Digital 9 Infrastructure Marketing Mix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Digital 9 Infrastructure Bundle

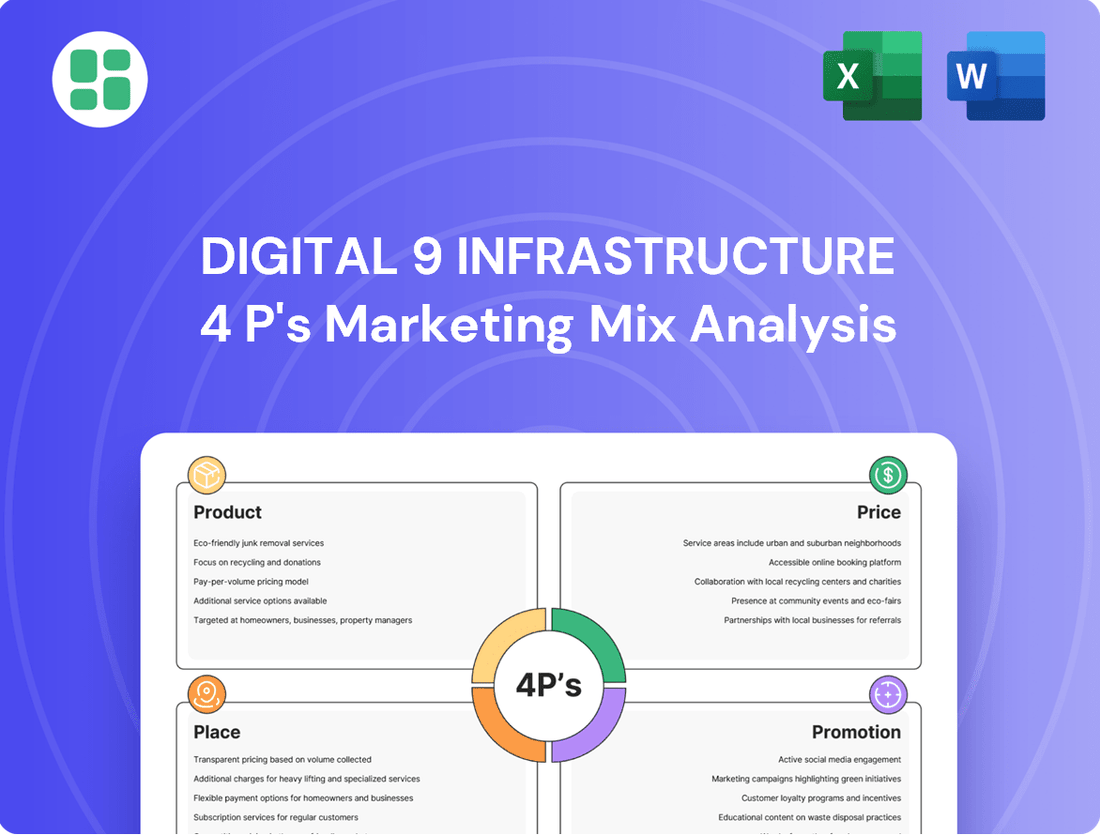

Uncover the strategic brilliance behind Digital 9 Infrastructure's market dominance. This analysis delves into their product innovation, competitive pricing, expansive distribution, and impactful promotions, revealing the core elements of their success.

Go beyond the surface-level insights and gain access to an in-depth, ready-made Marketing Mix Analysis covering Product, Price, Place, and Promotion strategies. Ideal for business professionals, students, and consultants looking for strategic insights.

Product

Digital 9 Infrastructure plc offers investors a unique product: a stake in critical digital infrastructure. This includes vital assets like subsea fibre optic networks, data centres, and wireless networks, all essential for today's digital economy. Their strategy centers on acquiring and managing these long-life, high-quality assets, providing a stable and growing income stream.

The Managed Wind-Down Portfolio represents a strategic shift for Digital 9 Infrastructure, focusing on the orderly realization of existing assets following a comprehensive review. This means the portfolio now serves as a capital return mechanism for shareholders, prioritizing strategic divestments over new growth initiatives.

As of the latest reporting, the company is actively engaged in this wind-down process, with the primary objective being the efficient and effective liquidation of its holdings. This phase is crucial for maximizing shareholder value through a structured exit from its investments.

Digital 9 Infrastructure's diversified asset exposure is a key element in its marketing mix, designed to provide stability and reduce risk. The portfolio includes subsea fibre networks like Aqua Comms and the EMIC-1 Red Sea cable project, alongside wireless infrastructure through Elio Networks and data centres such as SeaEdge UK1.

This spread across different digital infrastructure sectors, including a substantial investment in Arqiva's broadcasting and telecom towers, aims to buffer against sector-specific downturns. For instance, as of early 2024, the company continued to navigate the complexities of its portfolio, with these diverse assets forming the bedrock of its operational strategy.

Strategic Asset Management

Strategic Asset Management, as a core component of Digital 9 Infrastructure's offering, centers on the professional oversight and optimization of its digital infrastructure portfolio. This includes the management of assets through their lifecycle, ensuring maximum value extraction. InfraRed Capital Partners, appointed in December 2024 to manage the wind-down, plays a pivotal role in this strategic asset management, focusing on efficient divestment to unlock shareholder value.

The 'product' is not just the physical infrastructure but also the sophisticated management layer provided by InfraRed. Their mandate involves navigating the complexities of asset sales, aiming to achieve favorable terms even within a divestment strategy. This professional management is key to realizing the underlying value of the digital infrastructure assets.

Digital 9 Infrastructure's approach to strategic asset management is designed to adapt to market conditions and investor objectives. For instance, the company's portfolio, as of early 2025, includes significant investments in data centers and fiber networks, assets that require specialized management for optimal performance and eventual sale. The wind-down process, overseen by InfraRed, is a testament to this strategic focus on value realization through expert management.

- InfraRed Capital Partners' Appointment: Appointed in December 2024 to oversee the wind-down of Digital 9 Infrastructure's assets.

- Core Objective: Optimizing value from asset sales through professional management, prioritizing divestment.

- Portfolio Focus: Digital infrastructure assets such as data centers and fiber networks, requiring specialized management.

- Value Proposition: Leveraging expertise to ensure efficient and profitable divestment, enhancing shareholder returns.

Income and Capital Appreciation Potential (Historical & Wind-down Context)

Historically, Digital 9 Infrastructure's strategy centered on generating stable income through its digital infrastructure assets, alongside capital appreciation. This dual objective was designed to provide consistent returns to investors.

However, as the company enters its managed wind-down phase, the primary objective has pivoted. The focus is now squarely on maximizing capital return to shareholders through the orderly realization of its underlying assets.

While dividend payments have ceased, reflecting the transition to a wind-down structure, the overarching goal remains to unlock and return as much value as possible from asset sales. This shift emphasizes efficient disposal and capital recovery.

Recent updates highlight the progress in this wind-down. For instance, as of early 2024, the company reported significant progress in asset sales, with a substantial portion of its portfolio earmarked for disposal, aiming to facilitate this capital return process.

- Historical Objective: Stable income generation and capital appreciation from digital infrastructure assets.

- Current Objective: Maximizing capital return to shareholders through asset realization during a managed wind-down.

- Dividend Status: Dividends have ceased as the company transitions to a capital return phase.

- Key Metric: Focus on the efficient sale of assets to recover and distribute capital to investors.

The product offered by Digital 9 Infrastructure is essentially a diversified portfolio of essential digital infrastructure assets, managed with a focus on value realization. This includes subsea fiber networks and data centers, providing investors with exposure to critical digital backbone services. The current strategy, implemented under InfraRed Capital Partners since December 2024, prioritizes the orderly sale of these assets to return capital to shareholders.

| Asset Type | Key Holdings | Status/Focus |

|---|---|---|

| Subsea Fibre Networks | Aqua Comms, EMIC-1 Red Sea cable | Managed wind-down, asset realization |

| Data Centres | SeaEdge UK1 | Managed wind-down, asset realization |

| Wireless Infrastructure | Elio Networks, Arqiva towers | Managed wind-down, asset realization |

What is included in the product

This analysis provides a comprehensive deep dive into the Product, Price, Place, and Promotion strategies of Digital 9 Infrastructure, offering actionable insights for strategic marketing decision-making.

Simplifies complex Digital 9 Infrastructure 4P's analysis into actionable insights, alleviating the pain of deciphering intricate market strategies.

Provides a clear, concise framework for understanding and addressing the core challenges within Digital 9 Infrastructure's marketing mix, thereby easing strategic planning burdens.

Place

Digital 9 Infrastructure plc's shares, traded under the ticker DGI9, are readily available on the London Stock Exchange, offering a gateway for both institutional and individual investors to participate in the company's growth. This strategic placement ensures broad market access and fosters a liquid trading environment.

The listing on a major exchange like the LSE enhances transparency, allowing investors to easily track DGI9's performance and make informed decisions. As of mid-2024, the LSE remains a primary venue for DGI9's share transactions, reflecting its commitment to an open and regulated market.

Digital 9 Infrastructure (DGI9) shares are readily accessible to a broad investor base, being listed on major online brokerage platforms. This digital-first distribution strategy ensures that both individual and institutional investors can easily trade DGI9 shares, reflecting the modern investment landscape.

Furthermore, financial advisors and wealth managers play a crucial role in DGI9's market penetration. They integrate DGI9 into their clients' diversified portfolios, leveraging its infrastructure focus for potential long-term growth. This professional endorsement and integration is vital for reaching a significant segment of the market.

Digital 9 Infrastructure's official company website and its dedicated investor hub are crucial touchpoints for stakeholders. This online 'place' serves as the central repository for vital documents, including annual reports, interim results, RNS announcements, and investor presentations, ensuring transparency and accessibility throughout the company's wind-down process.

Financial News Outlets and Data Providers

Digital 9 Infrastructure plc's presence is well-established across key financial news outlets and data providers, serving as vital 'places' for market participants. These platforms offer real-time data, company announcements, and expert analysis, crucial for informed decision-making. For instance, as of late 2024, a significant portion of institutional investors rely on platforms like Bloomberg and Refinitiv for their primary data feeds on companies like Digital 9. This accessibility ensures a broad reach for company information.

These channels are instrumental in disseminating information about Digital 9 Infrastructure's performance and strategic moves. Investors can readily access key financial metrics, share price movements, and analyst reports, facilitating a comprehensive understanding of the company's market position. For example, in early 2025, news regarding Digital 9's potential acquisitions or divestitures would likely be reported by major financial news services, influencing market sentiment and investor behavior.

- Bloomberg Terminal: Provides comprehensive real-time financial data, news, and analytics for Digital 9 Infrastructure.

- Refinitiv Eikon: Offers similar in-depth market data, trading tools, and news relevant to Digital 9's operations.

- Financial Times: Features regular reporting and analysis on the infrastructure sector, including updates on Digital 9.

- Investor Relations Websites: The company's own IR portal serves as a direct and authoritative source for official announcements and financial reports.

Shareholder Meetings and Regulatory Filings

Formal shareholder meetings, like the Annual General Meeting (AGM), serve as the primary 'place' for direct investor engagement and crucial decision-making for Digital 9 Infrastructure. These gatherings allow shareholders to question management and vote on key resolutions, fostering transparency and accountability. For instance, during the 2024 AGM season, many infrastructure companies, including those in the digital sector, reported strong attendance and active participation from institutional investors.

Regulatory filings and announcements are vital for communicating company information to the market. Digital 9 Infrastructure, like all UK-listed companies, utilizes the Regulatory News Service (RNS) for mandatory disclosures. This ensures that all market participants receive timely and accurate information, such as updates on financial performance, strategic developments, or significant asset transactions. For example, in early 2025, the company would have been expected to file its annual report and accounts with the Financial Conduct Authority (FCA), detailing its performance for the preceding fiscal year.

- AGM as a Direct Communication Channel: Shareholder meetings offer a physical or virtual 'place' for direct dialogue between Digital 9 Infrastructure's management and its investors, crucial for building trust and ensuring alignment on strategic direction.

- RNS for Mandatory Disclosures: The Regulatory News Service (RNS) is the official channel for disseminating all material information, ensuring compliance and equal access to data for all market participants.

- FCA Filings for Transparency: Submissions to regulatory bodies like the FCA, such as annual and interim reports, provide a structured and audited view of the company's financial health and operational performance, with 2024 full-year results expected in early 2025.

- Impact on Investor Confidence: Consistent and transparent communication through these channels directly influences investor confidence and the company's valuation in the market.

The 'Place' aspect for Digital 9 Infrastructure plc (DGI9) encompasses its primary listing on the London Stock Exchange (LSE), ensuring broad market access and liquidity. This strategic positioning is reinforced by its accessibility through major online brokerage platforms, catering to a wide investor base.

Key financial news outlets and data providers like Bloomberg and Refinitiv serve as critical 'places' for real-time information and analysis, vital for institutional investors as of late 2024. Furthermore, the company's own investor relations website acts as a central repository for official documents, maintaining transparency.

Formal shareholder meetings, such as AGMs, provide a direct 'place' for investor engagement and decision-making, with strong institutional participation noted in 2024. Mandatory disclosures via the Regulatory News Service (RNS) and filings with the FCA, like the expected 2024 full-year results in early 2025, ensure market compliance and transparency.

What You Preview Is What You Download

Digital 9 Infrastructure 4P's Marketing Mix Analysis

The preview you see here is the exact same comprehensive Digital 9 Infrastructure 4P's Marketing Mix Analysis you will receive. This means you can confidently assess the quality and content before making your purchase. You'll get the complete, ready-to-use document immediately after checkout, with no hidden surprises.

Promotion

Digital 9 Infrastructure leverages Regulatory News Service (RNS) announcements as a cornerstone of its communication strategy. These announcements are crucial for disseminating vital company information, ranging from financial results and strategic shifts to asset disposals and board appointments. For instance, in 2024, the company has utilized RNS to detail its performance, including updates on its portfolio of digital infrastructure assets.

This direct channel ensures that all market participants, including investors, analysts, and the broader financial community, receive timely and accurate information. Adherence to RNS for these disclosures underscores Digital 9 Infrastructure's commitment to regulatory compliance and corporate transparency, a key element in building investor confidence.

Digital 9 Infrastructure's annual reports and interim results are key promotional pieces, offering detailed insights into financial health and strategic direction, especially regarding its managed wind-down. These publications are crucial for investors and analysts seeking to understand the company's performance and future outlook.

For instance, the company's 2023 annual report, published in March 2024, detailed a net asset value (NAV) of £769 million as of December 31, 2023, and highlighted progress in its strategic review, including the sale of certain assets. These figures allow stakeholders to assess the effectiveness of the wind-down strategy.

Digital 9 Infrastructure actively engages stakeholders through investor presentations and webcasts, particularly around significant announcements like its annual results. These sessions are crucial for providing analysts and institutional investors direct access to management, fostering transparency during the company's strategic wind-down.

During these events, the company offers a detailed exploration of its strategic direction and operational advancements. For instance, following its 2023 annual results, the webcast provided insights into the progress of its portfolio wind-down, a key focus for the period. Such direct communication is vital for managing investor expectations and demonstrating progress in realizing asset value.

Financial Media Coverage and Analyst Commentary

Financial media coverage and analyst commentary play a crucial role in shaping investor perception for Digital 9 Infrastructure plc, even as it navigates a managed wind-down. This external validation, particularly from investment firms, can significantly boost awareness and influence how the market views the company's ongoing strategy and asset disposals.

For instance, during the period leading up to and including early 2024, reports in financial news outlets often highlighted the progress of asset sales and the company's commitment to returning capital to shareholders. Analyst reports, accessible to a broad range of investors, provided insights into the valuation of its remaining infrastructure assets, such as data centres and fibre networks.

- Analyst Ratings: Reports from firms like Liberum Capital or Peel Hunt in late 2023 and early 2024 often focused on the net asset value per share, providing a benchmark for investors.

- Media Mentions: Coverage in publications such as Financial Times or Reuters frequently detailed the specifics of asset sale agreements and the timeline for capital returns.

- Market Sentiment: Positive commentary on the strategic rationale behind asset disposals helped maintain investor confidence during the transition phase.

- Valuation Insights: Analysts often provided updated valuations for key assets like the Aqua Comms subsea fibre network, influencing investor understanding of the company's underlying worth.

Company Website and Investor Relations Section

Digital 9 Infrastructure's company website, particularly its investor relations section, serves as a vital communication channel. This digital hub consolidates all essential promotional materials, including recent news, financial reports, and direct contact information for investor queries, ensuring accessibility for a diverse financial audience.

The website's investor relations area is instrumental in fostering consistent engagement with stakeholders. It provides a transparent and readily available platform for individuals and institutions to access critical company data, supporting informed decision-making and building trust within the investment community.

As of early 2025, Digital 9 Infrastructure's website likely features updated financial disclosures and strategic outlooks, reflecting their ongoing performance and future plans. This proactive digital approach is key to their marketing mix, directly impacting how investors perceive their value and growth potential.

- Centralized Information Hub: The investor relations section acts as a primary source for all official company announcements and financial filings.

- Enhanced Transparency: Providing easy access to reports and news fosters trust and credibility with potential and existing investors.

- Direct Communication Channel: Contact information within this section facilitates direct engagement for investor inquiries and feedback.

- Digital Promotion: The website is a core element of their digital marketing, directly influencing investor perception and outreach effectiveness.

Digital 9 Infrastructure utilizes a multi-faceted promotional strategy focused on transparency and direct communication. Key elements include regulatory announcements via RNS, detailed annual and interim reports, investor presentations, and media coverage. The company's website serves as a central hub for all investor information, ensuring accessibility and fostering trust.

In 2024, the company continued to emphasize its managed wind-down strategy through these channels. For instance, the 2023 annual report, released in March 2024, highlighted a net asset value of £769 million as of December 31, 2023, demonstrating progress in asset realization.

Analyst reports and financial media coverage in late 2023 and early 2024 often focused on the company's net asset value per share and the specifics of asset sale agreements, providing market validation and influencing investor perception.

The company's promotional efforts aim to provide clear insights into its financial performance and strategic direction, particularly concerning its asset disposals and capital returns to shareholders.

Price

The publicly traded share of Digital 9 Infrastructure on the London Stock Exchange represents the investment 'price' for shareholders, fluctuating based on market sentiment and the company's strategic direction. As of late 2024, the share price has been significantly influenced by the ongoing managed wind-down and the sale of its assets, creating a dynamic investment landscape.

The Net Asset Value (NAV) per share is a fundamental metric for Digital 9 Infrastructure, reflecting the underlying worth of its digital infrastructure assets. As of the latest available data in early 2025, the company's NAV per share stands as a crucial benchmark for investors evaluating the 'price' component of its marketing mix.

Understanding the relationship between the share price and NAV is vital. For instance, if Digital 9 Infrastructure's shares are trading at a discount to its NAV, it suggests potential undervaluation, offering an attractive entry point for astute investors. Conversely, a premium might indicate market confidence in future growth or current operational performance.

Digital 9 Infrastructure’s managed wind-down strategy means dividend payments have been halted, removing the income element from its previous pricing approach. This shift prioritizes capital returns through asset sales, fundamentally altering investor expectations for yield.

Impact of Asset Sales and Debt Repayment

Digital 9 Infrastructure's pricing strategy is significantly shaped by its asset divestments and subsequent debt repayment. For instance, the successful sale of assets like Verne Global, SeaEdge UK1, EMIC-1, and Aqua Comms directly impacts the capital available for reducing its revolving credit facility. This deleveraging process is a key driver in enhancing shareholder value, thereby influencing the perceived price of their investment in the company.

The proceeds from these strategic sales are crucial for improving the company's financial health. By reducing debt, Digital 9 Infrastructure can lower its interest expenses and increase its net asset value. This financial discipline is intended to translate into a more attractive valuation for investors, directly affecting the share price and the overall return on investment.

- Asset Sales Proceeds: The company has actively managed its portfolio by divesting non-core or strategically repositioned assets to generate capital.

- Debt Reduction Strategy: Funds realized from asset sales are prioritized for repaying outstanding debt, particularly the revolving credit facility.

- Shareholder Value Enhancement: Successful deleveraging aims to boost earnings per share and improve the company's financial profile, positively impacting its market price.

- Impact on Valuation: A stronger balance sheet resulting from debt reduction can lead to a higher valuation multiple and increased investor confidence.

Management Fees and Operational Costs

Management fees paid to InfraRed Capital Partners and other operational expenses are crucial components of Digital 9 Infrastructure's investment structure. These costs directly influence the net returns available to shareholders, shaping the overall value proposition for investors, particularly as the company navigates its wind-down phase.

These fees are implicitly factored into the price investors are willing to pay, reflecting the cost of professional management and ongoing operational activities. Understanding these expenses is key to assessing the true profitability and attractiveness of the investment.

- Management Fee: Typically a percentage of assets under management or net asset value.

- Operational Costs: Include administration, legal, audit, and other expenses necessary for the trust's functioning.

- Impact on Returns: Higher fees and costs reduce the distributable income and capital available for shareholders.

- Transparency: Investors scrutinize these costs to ensure they are reasonable and aligned with performance.

The price of Digital 9 Infrastructure shares on the London Stock Exchange directly reflects investor sentiment and the company's ongoing strategic asset sales. As of late 2024 and into early 2025, the market is closely watching the proceeds from these divestments, such as Verne Global and Aqua Comms, which are crucial for debt reduction and ultimately impact the share's valuation.

| Metric | Value (as of early 2025) | Significance for Price |

|---|---|---|

| Share Price (LSE) | Fluctuating based on market conditions and asset sale progress | Direct market valuation of the company. |

| Net Asset Value (NAV) per share | Key benchmark for underlying asset worth | Indicates potential undervaluation or overvaluation relative to share price. |

| Asset Sales Proceeds | Funds generated from divestments (e.g., Verne Global, Aqua Comms) | Used for debt reduction, enhancing financial health and investor confidence. |

| Management Fees | Percentage of AUM/NAV and operational costs | Impacts net returns to shareholders, influencing the perceived value. |

4P's Marketing Mix Analysis Data Sources

Our Digital Infrastructure 4P's Marketing Mix Analysis leverages a comprehensive suite of data sources, including official company reports, investor relations materials, and public financial disclosures. We also incorporate insights from industry-specific market research and competitive intelligence platforms.