Digital 9 Infrastructure Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Digital 9 Infrastructure Bundle

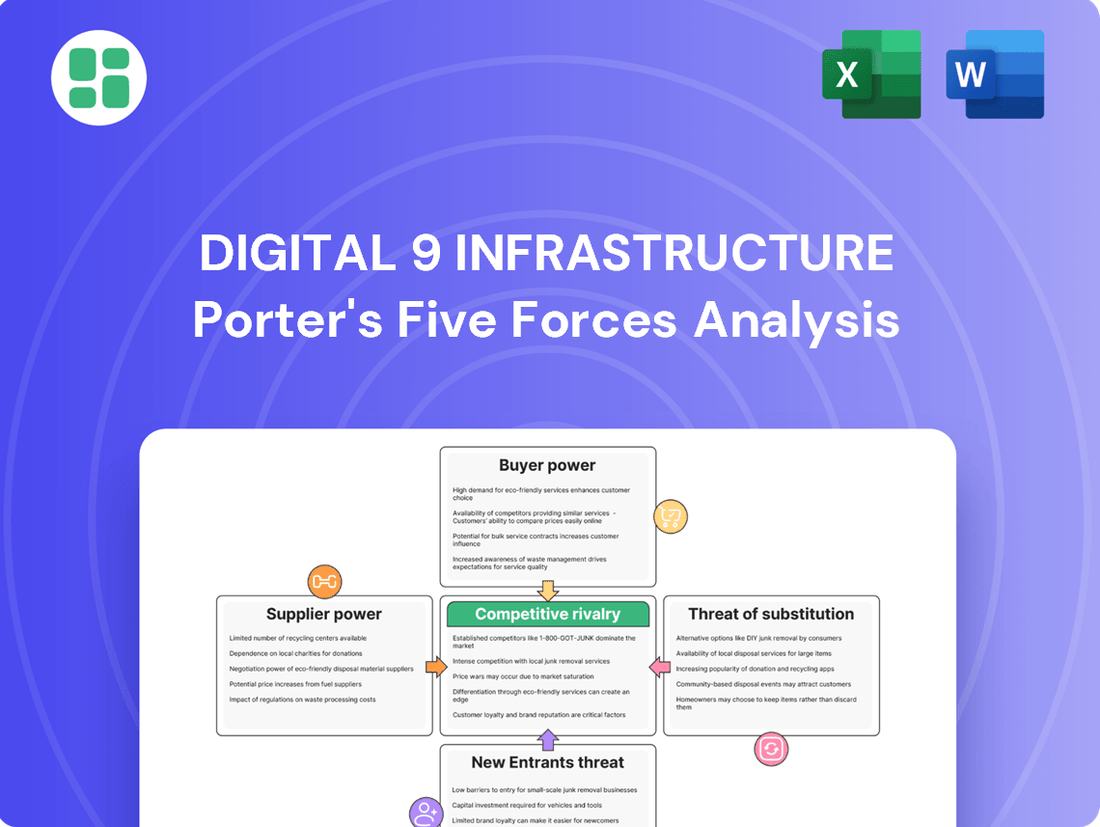

Digital 9 Infrastructure operates in a dynamic sector, facing moderate threats from new entrants and substitutes due to high capital requirements and specialized technology. Buyer power is also present, as large clients can negotiate terms, while supplier power is influenced by the availability of key components and skilled labor.

The complete report reveals the real forces shaping Digital 9 Infrastructure’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

Digital 9 Infrastructure's dependence on specialized equipment for its subsea fiber optic, data center, and wireless operations grants considerable leverage to its suppliers. These providers, often possessing unique, proprietary technologies developed through substantial R&D investments, face few competitors. For instance, the market for advanced subsea cable repeaters is highly concentrated, with a limited number of manufacturers capable of producing these critical components.

Strategic real estate and land owners hold significant bargaining power, especially for Digital 9 Infrastructure's assets like data centers and subsea cable landing stations. The availability of prime locations, particularly in dense urban or coastal areas, is scarce, giving these owners leverage in negotiations. For instance, securing land in key connectivity hubs can involve substantial upfront costs, potentially exceeding tens of millions of dollars for a single site, directly impacting project economics.

Developing and maintaining intricate digital infrastructure, like that managed by Digital 9 Infrastructure, hinges on a highly specialized workforce. This includes skilled engineers, network architects, and construction experts, whose expertise is not easily replicated.

The limited availability of these professionals can directly impact project costs and completion schedules. For instance, in 2024, the demand for cybersecurity engineers, a critical component of digital infrastructure, continued to outstrip supply, leading to higher salary expectations.

Consequently, specialized labor and engineering firms possess considerable bargaining power. They can command higher rates and favorable contract terms when bidding on large-scale digital infrastructure projects, as their unique skills are indispensable.

Energy and Power Providers

Energy and power providers hold significant sway over digital infrastructure firms like Digital 9 Infrastructure due to the immense electricity demands of data centers. Reliable and affordable power is non-negotiable for these operations.

In areas with strained energy grids or surging demand, utility companies can leverage their position. This can translate into higher electricity costs and potential roadblocks for expansion plans if power availability becomes a bottleneck. For instance, in 2024, the International Energy Agency reported that data centers, AI, and crypto mining could account for over 10% of global electricity demand by 2026, highlighting the critical nature of this supplier relationship.

- High Electricity Consumption: Data centers are major energy users, making power a primary operational cost.

- Regional Power Constraints: Limited energy infrastructure in certain locations amplifies supplier power.

- Cost Volatility: Fluctuations in energy prices directly impact profitability for digital infrastructure companies.

- Expansion Limitations: Insufficient power supply can restrict the growth and development of new facilities.

Regulatory and Permitting Bodies

Governmental and regulatory bodies, while not direct suppliers in the traditional sense, wield substantial bargaining power over Digital 9 Infrastructure. They control essential permits, licenses, and enforce compliance mandates that are critical for operation. For instance, in 2024, the average time to obtain a new telecommunications infrastructure permit in developed economies often exceeded six months, with significant variations and potential for delays based on local regulations.

These bodies can significantly influence project timelines and operational costs. Their decisions on environmental impact assessments, zoning laws, and spectrum allocation directly affect the feasibility and expense of deploying and maintaining digital infrastructure. Failure to comply with evolving regulations can lead to substantial fines or operational shutdowns, underscoring their leverage.

- Regulatory Hurdles: Obtaining necessary permits for new data centers or fiber optic network expansions can involve multiple agencies, each with its own requirements and review processes.

- Compliance Costs: Adherence to data privacy laws, cybersecurity standards, and environmental regulations adds to operational expenses, with compliance spending in the digital infrastructure sector projected to increase by 15-20% annually through 2025.

- Policy Shifts: Changes in government policy regarding net neutrality, digital taxation, or infrastructure investment can dramatically alter the operating environment and profitability for companies like Digital 9 Infrastructure.

- Permitting Delays: In 2024, some regions experienced an average increase of 10% in permitting application processing times for critical infrastructure projects due to staffing shortages or increased scrutiny.

Suppliers of highly specialized components for Digital 9 Infrastructure's subsea and data center operations hold significant bargaining power. This is due to the limited number of manufacturers capable of producing advanced equipment, such as subsea cable repeaters, and the substantial R&D required for these proprietary technologies. For instance, the market for these critical components is highly concentrated, with only a handful of global players.

Real estate owners in prime locations for data centers and subsea cable landing stations also possess considerable leverage. The scarcity of suitable sites, particularly in high-demand connectivity hubs, allows them to command premium prices. Securing a single strategic location in 2024 could involve acquisition costs in the tens of millions of dollars, directly impacting project viability.

The bargaining power of Digital 9 Infrastructure's suppliers is amplified by the critical nature of their products and services. For specialized equipment, the lack of readily available alternatives means Digital 9 Infrastructure must accept supplier terms or face significant project delays. Similarly, the scarcity of skilled labor, such as cybersecurity engineers, whose demand in 2024 continued to outpace supply, allows these professionals and their employing firms to negotiate higher compensation and favorable contract conditions.

Energy providers also exert substantial influence due to the immense electricity requirements of data centers. In 2024, the International Energy Agency highlighted that data centers, AI, and crypto mining could collectively represent over 10% of global electricity demand by 2026. This high consumption, coupled with regional power constraints and price volatility, gives utility companies significant leverage, potentially impacting Digital 9 Infrastructure's expansion plans and operational costs.

| Supplier Type | Bargaining Power Factors | Impact on Digital 9 Infrastructure | Example Data Point (2024) |

|---|---|---|---|

| Specialized Equipment Manufacturers | Proprietary technology, limited competition, high R&D costs | Higher component costs, potential supply chain delays | Concentrated market for subsea cable repeaters |

| Strategic Real Estate Owners | Scarcity of prime locations, high demand for connectivity hubs | Increased land acquisition costs, site selection constraints | Tens of millions of dollars for a single strategic site |

| Skilled Labor Providers (e.g., Cybersecurity Engineers) | High demand, limited supply of specialized expertise | Increased labor costs, potential project timeline extensions | Continued outstripping of demand by supply for cybersecurity roles |

| Energy Providers | High electricity consumption of data centers, regional power constraints, price volatility | Higher operational expenses, potential limitations on expansion | Data centers, AI, and crypto mining projected to exceed 10% of global electricity demand by 2026 |

What is included in the product

This analysis uncovers the competitive landscape for Digital 9 Infrastructure, examining the bargaining power of buyers and suppliers, the threat of new entrants and substitutes, and the intensity of rivalry within the digital infrastructure sector.

Instantly identify and mitigate competitive threats by visualizing the intensity of each of the Digital 9 Infrastructure's five forces.

Customers Bargaining Power

Digital 9 Infrastructure's large enterprise and hyperscale clients, like major cloud providers, wield considerable bargaining power. This stems from the massive volume of data center capacity and network connectivity they procure, often through lengthy, multi-year agreements.

These substantial clients can leverage their significant demand to negotiate highly favorable pricing, service level agreements (SLAs), and other contract terms. For instance, in 2024, hyperscale cloud providers continued to be a dominant force in the data center market, driving demand and influencing supplier pricing strategies.

Internet Service Providers (ISPs) and Mobile Network Operators (MNOs) are significant customers for digital infrastructure providers like Digital 9. Their substantial user bases give them considerable sway. For instance, in 2024, major ISPs and MNOs continued to consolidate their market positions, meaning fewer, larger buyers are negotiating for capacity and access. This concentration amplifies their ability to demand competitive pricing and favorable terms for subsea fiber and wireless network access.

The bargaining power of these customers is further enhanced by the potential for vertical integration, where they might invest in their own infrastructure, or by their ability to switch to alternative network providers if Digital 9's offerings are not sufficiently competitive. In 2023, several MNOs announced significant investments in expanding their own fiber backhaul networks, demonstrating this trend. However, the high switching costs associated with changing core infrastructure providers can provide Digital 9 with a degree of counter-leverage, making it less straightforward for these customers to move away.

For established clients of digital infrastructure providers like Digital 9 Infrastructure, switching costs can be a significant barrier. Integrating operations with a provider's network or data center involves substantial technical migration efforts, the risk of service disruptions during the transition, and potential contractual penalties. These factors effectively lock in customers, diminishing their immediate bargaining power once the initial agreement is in place.

Demand for Customization and Scalability

Customers in digital infrastructure, particularly growing tech firms, often demand highly customized solutions and significant scalability. This need for tailored services directly increases their bargaining power as providers vie to offer flexible, precise fits for client specifications. For instance, a major cloud computing client might negotiate better terms if they require a unique network architecture or guaranteed expansion capacity, knowing that providers are eager to secure such large, adaptable contracts. In 2024, the rapid growth of AI and big data analytics has intensified this trend, with many businesses needing infrastructure that can scale dynamically to handle unpredictable workloads.

The bargaining power of customers is further amplified by the demand for scalability and customization in digital infrastructure.

- Customization Needs: Businesses require tailored solutions for specific data processing, storage, and connectivity requirements.

- Scalability Demands: The ability to easily scale infrastructure up or down is critical for managing fluctuating workloads, especially for rapidly growing companies.

- Competitive Landscape: Providers compete intensely to offer flexible and scalable solutions, giving customers more leverage in negotiations.

- Impact of AI/Big Data: The surge in AI and big data analytics in 2024 has heightened the need for adaptable infrastructure, further empowering customers.

Diversified Customer Base

A diversified customer base for a digital infrastructure provider, such as Digital 9 Infrastructure, can significantly dilute the bargaining power of individual customers. By serving various sectors like cloud computing, telecommunications, enterprise solutions, and content delivery networks, the company reduces its dependence on any single client or industry segment.

This broad customer reach means that even if a few large clients exert pressure, the overall impact on Digital 9 Infrastructure's revenue and pricing power is lessened. For instance, if a major cloud provider demands lower rates, the company can still maintain strong relationships and pricing with its telecom or content delivery clients, ensuring a more stable financial footing.

- Diversification Across Sectors: Digital 9 Infrastructure's portfolio includes data centers and fiber networks, serving a wide array of clients from hyperscale cloud providers to smaller enterprises and content creators.

- Reduced Reliance on Key Clients: In 2023, Digital 9 Infrastructure reported that its top ten customers accounted for approximately 50% of its revenue, indicating a degree of concentration but still leaving a substantial portion from a broader client base.

- Mitigation of Pricing Pressure: A varied customer mix allows the company to absorb price concessions from one segment by leveraging its stronger position with others, thereby maintaining overall profitability.

- Enhanced Revenue Stability: Serving multiple industries provides a buffer against sector-specific downturns, contributing to more predictable and resilient revenue streams.

The bargaining power of customers for Digital 9 Infrastructure is substantial, particularly from large enterprise and hyperscale clients. These clients, like major cloud providers, procure vast amounts of data center capacity and network connectivity, often through long-term contracts. This significant demand allows them to negotiate favorable pricing and service level agreements. For example, in 2024, hyperscale cloud providers continued to be a dominant force, influencing pricing strategies due to their sheer volume of business.

Internet Service Providers (ISPs) and Mobile Network Operators (MNOs) also wield considerable influence due to their large user bases. In 2024, market consolidation among these entities meant fewer, larger buyers negotiating for capacity, amplifying their ability to demand competitive pricing for subsea fiber and wireless network access. This power is further bolstered by their potential to invest in their own infrastructure, though high switching costs for core infrastructure providers can offer Digital 9 some counter-leverage.

The need for customized and scalable solutions also enhances customer bargaining power. Businesses require tailored services for specific data needs, and the ability to scale infrastructure dynamically is crucial, especially for rapidly growing companies. The surge in AI and big data analytics in 2024 has intensified this demand for adaptable infrastructure, giving customers more leverage in negotiations.

Digital 9 Infrastructure's diversified customer base helps to mitigate the bargaining power of individual clients. By serving various sectors, the company reduces its reliance on any single customer or industry. While its top ten customers accounted for approximately 50% of revenue in 2023, this still leaves a significant portion from a broader client base, allowing the company to absorb price concessions from one segment by leveraging its position with others.

| Customer Segment | Bargaining Power Drivers | Impact on Digital 9 Infrastructure | 2024 Trend Impact |

|---|---|---|---|

| Hyperscale Cloud Providers | Massive volume, long-term contracts, potential vertical integration | Strong negotiation leverage on pricing and SLAs | Continued demand driving pricing influence |

| ISPs & MNOs | Large user bases, market consolidation, potential for own infrastructure | Ability to demand competitive pricing and favorable terms | Increased leverage due to fewer, larger buyers |

| Growing Tech Firms | Demand for customization, scalability for AI/Big Data | Negotiate for tailored solutions and flexible expansion | Heightened need for adaptable infrastructure |

| Diversified Client Base | Reduced reliance on any single client | Mitigates overall pricing pressure, enhances revenue stability | Maintains financial resilience against sector-specific downturns |

Full Version Awaits

Digital 9 Infrastructure Porter's Five Forces Analysis

This preview displays the complete Digital 9 Infrastructure Porter's Five Forces Analysis, offering a comprehensive examination of industry competition and profitability. The document you see here is the exact, professionally formatted report you will receive immediately after purchase, ensuring transparency and immediate usability for your strategic planning needs.

Rivalry Among Competitors

Digital 9 Infrastructure operates in a highly competitive landscape, facing off against substantial, well-funded rivals. These include other dedicated infrastructure investment funds, major global telecommunications companies, and even hyperscale cloud providers who possess their own vast network infrastructure.

These established players often boast deep financial reserves, entrenched market positions, and comprehensive service portfolios, which significantly escalates the battle for market share and customer acquisition. For instance, in 2024, major telecom operators continued their aggressive fiber rollout programs, often exceeding billions in capital expenditure, directly competing for the same customer base that Digital 9 Infrastructure targets.

Digital 9 Infrastructure operates in a sector characterized by extremely high capital intensity. Building assets like subsea cables and data centers demands massive upfront investment, often in the hundreds of millions or even billions of dollars. For instance, a new trans-Atlantic subsea cable can cost upwards of $300 million to $500 million.

These substantial initial outlays, coupled with long asset lifecycles that can span 20-30 years, create a competitive environment where securing long-term contracts is paramount. Companies like Digital 9 Infrastructure must ensure high utilization rates to recoup their significant investments and achieve profitability. This pressure can intensify rivalry as players vie for major clients and infrastructure projects.

The digital infrastructure sector is seeing significant consolidation, with companies merging or acquiring others to grow larger and reach more places. This drive for scale and specialized assets intensifies competition among the remaining, bigger players.

Rapid Technological Advancements

The digital infrastructure sector is characterized by intense competitive rivalry fueled by rapid technological advancements. Companies like Equinix and Digital Realty are constantly innovating to offer cutting-edge solutions, with significant R&D investments being crucial for staying ahead. For example, the global data center market size was valued at approximately $240 billion in 2023 and is projected to grow substantially, driven by demand for AI and cloud services, highlighting the pressure to invest in next-generation technologies.

This relentless pace of innovation means that rivals frequently compete on the performance and efficiency of their infrastructure, as well as their ability to quickly integrate new standards. For instance, the rollout of 5G technology requires substantial upgrades to network infrastructure, forcing companies to make significant capital expenditures to remain competitive. The ongoing development of AI-driven data center management further intensifies this rivalry, pushing for greater automation and predictive capabilities.

- R&D Investment: Companies are channeling billions into research and development to stay at the forefront of technological evolution.

- 5G Rollout Impact: The widespread adoption of 5G necessitates significant infrastructure upgrades, creating a competitive race to deploy enhanced network capabilities.

- AI Integration: The integration of AI into data center operations is becoming a key differentiator, driving competition in efficiency and automation.

- Capital Expenditure: Continuous investment in new technologies and upgrades represents a major cost for companies, shaping competitive dynamics.

Global Nature of Competition

Digital 9 Infrastructure's competitive landscape is inherently global, especially in the subsea fiber optic network sector. This means companies aren't just competing with local players; they're up against rivals from across continents, each with distinct strengths and market approaches. For instance, major players in the subsea cable market include companies like SubCom, Alcatel Submarine Networks, and NEC, all operating internationally.

This global nature intensifies rivalry, as firms vie for contracts and market share on an worldwide stage. Companies must navigate diverse regulatory environments and economic conditions. In 2024, the demand for enhanced global connectivity continues to drive significant investment in subsea infrastructure, making the competition even more dynamic.

- Global Reach: Subsea fiber optic networks are inherently international, with cables spanning oceans and connecting continents, creating a borderless competitive arena.

- Diverse Competitors: Digital 9 Infrastructure faces competition from established global telecommunications companies, specialized subsea cable providers, and even tech giants investing in their own networks.

- Strategic Advantages: Competitors may possess advantages such as extensive existing infrastructure, strong government relationships, or specialized technological expertise, all contributing to a complex competitive environment.

- Market Dynamics: The ongoing expansion of data traffic and the need for low-latency connections globally fuel intense competition for new projects and existing network upgrades.

Digital 9 Infrastructure faces intense rivalry from well-capitalized global players, including other infrastructure funds, telecom giants, and hyperscale cloud providers. These competitors often leverage deep financial reserves and established market positions, intensifying the battle for market share. For example, in 2024, major telecom operators continued substantial fiber rollout programs, investing billions to capture the same customer base.

The sector's high capital intensity, with subsea cable projects costing hundreds of millions, forces companies to secure long-term contracts, escalating competition for major clients. Innovation is another key battleground; companies like Equinix and Digital Realty invest heavily in R&D. The global data center market, valued at approximately $240 billion in 2023, highlights the pressure to adopt next-generation technologies like AI-driven management.

The global nature of digital infrastructure, particularly subsea cables, means competition extends beyond local markets. Companies like SubCom and Alcatel Submarine Networks operate internationally, vying for contracts in a dynamic 2024 market driven by increasing data traffic and the need for low-latency connections.

| Competitor Type | Key Characteristics | 2024 Focus/Examples |

|---|---|---|

| Infrastructure Funds | Capital-intensive investments, long-term assets | Acquiring existing networks, developing new fiber routes |

| Telecom Operators | Extensive existing infrastructure, broad service portfolios | Aggressive fiber-to-the-home (FTTH) rollouts, 5G network expansion |

| Hyperscale Cloud Providers | In-house network development, massive data traffic | Investing in private subsea cables, expanding data center footprints |

| Specialized Providers | Technological expertise, niche market focus | Innovation in subsea cable technology, data center efficiency |

SSubstitutes Threaten

While subsea fiber optic cables form the backbone of global internet, emerging alternative connectivity technologies present a potential, though currently minor, threat. Advanced satellite internet, particularly low-earth orbit (LEO) constellations like Starlink, is one such alternative. By mid-2024, Starlink reported over 3 million subscribers globally, demonstrating a growing user base.

These satellite services can offer connectivity in underserved or remote regions where laying fiber is cost-prohibitive, potentially fragmenting the market for traditional infrastructure providers. Furthermore, satellite solutions can serve as crucial backup connectivity, reducing the absolute necessity for fiber redundancy in some business continuity plans.

Large enterprises might opt for building their own on-premise data centers or private clouds, bypassing colocation services. This is often due to stringent data sovereignty, enhanced security needs, or unique performance demands that they feel only self-managed infrastructure can meet. For instance, in 2024, a significant portion of global IT spending continued to be allocated to on-premise solutions, reflecting ongoing enterprise investment in private infrastructure.

Hyperscale cloud providers like Amazon Web Services (AWS), Microsoft Azure, and Google Cloud are significantly bolstering their global network infrastructure. This includes substantial investments in subsea cables and expansive data center footprints, creating a powerful integrated offering that can bypass traditional third-party infrastructure providers. For instance, Google Cloud's extensive private subsea cable network, including Dunant and Grace Hopper, directly connects its data centers, enabling it to offer highly performant and reliable connectivity as a core service.

Edge Computing and Decentralized Networks

The increasing adoption of edge computing presents a potential threat to traditional centralized data center infrastructure. By processing data closer to its origin, edge computing can reduce the reliance on large, centralized facilities for certain applications. For instance, the global edge computing market was valued at approximately $20.5 billion in 2023 and is projected to grow significantly, indicating a shift in infrastructure demand.

Emerging decentralized network architectures, while still in early development, could also offer alternative models for data storage and transmission. These models might bypass the need for the extensive physical infrastructure currently dominated by traditional data center providers. While not a direct substitute today, the long-term implications of decentralized technologies could reshape the digital infrastructure landscape.

- Edge computing reduces latency and bandwidth needs by processing data locally.

- The edge computing market experienced substantial growth, reaching an estimated $20.5 billion in 2023.

- Decentralized networks offer potential future alternatives for data handling, impacting traditional infrastructure models.

Software-Defined Networking (SDN) and Network Function Virtualization (NFV)

Software-Defined Networking (SDN) and Network Function Virtualization (NFV) present a nuanced threat of substitutes for Digital 9 Infrastructure. While not direct replacements for physical fiber optic networks, these technologies can optimize existing infrastructure, potentially delaying or reducing the need for new physical builds in certain scenarios. For instance, by intelligently routing traffic and consolidating network functions onto general-purpose hardware, SDN and NFV can enhance the efficiency and capacity of current networks.

This efficiency gain can act as an indirect substitute, particularly for businesses looking to scale their network capabilities without immediate capital expenditure on new physical assets. For example, a company might leverage NFV to deploy virtualized firewalls or load balancers on existing servers, thereby reducing the reliance on dedicated physical appliances that might otherwise have been part of a new infrastructure deployment. Reports from 2024 indicate continued strong growth in the SDN and NFV markets, with global spending projected to increase significantly, underscoring their growing influence.

- SDN and NFV enable greater network efficiency and flexibility through software control.

- These technologies can reduce the immediate need for new physical infrastructure by optimizing existing assets.

- The growing adoption of SDN and NFV signifies a potential indirect threat to new physical infrastructure investments.

- Global spending on SDN and NFV solutions is expected to see substantial growth in 2024 and beyond.

While subsea fiber remains dominant, alternatives like advanced satellite internet, particularly LEO constellations, are emerging. By mid-2024, Starlink alone had over 3 million subscribers globally, showcasing a growing user base in areas where fiber is impractical.

These satellite services can serve as backup connectivity, potentially reducing the need for fiber redundancy in some enterprise continuity plans. Additionally, hyperscale cloud providers are heavily investing in their own integrated networks, including subsea cables and data centers, which can bypass traditional third-party infrastructure providers.

The rise of edge computing, with its market valued at approximately $20.5 billion in 2023, also presents a shift, processing data closer to the source and potentially lessening reliance on centralized facilities.

| Substitute Technology | Key Characteristic | Market Indicator (2023/2024 Data) | Impact on Digital 9 Infrastructure |

|---|---|---|---|

| Satellite Internet (LEO) | Global coverage, remote area access | Starlink: >3 million subscribers (mid-2024) | Potential for niche market capture, backup connectivity |

| Hyperscale Cloud Networks | Integrated infrastructure, direct connectivity | Significant ongoing investment in subsea and data centers | Bypassing third-party providers, competitive service offering |

| Edge Computing | Local data processing, reduced latency | Market valued at ~$20.5 billion (2023) | Shifting demand away from centralized facilities for certain applications |

Entrants Threaten

Entering the digital infrastructure arena, particularly for subsea cables and hyperscale data centers, necessitates colossal upfront capital. The sheer scale of investment, often reaching billions of dollars for land acquisition, facility construction, and network deployment, presents a significant hurdle for new competitors.

New entrants into the digital infrastructure sector, like Digital 9 Infrastructure, often grapple with intricate and time-consuming regulatory and permitting procedures. These hurdles span various jurisdictions, demanding extensive effort to secure licenses for critical assets such as spectrum, land use, and international cable landings. For instance, obtaining rights-of-way for fiber optic networks can involve dealing with numerous local, state, and federal authorities, each with its own set of rules and approval timelines.

The sheer complexity and cost associated with these processes act as a significant barrier to entry. In 2024, companies looking to deploy new data centers or expand network footprints frequently encounter delays and substantial legal and consulting fees to ensure compliance with environmental regulations and zoning laws. This substantial upfront investment and the uncertainty of approval timelines can deter potential new competitors from entering the market, thereby protecting existing players like Digital 9.

Established digital infrastructure providers, like those in the Digital 9, benefit immensely from economies of scale. This means they can spread their high fixed costs over a larger base of customers, leading to significantly lower per-unit costs. For instance, the massive capital expenditure required for building out fiber optic networks or data centers becomes more manageable when amortized across millions of users, making it tough for newcomers to match pricing.

Network effects further solidify the dominance of incumbents. As more users connect to a digital infrastructure network, its overall value increases for everyone. This creates a powerful barrier to entry, as a new entrant with a smaller user base offers less utility, making it challenging to attract and retain customers away from established, interconnected platforms.

Access to Key Resources and Locations

Securing essential resources like prime real estate for data centers, established fiber optic networks, and crucial subsea cable landing sites presents a significant hurdle for new players in the digital infrastructure sector. Existing operators frequently hold long-term leases, outright ownership, or exclusive agreements for these vital assets, creating a barrier for newcomers seeking similar, affordable access.

For instance, the cost of acquiring or leasing suitable land in major metropolitan areas, where demand for data center capacity is highest, can be prohibitive. Reports from 2024 indicate that land prices in key tech hubs have continued to escalate, making it challenging for new entrants to secure cost-competitive locations compared to incumbents who secured their sites years ago.

- Prime Real Estate Costs: In 2024, data center land acquisition in Tier 1 markets averaged over $5 million per acre, a significant increase from previous years.

- Fiber Network Access: Incumbents often control extensive fiber optic networks, with companies like Lumen Technologies boasting over 450,000 route miles of fiber in North America as of early 2024, limiting new entrants' ability to establish their own low-latency connectivity.

- Subsea Cable Landing Rights: Securing landing rights for subsea cables is a complex and often exclusive process, with major cable systems in 2024 already having established, long-term agreements at prime landing points.

Technological Expertise and Talent Acquisition

Developing, deploying, and maintaining cutting-edge digital infrastructure, like the advanced networks and data centers operated by Digital 9 Infrastructure, demands highly specialized technological expertise. This includes proficiency in areas such as fiber optic network management, data center operations, and cloud computing technologies.

New entrants face a significant hurdle in acquiring or developing this deep talent pool. For instance, the demand for skilled cybersecurity professionals, crucial for protecting digital infrastructure, saw a global shortage of 3.4 million workers in 2024, according to Cybersecurity Ventures. Attracting and retaining such talent requires substantial investment in competitive salaries, benefits, and continuous training, making it a costly endeavor for newcomers.

- Specialized Skills: Expertise in areas like network architecture, data center engineering, and cybersecurity is paramount.

- Talent Acquisition Costs: High demand for tech talent drives up recruitment and retention expenses, with average salaries for senior network engineers exceeding $120,000 annually in many developed markets as of 2024.

- Development Investment: Building in-house capabilities or acquiring specialized firms represents a substantial upfront capital requirement.

The threat of new entrants for Digital 9 Infrastructure is generally low due to the immense capital requirements and established economies of scale. Building new hyperscale data centers or laying subsea cables involves billions in investment, a significant barrier for most potential competitors. Furthermore, existing players benefit from network effects and control over critical infrastructure assets, making it difficult for newcomers to compete on cost or service. The need for specialized technical expertise and navigating complex regulatory landscapes also acts as a deterrent.

| Barrier Type | Description | 2024 Data/Example |

|---|---|---|

| Capital Requirements | High upfront investment for infrastructure development. | Hyperscale data center construction can cost $1 billion+, subsea cable projects often exceed $500 million. |

| Economies of Scale | Lower per-unit costs for incumbents due to large operational scale. | Large providers can offer lower bandwidth pricing due to amortized infrastructure costs over millions of customers. |

| Access to Distribution Channels | Control over existing fiber networks and landing sites. | Companies like Equinix manage extensive global data center footprints, limiting new entrants' physical access. |

| Network Effects | Increasing value of the network with more users. | Cloud providers like AWS or Azure become more attractive as more services and users integrate with their platforms. |

| Government Policy and Regulation | Complex permitting and licensing processes. | Securing rights-of-way for fiber deployment can take years and involve multiple regulatory bodies. |

| Switching Costs | Customer inertia and integration complexity. | Businesses often have significant investments in integrating with existing cloud or connectivity providers. |

Porter's Five Forces Analysis Data Sources

Our Digital 9 Infrastructure Porter's Five Forces analysis leverages data from company annual reports, industry-specific market research, regulatory filings, and technology trend publications to provide a comprehensive view of competitive dynamics.