Xiamen Tungsten Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Xiamen Tungsten Bundle

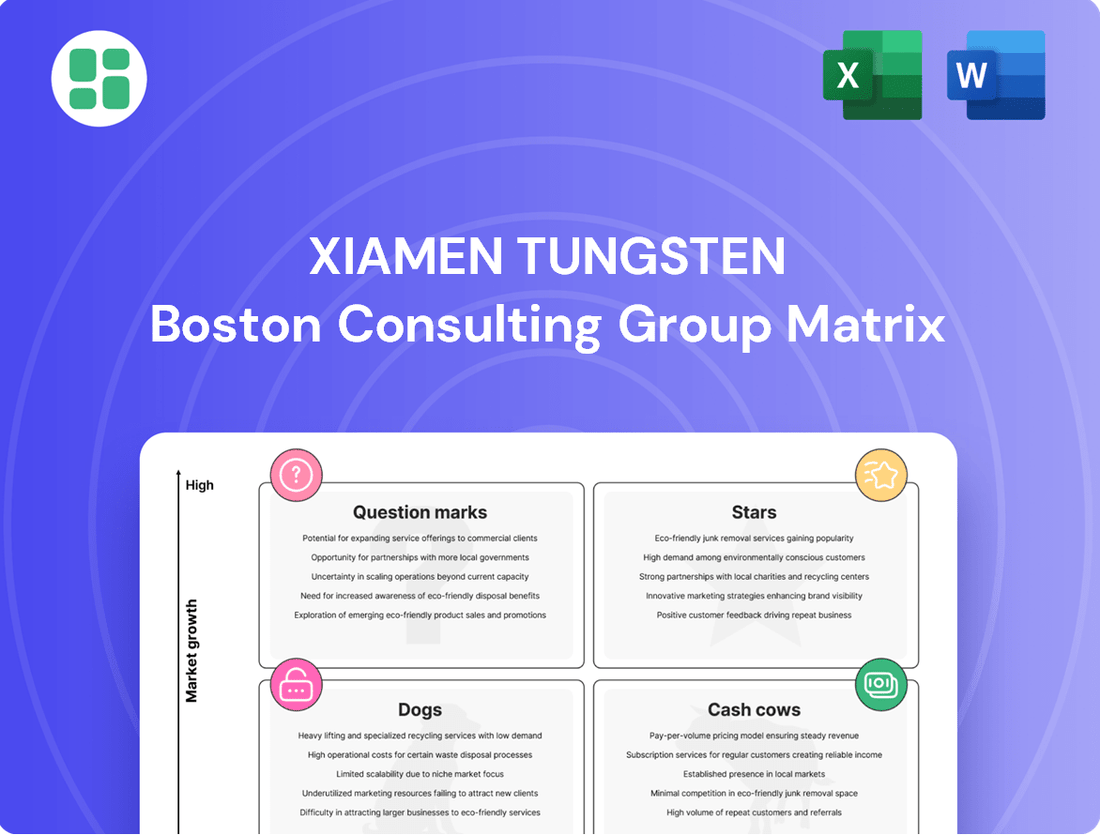

Curious about Xiamen Tungsten's strategic positioning? This glimpse into their BCG Matrix reveals their current market standing, highlighting potential growth areas and resource-intensive segments.

To truly understand Xiamen Tungsten's competitive landscape and unlock actionable insights, dive into the full BCG Matrix report. Gain a comprehensive view of their Stars, Cash Cows, Dogs, and Question Marks to inform your investment and product development strategies.

Don't miss out on the detailed quadrant analysis and data-backed recommendations that will empower you to make smarter, more informed decisions for Xiamen Tungsten. Purchase the complete BCG Matrix today and gain a significant strategic advantage.

Stars

Xiamen Tungsten's advanced battery materials, specifically through its subsidiary Xiamen Tungsten Xinneng, are a clear Star in the BCG matrix. The new energy materials segment demonstrated robust financial health in the first half of 2025, with revenue climbing 18.04% and net profit surging 27.76%.

This exceptional performance is fueled by the booming global lithium-ion secondary battery materials market, which is expected to see a compound annual growth rate between 9.18% and 15% from 2025 to 2031. The primary drivers are the escalating demand for electric vehicles and the increasing adoption of energy storage systems.

The company's strategic investment in an innovation center further solidifies this segment's position as a Star. This commitment to research and development, combined with the strong market tailwinds and the subsidiary's impressive financial results, highlights advanced battery materials as a high-growth, high-market-share component of Xiamen Tungsten's portfolio.

High-Performance Cemented Carbides represent a star in Xiamen Tungsten's portfolio. The global cemented carbide market is poised for robust expansion, with forecasts suggesting a compound annual growth rate (CAGR) between 4.6% and 7% from 2025 to 2033. This growth is primarily driven by the escalating demand from sophisticated manufacturing industries, including automotive, aerospace, and electronics.

As a prominent domestic supplier of hard alloys, drilling tools, and engineering tools, Xiamen Tungsten holds a significant market position within this expanding sector. Their proficiency in manufacturing premium cemented carbides for precision tooling underscores the star status of this product line, aligning perfectly with the market's upward trajectory.

The aerospace and defense industries are crucial for tungsten demand, utilizing its exceptional density and strength for high-temperature components, advanced armor-piercing projectiles, and missile systems. The global tungsten market is projected for robust growth, with an estimated compound annual growth rate (CAGR) between 8.1% and 9.2% from 2025 through 2029, underscoring the sector's importance.

Xiamen Tungsten, as a leading entity in the tungsten sector, is strategically positioned to capitalize on this demand, particularly given China's pivotal role in global critical mineral supply chains. This strong market presence allows Xiamen Tungsten to effectively serve this high-growth, specialized niche.

Tungsten for Integrated Circuits & Electronics

The increasing use of tungsten in integrated circuits and the ongoing miniaturization of electronic components are significant drivers for tungsten market expansion. The electronics industry's robust growth fuels a consistent demand for advanced materials such as tungsten, essential for creating smaller, more powerful devices.

Xiamen Tungsten, with its integrated tungsten supply chain, is strategically positioned to benefit from this rising demand in the electronics sector. Their specialized tungsten products for this market are considered a star performer.

- Market Growth Driver: Miniaturization of electronic components and widespread tungsten application in integrated circuits.

- Industry Demand: Sustained demand from the expanding electronics industry for high-performance materials.

- Xiamen Tungsten's Position: Well-positioned due to a comprehensive tungsten industry chain, enabling capitalization on electronics sector growth.

- Product Status: Specialized tungsten products for electronics are identified as a star in the BCG matrix.

Specialized Tungsten Mill Products

Specialized tungsten mill products, including foils, ribbons, wires, and tubes, are critical components across numerous sectors. Their unique characteristics, such as exceptional hardness and a very high melting point, make them indispensable for demanding applications.

The aerospace and electrical & electronics industries, in particular, are seeing significant expansion, directly fueling the demand for these specialized tungsten items. For instance, the global aerospace market was valued at approximately $873 billion in 2023 and is projected to grow substantially. Similarly, the electronics industry continues its upward trajectory, with global semiconductor sales reaching an estimated $583.7 billion in 2024.

Xiamen Tungsten's comprehensive industrial chain, enabling the production of a diverse array of tungsten products, positions it favorably within these high-growth markets. This integrated capability suggests a robust market presence and the ability to meet the sophisticated needs of industries reliant on advanced materials.

Key aspects of Xiamen Tungsten's specialized mill products include:

- High Melting Point: Tungsten's melting point of 3,422°C (6,192°F) is the highest of all metals, making it ideal for high-temperature applications.

- Exceptional Hardness: Tungsten alloys exhibit superior hardness and wear resistance, crucial for tools and components in harsh environments.

- Diverse Product Range: Xiamen Tungsten offers foils, ribbons, wires, and tubes, catering to a wide spectrum of industrial requirements.

- Integrated Supply Chain: A complete industrial chain from raw material processing to finished products ensures quality control and supply reliability.

Advanced battery materials, particularly cathode materials for lithium-ion batteries, are a significant Star for Xiamen Tungsten. The company's subsidiary, Xiamen Tungsten Xinneng, reported a substantial revenue increase of 18.04% and a net profit surge of 27.76% in the first half of 2025, reflecting strong market demand.

This segment benefits from the projected 9.18% to 15% CAGR in the global lithium-ion secondary battery materials market through 2031, driven by EV adoption and energy storage growth.

Xiamen Tungsten's strategic investments in R&D, including an innovation center, further solidify its leading position in this high-growth, high-market-share area.

| Product Segment | BCG Category | Key Growth Drivers | Xiamen Tungsten's Position | Financial Highlight (H1 2025) |

| Advanced Battery Materials | Star | EV demand, energy storage, market CAGR 9.18%-15% (2025-2031) | Leading domestic supplier, R&D investment | Revenue +18.04%, Net Profit +27.76% |

| High-Performance Cemented Carbides | Star | Demand from automotive, aerospace, electronics; market CAGR 4.6%-7% (2025-2033) | Prominent domestic supplier of hard alloys and tools | N/A (Segment specific data not provided) |

| Specialized Tungsten Mill Products | Star | Aerospace and electronics industry growth, high-temp applications | Integrated supply chain, diverse product range | Global semiconductor sales ~$583.7B (2024), Aerospace market ~$873B (2023) |

What is included in the product

Strategic insights for Xiamen Tungsten's product portfolio across BCG Matrix quadrants.

Highlights which units to invest in, hold, or divest for Xiamen Tungsten.

The Xiamen Tungsten BCG Matrix offers a clear, one-page overview, relieving the pain of complex strategic analysis by placing each business unit into a quadrant.

Cash Cows

Xiamen Tungsten's core operations in tungsten mining and primary processing form its robust cash cow. China's overwhelming dominance in global tungsten production, supplying around 80-82% of the world's output, positions Xiamen Tungsten favorably within this critical upstream segment.

Despite a stable overall market growth of approximately 8-9% CAGR for tungsten, Xiamen Tungsten's established and leading position in mining and initial processing guarantees a consistent and reliable generation of cash flow.

This foundational cash flow from its tungsten operations is crucial, serving as the primary financial engine that supports and enables the company's investments and development in its other business areas.

Standard cemented carbide products are a cornerstone for Xiamen Tungsten, serving industries like general machining and mining tools where demand is consistently strong. These established products hold a significant market share within a mature sector, contributing to stable revenue streams.

In 2024, Xiamen Tungsten's cemented carbide segment is expected to continue its role as a cash cow, leveraging its competitive advantages and reduced marketing expenses. The company's deep penetration in these foundational markets ensures a reliable profit generation, underpinning its overall financial stability.

Xiamen Tungsten's mature rare earth materials are solid Cash Cows. China's dominance in the rare earth market, holding over 58% share, underpins the stability of these products. Despite price fluctuations in 2024, the company's rare earth segment demonstrated positive net profit growth, highlighting its robust operational performance and ability to generate consistent cash flow from established, strategically vital applications.

Basic Tungsten Powders

Basic tungsten powders are the bedrock of Xiamen Tungsten's operations, acting as the essential raw material for a wide array of downstream tungsten products.

As a foundational element within the tungsten industry, Xiamen Tungsten's extensive vertical integration suggests a substantial market presence in this segment.

This business line, while situated in a mature, low-growth market, is characterized by its dependable, high-volume sales and robust cash generation capabilities, primarily driven by economies of scale and operational efficiencies.

- Market Position: Xiamen Tungsten is a leading global producer of tungsten products, with its basic powders segment forming a core part of its value chain.

- Financial Contribution: In 2023, Xiamen Tungsten reported revenue of approximately RMB 24.5 billion, with its tungsten products segment, including basic powders, being a significant contributor to this figure.

- Industry Dynamics: The global tungsten market is characterized by stable demand from industries like automotive, electronics, and aerospace, but growth rates are typically modest, reflecting the mature nature of the sector.

- Cash Flow Generation: The consistent demand and efficient production processes for basic tungsten powders allow Xiamen Tungsten to generate stable and predictable cash flows, supporting investment in other business areas.

Tungsten Chemicals for Industrial Use

Xiamen Tungsten's tungsten chemicals for industrial use represent a classic cash cow. These established products, integral to the company's comprehensive tungsten value chain, likely contribute significant and stable profits. Their mature market position, bolstered by Xiamen Tungsten's robust production capacity and market influence, points to consistent, high-margin cash generation.

The company's broad reach in the tungsten sector underpins the reliable performance of these chemical offerings. While specific growth figures for individual chemicals aren't publicly detailed, their role within a vertically integrated structure suggests consistent demand and profitability.

- Established Products: Tungsten chemicals are core to Xiamen Tungsten's integrated operations.

- Consistent Cash Flow: Mature market presence and strong production capabilities drive high-margin, stable earnings.

- Industry Integration: Their position within the complete tungsten industry chain ensures steady demand and profitability.

Xiamen Tungsten's basic tungsten powders are a prime example of a cash cow within its portfolio. These powders are essential raw materials for numerous downstream tungsten products, and the company's vertical integration ensures a significant market presence in this segment.

While operating in a mature, low-growth market, this business line benefits from dependable, high-volume sales and strong cash generation due to economies of scale and efficient production. In 2023, Xiamen Tungsten reported revenues of approximately RMB 24.5 billion, with its tungsten products segment, including basic powders, being a substantial contributor.

| Segment | 2023 Revenue (RMB Billion) | Market Position | Cash Flow Generation |

| Basic Tungsten Powders | Significant Contributor to RMB 24.5 Billion Total | Core Raw Material, High Volume Sales | Stable and Predictable |

| Tungsten Chemicals | Integral to Value Chain | Mature Market, Strong Production | Consistent, High-Margin |

| Rare Earth Materials | Positive Net Profit Growth in 2024 | China Holds >58% Global Share | Robust Operational Performance |

What You See Is What You Get

Xiamen Tungsten BCG Matrix

The Xiamen Tungsten BCG Matrix preview you see is the identical, fully completed document you will receive upon purchase. This means you're getting the exact strategic analysis, including detailed product positioning within the Stars, Cash Cows, Question Marks, and Dogs quadrants, ready for immediate application. No alterations or missing sections will be present; the file is prepared for your direct use in business planning and decision-making.

Dogs

Highly commoditized tungsten alloys often find themselves in the Dogs quadrant of the BCG Matrix. These are products facing intense competition, which can significantly squeeze profit margins. If Xiamen Tungsten doesn't find ways to differentiate these offerings, they could struggle to maintain a meaningful market share.

These types of alloys typically operate within market segments that experience slow growth and limited innovation. Consequently, they offer minimal returns on investment, making them less attractive from a strategic perspective. The focus here is on managing these products efficiently rather than expecting substantial expansion.

In the context of Xiamen Tungsten's portfolio, such commoditized alloys could potentially become cash traps. This means they might tie up valuable resources and capital without generating the significant growth prospects needed to justify continued investment. Careful management and potential divestment strategies might be considered for these product lines.

Xiamen Tungsten's outdated tungsten wire for declining applications, such as traditional incandescent lighting, would fall into the Dogs category of the BCG Matrix. These products likely hold a low market share in a shrinking market, offering minimal growth potential.

Given the significant decline in demand for traditional lighting, investments in these tungsten wire segments would yield very low returns. Xiamen Tungsten should consider divesting or minimizing operations related to these products to reallocate resources to more promising areas.

Within Xiamen Tungsten's portfolio, certain niche rare earth products might be classified as dogs. These are segments where the company faces intense competition or where demand is stagnating, despite the broader rare earth market's expansion. For instance, if Xiamen Tungsten's market share in specialized magnetic materials not critical for EVs or renewable energy is declining, these could be considered underperforming assets.

These "dog" segments likely represent areas where Xiamen Tungsten is investing resources but not seeing a commensurate return in revenue or market dominance. In 2024, with a global rare earth market projected to reach over $5 billion, a company's inability to capture growth in even niche areas points to strategic challenges. If these specific products are not integrated into high-demand sectors, their contribution to Xiamen Tungsten's overall performance would be minimal, potentially draining capital.

Non-Strategic Battery Recycling Unit (Divested)

Xiamen Tungsten's divestment of a 47% stake in Ganzhou Haopeng Technology Co., Ltd., a battery recycling unit, in May 2025, signals a strategic realignment. This move, transferring the stake to its subsidiary XTC New Energy Materials, indicates the unit may not align with the company's core growth strategy or meet desired performance benchmarks.

Such divestments are typical for assets categorized as 'Dogs' in the BCG Matrix. These are often characterized by low market share and low growth prospects, especially when compared to other, more promising segments within the company's portfolio.

The financial performance of such units, while not explicitly detailed for Ganzhou Haopeng's divested portion, generally reflects these challenges. For example, in 2023, the broader battery recycling industry saw significant investment, but profitability varied widely based on feedstock costs and processing efficiency, with some smaller players struggling to scale effectively.

- Strategic Realignment: Xiamen Tungsten transferred a 47% stake in Ganzhou Haopeng Technology Co., Ltd. to XTC New Energy Materials in May 2025.

- BCG Matrix Classification: This action suggests Ganzhou Haopeng is considered a 'Dog' due to potential underperformance or strategic misfit.

- Industry Context: The battery recycling sector, while growing, presents profitability challenges for less efficient or smaller-scale operations, impacting market share and growth potential.

Legacy Tungsten Products with Low R&D Investment

Legacy tungsten products with minimal R&D investment often find themselves in mature or declining markets. This lack of innovation means they struggle to keep pace with newer, more advanced tungsten materials. Consequently, these products typically hold a low market share.

The competitive landscape for these older tungsten offerings is challenging. They often face pressure from more technologically sophisticated alternatives, leading to stagnant growth and diminished profitability for the companies producing them. For instance, in 2024, the global market for certain basic tungsten powders saw limited growth, with companies heavily reliant on these legacy products reporting single-digit revenue increases.

- Low Market Share: Products with minimal R&D investment often occupy small niches in mature or declining markets.

- Lack of Innovation: Stagnant product development fails to address evolving customer needs or new technological advancements.

- Competitive Disadvantage: Older tungsten products struggle against newer, higher-performance materials.

- Stagnant Growth & Profitability: Limited market appeal and pricing pressure result in flat or declining financial performance.

Products in the Dogs quadrant, like Xiamen Tungsten's legacy tungsten wires for outdated lighting, are characterized by low market share in slow-growing or declining markets. These offerings typically generate minimal revenue and often require significant investment just to maintain their existing, albeit small, market presence. The strategic imperative is to manage these assets for cash generation or to divest them entirely.

For Xiamen Tungsten, this could mean re-evaluating product lines where innovation has stalled and demand is shrinking, such as certain types of specialized tungsten alloys not critical for emerging technologies. In 2024, the global market for basic tungsten materials saw only modest growth, underscoring the challenges for companies heavily reliant on such commoditized products.

The divestment of a stake in Ganzhou Haopeng Technology Co., Ltd. in May 2025 further exemplifies this strategy. Such moves are common for 'Dog' assets that no longer align with a company's core growth objectives or fail to deliver adequate returns, especially when compared to more promising segments within the broader rare earth market, which itself was projected to exceed $5 billion in 2024.

Ultimately, identifying and managing these 'Dog' products is crucial for optimizing resource allocation and improving overall portfolio performance, allowing Xiamen Tungsten to focus capital on areas with higher growth potential.

Question Marks

While the rare earth market shows strong overall growth, Xiamen Tungsten's revenue from its rare earth segment saw an 18.25% dip in the first three quarters of 2024, even as profits rose. This suggests that while sectors like electric vehicles and wind turbines are expanding, the company's penetration into newer, rapidly growing areas such as hydrogen fuel cells or advanced electronics may still be developing.

These emerging applications, though promising, demand substantial capital investment to translate potential into substantial market presence. Xiamen Tungsten's strategic focus will be crucial in capturing market share in these high-growth, but capital-intensive, segments of the rare earth industry.

The battery materials market is seeing a significant pivot towards high-nickel cathode chemistries and silicon-based anodes to boost energy density, a trend Xiamen Tungsten is actively addressing. Their investment in a dedicated high-end energy material innovation center underscores a strategic focus on these advanced technologies.

While these represent high-growth segments, Xiamen Tungsten may still be in the early stages of establishing market share. This necessitates considerable investment in research and development, along with substantial capital expenditure, with the expectation of delayed, though potentially significant, future returns.

The global tungsten market is increasingly recognizing additive manufacturing, or 3D printing, as a significant emerging application. This sector is poised for substantial growth, presenting a high-potential area for tungsten producers.

If Xiamen Tungsten is actively developing or producing specialized tungsten powders and components tailored for 3D printing applications, this signifies entry into a market with considerable future expansion. However, their current market share in this niche is likely minimal, necessitating substantial investment to build a strong foothold and secure market position.

Quantum Computing Tungsten Materials

Xiamen Tungsten's potential involvement in nano-tungsten for quantum computing places it in the Question Mark quadrant of the BCG matrix. This is due to the extremely high-growth, cutting-edge nature of quantum computing, where market share is currently minimal but future potential is vast.

Recent advancements highlight the use of nano-tungsten in enhancing conductivity and thermal stability for quantum computing chips. This specialized application represents a significant future growth opportunity, demanding substantial investment for Xiamen Tungsten to establish a competitive position.

- High Growth Potential: The quantum computing market is projected for exponential growth, with estimates suggesting it could reach hundreds of billions of dollars by the late 2030s.

- Nascent Market Share: Companies involved in supplying materials like nano-tungsten for this sector are likely to have very low current market share.

- Investment Requirement: Entering and scaling in quantum computing material supply chains necessitates significant R&D and capital expenditure.

- Strategic Importance: Securing a position in this field could offer Xiamen Tungsten a substantial competitive advantage in future high-technology markets.

Strategic Partnerships in New Energy Materials

Xiamen Tungsten's involvement in strategic partnerships within new energy materials, particularly through its subsidiary XTC New Energy Materials, positions it to capitalize on high-growth opportunities. The company's investments in firms like Xiamen Jinglu New Energy Materials Co., Ltd. and Ganzhou Highpower Technology Co., Ltd. are indicative of a strategy to explore emerging battery material technologies.

- Strategic Investments: Xiamen Tungsten actively funds and acquires stakes in promising battery material companies.

- High Growth Potential: These ventures target the dynamic and rapidly expanding new energy sector.

- Market Exploration: Such partnerships represent a proactive approach to discovering and developing new avenues for growth.

- Potential for Leadership: These initiatives require significant evaluation and investment to establish market leadership.

Xiamen Tungsten's ventures into areas like quantum computing materials and advanced battery components place them in the Question Mark category of the BCG matrix. These are characterized by rapid market growth but currently low market share for the company. Significant investment is required to develop these into future Stars.

The quantum computing sector, for instance, is projected to grow substantially, potentially reaching hundreds of billions of dollars by the late 2030s. Xiamen Tungsten's engagement with nano-tungsten for quantum chips, aiming to improve conductivity and thermal stability, highlights this high-potential, high-investment scenario.

Similarly, their strategic investments in new energy materials, such as those in battery technology through subsidiaries and partnerships, target a dynamic market. While promising, these require substantial R&D and capital expenditure to establish a leading market position.

The company's focus on emerging applications like additive manufacturing for tungsten powders also fits the Question Mark profile. This sector offers considerable future expansion, but Xiamen Tungsten likely holds a minimal current market share, necessitating investment to build a strong presence.

BCG Matrix Data Sources

Our Xiamen Tungsten BCG Matrix is built on verified market intelligence, combining financial data, industry research, and official reports to ensure reliable, high-impact insights.