Xiamen Tungsten Marketing Mix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Xiamen Tungsten Bundle

Uncover the strategic brilliance behind Xiamen Tungsten's market dominance by exploring their meticulously crafted Product, Price, Place, and Promotion strategies. This comprehensive analysis reveals how they effectively position their offerings, set competitive pricing, leverage distribution channels, and execute impactful promotions to capture market share.

Go beyond the surface-level understanding and gain actionable insights into Xiamen Tungsten's marketing engine. This ready-to-use, editable report provides a deep dive into each of the 4Ps, perfect for students, professionals, and anyone seeking to understand successful market strategies.

Save valuable time and effort with this pre-written, expert analysis. It's your shortcut to understanding Xiamen Tungsten's marketing mix, offering structured thinking and real-world examples for your own business planning or academic pursuits.

Product

Xiamen Tungsten's Product strategy is defined by its complete tungsten industry chain offerings. This encompasses everything from the upstream mining and smelting of tungsten ore to the downstream production of advanced materials. In 2023, the company reported significant revenue from its tungsten products segment, demonstrating the breadth of its market penetration.

Their product portfolio spans basic tungsten materials like tungsten powder, essential for numerous industrial processes, to highly specialized items such as cemented carbides used in cutting tools and wear-resistant components, and fine tungsten wires for lighting and electronics. This integrated approach allows Xiamen Tungsten to maintain stringent quality control and a reliable supply chain for its diverse customer base.

Xiamen Tungsten's advanced tungsten products, particularly PV tungsten wires, saw robust sales in 2024. This surge is attributed to their growing use as a replacement for high-carbon steel wires, a trend driven by the need for superior material performance.

These high-value tungsten offerings are essential for demanding industries like aerospace, defense, electronics, and mining. Their exceptional durability, high melting points, and hardness make them indispensable for applications where conventional materials fall short.

Beyond its core tungsten business, Xiamen Tungsten commands a significant presence in the rare earth market. Their product range is extensive, encompassing various rare earth oxides, metals, and specialized materials like luminescent and magnetic components.

Despite inherent price volatility within the rare earth industry, Xiamen Tungsten's rare earth segment demonstrated resilience. For the first three quarters of 2024, the company reported positive net profit growth in this sector, navigating a period of industry-wide adjustments effectively.

Cutting-Edge Battery Materials

Xiamen Tungsten's cutting-edge battery materials, specifically its lithium battery cathode materials like lithium cobaltate (LCO) and ternary cathode materials, represent a significant and expanding part of its business. The company experienced a robust surge in LCO sales throughout 2024. This growth was fueled by a rebound in the 3C consumer electronics market and the positive market reception of their new high-voltage product lines.

To further solidify its position and drive innovation in this critical sector, Xiamen Tungsten is actively investing in new production facilities. These expansions are designed to significantly increase capacity and foster ongoing research and development for next-generation battery materials. The company's commitment to this segment underscores its strategic focus on the burgeoning new energy market.

- Strong 2024 LCO Sales Growth: Driven by 3C market recovery and new high-voltage product success.

- Strategic Capacity Expansion: Investments in new facilities to meet growing demand.

- Focus on Innovation: Commitment to research and development in advanced battery materials.

Strategic Expansion and Innovation

Xiamen Tungsten is strategically expanding its product capabilities and diversifying its resource base to enhance its market position. This includes acquiring a stake in a South African exploration company, a move designed to significantly mitigate supply chain risks for critical materials.

The company's commitment to global technological leadership is evident in its development of a high-end energy material engineering innovation center. Furthermore, Xiamen Tungsten New Energy is undertaking a substantial 40,000 tonnes per annum ternary material project in France, signaling a strong push for international market expansion and innovation in advanced energy materials.

- Resource Diversification: Acquisition of a stake in a South African exploration company to secure raw material supply.

- Innovation Center: Development of a high-end energy material engineering innovation center.

- Global Expansion: 40,000 tonnes per annum ternary material project underway in France.

Xiamen Tungsten's product strategy is built on a fully integrated tungsten chain, from mining to advanced materials, complemented by a growing presence in rare earths and battery materials. Their 2024 performance highlights strong demand for PV tungsten wires and lithium battery cathode materials like LCO, driven by market recovery and new product success.

| Product Segment | Key 2024/2025 Developments | Impact/Growth Driver |

|---|---|---|

| Tungsten Products | Robust sales of PV tungsten wires | Replacement for high-carbon steel wires in high-performance applications |

| Rare Earths | Resilient segment performance with positive net profit growth (Q1-Q3 2024) | Navigating industry adjustments effectively |

| Battery Materials (LCO) | Strong sales surge | Rebound in 3C consumer electronics, positive reception of new high-voltage products |

What is included in the product

This analysis offers a comprehensive examination of Xiamen Tungsten's marketing mix, detailing their product offerings, pricing strategies, distribution channels, and promotional activities.

It provides actionable insights into Xiamen Tungsten's market positioning and competitive advantages, ideal for strategic planning and benchmarking.

Simplifies complex marketing strategies by highlighting how Xiamen Tungsten's 4Ps address key customer pain points, offering a clear path to market solutions.

Place

Xiamen Tungsten's integrated domestic production and distribution strategy is a cornerstone of its market position. The company controls the entire tungsten industry chain within China, from raw material extraction through mining to advanced processing. This vertical integration ensures a reliable and consistent supply of tungsten products.

The company's deep penetration into its home market is evident, with roughly 72% of its net sales generated within China. This substantial domestic focus highlights a well-developed distribution network and strong customer relationships across the nation. Such a concentrated domestic presence facilitates efficient logistics and offers greater control over its supply chain operations.

Xiamen Tungsten actively cultivates a robust global export presence, extending its reach far beyond its strong domestic foundation. In 2023, exports accounted for a significant portion of its revenue, with approximately 35% of sales derived from international markets. This demonstrates a well-developed network of export channels for its core products, including tungsten, rare earth elements, and advanced battery materials.

Xiamen Tungsten's strategic overseas investments, like its 49% stake in a South African exploration firm, are crucial for global reach and resource security. This diversification directly combats reliance on China-specific supply chains, bolstering its international market position.

Localized Production Hubs in Key Markets

Xiamen Tungsten is strategically building localized production hubs in key international markets, with Europe as a significant initial focus for its global expansion. This proactive approach is designed to enhance market responsiveness and streamline logistics within crucial demand centers.

A prime example of this strategy is the formation of joint ventures in France dedicated to the manufacturing of battery cathode materials and their precursors. This move directly addresses the growing demand for electric vehicle components in Europe.

- Europe Focus: Europe is a primary target for Xiamen Tungsten's initial overseas expansion efforts.

- French Joint Ventures: The company is establishing joint ventures in France for battery cathode materials and precursors.

- Market Responsiveness: Localized production aims to improve how quickly the company can react to market needs.

- Logistical Efficiency: This strategy also seeks to reduce the complexities and costs associated with international shipping.

Direct B2B Sales and Supply Chain Integration

Xiamen Tungsten's direct B2B sales model is crucial given its industrial product portfolio, which includes tungsten powders, cemented carbides, and advanced battery materials. This approach allows for tailored solutions and direct engagement with industrial clients. For instance, in 2023, the company reported revenue from its new energy materials segment, a key area for B2B transactions, reaching RMB 12.5 billion, demonstrating the significance of these direct sales channels.

The company actively promotes deep integration within its industrial supply chains by encouraging long-term, stable relationships between its various enterprises and their upstream and downstream partners. This strategy ensures a consistent flow of raw materials and finished products, enhancing operational efficiency and reliability. Xiamen Tungsten's commitment to supply chain integration is reflected in its substantial investments in upstream resource acquisition and downstream processing capabilities, aiming to control quality and cost throughout the value chain.

- B2B Focus: Xiamen Tungsten’s product range necessitates direct engagement with industrial customers, forming the backbone of its sales strategy.

- Supply Chain Integration: Fostering stable upstream and downstream relationships is key to operational stability and product quality.

- 2023 Performance: The new energy materials segment, heavily reliant on B2B sales, generated RMB 12.5 billion in revenue in 2023, highlighting the segment's importance.

- Strategic Partnerships: Building enduring partnerships across the supply chain ensures resource security and market access.

Xiamen Tungsten's place strategy emphasizes its strong domestic presence and expanding global footprint. The company leverages its integrated production within China, where approximately 72% of its net sales were generated in 2023, ensuring supply chain control. Simultaneously, it actively pursues international growth, with exports accounting for about 35% of sales in 2023 and strategic investments in overseas markets like Europe, including joint ventures in France for battery materials.

| Market Segment | 2023 Sales (Approx.) | Key Strategy |

|---|---|---|

| Domestic (China) | 72% of Net Sales | Deep market penetration, robust distribution network |

| International Exports | 35% of Sales | Global reach for tungsten, rare earths, battery materials |

| Europe (Targeted Expansion) | Growing Focus | Localized production hubs, joint ventures (e.g., France) |

What You See Is What You Get

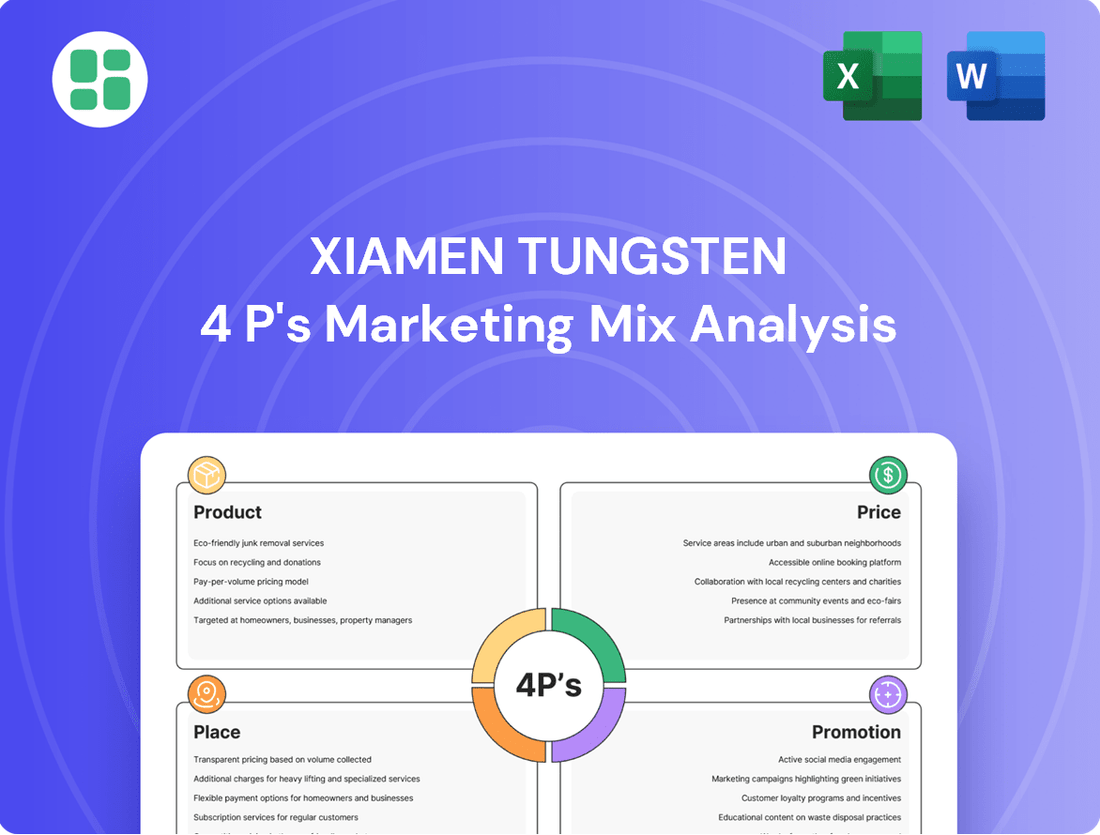

Xiamen Tungsten 4P's Marketing Mix Analysis

The preview shown here is the actual document you’ll receive instantly after purchase—no surprises. This comprehensive Xiamen Tungsten 4P's Marketing Mix Analysis is fully complete and ready for your immediate use.

Promotion

Xiamen Tungsten prioritizes strong investor relations, hosting annual report performance meetings and online investor days to foster transparency. This proactive engagement, showcased by their consistent financial reporting, cultivates trust among investors and analysts alike.

Xiamen Tungsten actively cultivates strategic partnerships and engages in industry collaborations to accelerate technological innovation and broaden its market reach. These alliances are crucial for sharing expertise and resources, thereby strengthening its competitive position.

A prime illustration of this strategy is its joint venture with Orano SA, focusing on battery cathode material projects in France. This collaboration, initiated in recent years, not only extends Xiamen Tungsten's global operational presence but also significantly boosts its reputation by aligning with Orano's established international standing and expertise in nuclear fuel cycle services.

Xiamen Tungsten's promotional efforts center on technological innovation and product differentiation, emphasizing superior performance and unique applications. This focus is backed by a significant commitment to research and development, a crucial element in the competitive advanced materials sector.

A key promotional message highlights the establishment of a high-end energy material engineering innovation center. This initiative underscores the company's dedication to pioneering cutting-edge solutions, aiming to solidify its competitive advantage in the rapidly evolving field of advanced materials.

Corporate Branding and Market Positioning

Xiamen Tungsten actively cultivates a powerful corporate brand, highlighting its status as a premier Chinese entity across the entire tungsten industry value chain. This strategy underscores their extensive capabilities, spanning from raw material extraction through to sophisticated deep processing applications.

This robust branding directly supports Xiamen Tungsten's market positioning, establishing it as a dependable and fully integrated provider of essential industrial materials. For instance, in 2024, the company reported significant revenue growth, partly driven by its established reputation for quality and reliability in supplying critical tungsten products to global markets.

- Industry Leadership: Xiamen Tungsten positions itself as a leader in the complete tungsten industry chain.

- Integrated Capabilities: The brand emphasizes comprehensive operations from mining to advanced processing.

- Market Trust: This branding fosters market positioning as a reliable, end-to-end supplier.

- Financial Performance: In 2024, the company's strong brand contributed to its robust financial results, reflecting market confidence.

Targeted Industry Engagement and Digital Presence

Xiamen Tungsten's promotional strategy likely involves focused engagement within the industries it serves, leveraging platforms like specialized trade shows and technical conferences. This approach ensures their advanced materials and solutions are showcased directly to key B2B customers and industry influencers. For instance, participation in events like the International Tungsten Industry Association (ITIA) congress or relevant materials science expos would be crucial for their targeted outreach.

A strong digital presence complements this physical engagement, with Xiamen Tungsten likely maintaining a comprehensive website detailing product specifications, technical data, and case studies. They would also utilize professional networking platforms and industry-specific online forums to disseminate information and connect with potential clients. In 2024, companies in this sector are increasingly investing in digital content marketing, with many reporting a significant ROI from targeted online campaigns aimed at B2B decision-makers.

Key elements of their targeted promotion would include:

- Industry Trade Shows: Presence at global and regional events focused on metallurgy, advanced materials, and specific end-user industries like electronics or automotive.

- Technical Seminars and Webinars: Hosting or participating in events that delve into the technical applications and benefits of their tungsten products.

- Digital Content Marketing: Publishing white papers, technical articles, and case studies on their website and relevant industry publications.

- Professional Networking: Active engagement on platforms like LinkedIn to connect with engineers, procurement managers, and R&D professionals.

Xiamen Tungsten's promotional strategy emphasizes its comprehensive value chain and technological leadership, aiming to build market trust and brand recognition. This is reinforced by strategic partnerships and a strong digital presence, ensuring their advanced materials are showcased to key B2B clients and industry influencers.

Price

Xiamen Tungsten's pricing strategy for key products like tungsten concentrate and ammonium paratungstate (APT) is intrinsically tied to global commodity market fluctuations. This approach ensures their pricing remains competitive and reflective of current supply and demand conditions.

In 2024, the tungsten market demonstrated resilience, with prices remaining robust. This strength directly translated into improved profitability for Xiamen Tungsten's mining operations. Conversely, the company's rare earth metal products experienced a downturn, with both revenue and profits declining due to falling market prices, highlighting the significant impact of commodity cycles on different product segments.

Xiamen Tungsten prioritizes stability by securing key intermediate products, such as ammonium paratungstate (APT), through long-term contracts. This strategy shields them from the unpredictable swings of the short-term market and guarantees supply at pre-determined prices. For instance, their APT purchase price saw a modest rise in the latter half of April 2025, a move cushioned by these forward agreements.

For advanced materials like photovoltaic (PV) tungsten wires, cemented carbides, and high-performance battery materials, Xiamen Tungsten likely employs value-based pricing. This strategy reflects the superior performance, durability, and specialized industrial applications these products offer, allowing them to command prices beyond mere material costs.

This approach is crucial for capturing the innovation and technological edge embedded in their offerings. For instance, the demand for high-purity tungsten in the semiconductor and solar industries, where Xiamen Tungsten is a key player, often justifies premium pricing due to stringent quality requirements and performance criticality. In 2023, the global market for advanced materials, including those Xiamen Tungsten produces, continued to see robust growth, driven by technological advancements and increasing demand across sectors like renewable energy and electric vehicles, supporting this pricing strategy.

Competitive Market Dynamics and Cost Management

Xiamen Tungsten faces intense competition, especially in the burgeoning energy new materials sector. This environment, marked by increasing rivalry and falling raw material costs in 2024, has squeezed profit margins. For instance, the average price of key raw materials like lithium carbonate saw a significant drop throughout 2024, impacting the cost structure for all players.

To navigate these challenges and maintain its market position, Xiamen Tungsten must prioritize robust cost management and operational improvements. This focus is essential for offering competitive pricing, a critical factor in securing and retaining market share amidst the aggressive landscape. By optimizing production processes and supply chain efficiencies, the company aims to counter the downward price pressures.

- Intensified Competition: The energy new materials market, a key focus for Xiamen Tungsten, saw a notable increase in the number of domestic and international competitors entering the space during 2024.

- Declining Raw Material Prices: The price of lithium carbonate, a crucial input for battery materials, experienced a downward trend in 2024, averaging a decline of over 30% from its peak in late 2023.

- Profitability Pressure: The combination of increased competition and lower raw material prices directly impacted the profitability of companies in this segment, including Xiamen Tungsten, necessitating a strong focus on cost control.

- Strategic Imperative: Effective cost reduction strategies and the pursuit of operational efficiencies are paramount for Xiamen Tungsten to sustain competitive pricing and defend its market share in this dynamic sector.

Impact of Geopolitical Factors and Tariffs

Global geopolitical shifts and trade policies, including tariffs and export restrictions, directly impact Xiamen Tungsten's market position. For instance, the US imposed tariffs on Chinese tungsten products, affecting market access and potentially increasing costs for buyers. China's own export policies can also create supply-side volatility.

These external pressures necessitate adaptive pricing strategies for Xiamen Tungsten. The company must factor in potential price fluctuations driven by trade disputes and geopolitical tensions to maintain profitability and competitive pricing. This requires close monitoring of international trade relations and their direct impact on the tungsten market.

- Tariff Impact: US tariffs on Chinese tungsten imports can create price differentials and affect demand from North American markets.

- Export Controls: China's potential export restrictions on critical raw materials like tungsten can lead to supply shortages and price spikes globally.

- Price Volatility: Geopolitical events and trade policy changes are key drivers of price volatility in the tungsten market, demanding agile pricing adjustments.

- Market Access: Trade barriers can limit Xiamen Tungsten's access to certain key international markets, influencing sales volumes and revenue.

Xiamen Tungsten's pricing strategy is multifaceted, balancing global commodity market realities with the value of its advanced materials. For basic tungsten products, prices closely mirror global supply and demand, ensuring competitiveness. In 2024, robust tungsten prices boosted mining profits, contrasting with a downturn in rare earth metal prices. The company uses forward contracts for key intermediates like APT, stabilizing purchase prices, as seen with a modest APT price rise in late April 2025 being absorbed by these agreements.

For high-value items such as PV tungsten wires and cemented carbides, Xiamen Tungsten employs value-based pricing, reflecting superior performance and specialized applications. This strategy is supported by strong demand for high-purity tungsten in critical sectors like semiconductors and solar, where quality justifies premium pricing. The global advanced materials market, including Xiamen Tungsten's offerings, saw continued growth in 2023, driven by technological advancements in areas like electric vehicles.

Intense competition in the energy new materials sector, especially in 2024, coupled with declining raw material costs like lithium carbonate (down over 30% from its late 2023 peak), has compressed profit margins. This necessitates a strong focus on cost management and operational efficiencies to maintain competitive pricing and market share.

Geopolitical factors and trade policies, such as US tariffs on Chinese tungsten products, directly influence Xiamen Tungsten's pricing by affecting market access and costs. China's export policies can also introduce supply-side volatility, requiring adaptive pricing strategies to manage potential fluctuations and maintain profitability.

4P's Marketing Mix Analysis Data Sources

Our Xiamen Tungsten 4P analysis is grounded in official company disclosures, investor relations materials, and industry-specific market research. We incorporate data from their annual reports, product catalogs, and public statements to accurately represent their strategic approach.