CVR Energy Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

CVR Energy Bundle

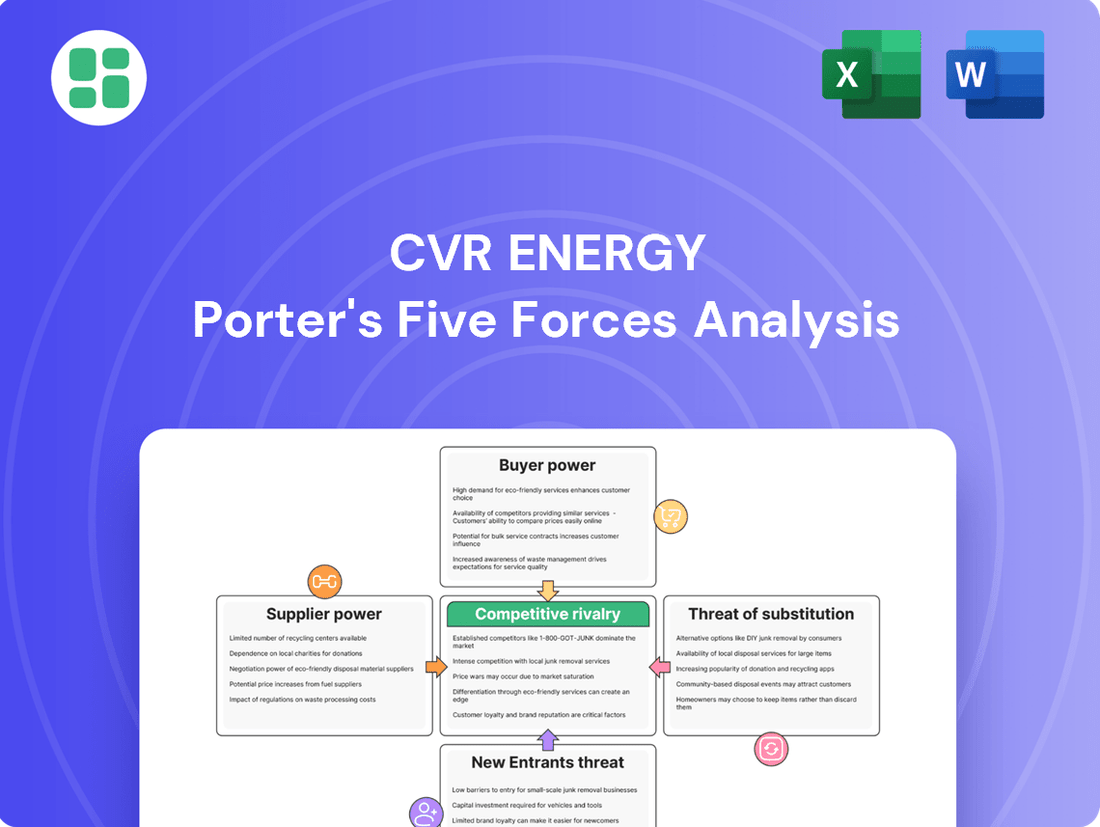

CVR Energy operates in a dynamic refining and marketing sector, where understanding the competitive landscape is paramount. Our analysis reveals how buyer power, the threat of substitutes, and the intensity of rivalry shape CVR Energy’s strategic options.

The complete report reveals the real forces shaping CVR Energy’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

CVR Energy's petroleum refining operations are significantly dependent on crude oil, a global commodity whose pricing is largely dictated by major oil-producing countries and large, integrated oil corporations. This reliance on a concentrated supplier base means that when crude oil supply is constrained or demand surges, these suppliers can wield considerable influence, directly affecting CVR Energy's cost of raw materials.

Similarly, CVR Energy's nitrogen fertilizer segment relies heavily on natural gas. The price of natural gas, a key feedstock, is often subject to regional supply-demand balances and can be volatile due to geopolitical events. The concentration of natural gas suppliers further amplifies their bargaining power, particularly during periods of tight supply, impacting CVR Energy's operational costs and profitability.

Switching crude oil types or natural gas sources for a refinery or fertilizer plant can involve substantial costs. These can range from infrastructure adjustments and processing modifications to complex supply chain reconfigurations. For instance, in 2024, the average cost for a refinery to retool for a different crude grade can easily run into millions of dollars, impacting operational efficiency and requiring significant capital expenditure.

These high switching costs directly limit CVR Energy's flexibility in choosing alternative suppliers. This, in turn, significantly increases the leverage of existing suppliers who provide these critical, specialized inputs. The specialized nature of refining and fertilizer production means that rapid shifts to new suppliers are often not feasible without considerable disruption and investment.

While crude oil and natural gas are generally seen as commodities, CVR Energy's mid-continent refineries rely on specific grades of crude. These specialized inputs can offer processing advantages, boosting efficiency and potentially lowering transportation costs for the refinery. For instance, in 2024, the availability and cost of WTI Midland crude, a key input for some refiners, significantly impacted operational economics.

Threat of Forward Integration by Suppliers

Large, integrated oil and gas companies possess the capability to forward integrate into refining or fertilizer production, a move that could increase supplier leverage. While less common for independent refiners like CVR Energy, this potential, however remote, grants suppliers a degree of bargaining power. This threat is amplified for smaller, less diversified entities within the industry.

- Supplier Integration Threat: Major integrated oil and gas firms can potentially move into refining or fertilizer manufacturing, impacting CVR Energy's supplier dynamics.

- Leverage in Negotiations: Even a theoretical possibility of forward integration by suppliers can strengthen their position in price and contract negotiations.

- Impact on Smaller Players: The risk of suppliers integrating forward is more significant for smaller, less diversified companies in the sector compared to larger, integrated ones.

Limited Availability of Substitute Inputs

For CVR Energy's primary operations in refining and nitrogen fertilizer production, the availability of direct substitutes for their core inputs—crude oil and natural gas, respectively—is quite limited. This scarcity significantly bolsters the bargaining power of their suppliers.

While the landscape for renewable energy is evolving, and alternative feedstocks for fuels are gaining traction, these still constitute a minor fraction of the inputs required for traditional refining processes. Consequently, CVR Energy's dependence on conventional fossil fuels remains substantial, giving upstream suppliers considerable leverage.

- Limited Substitutes: Direct substitutes for crude oil in refining and natural gas in fertilizer production are scarce, increasing supplier leverage.

- Technological Hurdles: Shifting to alternative feedstocks often requires significant technological advancements and substantial capital investment, making it impractical in the short to medium term.

- Emerging Renewables: While renewable feedstocks are growing, they are not yet a widespread replacement for traditional inputs in CVR Energy's core businesses.

- Supplier Reliance: CVR Energy's continued reliance on conventional fossil fuels grants suppliers a stronger position in price negotiations and supply agreements.

CVR Energy faces considerable bargaining power from its crude oil and natural gas suppliers due to the concentrated nature of these markets and the high costs associated with switching inputs. In 2024, the reliance on specific crude grades, like WTI Midland for mid-continent refineries, highlights this dependence, with significant price fluctuations directly impacting operational economics.

The limited availability of direct substitutes for crude oil and natural gas further strengthens supplier leverage. While renewable alternatives are emerging, they are not yet viable replacements for CVR Energy's core refining and fertilizer production needs, reinforcing the company's dependence on traditional fossil fuels and their suppliers.

| Input | Supplier Concentration | Switching Costs | CVR Energy's Vulnerability (2024) |

|---|---|---|---|

| Crude Oil | High (Major Oil Producers) | Millions of dollars for retooling | Significant due to specific grade requirements |

| Natural Gas | High (Regional Supply Balances) | Substantial infrastructure and supply chain costs | Vulnerable to price volatility and supply constraints |

What is included in the product

This analysis of CVR Energy's competitive landscape examines the intensity of rivalry, the bargaining power of buyers and suppliers, the threat of new entrants, and the impact of substitute products on its profitability.

Quickly identify and address competitive threats with a visual breakdown of CVR Energy's market pressures.

Customers Bargaining Power

CVR Energy's position in the fuels market is characterized by a fragmented customer base, encompassing wholesale distributors, retailers, and industrial clients. This broad distribution network means no single buyer holds significant leverage over CVR Energy's refined products like gasoline and diesel.

The ultimate consumers, individual drivers and businesses, also face a multitude of fuel providers. This abundance of choice for end-users effectively limits their individual ability to negotiate lower prices with CVR Energy, thereby diminishing their collective bargaining power.

In 2024, the average retail price for a gallon of gasoline in the U.S. fluctuated, but the sheer number of fueling stations available across the country ensures consumers can readily switch providers if prices become uncompetitive, a dynamic that inherently limits any single customer's power.

CVR Energy's refined fuels and nitrogen fertilizers are essentially commodity products. This means that when customers are making a purchase decision, the price of the product is the most important factor. For example, in 2024, the price of gasoline at the pump, a key refined fuel, fluctuated significantly, impacting consumer choices. Similarly, agricultural clients closely monitor the cost of nitrogen fertilizers, a critical input for their crops.

Because there's little to distinguish one supplier's product from another's in these markets, large buyers, like big farming operations or industrial companies, have a lot of leverage. They can easily switch to a competitor if they find a better price. This intense price competition directly translates into significant bargaining power for CVR Energy's customers.

For many of CVR Energy's customers, particularly those buying fuels or standard fertilizers, switching suppliers is quite simple and doesn't cost much. This low barrier to entry means customers can easily switch to a competitor if CVR Energy's prices aren't competitive or if they're unhappy with the service. In 2024, the energy sector saw fluctuating fuel prices, making price sensitivity a key concern for consumers and businesses alike.

Customer Knowledge and Transparency

In the fuel and fertilizer sectors, customers benefit from significant market transparency. This means they can easily access and compare pricing from different suppliers, understanding the going rates for products. For instance, in 2024, readily available data on crude oil futures and fertilizer commodity prices allows buyers to pinpoint competitive offers. This knowledge directly translates into stronger negotiation leverage for customers.

This informed position empowers buyers to push for better terms and pricing. When customers know what others are charging, they can effectively challenge higher quotes and demand more favorable deals. This dynamic intensifies the bargaining power of customers, making it a crucial factor for companies like CVR Energy to consider.

- Informed Customers: Buyers in fuel and fertilizer markets have access to transparent pricing data, enabling direct comparison of supplier offers.

- Negotiation Power: This transparency allows customers to negotiate more aggressively, leveraging their knowledge of market rates and competitor pricing.

- Market Dynamics: In 2024, the availability of real-time commodity price information, such as West Texas Intermediate (WTI) crude oil futures, directly enhances customer bargaining power.

Potential for Backward Integration by Large Customers

The potential for backward integration by major customers poses a significant threat to CVR Energy. For instance, large agricultural cooperatives, which are substantial buyers of fertilizers, could theoretically invest in their own production facilities if the economics become favorable. Similarly, major fuel distributors might explore building or acquiring their own refining capacity, bypassing CVR Energy altogether.

This threat, though often theoretical for most clients, can influence CVR Energy's pricing and contract negotiations, particularly with its largest customers. The mere possibility of a major client developing its own production capabilities can create leverage for those customers in their dealings with CVR Energy.

- Backward Integration Threat: Large agricultural cooperatives and industrial companies could consider producing their own fertilizers.

- Fuel Distributor Integration: Major fuel distributors might invest in their own refining operations.

- Pricing Influence: This theoretical capability can impact CVR Energy's pricing strategies for significant clients.

CVR Energy's customers, particularly those in the fuel and fertilizer markets, possess considerable bargaining power. This stems from the commodity nature of its products, where price is the primary differentiator, and the ease with which customers can switch between suppliers. The transparency in pricing, readily available through market data, further amplifies this power, allowing buyers to negotiate more effectively.

The threat of backward integration by large customers, such as agricultural cooperatives or fuel distributors, also contributes to their leverage. While often theoretical, this potential for self-sufficiency can influence CVR Energy's pricing and contract terms, especially for its most significant clients.

| Factor | Impact on CVR Energy | Customer Bargaining Power |

|---|---|---|

| Product Homogeneity | Limited product differentiation | High |

| Switching Costs | Low for most customers | High |

| Price Transparency | Easy access to market pricing | High |

| Backward Integration Potential | Threat of customers producing their own goods | Moderate to High |

Preview Before You Purchase

CVR Energy Porter's Five Forces Analysis

This preview shows the exact document you'll receive immediately after purchase—no surprises, no placeholders. It details the competitive landscape for CVR Energy through Porter's Five Forces, analyzing the threat of new entrants, the bargaining power of buyers, the bargaining power of suppliers, the threat of substitute products or services, and the intensity of rivalry among existing competitors.

Rivalry Among Competitors

The petroleum refining and nitrogen fertilizer sectors, where CVR Energy operates, are defined by substantial fixed costs. This means companies must run their facilities at near-full capacity to become profitable. For instance, refinery construction costs can run into billions of dollars, and fertilizer plants also represent significant capital investments.

This high fixed cost structure drives a relentless pursuit of high capacity utilization. Companies like CVR Energy are incentivized to keep production high, even if market conditions suggest otherwise. This can lead to aggressive pricing strategies, especially when there's too much product on the market or demand is sluggish, thereby intensifying competition among industry players.

In 2024, the global refining industry faced challenges with fluctuating crude oil prices and evolving demand patterns. Companies had to balance the need for high utilization to cover their fixed costs with the risk of oversupplying the market, which could depress margins. This dynamic directly fuels competitive rivalry as firms vie for market share.

CVR Energy navigates a competitive terrain populated by numerous and varied players. In the refining segment, established giants like PBF Energy and HF Sinclair present significant competition, often boasting larger operational capacities and broader market reach.

The fertilizer market is similarly crowded, with companies such as CF Industries being major rivals. This diverse group of competitors, ranging from integrated oil majors to specialized fertilizer manufacturers, intensifies the rivalry for market share and profitability.

CVR Energy operates in markets with highly commoditized products like refined fuels and nitrogen fertilizers. This means there's little to differentiate one company's offerings from another's, forcing competition to center almost entirely on price. In 2024, the average price for gasoline at the pump fluctuated significantly, impacting CVR's ability to pass on costs and maintain margins against competitors who might have lower operating expenses.

The intense price-based rivalry necessitates a relentless focus on operational efficiency and cost management for CVR Energy. For instance, in the first quarter of 2024, CVR reported a refined products operating margin of $17.34 per barrel, a figure directly influenced by their ability to control production costs and secure favorable feedstock pricing compared to rivals.

Slow Industry Growth in Mature Segments

While the renewable fuels sector, particularly renewable diesel, shows promise, the core petroleum refining market in the United States is largely mature. This limited overall growth in traditional refining means companies often fight harder for existing market share, intensifying competitive rivalry.

This dynamic is evident as companies like CVR Energy navigate a landscape where expansion relies more on capturing share from competitors than on a rapidly expanding overall market. For instance, while renewable diesel production is a growth area, it represents a shift within the broader energy consumption picture rather than a net increase in fuel demand that benefits all refiners equally.

- Mature Market Dynamics: The U.S. refining industry faces slow growth, particularly in its traditional gasoline and diesel segments, forcing companies to compete more aggressively for market share.

- Shift to Renewables: Growth is concentrated in areas like renewable diesel, but this often involves conversion or adaptation rather than pure market expansion, creating new competitive fronts.

- Intensified Rivalry: In mature segments, companies must focus on operational efficiency and cost control to maintain profitability, as demand growth is minimal.

High Exit Barriers

CVR Energy operates in industries with substantial capital requirements for its refineries and fertilizer plants. These significant upfront investments, often in the billions of dollars, make it incredibly difficult and costly for companies to exit the market. For instance, the construction of a new refinery can easily exceed $10 billion.

Furthermore, the specialized nature of refinery and fertilizer production assets means they have limited alternative uses, increasing the financial risk associated with divesting them. Companies also face potential environmental liabilities and decommissioning costs, which can add millions to exit expenses, discouraging even unprofitable operations from shutting down.

- High Capital Investment: Refineries and fertilizer plants require massive initial outlays, creating a significant financial commitment.

- Specialized Assets: The unique nature of these facilities limits their resale value or alternative applications.

- Environmental Liabilities: Potential cleanup and remediation costs upon closure act as a strong deterrent to exiting the market.

CVR Energy faces intense competition from numerous players in both refining and nitrogen fertilizer markets. Established companies like PBF Energy and HF Sinclair in refining, and CF Industries in fertilizers, often possess greater scale and market reach. The highly commoditized nature of their products means competition largely centers on price, forcing CVR to prioritize operational efficiency and cost control, as seen in its Q1 2024 refined products operating margin of $17.34 per barrel.

The U.S. refining sector, particularly for traditional fuels, is mature with limited growth, driving companies to fight harder for existing market share. While renewable diesel offers growth, it often involves adaptation rather than pure market expansion. This dynamic intensifies rivalry, as companies like CVR Energy focus on capturing share rather than benefiting from a rapidly expanding overall market.

High fixed costs in refining and fertilizer production necessitate high capacity utilization, even in challenging market conditions. This can lead to aggressive pricing strategies, especially when oversupply or weak demand occurs, further fueling competitive pressures. For example, fluctuating crude oil prices in 2024 directly impacted refiners' ability to manage costs and maintain margins against competitors.

The significant capital investment required for refineries and fertilizer plants, often exceeding $10 billion for a new refinery, creates high barriers to exit. Specialized assets with limited alternative uses and potential environmental liabilities discourage companies from leaving the market, even if unprofitable, which can contribute to sustained competitive pressure.

SSubstitutes Threaten

The increasing popularity of renewable fuels and electric vehicles presents a substantial long-term threat to CVR Energy's core petroleum refining business. As more consumers opt for electric cars, demand for gasoline, a key product for refiners, is projected to decline. For instance, by 2024, electric vehicle sales in the U.S. were expected to reach over 1.5 million units, a significant increase from previous years.

Furthermore, the rise of renewable diesel, a sector CVR Energy is also involved in, directly competes with traditional diesel fuel. This shift forces traditional refiners to either diversify their product offerings or risk market share erosion. The U.S. Environmental Protection Agency's Renewable Fuel Standard, which mandates a certain volume of renewable fuels, further incentivizes this transition away from petroleum-based products.

The growing adoption of bio-based and organic fertilizers presents a notable threat of substitutes for traditional synthetic nitrogen fertilizers, a key segment for CVR Energy. Environmental consciousness and a push for sustainable agriculture are driving this shift. For instance, the global bio-fertilizer market was valued at approximately $2.1 billion in 2023 and is projected to grow significantly, indicating a rising demand for these alternatives.

Advances in precision agriculture, soil testing, and nutrient management techniques allow farmers to optimize fertilizer application, potentially reducing the overall volume of synthetic fertilizers needed. For instance, in 2024, the global precision agriculture market was valued at approximately $10.5 billion, indicating significant investment in these efficiency-boosting technologies. This technological progress acts as a substitute for traditional, less targeted application methods, directly impacting the demand for bulk fertilizers that CVR Energy produces.

Alternative Energy Sources for Transportation

Beyond electric vehicles, alternative energy sources like natural gas (LNG/CNG) and hydrogen pose a growing threat to diesel and other refined products, particularly in heavy transport and industrial applications. While adoption is still developing, these alternatives could significantly impact demand for traditional fuels.

The market for alternative fuels is expanding, with significant investments being made globally. For instance, the global hydrogen fuel cell market was valued at approximately $2.8 billion in 2023 and is projected to reach over $12 billion by 2030, indicating a substantial shift in energy preferences.

- Natural Gas Vehicles: Compressed Natural Gas (CNG) and Liquefied Natural Gas (LNG) offer lower emissions and can be more cost-effective than diesel in certain regions. By the end of 2023, over 35 million natural gas vehicles were in operation worldwide.

- Hydrogen Fuel Cells: Hydrogen technology is gaining traction, especially for long-haul trucking and heavy-duty vehicles, offering zero tailpipe emissions. Several major automakers and logistics companies are piloting hydrogen-powered fleets.

- Infrastructure Development: The expansion of refueling infrastructure for both natural gas and hydrogen is crucial for their widespread adoption, and governments are increasingly supporting this development.

Recycling and Resource Recovery

The growing emphasis on circular economy models presents a potential threat through enhanced recycling and resource recovery. As more efficient methods for extracting nutrients from waste streams are developed, the demand for newly manufactured fertilizers could diminish, impacting CVR Energy's core business. This shift, while still developing, could offer a viable alternative to conventional fertilizer production.

For instance, advancements in anaerobic digestion and composting technologies are enabling the recovery of valuable nutrients like nitrogen and phosphorus from agricultural and municipal waste. The global market for organic fertilizers, a key area of resource recovery, was valued at approximately $11.5 billion in 2023 and is projected to grow significantly, indicating a tangible shift in consumer and industrial preferences towards sustainable alternatives.

- Nutrient Recovery: Technologies are improving the efficiency of extracting plant nutrients from waste.

- Circular Economy: Principles of reuse and recycling are gaining traction, potentially reducing demand for virgin materials.

- Organic Fertilizer Market: This sector, representing a substitute, saw substantial growth in 2023, reaching an estimated $11.5 billion.

The threat of substitutes for CVR Energy's products is multifaceted, stemming from evolving consumer preferences and technological advancements across its business segments. In refining, the increasing adoption of electric vehicles directly reduces demand for gasoline. For its fertilizer segment, bio-based alternatives and improved agricultural efficiency present significant substitution risks.

| Substitute Category | CVR Energy Product Impacted | Key Substitute Trend/Data (as of 2024/2023) | Substitution Impact |

|---|---|---|---|

| Electric Vehicles | Gasoline | U.S. EV sales expected to exceed 1.5 million units in 2024. | Decreased demand for refined gasoline. |

| Renewable Diesel | Diesel Fuel | U.S. Renewable Fuel Standard mandates increased renewable fuel volumes. | Competition with traditional diesel; potential market share erosion. |

| Bio-fertilizers | Synthetic Nitrogen Fertilizers | Global bio-fertilizer market valued at approx. $2.1 billion in 2023; growing demand. | Reduced demand for conventional fertilizers. |

| Precision Agriculture | Bulk Fertilizers | Global precision agriculture market valued at approx. $10.5 billion in 2024. | Optimized fertilizer use reduces overall volume needed. |

| Natural Gas & Hydrogen | Diesel, Refined Products | Over 35 million natural gas vehicles globally by end of 2023; hydrogen market projected to reach over $12 billion by 2030. | Potential shift in heavy transport and industrial fuel demand. |

Entrants Threaten

Establishing a new crude oil refinery or a large-scale nitrogen fertilizer plant, core businesses for CVR Energy, demands colossal capital outlays, often reaching billions of dollars. For instance, building a modern refinery can easily exceed $10 billion. This immense financial hurdle acts as a significant deterrent, effectively blocking most aspiring competitors from entering the market.

The refining and fertilizer sectors face substantial regulatory burdens, demanding a multitude of environmental permits, safety certifications, and adherence to intricate standards. For instance, in 2024, the Environmental Protection Agency (EPA) continued to enforce stringent regulations on emissions and waste disposal for refineries, adding layers of compliance costs.

Successfully navigating this complex web of regulations is both time-consuming and expensive, creating a formidable barrier for any new companies looking to enter these industries. The sheer capital investment required to meet these compliance requirements, often running into millions of dollars, deters many potential market entrants.

Existing players in the refining and marketing sector, like CVR Energy, leverage substantial economies of scale. This translates into lower per-unit costs for purchasing crude oil, manufacturing refined products, and distributing them. For instance, in 2024, CVR Energy's substantial refining capacity, exceeding 200,000 barrels per day across its key facilities, allows for more efficient operations and better negotiation power with suppliers.

New entrants would find it incredibly challenging to replicate these cost advantages. Building the necessary infrastructure to achieve comparable scale requires massive capital investment and time, making it a high-risk proposition. Without achieving similar operational volumes, newcomers would face higher production costs, hindering their ability to compete on price against established companies like CVR Energy.

Access to Raw Materials and Distribution Channels

New entrants face significant hurdles in securing reliable access to essential raw materials like crude oil and natural gas. The capital required to establish these supply chains and the long-term contracts already in place with established players create a substantial barrier. For instance, in 2024, the global energy market continued to see price volatility, making securing consistent, cost-effective feedstock a major challenge for any new refining or petrochemical operation.

Furthermore, building out extensive distribution networks for refined products, such as gasoline and diesel, and for agricultural fertilizers, is equally demanding. Existing companies have decades of investment in pipelines, terminals, and retail outlets. This established infrastructure provides incumbents with a significant cost and logistical advantage, making it difficult for newcomers to compete on delivery efficiency and reach.

- Capital Intensity: The sheer cost of acquiring or securing long-term access to crude oil and natural gas reserves, along with building out sophisticated refining and distribution infrastructure, represents a massive upfront investment for potential new entrants.

- Incumbent Relationships: Established energy companies have cultivated long-standing relationships with suppliers and logistical partners, often securing preferential terms and guaranteed capacity that are difficult for new players to replicate.

- Distribution Network Control: Access to and control over critical distribution channels, including pipelines, storage facilities, and retail networks, are largely held by existing market participants, creating a significant barrier to market entry for new gasoline and fertilizer producers.

Brand Loyalty and Established Relationships

While refined petroleum products and fertilizers are often viewed as commodities, CVR Energy benefits from deeply entrenched relationships with its distribution networks and key industrial and agricultural clients. These long-standing connections foster significant brand loyalty and trust, making it challenging for newcomers to gain traction.

New entrants face the hurdle of replicating the established trust and reliability that CVR Energy has cultivated over years of consistent service and product delivery. For instance, securing contracts with major agricultural cooperatives or large industrial consumers requires demonstrating a proven track record, which is a significant barrier.

These established relationships act as a formidable deterrent to new entrants:

- Customer Retention: CVR Energy's existing customer base is less likely to switch to an unproven supplier, even if offered slightly better pricing initially.

- Distribution Access: New companies may struggle to secure the necessary pipeline access, terminal agreements, and trucking contracts that CVR Energy already possesses.

- Market Knowledge: Decades of operation have provided CVR Energy with invaluable insights into customer needs and market dynamics that new entrants lack.

- Reputational Capital: The trust built over time translates into a strong reputation, which is difficult and expensive for new competitors to match.

The threat of new entrants in CVR Energy's core markets, refining and fertilizers, is significantly low due to immense capital requirements, exceeding billions for new facilities. Regulatory compliance, demanding extensive permits and adherence to standards like EPA emissions rules in 2024, adds substantial cost and time, deterring potential competitors. Furthermore, established players benefit from economies of scale, with CVR Energy's 2024 refining capacity of over 200,000 barrels per day enabling cost advantages that are difficult for newcomers to match.

Porter's Five Forces Analysis Data Sources

Our CVR Energy Porter's Five Forces analysis is built on a foundation of comprehensive data, including SEC filings, investor relations materials, and industry-specific market research reports to capture the competitive landscape.