Digital 9 Infrastructure PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Digital 9 Infrastructure Bundle

Unlock critical insights into the external forces shaping Digital 9 Infrastructure's future with our comprehensive PESTLE analysis. Understand the political, economic, social, technological, legal, and environmental factors influencing its growth and challenges. This expert-crafted report is your key to informed strategic planning and investment decisions. Download the full version now and gain a significant competitive advantage.

Political factors

Governments worldwide are prioritizing digital infrastructure, viewing it as a cornerstone for national competitiveness and economic development. This recognition translates into tangible support, with many nations offering incentives like tax breaks and direct subsidies to spur investment in critical areas such as data centers and high-speed broadband networks. For instance, the European Union's Digital Decade policy aims to ensure widespread gigabit connectivity by 2030, backed by significant public funding initiatives.

This governmental push is intrinsically linked to broader national strategies focused on digital sovereignty and fostering technological independence. By encouraging domestic development and deployment of digital assets, countries aim to reduce reliance on foreign technology providers and secure their digital future. Such proactive policy environments can substantially de-risk and enhance the financial attractiveness of digital infrastructure projects, making them more appealing to private capital.

Rising geopolitical tensions, such as ongoing conflicts in Eastern Europe and the Middle East, directly threaten the stability of global supply chains for digital infrastructure components. These disruptions can lead to increased costs and delays in building out new data centers and network capacity. For instance, the semiconductor supply chain, critical for digital infrastructure, faced significant strain in 2023 due to these geopolitical factors, with lead times for certain chips extending by over a year.

The drive for digital sovereignty is reshaping how nations approach data and technology. Countries like China and India are implementing stringent data localization laws, requiring data generated within their borders to be stored domestically. This trend, evident in policies enacted throughout 2024, forces international digital infrastructure providers to invest in local data centers and cloud regions, potentially fragmenting the global digital landscape and increasing operational complexity.

This focus on digital sovereignty is also spurring significant investment in national digital infrastructure. In 2024, governments worldwide committed billions to bolstering domestic cloud capabilities and cybersecurity defenses, aiming to reduce reliance on foreign technology. For example, the European Union's GAIA-X initiative, designed to create a secure and federated data infrastructure, continues to attract substantial public and private funding, reflecting a broader trend of nationalizing digital resources.

The UK's regulatory environment for investment trusts offers a degree of flexibility, as evidenced by temporary exemptions from certain EU-inherited cost disclosure rules. This adjustment allows for more bespoke regulations, potentially easing reporting burdens for trusts.

Despite these exemptions, firms like Digital 9 Infrastructure must still adhere to overarching regulations such as the Consumer Duty, ensuring fair treatment and clear communication with investors. This dual focus on tailored flexibility and fundamental consumer protection shapes the operational landscape.

National Security Concerns over Critical Infrastructure

Governments globally are increasing their oversight of foreign investment in critical digital infrastructure, driven by national security imperatives. This heightened scrutiny can significantly impact mergers, acquisitions, and divestments for entities like Digital 9 Infrastructure, especially concerning assets vital to national operations. For instance, in 2024, several countries have reviewed or blocked foreign bids for telecommunications and data center assets citing security risks.

These concerns directly influence the investment climate for companies managing essential digital assets. The potential for state-sponsored cyber threats or data espionage through control of subsea cables or national data networks leads to more stringent regulatory approval processes. This can translate into longer deal timelines and increased compliance costs for Digital 9 Infrastructure.

The implications for Digital 9 Infrastructure include:

- Increased regulatory hurdles for cross-border transactions involving critical infrastructure.

- Potential for divestment orders if existing foreign ownership is deemed a national security risk.

- A more cautious approach from international investors due to perceived geopolitical risks.

- Greater emphasis on demonstrating robust security protocols and data sovereignty measures.

Policy Stability and Predictability

Policy stability is crucial for digital infrastructure investments. In 2024, many governments are focusing on creating clearer regulatory frameworks for the digital economy, aiming to attract investment. For instance, the European Union's Digital Decade policy aims for widespread 5G coverage and gigabit connectivity by 2030, signaling a commitment to predictable growth in digital infrastructure.

Frequent policy shifts, however, can create significant headwinds. Changes in data localization laws or net neutrality regulations, for example, can disrupt business models and increase operational costs for digital infrastructure providers. The uncertainty generated by such shifts directly influences investor confidence and the willingness to commit capital to long-term projects.

Consider these impacts:

- Regulatory Uncertainty: Unpredictable changes in data privacy laws or cybersecurity mandates can lead to increased compliance costs and operational disruptions for digital infrastructure operators.

- Investment Risk: Policy volatility directly affects the perceived risk of investing in digital infrastructure, potentially leading to higher capital costs or a reluctance to invest in certain markets.

- Market Access: Shifting government stances on foreign investment and market access can create barriers for international players looking to build or operate digital infrastructure, impacting competition and innovation.

Governments are increasingly viewing digital infrastructure as a strategic national asset, driving policy that supports its expansion. This includes significant public funding and incentives aimed at boosting connectivity and data capabilities, as seen in the EU's Digital Decade targets for 2030. The push for digital sovereignty also means countries are enacting data localization laws, compelling providers to build local infrastructure, a trend that intensified through 2024.

Geopolitical tensions have also become a major political factor, disrupting supply chains for essential components like semiconductors, which saw lead times extend by over a year in 2023. Heightened national security concerns are leading to greater scrutiny of foreign investment in critical digital infrastructure, with several countries reviewing or blocking foreign bids for telecommunications and data center assets in 2024 due to security risks.

Policy stability is paramount, yet frequent shifts in regulations, such as data privacy or net neutrality rules, can create uncertainty and increase compliance costs for operators. This regulatory volatility directly impacts investor confidence and the cost of capital for long-term digital infrastructure projects.

What is included in the product

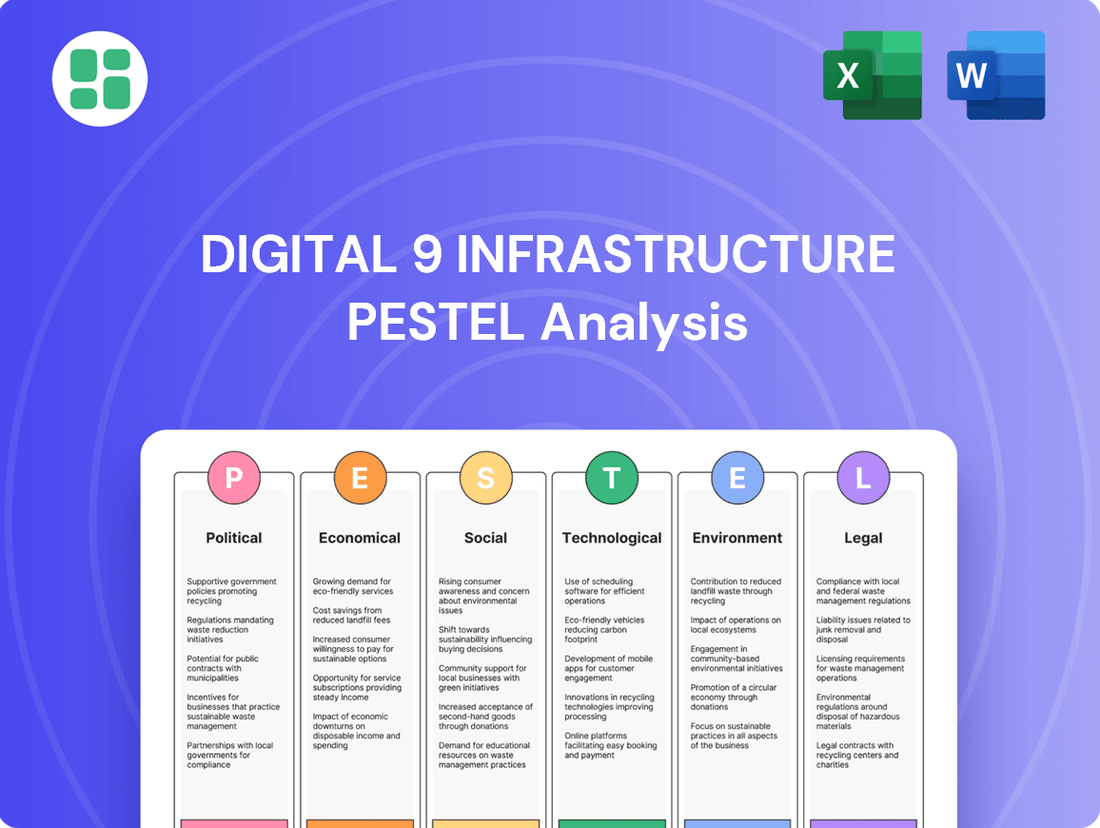

This PESTLE analysis provides a comprehensive examination of the external macro-environmental factors impacting the Digital 9 Infrastructure, detailing how Political, Economic, Social, Technological, Environmental, and Legal forces create both challenges and avenues for growth.

It offers actionable insights for stakeholders to navigate the complex landscape and develop robust strategies for the digital infrastructure sector.

Provides a concise version that can be dropped into PowerPoints or used in group planning sessions, offering immediate insights into the Digital 9 Infrastructure's external landscape to proactively address potential challenges.

Economic factors

Fluctuations in global interest rates directly influence the cost of financing for large-scale digital infrastructure projects. For instance, the Bank of England kept its base rate at 5.25% through early 2024, a level that significantly increases borrowing expenses for companies like Digital 9 Infrastructure.

Elevated interest rates can make debt financing more expensive, potentially impacting the feasibility of new developments and leading to downward pressure on the valuations of existing digital assets. This is a critical consideration for investment trusts managing a portfolio of such infrastructure.

Inflationary pressures significantly impact the operational costs for digital infrastructure providers. Rising energy prices, for instance, directly increase the expenses associated with powering data centers, a critical component of digital infrastructure. In the US, electricity prices for industrial users saw a notable increase, contributing to higher operational overheads.

While digital infrastructure companies often have revenue streams tied to inflation, such as through long-term contracts with escalation clauses, the lag and magnitude of cost increases can still squeeze profit margins. This dynamic can affect the overall profitability and the returns investors expect from these essential digital assets.

Global data consumption is skyrocketing, with projections indicating a surge to over 290 zettabytes annually by 2026, a significant leap from the 100 zettabytes consumed in 2020. This exponential growth is directly attributable to the widespread adoption of cloud computing, artificial intelligence, the Internet of Things (IoT), and the ongoing rollout of 5G networks.

This relentless demand for digital infrastructure assets, including data centers, subsea cables, and wireless networks, remains a robust pillar for long-term investment. For instance, the global data center market size was valued at approximately $275 billion in 2023 and is expected to reach over $500 billion by 2028, demonstrating sustained investor confidence despite broader economic uncertainties.

Asset Valuation and Market Sentiment

Market sentiment heavily impacts digital infrastructure asset valuations, especially as investors weigh the appeal of less liquid holdings against broader economic shifts. Digital 9 Infrastructure, for instance, saw its Net Asset Value (NAV) adjusted downwards significantly in its latest reporting period. This markdown, occurring in early 2024, directly reflects prevailing market conditions and the outcomes of asset sales, underscoring how external economic factors translate into tangible valuation changes for such specialized companies.

The adjustments to Digital 9 Infrastructure's NAV are a clear indicator of how market sentiment can recalibrate asset values. For example, the company reported a substantial NAV markdown in its interim report for the six months ending June 30, 2024, driven by revised valuations of its portfolio. This highlights the sensitivity of digital infrastructure assets to investor confidence and the broader economic outlook.

- NAV Adjustment: Digital 9 Infrastructure's Net Asset Value (NAV) experienced a significant markdown in early 2024, reflecting updated market valuations.

- Market Conditions Influence: Prevailing economic conditions and investor appetite for illiquid assets directly influenced these valuation adjustments.

- Asset Sale Impact: Recent asset sales by Digital 9 Infrastructure have provided concrete data points that contributed to the revised NAV figures.

Capital Allocation and Divestment Strategy

Digital 9 Infrastructure's economic strategy centers on a managed wind-down, aiming to systematically realize asset value and return capital to shareholders. This approach prioritizes strategic divestments, exemplified by the recent sales of Aqua Comms and EMIC-1, alongside ongoing refinancing initiatives.

The success of this wind-down hinges on the precise timing and optimal pricing of these asset disposals. For instance, the sale of Aqua Comms, completed in December 2023, generated approximately $220 million, demonstrating the company's commitment to this strategy.

- Managed Wind-Down: Focus on orderly asset realization to maximize shareholder value.

- Strategic Divestments: Sales of assets like Aqua Comms and EMIC-1 are key components.

- Capital Return: Refinancing efforts are in place to facilitate capital repatriation to investors.

- Timing and Pricing: Crucial factors for the successful execution of the divestment strategy.

Economic factors significantly shape the digital infrastructure landscape for Digital 9 Infrastructure. Rising interest rates, such as the Bank of England's 5.25% base rate through early 2024, directly increase borrowing costs for capital-intensive projects. Simultaneously, inflationary pressures, evident in rising industrial electricity prices in the US, elevate operational expenses, potentially impacting profitability even with inflation-linked revenue.

Despite these challenges, the insatiable global demand for digital services, projected to reach over 290 zettabytes annually by 2026, underpins the long-term value of digital infrastructure assets. The data center market, valued at approximately $275 billion in 2023 and expected to exceed $500 billion by 2028, illustrates this sustained growth and investor interest.

Market sentiment, however, can lead to significant valuation adjustments, as seen with Digital 9 Infrastructure's NAV markdown in early 2024, influenced by prevailing economic conditions and asset sale outcomes like the $220 million sale of Aqua Comms in December 2023.

| Economic Factor | Impact on Digital 9 Infrastructure | Key Data/Example |

| Interest Rates | Increased cost of debt financing, impacting project feasibility and valuations. | Bank of England base rate at 5.25% (early 2024). |

| Inflation | Higher operational costs (e.g., energy), potentially squeezing profit margins. | Rising US industrial electricity prices. |

| Market Sentiment | Valuation adjustments of digital infrastructure assets based on economic outlook. | NAV markdown in early 2024; Aqua Comms sale ($220M, Dec 2023). |

| Data Demand | Robust long-term demand for infrastructure assets. | Global data consumption to exceed 290 ZB by 2026; Data center market $275B (2023) to $500B+ (2028). |

Full Version Awaits

Digital 9 Infrastructure PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use for your Digital 9 Infrastructure PESTLE Analysis. This comprehensive report details the Political, Economic, Social, Technological, Legal, and Environmental factors impacting this critical sector. You can trust that the insights and structure you see are precisely what you'll gain access to.

Sociological factors

Societies are increasingly embracing digital lifestyles, with remote work, online learning, and e-commerce becoming commonplace. This pervasive shift fuels a constant demand for dependable digital connectivity. For instance, in 2024, global internet penetration reached 66%, with mobile internet users accounting for over 5.3 billion people, highlighting the critical need for expanded infrastructure.

The growing reliance on digital services means that robust and reliable digital infrastructure is no longer a luxury but a necessity. This fundamental societal trend directly supports the sustained growth and long-term viability of digital infrastructure investments. By 2025, it's projected that over 70% of the global population will be online, further solidifying this trend.

Societal expectations for instant gratification drive a significant demand for low-latency and high-bandwidth digital services. Consumers and businesses alike anticipate seamless, real-time access to information, entertainment, and communication, pushing infrastructure providers to constantly innovate.

This burgeoning demand directly translates into a need for continuous investment in and expansion of critical digital infrastructure. Think fiber optic networks, advanced 5G wireless deployments, and increased data center capacity. For example, global mobile data traffic is projected to grow significantly, reaching an estimated 292 exabytes per month by 2026, according to Cisco’s Annual Internet Report, underscoring the need for robust networks.

Bridging the digital divide remains a crucial societal focus, with ongoing efforts to extend internet access to rural and remote communities. For instance, in the US, the Broadband Equity, Access, and Deployment (BEAD) program, part of the Infrastructure Investment and Jobs Act, allocated $42.45 billion in 2023 to expand broadband access, aiming to connect millions of unserved and underserved households.

Investing in infrastructure for these areas not only addresses social equity but also unlocks new market opportunities for digital service providers. These government-backed initiatives, such as the BEAD program, are designed to foster economic development and ensure more equitable participation in the digital economy, aligning with broader societal objectives for inclusivity.

Privacy Concerns and Data Trust

Growing public awareness about data privacy significantly shapes how digital infrastructure companies, like those in Digital 9, operate. Concerns over how personal information is collected, stored, and used are paramount, influencing regulatory landscapes and consumer choices.

Maintaining public trust is no longer a soft metric; it's a critical business imperative. For instance, a 2024 survey indicated that over 70% of consumers are more likely to choose services that clearly demonstrate strong data protection. This directly impacts operational standards, necessitating robust security investments and transparent data handling policies.

The implications for Digital 9 infrastructure are substantial:

- Increased Compliance Costs: Adhering to evolving data protection regulations like GDPR and CCPA requires ongoing investment in compliance frameworks and personnel.

- Reputational Risk: Data breaches or perceived mishandling of data can lead to significant reputational damage, impacting customer acquisition and retention.

- Demand for Transparency: Users expect clear communication about data usage, pushing infrastructure providers to adopt more open practices.

- Investment in Security Technologies: Companies must allocate capital towards advanced cybersecurity measures to safeguard sensitive user information.

Remote Work and Hybrid Models

The ongoing shift towards remote and hybrid work has profoundly reshaped how we use data and networks. This societal trend means that reliable, high-speed internet at home is no longer a luxury but a necessity, significantly influencing the demand for and the very design of digital infrastructure. For instance, in early 2024, a significant portion of the workforce, estimated to be around 30-40% in many developed economies, continued to operate under some form of hybrid or fully remote arrangement, a stark contrast to pre-pandemic levels.

This sustained evolution in work patterns directly translates into increased demand for robust residential broadband services and consistent enterprise connectivity solutions. Companies are investing more in their employees' home office setups, and internet service providers are feeling the pressure to upgrade their networks to handle this persistent, distributed data load. By the end of 2024, global fixed broadband subscriptions were projected to exceed 1.2 billion, with a notable portion of this growth attributed to increased usage and demand from home-based workers.

The implications for digital infrastructure are substantial:

- Increased Demand for Bandwidth: Residential internet speeds and capacity requirements have escalated, pushing providers to offer faster and more reliable connections.

- Network Resilience Focus: Downtime is now more costly for individuals working from home, leading to a greater emphasis on network stability and redundancy.

- Enterprise Connectivity Evolution: Businesses are re-evaluating their connectivity strategies to ensure seamless and secure access for a dispersed workforce, often investing in SD-WAN and cloud-based solutions.

- Geographic Distribution of Traffic: Data traffic is less concentrated in central business districts and more spread out, requiring infrastructure upgrades in suburban and rural areas.

Societal expectations for instant gratification drive a significant demand for low-latency and high-bandwidth digital services, pushing infrastructure providers to innovate. By 2025, over 70% of the global population is projected to be online, underscoring the need for robust networks, with global mobile data traffic expected to reach 292 exabytes per month by 2026.

Bridging the digital divide remains a crucial societal focus, with initiatives like the US BEAD program allocating $42.45 billion to expand broadband access, aiming to connect millions of unserved households and foster economic development.

Growing public awareness about data privacy significantly shapes infrastructure operations, with over 70% of consumers favoring services with strong data protection, necessitating robust security investments and transparent data handling.

The sustained shift to remote work has made reliable, high-speed internet a necessity, driving demand for residential broadband and enterprise connectivity upgrades, with global fixed broadband subscriptions projected to exceed 1.2 billion by the end of 2024.

| Sociological Factor | Description | 2024/2025 Data Point |

|---|---|---|

| Digital Lifestyle Adoption | Increasing reliance on digital services for work, learning, and commerce. | Global internet penetration at 66% in 2024; over 5.3 billion mobile internet users. |

| Demand for Instant Gratification | Expectation of seamless, real-time access to digital content and services. | Projected 70%+ global online population by 2025; mobile data traffic to reach 292 EB/month by 2026. |

| Digital Divide Awareness | Societal focus on equitable internet access for all communities. | US BEAD program allocated $42.45 billion in 2023 for broadband expansion. |

| Data Privacy Concerns | Heightened public awareness and demand for secure and transparent data handling. | Over 70% of consumers prefer services with strong data protection (2024 survey). |

| Remote/Hybrid Work Impact | Shift in work patterns necessitates robust home and distributed connectivity. | 30-40% workforce in developed economies operating remotely/hybrid in early 2024; >1.2 billion fixed broadband subscriptions globally by end of 2024. |

Technological factors

The continued global expansion of 5G networks is a significant catalyst for infrastructure spending, promising vastly improved wireless speeds and reduced latency. This expansion necessitates substantial investment in new base stations and the strategic densification of existing networks. For instance, by the end of 2024, it's anticipated that over 3 million 5G base stations will be deployed globally, a figure projected to climb to over 7 million by the end of 2025, according to industry reports.

The rapid advancement and adoption of Artificial Intelligence (AI) are fundamentally reshaping the digital infrastructure landscape. AI applications, from machine learning to deep learning, demand massive computational power, directly translating into a heightened need for data center capacity. This surge is evident in the projected growth of AI-specific workloads, which are expected to consume a substantial portion of global data center energy by 2025.

Cloud computing continues its robust expansion, further fueling data center demand. As more businesses and individuals rely on cloud services for storage, processing, and applications, the underlying physical infrastructure must scale accordingly. This trend is supported by market data indicating consistent double-digit growth in the cloud services market, underscoring the ongoing need for more advanced and power-efficient data centers.

The convergence of AI and cloud computing necessitates a significant increase in hyperscale data center construction and the development of sophisticated cooling technologies. AI's intensive processing requirements generate substantial heat, prompting innovation in liquid cooling and other advanced thermal management solutions. For instance, the power density of AI-focused servers can be up to three times higher than traditional IT equipment, creating new operational challenges and opportunities for data center providers.

Continuous technological advancements in fiber optics, like coherent optical transmission systems and higher fiber counts, are significantly boosting the capacity and efficiency of both subsea and terrestrial networks. These innovations are absolutely vital for keeping pace with the ever-increasing demand for bandwidth and ensuring the long-term performance of digital backbone infrastructure.

For instance, the adoption of technologies enabling 400 Gigabit Ethernet (GbE) and the ongoing development towards 800 GbE and even 1.6 Terabit Ethernet (TbE) per wavelength are directly supported by these fiber optic improvements. This means Digital 9 Infrastructure's assets are becoming more capable of handling the massive data flows required by cloud computing, 5G services, and the growing Internet of Things (IoT) ecosystem, which is projected to reach over 29 billion connected devices by 2030.

Cybersecurity Technologies and Threats

The evolving landscape of cyber threats demands constant upgrades to cybersecurity defenses. For Digital 9, protecting its critical digital infrastructure, including data centers and networks, is essential for uninterrupted operations and client confidence. The financial impact of a breach can be substantial, with the average cost of a data breach reaching $4.45 million globally in 2024, according to IBM’s Cost of a Data Breach Report.

This necessitates ongoing investment in advanced security solutions. For instance, the global cybersecurity market was projected to reach $270 billion in 2024, highlighting the scale of investment required.

- Increased Sophistication of Threats: Ransomware attacks, phishing schemes, and state-sponsored cyber warfare are becoming more advanced, requiring multi-layered security approaches.

- Data Protection Mandates: Regulations like GDPR and CCPA impose strict requirements on data handling and security, with significant penalties for non-compliance.

- Investment in AI and Machine Learning: Cybersecurity firms are increasingly leveraging AI and ML for threat detection and response, a trend Digital 9 must align with.

- Cloud Security Challenges: As Digital 9 likely utilizes cloud services, ensuring the security of these environments against new vulnerabilities is a continuous technological imperative.

Energy Efficiency and Sustainable Technology

Technological advancements are heavily geared towards boosting data center and network component energy efficiency. This focus is driven by a dual need: minimizing environmental footprints and slashing operational expenses. For instance, the adoption of advanced cooling systems, such as liquid cooling, is on the rise, offering significantly better thermal management than traditional air cooling. This innovation is crucial as data centers consume a substantial amount of electricity, with global data center energy consumption projected to reach over 1,000 terawatt-hours annually by 2026, a significant portion of global electricity demand.

The integration of renewable energy sources into data center operations is no longer a niche trend but a critical strategy for sustainability and regulatory compliance. Companies are increasingly investing in on-site solar and wind power, or securing power purchase agreements for green energy. This shift is essential as governments worldwide are implementing stricter environmental regulations, pushing businesses towards more sustainable operational models. For example, by 2024, the EU's Digital Decade targets aim for a significant increase in renewable energy usage for data centers.

Key technological drivers in this area include:

- Liquid Cooling Solutions: Direct-to-chip and immersion cooling technologies are proving more effective at dissipating heat, allowing for denser server configurations and reduced energy consumption for cooling.

- AI-Powered Energy Management: Artificial intelligence is being employed to optimize power usage within data centers by intelligently managing workloads, cooling systems, and power distribution based on real-time demand.

- High-Efficiency Hardware: Manufacturers are continuously developing more energy-efficient processors, memory, and networking equipment, reducing the power draw per unit of performance.

- Renewable Energy Integration: Innovations in energy storage and smart grid connectivity enable data centers to more effectively utilize and integrate intermittent renewable energy sources like solar and wind.

The ongoing evolution of network technologies, particularly the widespread deployment of 5G and the development of 6G, is a primary technological driver for infrastructure. These advancements necessitate significant investment in upgrading and expanding network capacity, including fiber optic backbones and edge computing facilities. By 2025, the global 5G subscriber base is expected to exceed 1.5 billion, underscoring the demand for robust infrastructure.

Artificial Intelligence (AI) and machine learning are transforming infrastructure needs by demanding more processing power and specialized hardware, leading to increased data center density and advanced cooling solutions. The AI chip market alone was projected to reach over $100 billion by 2025, highlighting the scale of investment in this area.

The increasing reliance on cloud computing and the growth of the Internet of Things (IoT) continue to drive demand for scalable and efficient data storage and processing. Projections indicate that by 2025, IoT devices will generate over 100 zettabytes of data annually, requiring substantial infrastructure to manage.

The cybersecurity landscape is a critical technological factor, with continuous upgrades needed to protect digital assets from increasingly sophisticated threats. The average cost of a data breach globally reached $4.45 million in 2024, emphasizing the importance of robust security investments.

| Technology Trend | Impact on Digital Infrastructure | Key Data/Projections (2024-2025) |

|---|---|---|

| 5G/6G Deployment | Increased demand for fiber, small cells, and edge computing; higher bandwidth requirements. | Global 5G subscribers projected to exceed 1.5 billion by 2025. |

| Artificial Intelligence (AI) & Machine Learning | Higher data center power density, demand for specialized AI hardware, advanced cooling needs. | AI chip market projected to exceed $100 billion by 2025. |

| Cloud Computing & IoT Growth | Expansion of hyperscale data centers, increased need for data storage and processing capacity. | IoT devices to generate over 100 zettabytes of data annually by 2025. |

| Cybersecurity Advancements | Continuous investment in advanced security solutions for threat detection and data protection. | Average cost of a data breach reached $4.45 million globally in 2024. |

Legal factors

The digital infrastructure sector faces a dynamic and intricate web of global data protection and privacy regulations, including the EU's GDPR and the US's CCPA. These laws dictate how companies manage, store, and process user data, directly influencing operational strategies and investment in compliance infrastructure.

Adhering to these regulations necessitates substantial financial commitment towards robust data governance frameworks, advanced security protocols, and clear, transparent data handling policies. For instance, GDPR fines can reach up to 4% of global annual turnover or €20 million, whichever is higher, underscoring the significant financial risk of non-compliance.

Spectrum allocation and licensing are foundational to wireless network viability. In 2024, regulatory bodies globally continue to refine these frameworks, impacting infrastructure providers like Digital 9's Arqiva. For instance, the UK's Ofcom is actively managing spectrum auctions and reviews, influencing the cost and availability of essential frequencies for mobile and broadcast services.

Changes in licensing terms, such as duration or usage restrictions, directly affect the long-term investment calculus for wireless infrastructure. These shifts can alter the competitive dynamics, potentially increasing operational costs or opening new market opportunities for companies holding or seeking spectrum licenses.

Antitrust and competition laws are crucial for digital infrastructure, especially where competition is naturally limited, such as in national broadcasting or securing subsea cable landing rights. Regulatory bodies actively monitor these sectors to guarantee fair access and to prevent any monopolistic tendencies from taking hold.

These regulations directly impact the market's structure and can significantly influence merger and acquisition (M&A) activities. For instance, in 2024, the European Commission continued its scrutiny of digital infrastructure deals, with several proposed mergers in the telecommunications and data center sectors undergoing in-depth reviews to assess their potential impact on competition.

Environmental Regulations and Energy Efficiency Mandates

Environmental regulations are tightening, especially for data centers, focusing on energy use and carbon output. These laws are now legally enforceable, meaning non-compliance carries significant consequences.

For example, new European Union rules mandate that data centers track and report their Power Usage Effectiveness (PUE) and boost their use of renewable energy sources. This directly affects how data centers operate and what investments they need to make to stay compliant.

These legal shifts mean that companies like Digital 9 Infrastructure must adapt their infrastructure to meet higher energy efficiency standards. Failure to do so could result in fines or operational restrictions, impacting profitability and market position.

- EU Data Act (2024): Focuses on data governance and security, indirectly influencing data center operational practices and energy management.

- Energy Performance of Buildings Directive (EPBD) recast (effective 2024/2025): While primarily for buildings, its principles on energy efficiency and reporting can extend to data center infrastructure, pushing for lower PUE ratios.

- National Carbon Emission Targets (e.g., UK's Net Zero by 2050): Data centers contribute to national emissions, making them subject to broader climate legislation that may impose stricter energy efficiency mandates or carbon pricing mechanisms.

Investment Trust Specific Regulations and Disclosure

Digital 9 Infrastructure, as a UK-listed investment trust, navigates a landscape shaped by the Financial Conduct Authority (FCA) and the Listing Rules. These regulations mandate strict adherence to corporate governance standards, transparent shareholder communication, and specific protocols for asset disposal. For instance, the trust must comply with rules regarding timely announcements of material information and the process for seeking shareholder approval for significant transactions.

Recent regulatory developments, such as those introduced by the FCA, have sought to streamline disclosure requirements for investment trusts, aiming for greater efficiency. However, compliance with overarching principles like the Consumer Duty, which emphasizes fair treatment and good outcomes for customers, remains a critical obligation, influencing how the trust communicates its offerings and manages investor relationships.

The trust's operations are further influenced by ongoing discussions and potential future regulatory changes impacting the digital infrastructure sector. For example, evolving data privacy laws and cybersecurity regulations could necessitate adjustments in operational practices and reporting, potentially impacting asset valuations and investment strategies.

- FCA Listing Rules: Digital 9 Infrastructure is subject to the FCA's Listing Rules, which govern its public offering and ongoing obligations as a listed entity.

- Corporate Governance: Adherence to the UK Corporate Governance Code is essential, covering board structure, remuneration, and audit committee responsibilities.

- Shareholder Communications: Regulations dictate the frequency and content of communications with shareholders, including annual and interim reports, and announcements of significant events.

- Asset Disposal Regulations: Specific rules apply to the disposal of material assets, often requiring shareholder consent and adherence to valuation and disclosure standards.

Legal frameworks significantly shape digital infrastructure operations, from data privacy mandates like GDPR, impacting how data is handled and secured, to spectrum allocation rules that determine wireless network viability. Antitrust laws also play a critical role, ensuring fair market access and preventing monopolies in sectors like subsea cables.

Environmental regulations are increasingly stringent, particularly for data centers, focusing on energy efficiency and carbon emissions, with directives like the EPBD recast influencing operational standards. For listed entities like Digital 9 Infrastructure, compliance with FCA Listing Rules and corporate governance codes is paramount, dictating transparency and shareholder communication protocols.

The EU Data Act, effective in 2024, alongside national net-zero targets, reinforces the need for sustainable practices, directly affecting infrastructure investments. For example, the UK's commitment to Net Zero by 2050 means data centers must improve energy efficiency, potentially increasing capital expenditure for upgrades.

Environmental factors

Data centers are massive energy consumers, directly impacting their carbon footprint and presenting a significant environmental hurdle for digital infrastructure. In 2024, global data center energy consumption is projected to reach approximately 1.5% of total worldwide electricity usage, a figure expected to climb as data demands intensify.

The burgeoning need for data storage and processing places mounting pressure on the digital sector to embrace sustainable energy solutions and energy-efficient technologies. By 2025, it's estimated that renewable energy sources will power a larger, though still minority, portion of data center operations, driven by regulatory pushes and corporate sustainability goals.

Digital 9 Infrastructure's physical assets, including subsea fiber optic cables and coastal data centers, face increasing threats from climate change. Rising sea levels, for instance, pose a direct risk to low-lying coastal infrastructure, potentially leading to operational disruptions. A 2024 report from the Intergovernmental Panel on Climate Change (IPCC) highlighted that coastal erosion rates are accelerating globally, directly impacting the stability of buried subsea cable landing points.

Extreme weather events, such as hurricanes and floods, also present significant risks. These events can cause physical damage to data centers, disrupt power supply, and damage terrestrial fiber optic networks. For example, in 2023, Hurricane Ian caused widespread power outages and physical damage to infrastructure in Florida, impacting connectivity for millions.

Mitigating these climate-related risks is paramount for ensuring the long-term resilience and operational continuity of Digital 9 Infrastructure's network. Proactive measures, such as investing in flood defenses for data centers and reinforcing cable landing stations, are essential. The company's 2024 sustainability report indicated a capital expenditure of £50 million allocated towards climate adaptation and resilience measures across its portfolio.

The relentless evolution of digital infrastructure, from servers to networking gear, generates substantial electronic waste. In 2024, the global e-waste volume is projected to reach 61.3 million metric tons, a stark reminder of the environmental footprint of technological advancement.

Adopting circular economy principles offers a crucial path forward for Digital 9. This involves prioritizing the responsible recycling, reuse, and refurbishment of hardware, thereby minimizing landfill waste and conserving valuable resources. Companies that champion these practices not only mitigate environmental impact but also unlock economic opportunities through resource recovery.

Renewable Energy Integration in Operations

Digital 9 Infrastructure, like other digital infrastructure providers, faces increasing pressure to integrate renewable energy into its operations, particularly for power-hungry data centers. This shift is driven by both a growing market imperative and regulatory mandates aimed at decarbonization.

Many jurisdictions are now implementing regulations that require a minimum percentage of renewable energy usage. For instance, by 2025, the European Union's Green Deal aims for a significant reduction in emissions, impacting energy-intensive industries like data centers. These regulations directly influence Digital 9's strategies for site selection, favoring locations with robust renewable energy infrastructure and influencing their energy procurement approaches.

- Regulatory Mandates: Growing number of regions implementing renewable energy quotas for data centers.

- Site Selection Impact: Preference for locations with access to green energy sources.

- Procurement Strategies: Increased focus on Power Purchase Agreements (PPAs) for renewables.

- Operational Costs: Potential for long-term cost stability with renewable energy investments.

Resource Scarcity and Water Usage

Data centers, especially those employing older cooling systems, can consume substantial amounts of water. This is a growing concern in areas already experiencing water shortages. For instance, a typical large data center can use millions of gallons of water annually for cooling.

As a result, sustainable water management is becoming a key environmental factor for Digital 9 Infrastructure. This includes implementing water-efficient cooling technologies and exploring alternative cooling methods to reduce reliance on traditional water-intensive processes.

- Water Consumption: Some estimates suggest that data centers can consume as much water as a small city.

- Cooling Technologies: Innovations like free cooling (using outside air) and liquid cooling are gaining traction to reduce water usage.

- Regional Impact: Regions with high water stress, such as parts of California or the Middle East, present greater challenges for data center water management.

- Efficiency Gains: Companies are investing in upgrades and new designs to improve water usage efficiency (WUE), aiming for lower water consumption per unit of computing power.

The digital infrastructure sector, including Digital 9 Infrastructure, faces increasing scrutiny regarding its environmental impact, particularly concerning energy consumption and e-waste. Data centers are significant energy users, with global consumption projected to hit around 1.5% of worldwide electricity usage in 2024, a figure expected to rise. This necessitates a strong focus on renewable energy adoption and energy-efficient technologies to meet sustainability goals and regulatory requirements.

Climate change poses direct physical risks to Digital 9's assets. Coastal facilities are vulnerable to rising sea levels and increased erosion, as evidenced by accelerating coastal erosion rates reported by the IPCC in 2024. Furthermore, extreme weather events like hurricanes can damage infrastructure and disrupt operations, as seen with Hurricane Ian in 2023, which caused widespread outages and physical damage in Florida.

The substantial volume of electronic waste generated by the sector, projected to reach 61.3 million metric tons globally in 2024, demands a shift towards circular economy principles. Digital 9's commitment to responsible recycling and hardware reuse is crucial for minimizing its environmental footprint and conserving resources.

Water consumption by data centers, especially for cooling, is another critical environmental factor, with large facilities using millions of gallons annually. This is particularly concerning in water-stressed regions. Digital 9 is investing in water-efficient cooling technologies and exploring alternatives to reduce its water footprint, aiming for improved water usage efficiency (WUE).

| Environmental Factor | 2024/2025 Data/Trend | Impact on Digital 9 Infrastructure | Mitigation Strategy |

|---|---|---|---|

| Energy Consumption | Global data center energy use ~1.5% of world electricity in 2024, increasing. | High operational costs, carbon footprint, regulatory pressure. | Investment in renewable energy (PPAs), energy-efficient cooling. |

| Climate Change Risks | Accelerating coastal erosion, increased extreme weather events. | Physical damage to subsea cables, coastal data centers; operational disruptions. | Flood defenses, reinforcing cable landing stations, climate adaptation investments (£50M in 2024). |

| Electronic Waste (E-waste) | Global e-waste projected at 61.3 million metric tons in 2024. | Environmental pollution, resource depletion. | Circular economy principles: hardware recycling, reuse, refurbishment. |

| Water Consumption | Large data centers use millions of gallons of water annually for cooling. | Strain on water resources in stressed regions, operational risks. | Water-efficient cooling technologies, alternative cooling methods, improving WUE. |

PESTLE Analysis Data Sources

Our Digital 9 Infrastructure PESTLE Analysis draws on a comprehensive blend of data from government regulatory bodies, international economic organizations, and leading technology research firms. This ensures our insights into political, economic, social, technological, legal, and environmental factors are robust and current.