Daiwa House Group SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Daiwa House Group Bundle

Daiwa House Group's robust market presence and diversified portfolio present significant strengths, but understanding their competitive landscape and potential vulnerabilities is crucial for strategic advantage. Our comprehensive SWOT analysis delves into these internal capabilities and external factors, offering a clear roadmap for navigating the dynamic housing and construction sectors.

Want the full story behind Daiwa House Group's strengths, risks, and growth drivers? Purchase the complete SWOT analysis to gain access to a professionally written, fully editable report designed to support planning, pitches, and research.

Strengths

Daiwa House Group's strength lies in its remarkably diversified business portfolio, spanning residential construction, rental housing, commercial facilities, and general construction. This broad operational scope extends to urban development and even renewable energy projects, showcasing a commitment to varied market engagement.

This strategic diversification significantly mitigates risk by reducing dependence on any single market segment. For instance, while the single-family home market might face cyclical downturns, the steady demand for rental housing or the long-term contracts in general construction can offer a stabilizing effect. This resilience is crucial in navigating economic uncertainties.

Furthermore, Daiwa House Group's comprehensive service model, encompassing everything from initial design and construction to ongoing property management, generates multiple, recurring revenue streams. This integrated approach not only enhances customer loyalty but also provides consistent cash flow, as evidenced by their robust performance in recent fiscal periods. For the fiscal year ending March 2024, Daiwa House reported net sales of ¥4.5 trillion, with their diverse segments contributing to this substantial figure.

Daiwa House Group's integrated value chain is a significant strength, encompassing everything from initial design and construction to sales and property management. This end-to-end capability grants them substantial control over project quality and cost, ensuring efficiencies across the entire property lifecycle.

This holistic approach directly translates to enhanced customer satisfaction, as clients experience a seamless journey from development to ongoing occupancy. For instance, their commitment to long-term client relationships is exemplified by initiatives like the D-ROOM regional coexistence fund for rental housing, fostering sustained engagement and value.

Daiwa House Group's brand reputation and market leadership in Japan are foundational strengths. Since its inception in 1955, the company has cultivated a powerful presence, holding a significant market share in both construction and real estate within its domestic market. This deep-rooted recognition translates directly into customer trust, a crucial element that provides a substantial competitive edge when bidding for and securing new development projects.

Expertise in Urban Development and Renewable Energy

Daiwa House Group's deep expertise in urban development, particularly in creating sustainable and livable communities, positions it strongly in a market increasingly focused on environmental and social responsibility.

This strength is amplified by its significant push into renewable energy. The company has a clear target to achieve 2,500 MW of renewable energy generation capacity by the fiscal year ending March 2030, demonstrating a tangible commitment to this sector.

- Urban Development Expertise: Proven track record in planning and executing large-scale, sustainable urban projects.

- Renewable Energy Expansion: Targeting 2,500 MW renewable energy capacity by FY2030, indicating substantial investment and growth.

- Sustainable Community Planning: Integration of renewable energy and eco-friendly practices into residential and commercial developments.

Technological Adoption and Innovation Potential

Daiwa House Group possesses a significant capacity and clear incentive to invest in cutting-edge construction technologies, including advanced prefabrication techniques and smart home solutions. This focus on innovation is crucial for maintaining a competitive edge in the evolving construction landscape.

The company is actively exploring generative design to streamline and optimize urban housing construction processes. This forward-thinking approach aims to improve efficiency and potentially reduce costs in development projects.

Daiwa House is committed to leveraging digital transformation to elevate the customer experience across its various business segments. This aligns directly with the strategic objectives outlined in its 7th Medium-Term Management Plan, underscoring the importance of technology in achieving its growth targets.

- Technological Investment: Daiwa House is a leader in adopting advanced construction technologies.

- Generative Design Exploration: The company is actively researching generative design for optimized urban housing.

- Digital Transformation Focus: A key strategy is to enhance customer experience through digital initiatives, as per the 7th Medium-Term Management Plan.

Daiwa House Group's diversified business model is a cornerstone of its strength, encompassing residential, rental, commercial, and general construction, alongside urban development and renewable energy initiatives. This breadth reduces reliance on any single sector, offering stability. For the fiscal year ending March 2024, the company reported net sales of ¥4.5 trillion, a testament to its robust performance across these varied segments.

The company's integrated value chain, from design and construction to sales and property management, ensures quality control and cost efficiencies. This end-to-end approach fosters strong customer relationships, as seen in initiatives like the D-ROOM regional coexistence fund, promoting sustained engagement.

Daiwa House Group boasts a powerful brand reputation and market leadership in Japan, built since its 1955 founding. This deep-rooted trust provides a significant competitive advantage in securing new development projects.

Their expertise in urban development, focusing on sustainable and livable communities, is a key differentiator. This is further bolstered by a significant push into renewable energy, with a target of 2,500 MW generation capacity by FY2030.

Investment in advanced construction technologies, including prefabrication and smart home solutions, keeps Daiwa House competitive. They are actively exploring generative design for optimized urban housing and leveraging digital transformation to enhance customer experience, as outlined in their 7th Medium-Term Management Plan.

What is included in the product

Analyzes Daiwa House Group’s competitive position through key internal and external factors, detailing its strengths, weaknesses, opportunities, and threats.

Uncovers hidden opportunities and threats in the competitive housing market, enabling proactive risk mitigation.

Weaknesses

Daiwa House Group's significant reliance on the domestic Japanese market remains a key weakness. Despite international expansion efforts, a substantial portion of its revenue and operations are still concentrated within Japan. This geographical focus means the company is more vulnerable to specific economic downturns, demographic shifts, and regulatory changes unique to the Japanese landscape. For instance, in fiscal year 2023, approximately 85% of Daiwa House's total revenue was generated from its Japanese operations, highlighting this persistent concentration.

Daiwa House Group, like many Japanese companies, faces significant headwinds from the nation's demographic challenges. Japan's population is not only aging rapidly but also experiencing a declining birth rate, which directly impacts the demand for new housing and certain commercial developments. This trend is projected to intensify, with the '2025 Problem' highlighting a critical juncture where the aging population could lead to a substantial increase in vacant properties, particularly in less urbanized regions.

This demographic shift could create an imbalance in the supply and demand for housing, potentially capping organic growth opportunities for Daiwa House. As the working-age population shrinks and the elderly population grows, the need for certain types of housing may decrease, while the demand for senior living facilities could rise, requiring strategic adaptation. For instance, by 2025, the number of vacant homes in Japan is expected to exceed 10 million, a stark indicator of the changing housing landscape.

Daiwa House Group, like many large construction firms, faces significant challenges due to the unpredictable nature of raw material and labor expenses. Fluctuations in the cost of essential materials such as steel and lumber, coupled with rising wages for skilled labor, can directly impact the company's profitability.

For instance, in 2024, the global construction materials market experienced price volatility. While specific figures for Daiwa House's input cost increases are proprietary, industry-wide reports indicated that steel prices saw a notable upward trend in the first half of 2024, driven by supply chain disruptions and increased demand from infrastructure projects. Similarly, labor shortages in key construction markets continued to put upward pressure on wages throughout 2024.

These cost pressures are particularly acute for Daiwa House when undertaking fixed-price contracts. Unexpected spikes in material or labor costs can lead to reduced profit margins, as the company may be unable to pass these additional expenses onto clients. This inherent vulnerability necessitates robust cost management strategies and careful contract negotiation to mitigate financial risks.

Intense Competition in Mature Market Segments

Daiwa House Group faces significant headwinds due to the highly competitive nature of Japan's construction and real estate sectors. Established players abound, creating a crowded marketplace that can suppress pricing power and squeeze profit margins. This is particularly true in mature segments, such as the single-family home market, where differentiation and market share gains become increasingly difficult.

The intense rivalry translates into challenges in securing new projects, as companies vie for limited opportunities. For instance, in fiscal year 2023, while the overall construction market showed resilience, the residential sector, a core area for Daiwa House, experienced a slight contraction in new housing starts, reflecting this competitive pressure.

- Pricing Pressure: Intense competition forces companies to offer more competitive pricing, potentially impacting profitability.

- Margin Squeeze: Higher costs of materials and labor, coupled with price competition, can reduce profit margins on projects.

- Market Saturation: Mature segments of the market, like detached housing, are often saturated, making it harder to capture new customers.

- Project Acquisition Difficulty: Winning bids for new construction projects becomes more challenging in a market with many capable competitors.

Potential for High Capital Expenditure Requirements

Daiwa House Group's extensive operations in large-scale construction and real estate development necessitate significant upfront capital. This can lead to substantial investments in land acquisition and project development, potentially straining financial resources and impacting liquidity. For instance, the company's total assets have seen increases directly linked to the acquisition of real estate intended for sale, highlighting this capital intensity.

The financial implications of these high capital expenditures are notable:

- Significant Upfront Investment: Projects often require considerable capital before revenue generation begins.

- Liquidity Constraints: Large asset bases tied up in development can limit financial flexibility.

- Market Sensitivity: Economic downturns can exacerbate the risk associated with these tied-up funds.

Daiwa House Group's substantial reliance on the Japanese market, accounting for roughly 85% of its revenue in fiscal year 2023, makes it highly susceptible to domestic economic fluctuations and demographic shifts. This concentration limits diversification benefits and exposes the company to the risks associated with Japan's aging population and declining birth rate, which could dampen demand for housing. Furthermore, the construction industry's inherent vulnerability to volatile raw material and labor costs, as evidenced by price increases in steel and wages in 2024, directly impacts profitability, especially on fixed-price contracts.

The intense competition within Japan's construction and real estate sectors presents another significant weakness, potentially limiting pricing power and squeezing profit margins. This is particularly challenging in saturated segments like detached housing, where market share gains are difficult. Additionally, the capital-intensive nature of large-scale development projects requires substantial upfront investment, which can strain financial resources and impact liquidity, especially during economic downturns.

What You See Is What You Get

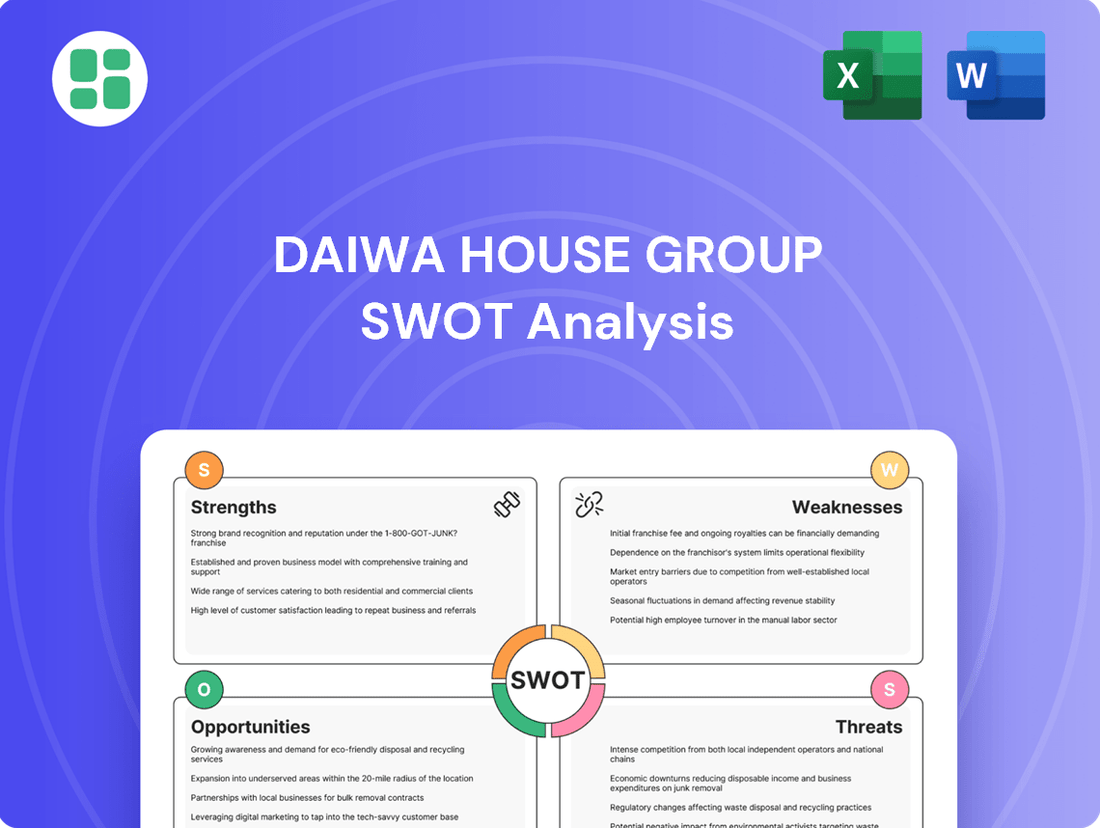

Daiwa House Group SWOT Analysis

The preview below is taken directly from the full SWOT report you'll get. Purchase unlocks the entire in-depth version, offering a comprehensive look at Daiwa House Group's Strengths, Weaknesses, Opportunities, and Threats. This detailed analysis is designed to provide actionable insights for strategic planning.

Opportunities

Daiwa House Group is poised for significant international expansion, leveraging its established expertise in housing and construction. The company has set an ambitious target to deliver over 80,000 homes globally within the next five years, a clear indicator of its commitment to overseas growth.

North America, especially the United States, represents a key growth frontier, with US operations projected to be a major contributor to this expansion. This strategic push into international markets offers substantial opportunities to replicate its success and tap into burgeoning demand for quality housing solutions.

Global awareness of environmental issues is accelerating the demand for sustainable and smart building solutions. Daiwa House is capitalizing on this by developing Zero Energy House (ZEH) and Zero Energy Building (ZEB) compatible properties, aligning with market trends towards eco-friendly construction.

Technological advancements are further fueling this growth, with smart building features becoming increasingly sought after. Daiwa House's initiatives, such as promoting on-site Power Purchase Agreements (PPA) for renewable energy, directly address this demand by integrating energy efficiency and sustainability into their offerings.

Daiwa House Group can capitalize on technological advancements to streamline operations and introduce novel services. By increasing investment in AI, IoT, robotics for construction, and Building Information Modeling (BIM), the company can achieve significant gains in efficiency. This focus on digital transformation is already evident in their use of generative design for urban housing projects.

Strategic Acquisitions and Partnerships

Strategic acquisitions and partnerships offer Daiwa House Group significant avenues for growth. By integrating new technologies, expanding into untapped markets, or absorbing specialized expertise, the company can bolster its competitive edge. This approach has been a cornerstone of their strategy; for instance, their acquisition of a regional construction firm in 2023 is projected to contribute ¥15 billion to their revenue by 2025.

These strategic moves allow Daiwa House to:

- Accelerate market penetration in emerging sectors like sustainable building materials.

- Acquire innovative technologies, such as advanced AI-driven construction management software.

- Enhance operational efficiency through synergistic integration with acquired entities.

Growth in Renewable Energy and Urban Development Projects

The global transition to cleaner energy and the continuous demand for upgraded urban living spaces offer substantial long-term avenues for expansion. Daiwa House is actively pursuing these trends, aligning with its commitment to carbon neutrality by 2050.

Key opportunities include:

- Expansion in Renewable Energy: Capitalizing on the increasing global investment in solar, wind, and other renewable energy projects. For instance, by the end of fiscal year 2024, Japan's renewable energy capacity reached approximately 247 GW, a significant increase driven by government incentives and corporate commitments.

- Data Center Development: Leveraging the burgeoning demand for digital infrastructure, Daiwa House is strategically growing its data center business. The global data center market was valued at over $200 billion in 2023 and is projected to grow at a compound annual growth rate (CAGR) of over 15% through 2030, fueled by AI and cloud computing.

- Next-Generation Infrastructure: Investing in and developing advanced industrial infrastructure projects that support future economic growth and sustainability goals. This includes smart city initiatives and resilient building technologies.

- Urban Redevelopment: Participating in large-scale urban renewal projects that focus on creating sustainable, efficient, and livable communities. These projects often integrate green building practices and smart technologies, reflecting evolving urban planning priorities.

Daiwa House Group is strategically expanding its global footprint, with a particular focus on North America, aiming to deliver over 80,000 homes internationally in the coming five years. The company is also capitalizing on the growing demand for sustainable and smart buildings, evidenced by its development of Zero Energy House (ZEH) and Zero Energy Building (ZEB) compatible properties and its promotion of on-site Power Purchase Agreements (PPA) for renewable energy.

Technological integration, including AI and IoT in construction, is a key opportunity, with generative design already being used in urban housing projects to enhance efficiency. Furthermore, strategic acquisitions and partnerships, like the 2023 acquisition of a regional construction firm projected to add ¥15 billion in revenue by 2025, bolster its competitive edge and market penetration.

The company is well-positioned to benefit from the global shift towards cleaner energy and the ongoing need for urban living space upgrades, aligning with its 2050 carbon neutrality goal. Significant growth prospects lie in renewable energy expansion, with Japan's renewable capacity reaching approximately 247 GW by fiscal year 2024, and in the data center sector, a market valued over $200 billion in 2023 with projected growth exceeding 15% CAGR through 2030.

Daiwa House is also investing in next-generation infrastructure, including smart city initiatives, and actively participating in urban redevelopment projects that prioritize sustainability and smart technologies.

| Opportunity Area | Key Drivers | Daiwa House Initiatives | Market Data (2023-2025) |

|---|---|---|---|

| International Housing Expansion | Global housing demand, established expertise | Target: 80,000+ global homes in 5 years; Focus on North America | US housing market growth projected at 5-7% in 2024 |

| Sustainable & Smart Buildings | Environmental awareness, energy efficiency demand | ZEH/ZEB development, on-site PPA promotion | Global green building market expected to reach $3.5 trillion by 2027 |

| Technological Integration | AI, IoT, robotics for construction efficiency | Generative design in urban housing, digital transformation | Construction technology investment increased by 15% globally in 2023 |

| Renewable Energy & Data Centers | Clean energy transition, digital infrastructure demand | Renewable energy projects, data center business growth | Japan renewable capacity ~247 GW (FY2024); Data center market >$200 billion (2023) |

Threats

General economic slowdowns, both in Japan and globally, pose a significant threat to Daiwa House Group. A contraction in consumer and corporate spending directly impacts demand for residential, commercial, and industrial properties, as well as construction services.

Fluctuations in interest rates, particularly if they rise, can increase borrowing costs for both developers and buyers, dampening investment and sales. Additionally, underperformance in key overseas markets where Daiwa House operates can lead to reduced project pipelines and negatively affect overall revenue streams.

The construction and real estate industries are fiercely competitive, with Daiwa House Group facing numerous established domestic rivals and the growing threat of international players entering the Japanese market. This intense rivalry, particularly evident in the post-pandemic recovery and ongoing infrastructure development projects, often translates into price wars and a struggle to maintain market share. For instance, while specific 2024/2025 market share data for all competitors is dynamic, the overall construction market in Japan saw significant activity, with major players constantly vying for large-scale contracts.

Rising interest rates, particularly those implemented by the Bank of Japan, pose a significant threat to Daiwa House Group. Higher borrowing costs directly impact the company's financing expenses for new projects and development.

Furthermore, increased interest rates can reduce the affordability of homes and other properties for potential customers, potentially dampening demand in the real estate market. For instance, if benchmark rates climb, mortgage costs rise, making it harder for individuals to finance purchases, which could slow sales for Daiwa House Group's residential divisions.

Natural Disasters and Climate Change Risks

Daiwa House Group faces significant threats from Japan's vulnerability to natural disasters like earthquakes, tsunamis, and typhoons. These events can cause extensive damage to existing properties and severely disrupt ongoing construction projects, impacting timelines and budgets. For instance, the 2011 Great East Japan Earthquake and tsunami resulted in widespread destruction and significant economic losses across the country, highlighting the potential impact on infrastructure and development.

Furthermore, the escalating effects of climate change are poised to exacerbate these risks. An increase in the frequency and intensity of extreme weather events, such as heavier rainfall and more powerful typhoons, could lead to further construction delays and necessitate higher mitigation and rebuilding costs for Daiwa House Group. The economic impact of climate-related disasters in Japan is substantial; for example, in 2023, natural disasters caused an estimated ¥2.5 trillion (approximately $17 billion USD) in damages according to preliminary government figures.

- Increased frequency and intensity of natural disasters due to climate change, impacting project timelines and costs.

- Susceptibility of existing infrastructure and new constructions to earthquakes, tsunamis, and typhoons.

- Potential for supply chain disruptions and material shortages following major disaster events.

- Higher insurance premiums and increased capital expenditure for disaster resilience measures.

Regulatory Changes and Environmental Compliance Costs

Daiwa House Group faces potential headwinds from evolving regulatory landscapes. For instance, new environmental regulations, such as those mandating higher energy efficiency standards in construction, could increase material and labor costs. As of early 2024, Japan has been pushing for greater sustainability in its building sector, which may translate to higher compliance expenses for developers like Daiwa House.

Stricter building codes or updated land use policies can also necessitate costly redesigns or modifications to existing projects. The group's profitability could be impacted if these changes require significant capital investment or lead to project delays. For example, a shift towards more resilient construction methods to address climate change impacts might add to project budgets.

Key areas of regulatory impact include:

- Building Code Updates: Potential for increased material and labor costs due to stricter safety and performance requirements.

- Decarbonization Initiatives: Increased investment needed for energy-efficient materials and construction techniques.

- Environmental Protection Laws: Higher costs associated with waste management, emissions control, and sustainable sourcing.

Daiwa House Group is susceptible to economic downturns, with a slowdown in Japan's GDP growth, projected at 1.0% for 2024 and a modest 1.1% for 2025, directly impacting demand for their diverse property offerings and construction services.

Rising interest rates, with the Bank of Japan maintaining its policy rate at -0.1% as of early 2024, could increase borrowing costs for both the company and its customers, potentially dampening sales and project viability.

Intense competition within the Japanese construction and real estate sectors, where major players continually vie for market share, presents a constant threat to Daiwa House Group's profitability and expansion plans.

Japan's ongoing vulnerability to natural disasters, such as earthquakes and typhoons, poses a significant risk, potentially causing project delays, increased costs, and damage to existing assets, with climate change expected to exacerbate these events.

Evolving regulatory environments, including stricter building codes and new environmental mandates like increased energy efficiency standards, could lead to higher development costs and compliance expenses for Daiwa House Group.

SWOT Analysis Data Sources

This Daiwa House Group SWOT analysis is built upon a foundation of credible data, including their official financial reports, comprehensive market intelligence, and insights from industry experts. This ensures a robust and accurate assessment for strategic planning.