CVR Energy Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

CVR Energy Bundle

Unlock the strategic blueprint behind CVR Energy's operations with our comprehensive Business Model Canvas. This detailed analysis reveals how CVR Energy effectively manages its refining and marketing segments, identifying key partners, value propositions, and revenue streams. Gain actionable insights into their competitive advantage and operational efficiencies.

Ready to dissect CVR Energy's success? Our full Business Model Canvas provides a granular look at their customer relationships, cost structure, and key resources, offering a clear roadmap for understanding their market position. Download the complete, professionally crafted document to accelerate your strategic planning.

Partnerships

CVR Energy's strategic alliances with crude oil suppliers are foundational to its refining operations. These partnerships are vital for securing a consistent and cost-competitive supply of crude oil, the primary feedstock for their refineries in Kansas and Oklahoma.

These relationships are critical for navigating the inherent volatility of global crude oil markets and mitigating supply chain disruptions. Long-term supply agreements are particularly important, enabling CVR Energy to lock in favorable pricing and ensure reliable delivery, which directly impacts operational stability and profitability.

CVR Energy's nitrogen fertilizer segment thrives on strategic alliances with agricultural cooperatives and prominent distributors. These partnerships are foundational for accessing a wide array of farming operations throughout the vital Southern Plains and Corn Belt. For instance, in 2024, CVR Energy's fertilizer segment continued to leverage its extensive distribution network to serve a significant portion of the U.S. agricultural market.

These collaborations are crucial for ensuring the timely and efficient delivery of essential products like ammonia and urea ammonium nitrate (UAN) directly to farmers. This streamlined supply chain is paramount for supporting optimal crop yields and bolstering overall agricultural productivity across key farming regions.

CVR Energy actively collaborates with technology providers and research institutions to drive innovation, particularly in its renewable fuels operations and refining processes. These partnerships are crucial for developing advanced processing techniques, boosting product yields, and implementing more sustainable operational methods.

For instance, in 2023, CVR Energy continued to invest in technologies aimed at improving the efficiency of its renewable diesel production. While specific partner names and financial commitments are often proprietary, the company's strategic focus on these areas underscores the value it places on external technological expertise to maintain a competitive edge and meet stringent environmental standards.

Logistics and Transportation Providers

CVR Energy relies heavily on a robust network of logistics and transportation partners to manage its diverse product flow. These include pipeline operators for crude oil and refined products, rail services for bulk transport, and trucking firms for last-mile delivery. In 2024, CVR's extensive use of these services is critical for maintaining operational efficiency and market reach across the United States.

The efficiency of these partnerships directly impacts CVR Energy's cost structure and its ability to meet customer demand. Reliable transportation ensures that crude oil reaches its refineries and finished products, such as gasoline and diesel, are delivered to market promptly. Similarly, timely fertilizer distribution is vital for agricultural clients.

- Pipeline Operators: Essential for the continuous movement of crude oil to refineries and refined products to distribution points.

- Rail Services: Utilized for transporting large volumes of crude oil and finished products, offering cost-effectiveness for long distances.

- Trucking Firms: Crucial for last-mile delivery of refined products to retail stations and fertilizers to agricultural customers.

Regulatory and Compliance Consultants

CVR Energy actively partners with regulatory and compliance consultants to navigate the intricate landscape of environmental and fuel standards, including the Renewable Fuel Standard (RFS). These partnerships are crucial for staying ahead of evolving mandates and managing compliance effectively.

These specialized consultants offer invaluable expertise, ensuring CVR Energy’s operations align with current regulations, thereby minimizing potential penalties and managing associated compliance costs. For instance, in 2024, the RFS program continues to shape the biofuel market, requiring constant adaptation.

This strategic engagement with consultants allows CVR Energy to proactively mitigate regulatory risks, safeguarding its operational continuity and maintaining its essential license to operate within the energy sector.

- Navigating RFS: Consultants provide critical insights into RFS compliance, a key factor for refiners like CVR Energy.

- Cost Management: Expert guidance helps optimize spending on compliance activities, a significant consideration for annual budgets.

- Risk Mitigation: Proactive adherence to regulations, supported by consultants, reduces the likelihood of fines and operational disruptions.

CVR Energy's key partnerships extend to financial institutions and investors, crucial for capital access and strategic growth initiatives. These relationships provide the necessary funding for refinery upgrades, acquisitions, and the expansion of its renewable energy segment. In 2024, the company's ability to secure favorable financing terms from these partners directly influences its capacity to undertake major capital projects and maintain a strong balance sheet.

These financial alliances are fundamental for managing debt, equity, and other financial instruments, enabling CVR Energy to navigate market fluctuations and pursue value-creating opportunities. The company's ongoing engagement with its investor base is also vital for maintaining market confidence and supporting its long-term strategic objectives.

CVR Energy also engages with industry associations and advocacy groups to shape policy and promote its interests within the energy sector. These collaborations are important for staying informed about regulatory changes and contributing to industry best practices. For instance, participation in groups focused on refining and renewable fuels allows CVR to advocate for policies that support its business model, particularly concerning renewable fuel mandates and environmental regulations impacting its operations.

| Partner Type | Role/Importance | 2024 Focus/Impact |

|---|---|---|

| Financial Institutions | Capital access, financing for growth | Securing funds for renewable diesel expansion, managing debt |

| Investors | Market confidence, equity funding | Maintaining investor relations, supporting strategic initiatives |

| Industry Associations | Policy advocacy, best practices | Navigating RFS changes, influencing energy policy |

What is included in the product

This Business Model Canvas provides a strategic overview of CVR Energy's operations, detailing its customer segments, refining and marketing channels, and its value proposition centered on fuel production and renewable energy integration.

CVR Energy's Business Model Canvas acts as a pain point reliever by offering a clear, one-page snapshot of their complex refining and marketing operations, simplifying strategic understanding.

This visual tool helps CVR Energy quickly identify and address operational inefficiencies and market challenges by condensing their multifaceted strategy into a digestible format.

Activities

CVR Energy's core activity revolves around the sophisticated operation of its two complex crude oil refineries, strategically located in Coffeyville, Kansas, and Wynnewood, Oklahoma. These facilities are designed to process a variety of crude oil blends, transforming them into essential high-value transportation fuels that power modern economies.

The refining process itself is intricate, involving multiple stages such as distillation, cracking, and treating. These complex chemical and physical processes allow CVR Energy to produce a range of refined products, primarily gasoline and diesel fuel, meeting strict quality standards for market distribution.

In 2024, CVR Energy's refineries demonstrated their operational efficiency. For the first quarter of 2024, the company reported a total refining throughput of 210,000 barrels per day, showcasing their capacity to consistently process crude oil. This operational tempo is crucial for their profitability.

CVR Energy's nitrogen fertilizer manufacturing involves producing ammonia and urea ammonium nitrate (UAN) primarily from natural gas. This operation is geared towards serving both agricultural and industrial markets, emphasizing efficient production to meet customer needs.

In 2024, CVR Energy's Coffeyville, Kansas, facility, a key nitrogen production site, maintained strong operational performance, contributing significantly to the company's overall output. The company's strategy hinges on maximizing the utilization of these production assets to capitalize on market demand for fertilizers.

CVR Energy's key activities heavily involve the marketing and distribution of its refined petroleum products and nitrogen fertilizers across the United States. This means actively managing a complex network of sales channels, from wholesale to retail, and securing favorable contracts with a diverse customer base.

A crucial aspect is the efficient coordination of logistics, ensuring timely delivery of products via pipelines, rail, and trucking. For instance, in 2024, CVR Energy's refining segment processed an average of 184,000 barrels per day, highlighting the scale of their distribution operations.

The company's success hinges on effective market penetration strategies and maintaining competitive pricing to drive revenue. This requires a deep understanding of market dynamics and customer needs to maximize sales and profitability for both its refining and renewable diesel segments.

Feedstock Procurement and Management

CVR Energy's core operations hinge on the consistent procurement of diverse crude oil feedstocks for its refining segment and natural gas for its nitrogen fertilizer production. This is a daily, ongoing effort that requires significant strategic planning and execution.

The company actively engages in strategic sourcing to secure the most advantageous crude oil and natural gas supplies. This process is not just about buying raw materials; it involves intricate inventory management to ensure operational continuity and robust risk mitigation strategies to buffer against the inherent volatility of commodity prices.

The efficiency and cost-effectiveness of feedstock procurement have a direct and substantial impact on CVR Energy's production expenses. Ultimately, how well they manage these inputs directly influences their overall profitability and competitive standing in the market.

Key activities in feedstock procurement and management include:

- Strategic Sourcing: Identifying and securing reliable suppliers for various grades of crude oil and natural gas, often through long-term contracts and spot market purchases.

- Inventory Management: Maintaining optimal levels of feedstock inventory to meet production demands while minimizing storage costs and managing potential obsolescence.

- Risk Mitigation: Employing hedging strategies and diversification of supply sources to protect against price fluctuations and supply disruptions.

- Logistics and Transportation: Efficiently managing the movement of feedstocks from suppliers to CVR Energy's facilities, whether by pipeline, rail, or barge.

Environmental Compliance and Renewable Fuels Development

CVR Energy actively manages its environmental compliance, a critical activity for its refining and marketing operations. This involves adhering to a complex web of federal and state regulations, including those related to air emissions, water discharge, and waste management. The company also focuses on meeting its obligations under the Renewable Fuel Standard (RFS), which mandates the blending of renewable fuels into the transportation fuel supply. In 2024, CVR Energy continued to invest in its renewable diesel capabilities, such as its Coffeyville Renewable Diesel unit, to capitalize on growing demand for sustainable fuel options and to manage its RFS compliance efficiently.

The development and operation of renewable fuel assets, particularly renewable diesel, represent a significant and growing key activity for CVR Energy. This strategic focus allows the company to diversify its product portfolio and meet evolving market preferences for lower-carbon fuels. By investing in these areas, CVR aims to enhance its long-term financial performance and maintain a competitive edge in a dynamic energy landscape. For instance, the company's renewable diesel production is directly tied to the value of Renewable Identification Numbers (RINs), which are credits generated under the RFS. In early 2024, RIN prices saw fluctuations, impacting the profitability of renewable fuel operations.

Key activities in this domain include:

- Environmental Regulatory Adherence: Continuously monitoring and complying with all applicable environmental laws and regulations across its operational sites.

- Renewable Fuel Standard (RFS) Management: Actively participating in the RFS program, including the generation, trading, and compliance of Renewable Identification Numbers (RINs).

- Renewable Diesel Unit Operations: Managing and optimizing the production of renewable diesel at facilities like the Coffeyville refinery, which processed approximately 105 million gallons of renewable diesel in 2023, contributing to its overall strategy.

- Sustainable Product Line Exploration: Investigating and pursuing opportunities to expand into other sustainable fuel and product lines that align with environmental goals and market demand.

CVR Energy's key activities encompass the efficient operation of its two refineries, transforming crude oil into essential transportation fuels like gasoline and diesel. The company also manufactures nitrogen fertilizers, primarily ammonia and UAN, serving agricultural and industrial sectors. Marketing and distributing these products across the U.S. through various sales channels and managing complex logistics are also vital functions.

What You See Is What You Get

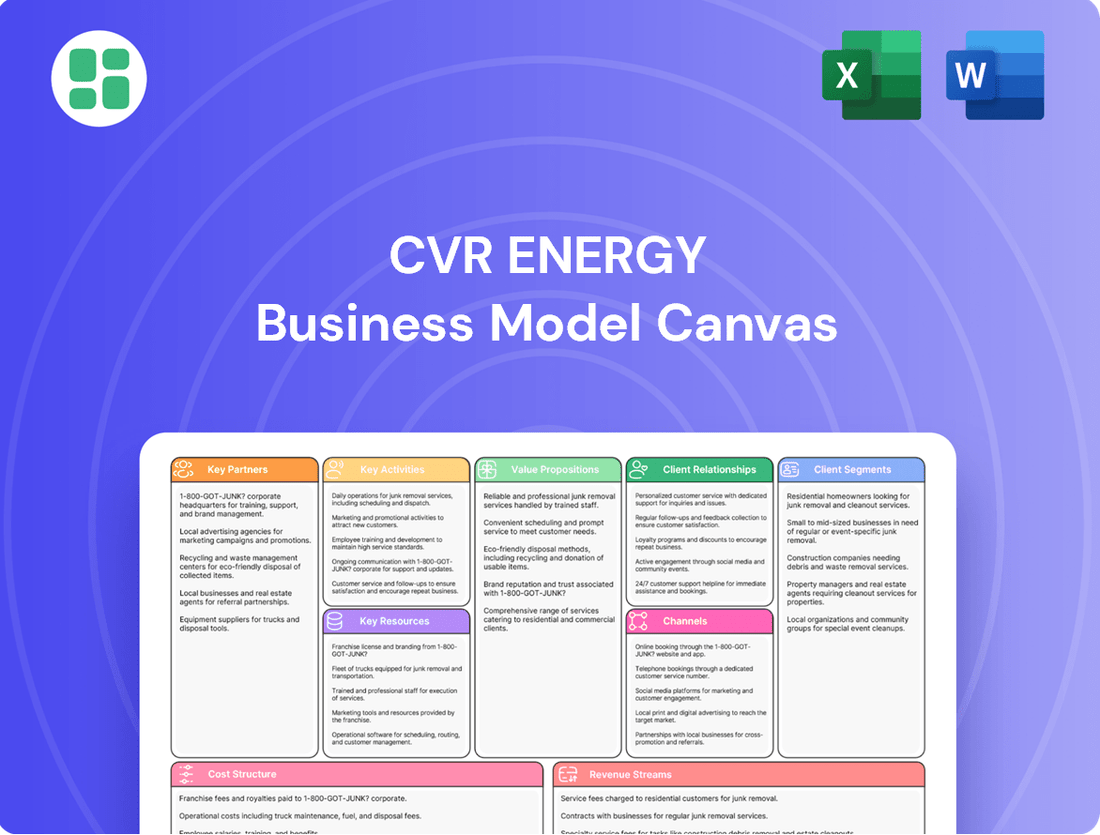

Business Model Canvas

The CVR Energy Business Model Canvas you are previewing is the exact document you will receive upon purchase. This is not a sample or a mockup, but a direct representation of the complete, ready-to-use file. You can be confident that the detailed structure and content you see here will be delivered to you in its entirety, allowing you to immediately leverage this valuable business analysis.

Resources

CVR Energy's core physical assets are its two sophisticated crude oil refineries, situated in Coffeyville, Kansas, and Wynnewood, Oklahoma. These facilities are the backbone of its operations, enabling the production of a diverse portfolio of refined petroleum products.

The Coffeyville refinery boasts a significant crude oil processing capacity, and the Wynnewood refinery complements this with its own substantial throughput. Together, these refineries are central to CVR Energy's ability to meet market demand for gasoline, diesel, and other essential fuels.

Strategically positioned within the Mid-Continent region, these refineries benefit from advantageous logistics. This location facilitates efficient crude oil sourcing and the distribution of finished products, a key factor in CVR Energy's operational efficiency and market reach.

CVR Energy's key resources include its strategically located nitrogen fertilizer manufacturing plants in Kansas. These facilities are critical for transforming natural gas into essential agricultural inputs like ammonia and urea ammonium nitrate (UAN). Their operational efficiency directly impacts the company's ability to serve the agricultural market.

The production capacity of these specialized plants is a significant asset, enabling CVR Energy to meet the demand for vital crop nutrients. In 2024, the company's fertilizer segment, which includes these plants, generated approximately $1.5 billion in revenue, highlighting their importance to the business.

CVR Energy's crude oil gathering systems and pipelines are fundamental to its refining operations, directly feeding its refineries and ensuring a consistent, cost-efficient crude supply. This integrated approach minimizes transportation costs and strengthens operational control.

In 2024, CVR Energy's infrastructure played a key role in managing its supply chain, allowing it to benefit from regional crude oil price differentials. The company's strategic investment in these assets underscores its commitment to operational efficiency and reliable feedstock procurement.

Skilled Workforce and Operational Expertise

CVR Energy relies heavily on its highly skilled workforce, encompassing engineers, operators, and specialized technicians. This human capital is crucial for the safe and efficient operation of its complex refining and fertilizer manufacturing facilities.

The collective operational expertise of these employees directly translates into optimized production and robust problem-solving capabilities, underpinning the company's efficiency and reliability.

- Skilled Workforce: CVR Energy employs a dedicated team of professionals essential for managing intricate industrial processes.

- Operational Expertise: Their deep understanding of refining and fertilizer production ensures high levels of safety and efficiency.

- Human Resource Value: The company's operational knowledge base, cultivated through its experienced staff, is a key competitive advantage.

Intellectual Property and Proprietary Processes

CVR Energy's competitive advantage is bolstered by its intellectual property, particularly in refining and fertilizer production. While specifics are proprietary, these assets are crucial for operational efficiency and market differentiation. This includes their advancements in renewable diesel technology, a key growth area.

The company's proprietary processes likely encompass unique catalyst formulations and operational methodologies that optimize yield and minimize costs in their refining and fertilizer segments. These intangible assets are difficult for competitors to replicate, providing a sustained edge. For instance, CVR Energy has been actively investing in its renewable diesel capabilities, aiming to capture a larger share of this growing market.

- Proprietary Refining Technologies: Enhancements in processing crude oil to maximize valuable product output.

- Catalyst Innovations: Development of specialized catalysts for more efficient chemical reactions in refining and fertilizer production.

- Operational Efficiency Improvements: Years of accumulated knowledge and refined techniques for streamlined plant operations.

- Renewable Diesel Production Advancements: Intellectual capital related to the conversion of renewable feedstocks into diesel fuel.

CVR Energy's key resources are its physical assets, including two major refineries and nitrogen fertilizer plants, supported by extensive logistics infrastructure and a skilled workforce. These tangible and intangible assets, combined with proprietary technologies, form the foundation of its competitive strength.

The company's refining capacity is significant, with its Coffeyville, Kansas, and Wynnewood, Oklahoma, facilities processing substantial volumes of crude oil. These refineries are crucial for producing a range of refined products. Complementing this are its fertilizer plants, which are vital for agricultural inputs.

In 2024, CVR Energy's fertilizer segment contributed approximately $1.5 billion in revenue, underscoring the economic importance of its fertilizer manufacturing operations. The company's pipeline network ensures efficient feedstock supply, a critical element for its refining segment's cost-effectiveness.

| Key Resource | Description | 2024 Impact/Data |

| Refineries | Coffeyville, KS & Wynnewood, OK | Core physical assets for refined product generation. |

| Fertilizer Plants | Kansas-based ammonia & UAN production | Generated ~$1.5 billion in revenue in 2024. |

| Logistics Infrastructure | Crude oil gathering systems & pipelines | Ensures cost-efficient crude supply and product distribution. |

| Skilled Workforce | Engineers, operators, technicians | Crucial for safe and efficient plant operations. |

| Proprietary Technologies | Refining & fertilizer process advancements | Enhances operational efficiency and market differentiation. |

Value Propositions

CVR Energy ensures a steady flow of vital transportation fuels like gasoline and diesel, which are absolutely crucial for keeping the U.S. economy moving and people going about their daily lives. Their refineries are positioned in smart locations across the country, making sure these fuels are readily available in different regions and helping to prevent any major hiccups in the supply chain for their clients.

This dependable fuel supply is a bedrock for countless businesses, from trucking companies to airlines, and for everyday consumers who rely on their vehicles. In 2024, CVR Energy processed an average of 216,000 barrels per day of crude oil, underscoring their significant role in meeting domestic fuel demand.

CVR Energy provides high-quality nitrogen fertilizers, including ammonia and urea ammonium nitrate (UAN). These products are fundamental for farmers aiming to boost crop yields and contribute to a robust food supply chain.

By ensuring reliable access to these essential crop nutrients, CVR Energy directly supports farmers in enhancing their productivity and ultimately their profitability. The consistent quality and punctual delivery of these fertilizers are critical factors for successful agricultural operations.

In 2024, the agricultural sector continued to rely heavily on efficient nutrient management. CVR Energy's commitment to delivering premium nitrogen fertilizers plays a significant role in meeting this demand, supporting the economic viability of farms across its service areas.

CVR Energy's business model offers a compelling diversification by operating across both petroleum refining and nitrogen fertilizer manufacturing. This dual focus acts as a natural hedge, mitigating risks associated with fluctuations in either the energy or agricultural commodity markets, thereby appealing to a broader investor base seeking balanced sector exposure.

In 2024, this diversified approach is particularly advantageous. For instance, while oil prices can be volatile, the demand for fertilizers is often more directly tied to agricultural cycles and global food needs, providing a degree of earnings stability. CVR Energy's commitment to renewable fuels, such as renewable diesel, further strengthens this diversification, aligning with growing market trends and environmental considerations.

Operational Efficiency and Cost Competitiveness

CVR Energy focuses on optimizing its complex refineries and fertilizer plants to achieve significant operational efficiency. This dedication to streamlined processes allows the company to maintain cost competitiveness, a crucial advantage in the dynamic energy and agricultural sectors. For instance, in 2024, CVR Energy's refining segment continued to emphasize yield optimization and energy efficiency initiatives across its facilities, contributing to its ability to manage costs effectively.

This drive for efficiency translates into tangible benefits, enabling CVR Energy to potentially offer its products at attractive price points or preserve robust profit margins, even when market conditions are volatile. The company's commitment to continuous operational improvement is a core element of its value proposition, benefiting both CVR Energy through enhanced profitability and its customers through reliable and competitively priced products.

- Refinery Throughput: CVR Energy's refineries processed an average of 210,000 barrels per day in the first quarter of 2024, showcasing consistent operational capacity.

- Cost Management: The company actively seeks to reduce per-unit production costs through technological upgrades and process enhancements, a strategy that yielded positive results in its 2023 financial reporting.

- Fertilizer Production Efficiency: CVR Energy's fertilizer segment aims for high-efficiency production cycles, crucial for meeting agricultural demand and maintaining competitive pricing in the fertilizer market throughout 2024.

Commitment to Environmental Adaptability

CVR Energy actively engages with environmental adaptability by investing in renewable fuels, notably renewable diesel. This strategic pivot allows the company to navigate and comply with evolving environmental regulations and market expectations.

The company's commitment is underscored by its participation in programs like the Renewable Fuel Standard (RFS). For instance, in 2023, CVR Energy produced approximately 300 million gallons of renewable diesel, demonstrating a tangible step towards more sustainable operations and meeting future demand for cleaner energy sources.

- Renewable Diesel Production: CVR Energy's significant investment in renewable diesel production, exceeding 300 million gallons in 2023, highlights its commitment to environmental adaptability.

- Regulatory Navigation: The company actively manages its compliance within complex regulatory frameworks such as the Renewable Fuel Standard (RFS), ensuring operational continuity and market access.

- Future Market Alignment: By focusing on sustainable products, CVR Energy positions itself to meet anticipated future market demands and stricter environmental mandates.

CVR Energy provides essential refined petroleum products and nitrogen fertilizers, ensuring reliable supply chains for both transportation and agriculture. Their strategic refinery locations and commitment to product quality support a wide range of industries and consumers. In 2024, they processed an average of 216,000 barrels of crude oil daily, highlighting their significant role in meeting domestic fuel needs.

The company's diversified business model, encompassing both refining and fertilizers, offers a built-in hedge against market volatility. This dual focus, coupled with a commitment to operational efficiency and investments in renewable fuels like renewable diesel, positions CVR Energy for sustained performance and adaptation to evolving market demands. Their 2023 renewable diesel production of around 300 million gallons exemplifies this forward-looking strategy.

| Value Proposition | Description | 2024 Data/Context |

|---|---|---|

| Reliable Fuel Supply | Consistent delivery of gasoline and diesel to keep economies moving. | Processed an average of 216,000 barrels/day of crude oil. |

| Essential Agricultural Inputs | High-quality nitrogen fertilizers (ammonia, UAN) for enhanced crop yields. | Supported farmers' productivity and profitability through consistent fertilizer access. |

| Business Diversification | Operating in both refining and fertilizers provides a natural market hedge. | Mitigates risk from oil price volatility and agricultural cycles. |

| Operational Efficiency | Focus on optimizing refineries and plants for cost competitiveness. | Emphasized yield optimization and energy efficiency in refining operations. |

| Environmental Adaptability | Investment in renewable fuels like renewable diesel. | Produced approximately 300 million gallons of renewable diesel in 2023. |

Customer Relationships

CVR Energy cultivates direct sales and account management for its significant industrial, agricultural, and fuel distribution clients. This approach ensures each major customer receives personalized attention from dedicated account managers, fostering tailored supply agreements and continuous dialogue to meet unique requirements.

These relationships are crucial for building enduring partnerships and ensuring high customer satisfaction. For instance, in 2024, CVR Energy reported that its direct sales channels were instrumental in securing key contracts within the refining and marketing segments, contributing to a stable revenue stream.

CVR Energy heavily relies on bulk sales and long-term contracts for its fuels and fertilizers, securing a substantial portion of its revenue. These agreements are crucial for managing customer relationships, especially with major commercial and industrial entities.

These contracts often feature negotiated pricing, specific delivery timelines, and guaranteed volume commitments, offering CVR Energy and its clients a predictable business environment. For instance, in 2023, CVR Energy's refining segment generated approximately $6.8 billion in revenue, underscoring the importance of these large-scale sales.

CVR Energy prioritizes technical support and product expertise, particularly for its agricultural clients who rely on sophisticated fertilizer products. This commitment ensures customers receive guidance on optimal application, safe storage, and proper handling techniques, maximizing the effectiveness of CVR's offerings and fostering customer success.

In 2024, CVR Energy continued to invest in its technical support teams, equipping them with deep product knowledge to assist agricultural partners. This proactive approach directly addresses the complexities of modern farming, where precise fertilizer management is key to yield optimization and environmental stewardship.

Online Investor Relations and Communications

CVR Energy prioritizes transparency for its investor segment through comprehensive online investor relations. Its corporate website serves as a central hub for financial reports, SEC filings, and timely news releases, ensuring easy access to critical information for all stakeholders.

Direct engagement with the financial community is facilitated through regular earnings calls and webcasts. These platforms allow investors to hear directly from management and ask questions, fostering a deeper understanding of the company's performance and strategy.

- Website Accessibility: CVR Energy’s investor relations portal provides readily available financial reports and SEC filings.

- Direct Communication: Regular earnings calls and webcasts offer direct interaction with the financial community.

- Information Dissemination: News releases are promptly published online to keep investors informed.

Industry Associations and Trade Relationships

CVR Energy actively participates in industry associations and cultivates robust trade relationships to stay ahead of market shifts and champion its interests. These connections are vital for gaining insights into evolving customer demands and navigating industry-wide challenges. For instance, in 2024, CVR Energy's engagement in key refining and marketing associations provided critical intelligence regarding regulatory changes impacting fuel standards and consumer preferences, allowing for proactive adjustments in product offerings.

These strategic alliances facilitate direct engagement with a wider customer spectrum and offer invaluable platforms for networking and identifying new business avenues. By fostering these relationships, CVR Energy can better anticipate market trends and solidify its position within the energy sector.

- Market Intelligence: Industry associations provide early access to data on refining margins, feedstock costs, and demand forecasts, crucial for optimizing operations.

- Advocacy: Trade groups allow CVR Energy to collectively voice concerns and influence policy decisions affecting the refining and marketing sectors.

- Customer Reach: Participation in trade shows and industry events, often facilitated by associations, directly connects CVR Energy with potential commercial clients and partners.

- Best Practices: Engagement with peers through these organizations promotes the adoption of operational efficiencies and safety standards, enhancing overall business performance.

CVR Energy's customer relationships are built on direct engagement, particularly with large industrial, agricultural, and fuel distribution clients through dedicated account management. This personalized approach ensures tailored supply agreements and ongoing dialogue to meet specific needs, fostering strong, lasting partnerships.

Bulk sales and long-term contracts are foundational, providing revenue predictability for both CVR Energy and its major commercial and industrial customers. These agreements often include negotiated pricing and guaranteed volumes, as seen in the refining segment's substantial revenue generation. In 2023, CVR Energy's refining segment generated approximately $6.8 billion in revenue, highlighting the significance of these large-scale transactions.

For its agricultural sector, CVR Energy provides crucial technical support and product expertise, guiding clients on optimal fertilizer use and handling. This commitment, reinforced by investments in knowledgeable support teams in 2024, aims to maximize product effectiveness and support customer success in modern farming practices.

| Customer Segment | Relationship Type | Key Engagement Methods | 2023 Revenue Contribution (Approx.) |

|---|---|---|---|

| Industrial, Agricultural, Fuel Distribution | Direct Sales, Account Management | Personalized attention, Tailored agreements, Continuous dialogue | Significant portion of total revenue |

| Commercial & Industrial (Bulk Fuels/Fertilizers) | Long-term Contracts | Negotiated pricing, Specific delivery, Guaranteed volumes | Underpins refining segment revenue |

| Agricultural (Fertilizers) | Technical Support, Product Expertise | Guidance on application, storage, handling | N/A (Integrated service) |

Channels

CVR Energy employs a direct sales force to cultivate relationships with major commercial, industrial, and agricultural clients. This hands-on approach facilitates direct negotiation and the development of tailored solutions, fostering robust customer loyalty. In 2024, CVR Energy's sales force was instrumental in securing significant supply contracts, contributing to their robust revenue streams.

Pipelines are CVR Energy's arteries, moving refined petroleum products like gasoline and diesel directly from refineries to crucial distribution terminals. This method is incredibly efficient for high-volume transport, ensuring fuels reach their destinations reliably. In 2024, CVR Energy's integrated refining and marketing segments heavily rely on this pipeline network to maintain a steady supply chain.

Rail and truck transportation are the backbone of CVR Energy's distribution network, ensuring its refined products and nitrogen fertilizers reach a wide customer base. In 2024, the company continued to leverage these channels to move significant volumes, with rail being particularly vital for cost-effective, long-haul movements of bulk commodities. Trucks, on the other hand, offer the essential flexibility for direct delivery to agricultural end-users and local businesses, completing the supply chain efficiently.

Third-Party Distributors and Retailers

CVR Energy relies heavily on third-party distributors and retailers to get its refined products, such as gasoline and diesel, to a broad customer base. These partnerships are crucial for ensuring CVR's products reach consumers across various markets. In 2024, CVR Energy's marketing and logistics segment, which includes these distribution channels, played a significant role in its overall revenue generation, demonstrating the effectiveness of this strategy.

By utilizing these established networks, CVR Energy effectively extends its market reach without the significant capital investment and operational complexity of managing its own extensive retail footprint. This allows the company to focus on its core refining operations while still benefiting from widespread product availability. The company's strategy emphasizes building strong relationships with these intermediaries to ensure efficient product delivery and market penetration.

- Market Reach: Third-party distributors and retailers provide access to a vast network of consumers, significantly expanding CVR Energy's market presence for refined products.

- Operational Efficiency: Outsourcing the final point-of-sale operations to these partners reduces CVR Energy's direct retail overhead and operational complexity.

- Sales Volume: In 2024, the volume of refined products sold through these channels contributed substantially to CVR Energy's financial performance, highlighting their importance.

- Strategic Partnerships: The success of this channel hinges on cultivating and maintaining robust relationships with key distributors and retailers across its operating regions.

Online Investor Relations Platform

CVR Energy’s online investor relations platform acts as a vital channel for its investor customer segment. This digital hub provides direct access to crucial financial reports, company updates, and regulatory filings like those submitted to the SEC. It ensures transparency and timely information delivery, which is essential for both existing and potential shareholders to make informed decisions.

The platform is designed to foster communication and engagement with the broader financial community. It serves as a central point for analysts, investors, and other stakeholders to gather data and understand CVR Energy's performance and strategic direction.

- Website Functionality: The official investor relations website is the primary digital channel for disseminating financial information, corporate news, and SEC filings.

- Transparency and Access: This platform offers transparent and timely access to essential data for current and prospective shareholders.

- Community Engagement: It facilitates communication and engagement with the financial community, including analysts and institutional investors.

- Data Dissemination: In 2023, CVR Energy (CVR) reported total revenues of approximately $7.1 billion, with key financial statements and operational data readily available through its investor relations portal.

CVR Energy utilizes direct sales for its commercial, industrial, and agricultural clients, fostering strong relationships and tailored solutions. This approach was key in securing major supply contracts in 2024, bolstering revenue. Pipelines are critical for efficient, high-volume transport of refined products like gasoline and diesel to distribution terminals, ensuring a steady supply chain in 2024.

Rail and truck transport are essential for distributing refined products and fertilizers to a broad customer base. Rail is vital for cost-effective bulk movements, while trucks provide flexibility for direct deliveries in 2024.

Third-party distributors and retailers are crucial for CVR Energy's market reach, allowing access to consumers without direct retail investment. These partnerships were significant for revenue generation in 2024.

CVR Energy's online investor relations platform provides direct access to financial reports and company updates for investors. This digital hub ensures transparency and timely information for shareholders.

| Channel | Description | 2024 Relevance |

| Direct Sales Force | Cultivates relationships with major commercial, industrial, and agricultural clients. | Secured significant supply contracts. |

| Pipelines | Efficient, high-volume transport of refined products to distribution terminals. | Maintained steady supply chain for refining and marketing segments. |

| Rail and Truck | Distributes refined products and fertilizers to a wide customer base. | Cost-effective bulk movements (rail) and flexible local deliveries (truck). |

| Third-Party Distributors/Retailers | Extends market reach for refined products to consumers. | Substantially contributed to financial performance through sales volume. |

| Online Investor Relations | Provides direct access to financial reports and company updates for investors. | Ensures transparent and timely information for shareholders. |

Customer Segments

Wholesale and commercial fuel distributors represent a cornerstone of CVR Energy's customer base. This segment encompasses major players like large-scale distributors, extensive commercial fleets, and significant industrial consumers who procure gasoline, diesel, and various other refined petroleum products in substantial quantities. These clients depend on CVR Energy for a steady and dependable supply chain, alongside pricing that remains competitive in the market. Reliable logistics are paramount for ensuring their day-to-day operations run without interruption.

These high-volume purchasers are absolutely vital for the efficient and widespread distribution of CVR Energy's refined petroleum products across various markets. For instance, in 2024, the demand for diesel fuel from commercial transportation sectors remained robust, underscoring the importance of these distributor relationships. CVR Energy's ability to meet the stringent logistical requirements and provide consistent product quality to these wholesale and commercial entities directly impacts its overall sales volume and market penetration.

Agricultural cooperatives and large-scale farmers represent a crucial customer segment for CVR Energy's nitrogen fertilizer operations. These entities rely heavily on ammonia and urea ammonium nitrate (UAN) to ensure effective crop nourishment, making a consistent and high-quality supply paramount.

These farmers and cooperatives seek not only dependable product delivery but also value-added services like technical guidance to optimize fertilizer application. Their purchasing decisions are intrinsically linked to the agricultural calendar, with demand peaking during planting seasons and heavily influenced by prevailing agricultural market conditions and commodity prices.

In 2024, the agricultural sector continued to face fluctuating input costs and global demand dynamics, directly impacting fertilizer purchasing patterns. For instance, the U.S. Department of Agriculture reported that corn planted acreage for 2024 was projected to be around 91.7 million acres, a slight decrease from the previous year, underscoring the sensitivity of fertilizer demand to crop choices and economic outlooks.

Beyond the agricultural sector, CVR Energy serves a crucial segment of industrial customers who rely on ammonia and UAN for their manufacturing operations. These users, such as those in the chemical and mining industries, demand specific product grades and a dependable supply chain to maintain their production schedules.

This industrial demand provides a valuable diversification for CVR Energy's fertilizer business, smoothing out some of the seasonality inherent in agricultural markets. For example, in 2024, CVR Energy's Coffeyville refinery, a key producer of ammonia, continued to supply various industrial clients, contributing to its overall revenue stream alongside its agricultural fertilizer sales.

Financial Investors and Shareholders

CVR Energy's financial investors and shareholders are a critical customer segment, comprising institutional investors like pension funds and mutual funds, as well as individual retail investors. These stakeholders are primarily driven by the pursuit of financial returns, demanding consistent profitability and dividend payouts. They closely monitor CVR Energy's financial health, strategic decisions, and operational performance. For example, as of the first quarter of 2024, CVR Energy reported adjusted EBITDA of $356 million, demonstrating its earnings potential to this segment.

Transparency in financial reporting and clear communication regarding the company's strategic direction are paramount for this group. They rely on detailed quarterly and annual reports, investor calls, and presentations to assess the company's value and future prospects. CVR Energy's investor relations department actively engages with these stakeholders to provide timely updates and address their concerns.

Key expectations from financial investors and shareholders include:

- Maximizing Shareholder Value: Through profitable operations and strategic capital allocation.

- Financial Transparency: Accurate and timely reporting of financial results and operational data.

- Clear Strategic Vision: Understanding the company's long-term plans and how they will drive growth.

- Consistent Performance: Demonstrating stable or improving operational and financial metrics.

Government Agencies and Regulated Markets

Government agencies and regulated markets are crucial for CVR Energy, not as direct purchasers, but as entities dictating operational parameters. Compliance with mandates like the Renewable Fuel Standard (RFS) directly influences CVR's product output and refinery operations. For instance, in 2023, CVR Energy reported RINs (Renewable Identification Numbers) generated and sold, a direct consequence of RFS compliance, contributing to its revenue stream.

These regulatory frameworks, such as EPA standards for fuel quality and emissions, are non-negotiable operational requirements. CVR Energy's success hinges on its capacity to adapt to evolving environmental regulations and fuel specifications set forth by these bodies. Failure to meet these standards can result in significant penalties and operational disruptions.

- Environmental Compliance: Adherence to EPA regulations on emissions and fuel content.

- Renewable Fuel Standard (RFS): Meeting obligations for blending renewable fuels, impacting product mix and RIN generation.

- Market Access: Ensuring products meet specifications required for sale in regulated fuel markets.

- Regulatory Navigation: Proactively managing and adapting to changes in environmental and fuel quality laws.

CVR Energy's customer segments are diverse, ranging from large-scale wholesale fuel distributors and commercial fleets to agricultural cooperatives and industrial users of nitrogen fertilizers. The company also serves financial investors and shareholders who are focused on profitability and dividends, and it must comply with government agencies and regulated markets that set operational standards.

The wholesale and commercial fuel distributors are critical for the widespread distribution of refined products, with diesel demand from the transportation sector remaining strong in 2024. Agricultural clients, including cooperatives and large farmers, depend on a consistent supply of fertilizers like ammonia and UAN, with fertilizer purchasing patterns influenced by crop choices and economic conditions, as seen with projected corn acreage in 2024.

Industrial customers in sectors like chemical and mining provide diversification for the fertilizer business, utilizing ammonia and UAN for manufacturing. Financial investors, such as institutional funds, closely monitor CVR Energy's financial health, with the company reporting $356 million in adjusted EBITDA in Q1 2024. Government agencies and regulations, like the Renewable Fuel Standard, dictate operational parameters, with CVR Energy generating and selling RINs in 2023.

Cost Structure

The most substantial part of CVR Energy's expenses comes from buying crude oil for its refining operations and natural gas for its fertilizer production. These commodity prices fluctuate significantly, directly influencing how much profit the company makes.

For instance, in the first quarter of 2024, CVR Energy reported that the cost of purchased crude oil and other feedstocks represented a significant portion of its Cost of Goods Sold. The average cost of West Texas Intermediate (WTI) crude oil, a key benchmark, saw considerable volatility throughout 2023 and into early 2024, with prices ranging from the low $70s to over $90 per barrel at various points.

Managing these volatile raw material expenses is critical. CVR Energy employs hedging strategies to lock in prices for a portion of its anticipated purchases, aiming to mitigate the impact of sharp price increases. Furthermore, optimizing procurement processes to secure favorable pricing and ensuring efficient logistics for delivery are vital for controlling this major cost component.

Direct operating expenses are a significant component of CVR Energy's cost structure, encompassing both petroleum refining and nitrogen fertilizer manufacturing. These costs include essential inputs like utilities, specialized labor, ongoing maintenance, and the chemicals crucial for production. For instance, in 2024, the company's cost of goods sold, which heavily reflects these direct operating expenses, was a major factor in its financial performance, with refining segment costs of goods sold impacting profitability significantly.

CVR Energy faces substantial compliance and regulatory costs, primarily driven by its Renewable Fuel Standard (RFS) obligations. These costs are a significant and often fluctuating expense for its petroleum refining operations.

A key component of these costs is the purchase of Renewable Identification Numbers (RINs), which are credits generated by renewable fuel producers. For example, in 2023, CVR Energy reported RIN expenses that significantly impacted its refining segment's profitability, highlighting the volatility of this market.

Managing these compliance expenses is crucial as they directly affect refining margins. The company's ability to navigate the RFS program and the associated RIN market fluctuations is a critical factor in its financial performance.

Logistics and Transportation Costs

Logistics and transportation represent a significant expenditure for CVR Energy. These costs encompass the movement of crude oil into their refineries and the distribution of finished products, such as gasoline and diesel, to various markets. Furthermore, transporting fertilizers to agricultural customers is also a key component of this expense category.

These expenses are influenced by factors like pipeline tariffs, rail freight charges, and trucking rates. CVR Energy's strategic use of its owned infrastructure, including pipelines and terminals, plays a crucial role in managing and reducing these logistical outlays, thereby enhancing its competitive position.

- Pipeline Tariffs: Costs associated with using third-party or CVR-owned pipelines to transport crude oil and refined products.

- Rail Freight: Expenses incurred for moving crude oil and finished goods via rail, particularly for routes not served by pipelines.

- Trucking Expenses: Costs for last-mile delivery of refined products to retail locations and fertilizer to end-users.

- Infrastructure Optimization: Investments and operational efficiencies in owned logistics assets to lower per-unit transportation costs.

Capital Expenditures and Maintenance

CVR Energy faces significant capital expenditures for refinery upgrades, ongoing maintenance, and crucial turnaround activities. These investments are vital for maintaining operational reliability, ensuring safety standards, and adhering to regulatory compliance. For instance, in 2023, CVR Energy reported approximately $434 million in capital expenditures, a substantial portion of which is allocated to these essential areas.

These planned investments are not merely for upkeep; they often aim to boost efficiency or increase production capacity, directly shaping the company's long-term cost structure. Turnaround projects, while inherently expensive, are indispensable for the sustained, efficient operation of their refining assets.

- Capital Expenditures: CVR Energy's 2023 capital expenditures reached $434 million, reflecting ongoing investment in refinery infrastructure.

- Maintenance and Upgrades: A significant portion of these funds is dedicated to routine maintenance and strategic upgrades to enhance operational performance.

- Turnaround Activities: Essential turnaround projects, though costly, are critical for ensuring the long-term safety and efficiency of refinery operations.

- Capacity Enhancement: Investments are also made to improve or expand production capacity, impacting future revenue and cost dynamics.

CVR Energy's cost structure is heavily influenced by its reliance on purchased crude oil and natural gas, which are subject to market volatility. For example, in Q1 2024, feedstock costs were a major component of its cost of goods sold, mirroring the fluctuating WTI crude oil prices seen throughout 2023 and early 2024.

Direct operating expenses, including utilities, labor, and maintenance for both refining and fertilizer segments, are also substantial. The company's 2023 capital expenditures totaled $434 million, with a significant portion allocated to essential maintenance and upgrades to ensure operational efficiency and compliance.

Compliance costs, particularly those related to the Renewable Fuel Standard (RFS) and the purchase of Renewable Identification Numbers (RINs), represent another significant and variable expense for CVR Energy's refining operations, as evidenced by their impact on profitability in 2023.

Logistics and transportation costs, covering the movement of raw materials and finished products via pipelines, rail, and trucking, are managed through strategic use of owned infrastructure to mitigate outlays.

| Cost Component | Description | 2023 Data/Relevance |

|---|---|---|

| Feedstock Costs | Purchased crude oil and natural gas | Major component of COGS; WTI prices fluctuated significantly in 2023-2024. |

| Direct Operating Expenses | Utilities, labor, maintenance, chemicals | Essential for refining and fertilizer production; impacted 2024 COGS. |

| Compliance Costs (RFS/RINs) | Costs related to renewable fuel mandates | Significant and volatile expense for refining segment, impacting 2023 profitability. |

| Logistics & Transportation | Pipeline, rail, trucking for materials and products | Managed via owned infrastructure to control costs. |

| Capital Expenditures | Refinery upgrades, maintenance, turnarounds | Totaled $434 million in 2023; crucial for operational reliability and efficiency. |

Revenue Streams

CVR Energy's core revenue driver is the sale of gasoline and diesel fuel, products refined from crude oil. These fuels are distributed through wholesale channels to commercial clients and retail outlets. In 2024, CVR Energy reported significant revenue from these sales, with crack spreads, demand for transportation fuels, and the volume of products sold directly impacting their financial performance.

Sales of Urea Ammonium Nitrate (UAN) represent a substantial revenue source for CVR Energy's nitrogen fertilizer operations. UAN is a popular liquid fertilizer essential for modern agriculture, making its sales a key driver of the company's financial performance.

The revenue generated from UAN sales is directly influenced by several factors: robust agricultural demand, prevailing market prices for UAN, and CVR Energy's own production capacity at its fertilizer facilities. For instance, in 2024, the agricultural sector's need for nutrients, coupled with fluctuating commodity prices, directly impacted UAN sales volumes and profitability.

CVR Energy generates revenue from selling ammonia, a key component in fertilizers and various industrial applications. The company's production volumes and the prevailing market prices for ammonia directly influence the income from this segment.

In 2024, CVR Energy's Renewable Diesel segment, which is closely tied to its fertilizer operations and ammonia production, saw significant demand. While specific ammonia sales figures for 2024 are not yet fully detailed, the company's overall performance in related segments indicates a robust market for its nitrogen-based products.

Sales of Other Refined Products and By-products

CVR Energy's revenue extends beyond primary fuels, encompassing a range of other refined products and by-products. This diversification includes sales of jet fuel, gas oil, propane, butane, sulfur, and petroleum coke. These additional revenue streams are crucial for maximizing the value derived from refinery operations.

These secondary products contribute significantly to CVR Energy's overall financial performance and operational efficiency. The market demand for these diverse outputs provides a degree of financial stability and helps to optimize the utilization of refinery capacity.

- Jet Fuel: CVR Energy supplies jet fuel to various aviation markets, contributing to its refined product sales.

- Propane and Butane: These liquefied petroleum gases (LPGs) are sold for heating, industrial, and fuel purposes, representing a key by-product revenue.

- Sulfur: Recovered during the refining process, sulfur is sold for agricultural and industrial applications, adding value to the output.

- Petroleum Coke: This solid carbonaceous material is a by-product of the coking process and is used in industries like cement production and aluminum smelting.

Renewable Diesel Sales and Associated Credits

CVR Energy generates revenue by selling renewable diesel produced at its Coffeyville, Kansas facility. This operation, which began in 2022, has become a significant contributor to the company's financial performance.

Beyond the direct sale of renewable diesel, CVR Energy also benefits from the sale of environmental credits. These include Renewable Identification Numbers (RINs) generated under the Renewable Fuel Standard and Low Carbon Fuel Standard (LCFS) credits from California. The market value of these credits can fluctuate, directly impacting the profitability of the company's renewable diesel segment.

- Renewable Diesel Sales: CVR Energy's renewable diesel unit commenced operations in 2022, establishing a direct revenue stream from product sales.

- Environmental Credit Generation: The company earns revenue from selling Renewable Identification Numbers (RINs) and Low Carbon Fuel Standard (LCFS) credits.

- Credit Value Impact: In 2023, the average price for a RIN was approximately $1.60, and LCFS credits in California traded in a range that significantly boosted renewable fuel economics.

- Segment Contribution: The renewables segment, driven by these sales and credits, is increasingly important to CVR Energy's overall revenue mix.

CVR Energy's primary revenue streams originate from its refining and marketing operations, specifically the sale of gasoline and diesel fuel. The company also generates substantial income from its nitrogen fertilizer segment, primarily through the sale of Urea Ammonium Nitrate (UAN) and ammonia. Furthermore, CVR Energy is increasingly capitalizing on its renewable diesel production, bolstered by the sale of environmental credits.

| Revenue Stream | Primary Products/Services | Key Drivers | 2024 Data Notes |

|---|---|---|---|

| Refining & Marketing | Gasoline, Diesel Fuel, Jet Fuel, Propane, Butane, Sulfur, Petroleum Coke | Crack Spreads, Fuel Demand, Product Volumes | Refinery utilization rates and product margins are critical indicators. |

| Nitrogen Fertilizers | Urea Ammonium Nitrate (UAN), Ammonia | Agricultural Demand, Fertilizer Prices, Production Capacity | Seasonal demand and global commodity prices significantly influence fertilizer revenues. |

| Renewable Energy | Renewable Diesel, Environmental Credits (RINs, LCFS) | Renewable Fuel Demand, Credit Market Values | The value of RINs and LCFS credits directly impacts the profitability of the renewables segment. |

Business Model Canvas Data Sources

The CVR Energy Business Model Canvas is built upon a foundation of robust financial statements, detailed market research reports, and internal strategic planning documents. These sources ensure each block is informed by accurate, verifiable data relevant to the energy sector.