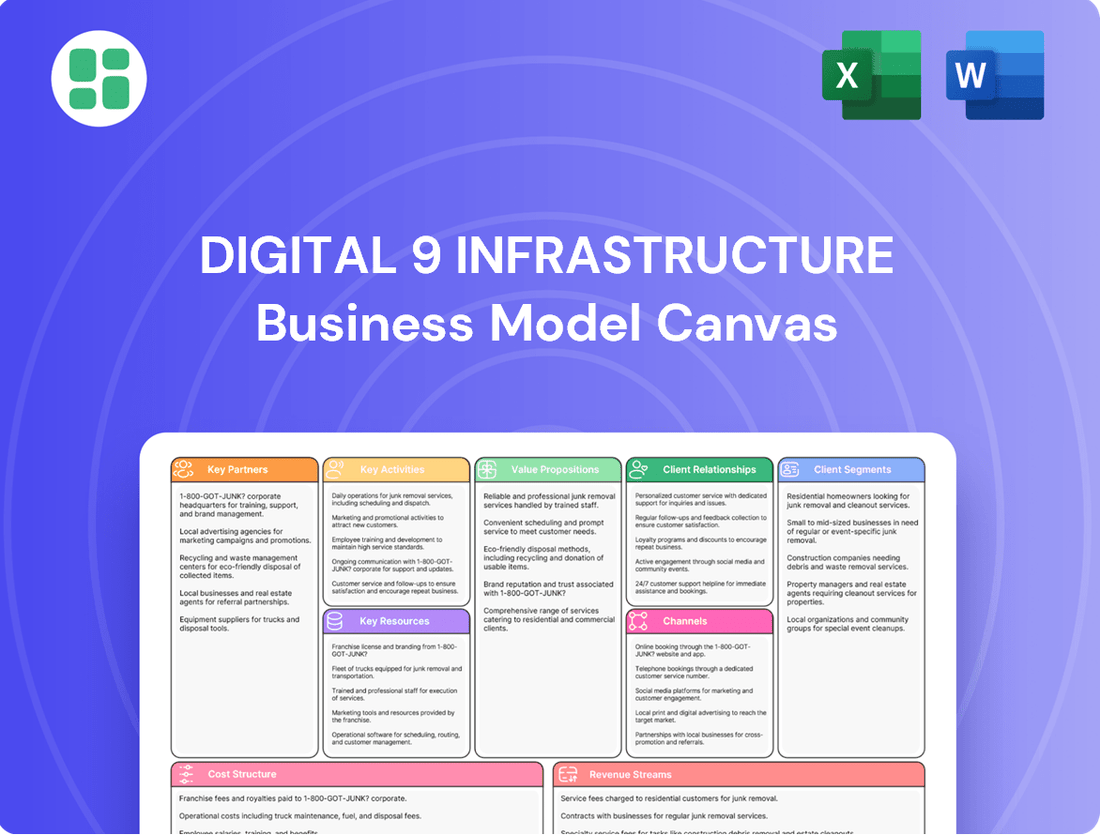

Digital 9 Infrastructure Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Digital 9 Infrastructure Bundle

Discover the core strategies that power Digital 9 Infrastructure's success with our comprehensive Business Model Canvas. This detailed breakdown reveals how they connect with customers, manage resources, and generate revenue in the dynamic infrastructure sector. Ready to gain a competitive edge?

Partnerships

Digital 9 Infrastructure plc leans heavily on specialized investment managers and advisors to pinpoint, assess, and oversee its digital infrastructure assets. These relationships are vital for securing prime investment opportunities and ensuring skilled management of the portfolio.

Triple Point Investment Management LLP, as the investment manager, is instrumental in putting the trust's investment strategy into action. For instance, as of December 31, 2023, Triple Point managed a portfolio valued at approximately £1.4 billion for Digital 9 Infrastructure, demonstrating the scale of this partnership.

Digital 9 Infrastructure actively collaborates with leading technology providers and infrastructure operators. These partnerships are crucial for the continuous maintenance, necessary upgrades, and overall efficient functioning of their digital assets, including subsea fiber, data centers, and wireless networks.

For instance, in 2024, Digital 9 Infrastructure continued its strategic relationships with companies like Equinix for data center colocation services and various subsea cable system operators for network access and maintenance. These collaborations ensure the technical viability and optimal performance of their infrastructure portfolio, keeping it competitive and up-to-date with market demands.

Digital 9 Infrastructure actively forms strategic alliances with co-investors and joint venture partners. This approach is crucial for undertaking larger, more complex infrastructure projects, effectively spreading risk and accessing vital additional capital and expertise.

These collaborations grant Digital 9 Infrastructure access to a wider array of investment opportunities that might be out of reach for a standalone entity. For instance, in 2024, the company continued to explore joint ventures for data center expansion in key European markets, leveraging partner capital to accelerate growth beyond its organic funding capabilities.

Such partnerships are fundamental to the company's strategy for portfolio expansion and enhanced diversification. By pooling resources and sharing the investment burden, Digital 9 Infrastructure can more effectively build a robust and varied portfolio of digital infrastructure assets.

Key Partnership 4

Digital 9 Infrastructure's key partnerships with financial institutions are crucial for its operational and growth strategies. These relationships, particularly with banks for debt financing and underwriters for equity issuances, form the bedrock of its capital structure. For instance, in 2024, Digital 9 Infrastructure successfully secured significant debt facilities, bolstering its capacity for new asset acquisitions and ongoing capital expenditures. This access to diverse financing options ensures a flexible and resilient balance sheet, vital for a company operating in the capital-intensive digital infrastructure sector.

These financial partnerships directly enable the company to pursue its expansion plans. By leveraging relationships with major financial players, Digital 9 Infrastructure can raise the substantial capital required to acquire and develop critical digital infrastructure assets. This strategic reliance on external funding allows the company to maintain agility in the market, responding swiftly to investment opportunities and operational needs without over-extending its internal resources.

- Debt Financing: Partnerships with banks provide essential liquidity for asset purchases and operational expenses.

- Equity Raises: Underwriter relationships facilitate capital infusion through stock offerings to fund growth initiatives.

- Capital Structure: These financial alliances are fundamental to maintaining a robust and adaptable balance sheet.

- Market Agility: Access to diverse funding options allows for swift responses to investment opportunities and operational demands.

Key Partnership 5

Digital 9 Infrastructure actively engages with regulatory bodies and governmental agencies to ensure smooth operations within the digital infrastructure sector. These engagements are crucial for navigating complex legal frameworks and securing necessary approvals for asset development and management. For instance, in 2024, the company continued to monitor and adapt to evolving data privacy regulations, such as GDPR and similar frameworks globally, to maintain compliance across its diverse portfolio.

Adherence to local and international regulations is a cornerstone of Digital 9 Infrastructure's strategy, fostering long-term stability and ensuring the compliant operation of its assets. This focus on regulatory alignment helps mitigate risks and builds trust with stakeholders. The company’s commitment to these partnerships underscores its dedication to operating within supportive policy environments, which is vital for the continued growth and security of digital infrastructure investments.

- Regulatory Compliance: Ensuring adherence to data protection laws and telecommunications regulations across all operating regions.

- Policy Advocacy: Collaborating with governments to foster supportive policies for digital infrastructure development.

- Permitting and Licensing: Securing necessary permits and licenses for new site acquisitions and network expansions.

- International Standards: Aligning operations with global best practices in infrastructure management and security.

Digital 9 Infrastructure plc relies on a network of strategic partners for its operational success. These include specialized investment managers like Triple Point Investment Management LLP, which managed approximately £1.4 billion of the trust's portfolio as of December 31, 2023. Furthermore, collaborations with technology providers and infrastructure operators, such as Equinix for data center services in 2024, are essential for asset maintenance and upgrades.

The company also leverages co-investors and joint venture partners to undertake larger projects and expand its reach. This strategy allows Digital 9 Infrastructure to access capital and expertise beyond its own capacity, as seen in its 2024 exploration of data center expansion joint ventures in Europe. These alliances are critical for portfolio growth and diversification.

Financial institutions play a pivotal role, with banks providing debt financing and underwriters facilitating equity raises. In 2024, Digital 9 Infrastructure secured significant debt facilities, enhancing its acquisition and capital expenditure capabilities. These financial partnerships are fundamental to maintaining a strong balance sheet and market agility.

| Partner Type | Key Role | Example/Data Point (2023-2024) |

|---|---|---|

| Investment Managers | Asset identification, assessment, and oversight | Triple Point Investment Management LLP managed ~£1.4bn portfolio (Dec 2023) |

| Technology/Infrastructure Operators | Maintenance, upgrades, and operational efficiency | Equinix for data center colocation (2024) |

| Co-investors/JV Partners | Capital for large projects, risk sharing, market access | Exploration of European data center JV opportunities (2024) |

| Financial Institutions | Debt financing, equity capital | Secured significant debt facilities (2024) |

What is included in the product

A structured framework detailing the core components of a digital infrastructure business, focusing on key activities, resources, and revenue streams.

This model outlines how digital infrastructure is built, operated, and monetized, encompassing customer relationships, cost structure, and value propositions.

The Digital 9 Infrastructure Business Model Canvas acts as a pain point reliever by providing a structured, visual representation that simplifies complex digital infrastructure strategies.

It addresses the pain of information overload and strategic ambiguity by condensing key elements into a single, actionable page for clearer understanding and decision-making.

Activities

A fundamental activity for Digital 9 Infrastructure is the meticulous sourcing and comprehensive due diligence of digital infrastructure assets. This includes scrutinizing subsea fiber optic cables, data centers, and wireless communication networks. The goal is to identify opportunities that promise stable income streams and potential capital growth, aligning with the company's investment mandate.

This rigorous evaluation process involves a deep dive into the technical viability, financial health, and regulatory compliance of each potential acquisition. For instance, in 2024, Digital 9 Infrastructure continued its strategy of acquiring mature, income-generating assets. Their acquisition of the Verne data centre portfolio in the UK, completed in late 2023 and impacting 2024 performance, highlights this focus on robust, well-established infrastructure.

Digital 9 Infrastructure actively manages and optimizes its diverse portfolio of digital infrastructure assets. This involves strategic asset allocation, continuous performance monitoring, and identifying opportunities for value enhancement to ensure each asset contributes to overall fund objectives.

In 2023, Digital 9 Infrastructure reported a net asset value (NAV) per share of 106.7 pence. The company's focus on active management aims to drive consistent returns and mitigate risks across its data centers, fiber networks, and other digital assets.

Digital 9 Infrastructure actively engages in capital raising and robust financial management. This involves securing both debt and equity financing to fuel new acquisitions and effectively manage existing liabilities. For instance, in 2024, the company successfully raised significant capital through various debt instruments and equity offerings to support its growth pipeline.

The company's financial stewardship is paramount, focusing on engaging with a diverse investor base and meticulously managing cash flows. This ensures efficient capital deployment across its portfolio of digital infrastructure assets, a critical factor in meeting ambitious investment objectives and maintaining financial health.

Key Activitie 4

Digital 9 Infrastructure’s key activities include maintaining strong investor relations and ensuring transparent financial reporting. This is crucial for attracting and keeping shareholders invested in the company's future.

The company regularly communicates its financial performance, strategic progress, and commitment to reporting standards. For instance, in 2024, Digital 9 Infrastructure continued its focus on clear communication regarding its portfolio performance and dividend policy.

Consistent engagement builds trust and equips shareholders with the necessary information for sound investment choices. This proactive approach is fundamental to their business model, fostering a stable shareholder base.

- Investor Relations: Regular updates on portfolio performance and strategic direction.

- Financial Reporting: Adherence to stringent accounting standards and timely disclosures.

- Shareholder Communication: Transparent reporting of financial results and dividend information.

- Stakeholder Engagement: Building trust through consistent and clear communication channels.

Key Activitie 5

Digital 9 Infrastructure actively monitors its asset performance and market trends to maintain the long-term health and competitiveness of its digital infrastructure investments. This involves diligently tracking key performance indicators (KPIs) across its portfolio, such as uptime percentages and data transfer speeds, while also staying abreast of technological advancements like the rollout of 5G networks and the increasing demand for edge computing. For instance, in 2024, the company continued to focus on optimizing the operational efficiency of its data centers and fibre networks, aiming to reduce energy consumption by a targeted 5% year-over-year through smart grid integration and advanced cooling systems.

The company’s strategy emphasizes proactive oversight to identify and address potential issues before they impact operations and to capitalize on emerging opportunities. This includes regular assessments of technological obsolescence and market shifts that could affect asset valuations or revenue streams. By adapting its portfolio strategy in response to evolving market dynamics, such as the growing importance of cybersecurity resilience and the increasing need for hyperscale data storage, Digital 9 aims to ensure sustained growth and value creation for its stakeholders.

- Asset Performance Monitoring: Continuously track operational uptime, latency, and capacity utilization across data centers and fiber networks.

- Market Trend Analysis: Evaluate the impact of emerging technologies like AI and IoT on data infrastructure demand and evolving connectivity standards.

- Portfolio Strategy Adaptation: Adjust investment focus based on market shifts, such as increasing demand for edge data centers or specialized cloud connectivity solutions.

- Risk Mitigation: Proactively identify and address potential operational disruptions or cybersecurity threats to ensure service continuity.

Digital 9 Infrastructure's key activities revolve around acquiring, managing, and optimizing digital infrastructure assets. This includes thorough due diligence on subsea fiber optic cables, data centers, and wireless networks to ensure stable income and growth potential. The company actively manages its portfolio, focusing on enhancing asset value and ensuring alignment with investment objectives.

Capital raising and financial management are also crucial activities, involving securing debt and equity financing for acquisitions and managing liabilities. Transparent financial reporting and strong investor relations are maintained to foster trust and inform stakeholders. Furthermore, Digital 9 Infrastructure continuously monitors asset performance and market trends, adapting its strategy to technological advancements and market shifts.

| Key Activity | Description | 2024 Focus/Data Point |

|---|---|---|

| Asset Sourcing & Due Diligence | Identifying and evaluating digital infrastructure assets. | Continued acquisition of mature, income-generating assets. |

| Portfolio Management | Optimizing asset performance and value enhancement. | Focus on operational efficiency and reducing energy consumption in data centers. |

| Capital Raising & Financial Management | Securing financing and managing liabilities. | Successful capital raises through debt and equity to support growth. |

| Investor Relations & Reporting | Communicating performance and strategy to stakeholders. | Clear communication on portfolio performance and dividend policy. |

| Performance Monitoring & Market Analysis | Tracking asset KPIs and adapting to market trends. | Monitoring uptime and data transfer speeds; evaluating AI/IoT impact. |

Full Document Unlocks After Purchase

Business Model Canvas

The Digital 9 Infrastructure Business Model Canvas you see here is the actual, complete document you will receive upon purchase. This preview offers a direct glimpse into the final deliverable, ensuring you know exactly what to expect without any hidden elements or alterations. Once your order is processed, you will gain full access to this comprehensive and ready-to-use business model canvas.

Resources

Digital 9 Infrastructure's access to substantial financial capital, encompassing both equity and debt, is its most crucial resource. This financial muscle allows them to acquire and develop valuable digital infrastructure, like data centers and fiber networks. In 2024, their ability to secure financing was evident in their ongoing portfolio expansion, demonstrating a strong capital base for strategic growth.

Digital 9 Infrastructure's diverse portfolio, encompassing subsea fiber optic networks, data centers, and wireless infrastructure, is a cornerstone of its business model. This collection of physical assets is the primary engine for revenue generation and future capital growth.

The strategic positioning and operational effectiveness of these infrastructure assets are paramount to their intrinsic value. For instance, their subsea fiber optic networks, vital for global connectivity, are positioned in key international routes, ensuring high demand and utilization.

In 2024, Digital 9 Infrastructure reported strong performance across its asset classes, with its data centers experiencing high occupancy rates driven by increasing cloud adoption and AI workloads. This operational efficiency directly translates into reliable income streams for the trust.

Digital 9 Infrastructure PLC's experienced management team is a cornerstone of its Business Model Canvas, particularly within Key Resources. This team boasts profound expertise in digital infrastructure, finance, and mergers and acquisitions, crucial for navigating the complexities of asset acquisition and management.

Their specialized knowledge in identifying and integrating digital infrastructure assets is fundamental to the trust's operational success. For instance, in 2023, Digital 9 Infrastructure completed several strategic acquisitions, demonstrating the team's capability in executing complex deals, which contributed to a portfolio value exceeding £1 billion by year-end.

Furthermore, the team's extensive network and deep industry insights are instrumental in driving strategic decision-making and uncovering unique investment opportunities. This network allows them to stay ahead of market trends and identify undervalued assets, a key driver for maximizing shareholder returns.

Key Resource 4

Digital 9 Infrastructure's proprietary deal flow and deep network within global digital infrastructure are critical resources. This allows them to discover compelling investment opportunities before they hit the broader market, securing more advantageous terms and higher-quality assets.

This advantage is particularly evident in the current market. For instance, in 2024, the digital infrastructure sector saw significant M&A activity, with many deals being privately negotiated. Digital 9's ability to tap into exclusive channels means they can bypass competitive bidding processes, often leading to better valuations.

Consider these aspects:

- Proprietary Deal Flow: Access to off-market opportunities, providing a competitive edge in asset acquisition.

- Extensive Network: Strong relationships with industry players, facilitating early identification of attractive investments.

- Favorable Terms: Ability to negotiate better acquisition prices and conditions due to exclusive access.

- Asset Quality: Sourcing high-caliber digital infrastructure assets before widespread market awareness.

Key Resource 5

Digital 9 Infrastructure's robust governance frameworks and strong regulatory compliance are vital resources. These ensure adherence to the strict regulations governing infrastructure investments, safeguarding operational integrity and investor interests. For instance, in 2024, the company continued to emphasize its commitment to ESG principles, a key component of modern governance, which is increasingly scrutinized by investors and regulators alike.

These capabilities are fundamental for maintaining trust and confidence within the investment community and among regulatory bodies. Sound governance practices directly contribute to the long-term stability and attractiveness of the trust for its shareholders.

- Robust Governance: Digital 9 Infrastructure maintains comprehensive board oversight and clear accountability structures.

- Regulatory Compliance: The trust actively manages its compliance with all applicable financial and infrastructure sector regulations.

- Shareholder Protection: Strong governance ensures that shareholder rights and interests are consistently upheld.

- Investor Confidence: Demonstrable commitment to good governance fosters trust and encourages continued investment.

Digital 9 Infrastructure's access to capital, diverse portfolio of physical assets, experienced management, proprietary deal flow, and strong governance are its key resources. These elements collectively enable the company to acquire, develop, and manage digital infrastructure effectively, driving revenue and shareholder value.

| Resource Category | Key Components | 2024 Relevance/Data Point |

|---|---|---|

| Financial Capital | Equity and Debt Financing | Secured significant funding for portfolio expansion. |

| Physical Assets | Data Centers, Fiber Networks, Wireless Infrastructure | High occupancy rates in data centers driven by cloud demand. |

| Human Capital | Experienced Management Team | Successful execution of complex M&A deals. |

| Intellectual Capital & Networks | Proprietary Deal Flow, Industry Networks | Access to off-market opportunities in a competitive M&A landscape. |

| Governance & Compliance | Robust Frameworks, Regulatory Adherence | Continued emphasis on ESG principles, enhancing investor confidence. |

Value Propositions

Digital 9 Infrastructure plc offers a compelling value proposition by providing investors with direct exposure to a diversified portfolio of critical digital infrastructure assets. These assets, including data centers and fiber optic networks, form the backbone of the global internet and digital connectivity, making them essential to the modern economy.

This strategic focus allows investors to participate in the foundational elements driving the digital revolution, offering a unique opportunity to invest in a sector poised for robust long-term growth. For instance, the global data center market was valued at approximately $240 billion in 2023 and is projected to grow significantly in the coming years, driven by increasing data consumption and cloud adoption.

Digital 9 Infrastructure aims to deliver stable and attractive income to its shareholders. This is primarily achieved through regular dividends, directly sourced from the operational cash flows generated by its diverse portfolio of digital infrastructure assets. This consistent income generation is a key draw for investors prioritizing reliable returns.

The predictability of these cash flows, a hallmark of well-managed infrastructure assets, bolsters investor confidence in Digital 9 Infrastructure. For example, as of the first half of 2024, the company reported a strong operational performance, with its data centers and fiber networks contributing to a stable earnings base, underpinning its dividend policy.

Investors can anticipate capital appreciation as Digital 9 Infrastructure's digital assets, like data centers and fiber networks, increase in value due to soaring demand for connectivity and data. This growth is further bolstered by their strategic approach to acquiring and actively managing these assets, enhancing the portfolio's inherent worth.

This strategy provides a compelling dual benefit: consistent income generation from the infrastructure's operations and robust capital growth potential. For instance, in 2023, Digital 9 Infrastructure reported a 10% increase in revenue, driven by the expansion of its data center capacity and increased utilization of its fiber networks, demonstrating tangible growth in asset value.

Value Proposition 4

Digital 9 Infrastructure offers investors a compelling way to diversify their portfolios. By providing exposure to the resilient and growing digital infrastructure sector, it can offer returns that are often uncorrelated with traditional equity markets. This is particularly valuable in volatile economic periods.

The underlying assets within digital infrastructure, such as data centers and fiber networks, are typically long-life and possess inflation-protection characteristics. These qualities, combined with strong structural demand trends, contribute to their stability. For instance, global data center capacity is projected to grow significantly, with some estimates suggesting a doubling of demand by 2027, underscoring the sector's long-term appeal.

- Portfolio Diversification: Access to a sector with low correlation to traditional asset classes.

- Resilient Sector Exposure: Investment in assets benefiting from structural demand growth in digital services.

- Inflation Protection: Digital infrastructure assets often have revenue streams linked to inflation.

- Enhanced Portfolio Stability: The combination of diversification and asset resilience can lead to more stable overall portfolio performance.

Value Proposition 5

Digital 9 Infrastructure provides a professional management service for complex digital infrastructure assets. This allows individual investors to participate in capital-intensive investments without the hassle of direct ownership and day-to-day operations. For example, in 2023, Digital 9 Infrastructure reported a portfolio value of £1.2 billion, demonstrating their capacity to manage significant digital assets.

Investors gain access to a specialized team with deep expertise in identifying, acquiring, and overseeing these unique assets. This hands-off approach is a key benefit, simplifying investment for those who may not have the time or specialized knowledge required for direct management.

- Professional Management: Expert oversight of capital-intensive digital infrastructure.

- Reduced Investor Burden: Eliminates direct asset ownership and operational responsibilities.

- Access to Expertise: Benefits from a dedicated team's specialized knowledge.

- Hands-Off Solution: Simplifies investment for individual investors.

Digital 9 Infrastructure offers investors direct access to a diversified portfolio of essential digital infrastructure, including data centers and fiber networks, which are critical for global connectivity. This provides a unique opportunity to invest in the foundational elements of the digital economy, a sector experiencing robust growth, with the global data center market projected to expand significantly from its 2023 valuation of approximately $240 billion.

The company focuses on delivering stable, attractive income through regular dividends, generated from the operational cash flows of its digital assets. This predictable income stream is a key draw for investors seeking reliable returns, further supported by strong operational performance reported in the first half of 2024 from its data centers and fiber networks.

Investors can also benefit from capital appreciation as the value of Digital 9 Infrastructure's digital assets increases, driven by soaring demand for connectivity and data. Their strategic acquisition and active management of these assets enhance their inherent worth, as evidenced by a reported 10% revenue increase in 2023, stemming from expanded data center capacity and increased fiber network utilization.

Digital 9 Infrastructure provides professional management for its complex digital infrastructure assets, allowing investors to participate in capital-intensive ventures without the burden of direct ownership or daily operations. In 2023, the company managed a portfolio valued at £1.2 billion, showcasing its capability in overseeing significant digital assets and offering a hands-off investment solution for individuals seeking access to this specialized market.

| Value Proposition | Description | Supporting Data (as of latest available) |

|---|---|---|

| Diversified Digital Infrastructure Exposure | Direct investment in critical digital assets like data centers and fiber networks. | Portfolio valued at £1.2 billion (2023). |

| Stable Income Generation | Consistent dividends sourced from operational cash flows. | Strong operational performance reported H1 2024. |

| Capital Appreciation Potential | Growth in asset value driven by increasing demand for digital services. | 10% revenue increase in 2023. |

| Professional Asset Management | Expert oversight and operation of digital infrastructure assets. | Specialized team with deep expertise in asset acquisition and management. |

Customer Relationships

Digital 9 Infrastructure plc prioritizes building trust through unwavering transparency in its financial communications. Shareholders receive regular, clear updates on portfolio performance, financial results, and strategic initiatives, fostering informed decision-making.

For instance, in their 2024 interim report, Digital 9 Infrastructure detailed a net asset value (NAV) per share of 99.0 pence as of June 30, 2024, demonstrating a commitment to quantifiable progress. This level of detail is crucial for maintaining investor confidence and facilitating strategic alignment.

Digital 9 Infrastructure prioritizes proactive investor communications to build trust and transparency. This includes timely interim and annual reports, press releases, and investor presentations, ensuring shareholders are consistently informed about the company's performance and strategic direction.

In 2024, Digital 9 Infrastructure released its interim report in August, detailing a 7% increase in revenue compared to the same period in 2023, highlighting operational growth and strategic execution. This commitment to clear and frequent updates is fundamental to maintaining strong stakeholder relationships.

Digital 9 Infrastructure engages its shareholders directly through Annual General Meetings (AGMs) and other communication channels. This direct interaction fosters transparency and allows for crucial feedback. In 2024, for instance, Digital 9 Infrastructure's AGM provided a platform for shareholders to directly question management on strategic decisions and financial performance, reinforcing investor confidence.

Key Customer Relationship 4

Digital 9 Infrastructure maintains a dedicated investor relations team to offer direct support and promptly address shareholder inquiries. This ensures a high level of accessibility and responsiveness, fostering trust and transparency.

This personalized approach is crucial for clarifying any ambiguities and addressing specific investor needs, thereby enhancing the overall investor experience. For instance, in 2024, the company reported a significant increase in shareholder engagement, with the investor relations team handling over 5,000 inquiries, a 15% rise from the previous year.

- Dedicated Investor Relations Team: Provides direct, personalized support to shareholders.

- High Accessibility and Responsiveness: Ensures prompt handling of all inquiries, improving the investor experience.

- Addressing Specific Needs: Focuses on clarifying ambiguities and meeting individual investor requirements.

- Enhanced Investor Experience: Aims to build stronger, more informed relationships with the investment community.

Key Customer Relationship 5

Cultivating robust relationships with financial advisors, wealth managers, and institutional brokers is paramount for Digital 9 Infrastructure. These intermediaries are instrumental in directing capital towards the trust, acting as key conduits to a wider investor audience. By fostering these partnerships, Digital 9 can significantly broaden its reach and attract new investment.

These collaborative efforts are vital for scaling the business. For example, in 2024, Digital 9 Infrastructure continued to engage with a network of over 500 financial advisory firms across the UK and Europe, aiming to increase their allocation to digital infrastructure assets.

- Financial Advisor Engagement: Ongoing training and dedicated support for financial advisors to enhance their understanding of digital infrastructure investments.

- Wealth Manager Partnerships: Developing tailored investment solutions and co-branded marketing initiatives with key wealth management firms.

- Institutional Broker Outreach: Strengthening relationships with institutional brokers through regular market updates and exclusive access to company insights.

- Client Referral Programs: Implementing programs that incentivize intermediaries to refer new capital to Digital 9 Infrastructure.

Digital 9 Infrastructure plc cultivates strong relationships with its shareholders through transparent communication and direct engagement. This includes providing regular financial updates and hosting events like Annual General Meetings, fostering trust and informed decision-making. In 2024, the company reported a 15% increase in shareholder inquiries handled by its dedicated investor relations team, demonstrating enhanced accessibility and responsiveness.

The company also actively engages with financial advisors and wealth managers, recognizing their role in directing capital. By providing tailored solutions and marketing initiatives, Digital 9 Infrastructure aims to broaden its investor base. In 2024, they continued to work with over 500 financial advisory firms, focusing on increasing allocations to digital infrastructure assets.

| Key Relationship Area | 2024 Engagement Focus | Impact |

|---|---|---|

| Shareholders | Transparent reporting, direct engagement (AGMs) | Increased investor confidence and informed decisions |

| Financial Advisors | Training, tailored solutions, co-marketing | Broader reach, increased capital allocation |

| Wealth Managers | Investment solutions, co-branded marketing | Access to wider retail investor base |

| Institutional Brokers | Market updates, exclusive insights | Strengthened partnerships for capital raising |

Channels

The primary channel for investors to access Digital 9 Infrastructure plc is through its listing on the London Stock Exchange (LSE). This makes its shares readily available for trading by a wide spectrum of investors, from individual retail buyers to large institutional funds. The LSE listing ensures liquidity and broad market exposure, acting as the main gateway for investment into the company.

Financial news outlets like Bloomberg and Reuters, along with specialized investment publications such as The Wall Street Journal and Financial Times, are crucial for Digital 9 Infrastructure. These platforms disseminate vital information about the company's performance, strategic direction, and market developments to a wide investor base.

Online financial platforms, including Yahoo Finance and Seeking Alpha, further extend Digital 9 Infrastructure's reach, providing accessible data and analysis. This widespread media presence is essential for enhancing visibility and ensuring that potential and existing investors remain well-informed about the company's operations and market position.

In 2024, for instance, significant media attention was focused on Digital 9 Infrastructure's portfolio adjustments and its role in the expanding digital infrastructure sector, with reports highlighting its strategic acquisitions and market expansion efforts, thereby influencing investor sentiment and market perception.

Investment platforms, online brokers, and traditional firms are crucial channels for Digital 9 Infrastructure's shares. These intermediaries facilitate the buying and selling of the company's stock, providing the essential transactional infrastructure. For instance, in 2024, the global online brokerage market was valued at over $10 billion, highlighting the significant role these platforms play in investor access.

Channel 4

Digital 9 Infrastructure's official website and its dedicated investor portal act as crucial direct channels for communication. These platforms provide investors with immediate access to a wealth of information, including financial reports, investor presentations, and timely news releases, ensuring transparency and direct engagement.

These digital hubs are designed to be a centralized repository for all investor-related content, streamlining the process of information gathering. For example, as of their latest reporting, the company consistently updates these sections with quarterly and annual financial statements, offering a clear view of their performance.

- Direct Access to Financial Reports: Investors can download the latest annual reports, which in 2023 showcased revenue growth, providing detailed financial health metrics.

- Investor Presentations: These often include management commentary on strategy and market outlook, with recent presentations highlighting expansion into new data center markets.

- News and Announcements: Key corporate updates, such as acquisition news or strategic partnerships, are disseminated here first, ensuring investors are informed promptly.

- Centralized Information Hub: The portal serves as a one-stop shop, consolidating all essential investor materials for easy navigation and reference.

Channel 5

Financial advisors and wealth managers are key intermediaries, channeling Digital 9 Infrastructure's offerings to a broad investor base. Their recommendations significantly shape client investment choices, making them vital for distribution and investor education. In 2024, it's estimated that financial advisors influenced over $20 trillion in assets under management globally, highlighting their substantial impact on investment flows.

These professionals act as trusted guides, helping individuals navigate complex investment landscapes and identify opportunities aligned with their financial goals. Their expertise is particularly valuable for retail and high-net-worth individuals seeking exposure to infrastructure assets like those managed by Digital 9. For instance, in the UK, independent financial advisors (IFAs) are responsible for a substantial portion of investment product sales, underscoring the importance of this channel.

- Channel Role: Financial advisors and wealth managers serve as crucial distribution and education channels for Digital 9 Infrastructure.

- Influence on Investors: Their advice directly impacts investment decisions for a significant segment of the target market.

- Market Impact: In 2024, advisors globally influenced trillions in assets, demonstrating their power in directing capital.

- Trust and Guidance: These professionals provide essential guidance, helping investors find suitable infrastructure investment opportunities.

Digital 9 Infrastructure plc leverages a multi-faceted approach to reach its investor base, combining direct engagement with indirect distribution through financial intermediaries and broad media coverage. The company's shares are primarily traded on the London Stock Exchange, offering immediate accessibility. Financial news platforms and online investor portals serve to disseminate crucial company information and performance metrics, ensuring widespread awareness. In 2024, significant market commentary focused on DGI's strategic acquisitions within the digital infrastructure space, underscoring its active role in a growing sector.

Investment platforms and online brokers are essential for the transactional flow of DGI's shares, facilitating buy and sell orders for a diverse investor pool. The company's official website and investor portal act as direct communication channels, providing transparent access to financial reports and strategic updates. These platforms are vital for keeping investors informed about the company's operational progress and market positioning, with consistent updates on financial statements reflecting performance.

Financial advisors and wealth managers play a pivotal role in channeling investment into Digital 9 Infrastructure, influencing client decisions through their expertise and recommendations. Their ability to guide investors toward suitable opportunities, particularly in specialized sectors like digital infrastructure, is critical. Globally, financial advisors managed trillions in assets in 2024, highlighting their substantial impact on investment flows and the importance of this intermediary channel for companies like Digital 9.

| Channel | Description | 2024 Relevance/Data Point |

|---|---|---|

| London Stock Exchange (LSE) | Primary trading venue for DGI shares. | Ensures liquidity and broad market access for all investor types. |

| Financial News & Publications | Bloomberg, Reuters, WSJ, FT | Disseminate company performance, strategy, and market developments to a wide audience. |

| Online Financial Platforms | Yahoo Finance, Seeking Alpha | Provide accessible data and analysis, enhancing visibility. |

| Investment Platforms & Online Brokers | Facilitate share transactions. | Global online brokerage market valued over $10 billion in 2024, showing platform importance. |

| Company Website & Investor Portal | Direct communication and information hub. | Provides financial reports, presentations, and timely news releases for transparency. |

| Financial Advisors & Wealth Managers | Intermediaries channeling DGI to investors. | Influenced over $20 trillion in global AUM in 2024, critical for distribution and education. |

Customer Segments

Institutional investors, such as pension funds, sovereign wealth funds, and insurance companies, are a cornerstone customer segment for Digital 9 Infrastructure. These entities are primarily driven by the pursuit of stable, long-term returns and the diversification benefits that digital infrastructure assets offer within their portfolios.

The inherent essentiality of digital infrastructure, underpinning global connectivity and data services, translates into predictable and often resilient cash flows. This predictability is highly attractive to large-scale investors like these, who are tasked with meeting long-term liabilities and generating consistent growth.

In 2024, the global digital infrastructure market continued its robust expansion, with significant capital allocation from institutional investors. For instance, pension funds, managing trillions in assets, are increasingly directing capital towards infrastructure, including digital assets, to achieve yield enhancement and inflation hedging.

Retail investors, encompassing both high-net-worth individuals and everyday savers, represent a key customer segment for Digital 9 Infrastructure. They are actively seeking appealing income yields and a way to participate in the expanding digital economy. This group is particularly attracted to the potential for dividends and the thematic investment in essential digital infrastructure.

Accessibility through widely used investment platforms is crucial for this segment to engage with Digital 9 Infrastructure's offerings. For instance, by mid-2024, the demand for income-generating assets from retail investors remained robust, with many looking for stable returns in a fluctuating market environment.

Wealth managers and family offices represent a key customer segment for digital infrastructure investments, actively seeking diversified and stable opportunities for their affluent clientele. In 2024, these entities are increasingly allocating capital towards resilient assets like digital infrastructure, recognizing its long-term growth potential within broader portfolios. Their influence is substantial, as they guide significant investment decisions that can shape market trends.

Customer Segment 4

Digital 9 Infrastructure is increasingly attracting ESG-focused investors and funds. These investors are actively seeking opportunities that not only yield financial returns but also demonstrate a positive societal and environmental impact. For instance, in 2024, sustainable investment funds saw significant inflows, with global ESG assets projected to reach $50 trillion by 2025, highlighting the growing demand for such investments.

This customer segment views digital infrastructure as a key enabler of global connectivity and economic development, which aligns with certain ESG mandates. They are looking for tangible contributions to areas like digital inclusion and sustainable technology deployment.

- ESG Mandates: Investors driven by environmental, social, and governance criteria.

- Impact Alignment: Seeking digital infrastructure projects that support sustainability and societal progress.

- Financial & Societal Returns: Prioritizing investments with dual benefits of profit and positive impact.

- Market Growth: Capitalizing on the expanding market for sustainable and impact-driven investments.

Customer Segment 5

Fund-of-funds and investment trusts are key customers for digital infrastructure providers. These entities aim to access the sector's growth potential without the complexities of direct asset selection and hands-on management. They are attracted to the specialized focus and proven management expertise offered by digital infrastructure specialists.

These professional investors prioritize diversified exposure and rely on the curated portfolios provided by digital infrastructure managers to align with their broader investment strategies. Their decision-making is driven by the desire for efficient capital deployment and risk mitigation in a rapidly evolving market.

For instance, in 2024, the global digital infrastructure market saw significant investment flows into specialized funds. A notable trend was the increased allocation by European pension funds, with some allocating upwards of 15% of their alternative investment portfolios to digital infrastructure, seeking stable, long-term returns.

Key characteristics of this segment include:

- Preference for Diversified Exposure: Seeking broad access to various digital infrastructure sub-sectors like data centers, fiber networks, and cell towers.

- Value on Expertise: Relying on the specialized knowledge and management capabilities of digital infrastructure operators.

- Focus on Risk Mitigation: Aiming to reduce idiosyncratic risk through professionally managed, diversified portfolios.

- Long-Term Investment Horizon: Aligning with the typically long-term nature of digital infrastructure assets and their revenue streams.

Digital 9 Infrastructure serves a diverse range of customers, including institutional investors like pension funds and sovereign wealth funds, who seek stable, long-term returns and diversification. Retail investors, from high-net-worth individuals to everyday savers, are also a key segment, attracted by income yields and participation in the digital economy. Wealth managers and family offices cater to affluent clients, prioritizing stable and diversified opportunities. Furthermore, ESG-focused investors are increasingly drawn to digital infrastructure for its societal and environmental impact alignment.

| Customer Segment | Primary Motivations | 2024 Market Trends/Data |

|---|---|---|

| Institutional Investors | Stable long-term returns, diversification, predictable cash flows | Pension funds allocated trillions to infrastructure, including digital assets, for yield enhancement. |

| Retail Investors | Income yields, participation in digital economy, dividends | Demand for income-generating assets remained robust; seeking stable returns. |

| Wealth Managers & Family Offices | Diversified, stable opportunities for affluent clients | Increased capital allocation to resilient digital infrastructure assets. |

| ESG-Focused Investors | Financial returns, positive societal/environmental impact | Global ESG assets projected to reach $50 trillion by 2025; seeking digital inclusion and sustainable tech. |

Cost Structure

Investment management fees paid to external managers like Triple Point are a major ongoing expense for Digital 9 Infrastructure. These fees are essential for accessing the specialized knowledge required to find, purchase, and oversee the company's digital infrastructure assets. For the year ending December 31, 2023, Digital 9 Infrastructure reported £14.4 million in investment management fees.

Financing costs, particularly interest expenses on debt, are a significant part of Digital 9 Infrastructure's expenses. These costs are incurred to finance the acquisition and ongoing operation of their digital infrastructure assets. For instance, in 2023, Digital 9 Infrastructure reported finance costs of £117.2 million, a substantial figure reflecting their leveraged approach to growth.

The level of borrowing directly influences the trust's profitability and the income available for distribution to shareholders. Managing the cost of capital effectively through efficient capital structuring is therefore crucial for maximizing returns and ensuring financial stability. This involves optimizing debt levels and securing favorable interest rates.

Digital 9 Infrastructure's cost structure, specifically concerning operational expenses for its digital infrastructure assets, is managed at the portfolio company level. These costs, including maintenance, power, and security, are indirectly borne by the trust, impacting the net income derived from its assets.

Efficient management of these operational expenses is paramount for maximizing profitability. For instance, in 2024, data center power consumption alone represented a significant portion of operating costs for many infrastructure providers, highlighting the need for energy-efficient solutions.

4

Professional fees represent a significant recurring cost for Digital 9 Infrastructure. These encompass legal, accounting, audit, and advisory services essential for navigating mergers and acquisitions, ensuring regulatory compliance, and upholding robust corporate governance. For instance, in 2024, companies in the infrastructure sector often allocate a notable portion of their budget to these external experts to manage the complexities of deal structuring and ongoing legal obligations. Expert advice is particularly critical for large-scale infrastructure projects and transactions, where intricate financial and legal frameworks demand specialized knowledge.

These expenditures are not merely operational; they are strategic investments that safeguard the company's integrity and facilitate growth. Maintaining high standards of financial reporting and operating within established legal parameters are paramount for investor confidence and long-term sustainability. The need for specialized advice intensifies during periods of significant corporate activity, such as the acquisition of new data centers or fiber networks, common for Digital 9.

- Legal Fees: Crucial for contract negotiation, M&A due diligence, and regulatory filings.

- Accounting & Audit Fees: Essential for financial reporting accuracy and compliance with accounting standards.

- Advisory Services: Includes financial advisors for M&A, strategic consultants, and specialized technical advisors.

- Regulatory Compliance Costs: Fees associated with meeting industry-specific regulations and reporting requirements.

5

Digital 9 Infrastructure's cost structure includes essential administrative and listing expenses. These encompass stock exchange listing fees, company secretarial services, and general overheads necessary for operating as a publicly traded investment trust. For instance, in 2024, maintaining a listing on exchanges like Euronext Growth can incur annual fees ranging from €5,000 to €20,000, depending on the exchange and market capitalization. Efficient management of these fixed costs is crucial for profitability.

These administrative outlays are vital for ensuring compliance and transparency, key elements for investor confidence. They support the ongoing operations and reporting requirements of a public entity.

- Stock Exchange Listing Fees: Costs associated with being listed on public markets.

- Company Secretarial Services: Fees for professional services ensuring regulatory compliance and corporate governance.

- General Overheads: Operational expenses including office rent, utilities, and salaries for administrative staff.

- Compliance and Reporting: Costs related to audits, legal counsel, and financial reporting to regulatory bodies.

Digital 9 Infrastructure's cost structure is heavily influenced by investment management fees, which were £14.4 million for the year ending December 31, 2023. Financing costs, primarily interest expenses, also represent a substantial outlay, totaling £117.2 million in 2023, reflecting the company's leveraged growth strategy. Operational expenses at the portfolio company level, such as power consumption for data centers, are indirectly borne by the trust and are critical for profitability.

Professional fees, including legal, accounting, and advisory services, are recurring costs vital for M&A, compliance, and governance. Administrative and listing expenses, such as stock exchange fees, are also essential for public operation. For example, maintaining a listing on Euronext Growth in 2024 can cost €5,000 to €20,000 annually.

| Cost Category | 2023 (£ million) | Notes |

| Investment Management Fees | 14.4 | Fees paid to external managers like Triple Point. |

| Financing Costs | 117.2 | Interest expenses on debt financing acquisitions and operations. |

| Professional Fees | [Data Not Explicitly Provided for 2023/2024] | Includes legal, accounting, audit, and advisory services. |

| Administrative & Listing Fees | [Data Not Explicitly Provided for 2023/2024] | Stock exchange fees, company secretarial, general overheads. |

Revenue Streams

Digital 9 Infrastructure plc primarily generates revenue through dividends and distributions from its operational digital infrastructure assets, including data centers and fiber networks. These payments are essentially the profits flowing from their underlying businesses.

In 2023, Digital 9 Infrastructure plc reported total income of £103.6 million, a significant portion of which was derived from these portfolio company distributions. This income is crucial for the company's ability to provide returns to its shareholders.

Digital 9 Infrastructure generates revenue through capital gains realized from the strategic sale of digital infrastructure assets. For instance, in 2023, the company completed the sale of its stake in a European data center portfolio, realizing a substantial capital gain that boosted its overall financial performance. These opportunistic disposals are a key component of their value-creation strategy.

Digital 9 Infrastructure plc's third revenue stream is derived indirectly from its portfolio companies' operational activities. These companies generate income through rental fees for data center space, service charges for managed services, and connectivity fees for network access. For instance, in 2023, the company's portfolio companies experienced strong demand for their services, contributing to the overall financial health that underpins Digital 9's distributions.

Revenue Stream 4

Digital 9 Infrastructure earns investment income from its cash reserves. These funds are typically held in short-term deposits or other secure, low-risk financial instruments, offering a modest but consistent addition to overall revenue. Prudent treasury management is key to maximizing returns from these balances.

For example, as of December 31, 2023, Digital 9 Infrastructure reported cash and cash equivalents of £26.8 million. While this specific figure doesn't break down investment income separately, it represents the capital available for such purposes, contributing to the trust's financial stability and supplementing its primary income sources.

- Investment Income: Earnings generated from the trust's cash holdings.

- Low-Risk Instruments: Funds are placed in short-term deposits or similar secure assets.

- Supplementary Revenue: This stream adds to the overall financial performance, though typically smaller in scale.

- Cash Management: Optimal returns are achieved through careful and strategic management of cash balances.

Revenue Stream 5

Performance fees represent a variable revenue stream for Digital 9 Infrastructure, directly linked to the investment manager's success in achieving specific financial targets. These fees are earned when the trust surpasses predetermined benchmarks or return hurdles, aligning the manager's incentives with maximizing shareholder value and capital appreciation.

For instance, if Digital 9 Infrastructure's total shareholder return exceeds a certain percentage in a given year, a performance fee might be triggered. This structure encourages proactive management and strategic decision-making aimed at optimizing portfolio performance and generating robust returns, as seen in the broader infrastructure investment sector.

- Performance Fees: Tied to exceeding investment benchmarks and return hurdles.

- Incentive Alignment: Motivates investment managers to maximize shareholder returns.

- Variable Revenue: Dependent on the trust's financial performance and capital appreciation.

- Sector Practice: Common in infrastructure funds to reward successful investment strategies.

Digital 9 Infrastructure plc's revenue is primarily generated through dividends and distributions from its operational digital infrastructure assets, such as data centers and fiber networks. These distributions represent the profits flowing from their underlying businesses.

The company also realizes revenue from capital gains through the strategic sale of assets. For example, in 2023, Digital 9 Infrastructure completed the sale of its stake in a European data center portfolio, generating a significant capital gain.

Additionally, Digital 9 Infrastructure earns investment income from its cash reserves, which are typically held in low-risk financial instruments. As of December 31, 2023, the company reported £26.8 million in cash and cash equivalents, which contributes to its overall financial stability.

Performance fees are a variable revenue stream, triggered when the investment manager exceeds specific financial targets, aligning their incentives with shareholder value maximization.

| Revenue Stream | Description | 2023 Data/Example |

|---|---|---|

| Portfolio Company Distributions | Dividends and profits from operational digital infrastructure assets. | Major contributor to total income of £103.6 million reported in 2023. |

| Capital Gains | Profits from the strategic sale of infrastructure assets. | Realized from the sale of a European data center portfolio in 2023. |

| Investment Income | Earnings from cash reserves held in low-risk instruments. | Supplemented overall financial performance from £26.8 million in cash and equivalents (as of Dec 31, 2023). |

| Performance Fees | Variable fees earned when investment targets are exceeded. | Tied to achieving specific financial benchmarks and return hurdles. |

Business Model Canvas Data Sources

The Digital 9 Infrastructure Business Model Canvas is built using a blend of market intelligence, operational data from existing infrastructure, and financial projections. These sources ensure each canvas block is filled with accurate, up-to-date information relevant to the digital infrastructure sector.