Daiwa House Group Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Daiwa House Group Bundle

The Daiwa House Group faces moderate bargaining power from buyers, as the housing market offers some alternatives, yet brand loyalty and customization options can mitigate this. The threat of new entrants is somewhat limited by high capital requirements and established reputations.

This brief snapshot only scratches the surface. Unlock the full Porter's Five Forces Analysis to explore Daiwa House Group’s competitive dynamics, market pressures, and strategic advantages in detail.

Suppliers Bargaining Power

The Japanese construction sector, which includes major players like Daiwa House Group, experiences significant supplier power due to the concentrated nature of essential material sourcing. Key inputs such as steel, cement, and aggregates are often provided by a limited number of major producers.

This market structure grants these suppliers considerable influence over pricing and availability, a trend exacerbated by rising material costs anticipated through 2024 and into 2025. For instance, the price of ready-mix concrete in Tokyo saw a substantial 14% increase by April 2025, hitting an all-time high, directly attributable to escalating expenses for cement and aggregate components.

Japan's construction industry faces significant labor shortages, a situation worsened by an aging workforce and new overtime regulations that took effect in April 2024. This scarcity directly boosts the bargaining power of construction workers and specialized subcontractors.

The so-called '2024 problem,' referring to these overtime caps, has already contributed to construction delays and pushed wages higher. For companies like Daiwa House Group, this translates into increased project expenses.

Suppliers offering cutting-edge construction technologies, unique building materials, or advanced renewable energy systems can wield significant influence. Daiwa House Group's strategic focus on smart city development and eco-friendly housing necessitates reliance on these specialized inputs, inherently strengthening supplier leverage in these critical segments.

The growing demand for energy-efficient structures, including Net Zero Energy Housing (ZEH) and Net Zero Energy Buildings (ZEB) compliant products, further amplifies the bargaining power of suppliers specializing in these niche, high-value areas. For instance, companies providing advanced insulation or high-performance solar panels often find themselves in a strong negotiating position.

Switching Costs for Daiwa House

Switching major construction materials or specialized services for Daiwa House can incur substantial costs. These include the expense of renegotiating contracts, reconfiguring existing supply chains, and implementing new quality assurance protocols. For instance, a shift in a key component supplier might necessitate extensive re-testing and certification, impacting project timelines and budgets.

These switching costs effectively limit Daiwa House's agility in sourcing from alternative providers, thereby amplifying the bargaining power of its current suppliers. This situation can lead to less favorable pricing or terms if suppliers are aware of the significant hurdles involved in finding replacements.

Furthermore, Daiwa House's established, long-term relationships with certain suppliers, while beneficial for stability and consistent quality, can inadvertently diminish its leverage in price negotiations. These deep-seated partnerships, often built over years, can make it more challenging to aggressively pursue lower costs from new or existing vendors.

- High Switching Costs: Daiwa House faces significant expenses when changing suppliers for critical materials or specialized construction services.

- Supply Chain Reconfiguration: New supplier integration requires costly adjustments to logistics, inventory management, and operational workflows.

- Quality Assurance & Certification: Transitioning suppliers often necessitates rigorous testing and certification processes, adding to project overhead.

- Supplier Relationship Leverage: Long-standing supplier relationships, while stable, can reduce Daiwa House's negotiating power.

Threat of Forward Integration by Suppliers

The threat of suppliers integrating forward into basic construction is generally low for large companies like Daiwa House Group. This is because construction is capital-intensive and requires significant expertise, making it a difficult leap for most material providers. For instance, in 2024, the average cost for a large-scale residential construction project in Japan can run into billions of yen, a substantial barrier to entry.

However, in niche segments such as modular or prefabricated construction, some material suppliers or technology firms might explore offering more integrated solutions. These companies could potentially move into providing finished modules or even managing smaller-scale assembly. While this remains a less common strategy, the possibility can subtly enhance supplier leverage.

This potential for forward integration, even if theoretical or limited to specific sectors, can grant suppliers a degree of bargaining power. It means they might be able to negotiate better terms or prices with major construction firms, knowing that in certain specialized areas, they possess capabilities that could bypass traditional builder relationships.

- Low Likelihood of Basic Construction Integration: Forward integration by material suppliers into core construction activities is generally improbable due to high capital requirements and operational complexity.

- Potential in Specialized Niches: In areas like modular or prefabricated construction, material providers or technology firms may offer more integrated solutions, presenting a limited forward integration threat.

- Supplier Bargaining Power: The mere possibility of forward integration, however remote, can provide suppliers with some leverage in negotiations with large construction groups.

Daiwa House Group faces considerable bargaining power from its suppliers, particularly for essential materials like steel and cement, where a limited number of producers dominate the market. This concentration is amplified by rising material costs, with ready-mix concrete prices in Tokyo experiencing a significant 14% increase by April 2025. Furthermore, the construction labor shortage, exacerbated by new overtime regulations effective April 2024, strengthens the position of specialized subcontractors and skilled labor providers, driving up project expenses.

Suppliers of advanced technologies or specialized eco-friendly building materials also hold strong leverage, as Daiwa House's focus on smart cities and Net Zero Energy Housing necessitates reliance on these high-value inputs. High switching costs, including contract renegotiations and re-certification processes, further entrench supplier power, making it difficult and expensive for Daiwa House to change providers. While forward integration by material suppliers into basic construction is generally low due to high capital and expertise barriers, potential integration in niche areas like modular construction could subtly enhance supplier leverage.

| Supplier Category | Key Factors Influencing Bargaining Power | Impact on Daiwa House Group | Relevant Data/Trends (as of mid-2025) |

|---|---|---|---|

| Basic Materials (Steel, Cement, Aggregates) | Market Concentration, Rising Input Costs | Increased material procurement costs, potential supply disruptions | Ready-mix concrete prices up 14% in Tokyo by April 2025. |

| Specialized Technologies & Eco-Materials | Unique Product Offerings, Demand for Sustainability | Higher costs for advanced components, reliance on innovation | Growing demand for Net Zero Energy Housing (ZEH) and Buildings (ZEB) compliant products. |

| Labor & Specialized Subcontractors | Labor Shortages, Overtime Regulations | Increased labor costs, project delays, higher overall project expenses | '2024 problem' (overtime caps) impacting construction timelines and wages. |

What is included in the product

This analysis unpacks the competitive forces impacting Daiwa House Group, detailing the intensity of rivalry, buyer and supplier power, threat of new entrants, and the impact of substitutes.

Instantly understand strategic pressure with a powerful spider/radar chart, allowing Daiwa House Group to quickly identify and address competitive threats.

Customers Bargaining Power

Daiwa House Group's customer base is remarkably varied, encompassing individual homeowners, property investors, businesses needing commercial spaces, and even government bodies involved in urban planning and renewable energy initiatives. This wide reach typically diffuses the power of any one group of customers to dictate terms.

While the broad customer spectrum generally moderates individual bargaining power, significant exceptions exist. For instance, major institutional investors or government agencies commissioning large-scale urban development projects can wield considerable influence due to the sheer volume and strategic importance of their contracts.

In the competitive residential sector, individual homebuyers often exhibit significant price sensitivity, especially when considering new condominium and detached house purchases. Data from early 2025 indicated modest price declines for new condominiums in key markets like Tokyo and Osaka, a trend that directly amplifies buyer leverage.

This price sensitivity means that developers like Daiwa House Group must carefully consider their pricing strategies. For instance, while existing condominium prices in Tokyo showed upward momentum, the dip in new unit prices in major urban areas during the first half of 2025 provided consumers with more room to negotiate, thereby increasing their bargaining power.

Customers wield significant bargaining power due to the wide array of housing and construction alternatives available. They can choose from existing homes, rental markets, or the diverse offerings of countless other developers and real estate firms.

The growing number of vacant homes across Japan, especially in less populated regions, further amplifies customer choice and strengthens their negotiating position. For instance, as of 2023, Japan's vacant home rate, or 'akiya', reached a record high, offering buyers and renters more options than ever before.

Information Transparency and Access

Information transparency significantly bolsters customer bargaining power for Daiwa House Group. With a wealth of property listings and market data readily accessible online, potential buyers in Japan are better equipped to compare prices, features, and available alternatives. This ease of access means customers can negotiate more effectively, as they have a clearer understanding of fair market value.

This heightened transparency translates directly into stronger customer leverage. For instance, in 2024, the Japanese real estate market saw continued growth in online property portals, with many platforms reporting double-digit increases in user engagement and listing views. This digital accessibility empowers buyers to conduct thorough due diligence, reducing information asymmetry and strengthening their position when negotiating with developers like Daiwa House.

- Informed Decision-Making: Customers can easily access comparable property data, influencing their willingness to pay.

- Negotiation Leverage: Greater market awareness allows buyers to negotiate prices and terms more assertively.

- Increased Competition: Transparency encourages developers to offer competitive pricing and superior value propositions.

- Digital Influence: The proliferation of online real estate platforms in Japan, with millions of active users in 2024, amplifies customer voice and bargaining capacity.

Switching Costs for Customers

For individual homebuyers engaging with Daiwa House Group, switching costs after committing to a purchase can be substantial. These costs include legal fees, potential penalties for breaking financing agreements, and the significant emotional investment tied to selecting and customizing a home. This high personal commitment generally lowers their immediate bargaining power.

However, the situation differs for corporate clients or investors in Daiwa House Group's rental housing and commercial property segments. For these entities, the ease of sourcing alternative developers or properties can be considerably higher, particularly in competitive markets. For instance, in 2024, the Japanese commercial real estate market saw increased supply in key urban areas, potentially giving these business clients more leverage due to readily available alternatives.

- Individual Homebuyers: High switching costs due to legal, financial, and emotional commitments.

- Corporate Clients/Investors: Lower switching costs in segments like rental housing and commercial facilities, especially in markets with ample supply.

- Market Conditions Impact: Increased property supply in 2024, particularly in Japanese urban centers, enhanced bargaining power for business clients.

The bargaining power of Daiwa House Group's customers is a mixed bag, influenced by market conditions and the type of customer. While individual homebuyers face high switching costs, corporate clients and investors often find more leverage, especially in markets with ample supply.

For instance, the Japanese commercial real estate market in 2024 saw increased supply in major urban areas, giving business clients more options and thus greater bargaining power. This trend, coupled with the growing transparency in the property market, empowers buyers to negotiate more effectively.

| Customer Segment | Switching Costs | Bargaining Power Factors | 2024/2025 Data Point |

|---|---|---|---|

| Individual Homebuyers | High (legal, financial, emotional) | Price sensitivity, emotional investment | Modest price declines in new Tokyo condominiums (early 2025) |

| Corporate Clients/Investors | Lower (easier to source alternatives) | Availability of alternatives, market supply | Increased commercial property supply in urban Japan (2024) |

| General Market | Varies | Information transparency, online platforms | Double-digit user engagement growth on property portals (2024) |

Preview the Actual Deliverable

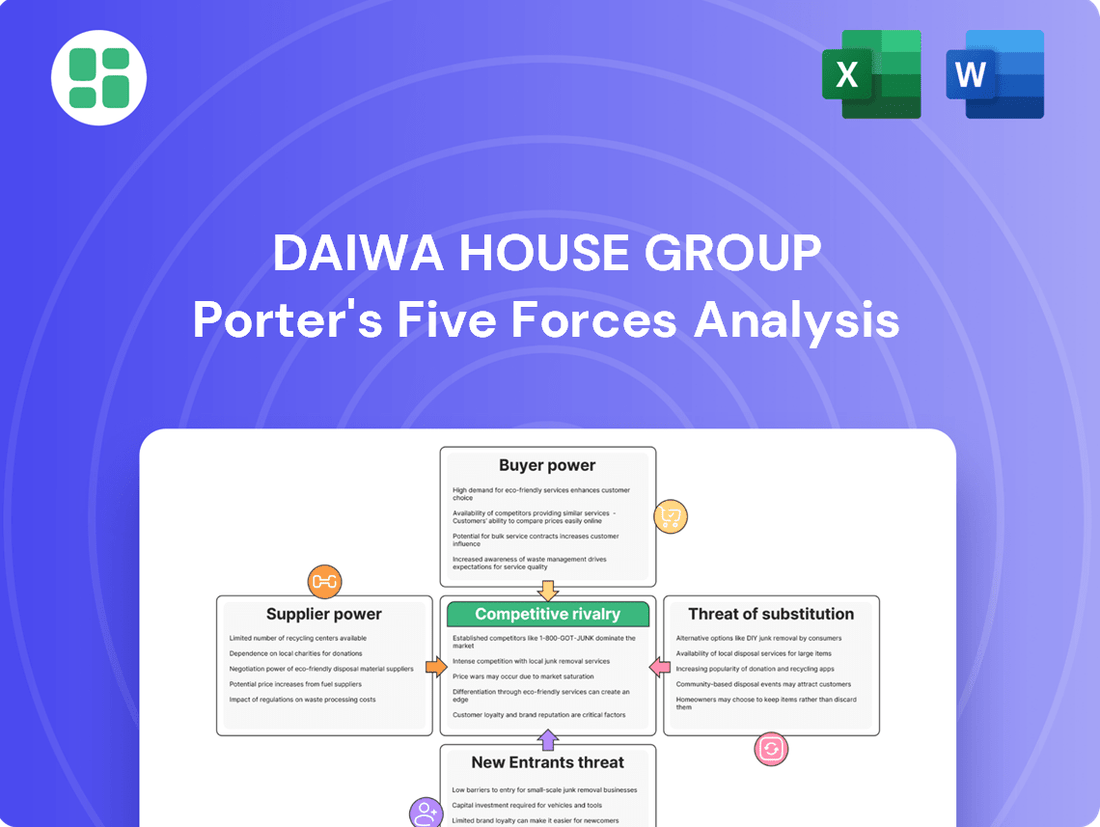

Daiwa House Group Porter's Five Forces Analysis

This preview showcases the complete Daiwa House Group Porter's Five Forces Analysis, offering a detailed examination of competitive forces within the housing and construction industry. You're viewing the exact document that will be delivered instantly upon purchase, providing a comprehensive understanding of the industry's landscape and Daiwa House Group's strategic positioning.

Rivalry Among Competitors

The Japanese construction and real estate sector presents a unique competitive landscape, featuring a blend of numerous smaller firms alongside a few dominant giants. Daiwa House Group operates within this dynamic, facing intense rivalry from major players such as Sekisui House, Sumitomo Forestry, and others who command significant market share.

While the sheer volume of local builders contributes to market fragmentation, the high barriers to entry for large-scale projects and comprehensive service offerings mean that Daiwa House's most direct competition comes from a concentrated group of established corporations. For instance, in the prefabricated housing market, a segment where Daiwa House holds a strong position, competition is particularly fierce among a handful of leading manufacturers.

While Japan's construction sector shows promise, specific areas like new housing are experiencing a slowdown. This is largely due to the country's aging population and changing demographics, which can lead to too many homes being available for the number of people wanting to buy them.

This slower growth in certain market segments intensifies the battle for customers among construction companies. They are all trying to capture a larger piece of a shrinking pie, making rivalry fiercer.

The anticipated rise in vacant homes, often referred to as the '2025 Problem', underscores this shifting supply and demand dynamic. It means companies will need to be more strategic in how they allocate resources and target their projects.

Daiwa House Group operates in a sector with significant fixed assets like land banks and specialized equipment, alongside long-term project commitments. This substantial investment makes exiting the market exceptionally difficult, leading to persistent competition even when market conditions are unfavorable. For instance, the sheer scale of capital tied up in ongoing urban development projects means companies are incentivized to remain active and compete for new ventures rather than divest.

Product Differentiation and Service Breadth

Daiwa House Group stands out by offering a complete suite of services, from initial design and construction to sales and ongoing property management. This integrated approach, coupled with a diverse portfolio encompassing single-family homes, rental properties, commercial spaces, urban development projects, and even renewable energy, creates a robust value proposition that lessens the pressure of direct price competition.

This broad service spectrum and commitment to quality and sustainability allow Daiwa House to carve out unique market positions. For instance, their focus on eco-friendly building practices and smart home technologies, which were increasingly important in 2024, appeals to a growing segment of environmentally conscious consumers and businesses. Competitors, recognizing this trend, are also channeling resources into similar sustainable initiatives and technological advancements, intensifying the rivalry in these specialized areas.

- Comprehensive Service Offering: Design, construction, sales, and property management integrated for end-to-end customer solutions.

- Diversified Business Segments: Single-family homes, rental housing, commercial facilities, urban development, and renewable energy.

- Sustainability and Quality Focus: Differentiates through eco-friendly practices and high-quality construction, appealing to a growing market demand observed in 2024.

- Technological Investment: Competitors are also investing in sustainability and technology, narrowing the differentiation gap in certain segments.

Intensity of Competition in Key Urban Areas

Competitive rivalry is particularly fierce in Japan's prime urban centers, such as Tokyo and Osaka. Despite escalating construction expenses and some fluctuations in pricing, demand in these areas remains robust.

New condominium prices in Tokyo's 23 wards are projected to keep climbing, signaling a competitive yet highly desirable market. For instance, the average price of a new condominium in Tokyo's 23 wards reached approximately 6,500,000 JPY per square meter in early 2024, a notable increase from previous years.

The intensity of this rivalry is further amplified by major development projects and high-value properties that attract a significant influx of both domestic and international investors and developers. This creates a dynamic environment where established players like Daiwa House Group face constant pressure to innovate and maintain market share.

- Intense Rivalry in Tokyo and Osaka: Demand remains strong despite rising construction costs and price volatility.

- Projected Price Increases: New condominium prices in Tokyo's 23 wards are expected to continue their upward trend.

- Attraction of Major Projects: High-value properties and significant developments draw intense competition from global and local entities.

Daiwa House Group faces intense competition from established players like Sekisui House and Sumitomo Forestry, particularly in segments like prefabricated housing. The high capital investment required for large-scale projects and long-term commitments makes exiting the market difficult, ensuring persistent rivalry even in challenging conditions.

The company's integrated service model and diversified portfolio help differentiate it, but competitors are also investing in sustainability and technology, narrowing the competitive gap. This is especially true in prime urban centers like Tokyo and Osaka, where demand remains strong despite rising costs, with new condominium prices in Tokyo's 23 wards averaging around 6,500,000 JPY per square meter in early 2024.

| Key Competitors | Market Position | Competitive Strategy |

| Sekisui House | Major player in detached housing and urban development | Focus on quality, design, and customer service |

| Sumitomo Forestry | Strong in timber-based housing and real estate | Leveraging forestry resources and sustainable building |

| Other Local Builders | Fragmented market, strong regional presence | Price competition and localized offerings |

SSubstitutes Threaten

A significant substitute for new homes constructed by Daiwa House is the substantial existing housing stock in Japan. As of 2024, the number of vacant homes, known as 'akiya', continues to be a considerable factor, with estimates suggesting over 11 million akiya nationwide in recent years. This abundance of pre-owned properties presents a readily available alternative for potential homebuyers.

The resale market, encompassing both existing condominiums and detached houses, offers compelling alternatives to new builds. These properties can often be more affordable, especially in areas outside of major metropolitan hubs. In 2023, the resale market for condominiums in Tokyo saw transaction volumes remain robust, indicating continued demand for established housing options.

The rental market presents a significant threat to Daiwa House Group's new home sales. For many individuals and families, renting offers a more accessible and flexible alternative to homeownership, especially in high-demand urban areas. This is particularly true as rental demand continues to climb, with a strong focus on filling vacancies.

In 2024, the rental market's appeal is bolstered by lower upfront costs and the ability to relocate with greater ease compared to the commitment of purchasing a new home. This flexibility directly competes with Daiwa House's core business, potentially diverting a portion of the customer base that might otherwise consider buying a new property.

The rise of modular and prefabricated construction presents a significant threat of substitutes for traditional on-site building methods, even for established players like Daiwa House Group. As these off-site construction techniques become more sophisticated and widely adopted, they offer compelling alternatives that can appeal to a broad range of customers seeking faster project completion and potentially lower costs. This trend is particularly relevant in markets like Japan, where the demand for efficient building solutions is high.

The Japanese prefabricated buildings market is experiencing substantial growth, with projections indicating continued expansion. For instance, the market was valued at approximately ¥1.6 trillion in 2023 and is expected to grow at a compound annual growth rate (CAGR) of around 5% through 2028. This robust growth signifies that customers increasingly view prefabricated options not just as a niche, but as a viable and often preferable substitute for conventional construction, directly impacting the competitive landscape.

Alternative Commercial and Industrial Space Solutions

For commercial and industrial clients, substitutes like repurposing existing structures or adopting flexible co-working arrangements present a significant threat. The increasing adoption of remote work models further diminishes the demand for traditional office footprints. In 2024, the commercial real estate market saw a notable polarization, with prime, modern spaces commanding higher rents, while older, less adaptable properties faced greater vacancy challenges.

This trend highlights how the appeal of renovating or replacing older buildings with contemporary, efficient designs becomes a more attractive alternative to maintaining outdated facilities. For instance, a significant portion of older office stock may require substantial capital investment to meet current tenant expectations regarding sustainability and technology, making alternative solutions more cost-effective.

- Repurposing Existing Buildings: Older structures can be converted into residential units, mixed-use developments, or specialized industrial facilities, offering a viable alternative to new construction.

- Co-working and Flexible Office Spaces: Companies are increasingly opting for flexible leases and shared workspaces, reducing their need for long-term commitments to traditional office leases.

- Remote Work Adoption: The sustained trend of remote and hybrid work models directly reduces the overall square footage required by businesses, impacting demand for commercial space.

Self-Build or DIY Construction (Limited Threat)

For smaller, less complex projects, individuals or small businesses might opt for self-build or DIY construction. However, the intricate nature of modern building regulations and the specialized expertise required for quality construction in Japan significantly limit this as a viable substitute for a full-service builder like Daiwa House Group. The threat is minimal due to substantial barriers to entry for achieving professional standards in residential and commercial building.

Consider these points regarding the threat of self-build or DIY construction:

- Limited Scope: DIY construction is generally feasible only for very basic structures or renovations, not for the comprehensive housing and commercial projects Daiwa House Group undertakes.

- Regulatory Hurdles: Navigating Japan's stringent building codes, permits, and safety standards requires professional knowledge and experience that the average DIYer lacks.

- Skill and Equipment Gaps: Modern construction demands specialized tools and a broad range of skills, from structural engineering to advanced finishing, which are typically beyond the reach of individual builders.

- Quality and Durability Concerns: The risk of substandard construction, leading to long-term issues with safety, durability, and resale value, makes DIY a poor substitute for established builders.

The abundance of existing homes in Japan, including over 11 million vacant properties (akiya) as of 2024, presents a direct substitute for Daiwa House's new builds. The resale market also offers a strong alternative, with robust transaction volumes in Tokyo's condominium market in 2023, often at more accessible price points.

The rental market remains a formidable substitute, particularly in urban areas, due to lower upfront costs and greater flexibility compared to homeownership. This is further amplified by continued demand for rental properties and the ease of relocation it affords potential residents.

Prefabricated construction is a growing threat, with the Japanese market valued at approximately ¥1.6 trillion in 2023 and projected to grow at a 5% CAGR. This indicates increasing customer preference for faster, potentially more cost-effective building solutions, directly challenging traditional construction methods.

Commercial clients increasingly consider repurposing existing structures or utilizing flexible co-working spaces, especially with the sustained trend of remote work. In 2024, the commercial real estate market showed a clear divide, with older, less adaptable properties facing higher vacancy rates, making renovations or modern replacements more appealing alternatives.

| Substitute Type | Description | 2024 Relevance/Data Point |

|---|---|---|

| Existing Housing Stock | Abundance of pre-owned properties and vacant homes (akiya). | Over 11 million akiya nationwide. |

| Resale Market | Existing condominiums and detached houses. | Robust transaction volumes in Tokyo condominiums (2023). |

| Rental Market | Flexible and lower upfront cost alternative to ownership. | Continued climbing rental demand and vacancies. |

| Prefabricated Construction | Off-site building techniques offering speed and potential cost savings. | Japanese market valued at ¥1.6 trillion (2023), 5% CAGR projected. |

| Repurposing/Co-working | Converting existing structures or using flexible office spaces. | Impacted by sustained remote work trends, affecting commercial demand. |

Entrants Threaten

Entering the construction and real estate development arena, particularly at the scale Daiwa House Group operates, demands immense capital. This includes significant outlays for acquiring land, sourcing materials, purchasing equipment, and covering labor costs. For instance, in 2024, major infrastructure projects in Japan often exceeded billions of dollars in initial investment, creating a substantial financial hurdle.

Strong brand recognition and deep customer loyalty represent a significant barrier to new entrants in the housing and construction sector, particularly for established firms like Daiwa House Group. Daiwa House, for instance, has cultivated a reputation for quality and reliability over many years, fostering trust among its customer base. In 2023, Daiwa House reported net sales of ¥4,417.7 billion, reflecting its substantial market presence and the loyalty it commands.

New companies entering this market would face considerable challenges in replicating this established trust. Building brand awareness and convincing consumers to invest in their properties requires extensive marketing campaigns and a proven track record, which naturally takes time and significant capital. The long sales cycles and high value of real estate transactions amplify the importance of reputation, making it difficult for newcomers to gain traction against established, trusted brands.

The construction and real estate industries in Japan are heavily regulated, presenting a substantial barrier to entry for new players. Companies must navigate complex building codes, stringent licensing requirements, and evolving standards related to seismic resilience, energy efficiency, and environmental protection. For instance, Japan's Building Standards Act, last amended in 2023, mandates rigorous safety protocols and material specifications, requiring significant upfront investment and expertise to comply with.

Access to Supply Chains and Distribution Networks

The threat of new entrants concerning access to supply chains and distribution networks for a company like Daiwa House Group is relatively low. Existing players have cultivated deep, long-standing relationships with crucial suppliers, specialized subcontractors, and established distribution channels for both sales and ongoing property management. These networks are not easily replicated.

Newcomers would face significant hurdles in building comparable infrastructure and securing reliable partnerships. This often translates to higher initial operating costs and a greater risk of supply chain disruptions, making it difficult to compete on price or service quality. For instance, in 2024, the average lead time for specialized construction materials in Japan, a key market for Daiwa House, remained a critical factor, with established firms leveraging their volume discounts and priority access.

- Established Supplier Relationships: Daiwa House benefits from long-term contracts and volume purchasing power, securing favorable terms and consistent material availability.

- Subcontractor Networks: Access to a reliable pool of skilled subcontractors, often built over decades, is vital for project execution and quality control.

- Distribution Channels: Existing sales networks and property management infrastructure provide immediate market access and ongoing revenue streams for established firms.

- Barriers to Entry: The time and capital required to build equivalent supply chain and distribution capabilities present a substantial barrier for potential new entrants in the construction and real estate sectors.

Economies of Scale and Experience Curve

Daiwa House Group's substantial economies of scale in procurement, construction, and project management present a significant barrier to new entrants. For instance, in 2023, Daiwa House reported total revenue of ¥4,346.7 billion (approximately $29 billion USD), reflecting their vast operational capacity. This scale allows them to negotiate better prices for materials and labor, and to manage large-scale projects with greater efficiency than a newcomer could hope to achieve.

New companies entering the housing and construction market would struggle to match Daiwa House's cost-effectiveness due to their lack of established supply chains and operational experience. The cumulative experience curve, honed over decades of diverse projects from residential to commercial, gives Daiwa House an inherent advantage in project execution and risk management, making it difficult for less experienced competitors to compete on either price or complexity.

- Economies of Scale: Daiwa House's ¥4.3 trillion in revenue (2023) demonstrates significant purchasing power.

- Experience Curve: Decades of diverse project execution provide unmatched operational expertise.

- Cost Competitiveness: New entrants face challenges matching Daiwa House's efficient cost structure.

- Project Complexity: Ability to undertake and manage large, complex projects is a key differentiator.

The threat of new entrants for Daiwa House Group is generally considered moderate to low due to significant capital requirements, established brand loyalty, and stringent regulatory environments. New companies face substantial upfront costs for land acquisition and development, often running into billions of dollars for major projects in Japan as seen in 2024. Furthermore, replicating Daiwa House's decades-long reputation for quality and reliability, which underpins its ¥4,417.7 billion net sales in 2023, is a lengthy and expensive undertaking.

| Barrier | Impact on New Entrants | Daiwa House Advantage (2023 Data) |

|---|---|---|

| Capital Requirements | High (e.g., billions for major projects) | Established financial capacity |

| Brand Loyalty & Reputation | Difficult to build | ¥4,417.7 billion net sales |

| Regulatory Compliance | Complex and costly (e.g., Building Standards Act amendments in 2023) | Expertise and established processes |

| Supply Chain & Distribution | Challenging to replicate | Long-standing supplier/subcontractor relationships |

| Economies of Scale | Lack of cost efficiency | ¥4,346.7 billion total revenue |

Porter's Five Forces Analysis Data Sources

Our Porter's Five Forces analysis for Daiwa House Group leverages a robust combination of data sources, including the company's annual reports, investor presentations, and official press releases. We also incorporate industry-specific market research reports from reputable firms and relevant government publications to provide a comprehensive understanding of the competitive landscape.