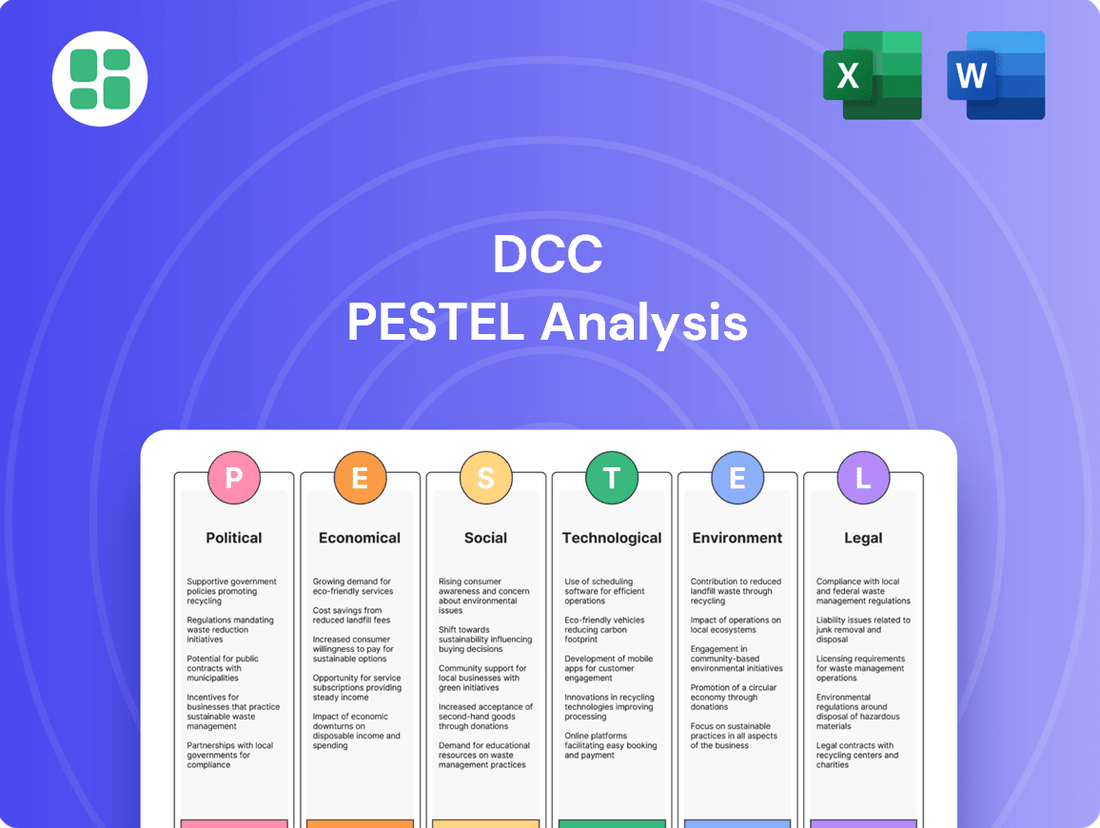

DCC PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

DCC Bundle

Uncover the critical political, economic, social, technological, legal, and environmental factors shaping DCC's future. Our comprehensive PESTLE analysis provides the actionable intelligence you need to anticipate market shifts and capitalize on opportunities. Download the full report now to gain a strategic advantage.

Political factors

Governments worldwide are actively pushing for an energy transition, offering incentives like subsidies for renewables and implementing carbon taxes. This creates a favorable environment for companies like DCC Energy to invest in sustainable alternatives.

DCC Energy is strategically aligning with these trends, evident in their significant investments in biofuels such as hydrotreated vegetable oil (HVO) and their expansion into solar energy solutions. These moves are designed to capitalize on the growing demand for cleaner energy sources.

The company has set ambitious targets to double its profits while simultaneously cutting its carbon emissions by half by 2030, a clear demonstration of how government policy is shaping corporate strategy and driving operational changes towards sustainability.

Healthcare regulatory changes significantly impact companies like DCC. For example, ongoing discussions around drug pricing controls in the US, a major market for many healthcare firms, could affect revenue streams. Similarly, evolving medical device approval processes, such as those managed by the FDA, can influence time-to-market and R&D investment decisions.

In 2024, the healthcare sector continued to see a focus on data privacy. Updates to regulations like HIPAA in the United States are strengthening cybersecurity requirements for electronic health information. This necessitates ongoing investment in compliance and robust data protection measures for companies operating within this space.

Global trade policies, including potential tariffs from major economies like the United States, pose a significant risk to DCC Technology's international distribution of IT and consumer electronics. For instance, the US imposed tariffs on goods from China, impacting many tech components.

These trade measures can disrupt DCC's established supply chains, leading to increased import costs for components and finished products. This necessitates strategic adjustments to its international distribution networks to mitigate the financial impact and maintain competitive pricing.

Environmental Legislation and Waste Management

Evolving environmental legislation, such as the EU Green Deal and national waste management plans, is increasingly shaping the operational landscape for companies like DCC. These regulations impose stricter requirements on recycling, waste reduction, and resource recovery, directly impacting how DCC manages its waste streams and resources.

DCC Environmental must actively navigate these evolving regulations, which include mandates for circular economy practices and more rigorous hazardous waste management plans. For instance, the EU's Circular Economy Action Plan, updated in 2024, emphasizes extended producer responsibility and targets for recycled content in various products, requiring significant adaptation in supply chains and product design.

- Stricter Recycling Mandates: Compliance with targets for plastic packaging recycling, aiming for 55% by 2030 under revised EU directives.

- Waste Reduction Targets: Adherence to national goals for reducing landfill waste, with some countries setting targets below 10% by 2030.

- Circular Economy Integration: Implementing strategies for product longevity, repairability, and the use of recycled materials, driven by policies promoting a closed-loop system.

- Hazardous Waste Management: Ensuring compliance with updated regulations on the identification, tracking, and disposal of hazardous materials, with increased penalties for non-compliance.

Political Stability in Key Operating Markets

Political stability across DCC's 22 operating markets is a critical factor. Geopolitical tensions, such as those observed in Eastern Europe and the Middle East throughout 2024 and into early 2025, can significantly impact market sentiment and create regulatory uncertainty. This instability directly affects DCC's ability to maintain consistent operations and manage investment risks across its diverse portfolio.

Global economic outlooks from institutions like the IMF in late 2024 consistently pointed to ongoing geopolitical risks as a drag on international trade and investment flows. For DCC, this translates to potential disruptions for its various divisions, from energy sales to healthcare and environmental services, as supply chains and consumer demand become less predictable.

- Geopolitical Risk Impact: Increased geopolitical tensions in key regions where DCC operates can lead to heightened operational costs and potential supply chain disruptions.

- Regulatory Uncertainty: Political instability often correlates with changes in regulatory frameworks, creating challenges for DCC's compliance and strategic planning.

- Market Confidence: Fluctuations in political stability directly influence investor and consumer confidence, impacting demand for DCC's products and services.

- Trade and Investment Flows: Global economic forecasts for 2024-2025 indicate that geopolitical events continue to pose a threat to smooth international trade and investment, a critical area for DCC's diversified business model.

Governmental support for renewable energy, including tax credits and subsidies, is a significant political driver for DCC Energy. For instance, the US Inflation Reduction Act of 2022, with its extended tax credits for clean energy projects, continues to shape investment decisions into 2025. This policy environment encourages DCC's expansion into biofuels and solar power.

Healthcare policy, particularly regarding drug pricing and medical device approvals, directly influences DCC Healthcare's market access and profitability. The ongoing debate around price negotiations for pharmaceuticals in the US, which gained momentum in 2024, could impact revenue streams for companies supplying these markets.

Trade policies and geopolitical stability are critical for DCC Technology and DCC Environmental. Tariffs imposed on technology components, a concern throughout 2024, can increase costs. Furthermore, political instability in regions where DCC operates can disrupt supply chains and create regulatory uncertainty, impacting market confidence and investment.

| Policy Area | Impact on DCC | Example/Data (2024-2025) |

|---|---|---|

| Renewable Energy Incentives | DCC Energy investment in biofuels and solar | US IRA tax credits extending through 2030; EU Green Deal targets driving demand for cleaner fuels. |

| Healthcare Regulation | Revenue and market access for DCC Healthcare | US Medicare drug price negotiation discussions impacting pharmaceutical revenues; FDA evolving approval timelines for medical devices. |

| Global Trade Policies | Supply chain costs and distribution for DCC Technology | Continued impact of US tariffs on Chinese tech imports; geopolitical tensions affecting global trade routes. |

| Environmental Legislation | Waste management and circular economy practices for DCC Environmental | EU Circular Economy Action Plan updates in 2024, setting higher recycling targets for plastics (aiming for 55% by 2030). |

What is included in the product

This DCC PESTLE analysis examines the influence of Political, Economic, Social, Technological, Environmental, and Legal factors on the organization's strategic landscape.

Provides a concise version that can be dropped into PowerPoints or used in group planning sessions, simplifying complex external factors into actionable insights.

Economic factors

The global economic growth trajectory directly impacts demand for DCC's diverse product lines. Projections indicate a slowdown in global growth from an estimated 3.3% in 2024 to 2.9% in 2025, a factor that could temper overall market expansion.

However, the economic landscape presents a mixed picture for DCC. A robust US economy is expected to provide a stable demand base, while a potential recovery in Europe could open up new avenues for growth, offsetting some of the global slowdown concerns.

Recession risks, though present, are being closely monitored. A significant downturn could lead to reduced consumer spending and business investment, directly affecting DCC's revenue streams across various segments.

Persistent inflation continues to be a significant factor for DCC, directly impacting its diverse operations. For instance, rising fuel prices, a direct consequence of inflation, increase the cost of energy distribution, a core business for the company. Similarly, logistics expenses for its healthcare and technology segments are also elevated by inflationary pressures.

While projections from the International Monetary Fund (IMF) in their October 2024 World Economic Outlook suggest a moderation in headline inflation across G20 economies, the lingering effects of past price increases and potential for renewed spikes mean inflationary pressures remain a concern for DCC's profitability throughout 2024 and into 2025.

Changes in interest rates by central banks directly impact DCC's borrowing costs for crucial acquisitions and investments, influencing the overall investment climate. For instance, if the Bank of England maintains its bank rate at 5.25% through 2024, as it has, it signifies a higher cost for DCC's debt financing.

Conversely, downward adjustments in interest rates, a prospect for some economies in 2025, could significantly bolster private demand and encourage new investment by making borrowing cheaper.

Currency Exchange Rate Volatility

Currency exchange rate volatility presents a significant challenge for DCC plc, an international group. Fluctuations in foreign exchange markets can directly impact the reported revenues and profits derived from its diverse global operations. For instance, a strengthening US dollar, a trend observed throughout much of 2024, can create headwinds for companies with substantial overseas earnings when translated back into the reporting currency.

The impact of these currency movements is not merely theoretical; it directly affects DCC's financial performance. For example, if DCC generates a significant portion of its revenue in Euros and the Euro weakens against the Pound Sterling, those Euro revenues will translate into fewer Pounds, negatively impacting reported profitability. Conversely, a weaker Pound could boost reported earnings from operations in countries with stronger currencies.

- Impact on Reported Earnings: DCC's consolidated financial statements reflect revenues and profits earned in various currencies. When these currencies fluctuate against DCC's reporting currency (likely GBP), the reported figures can be significantly altered, creating a disconnect from the underlying operational performance.

- Headwinds and Tailwinds: A strong reporting currency can act as a headwind, reducing the Pounds Sterling value of foreign earnings. Conversely, a weaker reporting currency can provide a tailwind, increasing the Pounds Sterling value of those same earnings.

- 2024/2025 Considerations: Throughout 2024 and into early 2025, the US dollar has exhibited considerable strength against many major currencies. This trend would have likely presented a headwind for DCC's reported results if a significant portion of its earnings were denominated in currencies that weakened against the dollar, or if the dollar strengthened against the Pound Sterling.

Supply Chain Disruptions

Ongoing risks from supply chain disruptions, driven by geopolitical tensions and economic volatility, continue to affect the availability and pricing of products within DCC's Technology and Healthcare segments. For instance, the semiconductor shortage, a lingering effect of pandemic-related disruptions and increased demand, impacted electronics manufacturing globally throughout 2023 and into early 2024, potentially affecting DCC's technology offerings.

To navigate these challenges, DCC's reliance on efficient logistics and advanced real-time tracking technologies is paramount. These tools are essential for mitigating the impact of unforeseen delays and ensuring product continuity. The global logistics market, valued at over $10 trillion in 2023, underscores the critical nature of these operations.

- Geopolitical Instability: Events like the ongoing conflict in Eastern Europe can disrupt energy supplies and raw material sourcing, directly impacting manufacturing costs and lead times for businesses like DCC.

- Economic Shifts: Inflationary pressures and currency fluctuations, prevalent in 2024, can significantly alter the cost of goods and transportation, necessitating agile supply chain management.

- Technological Solutions: Investments in digital supply chain platforms and AI-driven forecasting are becoming standard for companies to enhance visibility and responsiveness to disruptions.

- Sector Impact: The healthcare sector, in particular, faces heightened scrutiny regarding the reliability of its supply chains for essential medicines and medical devices, a factor DCC Healthcare must continuously address.

The global economic outlook for 2024-2025 presents a nuanced backdrop for DCC. While overall global growth is projected to moderate, specific regional strengths, particularly in the US, offer a degree of stability. However, persistent inflation and fluctuating interest rates remain key concerns, directly impacting operational costs and financing for DCC's diverse business segments.

Currency volatility also poses a significant challenge, with a strong US dollar potentially impacting the translation of overseas earnings. DCC's ability to manage these economic headwinds through efficient operations and strategic financial management will be crucial for maintaining profitability and supporting growth initiatives throughout the forecast period.

| Economic Factor | 2024 Projection/Status | 2025 Projection | Impact on DCC |

| Global GDP Growth | ~3.3% (estimated) | ~2.9% (projected) | Tempered overall market demand |

| US Economic Strength | Robust | Expected to remain stable | Provides a stable demand base |

| European Economic Recovery | Potential | Potential for growth | Opens new avenues for growth |

| Inflation (G20 headline) | Moderating but persistent | Continued moderation expected | Elevated operating and logistics costs |

| Bank of England Bank Rate | 5.25% (maintained) | Potential for adjustments | Higher borrowing costs; potential for cheaper financing |

| US Dollar Strength | Considerable strength | Potential continued strength | Headwind for reported overseas earnings |

Preview Before You Purchase

DCC PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive DCC PESTLE analysis covers all critical external factors influencing your business. You'll gain actionable insights into Political, Economic, Social, Technological, Legal, and Environmental aspects.

Sociological factors

Consumers are increasingly prioritizing environmental and social impact, with a significant portion willing to pay a premium for sustainable goods and services. This growing demand is a powerful driver for businesses to adopt greener practices. For instance, a 2024 NielsenIQ report indicated that 73% of global consumers would change their consumption habits to reduce their environmental impact, and 48% said they would pay more for sustainable products.

This societal shift directly benefits DCC's strategic direction, particularly within DCC Energy's focus on cleaner energy alternatives and DCC Environmental's expansion of recycling and waste management solutions. The market for sustainable products is not just a niche; it's becoming mainstream, influencing purchasing decisions across various sectors.

The world's population is getting older, and people are paying more attention to their health and taking care of themselves. This means there's a bigger demand for things like healthcare products, ways to prevent sickness, and products that help people feel better. For instance, the global health and wellness market was valued at over $4.4 trillion in 2023 and is projected to reach $6.6 trillion by 2028, showing a significant upward trend.

This aging population and the growing focus on wellbeing create excellent opportunities for companies like DCC Healthcare, which specializes in making nutritional supplements and medical products. As more individuals prioritize preventative health measures, the market for scientifically backed supplements and advanced medical devices is expected to expand considerably, benefiting companies well-positioned in these sectors.

Digital literacy is soaring globally, with an estimated 5.3 billion internet users by early 2024, a significant increase from previous years. This widespread adoption of technology directly shapes how consumers interact with products and services, impacting demand for IT hardware and software distributed by DCC Technology. For instance, the increasing reliance on smart devices and online platforms means DCC Technology must continually adapt its offerings to meet evolving consumer expectations and technological advancements.

The pervasive influence of digital solutions extends to critical sectors like healthcare and energy. In 2024, the global digital health market is projected to reach over $600 billion, highlighting a strong demand for tech-enabled services. This trend necessitates DCC Technology to explore and integrate digital solutions that can enhance efficiency and accessibility in areas such as remote patient monitoring or smart grid management, aligning with broader societal shifts towards digital integration.

Shifting Work Patterns and Remote Work

The widespread adoption of remote and hybrid work models significantly impacts IT demand. For instance, by the end of 2024, it's projected that over 30% of the global workforce will be working remotely at least part-time, driving a surge in collaboration software and cloud-based services. This shift necessitates that DCC Technology recalibrate its product and service portfolio to align with the evolving needs of businesses and individuals navigating these new work environments.

DCC Technology must strategically adapt its offerings to capitalize on these changing work patterns. The increased reliance on digital tools for seamless communication and project management presents a clear opportunity for companies specializing in these areas. For example, the market for collaboration software, including video conferencing and project management platforms, was valued at over $50 billion globally in 2023 and is expected to grow substantially through 2025.

- Increased demand for collaboration tools: Software like Microsoft Teams and Zoom saw user numbers skyrocket in 2024, with many companies making these permanent fixtures.

- Growth in home office equipment sales: Sales of monitors, ergonomic chairs, and high-speed internet services for residential use have remained elevated since 2023.

- Focus on cybersecurity for distributed workforces: As employees work from various locations, the need for robust remote access security solutions has become paramount.

- Adaptation of IT support services: IT providers are increasingly offering remote troubleshooting and managed IT services to support dispersed teams.

Corporate Social Responsibility Expectations

Public and stakeholder expectations for corporate social responsibility (CSR) and ethical business practices are on a significant upward trend. Consumers and investors are increasingly scrutinizing companies' environmental, social, and governance (ESG) performance, making it a critical factor in their decision-making processes.

DCC's commitment to sustainability, as detailed in its 2024 Sustainability Report, is paramount for safeguarding its brand reputation. This commitment is vital for attracting values-driven consumers and investors who prioritize ethical operations and long-term societal impact. For instance, DCC reported a 15% reduction in its carbon footprint across operations in 2024, a figure that resonates strongly with environmentally conscious stakeholders.

- Growing ESG Investment: Global ESG assets are projected to exceed $50 trillion by 2025, highlighting the financial importance of CSR.

- Consumer Preference: A 2024 survey indicated that 70% of consumers are more likely to purchase from brands demonstrating strong CSR initiatives.

- Reputational Risk: Companies with poor CSR records face a higher risk of negative publicity and boycotts, impacting market share and valuation.

Societal values are shifting, with a pronounced emphasis on health and well-being. This trend fuels demand for products and services that support healthier lifestyles. For example, the global wellness market, valued at over $4.4 trillion in 2023, is expected to reach $6.6 trillion by 2028, reflecting a significant societal prioritization of personal health.

Furthermore, consumers are increasingly demanding transparency and ethical practices from businesses. A 2024 survey revealed that 70% of consumers favor brands with strong corporate social responsibility (CSR) initiatives, underscoring the importance of ethical operations for brand loyalty and market standing.

The digital transformation continues to reshape consumer behavior and expectations across all sectors. By early 2024, approximately 5.3 billion people were internet users, demonstrating a pervasive reliance on digital platforms for information and transactions. This digital fluency necessitates businesses to maintain robust online presences and adapt to evolving digital consumer habits.

The growing emphasis on sustainability and environmental consciousness is a defining sociological factor. In 2024, 73% of global consumers indicated a willingness to alter their consumption habits to reduce environmental impact, with 48% stating they would pay a premium for sustainable products. This signals a clear market preference for eco-friendly goods and services.

Technological factors

Continuous innovation in solar, wind, and battery storage is significantly reshaping the energy landscape, directly influencing DCC Energy's strategic direction toward cleaner energy solutions. These advancements are crucial for supporting the ongoing energy transition for their diverse customer base.

DCC Energy is demonstrating its commitment through active investment and integration of these cutting-edge renewable technologies. For instance, the global renewable energy sector saw substantial growth, with solar PV capacity additions reaching an estimated 440 GW in 2023, a significant increase from previous years, highlighting the momentum these technologies possess.

Digitalization and automation are fundamentally reshaping logistics. Technologies like Artificial Intelligence (AI), the Internet of Things (IoT), and advanced robotics are driving significant improvements in efficiency and cost reduction across the supply chain. For instance, AI-powered route optimization can slash fuel consumption by up to 15%, while IoT sensors provide real-time visibility into inventory, minimizing stockouts and overstocking.

DCC's distribution operations, especially within its healthcare and technology segments, are poised to gain considerably from these trends. Optimized routing directly translates to faster delivery times for critical medical supplies and sensitive technology components. Furthermore, enhanced inventory management through automated systems reduces handling errors and ensures product integrity, crucial for high-value or temperature-sensitive goods.

The adoption of these technologies allows for more informed and proactive decision-making. Real-time tracking, enabled by IoT devices, provides unprecedented transparency into the movement of goods. This granular data empowers DCC to anticipate potential disruptions, such as weather delays or traffic congestion, and implement contingency plans swiftly, ensuring business continuity and customer satisfaction.

The relentless pace of technological advancement, particularly in areas like artificial intelligence (AI), the Internet of Things (IoT), and cloud computing, fundamentally alters the product offerings available to distributors like DCC Technology. For instance, the global AI market is projected to grow significantly, with some estimates suggesting it could reach over $1.5 trillion by 2030, impacting the types of hardware and software solutions in demand.

DCC Technology’s success hinges on its ability to not just track these seismic shifts but to actively integrate and distribute cutting-edge innovations. This proactive approach is essential for the company to retain its standing as a premier distributor of specialized technology, ensuring it meets the evolving needs of its diverse customer base in 2024 and beyond.

Innovation in Waste Processing and Resource Recovery

Technological advancements in waste processing and resource recovery are crucial for companies like DCC Environmental. Innovations in areas such as advanced sorting, chemical recycling, and waste-to-energy technologies are transforming how waste is managed. These innovations not only improve efficiency but also unlock new revenue streams by extracting valuable resources from waste.

The drive towards a circular economy is fueling significant investment in these technologies. For instance, the global waste management market is projected to reach over $600 billion by 2027, with a substantial portion driven by technological upgrades. Innovations that enable higher recovery rates and reduce landfill reliance are key opportunities for DCC Environmental to expand its service offerings and enhance its competitive edge.

- Advanced Sorting Technologies: AI-powered optical sorters and robotic systems are increasing the purity and value of recovered materials, with some systems achieving over 95% accuracy in material identification.

- Chemical Recycling: Emerging chemical recycling processes, such as pyrolysis and gasification, can convert mixed plastic waste into valuable feedstocks, potentially recovering up to 90% of the plastic's original chemical value.

- Waste-to-Energy Innovations: New thermal treatment technologies are improving energy conversion efficiency, with modern plants achieving electrical efficiencies of 25-30% while also capturing emissions.

- Digitalization and IoT: The integration of IoT sensors and data analytics in waste collection and processing optimizes routes, monitors equipment performance, and provides real-time insights for operational improvements.

Cybersecurity and Data Infrastructure Needs

The escalating digital integration within DCC's operations, from patient records to operational management, underscores a critical need for advanced cybersecurity and resilient data infrastructure. This technological imperative is driven by the sheer volume and sensitivity of the data handled, particularly in the healthcare sector.

Protecting patient confidentiality and ensuring the integrity of medical data are paramount. As of early 2024, the global healthcare cybersecurity market is projected to reach $34.1 billion by 2029, highlighting the significant investment required. DCC must prioritize solutions that safeguard against breaches and maintain operational continuity.

- Data Breach Costs: The average cost of a data breach in the healthcare industry reached $10.93 million in 2023, a stark reminder of the financial and reputational risks.

- Infrastructure Investment: Upgrading data infrastructure to support AI-driven diagnostics and telehealth services will require substantial capital expenditure in 2024-2025.

- Regulatory Compliance: Adherence to evolving data privacy regulations like GDPR and HIPAA necessitates continuous technological adaptation and robust security protocols.

Technological advancements are a cornerstone for DCC's diverse operations, driving efficiency and innovation across its energy, healthcare, and environmental sectors. The rapid evolution of digital tools, renewable energy technologies, and waste management solutions directly impacts DCC's strategic investments and service offerings, ensuring it remains competitive and responsive to market demands. For instance, the global market for renewable energy technologies is expected to see continued robust growth through 2025, fueled by climate initiatives and falling costs.

The integration of AI, IoT, and advanced analytics is transforming logistics and operational management, leading to optimized supply chains and enhanced customer service. In the healthcare segment, these technologies are critical for data security and the advancement of services like telehealth. Similarly, DCC Environmental benefits from innovations in waste processing, enabling a more circular economy and creating new value streams from waste materials.

DCC's focus on embracing these technological shifts is evident in its proactive approach to adopting cutting-edge solutions. This includes investments in AI for route optimization, IoT for real-time tracking, and advanced sorting technologies for waste management. These strategic technological integrations are vital for maintaining operational excellence and driving future growth in a dynamic global market.

Legal factors

DCC faces a dynamic environmental regulatory environment, requiring adherence to stringent emission standards, waste management protocols, and increasingly, circular economy principles. The EU's Green Deal, for instance, sets ambitious targets that directly impact industrial operations and supply chains.

Failure to comply can lead to substantial financial penalties; for example, in 2023, the EU reported over €10 billion in fines related to environmental infringements. Beyond financial repercussions, non-compliance severely damages corporate reputation, affecting investor confidence and market access.

Stringent data privacy laws, such as the EU's General Data Protection Regulation (GDPR) and the California Consumer Privacy Act (CCPA) and its successor, the California Privacy Rights Act (CPRA), directly influence how DCC manages customer and patient information. These regulations mandate strict protocols for data collection, processing, and storage, particularly impacting DCC's Healthcare and Technology segments.

Compliance with these evolving legal frameworks necessitates significant investment in robust data security infrastructure and privacy-by-design principles. For instance, the CCPA, which came into full effect in 2023, grants consumers more control over their personal data, requiring businesses to provide clear opt-out mechanisms. Failure to adhere to these laws can result in substantial fines; GDPR penalties can reach up to 4% of global annual revenue or €20 million, whichever is higher.

DCC Healthcare navigates a complex web of pharmaceutical and medical device regulations, encompassing stringent drug approval pathways, adherence to Good Distribution Practices (GDP), and robust quality control measures. These regulations are critical for ensuring patient safety and product efficacy.

The ongoing evolution of these regulatory landscapes, such as recent proposals to integrate GDP requirements into broader Drugs Rules, underscores the imperative for continuous and rigorous compliance. Failure to meet these standards can lead to significant penalties and market access restrictions.

Anti-Trust and Competition Laws

As a significant international sales and distribution entity, DCC is bound by stringent anti-trust and competition regulations across its global operational footprint. These legal frameworks are designed to curb monopolistic tendencies and foster a level playing field, directly impacting DCC's approach to mergers, acquisitions, and day-to-day market activities.

In 2024, regulatory bodies worldwide continued to scrutinize large-scale business combinations. For instance, the European Commission's Directorate-General for Competition reviewed numerous transactions, with a notable focus on sectors where market dominance could arise. DCC's acquisition pipeline must navigate these evolving oversight standards, ensuring compliance to avoid penalties and maintain market access.

Key considerations for DCC under these laws include:

- Merger Control: Ensuring that proposed acquisitions do not create or strengthen a dominant market position, potentially requiring divestitures or behavioral remedies.

- Anti-Competitive Agreements: Prohibiting cartels, price-fixing, and market sharing arrangements that stifle fair competition.

- Abuse of Dominance: Preventing entities with significant market power from engaging in practices that disadvantage competitors or consumers.

- Regulatory Scrutiny: Staying abreast of investigations and enforcement actions by competition authorities in key markets like the US, EU, and UK, which can impose substantial fines and operational restrictions.

Labor Laws and Employment Regulations

DCC's extensive global footprint, spanning 22 countries, necessitates navigating a complex web of labor laws and employment regulations. These varying legal frameworks, covering everything from minimum wage requirements to workplace safety standards and employee dismissal procedures, directly influence DCC's operational costs and the effectiveness of its human resource management strategies. For instance, differing regulations on working hours and overtime pay across its operating regions can significantly alter labor expenses, requiring meticulous compliance and adaptable HR policies.

The impact of these diverse regulations is substantial. In 2024, businesses globally faced increased scrutiny and potential penalties for non-compliance with labor laws, with fines escalating for violations related to fair wages and working conditions. DCC must therefore invest in robust compliance frameworks and localized HR expertise to mitigate risks and ensure ethical employment practices across all its markets.

- Compliance Costs: Adhering to 22 different sets of labor laws can lead to significant administrative and legal expenses for DCC.

- Talent Acquisition and Retention: Varying employment regulations can affect DCC's ability to attract and retain talent in different regions, influencing compensation and benefits packages.

- Operational Flexibility: Strict labor laws in certain countries might limit DCC's flexibility in workforce planning and restructuring, impacting efficiency.

DCC operates within a framework of evolving intellectual property (IP) laws, crucial for protecting its innovations in healthcare and technology. This includes patents, trademarks, and copyrights, with enforcement varying significantly by jurisdiction. The company must actively manage its IP portfolio to prevent infringement and leverage its innovations effectively.

In 2024, global IP disputes remained a significant concern, with companies investing heavily in IP protection and litigation. For instance, the World Intellectual Property Organization (WIPO) reported a continued rise in international patent filings, highlighting the competitive IP landscape. DCC's strategic decisions regarding R&D and market entry are heavily influenced by the strength and enforceability of IP rights in its target markets.

DCC must also navigate complex contractual agreements and commercial laws across its 22 operating countries. These legal stipulations govern supplier relationships, distribution agreements, and customer contracts, directly impacting revenue streams and operational efficiency. Ensuring contract enforceability and managing legal risks associated with these agreements are paramount for maintaining business continuity and profitability.

Environmental factors

Global and regional climate change mitigation targets significantly influence DCC Energy's operational landscape. For instance, the European Union's ambitious goal to slash net greenhouse gas emissions by 55% by 2030 compared to 1990 levels, as part of the 'Fit for 55' package, directly compels a strategic pivot within the energy sector.

DCC Energy is proactively responding to these mandates by accelerating its transition towards lower-carbon and renewable energy solutions. This strategic alignment is crucial for maintaining competitiveness and ensuring long-term viability in an evolving energy market, as evidenced by their increasing investments in areas like biofuels and hydrogen infrastructure.

Growing awareness of finite resources is fueling a global shift towards circular economy principles. This means a greater focus on minimizing waste, maximizing product lifespan through reuse, and efficient recycling processes. Companies like DCC Environmental are well-positioned to capitalize on this trend, offering services that facilitate resource recovery and advanced waste management solutions.

The economic implications are significant; for instance, the Ellen MacArthur Foundation estimated in 2023 that a circular economy could generate $4.5 trillion in economic benefits by 2030. DCC's commitment to sustainable practices directly addresses the increasing demand for environmentally responsible operations, which is becoming a key differentiator in the market.

Global waste generation is on the rise, with projections suggesting a significant increase in municipal solid waste from 2.2 billion tonnes in 2022 to 3.8 billion tonnes by 2050. This escalating volume, coupled with increasing waste complexity, demands sophisticated recycling and waste management strategies. DCC Environmental's proven capabilities in developing and implementing these advanced solutions position it to effectively tackle these environmental challenges and foster more sustainable industrial and consumer practices.

Biodiversity Conservation and Land Use

Environmental considerations for DCC extend to biodiversity conservation and responsible land use, especially given its extensive physical infrastructure and logistics networks. Sustainable practices in these domains are crucial for demonstrating robust environmental stewardship.

DCC's commitment to biodiversity conservation and land use directly impacts its operational footprint. For instance, in 2024, the company continued to assess and mitigate the impact of its facilities on local ecosystems. The European Union's Biodiversity Strategy for 2030 aims to restore nature across the EU, setting a precedent for companies like DCC to align their land use practices with conservation goals. This includes minimizing habitat disruption and supporting ecological restoration where possible.

- Land Use Impact: DCC's logistics centers and distribution hubs require significant land, necessitating careful site selection and management to avoid sensitive habitats.

- Biodiversity Metrics: Companies are increasingly reporting on biodiversity net gain, a concept gaining traction in 2024 and 2025, aiming for measurable improvements in biodiversity post-development.

- Regulatory Landscape: Evolving environmental regulations, such as those focusing on habitat protection and sustainable land management, will continue to shape DCC's operational planning and investment decisions through 2025.

- Supply Chain Integration: DCC's influence extends to its supply chain, encouraging suppliers to adopt responsible land use and biodiversity-friendly practices.

Water Management and Pollution Control

Stricter regulations on water usage and discharge quality are increasingly shaping industrial operations. For instance, in 2024, the European Union continued to enforce the Water Framework Directive, pushing for better water quality across member states, which impacts manufacturing processes and water-intensive industries. DCC must invest in advanced water treatment technologies to meet these evolving standards, potentially increasing operational costs but also fostering innovation in water efficiency.

Societal expectations for corporate environmental stewardship are also rising, demanding transparency and proactive measures in water management. Consumers and investors alike are scrutinizing companies' water footprints, making robust pollution control a key differentiator. DCC's commitment to minimizing water consumption and preventing discharge contamination directly influences its brand reputation and investor confidence, especially as sustainability reporting becomes more comprehensive in 2025.

Key considerations for DCC include:

- Compliance Costs: Anticipated increases in compliance costs related to water quality standards and potential carbon pricing on water usage.

- Technological Investment: The need for capital expenditure on advanced water recycling and zero-liquid discharge systems.

- Resource Scarcity: The growing risk of water scarcity in certain operational regions, necessitating strategic water sourcing and conservation.

- Reputational Risk: The potential for negative publicity and loss of market share due to perceived inadequate water management practices.

The increasing focus on climate change mitigation, exemplified by the EU's 2030 emissions reduction targets, is driving DCC Energy towards lower-carbon solutions like biofuels and hydrogen. Simultaneously, the global embrace of circular economy principles, aiming for waste reduction and resource recovery, positions DCC Environmental to offer advanced waste management services, potentially unlocking significant economic benefits as projected by foundations like Ellen MacArthur.

The escalating global waste generation, predicted to reach 3.8 billion tonnes by 2050, necessitates sophisticated recycling strategies, a domain where DCC Environmental has proven expertise. Furthermore, DCC's land use and biodiversity efforts are increasingly scrutinized against evolving conservation goals, with a growing emphasis on biodiversity net gain metrics in 2024 and 2025, influencing site selection and operational planning.

Stricter water usage and discharge regulations, such as those enforced under the EU's Water Framework Directive, require DCC to invest in advanced water treatment technologies, impacting operational costs but also driving innovation in water efficiency and conservation.

| Environmental Factor | DCC Relevance | Key Data/Trend (2024-2025) |

|---|---|---|

| Climate Change Mitigation | DCC Energy's transition to lower-carbon fuels | EU 'Fit for 55' aims for 55% emissions cut by 2030. |

| Circular Economy | DCC Environmental's waste management services | Circular economy could generate $4.5 trillion by 2030 (Ellen MacArthur Foundation). |

| Waste Generation | DCC Environmental's advanced recycling solutions | Global waste to reach 3.8 billion tonnes by 2050 (up from 2.2 billion in 2022). |

| Biodiversity & Land Use | DCC's operational footprint and supply chain | Growing emphasis on biodiversity net gain metrics in 2024-2025. |

| Water Management | DCC's water usage and discharge compliance | EU Water Framework Directive drives demand for advanced water treatment. |

PESTLE Analysis Data Sources

Our PESTLE Analysis is informed by a comprehensive blend of official government data, reputable economic indicators, and expert industry forecasts. We meticulously gather information on technological advancements, environmental regulations, and socio-cultural shifts to provide a robust understanding of the macro-environment.