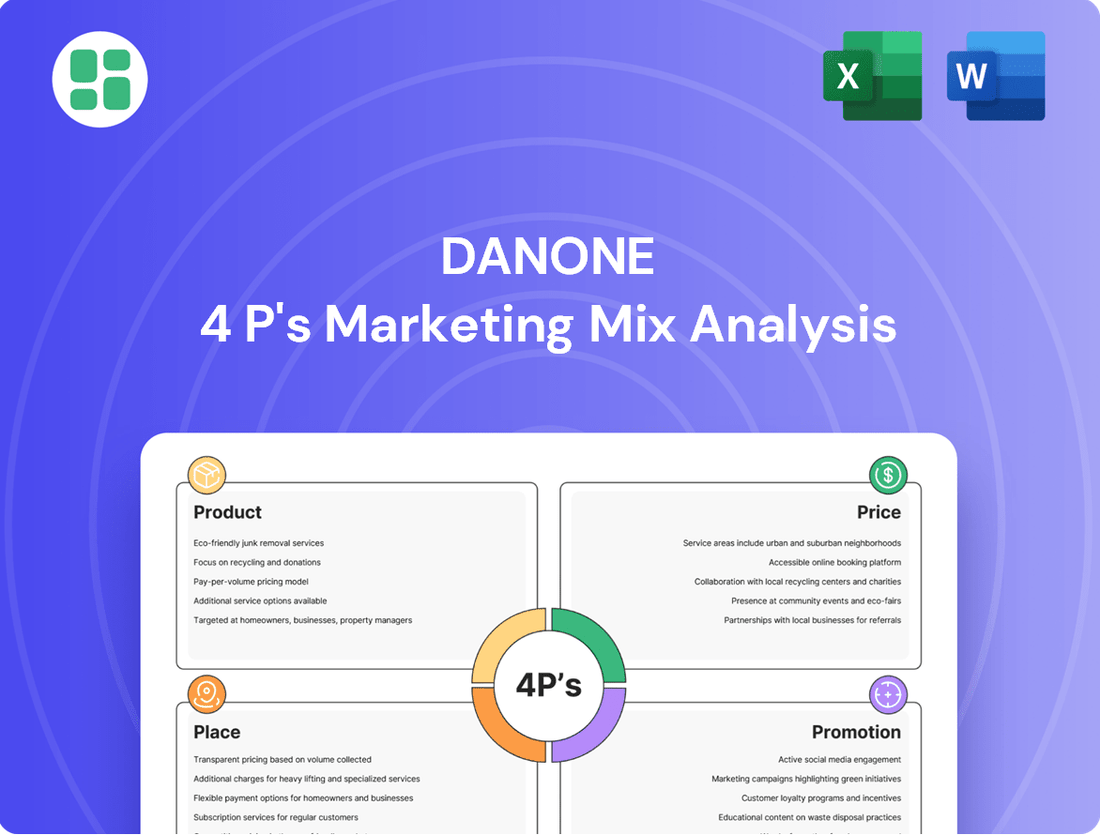

Danone Marketing Mix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Danone Bundle

Danone masterfully crafts its product portfolio, from nourishing yogurts to innovative plant-based alternatives, ensuring broad appeal and health-conscious consumer alignment. Their pricing strategies balance accessibility with premium positioning, reflecting the quality and brand trust they've cultivated. This strategic approach to the 4Ps drives their global market leadership.

Go beyond this snapshot and unlock a comprehensive, editable Marketing Mix Analysis for Danone. Ideal for business professionals and students seeking actionable insights into their product, price, place, and promotion strategies.

Product

Danone's diverse health-focused portfolio is a cornerstone of its marketing strategy, encompassing dairy and plant-based alternatives, specialized nutrition, and bottled water. This broad range addresses various consumer health needs, from early life nutrition like infant formula to critical medical nutrition for adults, demonstrating a commitment to wellness across all life stages.

In 2024, Danone continued to emphasize its health-centric approach, with its Specialized Nutrition division, a key driver of its health focus, reporting strong performance. For instance, the company highlighted growth in its early life nutrition segment, which is crucial for its health-focused brand image.

Danone's commitment to innovation is evident in its science-backed product development, focusing on enhanced nutritional benefits like high-protein, gut health, and reduced sugar content. This dedication to R&D fuels their pipeline, with approximately 40 new products launched annually.

The company heavily invests in research, particularly in areas like microbiota health, aiming to create offerings that cater to evolving consumer demands for healthier options. This scientific approach underpins their strategy to deliver functional foods and beverages.

Danone is aggressively expanding its plant-based alternatives, a key element of its product strategy. The company has set an ambitious goal to triple sales in this segment by 2025. This growth is fueled by introducing new vegan yogurt options and bolstering established brands such as Alpro and Silk, tapping into a significant rise in consumer preference for sustainable choices.

Strategic Growth in Specialized Nutrition

Danone's Specialized Nutrition division is a key growth engine, focusing on early life and medical nutrition. This segment is actively expanding through strategic acquisitions and ongoing product innovation, aiming to deliver precise nutritional solutions for critical life stages and health conditions.

In 2024, Danone's Specialized Nutrition saw robust performance, with sales reaching €8.1 billion, representing a 7.5% like-for-like increase. This growth was driven by strong demand in both early life nutrition, particularly in emerging markets, and medical nutrition, where the company is expanding its portfolio of specialized formulas.

- Product Innovation: Continuous development of science-backed formulas for infants with specific dietary needs and patients requiring therapeutic nutrition.

- Market Penetration: Expanding reach in key geographies and strengthening presence in channels catering to vulnerable populations.

- Acquisition Strategy: Pursuing targeted acquisitions to enhance product offerings and market access within specialized nutrition.

- R&D Investment: Significant investment in research and development to maintain a competitive edge and address evolving health demands.

Sustainability in Design

Danone's commitment to sustainability is deeply embedded in its product design, aligning with its 'One Planet. One Health' vision. This means considering the environmental impact throughout the product lifecycle, from sourcing ingredients to packaging.

A key focus for Danone is packaging innovation. By 2025, the company aims for all its packaging to be 100% recyclable, reusable, or compostable. This is a significant undertaking, especially for a global food and beverage company.

Furthermore, Danone is actively working to reduce its carbon footprint. This includes increasing the proportion of plant-based proteins in its product portfolio, which generally have a lower environmental impact compared to animal-based proteins. For instance, their plant-based brands like Alpro continue to see strong growth.

- Packaging Goals: 100% recyclable, reusable, or compostable packaging by 2025.

- Carbon Footprint Reduction: Increasing plant-based protein content in products.

- Brand Alignment: Reflects the 'One Planet. One Health' company vision.

Danone's product strategy centers on its health-focused portfolio, spanning dairy, plant-based alternatives, specialized nutrition, and water. The company actively innovates, launching around 40 new products annually, with a strong emphasis on science-backed formulations that cater to evolving consumer demands for gut health, reduced sugar, and increased protein. By 2025, Danone aims for all its packaging to be 100% recyclable, reusable, or compostable, underscoring its commitment to sustainability.

| Product Category | Key Focus Areas | 2024 Performance Highlight | Sustainability Goal |

|---|---|---|---|

| Dairy & Plant-Based | Plant-based expansion, vegan options | Strong growth in plant-based segment | 100% recyclable packaging by 2025 |

| Specialized Nutrition | Early life & medical nutrition, microbiota health | Sales reached €8.1 billion (7.5% LFL growth) | Science-backed formulations |

| Bottled Water | Hydration, natural sources | Continued market presence | Focus on sustainable sourcing |

What is included in the product

This analysis offers a comprehensive breakdown of Danone's Product, Price, Place, and Promotion strategies, grounded in real-world brand practices and competitive context.

It's designed for professionals seeking to understand Danone's marketing positioning, providing actionable insights for strategic planning and benchmarking.

Simplifies complex Danone 4P's analysis into actionable insights, alleviating the pain of information overload for strategic decision-making.

Provides a clear, concise overview of Danone's marketing strategy, easing the burden of understanding and communicating key elements to diverse teams.

Place

Danone boasts an extensive global distribution network, a cornerstone of its marketing strategy. This vast infrastructure spans over 120 countries, featuring numerous production facilities and strategically placed distribution hubs. This ensures their diverse product portfolio, from dairy and plant-based alternatives to specialized nutrition, reaches consumers efficiently across the globe.

Danone ensures its products reach consumers through a robust multi-channel strategy, encompassing traditional retail like supermarkets and convenience stores. This broad accessibility is crucial for capturing a wide customer base, making their products readily available where people typically shop for groceries.

Beyond traditional outlets, Danone is strategically increasing its presence in 'away-from-home' channels. This includes impulse purchases, pharmacies for health-focused products, hospitals, and even homecare services, demonstrating a commitment to meeting diverse consumer needs and occasions.

In 2023, Danone's global sales reached €27.1 billion, with a significant portion attributed to the effectiveness of its widespread distribution networks. This expansive reach across various retail and service points directly contributes to their market penetration and sales volume.

Danone is strategically bolstering its e-commerce footprint and digital engagement to connect with younger demographics and align with shifting consumer buying patterns. This involves forging alliances with key online retail partners and implementing direct-to-consumer marketing initiatives.

In 2024, Danone reported that its plant-based division, which heavily relies on digital sales channels, saw continued growth. For instance, sales from e-commerce platforms accounted for a significant portion of the revenue for brands like Silk and So Delicious, reflecting a strong consumer preference for online grocery shopping.

Efficient Supply Chain and Logistics

Danone's commitment to an efficient supply chain and logistics is a cornerstone of its marketing mix, directly impacting product availability and cost. The company prioritizes operational excellence, aiming for customer centricity, cost competitiveness, and cash efficiency, all while striving for carbon reduction. This focus is particularly evident in their advanced cold chain logistics, crucial for maintaining the quality of sensitive products like dairy and plant-based beverages.

In 2024, Danone continued to invest in optimizing its global distribution networks. For instance, their efforts in the dairy sector have focused on minimizing spoilage and ensuring freshness from farm to shelf. This operational efficiency translates into a more reliable product offering for consumers and a stronger competitive position in the market.

- Customer Centricity: Ensuring products are available when and where consumers want them, with a focus on freshness.

- Cost Competitiveness: Streamlining logistics to reduce operational expenses, allowing for competitive pricing.

- Cash Efficiency: Improving inventory management and reducing waste to free up working capital.

- Carbon Reduction: Implementing sustainable logistics practices, such as optimizing transport routes and exploring lower-emission vehicles, contributing to Danone's environmental goals. For example, in 2023, Danone reported a reduction in Scope 3 emissions related to transportation.

Strategic Investments in Local Production & Distribution

Danone is strategically investing in its production and distribution network to enhance its market presence. This includes expanding manufacturing facilities and regional distribution centers, notably in North America, a key growth market. These investments aim to streamline the supply chain, reducing lead times from production to consumer availability.

The company's focus on localizing production and distribution is a direct response to evolving consumer demands for fresher products and more resilient supply chains. By bringing operations closer to key markets, Danone can better manage inventory and respond swiftly to regional market shifts. This approach is crucial for maintaining product quality and competitive pricing.

Recent financial reports indicate significant capital expenditure allocated to these infrastructure upgrades. For instance, Danone's 2023 capital expenditure was €1.3 billion, with a substantial portion earmarked for supply chain and manufacturing enhancements. This ongoing investment underscores their commitment to operational efficiency and market responsiveness.

- Expansion of North American facilities: Danone is increasing its production capacity in the US and Canada to meet growing demand for its dairy and plant-based products.

- Regional distribution center development: Investments are being made in new and upgraded distribution hubs to optimize logistics and reduce delivery times.

- Supply chain resilience: The focus is on building a more robust and agile supply chain capable of weathering disruptions and ensuring consistent product availability.

- Cost optimization: Localized production and distribution are expected to yield efficiencies, contributing to improved profitability and competitive pricing.

Danone's place strategy is defined by its extensive global reach and multi-channel distribution. They operate in over 120 countries, leveraging a vast network of production facilities and distribution hubs to ensure efficient delivery of their diverse product range, from dairy to specialized nutrition.

This broad accessibility is further enhanced by their presence in traditional retail, complemented by a strategic expansion into 'away-from-home' channels like pharmacies and hospitals. In 2024, Danone's commitment to e-commerce grew, with online sales contributing significantly to brands like Silk, reflecting evolving consumer habits.

The company's investment in supply chain optimization, including advanced cold chain logistics, directly supports product freshness and availability. In 2023, Danone's capital expenditure of €1.3 billion included substantial allocations for supply chain and manufacturing upgrades, underscoring their focus on operational efficiency and market responsiveness.

| Distribution Channel | Key Focus Areas | 2023/2024 Relevance |

| Traditional Retail | Supermarkets, Convenience Stores | Core for broad market penetration. |

| Away-from-Home | Pharmacies, Hospitals, Impulse | Meeting diverse consumer needs and occasions. |

| E-commerce | Online Retailers, Direct-to-Consumer | Growing importance, especially for plant-based divisions; significant revenue contribution for brands like Silk. |

| Supply Chain & Logistics | Cold Chain, Route Optimization, Localisation | Ensuring freshness, cost competitiveness, and carbon reduction. €1.3bn capex in 2023 for enhancements. |

Full Version Awaits

Danone 4P's Marketing Mix Analysis

The preview shown here is the actual document you’ll receive instantly after purchase—no surprises. This comprehensive analysis of Danone's 4Ps (Product, Price, Place, Promotion) is ready for immediate download.

Promotion

Danone's promotion strategy strongly aligns with its mission to promote health through food, consistently positioning its diverse brands as contributors to consumer well-being from infancy through adulthood. This focus is evident in campaigns that spotlight the nutritional advantages and functional ingredients within products like Activia yogurt, which promotes digestive health, or Aptamil infant formula, designed for optimal early development.

In 2024, Danone continued to invest heavily in digital marketing and influencer collaborations to amplify these health-centric messages. For instance, their "Food for Good" initiative, launched in 2023 and ongoing through 2024, highlights community-based projects and sustainable sourcing, further reinforcing the brand's commitment to holistic health and societal well-being. This approach aims to build trust and resonate with consumers increasingly prioritizing health-conscious choices.

Danone is leaning heavily into digital and social media, with campaigns on platforms like Pinterest reaching millions. Their strategy involves creating engaging content through blogs and social channels to build stronger connections with consumers.

In 2024, Danone's digital ad spend is projected to increase, reflecting a commitment to these channels for brand building and product promotion, especially targeting younger demographics active on social media.

Danone actively builds brand equity through targeted campaigns, such as 'Making Every Age the Best Age' and 'Activia Gut Glow-Up,' aligning with consumer interests in immunity and gut health. These initiatives are crucial for differentiating its portfolio in a competitive market.

The company also leverages celebrity endorsements for key brands, enhancing visibility and consumer trust. For instance, Activia's campaigns often feature relatable personalities to amplify its message about digestive well-being.

Responsible Marketing and AI Integration

Danone is committed to responsible marketing, with a clear roadmap for its media and advertising practices. This includes prioritizing brand safety, promoting diversity in its campaigns, and embedding sustainability principles throughout its communications. For instance, in 2024, Danone continued to refine its digital advertising standards to ensure alignment with its corporate social responsibility goals, aiming for more ethical and impactful messaging.

The company is also strategically integrating artificial intelligence to elevate its marketing efforts. AI is being explored to streamline digital content creation, ensuring more relevant and engaging brand experiences. Furthermore, Danone is leveraging AI to optimize its media buying, seeking greater efficiency and reach in its advertising spend. This technological adoption is expected to enhance campaign performance and provide deeper consumer insights.

- Responsible Media Focus: Danone’s 2024 initiatives emphasized brand safety and sustainability in advertising, aligning with growing consumer demand for ethical brand practices.

- AI in Content & Media: Exploration of AI for digital content production and media buying optimization aims to improve efficiency and personalization in marketing.

- Sustainability Integration: The company’s roadmap includes embedding sustainability messaging, reflecting a broader industry trend towards environmentally conscious marketing.

- Digital Optimization: AI-driven media buying strategies are designed to enhance return on investment by targeting audiences more effectively and reducing waste.

Sustainability and Purpose-Led Communication

Danone’s promotion strategy heavily leans into sustainability and purpose-led communication, aligning with its 'One Planet. One Health' vision. This approach emphasizes environmental stewardship, ethical sourcing, and social responsibility, resonating with a growing segment of conscious consumers.

The company actively communicates its B Corp certification, a testament to its commitment to balancing profit with purpose. This not only builds brand loyalty but also differentiates Danone in a crowded marketplace, attracting consumers who prioritize values-driven purchasing decisions.

- Brand Alignment: Danone's 2023 sustainability report highlighted a 15% reduction in water usage across its global operations, directly supporting its 'One Planet. One Health' framework.

- Consumer Trust: As of early 2024, over 60% of consumers surveyed indicated that a brand's commitment to sustainability influences their purchasing decisions, a trend Danone actively leverages.

- B Corp Impact: Danone was recertified as a B Corp in 2023, reinforcing its legal commitment to social and environmental performance, accountability, and transparency.

Danone's promotion strategy in 2024 and early 2025 centers on digital engagement, influencer marketing, and purpose-driven messaging, particularly highlighting health and sustainability. The company is investing in AI to optimize content creation and media buying, aiming for more personalized and efficient campaigns. This digital-first approach, coupled with a strong emphasis on corporate social responsibility, seeks to build consumer trust and brand loyalty.

| Promotion Tactic | 2024/2025 Focus | Key Data/Impact |

|---|---|---|

| Digital Marketing & Social Media | Content creation, influencer collaborations, paid social campaigns | Pinterest campaigns reaching millions; increased digital ad spend projected for 2024 |

| Purpose-Led Communication | Sustainability initiatives, B Corp certification, community projects | 'One Planet. One Health' vision; 15% water usage reduction (2023 report); over 60% of consumers influenced by sustainability (early 2024) |

| Brand Building Campaigns | Health benefits, immunity, gut health, celebrity endorsements | Campaigns like 'Activia Gut Glow-Up'; relatable personalities for Activia |

| AI Integration | Content creation, media buying optimization | Streamlining digital content, enhancing campaign performance and reach |

Price

Danone utilizes value-based pricing for its premium offerings, such as Activia or Evian, where consumers perceive higher quality and health benefits, particularly in established markets like Western Europe and North America. This strategy allows them to capture a higher margin reflecting the perceived value. For instance, in 2023, Danone's Specialized Nutrition segment, which includes premium baby food and medical nutrition, continued to be a strong performer, contributing significantly to overall revenue growth.

In contrast, for broader market segments and in developing economies, Danone adopts more selective pricing. This can involve penetration pricing to gain market share, especially with their dairy and plant-based products in regions like Southeast Asia or Latin America, making products more accessible. For example, Danone has been actively expanding its presence in India, a market where affordability is a key driver for consumer adoption in the dairy sector.

Danone actively manages its pricing strategy to counter rising costs in raw materials, transportation, and labor. For instance, in 2023, the company noted that its pricing actions contributed significantly to its sales growth, with an average price increase of 6.3% across its portfolio.

While the pace of price increases has moderated from previous periods, Danone continues to implement selective price adjustments. These adjustments are carefully considered based on the specific category performance and regional market dynamics, ensuring competitiveness while addressing ongoing inflationary pressures.

Danone’s pricing strategy is finely tuned to its market standing as a premium nutrition and wellness brand, ensuring its products are perceived as high-quality yet remain competitive. For instance, in the competitive yogurt market, Danone often positions its premium lines like Oikos slightly above mainstream brands, reflecting its focus on specialized ingredients and health benefits. This approach aims to capture value from consumers willing to pay more for perceived health advantages.

The company actively monitors competitor pricing across its diverse product categories, from dairy and plant-based alternatives to specialized nutrition. For example, in the burgeoning plant-based milk sector, Danone’s Silk and So Delicious brands must contend with aggressive pricing from established and emerging players. Their pricing decisions in 2024 and 2025 will likely reflect a balance between maintaining brand equity and ensuring market share growth in this dynamic segment.

Accessibility remains a key consideration, especially for core products like Activia or Danimals. Danone strives to offer competitively priced options within these lines, making healthy choices attainable for a broader consumer base. This dual focus on premium positioning and accessible pricing allows Danone to cater to different market segments and maintain a strong presence across various retail channels.

Perceived Value and Product Differentiation

Danone's pricing strategy is deeply intertwined with how consumers perceive the value of its offerings, particularly in categories like specialized nutrition and functional foods. For these products, the company often employs premium pricing, a move supported by robust scientific research and clear health benefits that justify a higher cost. This approach aims to capture the willingness to pay for enhanced wellness and specific dietary needs.

The company's portfolio reflects this strategic pricing. For instance, Danone's early life nutrition products, such as Aptamil and Nutrilon, are positioned as premium options, leveraging extensive research and development to command higher prices compared to standard infant formulas. This strategy is supported by the fact that the global infant formula market was valued at approximately $50 billion in 2023 and is projected to grow, with specialized and premium segments showing strong expansion.

- Premium Pricing for Specialized Nutrition: Danone leverages scientific backing and health benefits to justify higher price points for products like Aptamil and Nutrilon, targeting parents seeking advanced infant nutrition.

- Functional Foods and Perceived Wellness: In categories like plant-based products (e.g., Silk, So Delicious) and dairy alternatives, pricing reflects the perceived health and lifestyle benefits, aligning with growing consumer demand for wellness-oriented foods.

- Market Value Justification: The global infant formula market, a key area for Danone, was valued around $50 billion in 2023, with specialized segments driving growth and supporting premium pricing strategies.

- Product Differentiation through Innovation: Danone invests heavily in R&D, enabling product differentiation through unique formulations and health claims, which in turn supports its premium pricing architecture.

Financial Discipline and Growth Targets

Danone's pricing strategy is intrinsically linked to its overarching financial objectives. The company aims for consistent expansion, targeting like-for-like net sales growth between 3% and 5% annually. This growth is not merely about increasing revenue but also about enhancing profitability.

To underscore this commitment to profitable growth, Danone strives to ensure its recurring operating income expands at a faster rate than its net sales. This suggests a focus on efficiency and margin improvement as key drivers alongside volume increases. For instance, in the first half of 2024, Danone reported a 5.0% like-for-like net sales growth, with recurring operating income showing a stronger performance, indicating successful execution of this pricing and financial discipline.

This dual focus on sales growth and margin expansion influences how Danone sets prices for its diverse product portfolio. It reflects a strategic balance between maintaining competitive market positioning and maximizing shareholder value.

- Targeted Annual Growth: Danone aims for 3-5% like-for-like net sales growth.

- Profitability Focus: Recurring operating income is expected to outpace net sales growth.

- H1 2024 Performance: Achieved 5.0% like-for-like net sales growth, demonstrating progress towards financial targets.

Danone's pricing strategy is multifaceted, balancing premium positioning with market accessibility. For its specialized nutrition lines, such as Aptamil, premium pricing is justified by extensive R&D and clear health benefits, a strategy supported by the robust growth in the global infant formula market, which neared $50 billion in 2023. Conversely, for broader consumer segments, particularly in emerging markets, Danone employs more accessible pricing, sometimes using penetration strategies to build market share, as seen in its expansion within India's dairy sector.

The company actively manages pricing to offset rising operational costs, with 2023 seeing an average price increase of 6.3% across its portfolio. While price adjustments are selective and informed by category performance and regional dynamics, they aim to maintain competitiveness and brand equity. This is evident in competitive sectors like plant-based alternatives, where brands like Silk must navigate aggressive pricing from rivals.

Financially, Danone targets 3-5% like-for-like net sales growth annually, with a focus on increasing recurring operating income faster than net sales. This objective drives pricing decisions, ensuring profitable expansion. The first half of 2024 demonstrated this, with 5.0% like-for-like net sales growth and stronger operating income performance, reflecting successful execution of their pricing and financial discipline.

| Pricing Strategy Element | Product Example/Segment | Market Context/Justification | Financial Implication |

| Value-Based/Premium Pricing | Activia, Evian, Aptamil, Nutrilon | Perceived higher quality, health benefits, scientific backing. Global infant formula market ~$50B (2023). | Captures higher margins, supports R&D investment. |

| Selective/Penetration Pricing | Dairy & plant-based in emerging markets (e.g., India, SE Asia) | Affordability as a key driver, gaining market share. | Increases accessibility, drives volume growth. |

| Cost-Plus/Inflationary Adjustment | Across portfolio | Countering rising costs (materials, transport, labor). 6.3% average price increase (2023). | Maintains profitability amidst cost pressures. |

| Competitive Pricing | Silk, So Delicious (plant-based) | Responding to aggressive competitor pricing in dynamic markets. | Balances market share defense with brand equity. |

4P's Marketing Mix Analysis Data Sources

Our Danone 4P's analysis is grounded in comprehensive data, including official company reports, market research, and competitor intelligence. We leverage insights from product portfolios, pricing strategies, distribution networks, and promotional activities to provide a holistic view.