DCC Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

DCC Bundle

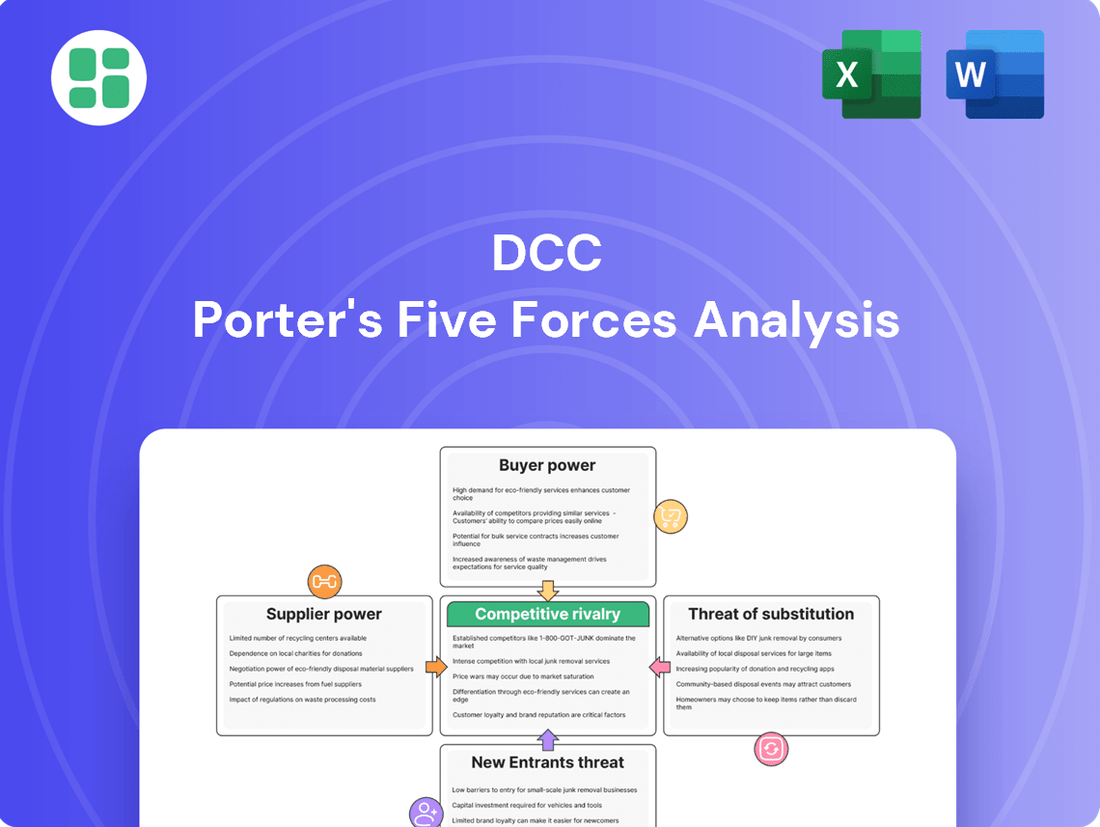

DCC's competitive landscape is shaped by five key forces: the bargaining power of buyers and suppliers, the threat of new entrants and substitutes, and the intensity of rivalry among existing competitors. Understanding these dynamics is crucial for strategic planning.

This brief snapshot only scratches the surface. Unlock the full Porter's Five Forces Analysis to explore DCC’s competitive dynamics, market pressures, and strategic advantages in detail.

Suppliers Bargaining Power

The concentration of suppliers significantly impacts DCC's bargaining power. For instance, in DCC's energy segment, while crude oil and LPG are globally traded commodities, the supply of specialized equipment for renewable energy projects can be concentrated among fewer providers. This specialization can grant those suppliers increased leverage, particularly if their technology is critical and alternatives are scarce. In 2024, the global market for advanced waste-to-energy technology, a key area for DCC Environmental, saw significant growth, but the number of highly specialized technology providers remained relatively limited, suggesting potential supplier power.

DCC generally encounters moderate to high switching costs, varying with the specific supplier and business division. For example, in DCC Technology, switching major IT or pro-AV brand suppliers can necessitate substantial re-tooling, employee training, and may even risk alienating customer relationships tied to existing product lines.

Similarly, within DCC Healthcare, long-term agreements and deeply integrated supply chains with pharmaceutical manufacturers often result in elevated switching costs. This integration makes it challenging and expensive to transition to new suppliers, thereby strengthening the bargaining power of these key partners.

The criticality of supplier inputs is high across all of DCC's diverse divisions. DCC depends on a steady and high-quality supply of energy products, pharmaceutical and medical goods, and technology to keep its operations running smoothly and to satisfy its broad customer base.

Any interruption in this supply chain or a substantial price hike from crucial suppliers could directly affect DCC's financial performance and how efficiently it operates. For instance, in the energy sector, fluctuations in global oil and gas prices, often dictated by major producers, can significantly impact DCC's cost of goods sold and, consequently, its profit margins.

Threat of Forward Integration by Suppliers

The threat of suppliers integrating forward into distribution is generally low for DCC. This is primarily because establishing the extensive logistical infrastructure, robust sales networks, and deep customer relationships necessary to compete effectively requires substantial investment and time. For instance, while some large manufacturers might possess the capability for direct sales, they often lack the broad geographical reach and the diversified service portfolio that DCC offers across a wide array of product categories.

DCC's established market penetration and its provision of value-added services serve as significant deterrents to potential forward integration by suppliers. These elements create a barrier to entry that is difficult for most suppliers to overcome. In 2024, DCC continued to demonstrate its strength in these areas, with its diversified operations spanning multiple sectors and geographies, making it a formidable competitor in its distribution channels.

- Low Threat of Forward Integration: Suppliers typically lack the capital and established infrastructure to replicate DCC's extensive distribution and customer service capabilities.

- DCC's Competitive Advantages: DCC's broad market reach, diversified product offerings, and value-added services are difficult for suppliers to match.

- Market Penetration: DCC's deep presence across various sectors and geographies in 2024 makes direct competition by suppliers challenging.

- Investment Barrier: The significant investment required for logistics, sales networks, and customer relationships deters most suppliers from attempting forward integration.

DCC's Scale and Diversification

DCC's significant scale, evidenced by its £18.0 billion in revenue for FY2025, grants it considerable bargaining power with suppliers. This large revenue base allows DCC to negotiate more favorable pricing and terms, reducing the impact of individual supplier power.

The company's historical diversification across energy, healthcare, and technology segments meant it wasn't overly dependent on any single supplier group. This broad operational base naturally diffused the bargaining power of any one supplier.

However, DCC's strategic focus is increasingly on the energy sector, following the sale of DCC Healthcare and a review of DCC Technology. This consolidation means supplier relationships will become more concentrated within energy markets, potentially altering the dynamics of supplier power in the future.

- Scale Advantage: DCC's £18.0 billion FY2025 revenue provides substantial leverage in supplier negotiations.

- Diversification Benefit: Past diversification reduced reliance on single supplier categories, mitigating supplier power.

- Strategic Consolidation: A sharper focus on energy may lead to more concentrated supplier relationships, impacting future bargaining power.

The bargaining power of suppliers for DCC is influenced by factors like supplier concentration, switching costs, and the criticality of their inputs. While DCC's scale provides leverage, its strategic shift towards energy may concentrate supplier relationships, potentially increasing supplier power in that segment. For instance, in 2024, the limited number of specialized technology providers in waste-to-energy highlighted potential supplier leverage.

| Factor | DCC's Position | Impact on Supplier Power |

|---|---|---|

| Supplier Concentration | Varies; specialized areas can have few providers. | Moderate to High in specialized segments. |

| Switching Costs | Generally moderate to high due to integration. | Strengthens supplier power. |

| Criticality of Inputs | High across all divisions. | Increases supplier power. |

| Forward Integration Threat | Low due to DCC's infrastructure. | Weakens supplier power. |

| DCC's Scale (£18.0bn FY2025 Revenue) | Significant leverage. | Reduces supplier power. |

What is included in the product

Assesses the five forces shaping DCC's competitive environment, including the threat of new entrants, bargaining power of buyers and suppliers, threat of substitutes, and industry rivalry, to inform strategic decisions.

Effortlessly identify and quantify competitive pressures, transforming complex market dynamics into actionable insights for strategic advantage.

Customers Bargaining Power

DCC's customer base is incredibly broad, spanning individual homes and small businesses all the way to major entities like hospitals, pharmacies, large retailers, and even entire towns. This diversity means bargaining power varies significantly across its segments.

While a single homeowner has minimal impact, large clients such as major supermarket chains or industrial users who buy substantial quantities of fuel or other products wield considerable influence. In 2024, for instance, DCC's Energy division reported that its largest customers, often industrial or commercial, accounted for a significant portion of its revenue, enabling them to negotiate better pricing and terms.

These high-volume customers frequently seek competitive pricing, adaptable contract conditions, and solutions specifically designed to meet their operational needs, directly impacting DCC's ability to maintain its margins in these key relationships.

Customer switching costs are a key factor in how much power customers have. For DCC, these costs differ significantly by division. In markets for basic goods like oil and LPG, customers can often switch suppliers with little hassle, making them more sensitive to price differences.

However, when DCC offers more complex, integrated solutions, such as in renewable energy or specialized medical supplies, the cost and effort for customers to switch can be much higher. This is often due to the need to re-integrate systems, build new relationships, and the loss of value from ongoing support and service agreements.

DCC actively works to increase customer loyalty by providing value-added services. This strategy aims to make it more difficult and less appealing for customers to switch to competitors, thereby strengthening DCC's position.

Customers wield significant power when numerous substitute products or services exist, allowing them to easily switch if prices rise or quality declines. For instance, in the energy sector, consumers can choose between different utility providers, explore alternative fuels like natural gas or propane, or even invest in direct renewable energy sources such as solar panels. This broad range of options directly impacts the bargaining power of customers.

Similarly, in the technology market, customers aren't limited to single vendors. They can purchase devices and software directly from manufacturers, explore a multitude of third-party distributors, or even opt for open-source alternatives. This ease of switching, particularly for less differentiated products, amplifies customer bargaining power, forcing businesses to remain competitive on price and value.

Customer Price Sensitivity

Customer price sensitivity is a significant factor for DCC, especially in its Energy and Technology divisions. For instance, in the highly competitive fuel retail market, consumers are acutely aware of price differences, which can influence their choice of supplier. DCC's 2024 performance in DCC Energy, which saw continued strong operational execution despite volatile energy markets, highlights the need to manage this sensitivity.

In DCC Technology, the consumer electronics sector often experiences rapid product cycles and intense price competition. This means that the perceived value of a product, beyond its base price, becomes paramount. DCC’s strategy to focus on adding value through service and reliability is key to mitigating the impact of price-driven purchasing decisions.

The bargaining power of customers is amplified by economic conditions and the availability of competitive alternatives. When economic headwinds persist, customers naturally become more focused on cost. For example, if inflation continues to impact household budgets in 2024, consumers may delay discretionary purchases or seek out the lowest-priced options more aggressively.

- Price Sensitivity in Energy: Customers in DCC Energy markets, particularly for fuels, are highly sensitive to price fluctuations, directly impacting purchasing decisions.

- Technology Price Pressure: DCC Technology faces pressure from price-conscious consumers in the fast-moving consumer electronics market.

- Economic Influence: Broader economic conditions in 2024 are likely to heighten customer focus on price across DCC's diverse markets.

- Value Beyond Price: DCC's ability to differentiate through reliable supply and superior service is crucial for maintaining margins against price competition.

Threat of Backward Integration by Customers

The threat of customers integrating backward into distribution for DCC is generally low. This is because most of DCC's clients, like hospitals, retailers, or municipalities, typically don't possess the necessary scale, infrastructure, or specialized knowledge to build and manage their own complex distribution systems across various product lines.

Their primary focus remains on their core operations, making the substantial investment and operational challenges of establishing independent distribution networks economically impractical for them. For instance, a hospital's expertise lies in healthcare, not in managing a nationwide logistics network for medical supplies.

- Low Scale of Individual Customers: Many of DCC's customers operate on a smaller scale, lacking the volume to justify the significant capital expenditure for backward integration.

- Infrastructure and Expertise Gaps: Building and maintaining sophisticated distribution networks requires specialized logistics infrastructure and expertise that most customer segments do not possess.

- Focus on Core Competencies: Customers prioritize their own core business activities, such as patient care or retail sales, rather than diverting resources to distribution.

DCC's customers can exert significant bargaining power, particularly when dealing with large-volume purchases or when switching suppliers is easy and inexpensive. This is evident across DCC's diverse segments, from individual consumers to major corporations. The ability of customers to easily substitute products or services, coupled with their sensitivity to price, directly influences DCC's pricing strategies and profit margins.

In 2024, DCC Energy faced continued price sensitivity from consumers and businesses alike, especially in the volatile fuel markets. Similarly, DCC Technology's consumer electronics sector is characterized by rapid innovation and intense price competition, forcing DCC to emphasize value beyond the base product. Economic conditions in 2024, marked by persistent inflation, further amplified customer focus on cost across all of DCC's operations, making competitive pricing and reliable service crucial differentiators.

| DCC Division | Customer Bargaining Power Factors | Impact on DCC | 2024 Data/Context |

|---|---|---|---|

| Energy | High volume purchases, price sensitivity, availability of alternative fuels | Negotiations for better pricing and terms, pressure on margins | Continued strong operational execution despite volatile energy markets; high price sensitivity in fuel retail. |

| Technology | Rapid product cycles, intense price competition, availability of open-source alternatives | Need for value-added services, focus on reliability to mitigate price-driven decisions | Consumer electronics sector experiencing significant price pressure. |

| Healthcare | Specialized needs, integration of solutions, higher switching costs for complex services | Lower bargaining power for individual clients, stronger for large integrated contracts | Focus on integrated solutions to increase customer stickiness. |

What You See Is What You Get

DCC Porter's Five Forces Analysis

The document you see is your deliverable. It’s ready for immediate use—no customization or setup required. This comprehensive DCC Porter's Five Forces Analysis provides an in-depth examination of the competitive landscape, detailing the bargaining power of buyers and suppliers, the threat of new entrants and substitutes, and the intensity of rivalry within the industry. You're previewing the final version—precisely the same document that will be available to you instantly after buying.

Rivalry Among Competitors

DCC operates in diverse sectors, each presenting a unique competitive landscape. In energy distribution, the market is often fragmented, featuring a mix of regional, national, and large integrated energy companies, creating a dynamic competitive environment.

Prior to its divestment, DCC Healthcare contended with a concentrated market structure, dominated by a few major global pharmaceutical distributors. This indicated a more consolidated competitive force in that segment.

DCC Technology navigates a competitive space populated by substantial international distributors and more niche, specialized firms. This dual presence of large and small players shapes its competitive pressures.

In the environmental services sector, DCC Environmental faces competition from established, large-scale waste management corporations, suggesting a market characterized by significant established players.

The growth rate of the industries DCC operates in significantly shapes competitive rivalry. For instance, DCC Energy's robust growth, fueled by initiatives like the 'Cleaner Energy in Your Power' strategy and strategic acquisitions in renewable energy, can attract new entrants and intensify competition as players vie for market share in expanding segments.

While DCC Healthcare experienced a return to organic growth in the latter half of fiscal year 2024, the broader healthcare market's concentration means that established players are likely to fiercely defend their positions, leading to heightened rivalry among them for market dominance.

Conversely, DCC Technology encountered a challenging market characterized by reduced demand for consumer electronics in 2024. This contraction in demand naturally escalates competitive pressures as companies fight for a smaller pool of customers, often leading to price wars and increased promotional activities.

Product differentiation for DCC varies significantly across its diverse business segments. In the realm of commodity energy products like LPG and oil, differentiation is inherently low, meaning competition often centers on price. For instance, in the UK LPG market, while DCC’s Flogas brand emphasizes service, the fundamental product is largely undifferentiated, leading to intense price sensitivity among consumers.

However, DCC actively pursues differentiation in other areas. This is evident in its energy transition services, where it offers integrated solutions and expertise, moving beyond simple fuel supply. Similarly, its healthcare and technology segments, such as DCC Healthcare and DCC Technology, differentiate through specialized services, product quality, and innovation, aiming to build customer loyalty and command premium pricing, thereby mitigating direct price wars.

Exit Barriers

Exit barriers for companies like DCC within its core sectors are notably high. This is largely due to the substantial capital required for specialized infrastructure, unique assets, and intricate logistical systems that are difficult to repurpose or sell off. For example, investments in chemical processing plants or energy distribution networks represent significant sunk costs.

These high exit barriers mean that companies are often reluctant to leave a market, even when facing declining profitability. This persistence intensifies competition as existing players fight harder for market share rather than seeking an exit. The financial implications of divesting such assets can be substantial, discouraging premature departures and contributing to ongoing rivalry.

Consider the impact on competitive dynamics. When exiting is costly, companies are incentivized to maintain their presence and fight for every available customer. This can lead to price wars or increased marketing spend, further pressuring margins for all participants.

- High Capital Investment: Industries such as energy and environmental services demand extensive upfront capital for infrastructure and technology, creating significant barriers to exit.

- Specialized Assets: Many assets are industry-specific and lack alternative uses, making them difficult to sell or repurpose upon exiting.

- Logistical Networks: Established and complex distribution and supply chains are costly to dismantle or transfer, further increasing exit costs.

- Divestment Costs: The process of selling off operations, as seen with DCC Healthcare's divestment, can incur substantial transaction fees and potential asset write-downs, discouraging quick exits.

Strategic Shifts and Acquisitions

DCC's strategic pivot, including the planned sale of DCC Healthcare in 2025 and a review of its technology division, signals a concentrated effort on its energy segment. This move is designed to amplify DCC Energy's market presence and profitability, potentially leading to more aggressive competition within the energy sector as capital is redeployed.

The divestment of non-core assets allows DCC to channel greater resources into its energy operations, enhancing its competitive standing. For instance, by shedding its healthcare business, DCC can focus on optimizing its extensive distribution network and supply chain in the energy market, a sector where it already holds significant scale.

- Strategic Focus: DCC's decision to concentrate on energy aims to unlock greater value and competitive advantage.

- Divestment Impact: The sale of DCC Healthcare, expected in 2025, frees up resources for energy sector investments.

- Competitive Intensification: Increased focus on DCC Energy may lead to heightened rivalry in the energy distribution and marketing landscape.

- Resource Allocation: Simplified structure allows for more targeted capital deployment to bolster DCC Energy's market position and operational efficiency.

Competitive rivalry within DCC's operating sectors is shaped by industry structure, growth rates, product differentiation, and exit barriers. In energy, a growing market with relatively undifferentiated products like LPG leads to intense price-based competition, amplified by DCC's strategic focus on this segment. Conversely, technology faces pressure from reduced demand in 2024, intensifying competition for a shrinking customer base.

High capital investment and specialized assets create substantial exit barriers across DCC's core businesses. This means companies are less likely to leave even in downturns, leading to sustained rivalry as existing players fight to maintain market share. DCC's divestment of its healthcare business, planned for 2025, will likely redirect capital and focus, potentially intensifying competition within its energy operations.

| DCC Segment | Key Competitive Factors | 2024/2025 Outlook |

|---|---|---|

| DCC Energy | Fragmented market, price sensitivity (LPG), growth in renewables | Intensified rivalry due to strategic focus and capital reallocation. |

| DCC Technology | Reduced consumer electronics demand, competition from niche players | Heightened pressure from lower demand, focus on specialized services. |

| DCC Healthcare | Concentrated market, established global distributors | Planned divestment in 2025 may alter competitive dynamics for remaining players. |

| DCC Environmental | Competition from large waste management corporations | Established players likely to maintain strong market positions. |

SSubstitutes Threaten

The threat of substitutes is particularly strong for DCC Energy, especially concerning its traditional oil and LPG offerings. Consumers have readily available alternatives like natural gas, grid electricity, and a growing array of renewable energy solutions such as solar power, wind energy, and heat pumps.

DCC is proactively addressing this by strategically investing in and expanding its renewable energy solutions portfolio. This diversification is crucial as the market increasingly shifts towards cleaner and more sustainable energy sources, with global renewable energy capacity additions reaching record levels in 2023, further intensifying the pressure from substitutes.

The relative price and performance of substitutes are critical factors in their ability to attract customers away from existing products or services. When substitutes become cheaper or offer superior benefits, they naturally gain traction.

For instance, the decreasing cost of solar panels and advancements in battery storage technology in 2024 are making renewable energy a more compelling alternative to traditional fossil fuel distribution. The levelized cost of electricity (LCOE) for utility-scale solar PV has fallen significantly, with some projects in 2024 reporting LCOE below $20 per megawatt-hour, directly challenging the economics of fossil fuels.

Government policies, such as tax credits and subsidies for renewable energy adoption, further enhance the attractiveness of these substitutes. These incentives, coupled with growing consumer demand for sustainable options, are accelerating the shift, making cleaner energy sources increasingly viable and competitive.

Customer propensity to substitute is on the rise, fueled by growing environmental awareness, stricter regulations, and a persistent drive for cost efficiency. This trend means more consumers and businesses are actively seeking out greener energy options and more sustainable approaches to waste disposal, directly impacting industries like those DCC operates within.

For instance, in 2024, the global renewable energy market saw significant growth, with solar power installations alone increasing by an estimated 25% year-over-year, according to industry reports. This surge in accessible and increasingly affordable alternatives directly challenges traditional energy providers and waste management services, forcing companies to adapt or risk losing market share.

Technological Advancements

Rapid technological advancements are a significant driver of substitution threats, particularly in sectors where DCC operates. Innovations in energy are creating new options that could displace traditional offerings. For instance, the increasing efficiency and decreasing cost of battery storage solutions are making intermittent renewable energy sources more viable, directly challenging the need for conventional power generation. Similarly, the development of smart grids allows for more dynamic energy distribution and consumption, potentially reducing reliance on centralized power plants.

In waste management, emerging technologies are presenting viable alternatives to traditional landfilling. Advanced recycling techniques, such as chemical recycling, can recover valuable materials from complex waste streams that were previously difficult or impossible to process. Waste-to-energy technologies are also gaining traction, converting waste into usable heat or electricity, thereby reducing the volume of material sent to landfills and offering an alternative energy source. These advancements create a competitive pressure on existing waste disposal methods.

DCC's strategic investments in energy transition solutions, including renewable energy generation and energy efficiency services, are a direct response to these evolving substitution threats. By actively participating in these emerging technological landscapes, DCC aims to mitigate the impact of disruptive technologies and position itself to capitalize on the shift towards more sustainable and technologically advanced solutions. For example, DCC's commitment to expanding its renewable energy portfolio, which saw significant investment in 2023, directly addresses the growing demand for alternatives to fossil fuels.

- Technological Advancements: Innovations in battery storage and smart grids offer alternatives to traditional energy infrastructure.

- Waste Management Innovations: Advanced recycling and waste-to-energy technologies provide substitutes for landfilling.

- DCC's Response: DCC's investments in energy transition solutions are a strategic move to counter these substitution threats.

- Market Shift: The energy sector, in particular, is experiencing a rapid shift driven by technological progress, impacting established business models.

Regulatory and Environmental Drivers

Government regulations and increasing environmental consciousness are powerful catalysts pushing for substitute adoption, especially within the energy and environmental industries. For instance, the European Union's target to reduce greenhouse gas emissions by at least 55% by 2030 compared to 1990 levels directly incentivizes the use of renewable energy sources over traditional fossil fuels.

Policies aimed at decarbonization, waste minimization, and the implementation of circular economy principles actively encourage a move away from established services towards more sustainable options. This dynamic presents a dual challenge and opening for companies like DCC.

- Regulatory Push: Policies like the UK's Plastic Packaging Tax, introduced in April 2022, increase the cost of virgin plastic, making recycled or alternative materials more attractive substitutes.

- Environmental Awareness: Consumer demand for eco-friendly products is rising, with studies showing a significant percentage of consumers willing to pay more for sustainable goods, impacting choices in packaging and energy.

- Decarbonization Mandates: National and international climate agreements are forcing industries to explore and adopt lower-carbon alternatives, threatening businesses reliant on high-emission services.

- Circular Economy Initiatives: The promotion of reuse, repair, and recycling models creates substitutes for single-use products and linear consumption patterns.

The threat of substitutes for DCC's energy and environmental sectors is significant, driven by evolving consumer preferences and technological advancements. The increasing affordability and accessibility of renewable energy sources like solar and wind power directly challenge DCC's traditional fuel distribution business. Furthermore, innovations in waste management, such as advanced recycling and waste-to-energy solutions, offer alternatives to conventional disposal methods.

Government policies and growing environmental awareness are accelerating the adoption of these substitutes. For example, the global renewable energy market experienced substantial growth in 2023, with solar installations alone seeing a significant year-over-year increase, making cleaner alternatives more competitive. In 2024, the decreasing levelized cost of electricity for solar PV, with some projects reporting costs below $20 per megawatt-hour, further intensifies this competitive pressure.

| Substitute Category | Key Substitutes | Impact on DCC | 2024 Data/Trend |

|---|---|---|---|

| Energy | Solar Power, Wind Energy, Grid Electricity, Heat Pumps | Reduces demand for LPG and traditional fuels | Solar PV LCOE < $20/MWh; Global renewable capacity additions hit records in 2023 |

| Waste Management | Advanced Recycling, Waste-to-Energy, Material Reuse | Decreases reliance on landfilling and incineration | Increased investment in chemical recycling technologies |

Entrants Threaten

The capital requirements to enter DCC's core markets, particularly energy distribution and environmental services, are substantial. These sectors necessitate significant investment in infrastructure, logistics networks, and specialized operational assets, creating a considerable barrier to entry. For instance, building out a new energy distribution network or acquiring and upgrading environmental processing facilities can easily run into hundreds of millions of pounds.

DCC enjoys substantial economies of scale and scope, which translate into significant cost advantages in areas like procurement, logistics, and administrative functions. For instance, in 2024, DCC's integrated supply chain allowed for optimized fuel purchasing and distribution, a key cost driver in its energy businesses.

New companies entering DCC's markets would find it extremely challenging to replicate these efficiencies without achieving a comparable scale of operations. This makes it difficult for them to compete effectively on price and service from the outset, acting as a considerable barrier.

New companies entering the energy and environmental services sector face significant hurdles in securing reliable distribution channels and cultivating essential relationships. DCC, with its established networks spanning 22 countries and decades of operational experience, has built formidable ties with both suppliers and customers. This deep integration makes it incredibly difficult for newcomers to gain comparable market access and establish the trust necessary for sustained business operations.

Regulatory and Licensing Hurdles

The energy and healthcare sectors, where DCC operates, are particularly challenging due to extensive regulations. Obtaining necessary licenses and permits, along with complying with strict safety and environmental rules, presents a substantial barrier. For instance, in 2024, the average time to secure an energy sector operating license in the UK could extend over 18 months, involving multiple government bodies and detailed environmental impact assessments.

These regulatory complexities significantly escalate the costs and extend the timeline for any new company aiming to enter these markets. Potential entrants must invest heavily in legal expertise and compliance infrastructure, making it difficult to compete with established players like DCC who have already navigated these systems.

- High Capital Investment: New entrants face substantial upfront costs for licensing and compliance.

- Extended Time-to-Market: Regulatory approval processes can delay market entry by years.

- Complex Compliance Requirements: Adhering to evolving safety and environmental standards demands continuous investment and expertise.

Brand Loyalty and Differentiation

While DCC operates in some markets that can resemble commodities, its long-standing brand reputation, consistent service quality, and the provision of integrated solutions cultivate a significant level of customer loyalty. This loyalty acts as a barrier for newcomers.

New entrants would face substantial hurdles, requiring considerable investment in marketing and a clear strategy for service differentiation to effectively challenge DCC's established incumbency advantage and that of other existing players in the market.

- Brand Loyalty: DCC's established brand equity, built over years of reliable service, encourages repeat business and makes customers less likely to switch to new, unproven providers.

- Service Differentiation: Beyond just product offerings, DCC's focus on service quality, technical support, and tailored solutions provides a competitive edge that new entrants must actively replicate or surpass.

- Incumbency Advantage: Existing relationships, economies of scale, and established distribution networks give DCC a head start that new competitors must overcome through significant strategic investment and innovation.

The threat of new entrants for DCC is generally low due to significant barriers. High capital requirements for infrastructure, established economies of scale, and strong customer loyalty make it difficult for newcomers to compete effectively. Regulatory hurdles and the need for extensive distribution networks further deter potential entrants, solidifying DCC's market position.

| Barrier Type | Description | Impact on New Entrants |

|---|---|---|

| Capital Requirements | Substantial investment needed for infrastructure and operations. | High barrier, requiring significant upfront funding. |

| Economies of Scale | DCC's large operational size provides cost advantages. | New entrants struggle to match cost efficiencies without comparable scale. |

| Brand Loyalty & Incumbency | Established customer relationships and reputation. | New entrants need to invest heavily in marketing and differentiation. |

| Regulatory Environment | Complex licensing, safety, and environmental compliance. | Extends time-to-market and increases initial costs significantly. |

Porter's Five Forces Analysis Data Sources

Our Porter's Five Forces analysis leverages a comprehensive array of data, including company annual reports, industry-specific market research, and government economic data, to provide a robust understanding of the competitive landscape.