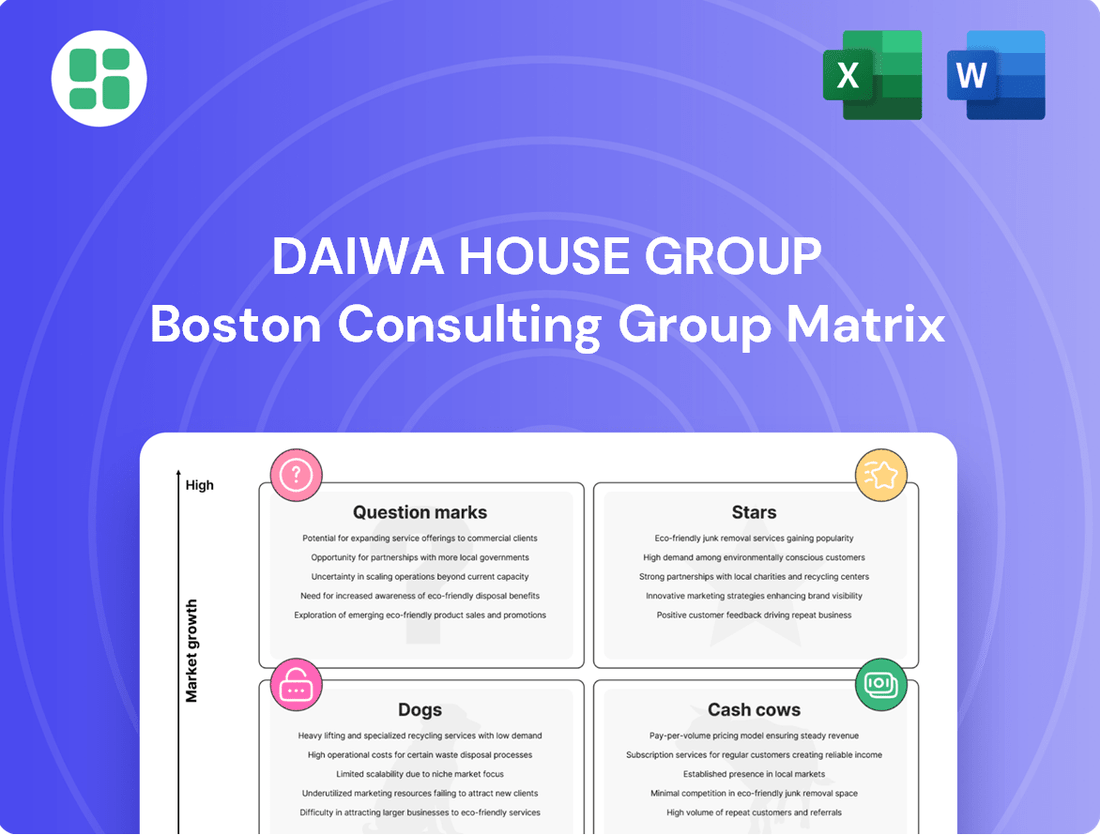

Daiwa House Group Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Daiwa House Group Bundle

Curious about Daiwa House Group's strategic positioning? This glimpse into their BCG Matrix reveals how their diverse portfolio is performing in the market, highlighting potential Stars and Cash Cows. To truly understand where their growth lies and which segments require careful management, you need the full picture.

Unlock the complete Daiwa House Group BCG Matrix to gain a granular understanding of each business unit's market share and growth rate. This detailed analysis will equip you with the insights needed to make informed decisions about resource allocation and future investment. Purchase the full report for actionable strategies that will drive your own business forward.

Stars

Daiwa House Group's overseas residential development, especially in the United States, is a prime example of a Star in their BCG Matrix. Their strategic acquisitions of companies like Stanley Martin, Trumark, and CastleRock have fueled aggressive expansion in the vibrant US housing market.

This segment is positioned as a Star due to its strong market presence, bolstered by these key acquisitions, and its significant growth trajectory. The company has set an ambitious target for its North American operations, aiming for ¥730 billion in sales by 2026, underscoring its high-growth potential and strong market share.

Daiwa House Group's Logistics, Business & Corporate Facilities segment, a significant growth engine, includes expansive logistics centers, business parks, and a growing emphasis on data centers. This area is experiencing strong operating income growth, driven by the high demand for contemporary infrastructure solutions. For instance, the company has actively expanded its logistics facility portfolio, contributing to its robust financial performance.

Daiwa House Group is making significant strides in renewable energy, aiming for 2,500 MW of power generation capacity by 2030. This aggressive expansion, coupled with a pledge to achieve RE100 status by 2040, positions this segment as a Star. The company's current operational capacity, combined with its strategic development of new solar and wind power plants, taps into a rapidly expanding environmental energy market.

Single-Family Houses (Strategic Growth Initiatives)

Despite broader demographic challenges in Japan's housing market, Daiwa House's Single-Family Houses segment has shown resilience and growth. This is largely due to effective sales strategies and a focus on operational cost management, which have boosted operating income significantly. For instance, in fiscal year 2024, the segment reported robust performance, reflecting these strategic advantages.

Daiwa House is actively pursuing market share in the single-family home sector with initiatives like 'Ready Made Housing'. This product line is designed to meet consumer demand for quality homes at accessible price points. This strategic move targets a segment with sustained, albeit changing, customer needs.

- Strong Operating Income Growth: The single-family homes segment has achieved considerable operating income growth, driven by strategic sales and cost control measures.

- 'Ready Made Housing' Launch: This new product line aims to capture market demand by offering a balance of quality and affordability.

- Market Share Focus: The initiative signifies a strategic effort to increase market share in a segment with persistent, evolving demand.

Urban Development & Smart City Technologies

Daiwa House Group's engagement in urban development, particularly through the integration of smart city technologies, positions it in a high-growth sector. The company is actively leveraging digital transformation to improve customer experiences and create innovative living environments. This strategic focus on advanced urban solutions and new business ventures through corporate venture capital (CVC) and internal incubation aligns with the characteristics of a 'Question Mark' poised for significant growth.

While precise market share figures for the broad category of smart city technologies can be fluid, the underlying trend indicates substantial expansion. For instance, the global smart cities market was valued at approximately $400 billion in 2023 and is projected to reach over $1 trillion by 2030, demonstrating a robust compound annual growth rate (CAGR) of around 15-20%. Daiwa House's investment in this domain, including initiatives aimed at enhancing connectivity, sustainability, and resident well-being within its developments, directly taps into this expanding market.

- Urban Development Focus: Daiwa House is committed to creating comprehensive urban environments, integrating residential, commercial, and public spaces.

- Smart City Technology Integration: The company actively incorporates digital transformation and smart technologies to enhance efficiency and customer experience in its developments.

- Growth Potential: This sector represents a high-growth area, driven by increasing global demand for sustainable and technologically advanced urban living.

- Strategic Investment: Through CVC and in-house entrepreneurship, Daiwa House is exploring new business challenges and opportunities within the smart city landscape.

Daiwa House Group's overseas residential development, particularly in the United States, is a significant Star. The company's strategic acquisitions of Stanley Martin, Trumark, and CastleRock have propelled its expansion in the robust US housing market. This segment is characterized by strong market share and a high growth trajectory, with North American operations targeted for ¥730 billion in sales by 2026.

The renewable energy segment is also a Star, with Daiwa House aiming for 2,500 MW of power generation capacity by 2030 and RE100 status by 2040. This aggressive expansion into solar and wind power taps into a rapidly growing environmental energy market, supported by its current operational capacity and strategic development of new plants.

| Segment | BCG Category | Key Drivers |

|---|---|---|

| Overseas Residential (US) | Star | Strategic acquisitions, strong market presence, high growth potential |

| Renewable Energy | Star | Ambitious capacity targets, RE100 commitment, growing environmental energy market |

What is included in the product

This BCG Matrix overview highlights Daiwa House Group's portfolio, identifying units for investment, divestment, or maintenance based on market share and growth.

The Daiwa House Group BCG Matrix offers a clear, one-page overview, simplifying complex business unit analysis to alleviate strategic decision-making pain points.

Cash Cows

Daiwa House's D-ROOM brand represents a significant cash cow within the group's portfolio. Operating in Japan's domestic rental housing market, this segment benefits from a mature landscape where Daiwa House commands a substantial market share. The brand consistently achieves high occupancy rates, underscoring its strong demand and operational efficiency.

This established business reliably generates substantial and stable cash flow. These earnings are crucial for funding other ventures within Daiwa House or can be returned to investors. The strategy for D-ROOM is centered on maintaining its competitive edge through efficiency and quality, rather than pursuing aggressive expansion, reflecting its mature market position.

Daiwa House Group's established domestic commercial facilities, encompassing shopping centers and managed properties, act as significant cash cows. This segment benefits from a high market share within Japan, ensuring a steady stream of rental income and robust profit margins. The company's strategy here centers on maximizing the value of its existing portfolio through optimization and enhancement initiatives.

Daiwa House Group's domestic property management services, including those offered by subsidiaries like Daiwa Lifenext and Daiwa House Property Management, represent a significant Cash Cow. These operations manage an extensive portfolio of residential and logistics properties throughout Japan, a testament to their established market position.

This segment functions within a mature market, characterized by high recurring revenue streams derived from property management agreements. This consistent income generation provides a stable and predictable cash flow, a hallmark of a Cash Cow business.

The sheer volume of units under management underscores the company's substantial market penetration. As of the fiscal year ending March 2023, Daiwa House reported a substantial number of managed properties, contributing significantly to the group's overall stability and profitability.

Established Logistics Facilities (REIT Portfolio)

Daiwa House Logistics Trust, a Singapore-listed Real Estate Investment Trust (REIT), represents a significant cash cow for the Daiwa House Group. Its portfolio is anchored by high-quality logistics facilities, predominantly situated in Japan.

These assets are well-established and operate within a mature phase, which translates into a consistent and reliable stream of income and distributions for the trust. This stability is a hallmark of a classic cash cow.

The trust's position as a cash generator is further reinforced by strategic acquisitions. For instance, the acquisition of additional properties in early 2025 is set to enhance its revenue-generating capacity and solidify its role within the Group's broader financial strategy.

- Portfolio Focus: Primarily high-quality logistics facilities in Japan.

- Income Generation: Mature assets providing stable, consistent income and distributions.

- Strategic Growth: Acquisitions in early 2025 are expected to bolster its cash-generating status.

Traditional General Construction (Stable Large-Scale Projects)

Daiwa House Group's traditional general construction, focusing on large-scale projects like factories and offices for Japanese corporations, is a prime example of a Cash Cow. This segment benefits from the company's deep-rooted expertise and a loyal client network, ensuring a substantial market share in a mature industry.

While the growth rate in this sector is modest, it provides a stable and predictable revenue stream. For instance, in fiscal year 2023, Daiwa House reported consolidated net sales of ¥4,551.9 billion, with its Construction segment contributing significantly. The company's ability to secure repeat business from established clients underscores its strong position.

- Mature Market Segment: Focuses on established corporate clients in Japan.

- Stable Revenue Generation: Benefits from consistent demand for large-scale projects.

- High Market Share: Leverages long-standing expertise and client relationships.

- Lower Margins, High Predictability: Generates steady income despite slower growth compared to newer business areas.

Daiwa House Group's domestic rental housing, exemplified by the D-ROOM brand, stands as a robust cash cow. Operating within Japan's mature rental market, this segment benefits from Daiwa House's substantial market share and high occupancy rates, ensuring a consistent and significant cash flow. The strategy here focuses on maintaining efficiency and quality rather than aggressive expansion, reflecting its established position.

The group's commercial facilities and property management services also function as key cash cows. These mature businesses, with high recurring revenue streams from rental income and management agreements, provide stable and predictable cash flows, a hallmark of this category. For example, as of the fiscal year ending March 2023, Daiwa House managed a substantial number of properties, contributing significantly to the group's overall financial stability.

Daiwa House Logistics Trust, a Singapore-listed REIT, is another crucial cash cow, primarily holding Japanese logistics facilities. These mature assets generate reliable income and distributions, further bolstered by strategic acquisitions, such as those in early 2025, which are expected to enhance its revenue-generating capacity.

| Business Segment | Market Position | Income Stability | Strategic Focus |

|---|---|---|---|

| D-ROOM (Rental Housing) | High Market Share in Japan | High Occupancy Rates, Stable Cash Flow | Maintain Efficiency & Quality |

| Commercial Facilities | Significant Market Share in Japan | Consistent Rental Income, Robust Margins | Portfolio Optimization & Enhancement |

| Property Management | Extensive Portfolio Under Management | High Recurring Revenue Streams | Leverage Scale & Existing Contracts |

| Logistics Trust (REIT) | Dominant in Japanese Logistics | Stable Income & Distributions from Mature Assets | Strategic Acquisitions for Growth |

| General Construction | Established Corporate Clients in Japan | Predictable Revenue from Repeat Business | Leverage Expertise & Client Relationships |

Delivered as Shown

Daiwa House Group BCG Matrix

The preview you are currently viewing is the complete and final Daiwa House Group BCG Matrix report that you will receive immediately after your purchase. This document is not a sample or a demo; it is the fully formatted, analysis-ready strategic tool you need for informed decision-making.

Rest assured, the Daiwa House Group BCG Matrix you see here is precisely the document you will download upon completing your purchase. It's a professionally compiled report, offering a clear strategic overview of Daiwa House Group's business units, ready for immediate integration into your business planning.

Dogs

Daiwa House Group's domestic condominium segment is currently positioned as a 'Dog' in the BCG Matrix. This is due to a noticeable decline in sales and operating income during the first nine months of fiscal year 2025, directly linked to strategic restructuring within the business.

Despite a generally growing Japanese condominium market, Daiwa House's performance in this specific area indicates a potential low market share or lagging performance. This underperformance necessitates a thorough re-evaluation of the segment's strategy, with divestment being a potential outcome.

Underperforming older properties and assets within Daiwa House Group's extensive portfolio are a key consideration. These might be older buildings, those in less desirable locations, or assets requiring substantial investment for upkeep without generating adequate returns.

Daiwa House's strategic focus on renovation and efficiency improvements highlights the importance of tackling these underperforming assets. For instance, in fiscal year 2023, the company reported a net sales figure of ¥4,570.4 billion, and managing a diverse portfolio means identifying and addressing any segments that drag down overall performance.

Addressing these older properties is crucial for optimizing capital allocation and enhancing the group's overall profitability. By strategically managing or divesting these assets, Daiwa House can free up resources for more promising growth areas.

Daiwa House Group's divestment of non-core businesses, such as the transfer of Daiwa Resort and Cosmos Initia shares, signals a strategic move away from underperforming segments. These divested entities were likely cash cows or dogs in the BCG matrix, not contributing meaningfully to the group's overall growth or profitability. For instance, the sale of Cosmos Initia in fiscal year 2024, as reported in their financial results, underscores a focus on optimizing the portfolio by exiting less synergistic operations.

Traditional Built-for-Sale Housing (Without New Initiatives)

The traditional built-for-sale housing segment, without new strategic initiatives, faces challenges in Japan's evolving market. Demographic shifts and a general slowdown in housing starts have contributed to a declining volume in this core business for companies like Daiwa House Group.

This segment, if considered in isolation and without the benefit of growth-oriented programs, can be characterized as a 'Dog' within the BCG matrix framework, reflecting its position in a contracting market. For instance, Japan's total housing starts have fluctuated, with some periods showing a downward trend, impacting the volume of traditionally built homes. In 2023, for example, housing starts were reported to be around 800,000 units, a figure that has been on a general decline from previous decades.

- Declining Market Share: The core business of building standard single-family homes for sale is in a market experiencing reduced demand due to an aging population and lower birth rates.

- Impact of Demographic Trends: Japan's demographic profile, with a shrinking and aging population, directly affects the demand for new, traditional housing units.

- Historical Volume Decline: The volume of single-family houses supplied has historically decreased, a trend that continues without targeted interventions or diversification.

- Low Growth Potential: Without specific growth strategies, this segment is unlikely to generate significant future growth, placing it in the 'Dog' quadrant of the BCG matrix.

Less Profitable Niche Construction Services

Within Daiwa House Group's extensive construction operations, some highly specialized or niche services might be experiencing declining demand or facing fierce price wars. These areas, characterized by persistently low profit margins, could be considered less profitable niche construction services.

These sub-segments, while part of the larger construction umbrella, may not offer significant growth prospects and could tie up valuable resources without yielding substantial returns. For instance, certain types of specialized repair or maintenance work, if not adequately priced or if facing oversupply of providers, could fall into this category.

- Low Profitability: These services may consistently operate with profit margins below the group's average, impacting overall earnings.

- Dwindling Demand: Shifts in market needs or technological advancements might reduce the demand for specific niche construction skills.

- Intense Competition: A crowded market for specialized services can drive down prices and erode profitability.

- Resource Drain: Continued investment in these areas without a clear path to improved returns could be inefficient.

Daiwa House Group's domestic condominium segment, along with its traditional built-for-sale housing, are categorized as 'Dogs' in the BCG Matrix due to declining sales and market share. This positioning stems from factors like demographic shifts and reduced housing starts in Japan, impacting these core businesses. For example, in fiscal year 2023, Daiwa House reported net sales of ¥4,570.4 billion, and these 'Dog' segments require careful management or divestment to optimize capital allocation.

The company's strategic moves, such as divesting non-core businesses like Cosmos Initia in fiscal year 2024, highlight an effort to shed underperforming assets. These 'Dogs' may include older properties or niche construction services with low profit margins, tying up resources without significant returns.

The traditional built-for-sale housing segment, facing a contracting market with Japan's declining birth rates and aging population, exemplifies a 'Dog' due to its low growth potential. Housing starts in Japan, around 800,000 units in 2023, reflect this broader market challenge.

Addressing these 'Dog' segments is crucial for Daiwa House Group to reallocate resources towards more promising growth areas and improve overall profitability.

Question Marks

Daiwa House Group's expansion into new international markets like Europe, exemplified by Daiwa House Modular Europe, and Southeast Asia for logistics and hotel ventures, positions these ventures as potential stars in their BCG matrix. While these regions offer substantial growth opportunities, Daiwa House is still in the early stages of building its presence and market share, necessitating considerable investment to scale operations and establish a strong foothold.

Daiwa House Group's venture into ready-to-assemble housing in Ukraine positions it as a Question Mark in the BCG matrix. The company is eyeing full-scale business development, including local parts manufacturing, to address Ukraine's significant reconstruction needs, indicating high growth potential.

This strategic move taps into a market ripe for rebuilding, with the World Bank estimating reconstruction costs could exceed $400 billion by early 2024. However, as a new entrant with no existing market share, this project demands considerable investment to establish operations and gain traction.

Daiwa House Group's onsite PPA (Power Purchase Agreement) business in overseas renewable energy, specifically targeting new markets like Thailand and Vietnam, can be categorized as a Question Mark in the BCG Matrix. This classification stems from its position in a high-growth sector – distributed energy – driven by increasing demand for sustainable power solutions.

While the renewable energy sector as a whole is a Star, this particular venture for Daiwa House is in its early stages in these new overseas territories. This means it likely has a low market share in Thailand and Vietnam, despite the attractive growth prospects of the distributed energy market.

The business requires significant investment to establish its presence and scale operations, characteristic of a Question Mark. For instance, in 2024, the global distributed solar market is projected to see substantial growth, and Daiwa House's entry into these specific markets aligns with this trend, but the initial investment in infrastructure, sales, and regulatory navigation will be considerable.

Data Center Business Division (Initial Phase)

Daiwa House Group's Data Center Business Division, established in April 2025 as a preparatory office, is positioned as a Question Mark in the BCG matrix. This new venture aims to become a core business, tapping into a rapidly expanding global data center market, which was projected to reach over $280 billion in 2024. As a new entrant, Daiwa House currently holds a minimal market share, necessitating substantial investment to gain traction and compete effectively in this high-growth, high-investment segment.

- Market Growth: The global data center market is experiencing significant expansion, driven by cloud computing, AI, and IoT adoption. Projections indicated continued robust growth through 2025.

- Daiwa House's Position: As a new entrant, Daiwa House's market share is currently low.

- Strategic Imperative: Significant investment is required to penetrate the market and establish a competitive position.

- Investment Focus: Capital will be directed towards infrastructure development, technology acquisition, and building operational expertise.

Investments in New Business Challenges (CVC and In-House Startups)

Daiwa House Group's strategic allocation of up to ¥30 billion towards its Corporate Venture Capital (CVC) fund and internal startup initiatives clearly positions these ventures within the 'Question Mark' quadrant of the BCG Matrix. This significant investment is aimed at exploring and establishing footholds in nascent, high-potential sectors such as digital transformation (DX) within construction, advancements in food industrialization, and emerging space-related businesses. These areas represent considerable growth opportunities, but also carry substantial risk due to their unproven market viability and Daiwa House's limited existing presence.

The rationale behind this aggressive investment strategy is to foster innovation and diversify the company's revenue streams beyond its established core businesses. By channeling capital into these 'Question Marks', Daiwa House is essentially betting on future market leadership. For instance, the construction industry's DX market is projected for robust growth, with global spending on construction technology expected to reach hundreds of billions of dollars annually in the coming years, highlighting the potential reward for early movers.

- Investment Focus: Targeting high-growth, high-risk sectors like construction DX, food industrialization, and space ventures.

- Strategic Rationale: To foster innovation and secure future market share in areas where Daiwa House currently has minimal or no presence.

- Financial Commitment: An allocation of up to ¥30 billion demonstrates a serious commitment to exploring these new frontiers.

- BCG Matrix Classification: These initiatives align with the 'Question Mark' profile due to their high growth potential coupled with significant uncertainty and risk.

Daiwa House Group's foray into the ready-to-assemble housing market in Ukraine, with plans for local manufacturing, is a prime example of a Question Mark. This initiative targets a significant reconstruction market, estimated by the World Bank to require over $400 billion in early 2024. However, as a new entrant, Daiwa House must invest heavily to build its market share and operational capacity.

The company's expansion into overseas renewable energy, specifically onsite PPA businesses in Thailand and Vietnam, also falls into the Question Mark category. While the distributed energy sector is growing rapidly, Daiwa House's presence in these new markets is nascent, meaning low market share despite high growth potential. Significant capital investment is necessary for infrastructure and market penetration in 2024.

Daiwa House's newly established Data Center Business Division, created in April 2025, is a classic Question Mark. The global data center market, projected to exceed $280 billion in 2024, offers substantial growth. However, as a new player, Daiwa House faces the challenge of building market share from a minimal base, requiring considerable investment in infrastructure and expertise.

The Group's allocation of up to ¥30 billion to its Corporate Venture Capital fund and internal startups, targeting areas like construction DX and space ventures, firmly places these initiatives as Question Marks. These ventures are in high-growth but high-risk sectors, where Daiwa House has little to no existing market presence, necessitating substantial investment for future market leadership.

| Venture | Market Growth | Daiwa House Position | Investment Need | BCG Status |

| Ukraine Housing | High (Reconstruction Needs) | New Entrant (Low Share) | High | Question Mark |

| Overseas Renewables (SEA) | High (Distributed Energy) | New Market Entry (Low Share) | High | Question Mark |

| Data Centers | High (Global Market >$280B in 2024) | New Entrant (Minimal Share) | High | Question Mark |

| CVC/Startups | High (Emerging Tech Sectors) | New Ventures (No Share) | High (¥30B Allocation) | Question Mark |

BCG Matrix Data Sources

Our Daiwa House Group BCG Matrix draws from comprehensive financial reports, internal sales data, and detailed market research to accurately assess product portfolio performance.