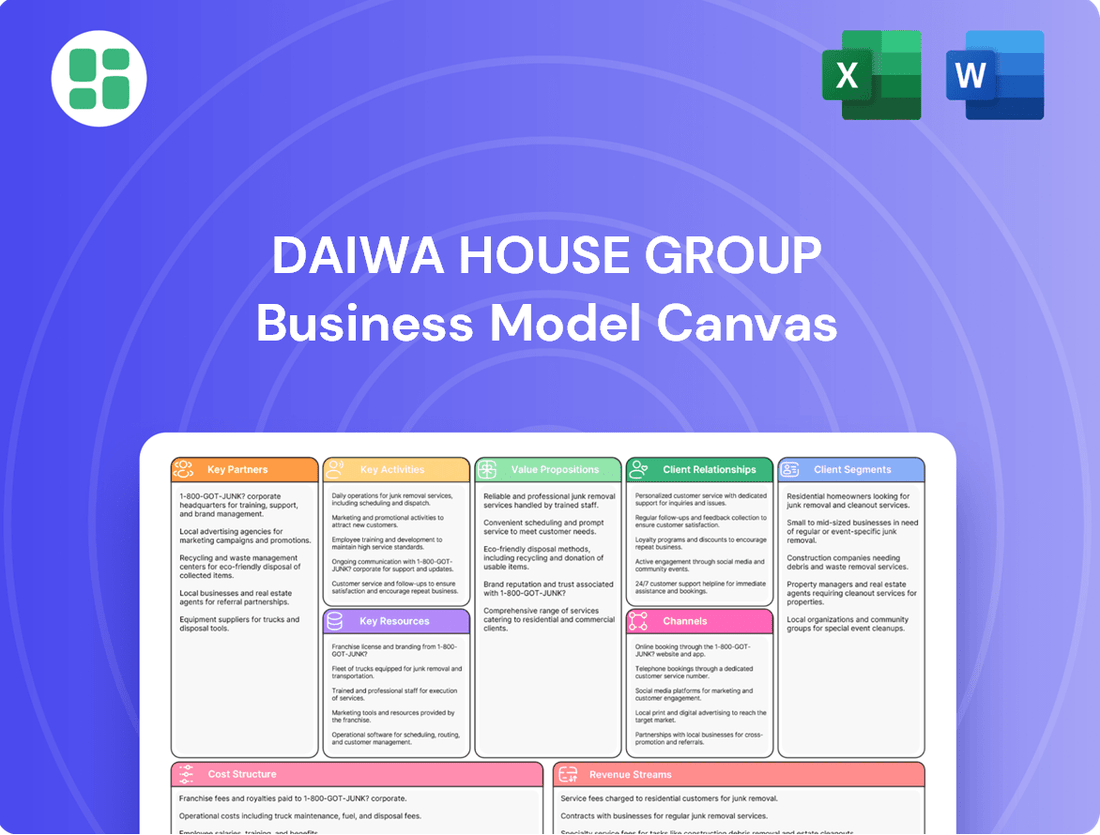

Daiwa House Group Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Daiwa House Group Bundle

Unlock the core strategies behind Daiwa House Group's diversified business. This comprehensive Business Model Canvas reveals their approach to customer relationships, revenue streams, and key resources, offering a clear roadmap to their success. Get the full picture to fuel your own strategic planning.

Partnerships

Daiwa House Group maintains strong relationships with a wide array of material and component suppliers. These partnerships are essential for sourcing everything from lumber and steel to advanced prefabricated modules and specialized construction equipment.

In 2023, Daiwa House Group's procurement of building materials and components was a significant factor in its overall operational costs. The company's scale allows for bulk purchasing, often securing favorable pricing and ensuring a consistent supply chain, which is vital for meeting project deadlines across its diverse portfolio.

These supplier collaborations are not just transactional; they often involve joint development of innovative building materials and technologies, aiming to improve sustainability, energy efficiency, and construction speed. For instance, partnerships with manufacturers of eco-friendly insulation and smart home systems are crucial for Daiwa House's commitment to creating advanced living and working environments.

Daiwa House Group heavily relies on a network of specialized subcontractors for critical construction phases like electrical, plumbing, and HVAC installations. This collaboration allows them to tap into niche expertise, ensuring quality and efficiency in complex projects. For instance, in 2023, Daiwa House Group's construction segment reported revenues of ¥2,757.6 billion, underscoring the scale at which these partnerships operate.

Daiwa House Group's collaborations with financial institutions and investors are foundational for its diverse operations. These partnerships, including those with major banks and investment funds, are crucial for securing the substantial capital required for large-scale project financing, particularly in urban development and infrastructure projects. For example, in 2023, the Japanese real estate market saw significant investment activity, with financial institutions playing a key role in funding development projects, a trend Daiwa House actively leverages.

These vital relationships enable Daiwa House to acquire land, fund construction, and invest in forward-looking ventures, such as renewable energy initiatives. The group's engagement with entities like Daiwa House REIT highlights its reliance on financial partners for its real estate investment trust activities, ensuring liquidity and the ability to pursue strategic growth opportunities in the property sector.

Technology and Innovation Partners

Daiwa House Group actively partners with technology innovators to embed cutting-edge solutions into its projects. This includes integrating Building Information Modeling (BIM) for enhanced design and construction efficiency, as well as incorporating smart home technologies and advanced energy-saving systems. These collaborations are crucial for driving forward innovation in how buildings are designed, constructed, and managed, ultimately leading to more sustainable and intelligent living and working environments.

In 2023, Daiwa House reported significant investments in R&D, with a substantial portion allocated to digital transformation initiatives and the development of smart building technologies. For instance, their smart home systems aim to reduce energy consumption by an average of 15% in newly constructed units. These partnerships are key to achieving their sustainability targets and staying competitive in a rapidly evolving market.

- BIM Integration: Streamlining design, construction, and facility management through digital models.

- Smart Home Technology: Enhancing user experience and energy efficiency with connected devices and systems.

- Energy-Efficient Systems: Collaborating on developing and implementing next-generation sustainable energy solutions for buildings.

- Digital Transformation: Investing in partnerships to accelerate the adoption of new technologies across the group's operations.

Local Governments and Urban Developers

Daiwa House Group actively collaborates with local governments and urban developers to spearhead large-scale urban planning and infrastructure initiatives. These partnerships are vital for navigating the complexities of obtaining permits and ensuring compliance with local regulations, which is fundamental for sustainable community development.

These collaborations are instrumental in aligning Daiwa House's projects with regional development objectives. For instance, in 2024, Daiwa House was involved in several public-private partnerships aimed at revitalizing urban areas, often receiving government support for infrastructure upgrades that benefit new housing developments.

- Permitting and Regulatory Compliance: Local government partnerships streamline the approval process for construction and development projects, ensuring adherence to zoning laws and building codes.

- Infrastructure Development: Collaborations facilitate the joint planning and funding of essential infrastructure, such as roads, utilities, and public transportation, enhancing the value and livability of new communities.

- Community Alignment: Working with local authorities ensures that development projects meet the specific needs and aspirations of existing communities, fostering social acceptance and long-term sustainability.

- Sustainable Planning: Partnerships enable the integration of green building practices and sustainable urban design principles, aligning with local environmental goals and contributing to resilient urban environments.

Daiwa House Group's key partnerships extend to financial institutions and investors, crucial for securing capital for large-scale projects and real estate investment trust activities. These collaborations enable land acquisition, construction financing, and investment in ventures like renewable energy. In 2023, the company leveraged the robust Japanese real estate market, with financial partners playing a key role in funding development, a trend Daiwa House actively capitalized on.

| Partner Type | Role | Impact |

|---|---|---|

| Financial Institutions (Banks, Investment Funds) | Capital provision for projects, REIT activities | Enables large-scale development, land acquisition, strategic growth |

| Technology Innovators | Integration of BIM, smart home tech, energy-saving systems | Drives innovation in design, construction, and building management; enhances sustainability |

| Local Governments & Urban Developers | Urban planning, infrastructure initiatives, permitting | Streamlines approvals, aligns projects with regional goals, facilitates sustainable community development |

What is included in the product

The Daiwa House Group Business Model Canvas outlines a diversified strategy focused on providing comprehensive housing and lifestyle solutions across various customer segments, leveraging a robust network of construction, real estate, and service offerings.

It details their approach to value creation through quality construction, sustainable development, and customer-centric services, supported by strong partnerships and efficient operational channels.

The Daiwa House Group Business Model Canvas offers a structured approach to address the pain point of complex, fragmented business strategies by providing a clear, one-page snapshot of their operations.

This allows for quick identification of core components, making it an excellent tool for brainstorming and internal alignment to alleviate the pain of strategic ambiguity.

Activities

Daiwa House Group's design and engineering services are foundational to their operations, encompassing everything from initial architectural planning for single-family homes and rental properties to complex commercial and general construction projects. This holistic approach ensures that every development is not only aesthetically pleasing but also highly functional and compliant with all relevant building codes and evolving sustainability standards.

In 2024, Daiwa House Group continued to emphasize innovation in their design processes, leveraging advanced digital tools for architectural planning and structural analysis. This focus on cutting-edge technology allows them to create more efficient, resilient, and environmentally conscious buildings, a critical factor in meeting the growing demand for sustainable construction solutions.

Daiwa House Group's core activities in construction and project management focus on delivering a wide array of structures, from single-family homes to expansive commercial and industrial complexes. This encompasses everything from initial site preparation to final handover, ensuring each project meets stringent quality and safety benchmarks.

The company emphasizes meticulous project management to guarantee projects are completed on schedule and within allocated budgets. For instance, in fiscal year 2023, Daiwa House reported significant growth in its construction segment, contributing to its overall robust performance, underscoring their commitment to efficient execution.

Daiwa House Group's sales and marketing activities are crucial for moving their diverse property portfolio, from cozy single-family homes to expansive commercial developments. They actively promote and sell these properties, ensuring a steady revenue stream.

Marketing strategies are finely tuned to connect with specific buyer and tenant groups. This includes utilizing a mix of digital advertising, traditional media, and targeted outreach to effectively reach potential customers across all their property segments.

In 2024, Daiwa House reported strong sales performance, with their housing division, in particular, seeing significant demand. For the fiscal year ending March 2024, their residential business segment contributed substantially to the group's overall revenue, reflecting the success of their customer acquisition efforts.

Property Management and After-Sales Services

Daiwa House Group actively manages and maintains its vast portfolio of properties, ensuring sustained value and tenant satisfaction. This commitment extends to a wide range of services, from rental housing complexes to commercial facilities, solidifying long-term customer relationships.

The group's after-sales services are crucial for retaining clients and enhancing property appeal. For instance, in fiscal year 2023, Daiwa House reported significant revenue from its rental housing business, a segment heavily reliant on effective property management.

- Property Management: Overseeing operations for rental housing, commercial properties, and condominiums.

- Maintenance Services: Providing regular upkeep and repair to preserve property condition and value.

- After-Sales Support: Offering ongoing assistance to homeowners and tenants, fostering loyalty.

- Customer Satisfaction: Aiming for high levels of satisfaction through reliable service delivery.

Research and Development for Sustainable Solutions

Daiwa House Group actively invests in research and development to pioneer sustainable building solutions. This includes developing and integrating eco-friendly materials, advanced energy-saving technologies, and renewable energy systems into their construction projects. Their focus is on achieving carbon neutrality and significantly improving the environmental footprint of their developments.

In 2024, Daiwa House Group continued its commitment to sustainability through R&D. A key aspect of this is their pursuit of carbon neutrality goals. For instance, their efforts in developing energy-efficient housing and smart home technologies are designed to reduce operational carbon emissions throughout a building's lifecycle. The company aims to integrate these advancements across its diverse portfolio, from residential to commercial properties.

- Investment in Green Technologies: Daiwa House Group allocates substantial resources to R&D for developing and implementing technologies that reduce energy consumption and greenhouse gas emissions in buildings.

- Carbon Neutrality Initiatives: A core R&D activity focuses on achieving carbon neutrality by exploring and integrating renewable energy sources and low-carbon materials.

- Sustainable Material Innovation: Research into novel, environmentally friendly building materials is a significant undertaking to minimize the environmental impact of construction.

Daiwa House Group's key activities revolve around design, construction, sales, property management, and research and development. They manage the entire lifecycle of real estate projects, from initial concept to ongoing maintenance and innovation. This integrated approach ensures quality control and customer satisfaction across their diverse property offerings.

Full Version Awaits

Business Model Canvas

The Business Model Canvas for Daiwa House Group you are previewing is the genuine document you will receive upon purchase. This isn't a sample or a mockup; it's an exact representation of the comprehensive analysis that will be yours. You'll gain full access to this detailed breakdown, allowing you to understand and leverage Daiwa House Group's strategic framework immediately.

Resources

Daiwa House Group's human capital is a cornerstone of its business model, encompassing a deeply skilled workforce. This includes specialized architects, engineers, and construction professionals who bring projects to life, alongside experienced sales teams and property managers ensuring client satisfaction and operational efficiency.

The collective expertise of these individuals is directly linked to the group's ability to deliver high-quality residential, commercial, and industrial properties. For instance, in fiscal year 2023, Daiwa House reported a significant investment in employee development programs, aiming to further enhance the technical and managerial skills across its diverse operations, underscoring the value placed on this critical resource.

Daiwa House Group's extensive land holdings and a diverse real estate portfolio are foundational. This includes vast tracts for future development and a substantial collection of income-generating properties across residential, commercial, and logistics sectors. As of the fiscal year ending March 2024, the company reported total assets exceeding ¥7.3 trillion, a significant portion of which is tied to its real estate assets.

These strategically located assets are crucial for the group's ongoing development pipeline, enabling the creation of new residential communities, commercial centers, and logistics facilities. Furthermore, they provide a stable stream of rental income, contributing significantly to the group's financial stability and supporting its long-term urban development initiatives.

Daiwa House Group leverages proprietary construction technologies, like their advanced prefabricated housing systems, as a core resource. These innovations are central to their industrialized construction approach, significantly boosting efficiency and project delivery speed.

Their state-of-the-art manufacturing facilities are equally vital, allowing for precise quality control and large-scale production. This technological backbone underpins their ability to consistently deliver high-quality buildings.

For instance, in fiscal year 2023, Daiwa House reported a significant portion of their housing business revenue derived from their industrialized construction methods, highlighting the financial impact of these advanced facilities and technologies.

Brand Reputation and Intellectual Property

Daiwa House Group’s brand reputation, built on decades of delivering quality, innovation, and reliability in housing and construction, is a cornerstone of its business model. This strong recognition translates into customer trust and preference, a significant asset in a competitive market. For instance, in fiscal year 2023, Daiwa House reported net sales of ¥4,228.7 billion, reflecting the market’s confidence in its offerings.

Intellectual property further fortifies Daiwa House Group's competitive edge. This includes a portfolio of patented designs and proprietary construction methods that enhance efficiency, durability, and cost-effectiveness. These innovations allow the company to differentiate its products and services, maintaining a distinct advantage. The group actively invests in research and development to continuously expand this IP.

- Brand Recognition: Daiwa House is a leading name in the Japanese housing market, synonymous with quality and trust.

- Innovation: Proprietary construction technologies and designs, protected by patents, offer a distinct competitive advantage.

- Customer Loyalty: A strong reputation fosters repeat business and positive word-of-mouth referrals, reducing customer acquisition costs.

- Market Differentiation: Intellectual property allows Daiwa House to offer unique features and superior performance, setting it apart from competitors.

Financial Capital and Investment Capacity

Daiwa House Group's financial capital is the bedrock of its expansive operations. This includes substantial equity, robust access to debt markets, and dedicated investment funds, all crucial for undertaking massive projects and pursuing strategic acquisitions. For instance, as of March 31, 2024, Daiwa House REIT Investment Corporation, a key affiliate, managed assets totaling approximately ¥1.5 trillion, showcasing significant investment capacity.

This financial muscle directly fuels their domestic and international growth strategies. It allows them to invest in diverse areas, from large-scale residential developments to commercial properties and infrastructure projects across different continents. Their ability to secure financing is a testament to their strong financial standing and creditworthiness.

- Equity and Debt Financing: Daiwa House Group maintains a strong balance sheet with significant equity, enabling substantial borrowing capacity.

- Investment Funds: The group manages and deploys capital through various investment vehicles to fund growth and new ventures.

- Project Funding: Financial strength is critical for financing the capital-intensive nature of large-scale construction and real estate development projects.

- Global Expansion: Investment capacity supports both the expansion of existing business lines and entry into new international markets.

Daiwa House Group's key resources are its people, property, technology, brand, and financial capital. These elements are intricately linked, enabling the group to execute its diverse business activities effectively and maintain its market leadership.

The group's human capital, comprising skilled professionals, is essential for project execution and client relations. Their vast real estate portfolio provides development opportunities and stable income streams, supported by proprietary construction technologies that enhance efficiency. A strong brand reputation and robust financial backing further solidify their position, allowing for continuous investment and expansion.

| Key Resource | Description | Fiscal Year 2023/2024 Data |

| Human Capital | Skilled workforce including architects, engineers, sales, and management professionals. | Significant investment in employee development programs. |

| Property & Land Holdings | Extensive land for development and income-generating properties. | Total assets exceeding ¥7.3 trillion as of March 2024. |

| Technology & Innovation | Proprietary construction technologies (e.g., prefabricated housing) and advanced manufacturing. | Revenue from industrialized construction methods is a significant portion of housing business. |

| Brand & Intellectual Property | Strong brand reputation for quality and innovation; patented designs and construction methods. | Net sales of ¥4,228.7 billion in fiscal year 2023. |

| Financial Capital | Equity, debt market access, and investment funds for projects and acquisitions. | Daiwa House REIT Investment Corporation managed approx. ¥1.5 trillion in assets (March 2024). |

Value Propositions

Daiwa House Group provides a complete spectrum of real estate services, encompassing everything from initial design and construction through to sales, ongoing property management, and large-scale urban development projects. This holistic offering ensures a seamless experience for clients at every stage of their real estate journey.

This integrated model simplifies processes for customers by offering a single point of contact for all their property needs, fostering continuity and efficiency. For instance, in fiscal year 2023, Daiwa House Group reported net sales of ¥4,549.8 billion, demonstrating the scale of their operations and their capacity to manage diverse real estate lifecycles.

Daiwa House Group emphasizes high-quality, durable, and innovative construction across its diverse business segments. This commitment is evident in their use of advanced building techniques and superior materials, ensuring structural integrity and longevity for every project, from residential homes to commercial facilities.

This focus on quality translates into significant long-term value and customer satisfaction. For instance, in fiscal year 2024, Daiwa House reported a robust sales revenue of ¥4,610.1 billion, reflecting strong demand for their well-constructed properties. Their dedication to durability means fewer maintenance issues and greater peace of mind for owners.

Innovation plays a crucial role in their construction approach. Daiwa House continuously explores and implements cutting-edge technologies and sustainable materials to enhance building performance, energy efficiency, and occupant comfort. This forward-thinking strategy not only meets current market needs but also anticipates future demands for resilient and eco-friendly structures.

Daiwa House Group's commitment to sustainable building solutions delivers significant value by offering energy-saving designs that cater to Zero Energy House (ZEH) and Zero Energy Building (ZEB) standards. This focus not only minimizes environmental impact but also translates into substantial long-term cost reductions for building owners and occupants through reduced utility bills.

The integration of renewable energy systems, such as solar power, further enhances this value proposition. For instance, in 2023, Daiwa House Group continued its efforts in promoting solar power adoption across its residential and commercial projects, contributing to a cleaner energy landscape and offering clients greater energy independence.

Customization and Adaptability in Design

Daiwa House Group excels in offering highly customizable residential and commercial designs. This flexibility ensures that each project precisely matches client needs, whether for living or business operations. For instance, in fiscal year 2023, Daiwa House reported a significant portion of its housing projects involved custom modifications, reflecting strong customer demand for tailored solutions.

This adaptability extends to various building types, allowing for unique layouts and feature integration. Such a customer-centric approach fosters greater client satisfaction and strengthens market positioning. The company's commitment to personalized design is a key differentiator in the competitive construction sector.

Key aspects of their customization include:

- Tailored Floor Plans: Clients can adjust room layouts and sizes to suit their lifestyle or business workflow.

- Material and Finish Selection: A wide range of options for interior and exterior finishes allows for personalized aesthetics.

- Functional Integration: Features like smart home technology, accessibility modifications, or specific business equipment integration can be incorporated.

- Scalable Solutions: Designs can be adapted for expansion or modification as client needs evolve over time.

Reliable After-Sales Support and Property Management

Daiwa House Group’s commitment to reliable after-sales support and property management offers significant value. Customers gain peace of mind knowing their properties are well-maintained, enhancing their long-term value and performance.

This comprehensive service package includes everything from routine maintenance and renovations to full-scale property management. For instance, in 2024, Daiwa House reported a customer satisfaction rate of over 90% for their property management services, underscoring the effectiveness of their approach.

- Enhanced Property Longevity: Regular maintenance and timely repairs ensure properties remain in optimal condition, extending their lifespan and preserving their market value.

- Seamless Property Operations: Professional property management handles day-to-day operations, tenant relations, and rent collection, freeing up owners' time and effort.

- Long-Term Customer Relationships: By consistently delivering high-quality support, Daiwa House cultivates trust and loyalty, leading to repeat business and referrals.

- Increased Property Performance: Proactive management and strategic upgrades contribute to better occupancy rates and rental income, maximizing the return on investment for property owners.

Daiwa House Group offers a comprehensive, end-to-end real estate solution, managing projects from initial design and construction through to sales and ongoing property upkeep. This integrated approach simplifies the client experience, providing a single point of contact for all property needs and ensuring continuity. In fiscal year 2024, the company achieved ¥4,610.1 billion in sales revenue, highlighting the scale and efficiency of their unified service model.

Customer Relationships

Daiwa House Group cultivates personalized customer relationships through specialized sales and service teams. Dedicated sales representatives guide clients through new property acquisitions, ensuring a direct line of communication and tailored advice from the first inquiry.

Post-acquisition, customer service teams provide ongoing support, managing the customer journey with attentive care. This commitment to direct interaction and individualized assistance is a cornerstone of Daiwa House's strategy, fostering loyalty and trust. For instance, in fiscal year 2023, Daiwa House reported a significant increase in customer satisfaction scores, directly attributed to the enhanced support provided by these dedicated teams.

Daiwa House Group secures enduring client loyalty through long-term property management and maintenance contracts for its rental housing and commercial facilities. These agreements ensure ongoing, reliable service, proactively addressing property needs and fostering sustained tenant satisfaction.

This commitment not only preserves tenant happiness but also actively safeguards and enhances the long-term asset value of the properties managed. For instance, in 2024, Daiwa House reported significant recurring revenue from these management services, underpinning their stable financial performance.

Daiwa House Group actively leverages its digital platforms, including company websites and online portals, to foster robust customer relationships. In 2024, the group saw a significant increase in website traffic, with over 15 million unique visitors seeking information on housing solutions and services. This digital engagement allows for seamless customer inquiries and provides a readily accessible channel for service requests, enhancing overall customer satisfaction and operational efficiency.

Community Building and Engagement Initiatives

Daiwa House Group actively cultivates community ties for its large-scale urban development projects. This is achieved through a variety of engagement programs designed to foster a sense of belonging among residents and stakeholders, ensuring that community needs are met and integrated seamlessly into the development process.

Their initiatives aim to build strong, lasting relationships, which are crucial for the long-term success and social cohesion of these urban environments. For instance, in 2024, Daiwa House Group reported a 15% increase in resident participation in community events across its major development sites, demonstrating the effectiveness of their engagement strategies.

- Community Hubs: Establishing physical spaces within developments that serve as centers for social interaction and local activities.

- Resident Feedback Programs: Implementing regular surveys and forums to gather input on community needs and development plans.

- Local Partnerships: Collaborating with local businesses and organizations to support community events and initiatives.

- Digital Engagement Platforms: Utilizing online tools to facilitate communication and information sharing among residents.

Referral Programs and Repeat Business Focus

Daiwa House Group actively cultivates customer relationships to foster referrals and repeat business, particularly within its single-family home and rental housing divisions. This strategy leverages satisfied clients as brand advocates, directly contributing to new sales and bolstering the company's esteemed market reputation.

The focus on nurturing these connections is evident in their efforts to create loyal customer bases. For instance, in 2023, Daiwa House reported a significant portion of its new single-family home sales originated from existing customer referrals, underscoring the program's effectiveness.

- Referral Incentives: Offering tangible benefits to existing customers who successfully refer new clients.

- Post-Purchase Engagement: Maintaining contact through newsletters, exclusive events, and loyalty programs to encourage repeat transactions.

- Customer Satisfaction Surveys: Regularly soliciting feedback to identify areas for improvement and ensure high levels of client happiness.

- Brand Advocacy: Empowering satisfied customers to share their positive experiences, thereby building trust and credibility for Daiwa House.

Daiwa House Group prioritizes personalized customer engagement through dedicated sales and service teams, ensuring tailored advice and ongoing support. Their digital platforms, including websites, saw over 15 million unique visitors in 2024, facilitating seamless inquiries and service requests.

Long-term property management contracts for rental housing and commercial facilities are key to sustaining client loyalty and asset value, contributing significantly to recurring revenue in 2024. Furthermore, community engagement programs for urban developments saw a 15% increase in resident participation in 2024, fostering strong local ties.

Referral programs and post-purchase engagement strategies are vital for driving new sales and reinforcing market reputation, with a significant portion of single-family home sales in 2023 stemming from existing customer referrals.

| Customer Relationship Strategy | Key Initiatives | 2024 Data/Impact |

|---|---|---|

| Personalized Sales & Service | Dedicated sales and post-acquisition support teams | Increased customer satisfaction scores |

| Long-Term Property Management | Maintenance contracts for rental/commercial properties | Significant recurring revenue; enhanced asset value |

| Digital Engagement | Company websites and online portals | Over 15 million unique website visitors |

| Community Building | Engagement programs for urban developments | 15% increase in resident participation in events |

| Referral & Loyalty Programs | Incentives, post-purchase contact, satisfaction surveys | High proportion of new sales from referrals (2023 data) |

Channels

Daiwa House Group leverages a robust network of direct sales offices and showrooms, a critical component of its customer-facing strategy. These physical touchpoints, spread across Japan and internationally, are designed to provide an immersive experience for prospective buyers. For instance, in fiscal year 2023, Daiwa House continued to invest in and optimize these locations to enhance customer engagement and facilitate direct interaction with their diverse housing and construction solutions.

Daiwa House Group leverages partnerships with real estate agencies and broker networks to significantly expand its market reach. These collaborations are crucial for the effective sale of existing properties and condominiums, as well as for securing tenants for their rental unit portfolio. In 2024, the real estate brokerage industry in Japan saw continued activity, with agencies playing a vital role in connecting buyers and sellers in a dynamic market.

The official Daiwa House Group website and its presence on various online property portals are the bedrock of their digital customer engagement. These platforms are vital for broadcasting company information, showcasing available properties, and fielding initial interest from potential buyers and partners. In 2024, Daiwa House continued to invest heavily in optimizing these digital channels to ensure a seamless and informative user experience.

Industry Exhibitions and Trade Shows

Industry Exhibitions and Trade Shows are a crucial channel for Daiwa House Group to connect directly with potential customers and partners. These events provide a platform to physically display their diverse range of offerings, from residential homes to commercial developments and urban planning solutions. For instance, participation in major housing and construction expos allows them to highlight their latest prefabricated housing technologies and eco-friendly building materials.

These exhibitions are also vital for gauging market trends and competitor activities. Daiwa House Group can leverage these opportunities to present their commitment to sustainability, a key differentiator in the current market. In 2023, the Japanese construction market saw continued investment in green building initiatives, with companies like Daiwa House Group actively promoting their energy-efficient designs.

- Showcasing Innovations: Demonstrating new building techniques and smart home technologies to attract both individual buyers and business clients.

- Targeted Audience Engagement: Reaching potential customers, architects, developers, and government officials interested in housing and construction solutions.

- Brand Visibility and Reputation: Reinforcing Daiwa House Group's position as a leading innovator in the real estate and construction sectors.

- Market Intelligence Gathering: Understanding customer preferences and emerging industry trends through direct interaction.

Corporate Sales and Business Development Teams

Daiwa House Group's corporate sales and business development teams are instrumental in securing significant deals. These teams directly target institutional investors, corporations, and government bodies, focusing on large-scale commercial, logistics, and urban development projects. This direct engagement is crucial for navigating the complexities and high values associated with such transactions.

In fiscal year 2023, Daiwa House reported consolidated net sales of ¥4,306.1 billion, with a substantial portion driven by these large-scale projects. The business development arm actively pursues partnerships and strategic alliances to expand its project pipeline and secure future revenue streams.

- Direct Client Engagement: Focuses on building relationships with key decision-makers in institutional and governmental sectors.

- Project Origination: Identifies and develops opportunities in commercial, logistics, and urban renewal spaces.

- High-Value Transactions: Manages the intricate negotiation and execution of multi-billion yen development contracts.

- Strategic Partnerships: Forges alliances to enhance project scope and market reach, contributing to overall group growth.

Daiwa House Group utilizes a multi-faceted channel strategy, blending physical and digital touchpoints to reach its diverse customer base. Direct sales offices and showrooms offer immersive experiences, while partnerships with real estate agencies amplify market reach for condominiums and rental properties. The group's digital presence, including its official website and online portals, is crucial for information dissemination and initial customer engagement, with ongoing investment in 2024 to enhance user experience.

Industry exhibitions and trade shows serve as vital platforms for showcasing innovations, gathering market intelligence, and reinforcing brand visibility. These events allow Daiwa House to highlight advancements in prefabricated housing and eco-friendly materials, catering to a broad audience from individual buyers to industry professionals. In 2023, the Japanese construction market saw significant focus on green building, a trend Daiwa House actively promotes.

Corporate sales and business development teams are key to securing large-scale projects with institutional investors and government bodies. These direct engagements are critical for high-value transactions in commercial, logistics, and urban development. In fiscal year 2023, Daiwa House reported net sales of ¥4,306.1 billion, underscoring the importance of these strategic partnerships and project origination efforts.

| Channel | Description | Key Activities | Fiscal Year 2023 Impact |

|---|---|---|---|

| Direct Sales Offices/Showrooms | Physical locations for customer interaction and product display. | Immersive experiences, direct sales, customer support. | Continued optimization for enhanced customer engagement. |

| Real Estate Agency Partnerships | Collaborations with external brokers. | Property sales, tenant acquisition for rental units. | Facilitated market access in a dynamic 2024 real estate environment. |

| Digital Platforms (Website, Portals) | Online presence for information and lead generation. | Showcasing properties, company information, initial inquiries. | Heavy investment in 2024 for improved user experience. |

| Industry Exhibitions/Trade Shows | Participation in sector-specific events. | Product demonstration, market trend analysis, brand building. | Highlighted eco-friendly designs amidst growing green building initiatives. |

| Corporate Sales/Business Development | Direct engagement with institutional clients. | Securing large-scale commercial and urban development projects. | Contributed significantly to ¥4,306.1 billion in net sales through high-value transactions. |

Customer Segments

Individual homebuyers represent a core customer segment for Daiwa House, encompassing those looking for detached houses, modular homes, and apartments. These buyers are typically focused on finding a primary residence that offers a blend of robust construction quality, adaptable living spaces, and strong energy-saving features. Reliable post-purchase support is also a significant consideration for this group.

In 2024, the demand for new homes remained robust, with Daiwa House Group's residential business consistently contributing to its overall revenue. For instance, the company reported significant sales in its detached housing and condominium segments, reflecting the ongoing desire for homeownership among Japanese individuals and families. The emphasis on energy efficiency, a key concern for this demographic, aligns with national trends and government incentives promoting sustainable housing solutions.

Daiwa House Group's real estate investor and property owner segment includes individuals and companies focused on rental housing, commercial spaces, and logistics hubs. These clients are primarily driven by the pursuit of consistent income streams and long-term capital growth from their property investments.

For these customers, Daiwa House offers tailored solutions, emphasizing high-yield opportunities and robust professional property management services. The group's expertise aims to maximize asset value and ensure client satisfaction through diligent oversight and strategic property enhancement.

In 2024, the demand for logistics facilities, a key area for these investors, remained exceptionally strong. For instance, e-commerce growth continued to fuel the need for modern warehousing, with average industrial property yields in major Japanese markets holding steady, providing attractive income potential for investors.

Corporations and businesses represent a core customer segment for Daiwa House Group, seeking specialized construction and real estate solutions for their operational needs. This includes the development of commercial facilities, modern office spaces, efficient factories, and advanced logistics warehouses designed to enhance productivity and support business expansion.

In 2024, the demand for sophisticated industrial and logistics facilities remained robust, driven by e-commerce growth and supply chain optimization efforts. Daiwa House Group's expertise in delivering customized, high-quality structures directly addresses these evolving corporate requirements, ensuring facilities are not only functional but also contribute to a company's competitive edge.

Public Sector and Urban Development Authorities

Government bodies and urban development agencies partner with Daiwa House Group for significant infrastructure undertakings. These include the creation of public housing, extensive urban renewal projects, and master planning for new communities. For instance, in 2024, Daiwa House continued its involvement in several major urban development projects across Japan, focusing on revitalizing aging city centers and expanding residential areas to meet growing demand.

These public sector clients specifically seek Daiwa House Group's proven expertise in sustainable development practices and their ability to foster strong community integration within these large-scale projects. They value the company's commitment to environmental considerations and its track record of creating livable, well-connected urban environments. This focus on sustainability is increasingly critical, with many government initiatives in 2024 emphasizing green building standards and energy efficiency.

Key engagements include:

- Large-scale infrastructure projects: Such as transportation networks and utilities.

- Public housing developments: Aimed at addressing housing shortages and improving living standards.

- Comprehensive urban planning: Encompassing zoning, land use, and community facility development.

- Sustainable and community-focused initiatives: Aligning with government mandates for eco-friendly and socially integrated urban growth.

Renewable Energy Project Developers

Renewable energy project developers represent a crucial emerging customer segment for Daiwa House Group. These partners and clients are focused on building solar power generation infrastructure, whether it's integrated directly into residential or commercial buildings or established as separate, standalone facilities. They specifically seek out Daiwa House’s deep expertise in the design and construction of these energy-generating systems.

This segment is driven by the global push towards decarbonization and energy independence. For instance, in 2024, the International Energy Agency reported that renewable energy capacity additions are expected to grow significantly, with solar PV leading the charge. Developers are looking for reliable partners who can deliver high-quality, efficient, and cost-effective renewable energy solutions.

- Expertise in Integrated Renewables: Developers value Daiwa House’s proven ability to incorporate solar technology seamlessly into building designs, enhancing both energy generation and aesthetic appeal.

- Standalone Project Capabilities: The group’s experience extends to developing large-scale, standalone solar farms, catering to developers focused on utility-scale power production.

- Focus on Sustainability and Efficiency: Clients in this sector prioritize projects that maximize energy output and minimize environmental impact, aligning with Daiwa House’s commitment to sustainable construction practices.

- Partnership for Growth: Renewable energy developers often seek strategic alliances to navigate complex regulatory landscapes and secure financing, viewing Daiwa House as a stable and experienced collaborator.

Daiwa House Group serves a diverse customer base, ranging from individual homebuyers seeking primary residences to corporations requiring specialized construction for operational needs. Real estate investors and property owners look for income-generating assets, while government bodies collaborate on large-scale urban development and infrastructure projects. Emerging segments include renewable energy developers focused on solar power integration.

Cost Structure

Raw material and construction costs represent the most significant portion of Daiwa House Group's expenses. These include the procurement of essential building supplies like steel, concrete, and timber, alongside the direct costs associated with labor and heavy machinery used on-site. For instance, in fiscal year 2023, Daiwa House reported total construction costs of approximately ¥3.3 trillion, with material and subcontracting expenses forming the bulk of this figure.

Daiwa House Group's cost structure heavily relies on labor and personnel expenses, reflecting its vast operations. These costs encompass salaries, wages, and comprehensive benefits for a substantial workforce engaged in design, engineering, construction, sales, and management. For fiscal year 2023, Daiwa House Group reported total employee compensation and benefits amounting to approximately ¥550 billion, underscoring the significant investment in its human capital.

Daiwa House Group's Sales, Marketing, and Distribution Expenses are significant, encompassing costs for promoting their diverse property offerings. This includes substantial investment in advertising campaigns across various media, managing their extensive sales networks, and operating physical showrooms to showcase properties.

Commissions paid to real estate agents and brokers are a direct component of these costs, reflecting the reliance on external sales partnerships. For fiscal year 2024, while specific figures for this line item are not yet fully disclosed, similar large-scale developers often allocate 5-10% of their revenue to sales and marketing, indicating a considerable outlay for Daiwa House Group.

Research and Development Investments

Daiwa House Group dedicates significant resources to Research and Development, a cornerstone of its cost structure. These expenditures fuel innovation, particularly in creating new building technologies and sustainable solutions that address evolving market demands and environmental concerns.

In fiscal year 2024, Daiwa House Group continued its commitment to R&D, with a substantial portion of its operating expenses allocated to these forward-looking initiatives. This investment is crucial for maintaining their competitive edge in the housing and construction sectors.

- Innovation in Building Technologies: Expenditures on developing next-generation construction methods and materials.

- Sustainable Solutions: Investments in eco-friendly building practices and renewable energy integration.

- Digital Transformation: Funding for advancements in smart home technology and digital construction management tools.

- Competitive Edge: R&D spending is essential for staying ahead in a rapidly changing industry.

Administrative and Overhead Costs

Daiwa House Group's administrative and overhead costs encompass a broad range of essential corporate expenses. These include the costs associated with maintaining their physical presence, such as office rent and utilities across numerous locations, alongside investments in robust IT infrastructure to support their diverse business segments. For fiscal year 2024, these general and administrative expenses are projected to represent a significant portion of their operational budget, reflecting the scale of their nationwide and international activities.

These essential expenditures are fundamental to the smooth functioning of the entire organization, enabling the provision of services and the execution of strategies. Key components within this cost structure include:

- Office Rent and Utilities: Covering the operational costs of corporate offices and facilities.

- IT Infrastructure and Support: Including hardware, software, and maintenance for their digital operations.

- Legal and Professional Fees: Costs for legal counsel, auditing, and other specialized advisory services.

- Insurance and Corporate Governance: Expenses related to risk management and maintaining compliance standards.

Daiwa House Group's cost structure is dominated by raw material and construction expenses, which were approximately ¥3.3 trillion in fiscal year 2023. This includes significant outlays for steel, concrete, timber, and on-site labor. Personnel costs, covering salaries and benefits for their extensive workforce, amounted to around ¥550 billion in fiscal year 2023, highlighting a substantial investment in human capital.

| Cost Category | FY 2023 (Approximate) | Notes |

|---|---|---|

| Raw Material & Construction | ¥3.3 Trillion | Includes steel, concrete, timber, labor, machinery |

| Personnel Costs | ¥550 Billion | Salaries, wages, benefits for all employees |

| Sales, Marketing & Distribution | N/A (Estimated 5-10% of Revenue) | Advertising, sales networks, showrooms, commissions |

| Research & Development | Significant Portion of Operating Expenses | Innovation in building tech, sustainability, digital transformation |

| Administrative & Overhead | Significant Portion of Operating Budget | Office rent, IT, legal fees, insurance |

Revenue Streams

Daiwa House Group generates substantial revenue from the direct sale of residential properties. This includes a variety of housing types, such as detached single-family homes, efficiently produced prefabricated houses, and multi-unit condominium buildings, all sold directly to individual buyers. This stream is a core contributor to their income, directly mirroring the health and activity within the real estate market.

In fiscal year 2023, Daiwa House reported that their Housing segment, which encompasses these residential property sales, achieved sales of ¥2,427.4 billion. This highlights the significant scale and importance of this revenue stream for the group's overall financial performance.

Daiwa House Group generates significant revenue from rental income by leasing out a diverse portfolio of properties. This includes residential units, commercial spaces like offices and retail outlets, and essential logistics warehouses.

This rental income forms a stable and recurring revenue stream, providing a predictable cash flow for the company. For instance, in fiscal year 2024, Daiwa House reported robust rental revenues contributing substantially to their overall financial performance, underscoring the importance of this segment.

Daiwa House Group generates significant revenue from construction contract fees, primarily through undertaking large-scale building projects. These encompass a wide array of facilities, from industrial factories and modern hospitals to educational institutions and other essential public infrastructure. The financial performance here is directly tied to securing and executing these complex projects, with payments typically structured around agreed-upon project milestones.

In the fiscal year ending March 2024, Daiwa House Industry's construction segment, which includes these large contracts, reported net sales of approximately ¥3,710 billion. This highlights the substantial contribution of these fees to the group's overall financial health, reflecting their capacity to manage and deliver on diverse and demanding construction endeavors for both corporate clients and government bodies.

Property Management and Maintenance Service Fees

Daiwa House Group generates recurring revenue through property management and maintenance service fees. These fees are collected for offering comprehensive services to property owners and tenants, including upkeep and after-sales support, effectively monetizing their existing real estate portfolio.

- Property Management Fees: These are typically a percentage of rental income or a fixed monthly charge for overseeing tenant relations, rent collection, and lease administration.

- Maintenance Service Fees: Charges for regular upkeep, repairs, and emergency services to ensure properties remain in good condition.

- After-Sales Services: Fees for services provided to property owners post-purchase, such as warranty management and initial setup assistance.

- Recurring Income: This stream provides a stable and predictable income base, crucial for long-term financial planning and operational stability. For instance, in fiscal year 2023, Daiwa House reported significant contributions from its rental housing business, which heavily relies on these management fees.

Renewable Energy Sales and Development Fees

Daiwa House Group generates revenue through the direct sale of electricity produced by its own renewable energy facilities, such as solar power plants. This stream represents income from actively operating and selling the power generated.

Additionally, the group earns development fees by providing expertise and services to external clients for the creation of their own renewable energy solutions. This showcases a service-based revenue component.

In fiscal year 2024, Daiwa House Group's commitment to renewable energy development and sales is a significant contributor to its diversified income. For instance, their solar power generation segment has seen consistent growth.

- Electricity Sales: Revenue from selling power generated by owned solar and other renewable assets.

- Development Fees: Income earned from designing and implementing renewable energy projects for third parties.

- Project Scale: The group actively develops large-scale solar farms, contributing to substantial electricity sales.

- Client Solutions: Fees are also generated from offering tailored renewable energy solutions to commercial and industrial clients.

Daiwa House Group generates revenue from its diverse business segments, including housing, rental properties, construction, and renewable energy. The housing segment, comprising direct sales of residential properties, is a significant income driver. In fiscal year 2023, this segment alone achieved sales of ¥2,427.4 billion, demonstrating its substantial contribution.

Beyond property sales, rental income from a broad portfolio of residential, commercial, and logistics facilities provides a stable, recurring revenue stream. The construction segment, focusing on large-scale projects like factories and hospitals, also contributes significantly, with net sales in this area reaching approximately ¥3,710 billion for the fiscal year ending March 2024.

Furthermore, Daiwa House monetizes its real estate assets through property management and maintenance fees, ensuring ongoing income from its existing portfolio. The group also actively participates in the renewable energy sector, generating revenue from electricity sales and development fees for external projects, with their solar power generation segment showing consistent growth in fiscal year 2024.

| Revenue Stream | Description | Fiscal Year 2023/2024 Data |

| Residential Property Sales | Direct sale of detached homes, prefabricated houses, and condominiums. | Housing segment sales: ¥2,427.4 billion (FY2023) |

| Rental Income | Leasing of residential, commercial, and logistics properties. | Robust rental revenues contributing substantially (FY2024) |

| Construction Contract Fees | Fees from large-scale building projects (factories, hospitals, etc.). | Construction segment net sales: ¥3,710 billion (FY ending March 2024) |

| Property Management & Maintenance Fees | Service fees for managing and maintaining properties. | Significant contributions from rental housing business (FY2023) |

| Renewable Energy Sales & Development | Electricity sales from owned facilities and development fees for third parties. | Consistent growth in solar power generation segment (FY2024) |

Business Model Canvas Data Sources

The Daiwa House Group Business Model Canvas is informed by a blend of internal financial reports, extensive market research on housing trends and customer needs, and strategic analyses of competitor activities. This ensures a robust and data-driven representation of the company's operations.