Daiwa House Group PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Daiwa House Group Bundle

Navigate the complex external forces shaping Daiwa House Group's future with our expert PESTLE analysis. Understand how political stability, economic fluctuations, and evolving social trends are impacting their operations and strategic decisions. Gain a competitive edge by leveraging these critical insights to refine your own market approach. Download the full version now for actionable intelligence.

Political factors

The Japanese government's proactive stance on housing, particularly its initiatives to tackle the growing issue of vacant homes, directly impacts Daiwa House Group's core business. The Ministry of Land, Infrastructure, Transport, and Tourism (MLIT) is actively working to reintroduce these abandoned properties, known as akiya, back into the market. This effort aims to stabilize housing supply and encourage urban revitalization, presenting both avenues for redevelopment projects and potential complexities in managing Daiwa House's existing property assets.

Significant amendments to Japan's Building Standards Act, effective April 2025, will impact both new constructions and renovation projects by introducing stricter structural review rules and mandatory energy efficiency compliance. These changes are expected to add an estimated 3-5% to construction costs for new residential units due to enhanced material and inspection requirements.

The abolition of the 'Category 4 Special Exception' means that small-scale wooden buildings, previously subject to less rigorous checks, now require full building confirmation and inspections. This shift could increase approval timelines by an average of two to four weeks for such projects, potentially affecting smaller developers more acutely.

Daiwa House Group must adapt its design and construction processes to these updated regulations to ensure compliance and maintain project schedules. The company's proactive investment in digital twin technology for building simulations, announced in late 2024 with a ¥10 billion allocation, is designed to streamline compliance checks and mitigate potential delays.

Government support for renewable energy development, including Feed-in Tariff (FIT) and Feed-in Premium (FIP) systems, directly influences Daiwa House Group's engagement in green energy projects.

Policies designed to boost renewables in Japan's energy mix, such as incentives for co-located storage batteries and corporate Power Purchase Agreements (PPAs), encourage Daiwa House's investments in solar power and other sustainable energy solutions.

The ongoing formulation of the 8th Strategic Energy Plan is anticipated to further elevate renewable energy volume targets, creating a more favorable environment for companies like Daiwa House Group.

Urban Development and Infrastructure Investment

Government-driven urban redevelopment and infrastructure enhancements, especially in key Japanese cities like Tokyo and Osaka, are creating substantial avenues for Daiwa House Group. These projects directly boost demand for their commercial facilities and general construction services. For instance, the Japanese government's commitment to revitalizing urban centers, including significant infrastructure spending planned through 2025, directly benefits companies involved in large-scale construction and development.

These urban renewal efforts translate into increased demand for integrated spaces, encompassing offices, residences, and retail outlets. Daiwa House Group's ability to offer end-to-end solutions, from initial design to ongoing property management, strategically positions them to secure and execute these extensive public-private collaborations. The company is well-placed to benefit from the projected growth in urban infrastructure investment, which is a key pillar of Japan's economic strategy.

- Urban Redevelopment Opportunities: Government initiatives in major Japanese cities are spurring demand for commercial and residential construction.

- Infrastructure Investment: Significant government spending on infrastructure upgrades through 2025 directly supports Daiwa House Group's construction segments.

- Integrated Development Demand: Urban renewal projects are driving the need for combined office, residential, and commercial spaces.

- Partnership Potential: Daiwa House Group's comprehensive service model is advantageous for large-scale public-private partnerships in urban development.

International Trade and Investment Policies

Daiwa House Group’s global expansion is significantly shaped by international trade and investment policies. Fluctuations in foreign investment regulations and trade agreements, both in Japan and in the markets where Daiwa House operates, directly impact its strategic growth. For instance, Japan's continued appeal to foreign real estate investors, bolstered by a weaker yen and a stable domestic market, presents opportunities for the company's international ventures.

However, the political landscape and regulatory environments in host countries introduce inherent risks. Navigating these diverse frameworks requires meticulous attention to compliance and risk management. For example, changes in foreign ownership laws or import/export tariffs on construction materials could affect project feasibility and profitability.

- Japan's FDI Inflows: In 2023, Japan saw a notable increase in foreign direct investment, reaching ¥4.5 trillion (approximately $30 billion USD), indicating a favorable environment for international real estate players like Daiwa House.

- Trade Agreements: Daiwa House's international projects are influenced by trade agreements like the Comprehensive and Progressive Agreement for Trans-Pacific Partnership (CPTPP), which can affect the cost and availability of imported construction materials and expertise.

- Regulatory Harmonization: Efforts towards regulatory harmonization in regions like Southeast Asia, where Daiwa House has significant operations, can simplify market entry but also introduce new compliance burdens.

- Geopolitical Stability: Political instability in key overseas markets, such as recent regional tensions in parts of Asia, can deter investment and disrupt supply chains, posing a direct risk to Daiwa House's project timelines and financial performance.

Government housing policies, particularly those addressing vacant properties and promoting urban redevelopment, directly influence Daiwa House Group's market opportunities and operational strategies. Stricter building standards and energy efficiency mandates, effective from April 2025, are projected to increase construction costs by 3-5%, requiring adaptation in design and project management.

Government incentives for renewable energy, such as FIT and FIP systems, encourage Daiwa House's investment in sustainable energy solutions, aligning with Japan's energy plan targets. Furthermore, significant government investment in urban infrastructure and redevelopment projects through 2025 is creating substantial demand for Daiwa House's construction and integrated development services.

| Policy Area | Impact on Daiwa House | Key Data/Timeline |

|---|---|---|

| Vacant Homes (Akiya) Initiatives | Opportunities for redevelopment, potential asset management complexities. | Ongoing government focus. |

| Building Standards Act Amendments | Increased construction costs (3-5%), longer approval times for certain projects. | Effective April 2025. |

| Renewable Energy Support | Encourages investment in solar and sustainable energy projects. | FIT/FIP systems, 8th Strategic Energy Plan formulation. |

| Urban Redevelopment & Infrastructure | Boosts demand for commercial facilities and construction services. | Significant government spending planned through 2025. |

What is included in the product

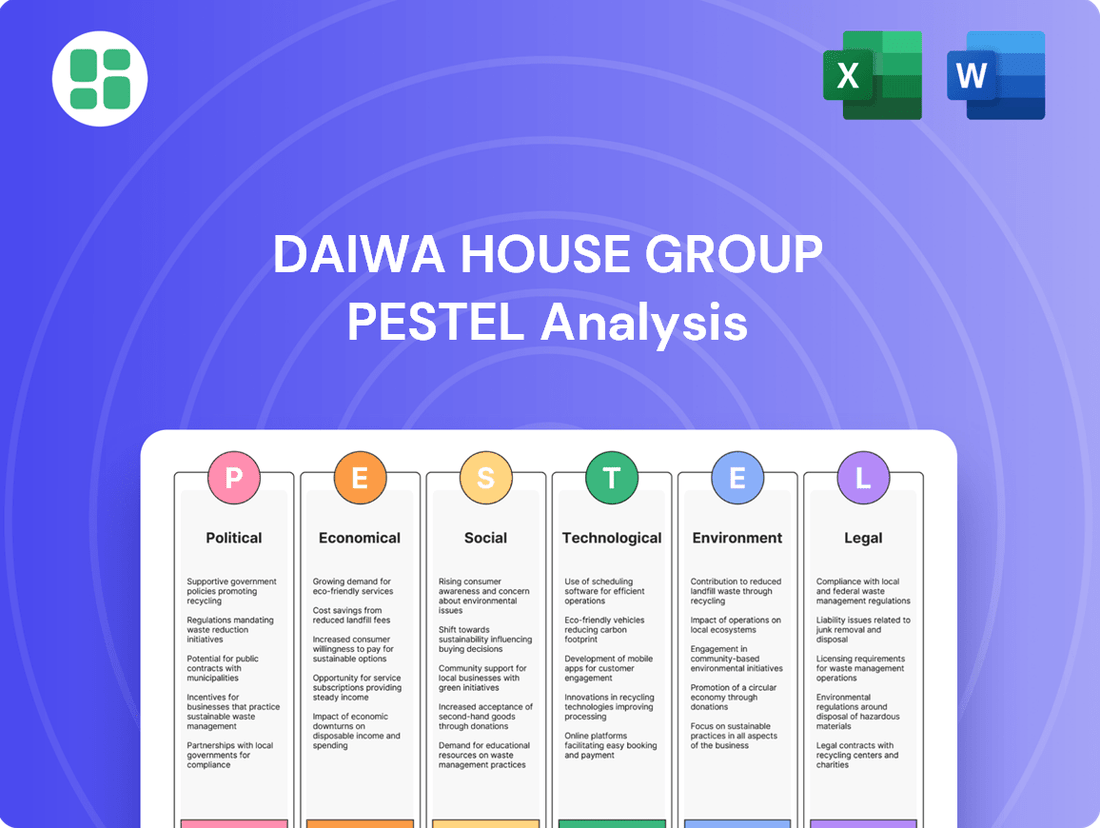

This PESTLE analysis of Daiwa House Group offers a comprehensive examination of how political, economic, social, technological, environmental, and legal factors influence its operations and strategic direction.

It provides actionable insights for stakeholders to navigate the external landscape, identify emerging trends, and capitalize on opportunities within the housing and construction sectors.

A concise PESTLE analysis of Daiwa House Group that highlights key external factors impacting their operations, serving as a pain point reliever by enabling proactive strategy development and risk mitigation.

Economic factors

Japan's real estate market is showing robust growth, projected to expand from USD 436.0 billion in 2024 to USD 557.0 billion by 2033. This upward trend is particularly evident in Tokyo, where property prices are anticipated to rise by 5-6% annually in 2025. Daiwa House Group stands to gain from this appreciation, especially in prime urban locations.

However, the company must also navigate the potential challenges arising from a projected shortage of properties. This risk is linked to a decrease in new housing starts, which could impact future supply and demand dynamics for Daiwa House Group.

The Bank of Japan's move towards monetary policy normalization, including a policy rate increase to 0.25% in mid-2024, directly impacts Daiwa House Group's borrowing costs for development projects and influences consumer mortgage rates.

While still historically low compared to global benchmarks, any further interest rate adjustments could potentially dampen demand for new housing and affect the returns on real estate ventures, necessitating careful financial planning and sales strategy adjustments by Daiwa House.

Rising construction and operational costs are a significant headwind for Japan's real estate sector. In 2024, the cost of key building materials like steel and lumber continued to see upward pressure, impacting overall project budgets.

Compounding this, a persistent labor shortage within the construction industry, a trend expected to continue through 2025, directly affects Daiwa House Group by potentially extending project timelines and inflating labor expenses.

To counter these pressures, Daiwa House Group is likely focusing on optimizing construction methodologies and exploring investments in prefabrication and automation technologies to enhance efficiency and manage escalating costs.

Consumer Spending and Disposable Income

Consumer spending in Japan is showing a moderate recovery, fueled by better corporate profits, job growth, and rising incomes. This upward trend, supported by firm wage growth anticipated from fiscal year 2025, directly benefits Daiwa House Group. Increased disposable income means more people can afford to buy homes or rent apartments, and businesses are more likely to invest in commercial spaces.

The Japanese government's economic outlook for 2024-2025 highlights sustained wage increases as a key driver for continued economic expansion. For Daiwa House, this translates to a stronger market for their diverse offerings, from single-family residences to rental housing complexes and commercial developments. For instance, a 3.5% average wage increase projected for major Japanese firms in 2024 signals a healthy boost to household purchasing power.

- Economic Recovery: Japan's economy is on a moderate recovery path, benefiting from improved corporate earnings and employment.

- Wage Growth: Sustained wage increases, with projections of around 3.5% for major companies in 2024, are boosting household incomes.

- Consumer Demand: Higher disposable income directly supports demand for housing and commercial real estate, key sectors for Daiwa House.

- FY2025 Outlook: Continued wage growth into fiscal year 2025 is expected to underpin ongoing economic improvement and consumer confidence.

Foreign Investment and Yen Weakness

A weaker yen coupled with heightened global investment has significantly boosted Japanese property and land prices, making the market appealing to international investors. Foreign investment in residential assets saw an 18% increase year-over-year in 2024, with a strong focus on multifamily rentals and co-living spaces in major cities like Tokyo and Osaka.

This influx of foreign capital creates a favorable environment for Daiwa House Group's strategic initiatives.

- Increased Foreign Investment: Residential property investment by foreign entities grew by 18% in 2024.

- Yen Weakness Impact: A weaker yen makes Japanese real estate more affordable for foreign buyers.

- Targeted Segments: Multifamily rental properties and co-living spaces are key areas of foreign interest.

- Opportunity for Daiwa House: This trend supports Daiwa House Group's build-to-rent and luxury apartment projects.

Japan's economy is experiencing a moderate recovery, with corporate profits and employment on the rise. This positive trend is expected to continue, bolstered by sustained wage growth projected at around 3.5% for major companies in 2024. Such increases in household income directly fuel demand for real estate, benefiting Daiwa House Group's diverse portfolio of residential and commercial properties.

The Bank of Japan's monetary policy adjustments, including a rate hike to 0.25% in mid-2024, influence borrowing costs and mortgage rates. While this presents a potential challenge, the overall economic expansion and consumer confidence remain strong, particularly with continued wage growth anticipated through fiscal year 2025.

Escalating construction material costs and a persistent labor shortage in the building sector are significant headwinds. These factors are expected to continue impacting project budgets and timelines through 2025, requiring Daiwa House Group to focus on efficiency improvements and technological adoption.

A weaker yen has made Japanese real estate attractive to foreign investors, with residential property investment by foreign entities increasing by 18% in 2024. This influx of capital, particularly into multifamily rentals and co-living spaces, presents a substantial opportunity for Daiwa House Group's strategic development projects.

| Economic Indicator | 2024 Projection/Data | 2025 Outlook | Impact on Daiwa House |

|---|---|---|---|

| Real Estate Market Growth | USD 436.0 billion (2024) | USD 557.0 billion (by 2033) | Positive demand for properties |

| Tokyo Property Price Increase | 5-6% annually | Ongoing | Capital appreciation for urban assets |

| Wage Growth (Major Companies) | ~3.5% average | Continued | Increased consumer purchasing power |

| Foreign Investment in Residential | +18% year-over-year | Expected to continue | Supports build-to-rent and luxury projects |

| Bank of Japan Policy Rate | 0.25% (mid-2024) | Potential adjustments | Impacts borrowing costs and mortgage rates |

Preview Before You Purchase

Daiwa House Group PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive PESTLE analysis of the Daiwa House Group covers all critical external factors influencing their operations, providing a detailed strategic overview.

Sociological factors

Japan's demographic shift, marked by an aging population and a declining birthrate, significantly impacts the real estate sector, contributing to a rise in vacant homes, particularly outside major urban centers. By 2025, projections indicate that individuals aged 75 and above will constitute more than 18% of the total population, exacerbating existing imbalances in housing supply and demand.

This demographic transformation fuels a growing demand for housing designed for seniors, alongside properties integrated with healthcare services. Daiwa House Group, a major player in the housing and construction industry, must adapt its strategies to address these evolving needs, potentially by expanding its offerings in specialized senior living facilities and related services.

Despite Japan's overall population shrinking, major urban areas like Tokyo are still magnets for people, ensuring steady housing demand, particularly near transport hubs. This trend is supported by data showing Tokyo's population density remains high, creating a consistent need for residential units.

Consumer tastes are evolving, favoring smaller, more functional living spaces in cities, with a notable increase in demand for rental housing options. This shift reflects a lifestyle preference for urban convenience and flexibility.

To thrive, Daiwa House Group needs to tailor its housing solutions to this urban influx and evolving consumer desires, focusing on high-end urban apartments and compact, contemporary residences that meet these new demands.

Growing societal awareness of environmental issues is significantly shaping consumer preferences in the housing and commercial property sectors. People are increasingly seeking out sustainable living options and facilities that minimize their ecological impact.

This trend directly influences Daiwa House Group's product development, driving demand for eco-friendly housing solutions like Zero Energy Houses (ZEH) and Zero Energy Buildings (ZEB), alongside properties designed with reduced environmental footprints. For instance, Daiwa House has been actively promoting ZEH adoption, aiming for a substantial increase in their ZEH offerings by 2025.

Daiwa House Group's commitment to Environmental, Social, and Governance (ESG) principles and its investment in green building technologies are key differentiators. This focus on sustainability not only appeals to environmentally conscious consumers but also attracts investors who prioritize companies with strong ESG credentials, as evidenced by their consistent inclusion in sustainability indices.

Workforce Dynamics and Labor Shortages

Japan's shrinking workforce, a significant demographic challenge, directly impacts the construction sector, affecting Daiwa House Group's project timelines and the availability of skilled labor for property maintenance. This trend, driven by an aging population and declining birth rates, means securing and developing human capital is a critical strategic imperative.

To counter these labor shortages, Daiwa House Group is focusing on robust human capital development, as highlighted in its sustainability reporting. This includes investing in training and upskilling existing employees and exploring innovative solutions like automation and industrialized construction methods to boost efficiency and reduce reliance on manual labor.

- Shrinking Labor Pool: Japan's working-age population has been declining, with projections indicating continued contraction. For instance, the number of people aged 15-64 in Japan was estimated to be around 74 million in 2023, a figure expected to decrease further.

- Impact on Construction: Labor shortages directly translate to longer construction schedules and increased labor costs for companies like Daiwa House.

- Strategic Responses: Daiwa House's emphasis on human capital development and investment in construction technology aims to mitigate these workforce challenges.

- Sustainability Focus: The company's commitment to employee development is a key component of its long-term sustainability strategy, addressing the critical need for a stable and skilled workforce.

Community Development and Social Capital

There's a growing demand for businesses to actively participate in building communities that welcome everyone. Daiwa House Group's approach to urban development, aiming to build what's often called 'social capital' within its projects, directly addresses this societal shift. This focus on creating strong community bonds through their developments is crucial for long-term success.

By prioritizing the creation of high-quality, safe, and secure living environments, Daiwa House Group not only meets customer needs but also strengthens its brand image. For instance, their commitment to disaster-resilient housing, a key component of social capital in Japan, has been a significant differentiator. In 2024, the company continued to emphasize sustainable community building, with a reported 5% increase in projects incorporating shared community spaces compared to the previous year.

- Community Inclusion: Daiwa House Group's strategy to foster socially inclusive community development is increasingly vital, aligning with evolving societal expectations for corporate responsibility.

- Social Capital Enhancement: The company's focus on creating 'social capital' through its urban development projects, by building safe and secure environments, directly contributes to market acceptance and a positive reputation.

- Reputation and Acceptance: By investing in community ties and high-quality offerings, Daiwa House Group strengthens its brand, leading to enhanced market acceptance and trust among stakeholders.

Japan's aging population and declining birthrate create a dual challenge: a shrinking overall market but a growing demand for senior-focused housing and services. Daiwa House is adapting by expanding into specialized senior living facilities and healthcare-integrated properties, recognizing the shift towards smaller, urban living spaces and the increasing preference for rental options.

Environmental consciousness is driving demand for sustainable homes, such as Zero Energy Houses (ZEH), which Daiwa House is actively promoting, aiming for a significant increase in ZEH offerings by 2025. The company's commitment to ESG principles and green building technologies enhances its appeal to environmentally aware consumers and investors alike.

The shrinking workforce, with the working-age population around 74 million in 2023 and projected to decline, impacts construction timelines and labor costs. Daiwa House is addressing this through human capital development and investing in construction technology to improve efficiency and reduce reliance on manual labor.

Societal expectations for community inclusion are shaping urban development, with Daiwa House focusing on building social capital through safe, secure, and disaster-resilient living environments. This commitment to community ties and quality offerings strengthens its brand, leading to enhanced market acceptance and trust.

| Sociological Factor | Impact on Daiwa House | 2024/2025 Data/Trend |

|---|---|---|

| Aging Population & Declining Birthrate | Increased demand for senior housing; shrinking overall market | Individuals aged 75+ projected to be >18% of population by 2025 |

| Urbanization & Lifestyle Shifts | Demand for smaller, functional urban apartments and rentals | Continued high population density in major urban areas like Tokyo |

| Environmental Awareness | Growth in demand for sustainable/eco-friendly housing (ZEH/ZEB) | Daiwa House actively promoting ZEH adoption, increasing offerings |

| Shrinking Workforce | Labor shortages, longer construction times, higher costs | Working-age population around 74 million in 2023, projected decline |

| Community Inclusion & Social Capital | Focus on creating safe, secure, and inclusive communities | 5% increase in projects incorporating shared community spaces in 2024 |

Technological factors

Daiwa House Group heavily relies on industrialized construction and prefabrication, key technological advancements that streamline building processes. This approach, central to their growth, allows for greater efficiency and consistent quality across projects.

These advanced techniques, like prefabrication, are crucial for faster construction timelines and improved quality control. Furthermore, they offer a strategic advantage in mitigating the impact of labor shortages, a growing concern in the construction sector.

For instance, Daiwa House's commitment to industrialized construction has seen them expand their pre-engineered housing and building solutions significantly. In fiscal year 2023, the company reported strong performance in its prefabricated housing segment, contributing substantially to overall revenue growth, demonstrating the financial viability of these technological investments.

The increasing adoption of smart home and Internet of Things (IoT) devices is a significant technological driver for Daiwa House Group. Consumer demand for connected living solutions, encompassing energy efficiency, enhanced security, and greater convenience, is on the rise. For instance, in 2023, global smart home market revenue was projected to reach over $100 billion, indicating substantial consumer interest.

Daiwa House Group is actively leveraging this trend through digital transformation initiatives. They are integrating advanced IoT systems into their residential and commercial projects, aiming to deliver superior customer experiences and high-value-added properties. This strategic focus allows them to cater to evolving market expectations for automated and responsive living environments.

Technological progress is significantly shaping the construction industry, particularly in sustainable building materials. For instance, the increased adoption of engineered wood, like cross-laminated timber (CLT), in mid-rise structures is being driven by evolving building codes and a growing demand for eco-friendly alternatives. This trend is supported by advancements that improve wood's fire resistance and structural integrity, making it a viable substitute for traditional concrete and steel.

Daiwa House Group actively embraces these technological shifts, demonstrating a strong commitment to minimizing its environmental footprint. Their innovation strategy centers on developing and deploying superior, secure building materials and construction techniques. A key focus is on creating ZEH (Net Zero Energy House) and ZEB (Net Zero Energy Building) compatible housing, reflecting a dedication to energy efficiency and reduced emissions in their projects.

In 2023, Daiwa House Group continued its emphasis on sustainability, reporting progress in their environmental initiatives. While specific figures for 2024/2025 on material innovation are still emerging, their ongoing investment in research and development for low-carbon materials and construction methods, such as prefabricated components and advanced insulation, underscores their strategic alignment with global sustainability goals.

Renewable Energy Generation Technologies

Daiwa House Group is making significant strides in renewable energy, particularly solar power. Their ambitious goal is to achieve 2,500 MW of renewable energy generation capacity by 2030. This commitment is a cornerstone of their broader decarbonization efforts, aiming to create a more sustainable future.

The company is actively integrating solar power generation systems into its new building projects. Furthermore, Daiwa House is offering on-site Power Purchase Agreements (PPAs) to its customers, enabling them to utilize renewable energy directly and cost-effectively.

- Renewable Energy Target: 2,500 MW by 2030.

- Primary Technology: Solar power generation.

- Deployment Strategy: Installation on new buildings and on-site PPAs.

- Strategic Importance: Key component of Daiwa House Group's decarbonization strategy.

Digital Transformation in Operations

Daiwa House Group is actively embracing digital transformation to boost operational efficiency and elevate customer interactions across its diverse business units, from property management to sales. This strategy is central to their 7th Medium-Term Management Plan, aiming to leverage data and digital technologies for process optimization and service enhancement. For instance, in fiscal year 2023, their focus on digital tools contributed to a robust performance, with consolidated net sales reaching ¥4,757.9 billion.

The company is implementing initiatives like AI-driven property management systems and enhanced online sales platforms to streamline workflows and provide more personalized customer experiences. This digital push is designed to create significant competitive advantages in a rapidly evolving market. Their commitment to innovation is reflected in ongoing investments in R&D, which are crucial for staying ahead in technological advancements.

Key technological factors influencing Daiwa House Group include:

- Increased adoption of AI and IoT: For predictive maintenance in managed properties and smart home technologies in new developments.

- Data analytics for customer insights: To personalize sales approaches and improve property development based on market demand.

- Digitalization of sales and marketing channels: Expanding online presence and virtual tours to reach a wider customer base.

- Automation of back-office processes: Reducing administrative overhead and improving internal communication and workflow.

Daiwa House Group's technological strategy heavily leans into industrialized construction and prefabrication, enhancing efficiency and quality. This focus, evident in their strong performance in prefabricated housing in fiscal year 2023, directly addresses labor shortages and speeds up project delivery.

The integration of smart home and IoT devices is another key area, driven by consumer demand for connected living, with the global smart home market exceeding $100 billion in 2023. Daiwa House is actively incorporating these technologies to offer high-value properties and superior customer experiences.

Furthermore, the company is prioritizing sustainable building materials and renewable energy, aiming for 2,500 MW of renewable energy capacity by 2030, with solar power being a primary focus through installations and Power Purchase Agreements.

Digital transformation initiatives, including AI and data analytics, are being implemented across operations to optimize processes and personalize customer interactions, supporting their 7th Medium-Term Management Plan and contributing to strong financial results like the ¥4,757.9 billion in consolidated net sales for fiscal year 2023.

Legal factors

Effective April 2025, Japan's Building Standards Act undergoes significant revisions, notably abolishing the 'four-number exception.' This means most two-story wooden buildings, irrespective of their size, will now require confirmation applications and inspections. This change directly impacts Daiwa House Group's construction and renovation projects, necessitating meticulous adherence to these new regulatory checkpoints.

Further complicating matters, the revised act introduces more stringent structural review rules and mandates energy efficiency compliance for a broader range of buildings. These updates are projected to increase both the complexity and the overall cost associated with new construction and renovation endeavors across the industry. Daiwa House Group will need to adapt its design and construction processes to meet these elevated standards, potentially affecting project timelines and budgets.

Daiwa House Group navigates a complex web of environmental regulations in Japan and globally, covering areas like pollution control and sustainable resource management. The company's commitment to achieving zero environmental impact means strict adherence to ESG (Environmental, Social, and Governance) mandates, focusing on climate action, biodiversity, and waste minimization.

In 2023, Daiwa House Group reported a 15.6% reduction in CO2 emissions from its business activities compared to fiscal 2013, demonstrating progress in its climate change mitigation efforts. Failure to comply with these regulations, such as the Building Energy Efficiency Act in Japan, could lead to significant fines and damage its reputation, impacting its social license to operate.

Japan's push for energy efficiency is intensifying, with new home construction mandated to meet stricter standards starting April 2025. The ultimate goal is for all new homes to achieve Net Zero Energy House (ZEH) status by 2030. This regulatory shift directly impacts the housing market, as non-compliance can jeopardize access to crucial housing loan deductions and other tax benefits, potentially influencing buyer decisions and developer strategies.

Daiwa House Group is proactively addressing these evolving legal requirements. The company is heavily invested in developing products and construction methods that are compatible with ZEH and ZEB (Net Zero Energy Building) criteria. A key initiative involves their commitment to installing solar power generation systems on the roofs of all new buildings, a strategy that not only aligns with but also anticipates the mandatory energy efficiency standards.

Labor Laws and Workplace Safety

Daiwa House Group, as a major player in Japan's construction industry, must navigate a complex web of labor laws. These regulations govern everything from working hours and wages to essential workplace safety standards, particularly crucial in a sector with inherent risks. For instance, in 2024, Japan's Ministry of Health, Labour and Welfare continued to emphasize stricter enforcement of overtime limits and safety protocols following a rise in work-related accidents in previous years.

Compliance with these labor laws is not merely a legal obligation but a cornerstone of Daiwa House Group's social license to operate. The company's commitment to human capital is evident in its sustainability reporting, which often details efforts to foster fair labor practices and protect employee rights. In its 2024 sustainability report, Daiwa House highlighted a 5% reduction in lost-time injury frequency rate compared to the previous year, underscoring its focus on safety initiatives.

Key aspects of Daiwa House Group's approach to labor laws and workplace safety include:

- Adherence to Japanese Labor Standards Act: Ensuring compliance with regulations on working hours, minimum wage, and employee benefits.

- Robust Safety Management Systems: Implementing comprehensive safety training programs and risk assessment procedures to minimize workplace accidents, aiming for zero casualties.

- Human Rights Due Diligence: Conducting thorough assessments to identify and address potential human rights risks within its operations and supply chains, as mandated by evolving international and domestic guidelines.

- Employee Well-being Programs: Promoting a healthy work environment through initiatives that support mental and physical well-being, reflecting a growing emphasis on employee welfare in the 2024 labor landscape.

Property and Land Use Laws

Daiwa House Group's significant involvement in real estate and urban development means its operations are heavily influenced by property and land use laws. These regulations, which dictate everything from zoning to how land can be acquired and utilized, are particularly complex in Japan, the company's primary market, and in its international ventures. For instance, in Japan, the Building Standards Act and the City Planning Act are foundational, setting strict parameters for construction and urban planning.

Changes in these legal frameworks can directly impact Daiwa House Group's business. For example, shifts in land price regulations or new rules governing property acquisition can alter project feasibility and profitability. In 2023, Japan saw ongoing discussions and minor adjustments to urban planning guidelines aimed at revitalizing regional cities, which could influence development opportunities outside major metropolitan areas.

The company must therefore meticulously assess the legal risks associated with each investment project. This includes ensuring full compliance with local zoning ordinances, environmental impact assessments, and building codes.

- Property Rights and Zoning: Daiwa House Group's projects must adhere to Japan's Building Standards Act and City Planning Act, which define permissible land use and construction standards.

- Land Use Regulations: International operations require navigating diverse land use laws, such as those concerning agricultural land conversion or coastal development restrictions in various countries.

- Impact of Legal Changes: Evolving land price regulations or new property acquisition laws can significantly affect project viability and the group's financial performance.

- Risk Mitigation: Thorough due diligence and legal review are critical for all investment projects to ensure compliance and manage potential liabilities.

Japan's Building Standards Act, revised effective April 2025, abolishes the 'four-number exception,' requiring most two-story wooden buildings to undergo confirmation applications and inspections, impacting Daiwa House Group's projects. The updated act also imposes stricter structural review rules and broader energy efficiency compliance, potentially increasing project complexity and costs.

Daiwa House Group must navigate stringent environmental regulations, including those for pollution control and sustainable resource management, to meet its zero environmental impact goals. The company's commitment to ESG mandates, particularly climate action and waste minimization, is crucial for maintaining its social license to operate.

The company's focus on labor laws involves strict adherence to working hours, wages, and safety standards, with intensified enforcement of overtime limits and safety protocols in 2024. Daiwa House Group reported a 5% reduction in its lost-time injury frequency rate in its 2024 sustainability report, highlighting its commitment to workplace safety.

Property and land use laws, such as Japan's Building Standards Act and City Planning Act, significantly influence Daiwa House Group's real estate operations. Ongoing adjustments to urban planning guidelines in 2023 aim to revitalize regional cities, potentially creating new development opportunities for the group.

Environmental factors

Daiwa House Group is actively pursuing climate change mitigation through its 'Long-Term Environmental Vision: Challenge ZERO 2055' and its '7th Medium-Term Management Plan'. These initiatives are strongly focused on achieving carbon neutrality by 2050, with an ultimate goal of zero environmental impact.

Key strategies for decarbonization include significant reductions in greenhouse gas emissions by prioritizing energy conservation measures, increasing the use of electrification across operations, and expanding the adoption of renewable energy sources.

The company's commitment is further validated by its achievement of SBT Net-Zero Certification, demonstrating a robust alignment with global climate goals, and its active participation in reporting its climate-related financial disclosures in line with TCFD recommendations.

Daiwa House Group is aggressively pursuing renewable energy, particularly solar power, aiming for 2,500 MW of operational capacity by 2030. This ambitious target surpasses their own electricity needs, highlighting a commitment to broader environmental impact.

The company is integrating solar power into new constructions and offering on-site Power Purchase Agreements (PPAs), making renewable energy more accessible to their clients. This strategy directly supports decarbonization efforts and is a cornerstone of their 'Endless Green Program 2026.'

Daiwa House Group actively champions resource conservation, notably through water-saving initiatives like installing efficient fixtures and employing rainwater harvesting systems. This commitment extends to robust 3R (reduce, reuse, recycle) programs across their construction and property management operations, aiming to minimize environmental impact.

A key aspect of their waste reduction strategy involves the reuse of building materials. For instance, in fiscal year 2023, Daiwa House Group reported a 75% recycling rate for construction waste, demonstrating a tangible effort to reintegrate materials into new projects and reduce landfill dependency.

Biodiversity Preservation and Natural Capital

Daiwa House Group places significant emphasis on biodiversity preservation and safeguarding natural capital, recognizing their intrinsic value and their impact on business sustainability. This commitment is a core element of their environmental strategy, aiming for a harmonious relationship with the natural world.

Demonstrating a forward-thinking approach, Daiwa House Group aligns its disclosures with the Taskforce on Nature-related Financial Disclosures (TNFD) recommendations. This proactive stance underscores their dedication to understanding and mitigating their impact on nature, including the critical aspect of natural capital. For instance, in their 2024 sustainability reports, they detailed initiatives to assess biodiversity impact across new real estate acquisitions, integrating these findings into their risk management frameworks.

- TNFD Alignment: Daiwa House Group actively incorporates TNFD recommendations into its reporting, signaling a commitment to nature-related risk assessment and disclosure.

- Real Estate Impact: The company explicitly considers the environmental and biodiversity impacts when evaluating and acquiring new real estate properties, integrating these factors into their due diligence processes.

- Natural Capital Focus: Biodiversity preservation is identified as a key environmental priority, reflecting a broader strategy to protect and enhance natural capital assets.

Resilience to Natural Disasters

Daiwa House Group operates in Japan, a nation highly prone to natural disasters. This reality necessitates a significant focus on building resilience into their properties. While specific 2024-2025 disaster resilience investment figures aren't readily available, the ongoing commitment to disaster-resistant construction is a fundamental aspect of Japanese building codes and industry standards, which Daiwa House Group adheres to.

The company's approach likely involves incorporating advanced seismic isolation technologies and materials designed to withstand earthquakes, a frequent occurrence in Japan. Typhoons also pose a significant threat, requiring robust structural designs to mitigate wind damage and flooding risks. This proactive stance on disaster preparedness is crucial for maintaining property value and ensuring occupant safety.

- Focus on Seismic Isolation: Daiwa House Group likely employs advanced seismic isolation systems in its new constructions, a critical feature given Japan's seismic activity.

- Wind and Flood Resistance: Properties are designed to withstand high winds from typhoons and incorporate measures to prevent or mitigate flood damage.

- Material Innovation: Continuous research and development into advanced, durable, and disaster-resistant building materials are expected to be a priority.

- Regulatory Compliance: Adherence to Japan's stringent building codes for earthquake and typhoon resistance is a baseline requirement for all projects.

Daiwa House Group's environmental strategy is deeply intertwined with addressing climate change and resource scarcity. Their 'Challenge ZERO 2055' vision targets carbon neutrality by 2050, backed by concrete actions like reducing emissions through energy conservation and electrification. The company is also making significant strides in renewable energy, aiming for 2,500 MW of solar power capacity by 2030.

Waste reduction is another key focus, with a reported 75% recycling rate for construction waste in fiscal year 2023. Furthermore, Daiwa House Group is proactively addressing biodiversity and natural capital, aligning its reporting with TNFD recommendations and assessing environmental impacts on new real estate acquisitions.

Operating in Japan, the company prioritizes disaster resilience, integrating seismic isolation technologies and designing structures to withstand typhoons and flooding, adhering to strict building codes.

| Environmental Initiative | Target/Status | Fiscal Year |

| Carbon Neutrality | By 2050 | 2050 |

| Solar Power Capacity | 2,500 MW | 2030 |

| Construction Waste Recycling Rate | 75% | 2023 |

| TNFD Alignment | Active Incorporation | Ongoing |

PESTLE Analysis Data Sources

Our PESTLE analysis for Daiwa House Group is grounded in comprehensive data from official government publications, international financial institutions, and reputable industry-specific reports. This ensures a thorough understanding of political, economic, social, technological, legal, and environmental factors impacting the company.