CVR Energy PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

CVR Energy Bundle

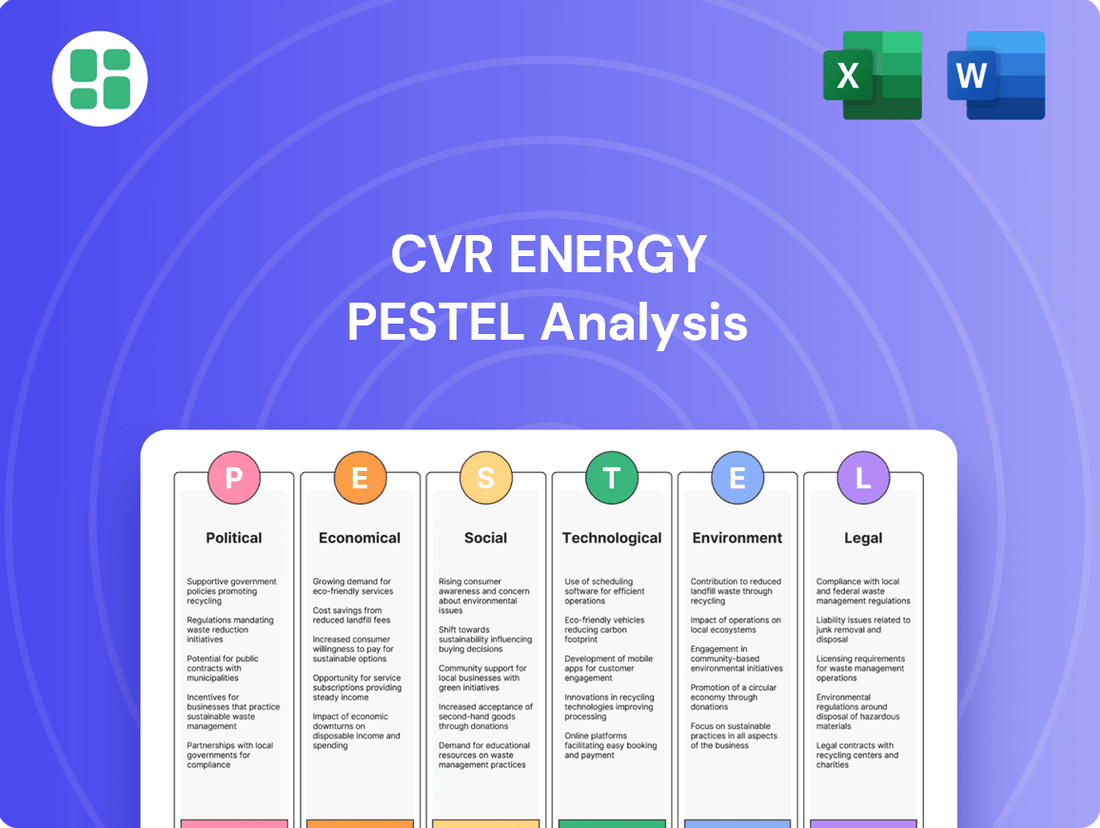

Navigate the complex external forces shaping CVR Energy's future with our comprehensive PESTLE analysis. Understand how political shifts, economic volatility, and technological advancements are impacting its operations and market position. Gain a critical edge by downloading the full report for actionable insights and strategic planning.

Political factors

Government energy policies, both at the federal and state levels, are pivotal for CVR Energy. Changes in these policies, such as new incentives for renewable fuels or increased taxes on fossil fuels, directly shape the company's refining business. For instance, shifts in biofuel mandates, like the Renewable Fuel Standard (RFS), can significantly alter demand for conventional refined products and introduce new compliance costs.

The Environmental Protection Agency (EPA) and state-level bodies significantly influence CVR Energy's operational landscape. For instance, in 2024, the EPA continued to emphasize stricter enforcement of air quality standards, impacting refinery operations and requiring ongoing capital investments for compliance. These regulations directly affect CVR's costs associated with emissions control technologies and process modifications.

Government policies, such as crop insurance programs and conservation initiatives, directly shape agricultural practices and, consequently, the demand for nitrogen fertilizers. For instance, the USDA's Conservation Reserve Program (CRP) encourages farmers to set aside environmentally sensitive land, potentially reducing acreage available for nitrogen-intensive crops. In 2023, the CRP enrolled approximately 23.5 million acres, a significant portion of U.S. farmland.

Subsidies for specific crops, like corn, can incentivize increased planting, driving higher demand for fertilizers. In 2024, projected U.S. corn planted acreage is around 91.7 million acres, according to USDA estimates, indicating a strong potential market for nitrogen products. These government interventions directly impact CVR Energy's fertilizer segment by influencing farmer purchasing power and planting decisions.

Trade Policies and Tariffs

International trade policies and tariffs significantly influence CVR Energy's operations. For instance, tariffs on crude oil imports could increase feedstock costs, while tariffs on refined product exports might limit market access and reduce profitability. In 2024, the global trade landscape continues to be shaped by ongoing geopolitical tensions and evolving trade agreements, directly impacting the cost and availability of essential raw materials for CVR Energy's refining processes.

Geopolitical events and trade disputes introduce considerable volatility into crude oil pricing. Disruptions in major oil-producing regions or the imposition of new sanctions can lead to sharp price swings, affecting CVR Energy's refining margins. For example, the ongoing conflict in Eastern Europe has demonstrated the potential for rapid shifts in global energy supply dynamics, impacting benchmark crude oil prices throughout 2024 and into early 2025.

- Tariff Impact: Potential for increased crude oil import costs impacting refining margins.

- Market Access: Tariffs on refined products could restrict export opportunities for CVR Energy.

- Volatility Driver: Geopolitical events and trade disputes are key contributors to crude oil price fluctuations.

Political Stability and Geopolitical Risks

Political stability in key oil-producing regions, particularly those impacting OPEC+ supply decisions, directly influences crude oil prices, a critical input for CVR Energy's refining operations. Geopolitical tensions, such as ongoing conflicts or trade disputes, can trigger supply chain disruptions and price spikes, affecting CVR's profitability. For instance, heightened tensions in the Middle East in late 2023 and early 2024 contributed to oil price volatility, with Brent crude futures fluctuating significantly. The U.S. Energy Information Administration (EIA) reported average Brent crude prices ranging from approximately $77 to $84 per barrel in the first half of 2024, demonstrating this sensitivity.

Domestic political stability in the United States is paramount for CVR Energy, as it shapes the regulatory landscape for the energy sector. Predictable policy environments foster long-term investment, while sudden shifts in environmental regulations, tax policies, or energy mandates can create uncertainty. The Biden administration's focus on energy transition policies and potential carbon pricing mechanisms, discussed throughout 2024, presents both opportunities and challenges for refiners like CVR. The Inflation Reduction Act of 2022, for example, continues to influence investment decisions in renewable energy and carbon capture technologies, indirectly impacting the traditional refining business model.

- Geopolitical Risk Impact: Increased geopolitical tensions in oil-producing nations can lead to supply disruptions, pushing crude oil prices higher and impacting CVR Energy's feedstock costs.

- Regulatory Predictability: Stable domestic political environments provide a clearer outlook for energy sector regulations, influencing CVR Energy's capital expenditure and operational planning.

- Energy Policy Influence: U.S. federal and state energy policies, including those related to emissions standards and renewable energy mandates, directly affect the operational and strategic direction of CVR Energy.

Government energy policies, including biofuel mandates like the Renewable Fuel Standard (RFS), directly influence CVR Energy's demand for refined products and compliance costs. For example, the EPA's 2024 RFS rule aimed to set blending targets for renewable fuels, impacting the market for conventional gasoline and diesel. Furthermore, evolving environmental regulations, such as stricter air quality standards enforced by the EPA, necessitate ongoing capital investments for CVR Energy's refineries to ensure compliance.

Domestic political stability in the U.S. is crucial for CVR Energy's strategic planning, as it shapes the regulatory environment for the energy sector. Policies enacted, such as the Inflation Reduction Act of 2022, continue to guide investments in renewable energy and carbon capture, indirectly affecting the traditional refining business. Geopolitical stability in oil-producing regions also plays a significant role, as demonstrated by the impact of Middle Eastern tensions on crude oil prices, with Brent crude averaging between $77-$84 per barrel in H1 2024.

| Factor | Impact on CVR Energy | 2024/2025 Data/Trend |

|---|---|---|

| Biofuel Mandates (RFS) | Affects demand for conventional fuels and compliance costs. | EPA's 2024 RFS rule set blending targets, influencing market dynamics. |

| Environmental Regulations | Requires capital investment for emissions control and operational adjustments. | Continued EPA focus on air quality standards necessitates ongoing compliance efforts. |

| Energy Policy (IRA) | Influences investment in renewables and carbon capture, indirectly impacting refining. | Inflation Reduction Act continues to shape energy investment decisions. |

| Geopolitical Stability (Oil Producing Regions) | Drives crude oil price volatility, impacting feedstock costs and refining margins. | Middle Eastern tensions in late 2023/early 2024 contributed to Brent crude price volatility ($77-$84/bbl in H1 2024). |

What is included in the product

This PESTLE analysis for CVR Energy provides a comprehensive examination of the Political, Economic, Social, Technological, Environmental, and Legal factors impacting its operations and strategic planning.

It offers actionable insights into the external landscape, enabling informed decision-making and proactive adaptation to market shifts.

Offers a concise PESTLE analysis of CVR Energy, streamlining complex external factors into actionable insights for strategic decision-making.

Economic factors

Fluctuations in global crude oil prices are a critical economic factor for CVR Energy, directly influencing its refining margins since crude oil is its main input. For instance, West Texas Intermediate (WTI) crude prices saw significant swings in 2024, averaging around $78 per barrel for the year, impacting the cost of goods sold for CVR's refineries.

When crude oil prices surge and cannot be fully passed on to consumers through higher gasoline and diesel prices, CVR Energy's profitability can be squeezed. Conversely, periods of lower crude oil costs, assuming stable refined product prices, can lead to wider refining margins and improved earnings, demonstrating the direct correlation between oil price dynamics and CVR's financial performance.

Natural gas is a major cost for CVR Energy's fertilizer operations, acting as a crucial ingredient for ammonia and UAN. Fluctuations in its price directly impact production expenses and the market position of their fertilizer products.

For instance, during 2023 and early 2024, natural gas prices saw considerable movement, with Henry Hub spot prices ranging from approximately $2.00 to over $3.00 per million British thermal units (MMBtu) at various points. This volatility creates uncertainty for CVR Energy's fertilizer segment, affecting their ability to forecast costs and maintain competitive pricing against rivals.

The demand for refined products like gasoline and diesel is closely tied to the overall health of the economy and how consumers and businesses behave. When the economy is growing, people tend to travel more and businesses increase their shipping and production, which naturally boosts the need for fuels. For CVR Energy, this means more opportunities to sell the products from its refining segment.

In 2024, economic growth projections, while varied by region, generally point towards continued, albeit perhaps moderate, expansion. This suggests a stable to increasing demand for transportation fuels. For instance, the U.S. Energy Information Administration (EIA) has projected that U.S. gasoline consumption will remain robust, with slight increases anticipated through 2025, directly benefiting companies like CVR Energy.

Transportation trends, including the increasing use of ride-sharing services and shifts in commuting patterns, also play a role. Furthermore, industrial activity, such as manufacturing and construction, directly influences the demand for diesel fuel. CVR Energy's refining segment revenue is therefore highly sensitive to these underlying economic and behavioral drivers.

Agricultural Commodity Prices

Agricultural commodity prices significantly impact CVR Energy's fertilizer business. When prices for crops like corn, wheat, and soybeans are robust, farmers see increased profitability. This financial health encourages them to invest more in their operations, including purchasing fertilizers to maximize crop yields.

For instance, as of late 2024, corn prices have shown volatility, influenced by global supply and demand dynamics, but generally remain at levels that support farmer investment. Similarly, soybean futures for 2025 indicate continued interest from buyers, suggesting a stable outlook for the agricultural sector's purchasing power.

- Higher commodity prices typically translate to increased farmer spending on fertilizers, boosting CVR Energy's sales.

- The USDA's projections for 2025 indicate that while some commodities may face price pressures, overall demand for agricultural products is expected to remain strong, supporting fertilizer markets.

- For CVR Energy, this means that a favorable commodity price environment in 2024 and into 2025 is a key driver for its fertilizer segment's performance.

Interest Rates and Inflation

Interest rates significantly influence CVR Energy's financial strategy. Higher rates increase the cost of borrowing for essential capital expenditures and day-to-day operations. For instance, the Federal Reserve's benchmark interest rate, the federal funds rate, saw multiple increases throughout 2023, reaching a target range of 5.25%-5.50% by July 2023, impacting borrowing costs for companies like CVR Energy.

Inflation presents a dual challenge for CVR Energy. Rising costs for crude oil, natural gas, and labor can squeeze profit margins. However, the company's ability to pass these increased costs onto consumers through higher product prices, such as gasoline and diesel fuel, is crucial for maintaining profitability. As of May 2024, the Consumer Price Index (CPI) indicated an annual inflation rate of 3.4%, a slight decrease from previous months but still a factor in operational costs.

- Impact of Interest Rates: Increased borrowing costs for capital projects and working capital.

- Inflationary Pressures: Higher expenses for raw materials, labor, and equipment.

- Profit Margin Sensitivity: Potential erosion of margins if cost increases cannot be passed on.

- Economic Environment: Federal Reserve's interest rate policies and overall inflation trends directly affect CVR Energy's financial performance.

CVR Energy's profitability is heavily influenced by the price of crude oil, its primary input. For example, West Texas Intermediate (WTI) crude averaged around $78 per barrel in 2024, directly impacting CVR's refining margins.

Natural gas is a key cost for CVR's fertilizer segment, with prices fluctuating. Henry Hub spot prices ranged from $2.00 to over $3.00 per MMBtu in early 2024, affecting fertilizer production costs.

Economic growth drives demand for refined products like gasoline and diesel. The EIA projected robust U.S. gasoline consumption for 2025, benefiting CVR's refining operations.

Agricultural commodity prices, such as corn and soybeans, influence farmer spending on fertilizers. Favorable prices in 2024 supported investment in fertilizers for the 2025 growing season.

Interest rates, like the Federal Reserve's target of 5.25%-5.50% in mid-2023, increase CVR's borrowing costs for capital expenditures.

Inflation, with the CPI at 3.4% year-over-year in May 2024, raises operational costs for raw materials and labor, potentially squeezing margins.

| Economic Factor | CVR Energy Impact | 2024/2025 Data Point |

|---|---|---|

| Crude Oil Prices | Refining Margins, Cost of Goods Sold | WTI Average: ~$78/barrel (2024) |

| Natural Gas Prices | Fertilizer Production Costs | Henry Hub: $2.00 - $3.00+/MMBtu (Early 2024) |

| Economic Growth/Demand | Refined Product Sales (Gasoline, Diesel) | U.S. Gasoline Consumption projected to increase slightly through 2025 (EIA) |

| Agricultural Commodity Prices | Fertilizer Demand from Farmers | Corn and Soybean prices supported farmer investment in 2024 for 2025 season |

| Interest Rates | Borrowing Costs for Capital & Operations | Federal Funds Rate target: 5.25%-5.50% (as of mid-2023) |

| Inflation | Operational Expenses (Raw Materials, Labor) | CPI: 3.4% annual rate (May 2024) |

Preview the Actual Deliverable

CVR Energy PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive CVR Energy PESTLE analysis delves into the Political, Economic, Social, Technological, Legal, and Environmental factors impacting the company. Understand the external forces shaping CVR Energy's strategic landscape.

Sociological factors

Public perception of fossil fuels is a significant factor for CVR Energy, influencing its social license to operate. Growing awareness of climate change in 2024 and 2025 is driving a shift in societal attitudes, with a strong demand for decarbonization and cleaner energy alternatives.

This evolving sentiment directly impacts investment sentiment towards companies like CVR Energy. Increased public pressure for sustainable solutions can lead to greater scrutiny of refining operations and potentially affect access to capital for traditional energy infrastructure.

For instance, surveys in late 2024 indicated that over 60% of consumers are actively seeking out more environmentally friendly products and services, a trend that extends to energy consumption and corporate responsibility.

Consumer demand for sustainably produced food is on the rise, impacting agricultural product preferences. This growing awareness means consumers are increasingly looking for products grown using environmentally friendly practices, which can shift demand for certain fertilizers and agricultural inputs. For instance, a 2024 survey indicated that over 60% of consumers are willing to pay a premium for food produced sustainably.

The availability of skilled labor in refining and chemical manufacturing, especially in CVR Energy's operational areas, is a critical factor. Demographic shifts, like an aging workforce, and evolving educational pathways directly impact the pool of qualified technicians and engineers. For instance, in 2024, the U.S. Bureau of Labor Statistics projected continued demand for chemical engineers and petroleum refinery operators, highlighting the ongoing need for specialized skills.

Community Relations and Social Responsibility

CVR Energy places a significant emphasis on fostering strong community relations and upholding its social responsibility. This commitment is crucial for maintaining operational licenses and ensuring public trust in the areas where its refineries and fertilizer plants are located. For instance, in 2024, CVR Energy reported ongoing engagement with local stakeholders, participating in community advisory panels and supporting local initiatives. This proactive approach helps to mitigate potential social risks and build a foundation of mutual respect.

Addressing community concerns directly is a cornerstone of CVR Energy's strategy. Key areas of focus include environmental stewardship, operational safety, and contributing to local economic development through employment opportunities. By transparently communicating its efforts and responding to feedback, the company aims to solidify its social license to operate. This focus on social responsibility is not merely about compliance but about being a valued member of the communities it serves.

- Community Engagement: CVR Energy actively participates in local forums and advisory boards to address community concerns regarding environmental impact and safety protocols.

- Social Investment: The company supports local initiatives and charitable organizations, contributing to the social and economic well-being of the communities where it operates.

- Employment Impact: CVR Energy prioritizes local hiring and workforce development, aiming to provide stable employment opportunities and contribute to the local economy.

- Risk Mitigation: Maintaining positive community relations is viewed as a critical factor in reducing operational risks and ensuring long-term business sustainability.

Consumer Behavior and Transportation Trends

Long-term shifts in consumer behavior, like the growing interest in electric vehicles (EVs) and the sustained impact of remote work, are poised to gradually temper demand for traditional liquid transportation fuels. This evolving landscape requires CVR Energy to engage in proactive, long-term strategic planning for its refining assets, anticipating potential shifts in fuel consumption patterns.

The accelerating adoption of EVs presents a clear challenge to conventional gasoline and diesel demand. For instance, by the end of 2024, it's projected that over 3 million EVs could be on U.S. roads, a significant increase from previous years. This trend directly impacts the volume of refined products CVR Energy will need to market.

- EV Adoption Growth: Projections indicate a continued upward trajectory for electric vehicle sales, potentially impacting gasoline demand by 5-10% in key markets by 2030.

- Remote Work Persistence: While some return-to-office mandates are in place, a significant percentage of the workforce continues to work remotely, reducing daily commuting miles and overall fuel consumption.

- Fuel Efficiency Improvements: Ongoing advancements in internal combustion engine (ICE) technology continue to improve fuel efficiency, meaning vehicles on the road consume less fuel per mile driven.

- Shifting Consumer Preferences: Beyond EVs, there's a broader consumer interest in sustainable transportation options, including biofuels and alternative fuel sources, which could further diversify fuel demand away from traditional refined products.

Societal views on environmental responsibility heavily influence CVR Energy's operational landscape, with a growing demand for sustainable practices impacting investment and public perception. Consumer preferences are shifting, with a notable increase in demand for environmentally friendly products and services, a trend that extends to energy consumption and corporate accountability. For example, surveys in late 2024 revealed that over 60% of consumers actively seek out more sustainable options, directly affecting how companies like CVR Energy are viewed and supported.

The availability of a skilled workforce remains a critical consideration for CVR Energy, particularly in its refining and chemical manufacturing sectors. Demographic shifts, such as an aging workforce, coupled with evolving educational pathways, directly affect the supply of qualified technicians and engineers. The U.S. Bureau of Labor Statistics projected in 2024 that demand for chemical engineers and petroleum refinery operators would continue to be strong, underscoring the persistent need for specialized expertise.

CVR Energy prioritizes robust community engagement and social responsibility to maintain its operational licenses and public trust. This involves active participation in local forums and advisory boards to address concerns about environmental impact and safety, as well as supporting local initiatives. For instance, in 2024, CVR Energy reported ongoing collaboration with local stakeholders, reinforcing its commitment to being a valued community member and mitigating social risks.

Shifts in consumer behavior, such as the increasing adoption of electric vehicles (EVs) and the persistence of remote work, are gradually influencing demand for traditional liquid transportation fuels. By the end of 2024, projections indicated that over 3 million EVs could be on U.S. roads, a significant increase that directly impacts the market for refined products. This evolving landscape necessitates proactive, long-term strategic planning for CVR Energy's refining assets to anticipate potential changes in fuel consumption patterns.

| Sociological Factor | 2024/2025 Data/Trend | Impact on CVR Energy |

|---|---|---|

| Public Environmental Sentiment | 60%+ consumers seeking eco-friendly options (late 2024 survey) | Influences social license to operate, investment sentiment, and scrutiny of operations. |

| Skilled Labor Availability | Continued strong demand for chemical engineers & refinery operators (BLS 2024 projection) | Critical for operational efficiency; aging workforce poses potential challenges. |

| EV Adoption | Over 3 million EVs projected on U.S. roads by end of 2024 | Gradually tempers demand for traditional liquid transportation fuels. |

| Community Relations | Active engagement in local forums and support for initiatives (CVR 2024 reporting) | Essential for operational licenses, risk mitigation, and long-term sustainability. |

Technological factors

CVR Energy is keenly focused on refining process advancements to boost its competitive edge. Innovations like advanced catalysts and energy-efficient processes are key to enhancing operational efficiency and reducing costs. For instance, the company's Coffeyville refinery utilizes a sophisticated hydrocracking unit, a testament to its investment in advanced refining technologies that improve product yields.

The advancement and economic feasibility of Carbon Capture, Utilization, and Storage (CCUS) technologies are becoming critical for lowering greenhouse gas emissions in sectors like refining and fertilizer manufacturing. For instance, the U.S. Department of Energy's Bipartisan Infrastructure Law allocated $2.1 billion in 2023 for CCUS projects, signaling significant government backing.

CVR Energy's strategic adoption of CCUS could prove instrumental in complying with evolving environmental mandates and enhancing its overall sustainability profile. This proactive approach may position the company favorably against competitors as carbon pricing mechanisms become more prevalent globally.

Advances in precision agriculture, such as sophisticated data analytics, an array of sensors, and drone technology, are revolutionizing how farmers apply fertilizers. These innovations allow for highly efficient and targeted application, meaning less waste and more precise nutrient delivery to crops. For instance, by 2024, the global precision agriculture market was valued at approximately $10.5 billion and is projected to reach $23.4 billion by 2030, showcasing significant growth and adoption.

This technological shift directly impacts the demand for fertilizer products. As precision agriculture becomes more widespread, farmers are likely to demand more specialized and potentially lower-volume, higher-efficiency fertilizers. This could influence CVR Energy's nitrogen product sales, requiring adaptation to meet evolving market needs for optimized crop nutrition rather than bulk commodity supply.

Renewable Energy Integration

Technological advancements in solar and wind power continue to drive down costs, directly impacting the long-term demand for traditional fossil fuels. For instance, the global average cost of electricity from solar photovoltaics (PV) fell by an estimated 89% between 2010 and 2022, making it increasingly competitive. This trend necessitates that companies like CVR Energy consider how these shifts will affect their core business and explore potential adaptations.

CVR Energy may find strategic advantages in integrating renewable energy sources into its operational framework. Such integration could serve a dual purpose: reducing overall energy expenditures and actively lowering the company's carbon intensity. This proactive approach aligns with growing market expectations and regulatory pressures for sustainability.

- Falling Renewable Costs: Global solar PV costs decreased by approximately 89% from 2010 to 2022, enhancing competitiveness against fossil fuels.

- Wind Power Efficiency: Advancements in wind turbine technology have led to increased capacity factors, making wind power a more reliable energy source.

- Energy Storage Solutions: Improvements in battery technology are making renewable energy more dispatchable, addressing intermittency concerns.

- CVR's Potential Integration: CVR Energy could explore using renewable energy for its refining and marketing operations to cut costs and reduce its carbon footprint.

Automation and Digitalization

CVR Energy is increasingly integrating automation and digitalization across its refining and marketing operations. This includes advanced process control systems and digital tools for supply chain management. For instance, in 2024, CVR Energy continued its investments in upgrading plant control systems to enhance safety and operational reliability, aiming to reduce unplanned downtime. These technological advancements are crucial for maintaining a competitive edge in the energy sector.

The benefits of this digital transformation are significant. Improved safety records and more effective predictive maintenance schedules are direct outcomes. Furthermore, enhanced operational efficiency, driven by real-time data analytics and streamlined processes, contributes to cost savings. By adopting these modern industrial technologies, CVR Energy is positioning itself for greater resilience and profitability in the evolving energy landscape.

- Enhanced Operational Efficiency: Digitalization can lead to a measurable increase in throughput and reduced energy consumption per barrel refined.

- Predictive Maintenance: Implementing AI-driven predictive maintenance can reduce unexpected equipment failures by an estimated 20-30%, minimizing costly shutdowns.

- Improved Safety: Advanced automation in hazardous environments significantly reduces human exposure to risks, contributing to a safer workplace.

- Supply Chain Optimization: Digital tools provide better visibility and control over the entire supply chain, from feedstock procurement to product distribution, leading to more efficient logistics.

CVR Energy's commitment to technological advancement is evident in its adoption of sophisticated refining processes and automation. Innovations like advanced catalysts and energy-efficient systems, such as the hydrocracking unit at its Coffeyville refinery, are central to improving yields and reducing operational costs. The company's embrace of digitalization and automation across its operations, including upgraded plant control systems in 2024, aims to boost safety, reliability, and overall efficiency, potentially reducing unplanned downtime by leveraging real-time data analytics.

The increasing feasibility of Carbon Capture, Utilization, and Storage (CCUS) technologies presents a significant technological factor, with the U.S. Department of Energy allocating $2.1 billion in 2023 for such projects, underscoring strong governmental support. CVR Energy's strategic integration of CCUS could be crucial for meeting environmental regulations and improving its sustainability credentials as carbon pricing mechanisms gain traction.

Furthermore, advancements in precision agriculture, including sensor technology and drone applications, are transforming fertilizer demand. This shift towards more targeted nutrient delivery means farmers may favor specialized, lower-volume fertilizers, potentially influencing CVR Energy's nitrogen product sales strategy as the global precision agriculture market, valued at approximately $10.5 billion in 2024, continues its rapid expansion.

The declining costs of renewable energy, with solar PV electricity costs falling by an estimated 89% between 2010 and 2022, directly challenge traditional fossil fuels. CVR Energy's potential integration of renewable energy sources into its operations could lower energy expenses and reduce its carbon intensity, aligning with market and regulatory demands for greater sustainability.

Legal factors

CVR Energy navigates a stringent regulatory landscape, with key environmental compliance laws like the Clean Air Act and Clean Water Act dictating operational standards. Failure to meet these requirements, which include managing hazardous waste, can lead to substantial penalties. For instance, in 2023, the EPA reported over $1 billion in penalties for environmental violations across various industries, a figure CVR Energy actively works to avoid.

The financial implications of non-compliance are significant, potentially including hefty fines and operational shutdowns. Beyond direct financial costs, reputational damage from environmental incidents can erode market confidence and impact investor relations. CVR Energy's commitment to environmental stewardship is therefore crucial for sustained business viability and stakeholder trust.

CVR Energy's refining and marketing operations are heavily influenced by Occupational Safety and Health Administration (OSHA) regulations. The company must maintain stringent safety protocols to prevent workplace accidents and ensure compliance, which can involve significant investment in training and equipment. Failure to adhere to OSHA standards, such as those related to process safety management, can result in substantial fines; for instance, in 2023, OSHA reported over $14 million in penalties for egregious violations.

CVR Energy faces significant legal scrutiny regarding product liability and quality standards for its refined fuels and fertilizers. Failure to meet stringent industry specifications, such as those set by the American Society for Testing and Materials (ASTM) for gasoline and diesel, can lead to costly lawsuits and reputational damage. In 2023, the petroleum refining industry, in general, saw continued focus on product integrity, with regulatory bodies like the EPA emphasizing compliance to ensure environmental and consumer safety.

Antitrust and Competition Laws

CVR Energy must adhere to antitrust and competition laws to maintain fair play in the energy and fertilizer sectors. These regulations prevent monopolies and price-fixing, ensuring a level playing field for all businesses.

Failure to comply can result in significant penalties. For instance, in 2023, the U.S. Department of Justice and the Federal Trade Commission continued to actively pursue cases against companies for anti-competitive practices, with fines often reaching millions of dollars.

CVR Energy’s operations, particularly its refining and marketing of petroleum products and its production of fertilizers, are subject to scrutiny by regulatory bodies like the Federal Trade Commission (FTC) and the Department of Justice (DOJ).

Potential legal challenges and investigations stemming from perceived anti-competitive actions could disrupt operations and negatively impact financial performance. In 2024, the focus on market concentration and potential collusion in key industries remains a priority for these agencies.

Permitting and Licensing Requirements

CVR Energy's operations, particularly its refineries and fertilizer plants, are subject to a complex web of permitting and licensing requirements. These mandates come from various federal, state, and local regulatory bodies, ensuring compliance with environmental, safety, and operational standards. For instance, the Environmental Protection Agency (EPA) plays a significant role in regulating emissions, waste disposal, and chemical handling, all of which necessitate specific permits.

The ongoing process of obtaining, maintaining, and renewing these permits represents a continuous legal obligation. This can directly influence operational timelines and incur substantial costs for CVR Energy. Failure to adhere to the stipulated conditions can lead to penalties, operational disruptions, and reputational damage. For example, in 2023, the refining industry, in general, faced increased scrutiny regarding air quality permits, potentially impacting expansion or modification projects.

Key legal factors impacting CVR Energy include:

- Environmental Permits: Compliance with the Clean Air Act, Clean Water Act, and Resource Conservation and Recovery Act (RCRA) requires numerous permits for emissions, wastewater discharge, and hazardous waste management.

- Operating Licenses: Facilities require specific licenses to operate refineries and produce fertilizers, often involving safety certifications and adherence to industry-specific regulations.

- Permit Renewals and Modifications: The cyclical nature of permit renewals and the need for modifications due to process changes or new regulations present ongoing legal and administrative challenges.

CVR Energy operates under a strict legal framework, encompassing environmental regulations, workplace safety, product liability, and antitrust laws. Compliance with these mandates, including those from the EPA and OSHA, is critical to avoid substantial fines and operational disruptions.

In 2023, environmental penalties across industries exceeded $1 billion, highlighting the financial risks of non-compliance. Similarly, OSHA violations can incur millions in fines, as seen with egregious cases in 2023. CVR Energy's adherence to these legal requirements directly impacts its financial health and market reputation.

The company must also navigate permitting and licensing, with ongoing renewal and modification processes presenting continuous legal and administrative burdens. Failure in these areas can lead to penalties and operational setbacks, as observed with increased scrutiny on air quality permits in the refining sector during 2023.

| Legal Factor | Key Regulations/Bodies | Potential Impact of Non-Compliance | Relevant Data Point (2023/2024) |

| Environmental Compliance | EPA (Clean Air Act, Clean Water Act, RCRA) | Fines, operational shutdowns, reputational damage | Over $1 billion in EPA penalties across industries in 2023. |

| Workplace Safety | OSHA | Fines, increased insurance costs, worker injury impact | Over $14 million in OSHA penalties for egregious violations in 2023. |

| Product Liability | ASTM, EPA | Lawsuits, recalls, brand damage | Continued industry focus on product integrity and consumer safety in 2023. |

| Antitrust & Competition | DOJ, FTC | Significant fines, divestitures, operational restrictions | DOJ and FTC actively pursued anti-competitive cases in 2023, with multi-million dollar fines. |

| Permitting & Licensing | Federal, State, Local Agencies | Operational delays, fines, project cancellations | Increased scrutiny on air quality permits impacting refining projects in 2023. |

Environmental factors

Federal and state governments are intensifying efforts to combat climate change, which could translate into stricter rules on greenhouse gas emissions for companies like CVR Energy. This focus might lead to the implementation of carbon taxes or cap-and-trade systems, directly affecting operational expenses and influencing future investment decisions within the energy sector.

For instance, the Biden administration's goal to cut U.S. emissions by 50-52% below 2005 levels by 2030, and the Inflation Reduction Act of 2022 providing significant tax credits for clean energy, signal a strong regulatory push. These policies could increase compliance costs for CVR Energy's refining and marketing operations, potentially requiring substantial capital outlays for emissions reduction technologies.

CVR Energy's refining and fertilizer operations are substantial water consumers. For instance, the petroleum refining process, particularly for cooling and steam generation, requires significant volumes. Similarly, fertilizer production, especially ammonia-based products, relies heavily on water as a feedstock and for cooling.

Growing concerns over water scarcity, especially in regions like the Permian Basin where some of CVR's operations are located, pose a risk. This scarcity can translate into more stringent water usage regulations and increased operational costs associated with acquiring and treating water. For example, in 2023, parts of Texas experienced moderate to severe drought conditions, potentially impacting water availability and pricing for industrial users.

Effective management of industrial waste, including hazardous materials and wastewater, is a critical environmental consideration for CVR Energy. The company's operations, particularly in refining, generate byproducts that require careful handling and disposal to meet environmental standards.

Stricter regulations on waste disposal and pollution control necessitate ongoing investment in advanced treatment technologies and responsible practices. For instance, in 2023, CVR Energy reported capital expenditures related to environmental compliance and improvements, reflecting a commitment to addressing these challenges. The company's focus on reducing emissions and improving water management aligns with evolving environmental expectations.

Air Quality and Emissions Standards

CVR Energy faces increasing pressure from evolving air quality regulations. The company must adapt to more stringent emission standards for key pollutants such as sulfur dioxide (SO2), nitrogen oxides (NOx), and particulate matter (PM) from its refining operations. This necessitates ongoing investment in advanced emissions control technologies to maintain compliance and minimize environmental impact.

For instance, in 2023, CVR Energy reported capital expenditures related to environmental compliance and improvements. While specific figures for air quality upgrades vary, the company's commitment to reducing its environmental footprint is evident in its operational strategies. Meeting these tightening standards is crucial for CVR Energy's long-term operational viability and social license to operate.

- Stricter SO2 Regulations: Continued focus on reducing sulfur dioxide emissions, a key component of acid rain and respiratory issues.

- NOx Emission Controls: Implementation of technologies to curb nitrogen oxide output, contributing to cleaner air and reduced smog formation.

- Particulate Matter Reduction: Investments aimed at capturing fine particles, which have significant public health implications.

- Compliance Investments: Ongoing capital allocation to upgrade facilities and ensure adherence to current and anticipated environmental mandates.

Biodiversity and Land Use Impact

CVR Energy's industrial activities, particularly in refining and marketing, carry inherent risks to local ecosystems. Concerns about soil contamination from historical or ongoing operations and potential habitat disruption for wildlife are significant environmental considerations. For instance, as of its 2023 environmental reporting, CVR Energy's Coffeyville refinery, like many in the industry, is subject to stringent regulations regarding emissions and waste management, which directly impact land use and biodiversity in its vicinity.

Responsible land use is paramount for CVR Energy to mitigate these impacts. This includes careful site selection, efficient resource management, and proactive measures to prevent spills or leaks that could contaminate soil and water. The company's commitment to environmental stewardship often involves investing in technologies and practices aimed at minimizing its ecological footprint and addressing any legacy environmental issues through remediation efforts.

The company's approach to land use is also shaped by regulatory landscapes and public expectations regarding environmental protection. For example, in 2024, increased scrutiny on industrial emissions and their effect on air and water quality continues to drive investment in cleaner technologies and more sustainable operational practices across the refining sector. CVR Energy's ability to adapt and invest in these areas will be crucial for maintaining its social license to operate and minimizing biodiversity impacts.

Key considerations for CVR Energy include:

- Minimizing soil and water contamination risks through robust operational controls and spill prevention plans.

- Investing in habitat restoration or conservation efforts in areas adjacent to its facilities where applicable.

- Adhering to and exceeding environmental regulations concerning land use and waste disposal.

- Implementing remediation strategies for any identified historical contamination to restore land quality.

Government policies aimed at curbing climate change, such as carbon taxes and emissions caps, directly impact CVR Energy's operational costs and investment strategies. The Inflation Reduction Act of 2022, for instance, offers tax credits for clean energy, signaling a regulatory shift that could increase compliance expenses for CVR Energy's refining and marketing segments.

Water scarcity is a growing concern, particularly in regions like the Permian Basin, where CVR Energy operates. This scarcity can lead to stricter water usage regulations and higher operational costs for water acquisition and treatment, as evidenced by drought conditions in Texas in 2023.

CVR Energy must manage industrial waste, including hazardous materials, to meet stringent disposal and pollution control standards. The company's 2023 capital expenditures reflect a commitment to environmental improvements, including investments in emissions reduction and water management technologies.

Air quality regulations are becoming more rigorous, requiring CVR Energy to invest in advanced emissions control technologies for pollutants like SO2 and NOx. The company's ongoing capital allocation for environmental compliance underscores its efforts to meet these evolving mandates.

PESTLE Analysis Data Sources

Our CVR Energy PESTLE Analysis is informed by a comprehensive review of official government reports, industry-specific publications, and reputable economic data providers. We incorporate insights from energy market analyses, regulatory updates, and technological advancements to ensure a robust understanding of the external environment.