Danone Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Danone Bundle

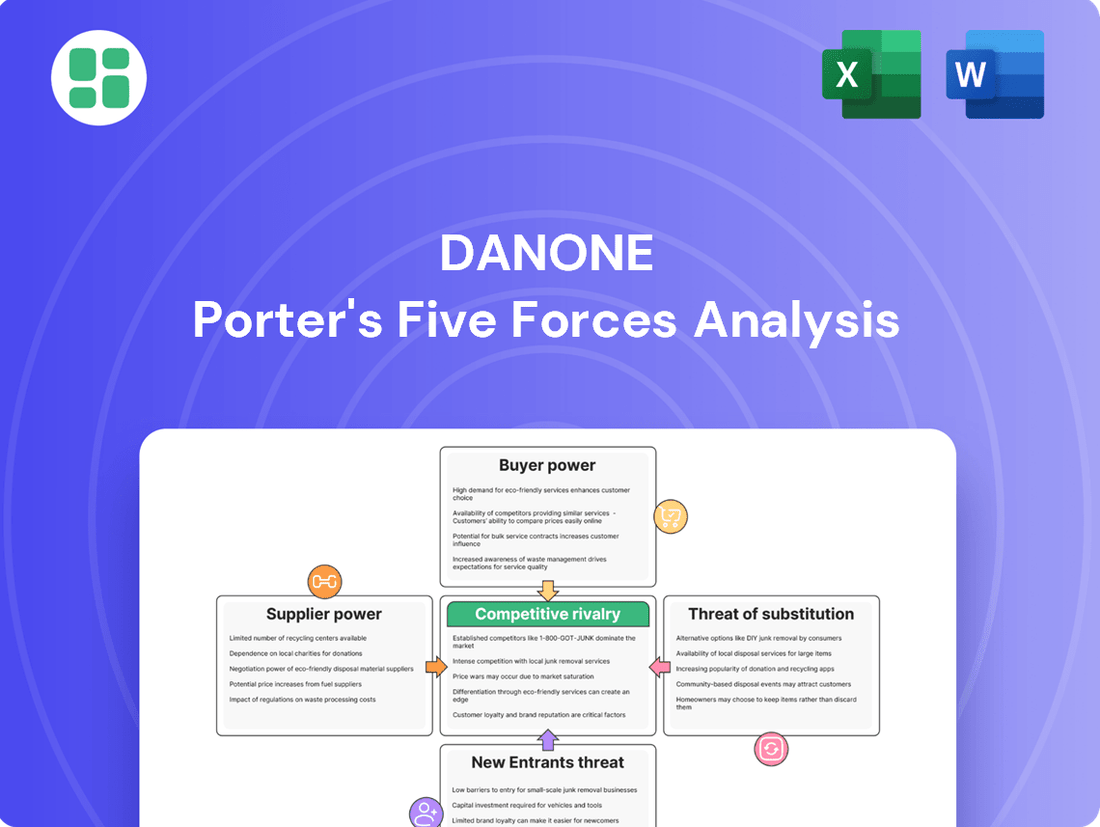

Danone navigates a complex landscape shaped by intense rivalry, significant buyer power, and the constant threat of substitutes. Understanding these forces is crucial for any stakeholder in the food and beverage industry.

The complete report reveals the real forces shaping Danone’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

Raw material price volatility significantly impacts Danone. The company's heavy reliance on agricultural commodities such as milk and various fruits means it's directly exposed to the unpredictable swings in these markets. For instance, global dairy market reports from 2024 highlighted a noticeable increase in milk production costs due to higher prices for essential inputs like animal feed and fertilizers. This trend is projected to persist into 2025, thereby strengthening the bargaining power of Danone's agricultural suppliers.

Danone's Specialized Nutrition segment might rely on a few key suppliers for crucial, unique ingredients. This concentration of specialized suppliers can grant them considerable leverage, particularly if finding other sources is challenging or requires extensive validation. For example, the market for specialized proteins experienced robust demand and notable price hikes throughout 2024, illustrating this supplier power.

Danone's bottled water brands, like Evian and Volvic, rely heavily on exclusive access to specific, high-quality natural water sources. This dependence means that the owners of these water sources, or the regional governing bodies, hold considerable sway. They can leverage this control to negotiate higher prices for water extraction rights or even impose limitations on how much water Danone can take, directly impacting production costs and supply stability.

In 2024, the global bottled water market continued its steady growth, with demand for premium and naturally sourced products remaining strong. Danone's commitment to water stewardship and watershed preservation is a strategic response to this supplier power. By investing in these programs, Danone aims to foster better relationships with source owners and authorities, ensuring long-term, sustainable access to its key resources while mitigating the risk of price hikes or supply disruptions.

Packaging Material Suppliers

Packaging material suppliers hold moderate bargaining power over Danone. As a major global consumer goods company, Danone's substantial demand for plastics, glass, and cardboard gives it leverage. However, this power is tempered by the potential for supply chain disruptions and the increasing costs of raw materials, which can shift the balance.

The drive towards sustainability also influences this dynamic. Danone's commitment to having 100% of its packaging be recyclable, reusable, or compostable by 2030 means suppliers who can meet these evolving environmental standards may gain an advantage. This push for eco-friendly materials could lead to a more concentrated supplier base for specialized packaging solutions, potentially increasing their bargaining power.

- Supplier Concentration: The market for specialized, sustainable packaging materials might be less fragmented, giving key suppliers more influence.

- Switching Costs: While Danone is a large buyer, significant changes to packaging materials can involve retooling and regulatory approvals, creating some switching costs.

- Input Costs: Fluctuations in the price of raw materials like oil (for plastics) or pulp (for cardboard) directly impact packaging suppliers' costs and their ability to negotiate prices.

- Demand for Sustainability: Suppliers capable of providing compliant and innovative sustainable packaging solutions are increasingly sought after, enhancing their position.

Sustainable Sourcing Demands

Danone's dedication to sustainable sourcing and regenerative agriculture means it actively seeks suppliers who meet stringent environmental and social standards. This commitment can narrow the available supplier base, potentially driving up costs as suppliers with the required certifications may charge a premium.

For instance, in 2024, Danone continued its efforts to reduce its water footprint across its supply chain, working collaboratively with farmers to implement best practices. This focus on sustainability directly impacts supplier relationships, as compliance with these evolving standards becomes a key negotiation point.

- Supplier Standards: Danone requires suppliers to adhere to specific environmental and social criteria, influencing sourcing decisions.

- Cost Implications: Meeting these sustainability demands can lead to higher input costs for Danone.

- Water Footprint Reduction: Collaborative initiatives with farmers aim to minimize water usage in 2024 and beyond.

Danone's reliance on agricultural commodities like milk and fruits exposes it to supplier power, particularly as input costs for animal feed and fertilizers rose in 2024, a trend expected to continue into 2025.

Specialized ingredients for its Nutrition segment can also grant suppliers leverage due to limited alternatives and high demand, as seen with rising prices for specialized proteins in 2024.

Furthermore, exclusive access to water sources for brands like Evian gives owners significant bargaining power, influencing extraction rights and supply volumes.

Danone's sustainability initiatives, including watershed preservation and eco-friendly packaging, aim to mitigate supplier power by fostering stronger relationships and meeting evolving market demands.

| Supplier Category | Impact on Danone | Key Factors Influencing Power (2024-2025) |

|---|---|---|

| Agricultural Commodities (Milk, Fruits) | High cost volatility, direct impact on production expenses | Rising feed/fertilizer costs, weather patterns, global demand |

| Specialized Ingredients | Potential for price increases due to limited alternatives | Concentrated supplier base, high demand for niche products |

| Water Sources | Control over extraction rights and volumes | Exclusive access to premium natural resources, regional regulations |

| Packaging Materials | Moderate power, influenced by demand and sustainability requirements | Raw material costs (oil, pulp), supplier innovation in eco-friendly solutions |

What is included in the product

This analysis dissects the competitive forces impacting Danone, evaluating the intensity of rivalry, the bargaining power of buyers and suppliers, the threat of new entrants, and the risk of substitutes within the food and beverage industry.

Quickly identify competitive threats and opportunities with a visual breakdown of each force, enabling faster, more informed strategic adjustments.

Customers Bargaining Power

Major supermarket chains and hypermarkets wield considerable influence over Danone. Their sheer size means they place large orders, and they control crucial shelf space, giving them leverage to negotiate better prices and terms. This power directly affects Danone's profitability.

In 2024, these large retailers represented a substantial portion of sales for Danone's plant-based foods and premium bottled water. Their ability to dictate terms, such as favorable pricing and promotional support, can squeeze Danone's profit margins, highlighting the intense bargaining power customers, in this case, large distributors, possess.

Danone faces significant consumer price sensitivity, particularly in its dairy and bottled water segments. For instance, in 2023, the global bottled water market saw intense competition, with consumers readily switching to store brands offering lower price points, impacting premium brands' market share.

This price sensitivity is amplified during economic downturns. If Danone's pricing strategy is perceived as too high, consumers are likely to seek out more affordable private label options or competitor products. This limits Danone's capacity to absorb rising production costs through price increases, as seen in 2024 commodity price fluctuations impacting the food industry.

Consumers increasingly favor healthier, plant-based, and sustainable products, a trend that significantly bolsters their bargaining power. This shift allows them to readily switch between brands or even entire product categories if their demands aren't met. For instance, the global plant-based food market was valued at approximately USD 29.7 billion in 2023 and is projected to reach USD 162 billion by 2030, highlighting the substantial impact of these preferences.

Brand Loyalty and Differentiation

Danone enjoys significant brand recognition with products like Activia and Evian, fostering customer trust. However, the food and beverage market is highly competitive, meaning this loyalty can be easily swayed. Customers can readily switch to competitors based on price, perceived quality, or newer products, thus amplifying their bargaining power.

The sheer volume of choices available to consumers significantly enhances their leverage. For instance, in the dairy sector alone, a consumer might choose between Danone's brands and numerous other local and international offerings. This abundance of alternatives means customers are less dependent on any single brand, giving them more power to negotiate or seek better deals.

Danone actively works to mitigate this by focusing on its health-oriented portfolio and continuous innovation. This strategy aims to create perceived value that transcends price, thereby solidifying customer relationships. For example, Danone's investment in research and development for products like its plant-based offerings aims to capture consumer interest in evolving health trends.

- Brand Strength vs. Competitive Landscape: While Danone's brands like Aptamil have strong market positions, the availability of numerous alternatives in categories like infant nutrition means customer loyalty is not absolute.

- Price Sensitivity and Switching Costs: For many Danone products, switching costs are low, making customers sensitive to price differences and more likely to explore competitor offerings.

- Innovation as a Counter-Leverage Tool: Danone's focus on innovation, such as expanding its plant-based dairy alternatives, aims to differentiate its products and reduce the customer's incentive to switch based solely on price.

- Consumer Demand for Health and Wellness: The growing consumer demand for healthier options plays into Danone's strengths, but also means competitors are rapidly developing similar offerings, maintaining customer choice and power.

Specialized Nutrition Buyer Influence

In Danone's specialized nutrition division, the bargaining power of customers is notably high, particularly with healthcare professionals, hospitals, and large institutions. These entities often possess specialized knowledge and established procurement procedures, enabling them to negotiate favorable terms. Their purchasing decisions are heavily influenced by clinical efficacy and the breadth of product offerings, leading them to demand specific formulations and consistent supply chains. For instance, in the significant elderly nutrition market, these institutional buyers can leverage their volume and expertise to exert considerable influence.

The specialized nature of these buyers means they are not easily substitutable and often require tailored solutions. This can translate into demands for customized product development and stringent quality controls, further amplifying their leverage. Danone's ability to meet these precise requirements is crucial in mitigating this customer power. The elderly nutrition segment, a key area for specialized nutrition, represents a substantial portion of the market, making the purchasing decisions within this segment particularly impactful on Danone.

- High influence from healthcare professionals and institutions in specialized nutrition purchasing.

- Decisions driven by clinical efficacy, product range, and long-term contracts.

- Specialized knowledge and procurement processes empower these customers.

- Elderly nutrition segment, a major application, contributes significantly to customer bargaining power.

The bargaining power of customers is a significant force for Danone, particularly evident with large retail chains. These powerful buyers, like major supermarket groups, can command favorable pricing and promotional terms due to their substantial order volumes and control over shelf space. In 2024, these retailers represented a critical channel for Danone's plant-based and premium water sales, directly impacting profit margins.

Consumer price sensitivity also plays a key role, especially in the competitive dairy and bottled water markets. During 2023, the bottled water sector saw consumers readily switch to lower-priced private labels, a trend amplified by economic pressures. This limits Danone's ability to pass on rising costs, as exemplified by commodity price fluctuations impacting the food industry in 2024.

The growing consumer preference for healthier, plant-based options further empowers customers, enabling easy brand switching. The global plant-based food market, valued at approximately USD 29.7 billion in 2023, underscores the impact of these evolving demands. While Danone benefits from brand recognition, intense competition means customer loyalty is not absolute, allowing for easy shifts to alternatives based on price, quality, or innovation.

| Customer Segment | Key Influencing Factors | Impact on Danone |

|---|---|---|

| Major Retailers | Order volume, shelf space control, negotiation leverage | Price pressure, margin squeeze |

| Price-Sensitive Consumers | Price, availability of private labels/competitors | Limited pricing power, potential volume loss |

| Health-Conscious Consumers | Product ingredients, health benefits, sustainability | Demand for innovation, potential for brand switching |

| Specialized Nutrition Buyers (e.g., Hospitals) | Clinical efficacy, product specifications, long-term contracts | Demand for tailored solutions, stringent quality requirements |

Preview the Actual Deliverable

Danone Porter's Five Forces Analysis

This preview showcases the complete Porter's Five Forces Analysis for Danone, offering a detailed examination of competitive rivalry, the threat of new entrants, the bargaining power of buyers, the bargaining power of suppliers, and the threat of substitute products. The document you see here is precisely the same professionally formatted and ready-to-use analysis you will receive immediately after purchase, ensuring no surprises and full immediate access to this valuable business intelligence.

Rivalry Among Competitors

Danone faces formidable competition from global giants like Nestlé, Unilever, and Lactalis. These behemoths vie for market share across numerous product segments, leveraging vast distribution channels and significant marketing investments. For instance, in 2023, Nestlé reported CHF 93.0 billion in sales, while Unilever's underlying sales grew by 7.0% in the same year, highlighting the scale of resources these competitors deploy.

Danone operates in markets characterized by intense rivalry across its key business segments. In dairy and plant-based products, it contends with major players like Lactalis, alongside numerous agile local competitors. The bottled water sector brings global giants such as Coca-Cola, with its Dasani brand, and PepsiCo, featuring Aquafina, into direct competition.

Furthermore, Danone's specialized nutrition division faces formidable opposition from multinational pharmaceutical corporations and other specialized nutrition companies, all vying for market share. Despite this competitive landscape, Danone demonstrated robust performance, with Q4 2024 sales highlighting significant momentum in North America, particularly within its High Protein, Coffee Creations, and Waters product lines.

Competitive rivalry in the dairy and plant-based food sector is intense, fueled by a relentless pursuit of product innovation and differentiation. Companies are constantly reformulating products, experimenting with new packaging designs, and highlighting enhanced health benefits to win over consumers. This dynamic landscape means that staying ahead requires a consistent stream of new offerings.

The market sees a continuous introduction of novel flavors, functional ingredients that cater to specific health needs, and a significant surge in plant-based alternatives. For instance, the global plant-based food market was valued at approximately $29.7 billion in 2023 and is projected to grow substantially. This rapid evolution is driven by shifting consumer preferences towards healthier and more sustainable options.

Danone itself places a strong emphasis on innovation and robust research and development to maintain its competitive edge. The company invests significantly in understanding consumer trends and developing products that align with these demands, such as its expanding portfolio of plant-based yogurts and beverages. This commitment to R&D is crucial for capturing market share and responding effectively to the evolving preferences of health-conscious consumers.

Marketing and Advertising Intensity

The competitive landscape for Danone is characterized by intense marketing and advertising efforts. Competitors frequently launch aggressive campaigns across various channels to capture consumer attention and boost sales. This high level of promotional activity, encompassing digital marketing, television, print, and in-store activations, significantly increases overall marketing expenditures for all industry participants.

Danone itself is committed to bolstering its brand portfolio and enhancing its operational capabilities. For instance, in 2024, Danone continued its strategic investments in brand building and innovation, aiming to differentiate its offerings in a crowded marketplace. This focus on marketing intensity is a critical factor in maintaining market share and driving growth.

- Aggressive Digital and Traditional Media Spending: Competitors are heavily investing in digital platforms and traditional advertising to build brand recognition and drive demand.

- Escalating Marketing Costs: The widespread use of promotions and advertising campaigns leads to higher operational costs for all companies in the sector, including Danone.

- Danone's Brand Investment Strategy: Danone prioritizes substantial investment in its brands and overall capabilities to maintain a competitive edge.

Pricing Strategies and Market Share Battles

Competitive rivalry within the food and beverage industry, particularly for Danone, is intense, often manifesting as price wars in commoditized areas like basic dairy products and bottled water. Competitors frequently employ aggressive pricing tactics to capture market share, directly impacting Danone's profit margins. For instance, in 2024, the bottled water market saw significant price competition, with major players adjusting their strategies to maintain or grow their consumer base.

Danone's own pricing approach, which has sometimes leaned towards premium positioning, has been noted as a potential vulnerability in segments where price sensitivity is high. This can lead to market share erosion if competitors offer more budget-friendly alternatives. The ongoing battle for consumer loyalty means that maintaining a delicate balance between perceived value and competitive pricing is crucial for Danone's sustained success.

- Price Wars: Persistent threat in dairy and water segments.

- Market Share: Aggressive pricing by rivals pressures Danone.

- Profitability: Price competition directly impacts Danone's bottom line.

- Pricing Strategy: Premium pricing can be a weakness in price-sensitive markets.

Competitive rivalry is a significant force for Danone, with global giants like Nestlé and Unilever constantly vying for market share across dairy, plant-based, and water segments. This intense competition is further amplified by agile local players and large beverage companies like Coca-Cola and PepsiCo entering the bottled water arena. Danone's strategic investments in brand building and innovation, as seen in its Q4 2024 North American performance, are crucial for navigating this dynamic landscape.

The market is characterized by aggressive marketing and advertising, driving up overall industry costs as companies deploy extensive campaigns across digital and traditional media. Price wars are also a persistent threat, particularly in commoditized areas like basic dairy and bottled water, directly impacting profit margins. Danone's premium pricing strategy can be a vulnerability in price-sensitive segments, necessitating a careful balance between value and cost to maintain market share.

| Competitor | 2023 Sales (approx.) | 2024 Growth (reported) |

|---|---|---|

| Nestlé | CHF 93.0 billion | N/A (Full year 2024 data pending) |

| Unilever | N/A (Reported 7.0% underlying sales growth in 2023) | N/A (Full year 2024 data pending) |

| Coca-Cola | USD 45.8 billion | N/A (Full year 2024 data pending) |

SSubstitutes Threaten

The threat of substitutes for Danone's dairy products is substantial, primarily driven by the booming plant-based alternatives market. Products like almond, oat, and soy milk, along with plant-based yogurts, are increasingly capturing consumer interest and market share.

This trend is not just a niche movement; the global plant-based food market is projected for significant expansion. Forecasts indicate a rise from approximately USD 10.7 billion in 2024 to an impressive USD 25.57 billion by 2032, underscoring the direct substitution pressure on Danone's core dairy business.

Tap water, often significantly cheaper and readily accessible, presents a substantial threat to Danone's bottled water business. In many developed regions, the quality and safety of tap water are high, making it a practical and cost-effective alternative for daily hydration. This direct substitute directly impacts the volume and price sensitivity of bottled water consumers.

Beyond tap water, a broad spectrum of other beverages, including juices, carbonated soft drinks, teas, and sports drinks, also vie for consumer preference and hydration occasions. While bottled water growth accelerated in 2024, the sheer variety and marketing power of these alternative beverage categories continue to pose a competitive challenge, potentially diverting market share.

The threat of substitutes, particularly from home-cooked meals and generic brands, presents a significant challenge for Danone. Consumers can easily prepare meals at home using readily available, often cheaper, ingredients, bypassing Danone's prepared products. This is especially true for basic dairy items and certain packaged foods where brand loyalty might be less pronounced.

Generic store brands offer a more affordable alternative to Danone's premium offerings, directly impacting market share, especially in price-sensitive segments. For instance, in 2024, private label dairy products continued to gain traction, capturing an estimated 20% of the yogurt market in key European countries, directly competing with Danone's core business.

Consumers are increasingly seeking tasty yet cheaper ingredients, which directly benefits demand for basic items like cheese, a category where Danone has a presence. This trend suggests that while Danone may focus on innovation, the fundamental need for affordable, versatile ingredients means substitutes will remain a potent competitive force.

Alternative Dietary Approaches for Specialized Nutrition

While Danone's specialized nutrition products, like those for infants or medical conditions, are designed for specific needs, other dietary approaches can act as substitutes. For instance, individuals managing certain health issues might opt for personalized meal plans developed with a registered dietitian rather than relying solely on specialized formulas.

The threat of substitutes is amplified by growing consumer interest in holistic health and wellness. In 2024, the global health and wellness market was projected to reach over $5 trillion, indicating a strong consumer inclination towards diverse health solutions.

Consider the example of managing digestive health. Instead of specialized medical foods, consumers might turn to over-the-counter probiotics, prebiotics, or specific food eliminations recommended by healthcare professionals. This flexibility in approach presents a viable alternative to purchasing dedicated specialized nutrition products.

The prevalence of chronic diseases, a key driver for specialized nutrition, also fuels the demand for alternative management strategies. With an estimated 6 in 10 adults in the US having a chronic disease, the market for both specialized nutrition and alternative health solutions is substantial, creating a competitive landscape where substitutes can gain traction.

- Dietary Modifications: Personalized meal plans and advice from nutritionists can replace specialized formulas for certain conditions.

- Over-the-Counter Products: Probiotics, prebiotics, and supplements offer alternative ways to address specific health needs.

- Medical Interventions: In some cases, direct medical treatments or lifestyle changes may be favored over specialized nutritional products.

- Market Trends: The growing health and wellness market, valued in the trillions, indicates a strong consumer interest in diverse health solutions, including substitutes.

Functional Foods and Supplements

The growing popularity of functional foods and dietary supplements presents a significant threat of substitutes for Danone. Consumers increasingly seek targeted health benefits, such as improved gut health through probiotics or enhanced muscle recovery with high-protein options. This trend means individuals might opt for a specialized supplement rather than a Danone product that offers similar, albeit broader, nutritional advantages.

For example, a consumer looking for a specific protein boost might choose a standalone protein powder or bar instead of a Danone yogurt. The market for specialized nutrition is substantial; in 2023, the global protein ingredients market alone was valued at over $45 billion, with projections indicating continued growth. This indicates a strong consumer willingness to explore alternatives that directly address particular dietary needs.

- Probiotic Supplements: Direct competitors to Danone's Activia line, offering concentrated probiotic strains.

- Protein Powders and Bars: Substitutes for Danone's high-protein dairy products, appealing to fitness enthusiasts.

- Vitamins and Minerals: Consumers may choose these over fortified foods if they perceive a more direct or potent delivery of nutrients.

- Specialized Nutritional Drinks: Beyond Danone's offerings, a wide array of plant-based and performance-oriented nutritional beverages are available.

The threat of substitutes for Danone's products is multifaceted, ranging from plant-based alternatives to everyday staples like tap water. The plant-based food market, projected to reach $25.57 billion by 2032, directly challenges Danone's dairy portfolio. Similarly, tap water's accessibility and low cost present a significant substitute for its bottled water business.

Moreover, generic brands and home-cooked meals offer more affordable alternatives, particularly impacting Danone's basic dairy and packaged food segments. In 2024, private label dairy products captured an estimated 20% of the yogurt market in key European countries, highlighting this competitive pressure.

Even in specialized nutrition, consumers can opt for dietary modifications, over-the-counter supplements, or alternative health strategies, driven by a global health and wellness market exceeding $5 trillion in 2024. The protein ingredients market alone, valued over $45 billion in 2023, demonstrates a strong consumer willingness to explore specialized alternatives.

| Product Category | Key Substitutes | Market Trend/Data Point |

|---|---|---|

| Dairy (Milk, Yogurt) | Plant-based milks (almond, oat, soy), plant-based yogurts | Global plant-based food market projected to reach $25.57 billion by 2032. |

| Bottled Water | Tap water, juices, soft drinks, teas | High quality and safety of tap water in developed regions. |

| Packaged Foods/Basic Dairy | Generic store brands, home-cooked meals | Private label dairy captured ~20% of European yogurt market in 2024. |

| Specialized Nutrition | Dietary modifications, OTC probiotics/supplements, personalized meal plans | Global health & wellness market >$5 trillion (2024); Protein ingredients market >$45 billion (2023). |

Entrants Threaten

Entering the global food and beverage sector, particularly to compete with established players like Danone, demands immense financial resources. For instance, establishing state-of-the-art manufacturing plants, securing sophisticated processing machinery, and building robust distribution networks can easily run into hundreds of millions of dollars. This significant capital outlay acts as a formidable barrier, discouraging many aspiring competitors from even attempting to enter the market.

Danone benefits from decades of brand building, fostering significant consumer trust across its diverse product lines like dairy, plant-based alternatives, and water. This established loyalty means new entrants face an uphill battle to gain consumer preference.

The financial barrier to entry is substantial, as new companies would need to invest heavily in marketing and advertising to build brand recognition and secure prominent shelf space in retail environments. For instance, global advertising spending in the food and beverage sector reached billions in 2024, highlighting the scale of investment required.

Danone's robust brand reputation directly strengthens its competitive position against potential new entrants. Consumers often gravitate towards familiar and trusted brands, making it challenging for newcomers to disrupt established market share without considerable resources and time.

The complexity of Danone's distribution networks presents a significant barrier to new entrants. Building out the intricate logistics required to reach consumers across diverse markets, from supermarkets to specialized health channels, is a massive undertaking. For instance, Danone's presence in over 120 countries means navigating varied regulatory environments and establishing relationships with countless local partners.

Replicating Danone's established global reach and deep-seated relationships with retailers and institutional buyers, such as hospitals and pharmacies, is incredibly challenging for newcomers. These established networks are the result of years of investment and trust, making it difficult for any new player to gain comparable market access and shelf space quickly.

Regulatory Hurdles and Food Safety Standards

The threat of new entrants in the food and beverage sector, especially in specialized nutrition like infant formula, is significantly dampened by rigorous regulatory hurdles and exacting food safety standards. These compliance demands necessitate substantial investments in research and development, robust quality control systems, and specialized legal counsel, creating a formidable barrier for aspiring newcomers. For instance, in 2024, the global infant formula market continued to see intense scrutiny over ingredient sourcing and manufacturing processes, requiring extensive documentation and certifications for market entry.

Navigating these complex regulatory landscapes requires deep expertise and financial resources that many new players may lack. The specialized nutrition market, valued at over $50 billion globally in 2023 and projected to grow, is particularly sensitive to these requirements, as consumer trust is paramount.

- Stringent Regulations: The food and beverage industry, particularly segments like infant nutrition, faces extensive regulations concerning product safety, labeling, and ingredient sourcing.

- High Compliance Costs: Meeting these standards involves significant capital expenditure on quality assurance, testing facilities, and regulatory affairs personnel.

- Market Access Barriers: Obtaining necessary approvals and certifications can be a lengthy and costly process, effectively limiting the number of new entrants.

- Specialized Nutrition Growth: The expanding specialized nutrition market, driven by health consciousness, attracts new players but is simultaneously constrained by these entry barriers.

Access to Raw Materials and Expertise

Newcomers face hurdles in securing consistent supplies of high-quality raw materials like milk and specific agricultural products. Existing strong relationships between established players, such as Danone, and their suppliers, coupled with potential supply limitations, can make it difficult for new entrants to gain a foothold. For example, in 2024, global dairy prices saw volatility, impacting the cost and availability of milk, a core ingredient for many of Danone's products.

Developing specialized expertise in areas like food science, nutrition, and sustainable agricultural practices represents another significant barrier. This requires substantial investment in research and development, as well as attracting and retaining skilled talent. Danone's strategic focus on science and innovation, evidenced by its significant R&D spending, creates a high bar for new companies to match.

- Raw Material Sourcing Challenges: New entrants struggle to establish reliable supply chains for key ingredients like milk, facing competition from established companies with long-standing supplier agreements.

- Expertise and R&D Investment: Building the necessary knowledge in food science, nutrition, and sustainability demands considerable financial commitment and talent acquisition, areas where incumbents like Danone have a distinct advantage.

- Market Dynamics in 2024: Fluctuations in commodity prices, such as dairy in 2024, further complicate the entry for new businesses needing to manage raw material costs effectively.

The threat of new entrants for Danone is relatively low due to substantial capital requirements for manufacturing, distribution, and marketing, alongside strong brand loyalty and complex regulatory environments, particularly in specialized nutrition sectors.

New players must overcome significant financial hurdles, including the billions spent on global advertising in 2024, to challenge Danone's established brand recognition and shelf space.

Danone's extensive global distribution networks, operating in over 120 countries, and deep relationships with retailers present a major logistical and access barrier for any new competitor.

The stringent food safety standards and regulatory compliance, especially in markets like infant formula, demand significant R&D and quality control investments, effectively deterring many potential entrants.

| Barrier Type | Description | Impact on New Entrants | Example Data (2024) |

|---|---|---|---|

| Capital Requirements | Establishing manufacturing, machinery, and distribution networks. | Very High - Discourages entry due to massive upfront costs. | Hundreds of millions of dollars for plant setup. |

| Brand Loyalty & Recognition | Decades of consumer trust and marketing investment. | High - New entrants struggle to gain consumer preference. | Billions spent on global F&B advertising. |

| Distribution Networks | Complex logistics and established retailer relationships. | Very High - Difficult to replicate Danone's reach. | Presence in over 120 countries. |

| Regulatory Hurdles | Stringent food safety and specialized nutrition standards. | High - Requires significant compliance investment and time. | Intense scrutiny in infant formula market. |

Porter's Five Forces Analysis Data Sources

Our Porter's Five Forces analysis for Danone leverages a comprehensive suite of data, including Danone's annual reports, investor presentations, and public financial filings. We also incorporate industry-specific market research from firms like Euromonitor and Mintel, alongside data from global economic indicators and regulatory bodies.