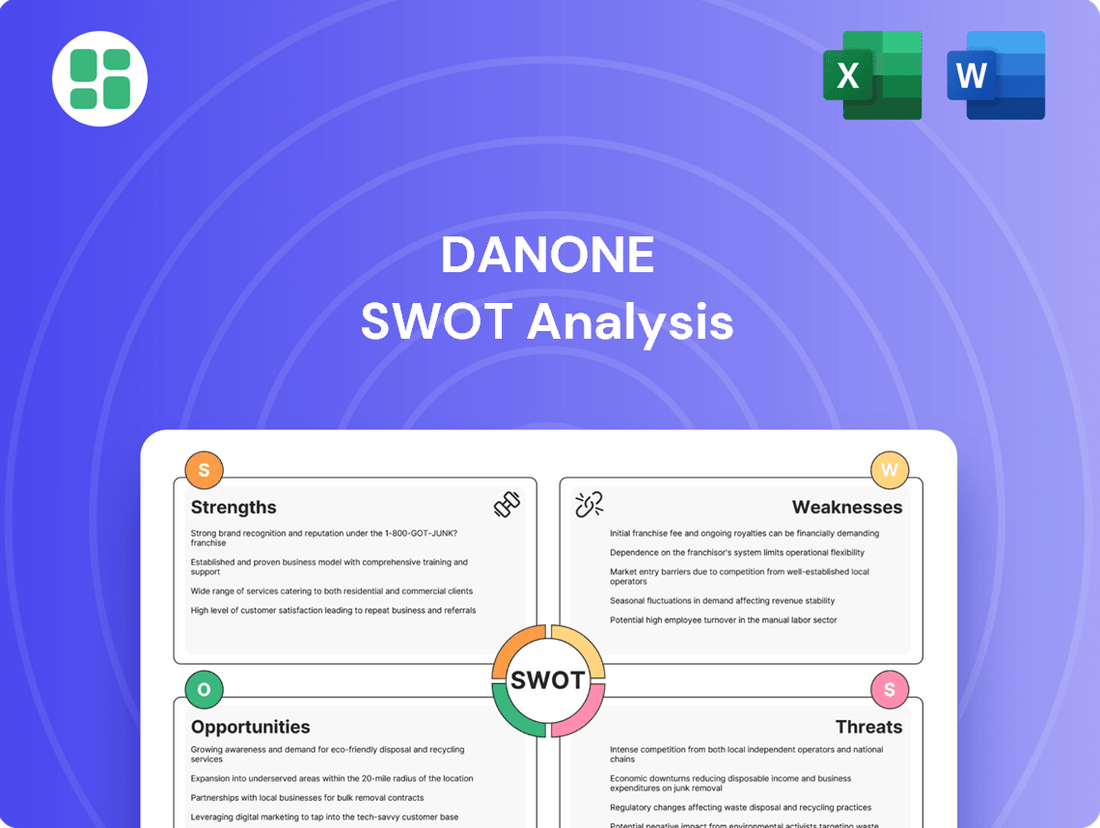

Danone SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Danone Bundle

Danone, a global leader in dairy and plant-based products, boasts strong brand recognition and a commitment to health and sustainability. However, it faces intense competition and evolving consumer preferences.

Discover the complete picture behind Danone's market position with our full SWOT analysis. This in-depth report reveals actionable insights, financial context, and strategic takeaways—ideal for entrepreneurs, analysts, and investors.

Strengths

Danone commands a formidable global market leadership, extending its operations across more than 120 countries. It stands as a top player in the dairy and plant-based product sectors, with substantial engagement in bottled water and specialized nutrition. This expansive geographical footprint and diverse product range, featuring well-known brands such as Activia, Alpro, Evian, and Aptamil, effectively mitigates risks tied to individual markets or product categories.

The company's strategic emphasis on health-focused products resonates strongly with prevailing consumer preferences, fostering steady sales expansion across its various operating regions. In 2023, Danone reported sales of €27.2 billion, with its specialized nutrition division alone achieving €8.1 billion in sales, underscoring the strength of its diversified approach.

Danone has demonstrated strong financial performance, achieving a 4.3% like-for-like sales growth in the first quarter of 2025 and throughout 2024. This growth was fueled by a combination of positive volume and mix, alongside effective pricing strategies.

The company's 'Renew Danone' strategy, initiated in 2022, has been instrumental in its success. This strategy has successfully realigned Danone's focus towards science-based and medical-forward business segments, leading to enhanced profitability and improved cash flow generation.

This strategic clarity and consistent execution have translated into tangible progress across key performance indicators. Danone's disciplined approach positions it favorably for sustained growth and continued positive momentum in the market.

Danone's fundamental mission to deliver health through food is a powerful strength, aligning perfectly with the growing global consumer preference for healthier, functional food options. This commitment is not just a slogan; it's deeply embedded in their product development and marketing strategies.

The specialized nutrition segment is a standout performer, showcasing consistent and strong growth. This includes vital areas like infant formula and medical nutrition, which are not only profitable but also represent significant opportunities for Danone's future expansion and market leadership.

With substantial investments in research and development, particularly in cutting-edge areas like the gut microbiome and high-protein products, Danone is solidifying its reputation as a science-driven innovator in the nutrition sector. For instance, in 2023, Danone reported its specialized nutrition division achieved like-for-like sales growth of 5.5%, underscoring its market strength.

Sustainability Leadership and ESG Initiatives

Danone's dedication to sustainability is a significant strength, clearly outlined in its 'Danone Impact Journey' roadmap. This strategy prioritizes Health, Nature, and People & Communities, demonstrating a holistic approach to corporate responsibility.

The company has set ambitious environmental targets, aiming for net-zero emissions by 2050 and actively working to reduce methane emissions. Furthermore, Danone is committed to advancing circular packaging solutions, reflecting a forward-thinking approach to environmental stewardship.

These proactive ESG initiatives not only mitigate environmental risks but also bolster Danone's brand image. They resonate strongly with a growing consumer base that increasingly favors products from environmentally conscious companies, thereby driving market appeal and potential sales growth.

- Net-Zero Target: Danone aims for net-zero emissions by 2050, aligning with global climate goals.

- Methane Reduction: The company is actively pursuing strategies to lower its methane footprint.

- Circular Economy Focus: Initiatives are in place to promote and implement circular packaging models.

- Brand Enhancement: Strong ESG performance improves brand reputation and consumer loyalty.

Innovation and Adaptability in Product Offerings

Danone's strength lies in its consistent introduction of new products and its agile adaptation to shifting consumer preferences. The company has effectively capitalized on the burgeoning demand for plant-based alternatives and high-protein dairy items, demonstrating a keen understanding of market trends. For instance, by early 2024, Danone's plant-based portfolio, including brands like Silk and So Delicious, continued to show robust growth, contributing significantly to its overall revenue streams.

The company's strategic flexibility is evident in its ability to pivot its category approach and accelerate growth in key channels. Danone has successfully expanded its presence in the 'away-from-home' sector, catering to evolving consumption patterns, and has also made significant inroads into medical nutrition. This adaptability, coupled with targeted geographical expansion, ensures Danone remains competitive and relevant in a fast-paced global market.

This commitment to innovation is a cornerstone of Danone's strategy, allowing it to maintain a leading edge. By continuously refreshing its product offerings and exploring new market segments, Danone reinforces its position as a forward-thinking organization. This proactive approach is crucial for sustained growth and market share in the dynamic food and beverage industry.

Danone's robust global presence, spanning over 120 countries, and its leadership in dairy, plant-based products, bottled water, and specialized nutrition are significant strengths. This diversification, supported by strong brands like Activia and Evian, reduces reliance on single markets or product lines.

The company's focus on health-aligned products aligns perfectly with consumer trends, driving consistent sales growth. In 2023, Danone achieved €27.2 billion in sales, with specialized nutrition contributing €8.1 billion, highlighting the success of its varied approach.

Danone's financial performance remains strong, evidenced by a 4.3% like-for-like sales growth in Q1 2025 and throughout 2024, driven by effective pricing and positive volume/mix strategies. The 'Renew Danone' strategy, implemented in 2022, has successfully shifted the company's focus to science-based and medical nutrition, boosting profitability and cash flow.

Innovation is a key strength, with Danone consistently launching new products and adapting to consumer demand for plant-based and high-protein options. By early 2024, brands like Silk and So Delicious demonstrated strong growth within Danone's plant-based portfolio, contributing significantly to revenue.

| Metric | 2023 Data | 2024/2025 Data (as of Q1 2025) |

|---|---|---|

| Total Sales | €27.2 billion | Continued growth trend |

| Specialized Nutrition Sales | €8.1 billion | 5.5% like-for-like growth (2023) |

| Overall Like-for-like Sales Growth | (Not specified for 2023) | 4.3% (Q1 2025) |

What is included in the product

Delivers a strategic overview of Danone’s internal and external business factors, highlighting its strong brand portfolio and market leadership alongside challenges in innovation and competition.

Offers a clear framework to identify and address Danone's strategic challenges and opportunities, alleviating the pain of uncertainty.

Weaknesses

Danone's significant reliance on emerging markets, which accounted for a substantial portion of its 2024 sales, leaves it vulnerable to economic downturns in these regions. For instance, the depreciation of currencies like the Mexican Peso, Brazilian Real, and Turkish Lira directly impacts Danone's reported revenue and profitability when translated back into Euros.

This exposure to macroeconomic instability and currency volatility presents a consistent challenge for Danone in achieving predictable and stable growth across its diverse global operations. The company must navigate these fluctuating economic landscapes to mitigate potential negative impacts on its financial performance.

Danone operates in a fiercely competitive global food and beverage landscape. Key areas like plant-based alternatives and infant nutrition see rivals like Nestlé and Unilever aggressively vying for market share, putting pressure on Danone's growth. This intense rivalry necessitates substantial ongoing investment in product development and marketing to simply stay relevant.

Danone's profitability is sensitive to the volatile costs of key commodities like milk and packaging materials. For instance, milk prices, a significant input for Danone's dairy and plant-based products, can fluctuate based on global supply and demand dynamics, weather patterns, and agricultural policies. These cost pressures can directly impact Danone's operating margins if the company cannot fully pass them on to consumers through selective pricing.

While Danone employs strategies to mitigate these risks, such as hedging and long-term supply agreements, substantial increases in input prices can still challenge its ability to maintain profitability. For example, reports from 2023 and early 2024 indicated persistent inflationary pressures on agricultural inputs, which would have directly affected Danone's cost of goods sold.

Challenges in Specific Market Segments or Geographies

Danone's otherwise robust performance can be hampered by localized headwinds. For example, the North American market saw pricing pressures and a slight sales dip in Q1 2025, though high-protein products showed strong like-for-like growth. This highlights the need for tailored strategies in diverse markets.

Furthermore, the company faces a significant hurdle in modernizing its dairy business within emerging economies. This transformation requires substantial investment and adaptation to local consumer preferences and regulatory landscapes, presenting a complex operational challenge.

- North American Market Pressures: Q1 2025 saw pricing challenges and a modest sales decline in North America, contrasting with growth in specific product lines.

- Emerging Market Dairy Transformation: Adapting and modernizing the dairy business in developing regions presents a complex operational and strategic challenge for Danone.

Regulatory and Geopolitical Risks

Danone navigates a complex web of global regulations, with new rules like the EU Deforestation-Free Products Regulation (EUDR) demanding significant compliance efforts. This regulatory landscape can create operational hurdles and increase costs.

Geopolitical shifts and regulatory instability in various operating regions pose a threat to Danone's business. Such instability can devalue non-financial performance metrics, complicate supply chain logistics, and restrict market access, impacting overall business strategy and profitability.

- Regulatory Complexity: Compliance with evolving regulations, such as the EUDR, adds operational burden and potential costs for Danone.

- Geopolitical Instability: Shifting political landscapes and inconsistent regulations in key markets can undermine the valuation of non-financial performance indicators.

- Supply Chain Disruption: Geopolitical factors and regulatory changes can directly impact the efficiency and reliability of Danone's global supply chains.

Danone's significant reliance on emerging markets, which accounted for a substantial portion of its 2024 sales, leaves it vulnerable to economic downturns in these regions. For instance, the depreciation of currencies like the Mexican Peso, Brazilian Real, and Turkish Lira directly impacts Danone's reported revenue and profitability when translated back into Euros.

This exposure to macroeconomic instability and currency volatility presents a consistent challenge for Danone in achieving predictable and stable growth across its diverse global operations. The company must navigate these fluctuating economic landscapes to mitigate potential negative impacts on its financial performance.

Danone operates in a fiercely competitive global food and beverage landscape. Key areas like plant-based alternatives and infant nutrition see rivals like Nestlé and Unilever aggressively vying for market share, putting pressure on Danone's growth. This intense rivalry necessitates substantial ongoing investment in product development and marketing to simply stay relevant.

Danone's profitability is sensitive to the volatile costs of key commodities like milk and packaging materials. For instance, milk prices, a significant input for Danone's dairy and plant-based products, can fluctuate based on global supply and demand dynamics, weather patterns, and agricultural policies. These cost pressures can directly impact Danone's operating margins if the company cannot fully pass them on to consumers through selective pricing.

While Danone employs strategies to mitigate these risks, such as hedging and long-term supply agreements, substantial increases in input prices can still challenge its ability to maintain profitability. For example, reports from 2023 and early 2024 indicated persistent inflationary pressures on agricultural inputs, which would have directly affected Danone's cost of goods sold.

Danone's otherwise robust performance can be hampered by localized headwinds. For example, the North American market saw pricing pressures and a slight sales dip in Q1 2025, though high-protein products showed strong like-for-like growth. This highlights the need for tailored strategies in diverse markets.

Furthermore, the company faces a significant hurdle in modernizing its dairy business within emerging economies. This transformation requires substantial investment and adaptation to local consumer preferences and regulatory landscapes, presenting a complex operational challenge.

- North American Market Pressures: Q1 2025 saw pricing challenges and a modest sales decline in North America, contrasting with growth in specific product lines.

- Emerging Market Dairy Transformation: Adapting and modernizing the dairy business in developing regions presents a complex operational and strategic challenge for Danone.

Danone navigates a complex web of global regulations, with new rules like the EU Deforestation-Free Products Regulation (EUDR) demanding significant compliance efforts. This regulatory landscape can create operational hurdles and increase costs.

Geopolitical shifts and regulatory instability in various operating regions pose a threat to Danone's business. Such instability can devalue non-financial performance metrics, complicate supply chain logistics, and restrict market access, impacting overall business strategy and profitability.

- Regulatory Complexity: Compliance with evolving regulations, such as the EUDR, adds operational burden and potential costs for Danone.

- Geopolitical Instability: Shifting political landscapes and inconsistent regulations in key markets can undermine the valuation of non-financial performance indicators.

- Supply Chain Disruption: Geopolitical factors and regulatory changes can directly impact the efficiency and reliability of Danone's global supply chains.

Danone's competitive positioning is challenged by the aggressive market strategies of key rivals, particularly in high-growth segments like plant-based alternatives and infant nutrition. For instance, Nestlé's continued innovation in specialized infant formulas and Unilever's expanding portfolio of plant-based brands directly compete with Danone's offerings, requiring significant R&D and marketing spend to maintain market share.

The company's financial performance is susceptible to fluctuations in commodity prices, a persistent issue throughout 2023 and into early 2025. Increases in the cost of raw materials such as milk, sugar, and packaging significantly impact Danone's cost of goods sold. For example, a 10% rise in global milk prices, as observed in certain periods of 2024, could reduce Danone's gross profit margin by approximately 50 basis points if not fully offset by price increases.

Danone's operational efficiency is also constrained by the need to adapt its dairy business in emerging markets. This involves substantial capital investment and strategic adjustments to meet diverse local consumer preferences and navigate varied regulatory environments, creating a complex undertaking that can slow down modernization efforts.

Furthermore, the company faces ongoing risks associated with geopolitical instability and evolving regulatory frameworks. The implementation of new trade policies or environmental regulations, such as those impacting supply chains in Southeast Asia, can disrupt operations and increase compliance costs, as seen with initial adaptation challenges for the EUDR in late 2024.

| Weakness | Description | Impact | Example/Data Point |

|---|---|---|---|

| Emerging Market Exposure | High reliance on sales from developing economies. | Vulnerability to economic downturns and currency depreciation. | 2024 sales showed significant contribution from emerging markets; currency fluctuations impacted reported revenue. |

| Intense Competition | Strong rivalry in key product categories. | Pressure on market share, requiring continuous investment in innovation and marketing. | Nestlé and Unilever actively compete in plant-based and infant nutrition segments. |

| Commodity Price Volatility | Sensitivity to rising costs of raw materials. | Potential reduction in operating margins if costs cannot be passed to consumers. | Milk prices, a key input, fluctuated significantly in 2023-2024 due to supply/demand and weather. |

| Regulatory & Geopolitical Risks | Navigating complex global regulations and political shifts. | Increased operational hurdles, compliance costs, and potential supply chain disruptions. | EU Deforestation-Free Products Regulation (EUDR) implementation in late 2024 created compliance challenges. |

Full Version Awaits

Danone SWOT Analysis

This is the actual SWOT analysis document you’ll receive upon purchase—no surprises, just professional quality. It provides a comprehensive overview of Danone's internal strengths and weaknesses, alongside external opportunities and threats.

The preview below is taken directly from the full SWOT report you'll get. Purchase unlocks the entire in-depth version, allowing you to leverage this strategic insight for your business planning.

Opportunities

Danone is well-positioned to capitalize on the growing demand for specialized nutrition. Opportunities abound in high-protein products, where the global market is projected to reach $17.5 billion by 2027, and in medical nutrition, a segment that saw significant growth in 2023. Furthermore, functional foods targeting gut health and immunity are increasingly sought after by consumers, creating a fertile ground for Danone's innovation.

The accelerating global trend towards plant-based and sustainable food choices presents a significant growth avenue for Danone. The plant-based food market is projected to reach $161.9 billion by 2030, according to Bloomberg Intelligence, highlighting the immense potential for brands like Danone's Alpro.

Danone can capitalize on this by expanding its plant-based product lines and reinforcing its commitment to sustainability and circular economy principles. This strategy resonates strongly with environmentally aware consumers, who increasingly prioritize brands demonstrating a genuine dedication to planetary health, thereby fostering enhanced brand loyalty and market share.

Danone has a significant opportunity to grow by expanding into emerging markets, especially in Asia-Pacific and Latin America. These regions are experiencing a surge in demand for dairy and nutritional products, with strong growth indicators observed in recent years. For instance, the Asia-Pacific dairy market alone was valued at approximately $200 billion in 2023 and is projected to grow at a CAGR of over 5% through 2028, presenting a substantial addressable market for Danone.

By broadening its geographic reach, Danone can access new consumer segments and adapt its business models, including a focus on 'away-from-home' channels. This strategic move allows the company to capitalize on evolving regional health trends and dietary preferences, fostering sustained revenue growth and market share expansion in these dynamic economies.

Strategic Acquisitions and Partnerships

Danone's robust cash flow generation, evidenced by its strong financial performance in 2024, positions it well for strategic acquisitions. The company is particularly keen on expanding its footprint in specialized nutrition and science-backed product segments, areas showing significant growth potential and aligning with evolving consumer health trends.

Furthermore, Danone can leverage joint ventures and strategic partnerships to its advantage. Collaborations with leading research institutions and key sustainability organizations are instrumental in accelerating product innovation and broadening market access. These alliances not only foster a competitive edge but also enhance Danone's commitment to sustainable business practices.

- Strategic Acquisitions: Danone's strong cash flow supports targeted acquisitions in high-growth specialized nutrition markets.

- Partnerships for Innovation: Collaborations with research bodies and sustainability groups can fast-track new product development.

- Market Expansion: Joint ventures offer pathways to enter new geographic regions and strengthen existing market positions.

- Portfolio Enhancement: Proactive management of its business portfolio through M&A and partnerships drives long-term value creation.

Leveraging Digital Transformation and Supply Chain Optimization

Danone can significantly boost its performance by investing in digital transformation, automation, and advanced analytics. This strategic move is designed to enhance operational efficiency, reduce costs, and build a more resilient supply chain. For instance, by optimizing logistics and improving demand forecasting, Danone can minimize waste and ensure products reach consumers effectively.

Utilizing data analytics offers a powerful opportunity to gain deeper insights into consumer preferences and evolving market dynamics. This allows for more agile and responsive business operations, enabling Danone to adapt quickly to changing consumer demands and competitive pressures. Such data-driven decision-making is crucial for staying ahead in the fast-paced food and beverage industry.

- Enhanced Efficiency: Digital tools and automation can streamline production and distribution processes, potentially leading to significant cost savings.

- Supply Chain Resilience: Advanced analytics can improve forecasting accuracy, reducing stockouts and overstock situations, thereby strengthening the supply chain.

- Consumer Insights: Leveraging data analytics provides a clearer understanding of consumer behavior, enabling more targeted product development and marketing strategies.

- Agility: A digitally transformed operation allows Danone to respond more rapidly to market shifts and consumer trends, a key advantage in today's economy.

Danone is well-positioned to capitalize on the growing demand for specialized nutrition, with opportunities in high-protein products and medical nutrition. The plant-based food market, projected to reach $161.9 billion by 2030, also presents a significant growth avenue for brands like Alpro.

Expanding into emerging markets, particularly in Asia-Pacific and Latin America, offers substantial growth potential, with the Asia-Pacific dairy market valued at approximately $200 billion in 2023.

Danone's strong cash flow supports strategic acquisitions in high-growth specialized nutrition segments, while partnerships can accelerate innovation and market access.

Investing in digital transformation and data analytics can enhance operational efficiency, improve supply chain resilience, and provide deeper consumer insights, enabling more agile responses to market dynamics.

| Opportunity Area | Market Projection/Data | Danone's Advantage |

|---|---|---|

| Specialized Nutrition | Medical Nutrition growth in 2023; High-protein market to reach $17.5B by 2027 | Leveraging existing expertise and strong cash flow for acquisitions |

| Plant-Based Foods | Global market to reach $161.9B by 2030 (Bloomberg Intelligence) | Strong brand portfolio (Alpro) and commitment to sustainability |

| Emerging Markets | Asia-Pacific dairy market ~$200B in 2023, CAGR >5% through 2028 | Adaptable business models and focus on regional health trends |

| Digital Transformation | Enhanced efficiency, supply chain resilience, consumer insights | Data analytics for agile operations and targeted strategies |

Threats

Consumer tastes are changing fast. Many people are moving away from traditional dairy products, preferring options like plant-based milks and yogurts. This shift could hurt Danone's sales if they don't keep up.

While Danone is investing in plant-based alternatives, a major change in what people want from their core products, like dairy, presents a significant risk. For example, the global plant-based dairy market is projected to reach over $50 billion by 2026, showing the scale of this trend.

Consumers are increasingly seeking value, leading to intensified price pressure. This trend is amplified by the growing popularity of private label brands, which offer a more budget-friendly option. For Danone, this means a tougher environment for implementing price increases.

The rise of private labels directly challenges Danone's market share and pricing power. If volume growth doesn't offset the reduced margins from potentially lower prices, Danone's profitability could be squeezed. For instance, in 2024, many grocery retailers reported significant gains in their private label sales, often outpacing national brands in key categories.

Global supply chain disruptions, exacerbated by geopolitical tensions and environmental challenges, present a significant threat to Danone. These factors can lead to shortages or price hikes for essential raw materials, directly affecting production efficiency and distribution networks. For instance, the ongoing impacts of climate change and regional conflicts have contributed to volatility in agricultural commodity prices throughout 2024 and into early 2025.

Danone's substantial dependence on agricultural inputs, particularly milk, exposes it to the vagaries of climate change. Issues like water scarcity and the potential for disease outbreaks in livestock populations can negatively impact agricultural yields, creating a direct threat to the company's supply stability and cost structure. Reports from the FAO in late 2024 highlighted increased risks to dairy production in several key regions due to extreme weather events.

Brand Reputation Risk and Food Safety Concerns

Danone, as a major global food producer, is inherently exposed to significant brand reputation risks stemming from food safety concerns. A single widespread product recall or contamination incident, like the 2022 voluntary recall of certain infant formula products in the US, can erode consumer confidence built over years. Such events directly impact sales and market share, as seen in the financial repercussions faced by companies experiencing major food safety failures.

The company's commitment to sustainability and ethical sourcing also presents a reputational vulnerability. Negative publicity surrounding ingredient sourcing, labor practices, or environmental impact can lead to consumer boycotts and damage brand loyalty. For instance, in 2023, reports questioning the environmental claims of some dairy products highlighted the ongoing scrutiny faced by large food conglomerates.

- Brand Reputation Risk: Any food safety lapse or ethical misstep can trigger widespread negative media attention and social media backlash, significantly impacting consumer trust.

- Sales Decline: A damaged reputation directly correlates with reduced sales volumes and market penetration, as consumers opt for perceived safer or more ethical alternatives.

- Financial Impact: Beyond immediate sales loss, reputational damage can lead to increased marketing costs for recovery, potential regulatory fines, and a decrease in stock valuation.

- Consumer Trust Erosion: Rebuilding trust after a significant safety or ethical scandal is a long and costly process, often requiring extensive transparency and demonstrable corrective actions.

Increased Regulatory Scrutiny and Compliance Costs

Increased regulatory scrutiny presents a significant challenge for Danone. The growing complexity and stringency of global food safety, environmental, and labeling regulations, such as the EU Deforestation Regulation (EUDR), demand substantial investment in compliance measures. This can directly translate to higher operational costs and potentially impact product development timelines.

The fragmented regulatory landscape, exemplified by Danone's decision to withdraw Nutri-Score in certain markets, creates strategic hurdles. Navigating these diverse and sometimes conflicting regulations across different regions requires agile market strategies and can limit the effectiveness of unified branding or product positioning efforts.

- Regulatory Complexity: Evolving global standards for food safety, environmental impact, and product labeling necessitate continuous adaptation and investment.

- Compliance Costs: Adhering to new regulations, like the EUDR, requires significant financial resources for supply chain audits, data management, and process adjustments.

- Market Fragmentation: Divergent regional regulatory approaches, such as varying stances on front-of-pack nutrition labeling systems, complicate international market strategies.

- Operational Impact: Non-compliance or the need for extensive product reformulation due to regulatory changes can disrupt operations and increase production expenses.

The intense competition from both established players and emerging brands, particularly those focused on plant-based alternatives and private labels, poses a significant threat to Danone's market share and pricing power. This dynamic is further complicated by evolving consumer preferences and the increasing demand for value, which can pressure margins. For instance, in 2024, private label brands continued to gain traction, with some retailers reporting double-digit growth in these categories, directly impacting national brand sales.

Supply chain volatility, driven by geopolitical instability and climate change impacts, directly threatens Danone's ability to secure raw materials at stable prices. Extreme weather events in 2024 and early 2025 have already led to price fluctuations in agricultural commodities, impacting production costs and potentially leading to shortages. This exposure is particularly acute for dairy, a key input for Danone, with reports from the FAO in late 2024 highlighting increased risks to dairy production due to adverse weather conditions.

Brand reputation risks, stemming from potential food safety incidents or ethical sourcing concerns, represent a critical vulnerability. A single product recall or negative publicity surrounding sustainability practices could rapidly erode consumer trust, leading to significant sales declines and financial repercussions. The scrutiny on environmental claims in 2023 demonstrated the sensitivity consumers have to these issues, impacting brand loyalty.

Navigating a complex and evolving global regulatory landscape presents ongoing challenges, requiring substantial investment in compliance and potentially fragmenting market strategies. New regulations, such as the EU Deforestation Regulation (EUDR), necessitate significant adjustments to supply chains and operational processes, increasing costs. The varied approaches to labeling, like differing stances on nutrition scoring systems across regions, also complicate unified marketing efforts.

SWOT Analysis Data Sources

This SWOT analysis is built upon a foundation of credible data, drawing from Danone's official financial reports, comprehensive market research, and insights from industry experts to provide a robust and informed strategic overview.