Danone Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Danone Bundle

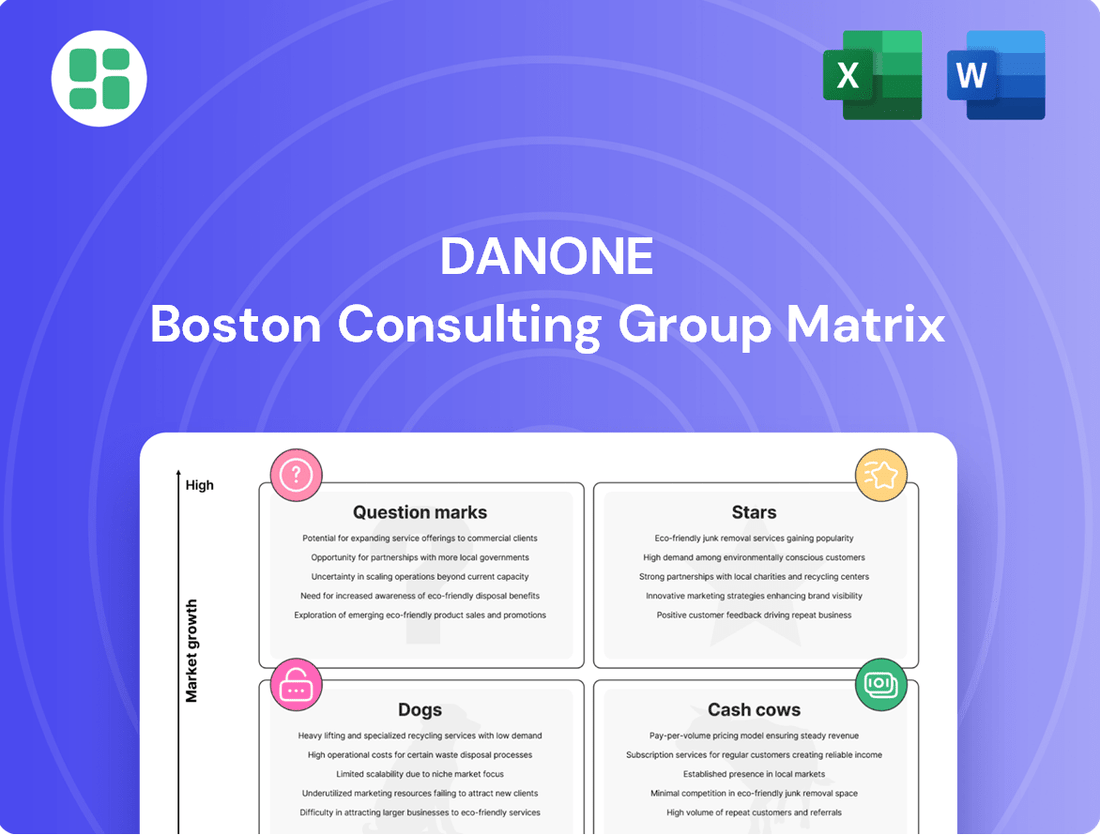

Curious about Danone's product portfolio? Our BCG Matrix analysis reveals which brands are leading the pack as Stars, which are reliable Cash Cows, which are struggling Dogs, and which are promising Question Marks. Understand the strategic implications of each placement to make informed decisions.

Dive deeper into Danone's market performance with the full BCG Matrix. Gain a clear view of where its products stand—Stars, Cash Cows, Dogs, or Question Marks—and unlock actionable insights for optimizing your investment and growth strategies. Purchase the full version for a complete breakdown and strategic insights you can act on.

Stars

Danone's Specialized Nutrition, particularly its medical nutrition segment, is a star performer, consistently delivering double-digit growth. This segment is a significant growth engine for the company, bolstered by strategic acquisitions like Kate Farms and The Akkermansia Company, aimed at solidifying its strong market position in the burgeoning health-conscious market.

Danone's high-protein dairy and plant-based products, exemplified by brands like YoPro and Oikos, represent a significant growth engine for the company. In 2024, this segment, particularly within North America, is a key strategic focus, demonstrating strong market share and robust growth momentum within the broader Essential Dairy and Plant-based (EDP) division. This category is a prime example of Danone capitalizing on consumer demand for healthier, protein-rich options.

Alpro is a significant 'star' for Danone, driving strong volume and mix growth across Europe. This brand is central to Danone's strategic focus on the rapidly expanding plant-based sector, particularly in areas like protein and gut health.

Infant Milk Formula (especially in China)

Danone's infant milk formula business, particularly its Aptamil and Essensis brands in China, represents a significant star in its portfolio. The demand for premium infant nutrition in China remains robust, driven by rising incomes and a strong focus on product safety and quality among parents.

In 2024, the Chinese infant formula market continued its trajectory, with Danone actively competing. While specific market share figures fluctuate, Danone has consistently aimed to capture a larger slice of this lucrative segment. The company's investment in research and development, alongside targeted marketing efforts, supports its star status.

- Aptamil's strong performance in China, a key growth driver for Danone.

- Essensis targeting specific nutritional needs, further solidifying market presence.

- The high-growth nature of the Asian infant formula market fuels this segment's star potential.

Coffee Creamers (North America)

Danone's coffee creamers in North America showed resilience in 2024, emerging as a key growth engine despite a minor setback in the first quarter of 2025. The category, while intensely competitive, continues to expand, underscoring the brand's solid footing.

In 2024, the North American coffee creamer market was valued at approximately $4.5 billion, with Danone holding a significant share. The sector is projected to grow at a compound annual growth rate (CAGR) of 4.2% through 2028.

- Growth Driver: Coffee creamers were a strong performer for Danone in 2024, contributing positively to overall revenue.

- Market Dynamics: The North American creamer market is characterized by high competition but also sustained consumer demand and category expansion.

- Q1 2025 Performance: Initial service challenges in Q1 2025 caused a temporary slowdown, but underlying demand remained robust.

- Brand Strength: Danone's brands within this segment have maintained a strong market presence, indicating effective brand management and consumer loyalty.

Danone's Specialized Nutrition, particularly its medical nutrition segment, is a star performer, consistently delivering double-digit growth. This segment is a significant growth engine for the company, bolstered by strategic acquisitions like Kate Farms and The Akkermansia Company, aimed at solidifying its strong market position in the burgeoning health-conscious market.

Danone's high-protein dairy and plant-based products, exemplified by brands like YoPro and Oikos, represent a significant growth engine for the company. In 2024, this segment, particularly within North America, is a key strategic focus, demonstrating strong market share and robust growth momentum within the broader Essential Dairy and Plant-based (EDP) division. This category is a prime example of Danone capitalizing on consumer demand for healthier, protein-rich options.

Alpro is a significant star for Danone, driving strong volume and mix growth across Europe. This brand is central to Danone's strategic focus on the rapidly expanding plant-based sector, particularly in areas like protein and gut health.

Danone's infant milk formula business, particularly its Aptamil and Essensis brands in China, represents a significant star in its portfolio. The demand for premium infant nutrition in China remains robust, driven by rising incomes and a strong focus on product safety and quality among parents.

In 2024, the Chinese infant formula market continued its trajectory, with Danone actively competing. While specific market share figures fluctuate, Danone has consistently aimed to capture a larger slice of this lucrative segment. The company's investment in research and development, alongside targeted marketing efforts, supports its star status.

Danone's coffee creamers in North America showed resilience in 2024, emerging as a key growth engine despite a minor setback in the first quarter of 2025. The category, while intensely competitive, continues to expand, underscoring the brand's solid footing.

In 2024, the North American coffee creamer market was valued at approximately $4.5 billion, with Danone holding a significant share. The sector is projected to grow at a compound annual growth rate (CAGR) of 4.2% through 2028.

| Segment | Key Brands | 2024 Performance Indicators | Market Context | Strategic Importance |

| Specialized Nutrition (Medical) | Kate Farms | Double-digit growth | Burgeoning health-conscious market | Acquisition-driven growth engine |

| Essential Dairy & Plant-Based (EDP) | YoPro, Oikos | Strong market share, robust growth (North America) | Consumer demand for protein-rich options | Key strategic focus, capitalizing on trends |

| Plant-Based | Alpro | Strong volume and mix growth (Europe) | Rapidly expanding plant-based sector | Central to plant-based strategy (protein, gut health) |

| Infant Nutrition | Aptamil, Essensis (China) | Robust demand for premium products | Rising incomes, focus on safety/quality in China | Key growth driver in lucrative Asian market |

| Beverages (North America) | Coffee Creamers | Resilient growth, strong market presence | $4.5B market in 2024, 4.2% CAGR projected through 2028 | Key growth engine despite competition |

What is included in the product

The Danone BCG Matrix analyzes its product portfolio, categorizing units into Stars, Cash Cows, Question Marks, and Dogs to guide investment and divestment decisions.

The Danone BCG Matrix offers a clear, visual roadmap for strategic resource allocation, easing the pain of uncertain investment decisions.

Cash Cows

Danone's established dairy brands, such as Activia and Actimel, are prime examples of Cash Cows within the BCG Matrix. These brands hold significant market share in mature European markets, consistently generating substantial profits with minimal need for further investment.

In 2023, Danone reported that its Specialized Nutrition division, which includes brands like Activia and Actimel, saw a 7.7% like-for-like sales growth, highlighting their ongoing strength and contribution to the company's overall financial health. These products are mature, requiring little marketing spend to maintain their position, thus producing robust cash flow.

Evian and Volvic are prime examples of Danone's cash cows, holding a significant market share in the mature but consistently profitable bottled water segment, especially in developed regions like Europe and North America. These premium brands have a long-standing reputation, contributing substantially to Danone's overall revenue stream.

In 2023, Danone's Waters division, which includes these brands, saw its sales grow by 5.6% on a like-for-like basis, reaching €6.5 billion. This growth underscores the stability and enduring demand for premium bottled water, even in saturated markets, solidifying Evian and Volvic's position as reliable revenue generators for the company.

Mizone, a leading vitamin drink brand in China, continued its strong performance, achieving double-digit sales growth throughout 2024 and into the first quarter of 2025. This consistent expansion highlights Mizone's established dominance within the Chinese market.

The brand's high cash generation is a direct result of its commanding market share in a region experiencing steady growth. Mizone's success positions it as a classic Cash Cow for Danone, reliably fueling other ventures.

Traditional Infant Formula (stable markets)

Danone's traditional infant formula, particularly in stable markets, represents a classic Cash Cow within its BCG Matrix. This segment benefits from Danone's established global presence, holding the second position in the Early Life Nutrition sector worldwide.

These mature markets offer consistent, high-margin revenue streams, contributing significantly to the company's overall profitability. For example, in 2024, the global infant formula market was valued at approximately $60 billion, with developed regions forming a substantial portion of this.

The stability of these markets allows Danone to leverage its strong brand recognition and distribution networks to maintain market share and generate reliable cash flow. This cash can then be reinvested into other areas of the business, such as Stars or Question Marks, to fuel future growth.

- Market Position: Danone is the #2 player globally in Early Life Nutrition.

- Revenue Generation: Traditional infant formula in stable markets provides consistent, high-margin cash.

- Market Maturity: Established markets offer predictable demand and lower competitive intensity.

- Strategic Role: Cash generated funds investment in growth areas within Danone's portfolio.

Functional Dairy Products (e.g., Skyr, Kefir in Europe)

Danone's functional dairy products, such as Skyr and new Kefir offerings in Europe, represent significant cash cows. These products consistently deliver positive volume and mix growth, reinforcing Danone's strong market position in a mature yet stable European dairy market. This consistent performance translates into reliable cash flow generation for the company.

The success of these functional dairy items is underpinned by growing consumer interest in health and wellness. For instance, the European yogurt market, which includes these functional dairy products, was valued at approximately €30 billion in 2023, with functional yogurts showing a notable growth rate. Danone's strategic focus on innovation within this segment has allowed it to maintain and even expand its market share.

- Consistent European Performance: Skyr and Kefir contribute reliably to Danone's positive volume and mix in Europe.

- High Market Share: These products solidify Danone's leading position in the functional dairy segment.

- Reliable Cash Flow: They generate steady income from a mature but stable market.

- Consumer Trend Alignment: Capitalizes on the growing demand for health-oriented dairy options.

Danone's established dairy brands, such as Activia and Actimel, are prime examples of Cash Cows. These brands hold significant market share in mature European markets, consistently generating substantial profits with minimal need for further investment. In 2023, Danone's Specialized Nutrition division, which includes these brands, saw a 7.7% like-for-like sales growth, highlighting their ongoing strength and contribution to the company's overall financial health.

Evian and Volvic are prime examples of Danone's cash cows, holding a significant market share in the mature but consistently profitable bottled water segment, especially in developed regions. These premium brands have a long-standing reputation, contributing substantially to Danone's overall revenue stream. In 2023, Danone's Waters division, which includes these brands, saw its sales grow by 5.6% on a like-for-like basis, reaching €6.5 billion.

Mizone, a leading vitamin drink brand in China, continued its strong performance, achieving double-digit sales growth throughout 2024 and into the first quarter of 2025, highlighting its established dominance within the Chinese market. The brand's high cash generation is a direct result of its commanding market share in a region experiencing steady growth, positioning it as a classic Cash Cow for Danone.

Danone's traditional infant formula in stable markets represents a classic Cash Cow, benefiting from its established global presence and holding the second position worldwide in Early Life Nutrition. These mature markets offer consistent, high-margin revenue streams, contributing significantly to profitability. For instance, in 2024, the global infant formula market was valued at approximately $60 billion, with developed regions forming a substantial portion.

| Brand/Category | Market Position | Revenue Contribution | Growth Rate (2023/2024 est.) | Strategic Role |

|---|---|---|---|---|

| Activia/Actimel (Specialized Nutrition) | High Market Share (Mature Markets) | Consistent, High-Margin Cash Flow | 7.7% (2023) | Funds growth initiatives |

| Evian/Volvic (Waters) | High Market Share (Developed Regions) | Stable Revenue Stream | 5.6% (2023) | Supports overall profitability |

| Mizone (China) | Dominant Market Share | Strong Cash Generation | Double-digit (2024 est.) | Fuels other ventures |

| Traditional Infant Formula (Stable Markets) | #2 Global Position (Early Life Nutrition) | Consistent, High-Margin Revenue | Stable (Market valued at ~$60B in 2024) | Reinvestment into growth areas |

Preview = Final Product

Danone BCG Matrix

The Danone BCG Matrix preview you are viewing is the precise, unedited document you will receive immediately after your purchase. This comprehensive analysis, detailing Danone's product portfolio within the Stars, Cash Cows, Question Marks, and Dogs categories, is ready for your strategic planning without any alterations or watermarks. You can confidently use this exact file for internal presentations, market research, or investment decisions, knowing it's the complete, professionally formatted report.

Dogs

Horizon Organic and Wallaby, previously part of Danone's US organic dairy portfolio, were divested in April 2024. This strategic move was driven by their noted dilutive impact on Danone's overall sales growth and operating margin.

The divestiture suggests these businesses were considered underperforming within the Danone framework, likely possessing low market share and limited growth potential in the competitive US organic dairy sector.

Danone's Essential Dairy and Plant-based (EDP) business in Russia was deconsolidated in May 2024. This move suggests the business was categorized as a 'Dog' within the BCG matrix, indicating low market share and low market growth. Such a classification often leads to divestment or liquidation to free up resources for more promising ventures.

Michel & Augustin, a French biscuit brand, was divested by Danone in February 2024. This sale is indicative of Danone's strategic move to streamline its portfolio, focusing on core growth areas. The brand's performance likely didn't meet the required growth metrics to remain a star or question mark in Danone's BCG matrix, positioning it as a potential cash cow or dog.

Older, Less Strategic Dairy Products in Declining Markets

Danone's approach to managing its portfolio suggests that older, less strategic dairy products likely fall into the Dogs category. These are typically products with low market share in mature or declining markets, requiring significant resources without generating substantial returns. For instance, in 2023, the global dairy market experienced a slowdown, with some traditional dairy segments facing increased competition from plant-based alternatives, impacting growth prospects for legacy products.

These "Dogs" within Danone's portfolio are characterized by their limited growth potential and low competitive advantage. The company's stated aim to "fix underperformers" directly addresses these units, which may be candidates for divestment or significant restructuring to reduce costs and minimize ongoing losses.

- Low Market Share: These products often hold a small percentage of their respective markets.

- Declining Market Growth: The overall market for these products is not expanding, or is even shrinking.

- Resource Drain: They may consume management attention and capital without yielding proportional profits.

- Potential for Divestment: Danone might consider selling off these less strategic assets to focus on more promising areas.

Non-core or Stagnant Water Brands in specific regions

Danone's strategic focus on its leading water brands, such as Evian and Volvic, which are recognized for their premium positioning and health benefits, naturally leads to the categorization of other water brands within its portfolio. Brands that are experiencing stagnant growth in specific regional markets or do not align with the company's overarching premium and health-centric strategy are likely to be classified as Dogs in the BCG Matrix.

These non-core brands, often characterized by low market share and low growth potential, require careful evaluation. For instance, if a regional bottled water brand in a mature market is showing declining sales and minimal prospects for expansion, it fits the profile of a Dog. Danone's 2024 performance reviews would likely highlight such brands if they are not contributing significantly to overall revenue or profitability. In 2023, Danone's water division saw a 3.1% like-for-like sales growth, underscoring the importance of brands with strong market momentum.

- Non-core water brands in stagnant regional markets.

- Brands lacking alignment with Danone's premium or health-focused strategy.

- Low market share and low growth potential in specific territories.

- Potential candidates for divestment or strategic repositioning.

Danone's divestment of Horizon Organic and Wallaby in April 2024, along with the deconsolidation of its Russian EDP business in May 2024, clearly indicates these were categorized as 'Dogs' in its BCG matrix. These units likely suffered from low market share and minimal growth prospects, necessitating their removal to optimize resource allocation. Michel & Augustin's divestment in February 2024 further supports this pattern of shedding underperforming assets.

These 'Dog' businesses are characterized by their low market share and limited growth potential, often draining resources without significant returns. Danone's strategy to address these underperformers through divestment or restructuring is evident in these recent actions, aligning with a broader portfolio optimization effort. For example, the global dairy market's slowdown in 2023 impacted legacy products, pushing some into the 'Dog' category.

Danone's management of its water portfolio also reveals 'Dogs' in the form of non-core regional brands. Brands with stagnant growth or those not fitting the premium, health-focused strategy, like certain regional bottled water brands showing declining sales in mature markets, are prime candidates. Danone's water division saw 3.1% growth in 2023, highlighting the need to divest brands not contributing to this momentum.

| Business Unit | BCG Category | Reasoning | Divestment/Deconsolidation Date |

| Horizon Organic (US) | Dog | Dilutive impact on sales growth and operating margin; low market share/growth in US organic dairy. | April 2024 |

| Wallaby (US) | Dog | Dilutive impact on sales growth and operating margin; low market share/growth in US organic dairy. | April 2024 |

| Essential Dairy and Plant-based (Russia) | Dog | Low market share and low market growth in the Russian market. | May 2024 |

| Michel & Augustin (France) | Dog | Likely did not meet growth metrics; portfolio streamlining. | February 2024 |

Question Marks

Danone's recent acquisitions of Kate Farms, a US-based plant-based medical nutrition company, and The Akkermansia Company, a specialist in biotics, represent strategic moves into burgeoning segments of the health and wellness market. These companies, while operating in high-growth areas, are relatively new to Danone's extensive portfolio, meaning they currently command a smaller market share within the broader company.

As such, these acquisitions likely fall into the Question Mark category of the BCG Matrix for Danone. This classification signifies that while they possess strong growth potential, they also require substantial investment to expand their market presence and achieve profitability. For instance, the plant-based nutrition market is projected to see significant expansion, with Kate Farms positioned to capitalize on this trend.

Danone is aggressively targeting the away-from-home market, aiming for significant expansion between 2025 and 2028. This strategic push acknowledges the sector's high growth potential, even though Danone's current market share there is relatively modest.

The away-from-home segment, encompassing food service, hospitality, and institutional catering, is projected to grow at a compound annual growth rate (CAGR) of approximately 6% globally through 2027. Danone’s investment in this area suggests a belief that it can capture a larger piece of this expanding pie, leveraging its brand strength in products like dairy and plant-based alternatives.

Danone is strategically targeting low-presence geographic markets like India and Southeast Asia, recognizing their substantial growth potential. These regions represent significant opportunities for Danone to build its brand and market share, although they necessitate considerable investment to establish a strong foothold.

In 2024, the Indian dairy market alone was projected to reach over $150 billion, showcasing the immense untapped potential. Similarly, Southeast Asia's burgeoning middle class and increasing disposable incomes present a fertile ground for Danone's diverse product portfolio, from dairy to plant-based alternatives.

Emerging Plant-Based Categories (beyond core dairy alternatives)

Danone's strategic focus on emerging plant-based categories beyond dairy, such as coffee creamers, plant-based baby nutrition, and specialized aging food solutions, targets markets with significant growth potential. These areas represent opportunities for Danone to establish a strong foothold, moving from a nascent market share to a more dominant position.

The global plant-based food market is projected to reach substantial figures, with some estimates suggesting it could exceed $160 billion by 2030. This expansion into coffee, for instance, taps into a market where plant-based milk usage is rapidly increasing, with some reports indicating that by 2025, over 50% of coffee shop beverages in the US could be made with non-dairy milk. Similarly, the plant-based baby food sector is gaining traction as parents seek alternatives to traditional options.

- Targeting High-Growth Segments: Danone is actively exploring and investing in plant-based extensions for coffee, baby food, and aging nutrition, recognizing these as key future growth drivers.

- Building Market Presence: The company aims to leverage its expertise to build significant market share in these emerging categories, starting from a relatively low initial presence.

- Market Opportunity: The broader plant-based food market is experiencing robust growth, with projections indicating continued expansion driven by consumer demand for healthier and more sustainable options. For example, the plant-based coffee creamer market alone is expected to see significant year-over-year growth in the coming years.

Early-Stage Science-Based Innovations (e.g., new gut health solutions)

Early-stage science-based innovations, such as novel gut health solutions, represent Danone's potential future Stars. These are typically found in rapidly expanding markets, but their current market share is minimal, demanding significant capital to foster growth and achieve widespread adoption.

Danone's strategic pivot towards becoming a science-based company, with a strong emphasis on protein and gut health, positions these nascent innovations at the forefront of its future portfolio. For instance, advancements in microbiome research are opening up new avenues for personalized nutrition, a sector projected for substantial growth.

- High Growth Potential: The global gut health market was valued at approximately $50 billion in 2023 and is expected to grow at a compound annual growth rate (CAGR) of over 7% through 2030, driven by increasing consumer awareness and demand for preventative health solutions.

- Low Market Share: While the overall market is large, specific early-stage scientific innovations within gut health often represent niche segments with very low current penetration.

- Investment Needs: Bringing these innovations to market requires substantial investment in R&D, clinical trials, regulatory approvals, and consumer education to build awareness and trust.

- Strategic Importance: These innovations are critical for Danone to maintain its competitive edge and leadership in the evolving health and wellness landscape, ensuring long-term revenue streams.

Danone's recent acquisitions like Kate Farms and The Akkermansia Company, alongside its focus on emerging plant-based categories and targeting low-presence geographic markets, exemplify the characteristics of Question Marks in the BCG Matrix. These ventures operate in high-growth sectors but currently hold a small market share, necessitating significant investment to capture market potential and achieve profitability.

The company's strategic push into the away-from-home market, projected for global growth around 6% CAGR through 2027, and its expansion into regions like India, where the dairy market alone was over $150 billion in 2024, highlight these high-potential, low-share scenarios.

These initiatives require substantial capital for R&D, market development, and building brand presence, reflecting the inherent risk and reward profile of Question Mark investments.

Danone's strategic focus on nascent scientific innovations in areas like gut health, a market valued at approximately $50 billion in 2023 with a projected CAGR over 7% through 2030, also places them firmly in the Question Mark quadrant, demanding significant investment to scale and mature.

BCG Matrix Data Sources

Our BCG Matrix leverages comprehensive market data, including sales figures, consumer behavior trends, and competitive landscape analysis, to accurately map product portfolios.