Digital 9 Infrastructure SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Digital 9 Infrastructure Bundle

Digital 9 Infrastructure's strengths lie in its robust portfolio of essential digital assets, positioning it for consistent demand. However, understanding its potential weaknesses and the evolving market threats is crucial for navigating future growth.

Want the full story behind Digital 9 Infrastructure's strengths, risks, and growth drivers? Purchase the complete SWOT analysis to gain access to a professionally written, fully editable report designed to support planning, pitches, and research.

Strengths

Digital 9 Infrastructure plc's strength lies in its diversified portfolio of essential digital assets, encompassing subsea fibre optic networks, data centres, and wireless infrastructure. These assets are fundamental to the global digital economy, ensuring vital internet connectivity and data transfer services.

This strategic diversification across different digital infrastructure segments enhances the attractiveness of individual assets to a broad range of potential buyers, even in a potential wind-down scenario.

Digital 9 Infrastructure's strategic importance is deeply rooted in its ownership of data centers and fiber networks, which are the backbone of the expanding digital economy. These assets are not just infrastructure; they are enablers of critical growth sectors.

The demand for Digital 9's assets is fueled by powerful secular trends. For instance, global data consumption is projected to reach 292 exabytes per day by 2026, a significant increase from 2023. The rapid advancement and adoption of artificial intelligence (AI) and the ongoing deployment of 5G technology further amplify the need for robust digital infrastructure, making Digital 9's holdings highly sought after.

Digital 9 Infrastructure has initiated a shareholder-approved managed wind-down process. This structured approach, overseen by a new board and investment manager, aims to methodically sell off the portfolio to maximize shareholder value.

The wind-down process avoids a distressed sale, providing a clear roadmap and a more orderly realization of assets. This strategy is designed to unlock the intrinsic value of its digital infrastructure holdings.

Experienced New Management

Digital 9 Infrastructure's appointment of InfraRed Capital Partners as its new investment manager marks a significant shift. InfraRed, known for its global reach and extensive infrastructure expertise, is tasked with overseeing the company's managed wind-down. This move follows a comprehensive strategic review, signaling a new direction for the company.

InfraRed's deep sector knowledge is particularly valuable given the current market conditions, which can be challenging for asset divestments. Their experience is expected to be instrumental in optimizing sale prices for Digital 9's portfolio. This leadership transition is critical for ensuring the effective execution of the wind-down strategy.

- New Management: InfraRed Capital Partners appointed as investment manager.

- Strategic Objective: Overseeing the managed wind-down of Digital 9 Infrastructure.

- Key Expertise: InfraRed brings global reach and deep infrastructure sector knowledge.

- Market Context: Crucial for navigating asset divestments and optimizing sale prices.

Successful Initial Asset Disposals

Digital 9 Infrastructure has made significant headway in its asset wind-down plan, successfully divesting key holdings like Verne Global, EMIC-1, and SeaEdge UK1. These strategic sales have generated substantial capital, which has been instrumental in reducing the company's outstanding revolving credit facility. For instance, the sale of Verne Global in early 2024 alone provided a significant cash injection, bolstering the company's financial flexibility during this transitional phase.

The successful execution of these disposals validates the company's divestment strategy and has demonstrably improved its liquidity position. This proactive approach to asset management is crucial for navigating the current market conditions and preparing for future strategic initiatives.

- Verne Global Sale: Completed in Q1 2024, generating substantial proceeds.

- EMIC-1 & SeaEdge UK1 Disposals: Further contributed to debt reduction.

- Revolving Credit Facility Repayment: Significant portions paid down using divestment capital.

- Liquidity Enhancement: Sales have provided much-needed cash during the transition.

Digital 9 Infrastructure's strengths are anchored in its portfolio of essential digital assets, including subsea fiber optic networks and data centers, which are critical for global connectivity. The company's strategic decision to pursue a managed wind-down, overseen by experienced new management like InfraRed Capital Partners, allows for an orderly realization of value. Successful disposals, such as Verne Global in early 2024, have already generated significant capital, bolstering liquidity and reducing debt, demonstrating the inherent value of its infrastructure in a robust market.

| Asset Type | Key Characteristic | Market Driver | 2026 Data Projection |

|---|---|---|---|

| Subsea Fibre Networks | Underpins global internet connectivity | Increasing data consumption | 292 exabytes/day |

| Data Centres | Essential for AI and cloud services | AI adoption and 5G deployment | N/A (specific data centre projection not available) |

| Wireless Infrastructure | Supports mobile communication | 5G rollout and IoT growth | N/A (specific wireless infrastructure projection not available) |

What is included in the product

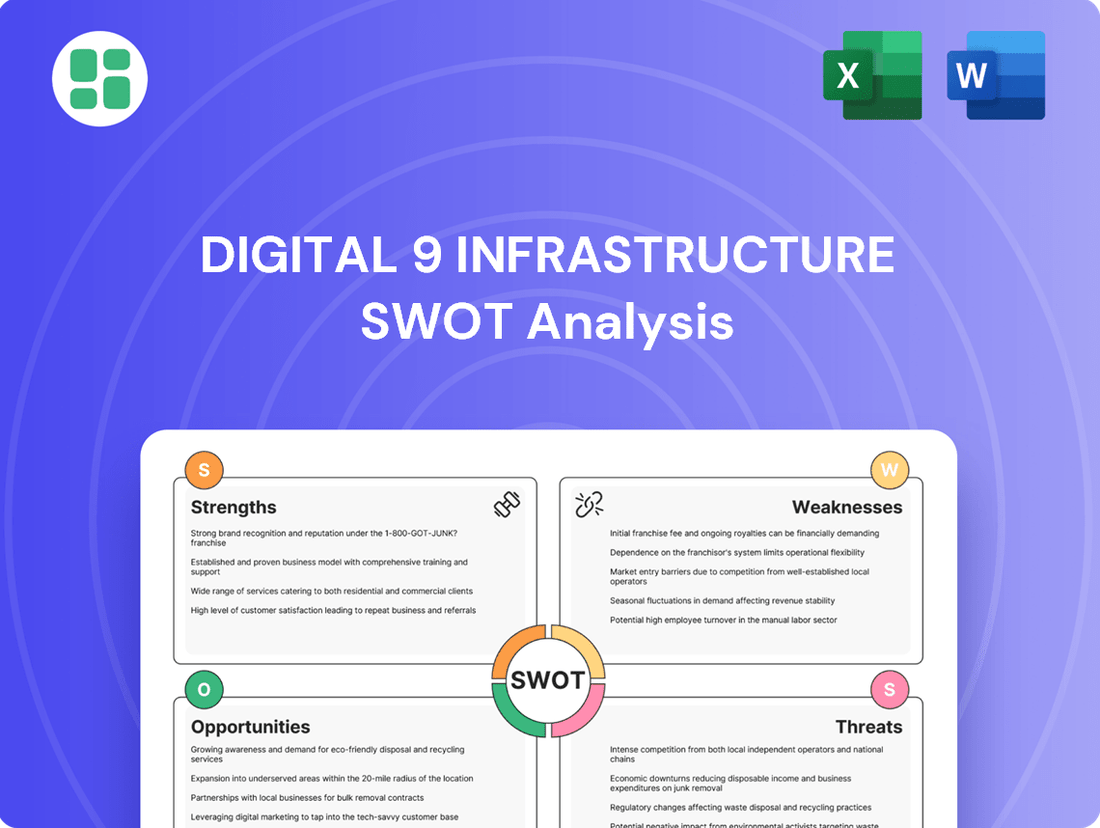

Delivers a strategic overview of Digital 9 Infrastructure’s internal and external business factors, highlighting its market position and future prospects.

Uncovers critical vulnerabilities and untapped opportunities in digital infrastructure, offering targeted solutions to mitigate risks and maximize growth.

Weaknesses

Digital 9 Infrastructure has faced a significant challenge with a substantial drop in its Net Asset Value (NAV). The NAV per share plummeted by 56.7%, from 79.3p at the close of 2023 to just 34.4p by the end of 2024. This sharp decline is primarily a result of thorough revaluation processes and adjustments linked to the sale prices of some of its core assets.

This considerable markdown directly affects how much value shareholders can expect, inevitably impacting their returns and potentially eroding investor confidence in the company's performance and future prospects.

Recent asset sales, including Aqua Comms and EMIC-1, have been executed at substantial discounts compared to their previous valuations, prompting analyst concerns. This has directly impacted the company's stock, which has plummeted by over 86% since its 2021 IPO.

These discounted divestitures highlight a difficult market environment for asset disposals and, critically, diminish the value held by shareholders.

Digital 9 Infrastructure's past is weighed down by governance issues and what were considered overly optimistic valuations under previous leadership. This history led to a significant write-down in the prior year, impacting investor confidence. For instance, the company's net asset value (NAV) per share saw a substantial decline, reflecting these valuation adjustments.

Uncertainty and Prolonged Capital Lock-up for Shareholders

Shareholders of Digital 9 Infrastructure are facing a significant period of uncertainty with the company's managed wind-down process, which is anticipated to continue until around 2028. This means capital is locked up for an extended duration, with no immediate prospect of new investment or growth initiatives.

Adding to this challenge, Digital 9 Infrastructure has stated that no further dividend distributions are expected in the medium term. This prolonged capital lock-up, coupled with the absence of income streams, presents a considerable deterrent for many investors seeking returns or liquidity.

- Extended Capital Lock-up: The managed wind-down is expected to last until approximately 2028, tying up shareholder capital for several years.

- No Medium-Term Dividends: The company has explicitly stated that no further dividend distributions are planned in the medium term, impacting income-seeking investors.

- Reduced Investor Appeal: The combination of prolonged capital immobility and a lack of income can make Digital 9 Infrastructure shares less attractive compared to other investment opportunities.

Challenges in Realizing Full Value for Remaining Assets

Digital 9 Infrastructure continues to grapple with realizing the full value of its remaining assets, a key weakness in its current strategic position. While some divestments have occurred, the company faces hurdles in maximizing returns on its more substantial and intricate holdings, notably Arqiva.

The board's decision to postpone the sale of Arqiva until at least 2027 underscores significant market uncertainties, particularly concerning contract renewals. This delay suggests that achieving optimal valuation for these assets will necessitate a patient, long-term approach and careful consideration of market timing.

- Delayed Arqiva Sale: The deferral of Arqiva's sale until 2027 highlights ongoing challenges in unlocking its full value.

- Contract Renewal Uncertainty: Fluctuations in contract renewals create a volatile environment for asset valuation.

- Strategic Patience Required: Extracting maximum value from complex assets demands a strategic, patient approach to market conditions.

Digital 9 Infrastructure's significant NAV decline, dropping by 56.7% from 79.3p to 34.4p by the end of 2024, directly impacts shareholder value. This markdown stems from asset sales at substantial discounts, with recent divestitures like Aqua Comms and EMIC-1 occurring below previous valuations.

The company's stock performance reflects these challenges, having fallen over 86% since its 2021 IPO. This prolonged period of capital lock-up, extending until approximately 2028 due to a managed wind-down, combined with the absence of medium-term dividends, significantly reduces investor appeal.

Furthermore, the delayed sale of Arqiva, postponed until at least 2027, highlights ongoing difficulties in realizing the full value of complex assets, exacerbated by uncertainties surrounding contract renewals.

Preview Before You Purchase

Digital 9 Infrastructure SWOT Analysis

You’re viewing a live preview of the actual SWOT analysis file for Digital 9 Infrastructure. The complete, in-depth version becomes available immediately after checkout, offering a comprehensive understanding of its strengths, weaknesses, opportunities, and threats.

Opportunities

The global appetite for digital infrastructure, encompassing data centers, fiber networks, and cell towers, continues to surge. This sustained demand is fueled by escalating data usage, the transformative impact of artificial intelligence, and the widespread deployment of 5G technology. For instance, global internet traffic is projected to reach 200 zettabytes per month by 2024, a significant jump from previous years, underscoring the need for robust digital foundations.

Anticipated interest rate cuts throughout 2024 and into 2025 are poised to reshape the private infrastructure market. Lower borrowing costs make it more attractive for potential buyers to finance acquisitions, potentially boosting demand for Digital 9's assets.

This macroeconomic shift could translate into increased liquidity and more favourable valuations for infrastructure portfolios. For instance, if rates fall by 100 basis points, the present value of future cash flows for infrastructure assets could see a notable uplift, making divestments more lucrative for Digital 9.

Institutional investors are demonstrating a robust and growing interest in infrastructure, a sector that offers long-term stability. Despite some recent market headwinds, there's a significant amount of uninvested capital, often referred to as dry powder, sitting within infrastructure funds, ready to be deployed. This indicates a receptive environment for infrastructure investment opportunities.

By the end of 2024, global infrastructure funds were estimated to hold over $1 trillion in dry powder, a figure that has been steadily climbing. This substantial capital pool is actively seeking long-duration, stable assets, making digital infrastructure a particularly attractive proposition for these investors looking to diversify their portfolios and achieve consistent returns.

Focus on Value-Enhancing Initiatives for Remaining Assets

Digital 9 Infrastructure is concentrating on making its remaining assets more valuable before selling them. For instance, with Elio Networks, the new manager, InfraRed Capital Partners, is implementing strategies to boost its appeal and potential sale price. This proactive approach aims to maximize returns by optimizing operations and contractual agreements.

This focus on value enhancement is crucial for assets like Elio Networks, especially as the infrastructure sector continues to evolve. By improving performance metrics and strengthening commercial terms, Digital 9 can position these assets for more favorable transactions in the current market. For example, successful operational improvements could lead to higher EBITDA multiples upon sale.

- Optimizing Operational Efficiency: Implementing best practices to reduce costs and improve service delivery for assets like Elio Networks.

- Strengthening Contractual Terms: Renegotiating or enhancing service agreements to secure longer tenors and more predictable revenue streams.

- Strategic Asset Repositioning: Identifying and executing initiatives that align assets with current market demand and investor preferences.

- Leveraging New Management Expertise: Utilizing InfraRed Capital Partners' experience to unlock hidden value and drive performance improvements.

Strategic Importance of European Digital Infrastructure

The strategic importance of European digital infrastructure is escalating due to global geopolitical realignments and a heightened focus on digital sovereignty. This trend is driving increased demand and investment in digital assets across the continent, including those held by Digital 9.

This favorable environment could present opportune moments for Digital 9 to divest its European holdings, potentially realizing enhanced valuations. For instance, the European Union's Digital Decade targets aim for significant expansion in connectivity and digital skills, underscoring the sector's strategic priority.

- Increased Demand for Secure Digital Assets: Geopolitical tensions are boosting the value of geographically stable and sovereign digital infrastructure.

- EU Digital Decade Ambitions: The EU's commitment to digital transformation, including investments in fiber networks and 5G, supports infrastructure asset growth.

- Potential for Divestment Gains: The strategic premium on European digital infrastructure could lead to favorable exit multiples for Digital 9's assets.

The ongoing surge in global data consumption, amplified by AI and 5G, creates a robust market for digital infrastructure. Anticipated interest rate reductions in 2024-2025 are expected to lower borrowing costs, making acquisitions more attractive and potentially increasing liquidity for infrastructure assets. Furthermore, a substantial amount of uninvested capital, exceeding $1 trillion in global infrastructure funds by late 2024, is actively seeking stable, long-duration assets like those Digital 9 holds.

| Opportunity Area | Description | Supporting Data/Trend |

|---|---|---|

| Growing Global Data Demand | Sustained increase in data usage drives need for digital infrastructure. | Global internet traffic projected to reach 200 zettabytes/month by 2024. |

| Favorable Interest Rate Environment | Potential rate cuts in 2024-2025 lower borrowing costs. | Expected rate reductions improve acquisition financing and asset valuations. |

| Institutional Investor Capital | Significant uninvested capital seeking infrastructure assets. | Over $1 trillion in global infrastructure dry powder by end of 2024. |

| European Digital Sovereignty | Increased demand for secure, strategically important European digital assets. | EU Digital Decade targets emphasize connectivity and digital transformation. |

Threats

Digital 9 Infrastructure faces a significant threat from further devaluations of its remaining assets, particularly as market conditions may necessitate sales during its managed wind-down. Recent asset sales have already seen substantial discounts compared to prior valuations, highlighting the vulnerability of its portfolio.

Deteriorating market sentiment or the pressure to divest quickly could trigger additional write-downs, directly impacting the capital ultimately returned to shareholders. For instance, the company's strategy to sell assets to repay debt, as seen in its plans to dispose of certain data centers, carries the inherent risk of achieving lower-than-expected prices in a potentially unfavorable market.

Divesting digital infrastructure assets, especially those spanning multiple countries like subsea cables, frequently necessitates approvals from various regulatory bodies. These processes can be lengthy and complex, impacting the timeline for asset sales.

For instance, Digital 9 Infrastructure's experience with Aqua Comms highlighted how delays in securing these multi-jurisdictional clearances can significantly extend the asset wind-down and, consequently, the return of capital to investors. This protracted process introduces considerable uncertainty and can lead to ongoing holding expenses.

Global macroeconomic instability, including persistent inflation and geopolitical tensions, presents a significant threat to infrastructure investments. For instance, the IMF projected global growth to slow to 2.7% in 2024, down from 3.0% in 2023, reflecting these persistent headwinds. This instability can dampen buyer sentiment and reduce transaction volumes in the digital infrastructure sector.

Persistent inflation, a key concern throughout 2024, directly impacts the cost of capital and operational expenses for infrastructure assets. Higher interest rates, a consequence of inflation-fighting measures, can also lead to a downward revision of asset valuations. This makes it harder for companies like Digital 9 Infrastructure to achieve their desired divestment outcomes.

Geopolitical tensions, such as ongoing conflicts and trade disputes, further exacerbate market volatility. These events can disrupt supply chains, increase energy costs, and create uncertainty for cross-border investments. Such an unpredictable environment challenges Digital 9 Infrastructure's ability to execute a smooth and value-maximizing divestment strategy.

Liquidity Constraints and Refinancing Risks during Wind-down

Digital 9 Infrastructure faces ongoing liquidity challenges as it works to repay debt, with its revolving credit facility maturing in 2025, posing a refinancing risk. Despite progress in debt reduction, unforeseen liquidity crunches or refinancing hurdles could disrupt the orderly wind-down process.

These constraints might necessitate asset sales on less favorable terms or further postpone capital distributions to investors. For instance, as of their latest reporting, the company's net debt remained a significant factor, and securing new financing or extending existing facilities will be crucial.

- Revolving Credit Facility Maturity: The company's revolving credit facility is set to mature in 2025, creating a refinancing deadline.

- Ongoing Financial Obligations: Despite debt repayments, significant financial commitments persist, requiring careful liquidity management.

- Potential for Unfavorable Asset Sales: Liquidity pressures could force the sale of assets at prices below their intrinsic value.

- Delayed Capital Returns: Difficulties in refinancing or managing liquidity may lead to further delays in returning capital to shareholders.

Shareholder Dissatisfaction and Litigation Risk

Shareholder dissatisfaction is a significant threat, fueled by a substantial decline in Digital 9 Infrastructure's Net Asset Value (NAV). For instance, as of its latest reported figures, the NAV per share has seen a notable decrease, impacting investor confidence.

The sale of assets at discounted prices, a necessary step in the trust's wind-down, further exacerbates this discontent. This financial reality, coupled with the extended period of capital lock-up for investors, creates a fertile ground for potential shareholder activism and litigation. Concerns may arise regarding the reliability of historical valuations and the stewardship of the trust's assets.

- NAV Decline: Reports indicate a significant drop in the trust's NAV, impacting investor returns.

- Discounted Asset Sales: The necessity of selling assets below their book value to facilitate the wind-down process is a key concern.

- Litigation Risk: Potential lawsuits could arise from shareholders questioning past valuations and management decisions.

- Resource Diversion: Legal battles and activist campaigns could divert crucial resources and management focus away from the orderly wind-down.

Digital 9 Infrastructure faces the threat of further asset devaluation as it navigates its managed wind-down, with recent sales occurring at significant discounts. This pressure to divest quickly could trigger additional write-downs, directly impacting shareholder returns, as seen in plans to sell data centers at potentially lower-than-expected prices.

Navigating multi-jurisdictional regulatory approvals for asset sales, particularly for assets like subsea cables, presents a significant hurdle. Delays in securing these clearances, as experienced with Aqua Comms, can extend the wind-down timeline and introduce considerable uncertainty, leading to ongoing holding expenses.

Global macroeconomic instability, including persistent inflation and geopolitical tensions, dampens buyer sentiment and transaction volumes in the digital infrastructure sector. For instance, the IMF projected global growth to slow to 2.7% in 2024, impacting investment environments and potentially forcing asset sales on less favorable terms.

The company's revolving credit facility matures in 2025, creating a refinancing deadline that poses a significant liquidity risk. Despite debt reduction efforts, ongoing financial obligations and potential refinancing hurdles could disrupt the wind-down process and delay capital returns to shareholders.

Shareholder dissatisfaction, driven by a substantial decline in Net Asset Value (NAV) and discounted asset sales, heightens the risk of activism and litigation. This situation could divert crucial resources and management focus away from the orderly wind-down.

| Threat Category | Specific Risk | Impact | Example/Data Point |

| Asset Devaluation | Further write-downs due to market conditions or forced sales | Reduced capital returned to shareholders | Recent asset sales at substantial discounts to prior valuations |

| Regulatory Hurdles | Delays in multi-jurisdictional approvals for asset divestments | Extended wind-down timeline, increased holding costs | Aqua Comms clearance delays impacting capital return |

| Macroeconomic Instability | Dampened buyer sentiment and transaction volumes | Less favorable asset sale terms | IMF projected 2.7% global growth in 2024 |

| Liquidity & Refinancing | Revolving credit facility maturity in 2025 | Disruption to wind-down, delayed capital returns | Net debt remains a significant factor; refinancing crucial |

| Shareholder Dissatisfaction | Potential activism and litigation due to NAV decline | Diversion of resources and management focus | Notable decrease in NAV per share impacting investor confidence |

SWOT Analysis Data Sources

This Digital 9 Infrastructure SWOT analysis is built upon a robust foundation of data, drawing from official financial disclosures, comprehensive market intelligence reports, and the expert opinions of industry analysts to ensure a thorough and accurate assessment.