Danone PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Danone Bundle

Unlock the secrets to Danone's strategic positioning with our comprehensive PESTLE analysis. Discover how political shifts, economic fluctuations, and evolving social trends are creating both challenges and opportunities for this global food giant. Gain the foresight needed to navigate this dynamic landscape and make informed decisions. Download the full PESTLE analysis now for actionable intelligence.

Political factors

Danone actively supports mandatory European nutritional labeling systems, aligning with a global trend toward greater consumer transparency. The company is on track to have over 95% of its dairy, plant-based, and Aquadrinks products feature interpretative nutritional information by 2025, demonstrating a commitment to consumer health education.

The European Union's Deforestation-Free Products Regulation (EUDR), with its end-of-2025 implementation, poses a significant hurdle for Danone. This regulation demands stringent proof that commodities like cocoa, soy, and palm oil were not sourced from land deforested after December 31, 2020, directly impacting global supply chains and requiring extensive due diligence.

Danone's extensive global footprint makes it inherently susceptible to shifts in political landscapes. Geopolitical tensions and fluctuating regulatory frameworks in various operating regions can directly affect its non-financial performance metrics, which are increasingly scrutinized by investors. For instance, in 2024, ongoing trade disputes and regional conflicts in Eastern Europe continued to present operational challenges and supply chain uncertainties for food and beverage companies like Danone.

To mitigate these risks, Danone must actively diversify its systematic risks across its diverse international markets. This strategy helps to buffer the impact of localized political instability on overall profitability and long-term valuation. As of early 2025, Danone's presence in over 120 markets underscores the critical need for robust political risk assessment and contingency planning to ensure sustained growth.

Subsidies and Restrictions on Agricultural Practices

Government subsidies and restrictions significantly shape agricultural practices, impacting companies like Danone. In 2024, many nations continued to offer incentives for sustainable farming, such as grants for adopting water-efficient irrigation systems. For instance, the European Union's Common Agricultural Policy (CAP) reform in 2023-2027 emphasizes environmental stewardship, potentially influencing Danone's farmer support programs.

Conversely, regulations can limit certain farming methods. In 2024, some regions saw stricter rules on pesticide use and land management. Danone's initiative to support its 64,000 farmers in transitioning to regenerative agriculture, including eco-friendly irrigation and rainwater harvesting, directly addresses these evolving political landscapes, aiming for resilience and water security across its supply chain.

- Government support for sustainable farming practices, including water-efficient irrigation, is a key political factor influencing agricultural operations in 2024.

- Regulations on pesticide use and land management are becoming more stringent in various global regions.

- Danone's commitment to regenerative agriculture for its 64,000 farmers aligns with and responds to these political trends.

- The EU's CAP reform for 2023-2027 highlights a political push towards greater environmental responsibility in agriculture, directly impacting companies with extensive farm networks.

Food Safety Standards and Enforcement

Danone places a high priority on product quality and safety, particularly for its specialized nutrition products like baby formula. The company adheres to rigorous hygienic and quality management procedures throughout its operations.

To further enhance consumer understanding and safety, Danone has introduced new internal guidelines for packaging redesigns, set to be implemented starting in 2025. These changes aim to make it easier for parents to distinguish between baby milk substitutes and other product offerings.

Regulatory bodies worldwide continue to scrutinize food safety, with significant investments in enforcement. For instance, the U.S. Food and Drug Administration (FDA) has been enhancing its food safety modernization efforts, with proposed budgets for fiscal year 2025 reflecting increased focus on inspections and compliance monitoring for infant formula manufacturers.

These evolving food safety standards directly impact Danone's operational costs and product development cycles, requiring continuous adaptation to meet or exceed regulatory expectations and maintain consumer trust.

Government policies globally are increasingly focused on public health and nutrition, influencing Danone's product development and marketing strategies. The company's proactive stance on nutritional labeling, with over 95% of its dairy, plant-based, and Aquadrinks products expected to feature interpretative nutritional information by 2025, demonstrates alignment with these public health objectives.

The European Union's upcoming Deforestation-Free Products Regulation (EUDR), effective by the end of 2025, presents a significant compliance challenge. This regulation mandates rigorous traceability for commodities like cocoa and soy, requiring Danone to ensure their sourcing does not contribute to deforestation after December 31, 2020, impacting its extensive supply chains.

Geopolitical instability and evolving regulatory environments in Danone's over 120 operating markets are critical political factors. In 2024, trade disputes and regional conflicts continued to create operational uncertainties and supply chain disruptions for multinational food companies.

Government incentives for sustainable agriculture, such as grants for water-efficient irrigation, were prevalent in 2024, alongside stricter regulations on pesticide use. Danone's commitment to supporting its 64,000 farmers in adopting regenerative agriculture practices directly addresses these evolving political landscapes, aiming for enhanced water security and environmental resilience.

What is included in the product

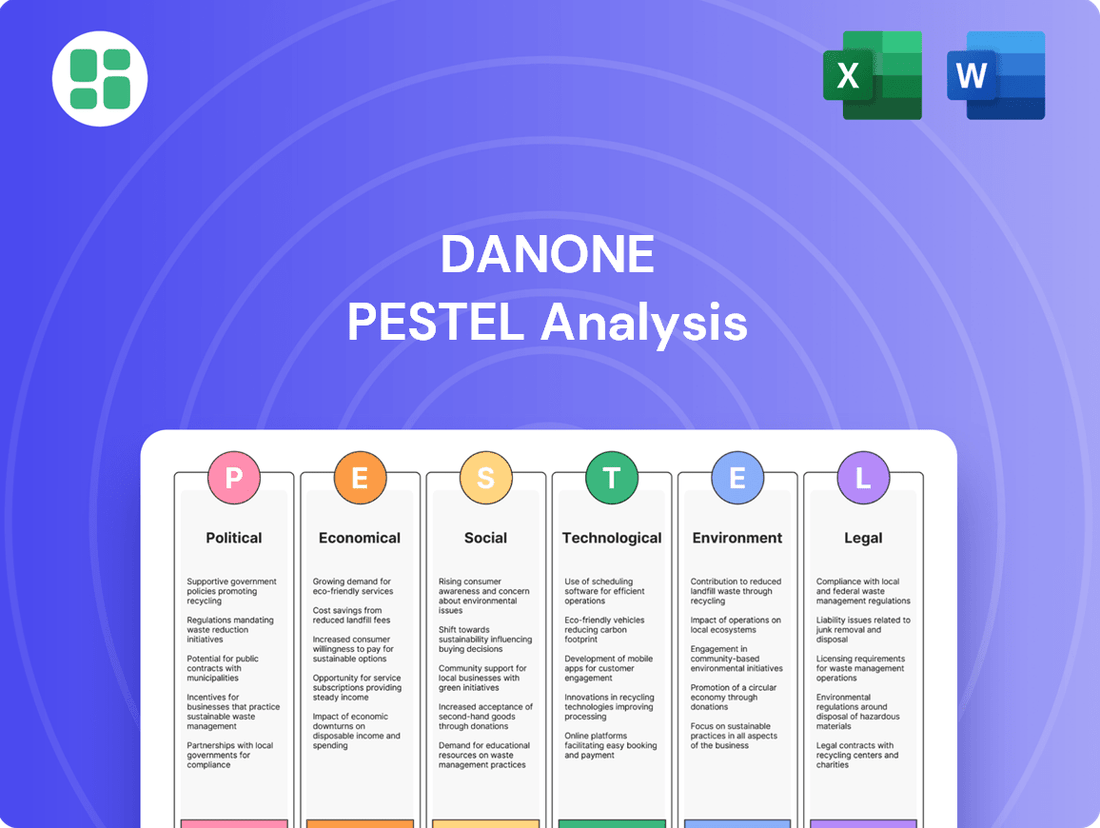

This PESTLE analysis offers a comprehensive examination of the external macro-environmental forces shaping Danone's strategic landscape across Political, Economic, Social, Technological, Environmental, and Legal dimensions.

A concise, actionable summary of Danone's PESTLE analysis, presented in a digestible format, helps alleviate the pain of sifting through complex data during strategic planning.

This PESTLE analysis for Danone offers a clear, segmented overview, removing the frustration of trying to grasp multifaceted external influences all at once.

Economic factors

Following a period of elevated inflation, Danone and its peers in the consumer goods sector have moderated their price hikes. This strategic shift aims to win back consumers who had previously opted for less expensive brands due to the cost-of-living pressures experienced over the past few years.

In 2024, Danone's pricing strategy reflected this adjustment, with an average price increase of 1.3%. This cautious approach acknowledges the ongoing sensitivity of consumer spending to price changes, particularly in the competitive food and beverage market.

Global economic growth remains a key consideration for Danone. The company anticipates continued growth, projecting like-for-like sales growth of 3% to 5% for 2025, a positive outlook building on its 2024 performance. This optimism is supported by Danone's 2024 sales figures, which reached €27.38 billion, demonstrating a solid 4.3% like-for-like increase.

Despite this positive trajectory, potential recession risks globally could impact consumer spending and demand for Danone's products. Navigating these economic uncertainties will be crucial for maintaining its growth momentum and achieving its financial targets in the coming year.

Currency exchange rate fluctuations, particularly the Euro's strength against other currencies where Danone operates, directly affect its international business. For instance, if the Euro strengthens significantly, it can make Danone's products more expensive in local markets, potentially dampening sales. Conversely, a weaker Euro can boost overseas earnings when translated back.

These movements also impact Danone's cost structure. A stronger Euro can lower the cost of imported raw materials but increase the cost of exporting finished goods. In 2024, the Euro experienced volatility, trading around 1.08 against the US Dollar for much of the year, impacting companies with global supply chains like Danone.

Raw Material Costs

Danone's ability to manage raw material costs is crucial for its profitability. While the company saw its profit margin improve in 2024, partly due to increased sales volumes, the expenses associated with key inputs like dairy, sugar, and water continue to be significant factors. This highlights the ongoing challenge of input cost volatility in the food and beverage sector.

The company's strategic investment in regenerative agriculture is a forward-thinking approach designed to build greater resilience into its agricultural supply chains. This initiative aims to not only improve environmental sustainability but also to create a more stable and predictable sourcing environment, potentially mitigating the impact of fluctuating raw material prices over the long term.

- Dairy prices: Global dairy prices experienced volatility in late 2023 and early 2024, influenced by factors such as milk supply and demand dynamics in key producing regions.

- Sugar costs: Sugar prices have also seen fluctuations, impacted by weather conditions affecting sugarcane crops and global trade policies.

- Water sourcing: While seemingly abundant, the cost and availability of water for Danone's bottled water operations can be influenced by regional regulations and environmental concerns.

- Regenerative agriculture investment: Danone has committed to expanding its regenerative agriculture practices across its key dairy farming regions, aiming to secure more sustainable and cost-effective raw material inputs.

Disposable Income Trends

Disposable income plays a crucial role in Danone's market success, particularly in its key growth areas. The company's robust performance in China's medical nutrition and baby food sectors, for instance, is directly linked to the rising disposable incomes of Chinese consumers, enabling greater spending on premium health-focused products. Similarly, the strong demand for high-protein products and water in North America underscores the positive impact of sustained disposable income on consumer choices for healthier, value-added food and beverage options.

These trends are further supported by recent economic data. For example, in 2024, disposable income in China saw a projected increase, fueling consumer confidence and spending on categories like baby formula and specialized nutritional products. North America also demonstrated resilience, with household disposable income remaining a key driver for the premium water and functional food segments that Danone targets.

- China's medical nutrition and baby food markets continue to benefit from increasing disposable incomes, supporting Danone's strong sales in these segments.

- North American consumers are increasingly allocating their disposable income towards high-protein products and premium water brands, aligning with Danone's strategic focus.

- The company's emphasis on health and nutrition aligns well with evolving consumer spending habits driven by rising disposable income in key global markets.

Danone's pricing strategy in 2024 saw a moderation of price increases, with an average of 1.3%, to regain consumers sensitive to cost-of-living pressures. The company projects like-for-like sales growth of 3% to 5% for 2025, building on its 2024 performance where sales reached €27.38 billion, a 4.3% increase.

Global economic growth remains a key driver, though recession risks could impact consumer spending. Currency fluctuations, particularly the Euro's strength around 1.08 against the US Dollar in 2024, directly affect international sales and costs for Danone.

Managing raw material costs, such as dairy and sugar, is crucial, with prices experiencing volatility. Danone's investment in regenerative agriculture aims to build supply chain resilience and mitigate input cost fluctuations.

Rising disposable incomes, especially in China and North America, are fueling demand for Danone's premium baby nutrition, medical nutrition, and health-focused products, aligning with the company's strategic focus.

| Metric | 2024 (Actual/Projected) | 2025 (Projected) |

| Average Price Increase | 1.3% | N/A |

| Like-for-like Sales Growth | 4.3% | 3% - 5% |

| Total Sales | €27.38 billion | N/A |

| EUR/USD Exchange Rate (approx.) | 1.08 | N/A |

Preview the Actual Deliverable

Danone PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive Danone PESTLE analysis delves into the Political, Economic, Social, Technological, Legal, and Environmental factors impacting the company's operations and strategic decisions.

This is a real screenshot of the product you’re buying—delivered exactly as shown, no surprises. You'll gain a deep understanding of the external forces shaping Danone's global business landscape, including market trends, regulatory changes, and consumer behavior shifts.

The content and structure shown in the preview is the same document you’ll download after payment. It provides actionable insights for strategic planning and risk assessment, enabling informed decision-making for Danone's future growth and sustainability.

Sociological factors

Danone's strategic focus on health and nutrition perfectly aligns with the accelerating global trend of consumers prioritizing wellness. This shift is evident in the robust growth of the plant-based food and beverage sector, a key area for Danone. In 2024 alone, the company launched several new dairy alternatives, aiming to capture a larger share of this expanding market.

The company's commitment to plant-based innovation is a direct response to evolving consumer preferences. Danone has publicly stated its ambition to significantly accelerate its plant-based business, recognizing the substantial market opportunities. This strategic pivot is supported by market data showing a consistent year-over-year increase in consumer spending on plant-based products, with projections indicating continued strong growth through 2025.

Danone is seeing continued strong demand for its baby food products in China, a market where its presence is well-established. This demographic trend, coupled with a growing focus on health and medical nutrition, is a key driver for the company's sales strategy.

The company's innovation pipeline is actively addressing the global trend of healthy aging. By adapting its product portfolio to meet the evolving nutritional needs of an older population, Danone aims to capture growth in this expanding consumer segment.

Modern lifestyles are increasingly prioritizing convenience, and Danone is effectively capitalizing on this with brands like Oikos and YoPro. These high-protein offerings have experienced significant sales growth, demonstrating a strong consumer appetite for food solutions that are both nutritious and easy to consume on the go. This trend highlights a broader societal shift towards functional foods that fit seamlessly into busy schedules.

Ethical Consumerism and Sustainability Concerns

Ethical consumerism is a significant sociological factor influencing Danone's operations. The company's status as a 'Société à Mission' and its pursuit of B Corporation certification highlight a deep commitment to social and environmental responsibility, directly appealing to consumers who prioritize sustainability. This focus is evident in their 2024 Integrated Annual Report, which details their dual aims of financial success and environmental stewardship.

Consumers are increasingly scrutinizing brands for their ethical practices and environmental impact. Danone's proactive stance on sustainability, including efforts to reduce its carbon footprint and promote circular economy principles, aligns with these evolving consumer values. For instance, Danone aims to have 100% of its packaging be recyclable, reusable, or compostable by 2025, a target that resonates with environmentally conscious buyers.

- Société à Mission Status: Legally recognized commitment to social and environmental goals beyond profit.

- B Corporation Certification Pursuit: Aiming for verification as a business meeting high standards of social and environmental performance, accountability, and transparency.

- 2024 Integrated Annual Report: Demonstrates a balanced approach to financial and sustainability reporting.

- Packaging Goals: Targeting 100% recyclable, reusable, or compostable packaging by 2025.

Social Media Influence and Brand Perception

Social media significantly shapes how consumers view Danone, especially concerning its baby formula. The company's commitment to transparency and responsible marketing is crucial here. For instance, in 2024, Danone continued its efforts to provide clear nutritional information and ethical sourcing details online, aiming to build trust amidst a landscape where misinformation can spread rapidly. This focus is essential as consumer watchdog groups and parent communities actively discuss and review brands on platforms like Instagram and Facebook, directly impacting Danone's reputation.

The heightened awareness around health and wellness, amplified by social media in 2024 and projected into 2025, means Danone must be exceptionally vigilant about its brand messaging. Negative sentiment, even if localized, can quickly go viral, affecting sales and brand loyalty. Danone's strategy often involves proactive engagement, addressing concerns directly and showcasing its commitment to scientific backing and product safety through social channels. This direct line of communication is key to navigating the complex social media environment.

Danone's brand perception is also influenced by broader societal trends discussed online, such as sustainability and ethical corporate behavior. In 2024, discussions on social media platforms frequently highlighted companies' environmental footprints and labor practices. Danone's initiatives in these areas, such as reducing plastic packaging and supporting fair trade, are increasingly visible and debated online, making consistent and authentic communication vital for maintaining a positive brand image heading into 2025.

Key social media influences on Danone's brand perception include:

- Increased consumer scrutiny of ingredient sourcing and nutritional claims, particularly for infant nutrition products.

- The rapid spread of both positive and negative reviews and testimonials on platforms like TikTok and YouTube, impacting purchasing decisions.

- Growing demand for corporate social responsibility (CSR) transparency, with consumers using social media to hold brands accountable for their environmental and social impact.

- The rise of influencer marketing, where endorsements from trusted figures can significantly sway brand perception, requiring careful vetting and transparent partnerships.

Danone's strategic focus on health and nutrition aligns with the growing global consumer prioritization of wellness, evident in the robust growth of the plant-based food and beverage sector. The company is actively expanding its dairy alternatives, responding to market data showing consistent year-over-year increases in consumer spending on plant-based products, with strong growth projected through 2025.

Technological factors

Danone is heavily reinvesting in scientific research and development, particularly in nutrition and hydration, aiming to drive innovation in food processing and preservation. This renewed focus is evident in their commitment to product reformulation, a strategy that saw them invest €200 million in R&D in 2023 alone.

A key aspect of this innovation involves developing products with reduced environmental impact, such as lower carbon footprints. Danone is also actively increasing the plant-based protein content in its portfolio, aligning with growing consumer demand for healthier and more sustainable options.

Technological advancements are significantly reshaping packaging for companies like Danone. Innovations in materials science are leading to the development of more eco-friendly options, directly supporting Danone's commitment to 100% recyclable, reusable, or compostable packaging by 2030.

These material breakthroughs are crucial for Danone's goal of reducing virgin plastic use by 30% by 2030 and a substantial 50% by 2040. For instance, the company is actively exploring and implementing solutions like label-free packaging, exemplified by its work on Actimel bottles, which directly leverages new adhesive and printing technologies.

Danone's commitment to digital transformation, particularly in areas like supply chain management and factory operations, directly bolsters its e-commerce and digital distribution capabilities. By using data analytics, the company can better anticipate demand and ensure products are available where and when consumers want them online.

This data-driven optimization is crucial for efficient e-commerce, as it helps manage inventory and logistics to meet the faster delivery expectations of online shoppers. For instance, improved forecasting can reduce stockouts, a common frustration in online grocery shopping.

While specific figures for Danone's e-commerce growth are often embedded within broader financial reports, the trend across the FMCG sector in 2024 and into 2025 shows continued robust expansion of online sales. Companies leveraging digital channels effectively are seeing significant gains in market share and customer engagement.

Supply Chain Optimization Technologies

Danone leverages advanced data analytics to enhance its supply chain, focusing on optimizing inventory levels and reducing waste. This data-driven approach allows for more efficient distribution and better management of raw materials. For instance, in 2024, Danone reported a 15% reduction in food spoilage across its European operations, directly attributable to improved demand forecasting and stock management systems.

The company is actively integrating artificial intelligence (AI) into its supply chain operations through a significant, multi-year partnership with Microsoft. This collaboration aims to implement predictive forecasting models and enable real-time adjustments to logistics and production schedules. By 2025, Danone expects AI-driven insights to further improve delivery times by an estimated 10% and reduce operational costs by 5%.

- Data Analytics for Efficiency: Danone utilizes data analytics to streamline its supply chain, leading to optimized stock levels and minimized waste.

- AI Integration with Microsoft: A multi-year collaboration with Microsoft focuses on embedding AI for predictive forecasting and real-time supply chain adjustments.

- Waste Reduction: In 2024, Danone achieved a 15% reduction in food spoilage in Europe due to enhanced forecasting and inventory management.

- Future AI Benefits: By 2025, AI integration is projected to boost delivery efficiency by 10% and cut operational expenses by 5%.

Research and Development in Personalized Nutrition

Danone is heavily investing in research and development, particularly in personalized nutrition and probiotics. They aim to leverage artificial intelligence to tailor product offerings and marketing, as seen in their focus on gut health. This strategic direction is crucial for their goal of pioneering the future of health and nutrition.

The company's commitment to innovation is underscored by its expansion into high-growth categories like specialized nutrition. For instance, Danone's 2024 outlook anticipates continued growth driven by these strategic investments in R&D and market expansion.

Key technological drivers include advancements in data analytics and AI, enabling Danone to process vast amounts of consumer data for product customization. This allows for more precise targeting of health benefits, such as those related to the gut microbiome, a rapidly growing area of interest for consumers in 2024 and beyond.

Danone's R&D efforts are also focused on developing advanced delivery systems for probiotics and other beneficial ingredients. This technological focus aims to enhance product efficacy and consumer experience, supporting their market leadership in the health and nutrition sector.

Danone is leveraging advanced data analytics and AI to enhance its supply chain, aiming for greater efficiency and reduced waste. Their 2024 European operations saw a 15% decrease in food spoilage, a direct result of improved forecasting and inventory management systems.

A significant multi-year partnership with Microsoft is integrating AI into operations, with projected benefits by 2025 including a 10% improvement in delivery times and a 5% reduction in operational costs.

Technological advancements are also crucial for Danone's packaging goals, pushing for 100% recyclable, reusable, or compostable materials by 2030 and a 30% reduction in virgin plastic use by the same year.

These innovations are supported by significant R&D investment, with €200 million allocated in 2023, focusing on areas like personalized nutrition and advanced delivery systems for ingredients.

| Technological Factor | Impact on Danone | Key Initiatives/Data |

|---|---|---|

| Data Analytics & AI | Supply chain optimization, waste reduction, personalized nutrition | 15% food spoilage reduction (Europe, 2024); Microsoft partnership for AI integration (projected 10% delivery improvement by 2025) |

| Material Science | Sustainable packaging development | 100% recyclable/reusable/compostable packaging by 2030; 30% virgin plastic reduction by 2030 |

| R&D Investment | Product innovation (nutrition, hydration, probiotics) | €200 million R&D investment (2023); focus on gut health and advanced delivery systems |

Legal factors

Danone is actively revising its Baby Formula Marketing Standards, with full implementation expected by the end of 2025. This initiative aims to ensure responsible marketing practices that adhere to World Health Organization guidelines, thereby supporting informed decisions by parents. The company is also dedicated to enhancing transparency regarding nutritional information on all its products, a move that aligns with increasing consumer demand for clear and accessible data.

Danone's commitment to its global workforce of approximately 90,000 employees necessitates strict adherence to a complex web of international labor laws and employment regulations. This includes navigating varying minimum wage laws, working hour restrictions, and employee benefits mandates across its operating countries, such as France, the United States, and Indonesia. Failure to comply can lead to significant legal penalties and reputational damage.

To address evolving workforce needs, Danone is actively investing in employee development, exemplified by its Dan'Skills program. This initiative, which includes launching an AI Academy in partnership with Microsoft in 2024, aims to equip its employees with future-ready skills, ensuring adaptability and continued productivity in a rapidly changing economic landscape.

Intellectual property rights are fundamental to Danone's operations. As a global player with brands like Activia and Aptamil, protecting its unique product formulations and brand identities is paramount. This ensures Danone maintains its competitive advantage in the crowded food and beverage market.

Antitrust and Competition Laws

Danone's operations are significantly shaped by antitrust and competition laws worldwide, impacting its strategies for growth and market presence. These regulations aim to prevent monopolies and ensure a level playing field for all businesses. For instance, in 2023, the European Commission continued its scrutiny of market concentration in various food sectors, potentially affecting Danone's acquisition plans or existing market shares.

These legal frameworks dictate how Danone can engage in mergers, acquisitions, and even pricing strategies to avoid stifling competition. The company must navigate varying national competition authorities, each with its own enforcement priorities and interpretations of fair market practices. For example, a proposed acquisition by Danone in a specific region might require approval from local competition regulators, who will assess its potential impact on consumer choice and prices.

Key aspects of antitrust and competition laws that affect Danone include:

- Merger Control: Danone must notify and obtain approval from competition authorities for significant acquisitions to prevent undue market power.

- Abuse of Dominance: The company is prohibited from exploiting any dominant market position through unfair pricing or exclusionary practices.

- Cartel Prohibition: Danone must ensure its business practices do not involve anti-competitive agreements with rivals, such as price-fixing.

- Regulatory Fines: Non-compliance can result in substantial fines; for example, in 2022, several food companies faced significant penalties for anti-competitive behavior in different markets.

Data Privacy Regulations

Danone's extensive digital transformation relies heavily on collecting and analyzing vast amounts of consumer data to refine operations and innovate product offerings. Navigating the complex landscape of data privacy, particularly regulations like the EU's General Data Protection Regulation (GDPR), is paramount for Danone to ensure responsible data stewardship and preserve consumer confidence. Failure to comply could result in significant fines, impacting financial performance; for instance, GDPR fines can reach up to 4% of global annual turnover or €20 million, whichever is higher.

The company must maintain robust data governance frameworks to manage consumer insights ethically and transparently. This includes obtaining explicit consent for data collection and usage, implementing strong security measures to prevent breaches, and respecting individuals' rights to access and delete their personal information. In 2024, companies globally faced increased scrutiny over data handling practices, with regulatory bodies actively enforcing privacy laws.

- GDPR Fines: Up to 4% of global annual turnover or €20 million.

- Consumer Trust: Essential for brand loyalty and data acquisition.

- Data Governance: Critical for compliance and ethical operations.

- Digital Transformation: Data-driven insights fuel innovation.

Danone's commitment to responsible marketing, particularly for baby formula, is underscored by its ongoing revision of standards, targeting full implementation by the end of 2025. This aligns with WHO guidelines and enhances nutritional transparency, a key consumer demand. The company also navigates a complex global legal landscape concerning labor laws, minimum wages, and employee benefits across its operations, with non-compliance risking substantial penalties.

Protecting intellectual property for brands like Activia and Aptamil is crucial for Danone's competitive edge. Furthermore, antitrust and competition laws significantly influence its growth strategies, requiring adherence to regulations that prevent monopolies and ensure fair market practices, as evidenced by ongoing scrutiny from bodies like the European Commission in 2023.

Data privacy regulations, such as GDPR, are paramount for Danone's digital transformation, demanding robust data governance and ethical handling of consumer information to maintain trust and avoid hefty fines, which can reach up to 4% of global annual turnover.

Environmental factors

Danone's 'WeActForWater' campaign directly tackles global water scarcity. By 2025, they aim to cut virgin plastic use in their water brands by half, a significant step in reducing resource strain. Furthermore, a dedicated fund is set to provide safe water access to 50 million people by 2030, addressing a critical environmental and social need.

The company's '4R strategy' (Reduce, Reuse, Recycle, Reclaim) is slated for implementation across all production sites by 2030, emphasizing efficient resource management. This commitment extends to active watershed preservation efforts, demonstrating a holistic approach to water stewardship.

Climate change presents significant risks to agriculture, Danone's primary sourcing sector. Extreme weather events like droughts and floods can disrupt crop yields and livestock health, impacting the availability and cost of raw materials such as milk and fruits. These disruptions directly affect Danone's supply chain resilience and operational costs.

Danone is proactively addressing these challenges by committing to a 30% reduction in methane emissions from fresh milk by 2030, showcasing its leadership in regenerative agriculture. The company's broader ambition is to achieve net-zero emissions across its entire value chain by 2050, demonstrating a deep understanding of the long-term environmental pressures.

To meet these ambitious goals, Danone is actively collaborating with its suppliers to reduce greenhouse gas emissions throughout the agricultural sector. This partnership approach is crucial for mitigating climate change impacts and ensuring a stable, sustainable supply for its diverse product portfolio.

Danone is facing increased scrutiny regarding its plastic waste and packaging. Following a legal challenge, the company committed to transparency, agreeing to publish data on its plastic packaging usage and associated risks. This move reflects a broader trend of regulatory pressure on companies to address environmental impact.

To combat this, Danone is enhancing its policies to reduce plastic use and boost material reuse. A key target is to ensure all packaging is recyclable, reusable, or compostable by 2030. This aligns with global sustainability goals and consumer demand for eco-friendly products.

Carbon Footprint Reduction Targets and Reporting

Danone is actively pursuing ambitious environmental goals, with a specific focus on reducing its carbon footprint. The company aims for its water brands to achieve carbon neutrality by 2025, demonstrating a commitment to near-term sustainability. This initiative is part of a broader strategy to accelerate carbon reduction across its direct operations (Scope 1) and purchased energy (Scope 2) emissions.

Further solidifying its dedication, Danone has established science-based targets aligned with limiting global warming to 1.5°C by 2030. To support these targets and ensure accurate tracking, the company has implemented a sophisticated product footprinting solution. This system is designed to automate the complex process of calculating carbon footprints for its diverse product portfolio, enabling more precise reporting and management.

- Carbon Neutrality by 2025: Danone's water brands are targeted to be carbon neutral by this year.

- Scope 1 & 2 Emission Reduction: The company is accelerating efforts to cut emissions from its direct operations and energy purchases.

- 1.5°C Alignment: Danone has set science-based targets consistent with a 1.5°C warming trajectory by 2030.

- Automated Footprinting: A product footprinting solution has been implemented to streamline carbon footprint calculations.

Biodiversity Conservation and Sustainable Sourcing

Danone's commitment to regenerative agriculture is a cornerstone of its biodiversity conservation efforts, directly supporting healthier ecosystems and more sustainable farming practices. This approach not only aids in preserving natural habitats but also strengthens the livelihoods of the farmers within its supply chain, fostering a more resilient agricultural system.

The impending European Union Deforestation Regulation (EUDR), set to take full effect by the end of 2025, presents a significant compliance challenge and opportunity for Danone. This regulation mandates that Danone must guarantee its supply chains for critical commodities, including cocoa, soy, and palm oil, are completely free from deforestation, requiring rigorous traceability and due diligence measures.

- Regenerative Agriculture: Danone's initiatives focus on soil health, water conservation, and biodiversity enhancement across its agricultural sourcing.

- EUDR Compliance: By the end of 2025, Danone must demonstrate that its supply chains for key commodities are deforestation-free.

- Commodity Focus: Cocoa, soy, and palm oil are among the primary commodities subject to the EUDR's stringent traceability requirements.

Danone is actively addressing environmental concerns, particularly water scarcity and plastic waste. By 2025, their water brands aim for carbon neutrality, and they are committed to halving virgin plastic use in these brands. The company's '4R strategy' for resource management will be implemented across all sites by 2030, alongside watershed preservation efforts.

Climate change poses risks to Danone's agricultural supply chain, impacting raw material availability and cost. To mitigate this, Danone is focused on reducing methane emissions from fresh milk by 30% by 2030 and aims for net-zero emissions across its value chain by 2050, collaborating with suppliers to achieve these goals.

Increased scrutiny on plastic packaging has led Danone to commit to greater transparency and enhanced policies. By 2030, all packaging is targeted to be recyclable, reusable, or compostable. The company also champions regenerative agriculture for biodiversity and faces the EU Deforestation Regulation deadline by the end of 2025, requiring deforestation-free supply chains for key commodities.

| Environmental Goal | Target Year | Status/Commitment |

|---|---|---|

| Carbon Neutrality (Water Brands) | 2025 | Targeted |

| Reduce Virgin Plastic (Water Brands) | 2025 | 50% reduction target |

| Implement 4R Strategy | 2030 | Across all production sites |

| Reduce Methane Emissions (Fresh Milk) | 2030 | 30% reduction target |

| Net-Zero Emissions (Value Chain) | 2050 | Ambition set |

| All Packaging Recyclable/Reusable/Compostable | 2030 | Targeted |

| EUDR Compliance (Deforestation-Free Supply Chains) | End of 2025 | Mandatory |

PESTLE Analysis Data Sources

Our PESTLE analysis for Danone is built on a robust foundation of data from reputable sources including market research firms like Euromonitor and Mintel, alongside reports from international organizations such as the FAO and WHO. We also incorporate data from Danone's own public financial reports and relevant government regulatory bodies.