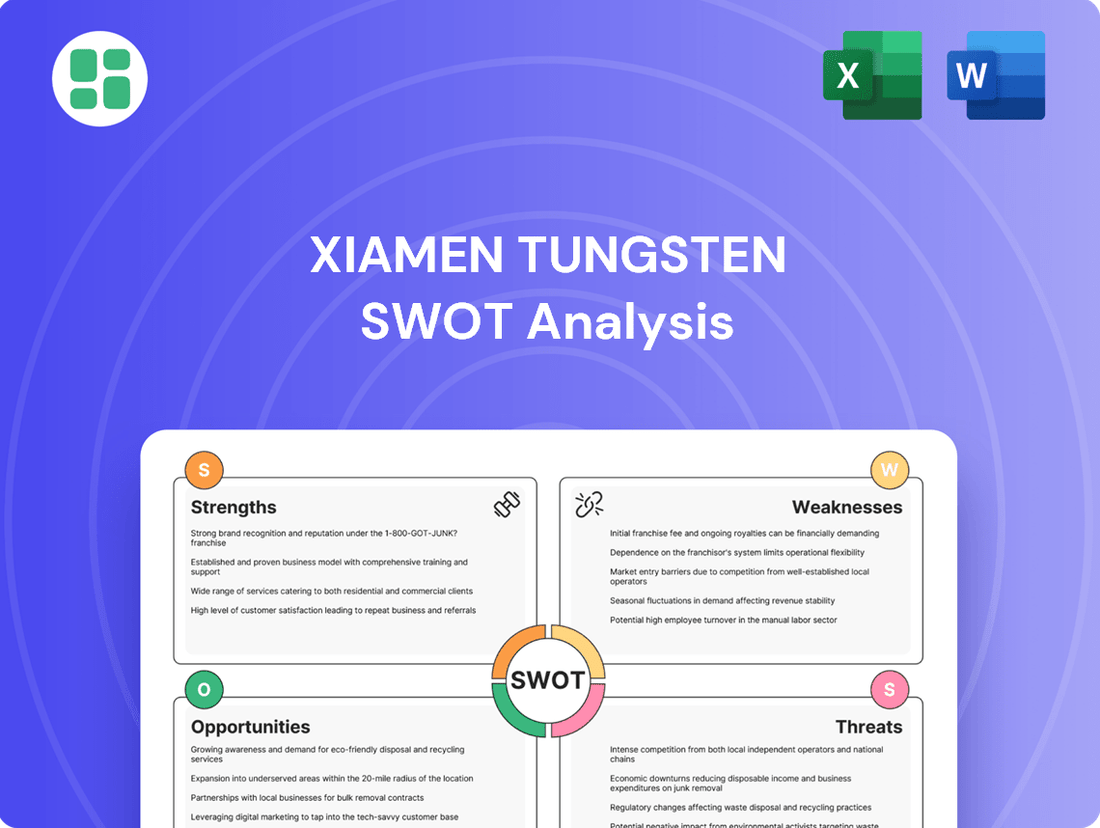

Xiamen Tungsten SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Xiamen Tungsten Bundle

Xiamen Tungsten's dominance in the rare earth and tungsten markets presents significant strengths, but understanding the nuances of its opportunities and threats is crucial for strategic advantage. Our comprehensive SWOT analysis delves into these critical areas, providing a clear roadmap for navigating the competitive landscape.

Want the full story behind Xiamen Tungsten's market position and future trajectory? Purchase the complete SWOT analysis to gain access to a professionally written, fully editable report designed to support your strategic planning, investment decisions, and competitive research.

Strengths

Xiamen Tungsten Co., Ltd. boasts a fully integrated value chain, covering everything from tungsten mining to smelting and advanced processing. This end-to-end control is a major strength, ensuring a consistent supply of raw materials and maintaining high product quality throughout the manufacturing process.

This vertical integration significantly reduces Xiamen Tungsten's dependence on outside suppliers, leading to more predictable costs and streamlined operations. For instance, in 2023, the company's revenue reached RMB 32.3 billion, demonstrating the scale and efficiency of its integrated model.

Xiamen Tungsten's strength lies in its diversified product portfolio, extending well beyond its foundational tungsten business. The company has successfully expanded into critical areas like rare earth materials and battery materials, creating a robust offering that includes tungsten powder, cemented carbides, tungsten wires, and advanced battery materials.

This strategic diversification is a significant advantage, allowing Xiamen Tungsten to serve a wide array of industrial needs. For instance, its battery materials segment is well-positioned to capitalize on the booming electric vehicle market, a sector projected for substantial growth through 2025 and beyond.

By catering to diverse applications, Xiamen Tungsten effectively reduces its reliance on any single market. This broad product base helps cushion the company against price volatility in specific commodities, such as tungsten, while simultaneously opening up new avenues for expansion in high-growth industries.

Xiamen Tungsten commands a leading market position within China, the world's largest tungsten market. This dominance is crucial as China is both a primary producer and a significant consumer of tungsten. In 2023, China accounted for approximately 70% of global tungsten mine production, underscoring the strategic advantage of Xiamen Tungsten's strong domestic foothold.

Commitment to Research and Development

Xiamen Tungsten's dedication to research and development is a significant strength. The company consistently invests heavily in R&D, particularly focusing on cutting-edge tungsten processing and emerging new energy materials. For instance, in 2023, Xiamen Tungsten allocated a notable portion of its revenue to R&D, aiming to enhance product performance and develop more environmentally friendly manufacturing processes.

This commitment to innovation is crucial for maintaining a competitive edge and driving future growth. It allows Xiamen Tungsten to stay ahead of technological curves and develop proprietary technologies. The company's R&D efforts are directly linked to its ability to introduce high-value products to the market.

Key R&D focus areas include:

- Advanced Tungsten Processing: Developing new methods for producing high-purity and specialized tungsten products.

- New Energy Materials: Researching and developing materials for batteries and other clean energy applications.

- Process Optimization: Improving production efficiency and reducing the environmental impact of manufacturing.

Strategic Expansion and Sustainability Initiatives

Xiamen Tungsten's strategic expansion is evident in its acquisition of a stake in a South African exploration company, a move designed to broaden its mineral resource base and bolster supply chain security. This diversification is crucial in an industry susceptible to geopolitical and logistical disruptions.

Furthermore, the company is actively pursuing sustainability through a clear strategy focused on reducing its carbon footprint. This includes significant investments in advanced, cleaner production technologies and robust recycling programs for rare earth materials.

- Resource Diversification: Acquisition of a stake in a South African exploration company to mitigate supply chain risks.

- Sustainability Focus: Commitment to reducing carbon emissions through cleaner production technologies.

- Recycling Initiatives: Investment in recycling programs to enhance resource circularity.

- Long-Term Resilience: Actions align with global environmental trends and improve operational stability.

Xiamen Tungsten's integrated value chain, from mining to advanced processing, provides robust supply chain control and consistent quality. Its diversified product portfolio, including rare earth and battery materials, positions it well for high-growth sectors like electric vehicles. The company's leading market share in China, the world's largest tungsten market, is a significant advantage.

Strong investment in research and development fuels innovation in tungsten processing and new energy materials, ensuring a competitive edge. Strategic resource diversification, like its South African investment, and a focus on sustainability through cleaner technologies and recycling enhance long-term resilience.

| Metric | 2023 Value (RMB Billion) | Significance |

|---|---|---|

| Revenue | 32.3 | Demonstrates scale and efficiency of integrated model. |

| R&D Investment | Significant portion of revenue | Drives innovation and competitive advantage. |

| Market Share (China) | Leading | Leverages dominant position in the world's largest tungsten market. |

What is included in the product

Analyzes Xiamen Tungsten’s competitive position through key internal and external factors, detailing its strengths, weaknesses, opportunities, and threats.

Xiamen Tungsten's SWOT analysis offers a clear roadmap to navigate market volatility and identify strategic growth opportunities, alleviating concerns about competitive pressures.

Weaknesses

Xiamen Tungsten's revenue has shown some volatility. In 2024, the company saw a dip in its revenue, though its net profit managed to climb. This pattern continued into the first half of 2025, where revenue grew, but net profit attributable to shareholders decreased, largely because the prior year benefited from significant one-off investment gains.

Xiamen Tungsten's profitability is highly susceptible to fluctuations in the prices of its key raw materials, particularly tungsten and rare earth elements. This inherent vulnerability can lead to significant margin compression.

The company's rare earth segment experienced this firsthand, with revenue for the first three quarters of 2024 being negatively impacted by falling raw material prices. Such volatility makes accurate financial forecasting a considerable challenge.

Xiamen Tungsten's significant reliance on the Chinese market, with around 72% of its net sales originating from within China, presents a notable weakness. This high geographical concentration, while indicative of strong domestic market share, also heightens the company's vulnerability to fluctuations in China's economy, evolving domestic policies, and changes in local consumer preferences.

Impact of China's Export Restrictions

China's decision to implement tighter export controls on vital materials, including tungsten, starting in December 2024, poses a significant challenge. While Xiamen Tungsten operates domestically, these new regulations are expected to reshape global supply dynamics and pricing, potentially affecting the company's international market access and sales volumes.

The new export regime introduces considerable uncertainty for Xiamen Tungsten's overseas operations. These restrictions could lead to:

- Increased international tungsten prices due to reduced supply availability.

- Potential difficulties in fulfilling existing or future international contracts.

- A need to re-evaluate global market strategies and customer relationships.

Dependence on Cyclical Industrial Sectors

Xiamen Tungsten's reliance on industries like automotive and aerospace makes it vulnerable to economic cycles. For instance, a slowdown in global automotive production, which saw a modest recovery in 2024 but remained below pre-pandemic levels in many regions, directly impacts tungsten demand.

This cyclicality means that periods of reduced industrial activity, such as the potential for slower growth in electronics manufacturing projected for late 2024 and early 2025, can lead to decreased sales volumes and pressure on Xiamen Tungsten's profitability. The machine tool sector, a key consumer of tungsten carbide, also experiences significant fluctuations tied to broader capital expenditure cycles.

Key vulnerabilities include:

- Sensitivity to Automotive and Aerospace Cycles: Downturns in these major end-markets directly reduce demand for tungsten products.

- Impact of Electronics Manufacturing Slowdowns: Reduced activity in the electronics sector, a significant tungsten consumer, can negatively affect sales.

- Machine Tool Industry Volatility: Fluctuations in capital spending on machine tools create unpredictable demand for tungsten carbide.

Xiamen Tungsten's profitability is significantly tied to the volatile prices of tungsten and rare earth elements, leading to potential margin squeezes. For example, the company's rare earth segment saw revenue negatively impacted by falling raw material prices in the first three quarters of 2024.

The company's heavy reliance on the Chinese market, accounting for approximately 72% of its net sales, makes it susceptible to domestic economic shifts and policy changes. Furthermore, China's December 2024 export controls on critical materials like tungsten introduce uncertainty regarding international market access and pricing.

Xiamen Tungsten's exposure to cyclical industries such as automotive and aerospace presents a notable weakness. Downturns in these sectors, like the modest but still below pre-pandemic levels automotive production in 2024, directly dampen demand for its tungsten products.

| Metric | 2023 (Actual) | H1 2024 (Actual) | 2024 (Est.) |

|---|---|---|---|

| Net Sales (CNY Billion) | 27.6 | 13.5 | 28.0 - 29.0 |

| Net Profit Attributable to Shareholders (CNY Billion) | 1.1 | 0.4 | 1.0 - 1.2 |

| Domestic Sales % | ~72% | ~73% | ~70-75% |

Full Version Awaits

Xiamen Tungsten SWOT Analysis

The preview you see is the same document the customer will receive after purchasing. This ensures transparency and guarantees you get exactly what you expect.

You're viewing a live preview of the actual SWOT analysis file for Xiamen Tungsten. The complete version, offering a comprehensive breakdown of their Strengths, Weaknesses, Opportunities, and Threats, becomes available after checkout.

This is a real excerpt from the complete Xiamen Tungsten SWOT analysis. Once purchased, you’ll receive the full, editable version, allowing for further customization and integration into your strategic planning.

Opportunities

The global tungsten market is poised for robust expansion, with projections indicating a compound annual growth rate (CAGR) of approximately 4.5% through 2028, reaching an estimated market value of $7.8 billion. This growth is fueled by sustained demand from critical sectors such as defense, aerospace, and advanced electronics, all of which rely on tungsten's exceptional hardness and high melting point. Xiamen Tungsten is well-positioned to capitalize on this trend, potentially boosting sales volumes and solidifying its market leadership.

Xiamen Tungsten's strategic focus on battery materials is a significant opportunity, aligning perfectly with the rapid expansion of electric vehicles and renewable energy storage. The company's dedicated unit, XTC New Energy Materials, is actively investing in large-scale projects for lithium battery materials, anticipating robust demand.

This segment is poised for substantial growth, driven by the increasing global need for advanced battery components. For instance, the global EV battery market was valued at approximately $54.5 billion in 2023 and is projected to reach over $200 billion by 2030, showcasing the immense potential for companies like Xiamen Tungsten.

The global drive to diversify supply chains, especially for critical minerals, presents a significant opportunity for Xiamen Tungsten. Western economies are actively seeking alternatives to single-source dependencies, creating an opening for companies like Xiamen Tungsten to forge new international partnerships and secure supply agreements. This aligns with Xiamen Tungsten's strategy of investing in overseas exploration, as evidenced by its ongoing efforts to expand its global footprint and mitigate geopolitical risks.

Emerging Applications in Advanced Manufacturing

Technological leaps are opening new doors for tungsten. For instance, its use in additive manufacturing, or 3D printing, is growing significantly. This allows for the creation of highly precise components, a key area for growth. In 2024, the global 3D printing market was valued at over $19 billion, with advanced materials like tungsten playing a crucial role in specialized applications.

The demand for superior cutting and wear-resistant tools in advanced manufacturing sectors is also a major opportunity. Industries like aerospace and automotive are increasingly relying on tungsten carbide for its exceptional hardness and durability. This trend is expected to continue, with the global cemented carbide market projected to reach over $25 billion by 2027, showcasing a strong compound annual growth rate.

Xiamen Tungsten is well-positioned to capitalize on these trends. By continuing to invest in research and development, the company can innovate new tungsten-based materials and solutions tailored for these advanced applications, thereby securing a stronger market position.

- Additive Manufacturing: Growing demand for precision parts in aerospace and medical sectors.

- Advanced Cutting Tools: Increased need for high-performance tools in automotive and electronics manufacturing.

- R&D Investment: Xiamen Tungsten's focus on innovation to develop next-generation tungsten materials.

Leveraging Sustainability and Recycling Initiatives

The growing global emphasis on environmental issues and the scarcity of resources are significantly boosting the demand for sustainable practices and recycling within the metals sector. This trend presents a substantial opportunity for companies like Xiamen Tungsten that are already investing in cleaner production methods and recycling technologies. By aligning with these evolving market preferences and stricter regulatory landscapes, Xiamen Tungsten can solidify its market position and explore innovative business models centered around the circular economy.

Xiamen Tungsten’s proactive approach to sustainability, including its significant investments in advanced recycling processes for rare earth metals and tungsten, positions it favorably. For instance, the company's commitment to reducing its environmental footprint through technological upgrades is a key differentiator. This focus not only meets increasing customer demand for eco-friendly products but also anticipates future regulatory mandates, potentially lowering compliance costs and enhancing operational efficiency.

Leveraging these sustainability initiatives can translate into tangible business advantages. Xiamen Tungsten's enhanced brand reputation as an environmentally responsible producer can attract a wider customer base and foster stronger relationships with stakeholders. Furthermore, developing robust recycling capabilities can create new revenue streams and secure a more stable supply of critical raw materials, mitigating the risks associated with resource price volatility.

Key opportunities include:

- Expanding circular economy models: Developing closed-loop systems for tungsten and rare earth materials, potentially generating new service-based revenue.

- Strengthening brand equity: Highlighting sustainability certifications and performance metrics to appeal to environmentally conscious investors and customers.

- Meeting regulatory demands: Proactively adapting to stricter environmental regulations, such as those related to carbon emissions and waste management, which are becoming increasingly prevalent globally.

- Securing raw material supply: Reducing reliance on primary extraction through efficient recycling, ensuring greater supply chain resilience.

Xiamen Tungsten is strategically positioned to benefit from the global surge in demand for battery materials, particularly for electric vehicles. The company's investment in lithium battery materials through its XTC New Energy Materials unit aligns with a market projected to grow significantly, from approximately $54.5 billion in 2023 to over $200 billion by 2030.

The company can also capitalize on the global push for supply chain diversification, especially for critical minerals like tungsten. As Western economies seek to reduce single-source dependencies, Xiamen Tungsten's overseas exploration efforts and potential for new international partnerships present a clear avenue for growth and risk mitigation.

Furthermore, advancements in additive manufacturing and the increasing need for high-performance cutting tools in sectors like aerospace and automotive offer substantial opportunities. Xiamen Tungsten's focus on R&D to develop next-generation tungsten materials for these applications, like those used in the $19 billion global 3D printing market in 2024, is a key advantage.

The company's commitment to sustainability and circular economy models, including tungsten and rare earth recycling, is another significant opportunity. This not only appeals to environmentally conscious customers and investors but also strengthens supply chain resilience and prepares Xiamen Tungsten for increasingly stringent environmental regulations.

Threats

Rising geopolitical tensions, especially between China and Western nations, present a considerable threat. Trade disputes can lead to unpredictable market access and increased costs for Xiamen Tungsten.

China's potential export controls on vital materials like tungsten, alongside tariffs imposed by countries such as the United States, directly threaten to disrupt Xiamen Tungsten's supply chains. For instance, in 2023, the U.S. continued to impose tariffs on various Chinese goods, impacting bilateral trade flows.

The global tungsten market is seeing significant shifts with new supply sources emerging outside of China. For instance, the Sangdong mine in South Korea is ramping up production, and there are also developing projects in Europe, Australia, and the United States. This diversification is a direct challenge to China's historical dominance in tungsten supply.

This increased competition from these new operations, particularly Sangdong which aims to become a major global producer, could dilute Xiamen Tungsten's market share. Such a scenario might put downward pressure on tungsten prices, impacting Xiamen Tungsten's pricing power and overall profitability in the coming years as the market adjusts to these new supply dynamics.

The fluctuating costs of essential inputs like tungsten and rare earth elements present a considerable challenge for Xiamen Tungsten. For instance, tungsten prices saw significant swings in 2024, with market reports indicating a drop of over 15% in the first half of the year due to global economic uncertainties and shifts in demand from key industries like construction and automotive.

Such price volatility directly squeezes Xiamen Tungsten's profitability, as lower raw material costs can be offset by reduced selling prices for their finished products. This dynamic makes consistent revenue generation and margin management a complex undertaking.

Effectively navigating these market price swings is paramount for Xiamen Tungsten's long-term financial stability and competitive positioning in the global materials sector.

Stringent Environmental Regulations and Compliance Costs

Xiamen Tungsten faces significant threats from increasingly stringent environmental regulations, particularly in China's mining and processing sectors. These evolving standards, aimed at reducing pollution and promoting sustainable practices, could substantially increase operational compliance costs. For instance, stricter emissions controls or waste management requirements might necessitate costly upgrades to existing facilities or the adoption of entirely new, cleaner technologies. In 2023, China's Ministry of Ecology and Environment continued to emphasize enforcement of environmental protection laws, with penalties for non-compliance becoming more severe, potentially impacting companies like Xiamen Tungsten if they fail to adapt proactively.

These regulatory pressures can directly affect profitability and production efficiency. Investments required for environmental compliance, such as advanced wastewater treatment or dust suppression systems, divert capital that could otherwise be allocated to expansion or research and development. Failure to meet these standards could also lead to production halts or fines, creating significant financial and operational disruptions. For example, the push for greener manufacturing processes in 2024 and 2025 is expected to drive up the cost of raw material sourcing and processing for many industries, including those involved with rare earth metals and tungsten.

- Increased Capital Expenditure: Compliance with new environmental standards could require substantial investments in pollution control equipment and process modifications.

- Operational Disruptions: Failure to meet regulatory requirements may result in production stoppages or fines, impacting output and revenue.

- Higher Operating Costs: Ongoing expenses related to environmental monitoring, reporting, and waste disposal are likely to rise.

Global Economic Downturn and Industrial Slowdown

A global economic downturn poses a significant threat to Xiamen Tungsten. Should major economies experience a recession, or if key industrial sectors like automotive and electronics face a slowdown, demand for tungsten products would inevitably decrease. For instance, a projected global GDP growth of around 2.6% for 2024, down from previous years, signals potential headwinds for industrial output and, consequently, tungsten consumption.

Xiamen Tungsten's reliance on these cyclical industries means a sustained downturn could lead to:

- Reduced Sales Volumes: Lower demand from manufacturing sectors directly impacts the quantity of tungsten products Xiamen Tungsten can sell.

- Overcapacity: If production levels do not align with falling demand, the company could face issues with excess inventory and underutilized manufacturing capacity.

- Financial Pressure: Decreased revenue and potential price erosion due to lower demand can create significant financial strain, impacting profitability and cash flow.

The company faces substantial threats from escalating geopolitical tensions and potential trade protectionism. For example, the ongoing trade friction between China and the US could lead to further tariffs or restrictions on critical materials like tungsten, impacting Xiamen Tungsten's international sales and supply chain stability. These trade dynamics are a key concern for 2024 and 2025, as global trade policies remain uncertain.

Emerging supply sources outside China, such as the Sangdong mine in South Korea, are increasing global tungsten output. This diversification challenges China's historical market dominance and could lead to greater price competition, potentially affecting Xiamen Tungsten's market share and pricing power. By 2025, these new mines are expected to contribute significantly to global supply.

| Threat Category | Specific Threat | Potential Impact | Example/Data Point (2024/2025 Focus) |

|---|---|---|---|

| Geopolitical & Trade | Trade Wars & Tariffs | Disrupted supply chains, increased costs, reduced market access | US tariffs on Chinese goods continued in 2024; potential for further restrictions on critical minerals. |

| Competition | New Supply Sources | Market share erosion, downward price pressure | Sangdong mine (South Korea) ramping up production; expected to impact global supply balance by 2025. |

| Economic Factors | Global Economic Downturn | Reduced demand for industrial products, lower sales volumes | Projected global GDP growth around 2.6% for 2024 indicates potential headwinds for industrial demand. |

| Regulatory | Stricter Environmental Regulations | Increased operational costs, potential production disruptions | China's continued emphasis on environmental enforcement in 2023-2025 may require costly compliance investments. |

SWOT Analysis Data Sources

This Xiamen Tungsten SWOT analysis is built upon a foundation of robust data, incorporating their official financial statements, comprehensive market research reports, and expert industry analyses to provide a well-informed strategic overview.