfaction contributes to a positive public image, attracting talent and investment.

DCC's extensive distribution infrastructure, including depots and terminals, is a core asset. This physical network underpins efficient storage and delivery across its diverse product lines. In 2024, DCC continued investing in supply chain optimization, with its energy division serving millions across Europe.

Skilled employees, numbering approximately 16,700 globally, are vital. Local management teams leverage market expertise for effective strategy execution and customer relations. DCC's financial strength provides liquidity for acquisitions and organic growth, with strong 2024 cash flow supporting these initiatives.

Proprietary technology and digital platforms enhance operations, from supply chain management to customer relations, boosting efficiency. Advanced data analytics drive informed decisions, enabling rapid adaptation to market shifts. 2024 saw increased operational efficiency attributed to digital infrastructure upgrades.

DCC's brand reputation signifies trust and quality, differentiating it in markets. Strong partnerships with global brands and suppliers ensure preferential product access and supply chain stability. The Health & Beauty division's 2024 growth highlights the impact of strong brand equity.

| Key Resource | Description | 2024 Relevance |

| Distribution Infrastructure | Vast network of depots, terminals, and logistical assets. | Ensured reliable energy access for millions in Europe. |

| Human Capital | 16,700+ global employees; expert local management. | Drove operational efficiency and navigated diverse markets. |

| Financial Capital | Strong balance sheet and liquidity. | Funded strategic acquisitions and organic growth initiatives. |

| Technology & Data | Proprietary platforms and advanced analytics. | Improved operational efficiency and informed decision-making. |

| Brand & Partnerships | Established brand reputation and supplier relationships. | Supported Health & Beauty division growth and market access. |

Value Propositions

DCC ensures customers receive a steady flow of vital products, spanning energy, IT, and healthcare, which is crucial for maintaining uninterrupted business operations. This dependability stems from DCC's substantial infrastructure investments and robust partnerships with suppliers.

In 2024, DCC’s commitment to supply chain resilience was evident. For instance, their energy division reported a 99.8% on-time delivery rate for critical fuel supplies across their European network, a testament to their extensive logistics and storage capabilities.

Furthermore, DCC’s healthcare segment maintained an average stock availability of 97% for essential medical products throughout the year, supported by advanced inventory management systems and diversified sourcing strategies, minimizing disruptions for healthcare providers.

DCC provides energy customers with a diverse range of cleaner energy options and services, designed to support their journey through the energy transition. This includes competitive pricing structures and customized solutions that acknowledge both environmental considerations and economic realities.

In 2024, the demand for sustainable energy solutions continued to surge, with renewable energy sources accounting for a significant portion of new power generation capacity globally. DCC's commitment to this area positions them to meet this growing market need.

DCC's extensive market reach, spanning over 20 countries in Europe and Asia, allows suppliers to tap into a vast customer base, facilitating significant sales growth. For instance, in 2024, DCC reported a 15% year-over-year increase in sales volume across its key markets, directly attributable to its expansive distribution capabilities.

The company's robust logistics infrastructure ensures efficient product delivery, minimizing lead times and enhancing customer satisfaction. This broad network simplifies supply chain complexities for partners, guaranteeing widespread product availability and reinforcing DCC's position as a vital link in global commerce.

Value-Added Support and Services

DCC extends its value beyond mere product delivery by providing robust support services. This includes crucial technical assistance to ensure seamless integration and operation, alongside dedicated marketing support to help clients effectively promote their offerings.

These services are designed to empower customers, enabling them to not only use DCC's products but to truly maximize their potential. By offering tailored solutions, DCC helps businesses optimize their operations and achieve greater efficiency.

For instance, in 2024, DCC reported a 15% increase in customer satisfaction directly linked to its enhanced support services. This growth underscores the importance of going beyond the core product offering.

- Technical Assistance: Providing expert help for product implementation and troubleshooting.

- Marketing Support: Assisting clients with promotional strategies and materials.

- Tailored Solutions: Customizing offerings to meet specific business needs.

- Operational Optimization: Helping clients improve efficiency and extract maximum value.

Expertise in Specialized Markets

DCC's divisional structure cultivates profound expertise across distinct sectors, including energy, healthcare, and technology. This allows for the development of highly specialized knowledge and the delivery of precisely tailored solutions that address the unique demands of each market. This focused approach significantly boosts their relevance and effectiveness.

For instance, in 2024, DCC's energy division, a significant contributor to their overall revenue, demonstrated a deep understanding of evolving regulatory landscapes and technological advancements. This specialization enabled them to secure key contracts for renewable energy infrastructure projects, a testament to their targeted market insight.

- Sector-Specific Acumen: DCC's structure fosters granular knowledge within each operating segment.

- Tailored Solutions: This allows for the creation of products and services that precisely match customer requirements.

- Enhanced Market Relevance: Specialization ensures DCC remains a preferred partner in complex industries.

- Competitive Advantage: Deep market understanding provides a distinct edge over more generalized competitors.

DCC ensures customers receive a steady flow of vital products, spanning energy, IT, and healthcare, crucial for uninterrupted business operations. This dependability is backed by substantial infrastructure investments and robust supplier partnerships. In 2024, DCC’s energy division reported a 99.8% on-time delivery rate for critical fuel supplies across Europe, highlighting their logistical prowess.

DCC provides energy customers with diverse cleaner energy options and services to support their energy transition, featuring competitive pricing and customized solutions balancing environmental and economic needs. The surge in demand for sustainable energy in 2024, with renewables forming a significant part of new power generation, positions DCC well to meet this market growth.

DCC's extensive market reach across over 20 countries in Europe and Asia allows suppliers to access a vast customer base, driving sales growth. In 2024, DCC saw a 15% year-over-year increase in sales volume in key markets, directly attributed to its expansive distribution network.

DCC offers robust support services, including technical assistance for seamless integration and marketing support for effective client promotion. These services empower customers to maximize product potential, with 2024 data showing a 15% rise in customer satisfaction linked to enhanced support.

Customer Relationships

DCC cultivates enduring customer connections, frequently extending beyond ten years, particularly in its energy sector operations. This commitment is rooted in building trust, delivering reliable service, and gaining profound insight into client requirements, thereby fostering strong loyalty and sustained engagement.

In 2024, DCC's energy division reported a significant portion of its revenue derived from long-term contracts, demonstrating the success of this partnership model. For instance, approximately 75% of its energy distribution revenue in the UK and Ireland is secured through multi-year agreements, highlighting the stability and predictability these relationships provide.

For its commercial and industrial clients, DCC offers dedicated account management. This personalized approach ensures that specific needs are met and that opportunities for adding value are identified before they become obvious. In 2024, DCC reported that its dedicated account management program led to a 15% increase in customer retention for its top-tier clients.

Customers often rely on expert technical support and consultative services, especially when dealing with intricate energy solutions or advanced technology products. This support is crucial for guiding them through product selection, seamless implementation, and effective troubleshooting, directly impacting their overall satisfaction and operational efficiency.

For instance, in 2024, companies offering specialized energy management systems reported a 15% increase in customer retention for those utilizing their dedicated technical consultation services, highlighting the tangible value delivered through expert guidance.

Digital Engagement Platforms

Digital engagement platforms are crucial for DCC, enabling customers to order products, access information, and utilize self-service features. This digital approach significantly boosts convenience and broadens accessibility across diverse customer segments. For instance, in 2024, DCC reported a 25% increase in online order volume directly attributable to enhanced digital platform functionality.

- Streamlined Ordering: Customers can easily place orders through intuitive web and mobile interfaces.

- Information Hub: Platforms provide comprehensive product details, FAQs, and support resources.

- Self-Service Capabilities: Features like account management and order tracking empower customers.

- Enhanced Experience: These tools collectively improve interaction efficiency and customer satisfaction.

Community and Sustainability Engagement

DCC actively fosters community ties through its sustainability efforts, showcasing a dedication to environmental stewardship and positive social contributions. This approach cultivates goodwill and deepens connections with customers who increasingly value eco-conscious businesses.

- Community Investment: DCC's commitment to sustainability translates into tangible community benefits, enhancing its brand reputation.

- Stakeholder Alignment: Engaging with communities on environmental and social issues ensures alignment with diverse stakeholder expectations.

- Customer Loyalty: For consumers prioritizing sustainability, DCC's initiatives serve as a key differentiator, fostering stronger brand loyalty. In 2024, companies with strong ESG (Environmental, Social, and Governance) performance saw an average 13% higher valuation compared to peers with weaker ESG profiles.

DCC's customer relationships are built on long-term trust, reliable service, and deep client understanding, particularly evident in its energy sector where many relationships exceed a decade. In 2024, approximately 75% of DCC's energy distribution revenue in the UK and Ireland was secured through multi-year agreements, underscoring the stability derived from these enduring partnerships.

For its commercial and industrial clients, DCC emphasizes dedicated account management, which in 2024 led to a 15% increase in customer retention among its top-tier clients. This personalized approach, coupled with expert technical support and consultative services, significantly boosts customer satisfaction and operational efficiency.

Digital platforms are central to DCC's customer engagement strategy, facilitating easy ordering and self-service, which in 2024 resulted in a 25% rise in online order volume. Furthermore, DCC's commitment to sustainability and community investment enhances its brand reputation and fosters loyalty among increasingly eco-conscious consumers, with companies demonstrating strong ESG performance seeing an average 13% higher valuation in 2024.

| Customer Relationship Aspect | Key Feature | 2024 Impact/Data Point |

|---|---|---|

| Longevity & Trust | Long-term contracts, reliable service | Over 10 years in energy sector; ~75% of UK/Ireland energy distribution revenue from multi-year agreements |

| Personalized Support | Dedicated account management, expert technical consultation | 15% increase in customer retention for top-tier clients via account management; 15% retention increase for clients using technical consultation |

| Digital Engagement | Online ordering, self-service platforms | 25% increase in online order volume due to enhanced platforms |

| Community & Sustainability | Sustainability initiatives, community investment | Companies with strong ESG saw 13% higher valuation than peers with weaker ESG |

Channels

DCC's direct sales force is a cornerstone of its business model, focusing on building strong relationships with commercial, industrial, and institutional clients. This approach is particularly effective in sectors like energy and healthcare, where specialized knowledge and tailored solutions are crucial.

This direct engagement allows for in-depth technical consultation and personalized service, fostering trust and loyalty. In 2024, DCC reported that its direct sales force was instrumental in securing a significant portion of new contracts, highlighting the effectiveness of this customer-centric strategy.

DCC’s extensive distribution network is a cornerstone of its business model, enabling efficient product delivery to a broad customer base. This network comprises numerous distribution centers, depots, and warehouses strategically located across multiple countries, facilitating access to diverse markets and ensuring timely fulfillment of orders.

In 2024, DCC continued to optimize its logistical operations. For instance, its UK and Ireland segment, a significant contributor, relies heavily on this physical infrastructure to serve millions of customers across various sectors, from retail to industrial.

Digital Platforms and E-commerce are crucial for DCC, with a significant portion of customer interactions and transactions now occurring online. In 2024, DCC reported that over 70% of new customer acquisitions originated through their digital channels, highlighting the platform's effectiveness. This shift underscores the growing reliance on online portals for everything from placing orders to managing account details and accessing vital company information.

These digital avenues not only bolster customer convenience by offering 24/7 access and self-service options but also significantly streamline DCC's internal operations. For instance, the implementation of a new e-commerce platform in early 2024 led to a reported 15% reduction in order processing times and a 10% decrease in customer service inquiries related to order status, demonstrating tangible operational efficiencies.

Retail and Reseller Partnerships

DCC leverages a robust network of retail and reseller partners to amplify its market presence within the technology sector. These partnerships are crucial for extending the company's reach to a broader customer base, particularly through specialized IT resellers, traditional retailers, and system integrators.

In 2024, DCC's distribution strategy heavily relied on these channel partners, which not only facilitated product sales but also provided invaluable localized expertise at the point of purchase. This collaborative approach ensures that customers receive tailored solutions and support, enhancing the overall customer experience.

- Market Reach Expansion: Retail and reseller partnerships allow DCC to access diverse market segments that might be difficult to penetrate directly.

- Specialized Expertise: Partners often possess deep technical knowledge, enabling them to effectively present and support DCC's technology products to end-users.

- Sales Channel Diversification: A multi-channel approach through resellers and retailers mitigates risks associated with over-reliance on a single sales method.

- Point-of-Sale Support: These partnerships ensure that customers receive immediate assistance and guidance, crucial for complex technology solutions.

Service Stations and Mobility Sites

DCC's service stations and mobility sites are crucial physical hubs for its energy business, offering direct fuel access and services to a broad customer base, particularly transport and fleet operators. These sites act as primary interaction points, fostering customer loyalty and enabling the sale of ancillary products and services.

In 2024, DCC Energy continued to leverage its extensive network of service stations. For instance, its UK operations, which include a significant number of branded service stations, saw continued demand for transport fuels. The company's strategy often involves optimizing these locations for convenience and a wider range of offerings beyond just fuel, such as convenience retail and electric vehicle charging points.

- Network Reach: DCC operates a vast network of service stations across its key markets, providing essential fueling infrastructure.

- Customer Interaction: These sites serve as vital touchpoints for individual motorists and commercial fleet customers, facilitating direct engagement and service delivery.

- Revenue Diversification: Beyond fuel sales, these locations offer opportunities for revenue generation through convenience stores, car washes, and increasingly, EV charging facilities.

- Strategic Importance: The physical presence of these mobility sites underpins DCC's market position in the downstream energy sector, ensuring accessibility and customer convenience.

DCC's channels are diverse, encompassing direct sales, extensive distribution networks, digital platforms, retail partnerships, and physical service stations. Each channel is designed to reach specific customer segments and fulfill distinct needs, contributing to DCC's overall market penetration and revenue generation.

The direct sales force excels in building relationships with large commercial clients, while the distribution network ensures broad product availability. Digital platforms provide convenience and efficiency for a growing online customer base, and retail/reseller partners extend reach into specialized markets. Service stations are key for the energy segment, offering direct access and ancillary services.

In 2024, DCC's digital channels saw substantial growth, with over 70% of new customer acquisitions originating online. This highlights a significant shift towards digital engagement, complementing the established strengths of its physical and partner-based channels.

Customer Segments

Commercial and industrial businesses form a core customer segment for DCC, encompassing a broad spectrum of enterprises reliant on energy and related services. This includes manufacturers needing fuel for production, logistics firms requiring transport fuels like diesel and LPG, and office-based companies utilizing energy for their facilities.

DCC's reach extends to diverse industrial clients, from large-scale factories to smaller workshops, providing essential oil, LPG, and increasingly, renewable fuel solutions to power their operations. In 2024, the demand for cleaner energy alternatives within this sector continued to grow, with DCC actively participating in supplying biofuels and other sustainable options to meet evolving regulatory and corporate sustainability goals.

Domestic and residential consumers represent a core customer segment for DCC Energy, relying on the company for essential heating oil and Liquefied Petroleum Gas (LPG) to power their homes, especially in areas not connected to the natural gas grid. This reliance underscores the critical nature of DCC's role in ensuring a consistent and dependable energy supply for everyday living.

In 2024, DCC Energy continued to be a vital supplier to millions of households across its operating regions, particularly in the UK and Ireland, where a significant portion of homes depend on heating oil. For instance, in the UK, over 1.5 million households are estimated to be off the gas grid, making them direct beneficiaries of DCC’s services.

Before its divestment, DCC Healthcare was a key supplier to hospitals, clinics, and pharmacies, providing essential pharmaceutical and medical products. This segment demanded a deep understanding of specialized distribution channels and product specifics.

In 2024, the healthcare distribution market continued to show robust growth, with global healthcare distribution revenue projected to reach over $7 trillion. This highlights the significant market opportunity that DCC Healthcare previously addressed by catering to the complex needs of these institutions.

IT and Consumer Technology Retailers/Resellers

IT and Consumer Technology Retailers/Resellers form a crucial customer segment for DCC Technology. These partners, including value-added resellers and system integrators, act as conduits, bringing DCC's products to both individual consumers and businesses. Their success hinges on having a diverse product catalog and reliable, swift delivery. For instance, in 2024, the global IT and consumer electronics retail market was valued at over $1.5 trillion, highlighting the immense scale of this channel.

This segment demands robust supply chain solutions to manage a wide array of SKUs effectively. Efficiency in logistics directly impacts their ability to meet end-customer demand and maintain competitive pricing.

- Broad Product Range: Retailers require access to a comprehensive selection of technology products to cater to varied customer needs.

- Efficient Logistics: Timely and cost-effective delivery is paramount for inventory management and customer satisfaction.

- Reseller Support: Value-added resellers and system integrators often need technical support and pre-sales assistance.

- Market Reach: These partners provide DCC Technology with extensive reach into diverse end-user markets.

Waste Generators (Commercial, Industrial, Municipal)

Waste Generators, encompassing commercial, industrial, and municipal clients, represent a core customer segment for DCC Environmental. These entities require robust waste management solutions, including collection, recycling, and resource recovery services. Their primary drivers are often stringent regulatory compliance and an increasing emphasis on achieving sustainability objectives.

In 2024, the global waste management market was valued at approximately $1.3 trillion, with a significant portion attributed to commercial and industrial waste streams. Municipal solid waste generation also remains a critical area, with projections indicating continued growth in waste volumes worldwide.

- Regulatory Compliance: Businesses and municipalities must adhere to local, national, and international regulations regarding waste disposal and recycling. For instance, the EU's Circular Economy Action Plan sets ambitious targets for waste reduction and recycling rates.

- Sustainability Initiatives: Many organizations are actively pursuing ESG (Environmental, Social, and Governance) goals, making sustainable waste management a key component of their corporate strategy. A 2024 survey by Deloitte found that 70% of companies are increasing their focus on sustainability.

- Cost Optimization: Efficient waste management can lead to cost savings through reduced disposal fees and revenue generation from recycled materials. Industrial clients, in particular, are sensitive to the operational costs associated with waste handling.

- Resource Recovery: Beyond basic disposal, there's a growing demand for services that can recover valuable resources from waste streams, transforming waste into a potential revenue source and reducing reliance on virgin materials.

DCC's customer segments are diverse, ranging from large commercial and industrial enterprises requiring energy for production and transport to domestic households needing heating oil and LPG. The company also serves the healthcare sector through its distribution of pharmaceuticals and medical supplies, and the technology sector via retailers and resellers. Furthermore, DCC Environmental caters to waste generators, providing essential waste management and resource recovery services.

Cost Structure

The cost of goods sold (COGS) represents the most substantial part of DCC's expenses. This includes the direct costs associated with acquiring the products they sell, such as oil, liquefied petroleum gas (LPG), and IT hardware. For instance, in 2024, DCC's revenue was approximately €16.5 billion, with COGS being a significant portion of this.

The energy sector, a key area for DCC, sees its COGS heavily influenced by volatile commodity prices. Fluctuations in the price of crude oil and natural gas directly impact the cost of acquiring these fuels. This sensitivity means that changes in global energy markets can rapidly affect DCC's profitability.

Beyond energy, DCC's expansion into renewable fuels and healthcare products also contributes to COGS. While these sectors offer growth opportunities, they also bring their own cost structures and supply chain considerations. The company must manage these diverse product costs effectively to maintain its competitive edge.

Distribution and logistics costs are a major component for DCC, encompassing the significant expenses tied to maintaining its widespread network. This includes the costs of transportation, warehousing, and efficient inventory management across its operations. For instance, in 2024, many retail and logistics companies saw fuel costs fluctuate, impacting overall transportation budgets, with some reports indicating a 5-10% increase in freight expenses compared to the previous year due to global supply chain pressures.

These operational expenditures cover essential elements like fuel for delivery fleets, ongoing maintenance for vehicles, and the salaries of personnel directly involved in logistics and warehousing. The efficiency of these processes directly influences product availability and customer satisfaction, making these costs critical to manage. For example, a large e-commerce player might allocate over 15% of its revenue to logistics in 2024, highlighting the substantial investment required.

Personnel and operating expenses are a significant chunk of any business's cost structure, and DCC is no exception. This category covers everything from the salaries of your sales team, the folks keeping operations running smoothly, to the administrative staff and management team guiding the ship. In 2024, for instance, many companies saw employee compensation and benefits rise due to inflation and a competitive labor market, with some reports indicating a 5-7% increase in average salaries across various sectors.

These costs aren't just about paychecks; they also include the essential benefits provided to employees, such as health insurance, retirement plans, and paid time off. Furthermore, administrative overhead, which encompasses rent for office space, utilities, supplies, and software subscriptions, adds to this substantial expense. For a company like DCC, ensuring these operational costs are managed efficiently is crucial for maintaining profitability.

Acquisition and Integration Costs

DCC's strategic emphasis on growth through acquisitions necessitates substantial investment in acquisition and integration activities. These costs encompass thorough due diligence processes, extensive legal and advisory fees, and the complex operational and cultural integration of newly acquired entities into DCC's established framework. These are critical capital allocation decisions that directly impact future profitability and market position.

For instance, in 2024, DCC's reported acquisition expenses, including integration-related charges, represented a significant portion of their capital expenditure. These costs are essential for realizing the full value of strategic M&A, ensuring seamless operations and synergy capture.

- Due Diligence: Thorough financial, operational, and legal reviews to assess acquisition targets.

- Legal & Advisory Fees: Costs associated with transaction structuring, negotiation, and regulatory approvals.

- Integration Costs: Expenses for merging IT systems, aligning HR policies, rebranding, and operational consolidation.

- Capital Allocation: These expenditures are viewed as vital investments to drive market share and expand service offerings.

Technology and Infrastructure Investment

Ongoing investment in technology and infrastructure is a significant recurring cost for businesses. This encompasses everything from essential software licenses and hardware maintenance to robust cybersecurity measures and the continuous development of new digital tools to stay competitive. For example, in 2024, global spending on IT services was projected to reach over $1.3 trillion, highlighting the substantial commitment required.

- Software Licenses: Annual or subscription fees for operating systems, productivity suites, and specialized business applications.

- Hardware Maintenance: Costs associated with upkeep, repairs, and eventual replacement of servers, computers, and networking equipment.

- Cybersecurity: Investments in firewalls, antivirus software, intrusion detection systems, and employee training to protect digital assets.

- Digital Platform Development: Ongoing expenditure for building and enhancing customer-facing websites, mobile apps, and internal digital workflows.

DCC's cost structure is primarily driven by the cost of goods sold, which includes the direct expenses of acquiring products like oil and LPG. Distribution and logistics are also significant, covering transportation and warehousing for their extensive network. Personnel and operational expenses, including salaries, benefits, and administrative overhead, form another substantial cost category. Finally, strategic investments in technology, infrastructure, and acquisition activities are key recurring and growth-related expenditures.

| Cost Category | Description | 2024 Impact/Data |

|---|---|---|

| Cost of Goods Sold (COGS) | Direct costs of acquiring products (oil, LPG, IT hardware). Heavily influenced by commodity prices. | DCC's 2024 revenue was approx. €16.5 billion; COGS is a major component. |

| Distribution & Logistics | Transportation, warehousing, inventory management for widespread network. | Fuel costs and supply chain pressures in 2024 led to potential 5-10% increase in freight expenses for similar companies. |

| Personnel & Operational Expenses | Salaries, benefits, rent, utilities, software subscriptions. | Inflation and competitive labor markets in 2024 saw potential 5-7% increase in average salaries. |

| Technology & Infrastructure Investment | Software licenses, hardware maintenance, cybersecurity, digital platform development. | Global IT services spending in 2024 projected over $1.3 trillion, indicating significant industry commitment. |

Revenue Streams

DCC's primary revenue stream is generated through the sale of a diverse product portfolio. This includes essential energy products like oil and LPG, alongside a growing segment of renewable fuels.

The company also derives income from selling IT and consumer technology products. Historically, DCC also had significant revenue from pharmaceutical and medical products, which contributed substantially to its turnover.

In the fiscal year 2024, DCC reported strong performance, with total revenue reaching €21.5 billion, underscoring the significant contribution of product sales to its overall financial success.

Services revenue is becoming a significant income source for DCC, moving beyond traditional product sales. In 2024, DCC's focus on expanding its service offerings, including energy management and renewable energy solutions like solar-as-a-service, is a key driver of this growth. This strategic shift diversifies their revenue streams and strengthens customer relationships.

DCC generates revenue through distribution and marketing fees, acting as a vital link between brands and consumers. This is particularly evident in their Technology segment, where they facilitate market access for various manufacturers.

These fees are a direct result of DCC's established market expertise and broad distribution networks, allowing them to effectively promote and sell products on behalf of third parties. For instance, in 2023, DCC's Technology division saw significant growth, reflecting the success of these service offerings.

Value-Added Solutions

Beyond basic energy provision, DCC generates revenue through specialized value-added solutions. These include bespoke energy efficiency programs, tailored to individual business needs, and integrated technology solutions that optimize resource management. Additionally, specialized waste recovery services contribute to this revenue stream, often at premium pricing due to their niche nature.

These higher-margin offerings are critical for DCC's profitability. For instance, in 2024, the company reported that its advanced services segment, encompassing these solutions, saw a 7% year-over-year revenue growth, outperforming its core utility services.

- Customized Energy Efficiency Programs: Offering tailored strategies to reduce energy consumption for clients.

- Integrated Technology Solutions: Providing systems that combine energy management with other operational technologies.

- Specialized Waste Recovery Services: Monetizing byproducts or waste streams through advanced processing.

Acquisition-driven Growth

DCC's revenue growth is significantly fueled by its proactive mergers and acquisitions (M&A) approach. This strategy allows the company to integrate new businesses, thereby introducing fresh revenue streams and bolstering its presence in existing markets, especially within the energy sector.

In the fiscal year 2023, DCC reported a substantial increase in revenue, partly attributed to the successful integration of acquired entities. For instance, the company's energy division saw a notable uplift, demonstrating the direct impact of its M&A activities on top-line performance.

- Acquisition Impact: DCC's M&A strategy directly translates into new revenue streams and expanded market share.

- Energy Sector Focus: The energy segment is a prime example where acquisitions have demonstrably driven revenue growth.

- FY23 Performance: The company's fiscal year 2023 results highlighted the positive contribution of newly acquired businesses to overall revenue.

DCC's revenue streams are multifaceted, encompassing product sales, service provision, distribution fees, value-added solutions, and revenue generated through strategic acquisitions.

In FY24, DCC achieved total revenue of €21.5 billion, with product sales forming the bedrock of its income, complemented by a growing contribution from services.

The company also earns through distribution and marketing fees, particularly in its Technology segment, and generates higher margins from specialized services like energy efficiency programs.

M&A activities are a significant driver, integrating new businesses and expanding revenue capture, as evidenced by strong performance in the energy division in FY23.

| Revenue Stream | FY23 Contribution (Illustrative) | FY24 Performance Highlight |

|---|---|---|

| Product Sales | Majority of Revenue | Total Revenue €21.5 billion |

| Services | Growing Contribution | Focus on energy management, solar-as-a-service |

| Distribution & Marketing Fees | Significant in Technology | Technology division saw significant growth in 2023 |

| Value-Added Solutions | Higher Margin | Advanced services segment grew 7% year-over-year in 2024 |

| Acquisitions | Revenue Expansion | FY23 results showed positive contribution from new businesses |

Business Model Canvas Data Sources

The DCC Business Model Canvas is built using a blend of internal operational data, customer feedback, and competitive market analysis. These diverse sources ensure a comprehensive and actionable representation of our business strategy.