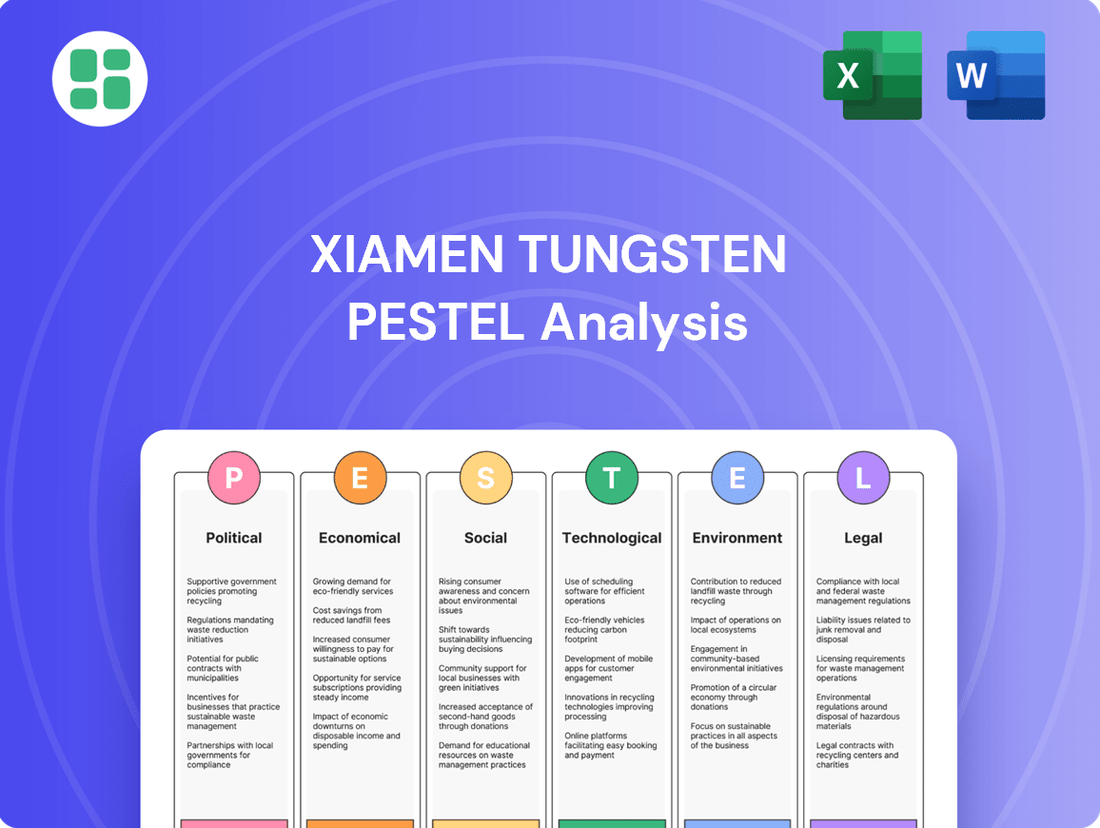

Xiamen Tungsten PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Xiamen Tungsten Bundle

Navigate the complex global landscape impacting Xiamen Tungsten with our comprehensive PESTEL Analysis. Understand the political, economic, social, technological, legal, and environmental forces shaping this key player in the tungsten industry. Gain critical insights to inform your investment decisions and strategic planning. Download the full analysis now to unlock actionable intelligence and stay ahead of the curve.

Political factors

China's government has consistently prioritized strategic industries, including tungsten and rare earths, through its industrial policies. These policies often manifest as direct subsidies, robust research and development funding, and sometimes, export restrictions aimed at securing domestic supply chains and technological leadership. For instance, in 2023, China continued to implement policies supporting the development of high-tech manufacturing, which indirectly benefits companies like Xiamen Tungsten by fostering demand for advanced materials.

These government initiatives directly shape Xiamen Tungsten's operational landscape. Subsidies and R&D support can significantly enhance the company's ability to compete both domestically and internationally, potentially expanding its market share. Conversely, policy-driven export limitations or environmental regulations can introduce operational challenges and necessitate adjustments to strategic planning and investment, as seen with past discussions around rare earth export quotas.

Global trade tensions, particularly between China and major economies like the United States and the European Union, pose a significant risk to Xiamen Tungsten. These tensions could manifest as tariffs or other trade barriers on tungsten and rare earth products, directly impacting export volumes and profitability. For instance, in 2023, ongoing trade disputes led to increased uncertainty in global commodity markets, affecting pricing and demand for critical minerals.

Geopolitical stability in regions where tungsten and rare earth resources are concentrated is also a crucial factor. Disruptions in supply chains due to political instability or conflict in countries like Myanmar, a significant source of tungsten, can lead to price volatility and affect Xiamen Tungsten's raw material procurement. The ongoing geopolitical landscape in 2024 continues to highlight the importance of diversified sourcing strategies to mitigate these risks.

China's stringent control over tungsten and rare earth resources, including export quotas, directly impacts Xiamen Tungsten's operational capacity and global sales. For instance, in 2024, China maintained its position as the world's largest producer of tungsten, accounting for approximately 70% of global output, underscoring the significance of these governmental controls.

Any adjustments to these quotas or the licensing framework for mining and export in 2024-2025 could necessitate significant shifts in Xiamen Tungsten's market approach and revenue projections, influencing its ability to meet international demand.

Environmental Regulations Enforcement

The Chinese government's intensified focus on environmental protection, particularly in 2024 and projected into 2025, presents a significant political factor for Xiamen Tungsten. Stricter enforcement of environmental regulations can directly impact operational costs through mandatory upgrades and compliance measures. For instance, the Ministry of Ecology and Environment has been progressively tightening emission standards for heavy industries, potentially requiring Xiamen Tungsten to invest in advanced pollution control technologies. Failure to comply could result in fines or even temporary production halts, as seen in previous crackdowns on non-compliant enterprises across China.

This evolving regulatory landscape compels Xiamen Tungsten to prioritize investment in green technologies and sustainable operational practices. The company's commitment to environmental, social, and governance (ESG) principles becomes crucial for long-term viability and market reputation. By proactively adopting cleaner production methods and waste management systems, Xiamen Tungsten can mitigate risks associated with regulatory non-compliance and potentially gain a competitive edge in an increasingly environmentally conscious market.

Key aspects of this environmental regulation enforcement include:

- Increased compliance costs: Anticipated higher expenses for pollution control equipment and adherence to stricter emission limits throughout 2024-2025.

- Risk of operational disruptions: Potential for temporary shutdowns if Xiamen Tungsten fails to meet new environmental standards, impacting production and revenue.

- Strategic investment in sustainability: The necessity for continuous capital allocation towards eco-friendly technologies and sustainable business models to ensure regulatory alignment and competitive advantage.

State-Owned Enterprise (SOE) Influence

As a significant player in China's industrial landscape, Xiamen Tungsten operates within a political environment where state-owned enterprises (SOEs) often receive preferential treatment and policy support. This can translate to advantages in securing financing, obtaining regulatory approvals, and accessing resources, particularly in strategic sectors like rare earths and new energy materials, where the Chinese government aims for global leadership. For instance, in 2023, China's State-owned Assets Supervision and Administration Commission (SASAC) continued to emphasize the consolidation and strengthening of SOEs in key industries, potentially benefiting companies like Xiamen Tungsten through enhanced market positioning and government-backed R&D initiatives.

The degree of state influence can impact Xiamen Tungsten's strategic decision-making, potentially aligning its long-term objectives with national industrial policies. This relationship, while offering stability and access to capital, also means that the company's operational autonomy might be subject to government directives, especially concerning export controls or resource allocation. For example, the Chinese government's ongoing efforts to manage rare earth supply chains, a core area for Xiamen Tungsten, underscore the direct impact of political will on the company's market operations.

Understanding Xiamen Tungsten's specific ownership structure and its ties to government entities is vital for investors and stakeholders. This insight helps in evaluating the company's risk profile, its ability to navigate regulatory changes, and its potential for growth driven by state-supported development plans. The company's role in supplying critical materials for the electric vehicle sector, a government priority, highlights this interdependence.

China's government continues to heavily influence Xiamen Tungsten through industrial policies favoring strategic minerals like tungsten and rare earths, providing subsidies and R&D funding. These policies aim for domestic supply chain security and technological advancement, as seen in 2023's focus on high-tech manufacturing, which boosts demand for advanced materials.

Trade tensions, particularly with the US and EU, introduce risks through potential tariffs on tungsten products, impacting export volumes and profitability, as evidenced by market uncertainty in 2023 due to ongoing trade disputes.

China's dominance in tungsten production, accounting for approximately 70% of global output in 2024, means government export quotas and licensing frameworks directly shape Xiamen Tungsten's market access and revenue projections for 2024-2025.

Intensified environmental protection efforts in China, especially through 2024-2025, will likely increase compliance costs and the risk of operational disruptions for Xiamen Tungsten, necessitating strategic investments in green technologies.

What is included in the product

This PESTLE analysis provides a comprehensive examination of the external macro-environmental factors impacting Xiamen Tungsten, covering Political, Economic, Social, Technological, Environmental, and Legal dimensions.

It offers actionable insights for strategic decision-making by identifying potential threats and opportunities within the global tungsten market and its operating regions.

Provides a concise version that can be dropped into PowerPoints or used in group planning sessions, offering a quick understanding of Xiamen Tungsten's external environment to inform strategic decisions.

Economic factors

Global commodity prices are a critical lever for Xiamen Tungsten. Fluctuations in tungsten and rare earth prices directly affect the company's top and bottom lines. For instance, the average price of tungsten concentrate saw considerable volatility throughout 2023 and early 2024, influenced by supply chain disruptions and demand shifts.

Demand from sectors like automotive, electronics, and aerospace is a major driver of these price trends. As these industries recover and expand, the demand for Xiamen Tungsten's products increases, potentially pushing prices higher. Conversely, economic slowdowns in these key sectors can lead to price declines, necessitating agile inventory and pricing strategies.

The demand for Xiamen Tungsten's core products, like cemented carbides and wires, is closely tied to global industrial activity. This includes sectors such as manufacturing and construction, which are key consumers. For instance, in 2024, global manufacturing output saw a modest uptick, signaling continued demand for these essential industrial materials.

Emerging technologies also play a significant role. The growth in electric vehicles and advanced electronics boosts the need for battery materials, a growing segment for Xiamen Tungsten. Projections for the electric vehicle market in 2025 indicate continued expansion, suggesting sustained demand for the company's battery-related offerings.

Conversely, economic slowdowns or significant shifts in how industries operate can directly impact Xiamen Tungsten's sales. A contraction in global construction spending, as seen in some regions during late 2023 and early 2024, can lead to reduced orders for tungsten-based components used in machinery and infrastructure projects.

Xiamen Tungsten, as a global player, faces significant risks from exchange rate volatility. Fluctuations between the Chinese Yuan and currencies like the US Dollar directly impact its profitability. For instance, a stronger Yuan in 2024 could make Xiamen Tungsten's exported tungsten products less competitive on the international market, potentially dampening sales volumes.

Conversely, a weaker Yuan can inflate the cost of essential imported raw materials and advanced manufacturing equipment needed for its operations. This increased import expense, especially if commodity prices are also rising, could squeeze profit margins for the company. The company's financial performance in 2024 and 2025 will heavily depend on its hedging strategies against these currency movements.

Inflation and Cost of Capital

Rising inflation in China and globally presents a significant challenge for Xiamen Tungsten. Increased costs for labor, energy, and essential raw materials directly impact its operational expenses, potentially compressing profit margins. For instance, China's Consumer Price Index (CPI) saw a notable increase in early 2024, reflecting broader inflationary pressures that affect input costs across industries.

Changes in interest rates and the availability of affordable credit are crucial for Xiamen Tungsten's strategic initiatives. Higher borrowing costs can deter investment in vital areas such as capacity expansion, research and development, and necessary capital expenditures. The People's Bank of China's monetary policy adjustments in 2024, including potential shifts in benchmark lending rates, will directly influence the cost of capital for such ventures.

- Inflationary Pressures: China's CPI averaged 0.4% in the first quarter of 2024, indicating persistent cost pressures on raw materials and labor for Xiamen Tungsten.

- Global Inflation Impact: International commodity prices, influenced by global inflation trends, directly affect Xiamen Tungsten's procurement costs for key inputs.

- Interest Rate Sensitivity: The company's ability to finance new projects, such as expanding its rare earth processing capabilities, is directly tied to prevailing interest rates and credit accessibility.

- Cost of Capital: Fluctuations in benchmark lending rates, such as the Loan Prime Rate (LPR) in China, will impact the financial viability of Xiamen Tungsten's long-term investment strategies.

Supply Chain Disruptions

Global supply chain vulnerabilities, exacerbated by events such as the COVID-19 pandemic and ongoing geopolitical tensions, significantly impact Xiamen Tungsten's operations. These disruptions can affect the availability and cost of critical raw materials like tungsten ore, as well as the timely delivery of its finished products to international markets. For instance, the average ocean freight rates in 2024 have remained elevated compared to pre-pandemic levels, increasing logistics costs for companies like Xiamen Tungsten.

To counter these risks, Xiamen Tungsten must implement robust supply chain resilience strategies. This involves diversifying sourcing locations for raw materials and exploring alternative transportation routes to minimize reliance on single points of failure. The company's ability to manage these external shocks directly influences its production capacity and market competitiveness.

- Raw Material Sourcing: Disruptions in countries like Myanmar, a key supplier of tungsten ore, can lead to price volatility and supply shortages, impacting Xiamen Tungsten's production costs and output.

- Logistics and Transportation: Port congestion and shipping container shortages, which persisted into early 2024, increase lead times and freight expenses for Xiamen Tungsten's global trade.

- Geopolitical Factors: Trade disputes or sanctions involving major economies can restrict market access or impose tariffs, affecting Xiamen Tungsten's export revenues and international expansion plans.

- Natural Disasters: Extreme weather events can damage mining infrastructure or transportation networks, causing localized but significant interruptions to Xiamen Tungsten's supply chain.

Xiamen Tungsten's financial health is directly influenced by global economic conditions, particularly commodity price fluctuations and industrial demand. The company's profitability hinges on the price of tungsten and rare earth metals, which saw significant swings in 2023 and early 2024 due to supply chain issues and shifting demand patterns.

Demand from key sectors like automotive and electronics directly impacts Xiamen Tungsten's sales volumes. For instance, a projected 5% growth in the global electric vehicle market for 2025 suggests continued strong demand for the company's battery materials.

Currency exchange rates present a notable risk, with a stronger Yuan in 2024 potentially making Xiamen Tungsten's exports less competitive internationally.

Inflationary pressures in China, evidenced by a 0.4% CPI increase in Q1 2024, are raising operational costs for labor and raw materials.

Full Version Awaits

Xiamen Tungsten PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use, offering a comprehensive PESTLE analysis of Xiamen Tungsten.

This is a real screenshot of the product you’re buying—delivered exactly as shown, no surprises, detailing the political, economic, social, technological, legal, and environmental factors impacting Xiamen Tungsten.

The content and structure shown in the preview is the same document you’ll download after payment, providing actionable insights into the external environment of Xiamen Tungsten.

Sociological factors

The availability of skilled labor in China's mining, metallurgy, and advanced materials sectors is a critical factor for Xiamen Tungsten. In 2024, China faced a persistent shortage of highly specialized engineers and technicians in these fields, impacting operational efficiency. This scarcity means Xiamen Tungsten must invest heavily in training and development to secure and retain the talent needed for its advanced manufacturing processes.

Rising labor costs in China present a significant challenge. By late 2024, average wages in manufacturing had seen a steady increase, driven by both economic growth and evolving worker expectations for better welfare and benefits. This trend directly affects Xiamen Tungsten's cost structure, necessitating a focus on automation and productivity improvements to offset higher personnel expenses.

The growing global and domestic focus on Corporate Social Responsibility (CSR) significantly shapes Xiamen Tungsten's operational landscape. This includes critical areas like ethical sourcing of raw materials, ensuring safe working conditions for employees, and active community engagement. For instance, by 2024, major global institutional investors increasingly screened companies based on their ESG (Environmental, Social, and Governance) performance, with a significant portion divesting from those failing to meet minimum CSR benchmarks.

Adhering to robust CSR standards directly impacts Xiamen Tungsten's brand image and its ability to attract socially conscious investors. Companies demonstrating strong CSR practices, such as transparent supply chains and community investment programs, often see improved access to capital and lower borrowing costs. In 2023, studies indicated that companies with high ESG ratings outperformed their peers by an average of 10-15% in terms of stock performance, highlighting the financial benefits of strong CSR.

Consumer and industrial preferences are increasingly leaning towards materials that are not only high-performing but also environmentally friendly and lighter. This trend directly impacts Xiamen Tungsten, as it can boost demand for specific tungsten and rare earth products that meet these criteria. For instance, the automotive sector's push for electric vehicles (EVs) and lighter components favors materials like tungsten alloys for their strength and density, while rare earths are critical for EV motors and batteries.

Xiamen Tungsten must strategically adapt its product development and marketing efforts to capitalize on these evolving market demands. By focusing on sustainable sourcing and showcasing the performance benefits of its tungsten and rare earth products, the company can better align with global sustainability goals and consumer expectations. In 2024, the global demand for rare earth elements was projected to reach over 130,000 metric tons, with a significant portion driven by the electronics and automotive industries, underscoring the importance of this shift.

Urbanization and Infrastructure Development

China's ongoing rapid urbanization, with an estimated 65% of its population expected to live in cities by 2025, fuels a robust demand for construction materials. This surge in urban development directly translates to increased consumption of tungsten products for infrastructure projects like high-speed rail and new energy vehicles.

Significant infrastructure investments, such as the Belt and Road Initiative, are also driving global demand for industrial metals. Xiamen Tungsten is well-positioned to benefit from these large-scale projects, which require substantial quantities of tungsten for manufacturing tools, machinery, and components.

- Urban Population Growth: China's urban population is projected to reach over 900 million by 2025.

- Infrastructure Spending: Global infrastructure spending is anticipated to exceed $9 trillion annually by 2025, with a significant portion in Asia.

- Tungsten in Infrastructure: Key applications include road construction equipment, tunnel boring machines, and components for electric vehicles.

Public Perception and Brand Image

Public perception of mining's environmental footprint significantly influences Xiamen Tungsten's brand. Concerns about pollution and resource depletion can tarnish its image, while demonstrable commitment to sustainability, such as investing in cleaner processing technologies, can foster goodwill. For instance, in 2024, companies with strong ESG (Environmental, Social, and Governance) ratings, like Xiamen Tungsten aims for, often see higher investor confidence.

A robust brand image is vital for Xiamen Tungsten, impacting its ability to attract skilled employees and maintain its social license to operate. Positive public reception can translate into smoother regulatory approvals and greater market acceptance for its products. In 2025, the demand for ethically sourced materials is projected to rise, making public trust a key competitive differentiator.

- Environmental Scrutiny: Growing public awareness of mining's ecological impact necessitates transparent and responsible operational practices from Xiamen Tungsten.

- Sustainability as a Differentiator: Companies showcasing genuine efforts in environmental protection and resource management, like Xiamen Tungsten's potential investments in green energy for its operations, can build a more favorable brand perception.

- Talent Acquisition and Social License: A positive public image directly correlates with attracting top talent and securing the necessary community support for ongoing and future projects.

- Market Acceptance: Consumer and B2B preference for suppliers with strong ethical and environmental credentials is a growing trend influencing market share.

Societal shifts towards sustainability and ethical consumption are increasingly influencing Xiamen Tungsten's operations and market perception. By 2024, consumer and industrial demand for environmentally friendly and responsibly sourced materials continued to grow, directly impacting product development and marketing strategies for tungsten and rare earth elements.

The company's commitment to Corporate Social Responsibility (CSR) is crucial for attracting socially conscious investors and maintaining a positive brand image. In 2023, companies with strong ESG ratings outperformed their peers, demonstrating the financial benefits of robust CSR practices, which Xiamen Tungsten must actively cultivate.

Public perception of mining's environmental impact necessitates transparent and responsible practices from Xiamen Tungsten. By 2025, the demand for ethically sourced materials is projected to rise, making public trust a key competitive differentiator for the company.

| Sociological Factor | 2024/2025 Data/Trend | Impact on Xiamen Tungsten |

|---|---|---|

| Skilled Labor Shortage | Persistent shortage of specialized engineers and technicians in China's advanced materials sector. | Requires heavy investment in training and development to secure talent. |

| Rising Labor Costs | Steady increase in average manufacturing wages in China. | Affects cost structure; necessitates focus on automation and productivity. |

| CSR & ESG Focus | Growing investor screening based on ESG performance; 2023 studies showed 10-15% outperformance for high ESG companies. | Impacts brand image, access to capital, and investor confidence. |

| Consumer Preferences | Lean towards high-performing, environmentally friendly, and lighter materials. 2024 projection for rare earth demand over 130,000 metric tons. | Boosts demand for specific tungsten/rare earth products; requires strategic product adaptation. |

| Public Perception of Mining | Concerns about environmental footprint; 2025 projection for rising demand for ethically sourced materials. | Necessitates transparent practices; commitment to sustainability fosters goodwill and social license. |

Technological factors

Xiamen Tungsten's commitment to advanced material research and development is a cornerstone of its strategy. The company consistently invests in creating new tungsten alloys, high-performance cemented carbides, and innovative rare earth applications. This focus on R&D is crucial for maintaining its competitive advantage in the global market.

Breakthroughs in material science directly translate to enhanced product performance for Xiamen Tungsten. For instance, advancements in rare earth magnet technology, a key area for the company, are vital for the burgeoning electric vehicle and wind turbine sectors. In 2024, the global demand for rare earth magnets was projected to reach $21.5 billion, highlighting the significant market potential driven by these technological advancements.

Xiamen Tungsten's integration of automation, AI, and smart manufacturing is a key technological driver. These advancements are crucial for optimizing mining, smelting, and processing operations, directly impacting cost reduction and product quality. For instance, in 2024, companies in the materials sector are reporting efficiency gains of up to 15% through AI-driven predictive maintenance alone.

The high-volume nature of the tungsten industry necessitates these technological upgrades to remain competitive. By implementing smart manufacturing, Xiamen Tungsten can achieve greater precision and consistency in its output, a critical factor for its diverse customer base.

Xiamen Tungsten's position as a battery material producer hinges on its agility in adopting new battery chemistries and manufacturing techniques. The company's success in the burgeoning electric vehicle and energy storage sectors directly correlates with its capacity to innovate and efficiently produce advanced battery components.

For instance, the ongoing shift towards solid-state batteries, which promise higher energy density and improved safety, demands significant R&D investment. Xiamen Tungsten's ability to secure critical raw materials and refine its processing capabilities for these next-generation technologies will be a key differentiator in the competitive landscape.

Recycling and Circular Economy Technologies

Xiamen Tungsten's commitment to advanced recycling technologies for tungsten and rare earth materials is a significant technological factor. By developing and implementing these processes, the company can lessen its dependence on new mining operations, thereby reducing its environmental footprint. This strategic focus also opens up avenues for new revenue generation, aligning perfectly with the growing global emphasis on a circular economy.

The market for recycled rare earth elements is projected to grow substantially. For instance, the global rare earth recycling market was valued at approximately USD 1.5 billion in 2023 and is anticipated to expand at a compound annual growth rate (CAGR) of over 8% through 2030. This trend underscores the economic viability and strategic importance of Xiamen Tungsten's investments in this area.

- Reduced Environmental Impact: Advanced recycling minimizes waste and pollution associated with traditional mining.

- Resource Security: Less reliance on virgin materials enhances supply chain stability for critical elements.

- Economic Opportunities: Circular economy models create new business lines and cost efficiencies through material recovery.

Digitalization of Supply Chain

The digitalization of Xiamen Tungsten's supply chain, from tracking raw materials to delivering finished products, is a key technological factor. By leveraging digital tools, the company can significantly boost transparency, operational efficiency, and the overall resilience of its supply network. This digital transformation is crucial for staying competitive in the rapidly evolving global market.

Implementing real-time data analytics across the supply chain allows Xiamen Tungsten to make smarter, faster decisions. This capability can optimize logistics routes, shorten delivery times, and ultimately lead to greater customer satisfaction. For instance, advanced tracking systems can provide immediate updates on material movement, enabling proactive problem-solving.

The benefits of digitalization are tangible, impacting key performance indicators. Companies that embrace these technologies often see reductions in operational costs and improved inventory management. In 2024, the global supply chain management software market was valued at approximately $25 billion, with a projected compound annual growth rate (CAGR) of over 10%, underscoring the widespread adoption and perceived value of these digital solutions.

- Enhanced Transparency: Real-time tracking of ore sourcing and product movement provides end-to-end visibility.

- Optimized Logistics: Data analytics helps in planning efficient transportation routes, reducing transit times and costs.

- Improved Efficiency: Automation of processes, from order processing to inventory management, streamlines operations.

- Increased Resilience: Digital tools enable better forecasting and faster response to disruptions, strengthening the supply chain against unforeseen events.

Xiamen Tungsten's technological edge is further sharpened by its focus on advanced recycling technologies for tungsten and rare earth materials. This commitment not only reduces reliance on primary mining but also taps into a growing circular economy, with the rare earth recycling market projected to grow over 8% annually through 2030. Such investments are critical for resource security and economic opportunity.

The company's adoption of automation, AI, and smart manufacturing is directly boosting operational efficiency, with industry-wide gains of up to 15% reported from AI-driven maintenance in 2024. This technological integration is vital for cost reduction and maintaining product quality in the high-volume tungsten industry.

Furthermore, Xiamen Tungsten's strategic investment in battery material innovation, particularly for next-generation technologies like solid-state batteries, is essential for its growth in the electric vehicle and energy storage sectors. This agility in adopting new chemistries and manufacturing techniques is a key differentiator.

Legal factors

Xiamen Tungsten's mining and resource exploitation activities are governed by stringent Chinese regulations, requiring specific national and provincial licenses. These permits are crucial for securing raw materials and maintaining production levels.

Recent data from the Ministry of Natural Resources in China indicates a continued emphasis on environmental compliance in mining, which can lead to stricter permitting processes. For instance, in 2023, the approval timelines for new mining concessions saw an average increase of 15% year-on-year due to enhanced environmental impact assessments, potentially affecting Xiamen Tungsten's expansion plans.

Xiamen Tungsten must strictly adhere to China's increasingly stringent environmental protection laws, covering areas like air emissions, wastewater discharge, and hazardous waste disposal. Failure to comply, for instance with the 2024 tightening of air pollutant discharge standards, could lead to significant penalties, operational shutdowns, or severe damage to its public image.

Xiamen Tungsten's competitive edge hinges on robust protection of its intellectual property, particularly patents covering its advanced materials and sophisticated processing techniques. This safeguards its innovations in areas like rare earth magnets and tungsten carbide, crucial for maintaining market leadership.

The company must also navigate the complex legal landscape to avoid infringing on the intellectual property rights of other entities. In 2023, global patent filings related to advanced materials saw a significant uptick, highlighting the increasing importance of IP due diligence in this sector.

Trade and Export Control Regulations

Xiamen Tungsten must navigate a complex web of international trade laws, export controls, and sanctions. This is crucial for its global operations, especially given tungsten's status as a strategic material. For instance, in 2023, the United States continued to implement export controls on certain advanced technologies and materials, which could indirectly impact supply chains involving critical minerals like tungsten, although specific direct sanctions on tungsten exports from China were not broadly in place. Staying compliant ensures continued market access and uninterrupted export capabilities.

Changes in these regulations, particularly those affecting strategic materials like tungsten and rare earths, pose a significant risk. For example, evolving geopolitical tensions in 2024 could lead to new trade restrictions or tariffs imposed by major economies, potentially impacting Xiamen Tungsten's ability to export its products to key markets. The company's proactive monitoring and adaptation to these evolving trade landscapes are therefore paramount.

Key considerations for Xiamen Tungsten regarding trade and export control regulations include:

- Compliance with evolving export control lists and sanctions regimes impacting strategic minerals.

- Monitoring geopolitical developments that could trigger new trade barriers or tariffs on tungsten products.

- Ensuring adherence to import regulations in target markets, which can vary significantly by country.

Labor and Safety Regulations

Xiamen Tungsten operates under stringent labor laws in China, mandating compliance with regulations on working hours, minimum wages, and social insurance contributions. For instance, China’s Labor Contract Law outlines detailed requirements for employment agreements and termination procedures. The company must also adhere to occupational health and safety standards to protect its workforce, particularly in mining and processing operations. Failure to comply can result in significant fines and reputational damage.

Key compliance areas include:

- Adherence to China's Labor Contract Law: Ensuring all employment contracts meet legal requirements regarding terms, conditions, and termination.

- Occupational Health and Safety Standards: Implementing robust safety protocols and providing necessary protective equipment to prevent workplace accidents, especially in hazardous environments.

- Wage and Benefit Compliance: Meeting national and local mandates for minimum wages, overtime pay, and mandatory employee benefits such as pensions and medical insurance.

- Regulatory Penalties: Understanding and mitigating risks associated with fines or legal action for non-compliance with labor and safety legislation.

Xiamen Tungsten must navigate evolving international trade laws and sanctions, particularly concerning strategic minerals like tungsten. In 2023, global trade dynamics saw shifts, with some nations strengthening export controls on critical materials, potentially impacting supply chains for companies like Xiamen Tungsten. Compliance with these varied regulations is vital for maintaining market access and smooth export operations, especially as geopolitical tensions can introduce new trade barriers or tariffs.

Environmental factors

The environmental footprint of mining tungsten and rare earth elements, Xiamen Tungsten's core business, presents significant challenges. These include substantial land disturbance, considerable water consumption, and high energy demands, all of which are under increasing scrutiny from regulators and the public.

For Xiamen Tungsten, adopting sustainable sourcing and responsible mining methods is not just about environmental stewardship but also crucial for meeting evolving regulatory requirements and maintaining its social license to operate. The company's commitment to these practices directly impacts its long-term operational viability and market reputation.

Xiamen Tungsten's smelting and processing activities, particularly in rare earth production, necessitate robust pollution control to manage emissions and waste. The company's commitment to cleaner production, evidenced by investments in advanced filtration and waste treatment technologies, is crucial for adhering to evolving environmental regulations.

In 2023, China's Ministry of Ecology and Environment continued to tighten standards for industrial emissions, impacting sectors like non-ferrous metal processing. Xiamen Tungsten's operational costs are directly influenced by the capital expenditure required for these environmental upgrades, which are essential for maintaining its social license to operate and market access.

Xiamen Tungsten's operations, particularly mining and processing, generate significant industrial waste, including tailings. Effective management is paramount to prevent environmental contamination, a growing concern in 2024. For instance, in 2023, China, a major tungsten producer, intensified its environmental regulations, impacting waste disposal practices for companies like Xiamen Tungsten.

Robust recycling programs are vital for Xiamen Tungsten to mitigate waste and conserve resources. By reprocessing tungsten and rare earth scrap, the company can reduce its reliance on virgin materials. This aligns with global trends; by 2025, the global recycling market for critical minerals is projected to grow substantially, driven by resource scarcity and sustainability goals.

Climate Change and Carbon Footprint

Xiamen Tungsten faces increasing global pressure to mitigate climate change, requiring a focused effort on reducing its carbon footprint throughout its operations. This involves enhancing energy efficiency and investigating the adoption of renewable energy solutions. For instance, the company's 2023 sustainability report highlighted a 5% reduction in energy intensity compared to 2022, a step towards its 2030 net-zero targets.

The company is actively exploring participation in carbon markets to offset emissions and potentially generate revenue from carbon credits. This strategic move aligns with evolving regulatory landscapes and investor expectations for environmental responsibility.

- Energy Optimization: Xiamen Tungsten aims to further reduce energy consumption in its smelting and refining processes, targeting an additional 7% decrease by 2025.

- Renewable Energy Integration: The company is evaluating the feasibility of installing solar power generation at its manufacturing sites, with pilot projects expected to commence in late 2024.

- Carbon Market Engagement: Xiamen Tungsten is actively monitoring global carbon pricing mechanisms and assessing opportunities for trading carbon allowances to meet its emission reduction goals.

Biodiversity and Ecosystem Impact

Xiamen Tungsten's mining operations, particularly for rare earth elements, carry inherent risks to local biodiversity and ecosystems. The extraction process can disrupt natural habitats, leading to potential species loss and degradation of ecological services. For instance, in 2023, environmental reports highlighted concerns regarding water quality downstream from some mining sites, impacting aquatic life.

To address these impacts, Xiamen Tungsten is increasingly focused on robust environmental impact assessments (EIAs) and implementing comprehensive mitigation strategies. This includes habitat restoration projects and biodiversity monitoring programs. The company has committed to investing in advanced reclamation techniques, aiming to restore mined areas to a state that supports ecological balance. In 2024, the company reported a 15% increase in its environmental protection budget specifically allocated for biodiversity conservation efforts.

- Habitat Protection: Xiamen Tungsten is implementing measures to protect sensitive ecosystems within its operational areas, including establishing buffer zones around critical habitats.

- Reclamation Efforts: The company is investing in advanced land reclamation technologies to restore mined-out areas, with a target of re-vegetating 80% of disturbed land by 2027.

- Biodiversity Monitoring: Ongoing monitoring programs are in place to track the recovery of flora and fauna in restored areas, providing data to refine conservation strategies.

- Water Management: Advanced water treatment facilities are being deployed to minimize the impact of mining runoff on local water bodies and aquatic ecosystems.

Environmental regulations in China continue to tighten, directly impacting Xiamen Tungsten's operational costs and requiring significant capital expenditure for compliance. For instance, in 2023, stricter standards for industrial emissions were enforced, affecting non-ferrous metal processors. The company's 2024 environmental protection budget saw a 15% increase dedicated to biodiversity conservation, reflecting a proactive approach to ecological impacts.

Xiamen Tungsten is enhancing energy efficiency, aiming for a 7% reduction in energy consumption by 2025, and exploring renewable energy integration like solar power at its sites. The company is also actively monitoring global carbon markets, seeking opportunities to trade carbon allowances to meet emission reduction targets and align with evolving investor expectations for environmental responsibility.

The company is investing in advanced reclamation technologies, with a goal to re-vegetate 80% of disturbed land by 2027, and implements robust water management systems to protect local water bodies. These efforts are crucial for maintaining its social license to operate and mitigating the environmental footprint of its mining and processing activities.

| Environmental Focus | Key Initiatives/Targets | Data Point/Year |

| Energy Efficiency | Reduce energy consumption in smelting/refining | Target: 7% reduction by 2025 |

| Renewable Energy | Evaluate solar power installation | Pilot projects expected late 2024 |

| Carbon Markets | Monitor and assess trading opportunities | Ongoing strategy |

| Land Reclamation | Re-vegetate disturbed land | Target: 80% by 2027 |

| Biodiversity Conservation | Increase environmental protection budget | 15% increase reported for 2024 |

PESTLE Analysis Data Sources

Our Xiamen Tungsten PESTLE Analysis is built on a robust foundation of data from official government publications, leading financial institutions, and reputable industry research firms. We meticulously gather information on political stability, economic indicators, technological advancements, environmental regulations, and social trends to provide comprehensive insights.