CVR Energy Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

CVR Energy Bundle

Curious about CVR Energy's strategic product positioning? This glimpse into their BCG Matrix highlights key areas, but to truly understand their market dominance and potential growth, you need the full picture. Discover which segments are fueling their success and where future investments should be directed.

Unlock actionable insights into CVR Energy's product portfolio by purchasing the complete BCG Matrix. Gain a comprehensive understanding of their Stars, Cash Cows, Dogs, and Question Marks, empowering you to make data-driven decisions for optimized resource allocation and strategic advantage.

Don't miss out on the detailed analysis that reveals CVR Energy's competitive landscape. The full BCG Matrix report provides the strategic depth needed to navigate their market effectively, offering a clear roadmap for growth and profitability. Invest in clarity today.

Stars

CVR Energy's Wynnewood renewable diesel unit saw a substantial increase in daily processing, reaching approximately 156,000 gallons in Q1 2025, a significant jump from 76,000 gallons per day in Q1 2024. This growth highlights the unit's expanding operational capacity and market engagement.

The company is strategically evaluating a conversion of the Wynnewood facility to produce sustainable aviation fuel (SAF). This move is driven by the burgeoning SAF market, fueled by global decarbonization initiatives and supportive tax incentives, positioning CVR Energy for future opportunities in a high-demand sector.

Despite the expiration of the blenders tax credit, the renewable diesel segment demonstrated resilience, posting positive adjusted EBITDA in Q1 2025. This financial performance underscores the segment's inherent profitability and CVR Energy's ability to navigate evolving regulatory and market landscapes.

CVR Energy is strategically exploring significant renewable energy ventures, notably the potential for Sustainable Aviation Fuel (SAF) production at its Coffeyville refinery. This move signals a clear intent to tap into the burgeoning SAF market, which is experiencing substantial global growth driven by environmental regulations and corporate sustainability goals.

The global aviation industry is under increasing pressure to decarbonize, making SAF a critical component of future flight operations. Projections indicate the SAF market could reach hundreds of billions of dollars in the coming decades, attracting substantial investment and robust government incentives, such as those outlined in the Inflation Reduction Act which offers production tax credits for SAF.

While CVR Energy has temporarily slowed certain development phases to gain further clarity on the evolving landscape of government subsidies and support mechanisms, the underlying market fundamentals for SAF remain exceptionally strong. The long-term demand for lower-emission aviation fuels is undeniable, positioning SAF projects as a key growth area for companies like CVR Energy.

High-value refined products, like premium gasoline, are a significant driver for CVR Energy. In the Group 3 region, demand for premium gasoline is robust, and it constitutes a substantial part of CVR's gasoline output. This segment within petroleum refining can be seen as a high-growth, high-market share niche.

CVR's strategic investments, such as the alkylation project at Wynnewood, are designed to boost the production of these more profitable, higher-margin products. For instance, in 2024, CVR Energy reported that its refining segment's gross profit per barrel benefited from the increased yield of higher-value products. This focus directly supports the Stars quadrant of the BCG matrix by capitalizing on strong market demand for premium offerings.

Strategic Investments in Refinery Upgrades

CVR Energy is strategically investing in refinery upgrades, such as the replacement of the hydrofluoric acid catalyst alkylation unit at its Wynnewood Refinery with a fixed bed catalyst system, slated for operational status by Q2 2027.

These upgrades are designed to boost operational efficiency and mitigate environmental risks, positioning CVR Energy’s refineries to produce more competitive products with potentially higher margins.

This proactive approach to modernization is vital for sustaining market leadership and cultivating future cash cows within the energy sector.

- Wynnewood Refinery Upgrade: Transitioning from hydrofluoric acid to a fixed bed catalyst system for alkylation.

- Operational Target: Expected to be operational by the second quarter of 2027.

- Strategic Benefits: Enhanced efficiency, reduced environmental risks, and improved product competitiveness.

- BCG Matrix Implication: Positions these upgraded facilities as potential future cash cows through strategic investment.

Future Hydrogen Production for Blue Ammonia

CVR Energy's Coffeyville facility is positioned for a significant growth opportunity in future hydrogen production for blue ammonia. This strategy hinges on leveraging natural gas as an alternative feedstock for nitrogen fertilizer production. The U.S. tax incentives specifically for blue ammonia, which involves sequestering carbon dioxide, further bolster this high-growth potential. By utilizing its existing infrastructure and these incentives, CVR can aim to produce lower-carbon ammonia, securing a substantial market share in an increasingly environmentally aware market.

The market for lower-carbon ammonia is expanding, driven by global decarbonization efforts. For instance, the International Energy Agency (IEA) has projected significant growth in low-carbon hydrogen production, with ammonia being a key carrier. In 2023, the global ammonia market was valued at approximately $60 billion, and projections indicate continued expansion. CVR's ability to tap into this market with a more sustainable product could be a game-changer.

- Blue Ammonia Incentive: The U.S. Inflation Reduction Act (IRA) provides significant tax credits, such as the 45Q tax credit, for carbon capture and sequestration, making blue ammonia production economically attractive.

- Market Demand: Growing demand for fertilizers with a lower carbon footprint and the use of ammonia as a clean fuel and hydrogen carrier are key market drivers.

- Infrastructure Advantage: CVR's existing nitrogen fertilizer production assets at Coffeyville provide a foundational advantage for transitioning to or integrating blue ammonia production.

- Competitive Positioning: Successfully producing blue ammonia could position CVR as a leader in a niche but rapidly developing segment of the chemical and energy markets.

CVR Energy's focus on high-value refined products, like premium gasoline, places it firmly in the Stars quadrant of the BCG matrix. The strong demand for these products in regions like Group 3, coupled with strategic investments like the alkylation project at Wynnewood, enhances profitability. In 2024, CVR Energy noted that its refining segment's gross profit per barrel benefited from increased yields of these higher-margin products, directly capitalizing on robust market demand.

The company's strategic investments in refinery upgrades, such as the transition at Wynnewood to a fixed bed catalyst system for alkylation, are designed to boost efficiency and competitiveness. These enhancements aim to ensure CVR's refineries can produce more profitable products, solidifying their position as potential future cash cows by meeting strong market demand for premium offerings.

The Wynnewood renewable diesel unit's processing capacity saw a significant increase, reaching approximately 156,000 gallons per day in Q1 2025, up from 76,000 gallons per day in Q1 2024. This expansion, alongside the positive adjusted EBITDA in the renewable diesel segment despite the expiration of the blenders tax credit in Q1 2025, highlights the strength and growth potential of these ventures.

CVR Energy's strategic exploration of sustainable aviation fuel (SAF) production at its Coffeyville refinery, driven by global decarbonization and supportive tax incentives, positions it for high growth in a burgeoning market. The company is also eyeing future hydrogen production for blue ammonia, leveraging U.S. tax incentives like the 45Q tax credit for carbon capture. This dual focus on SAF and blue ammonia underscores CVR's commitment to capitalizing on environmentally driven market opportunities.

What is included in the product

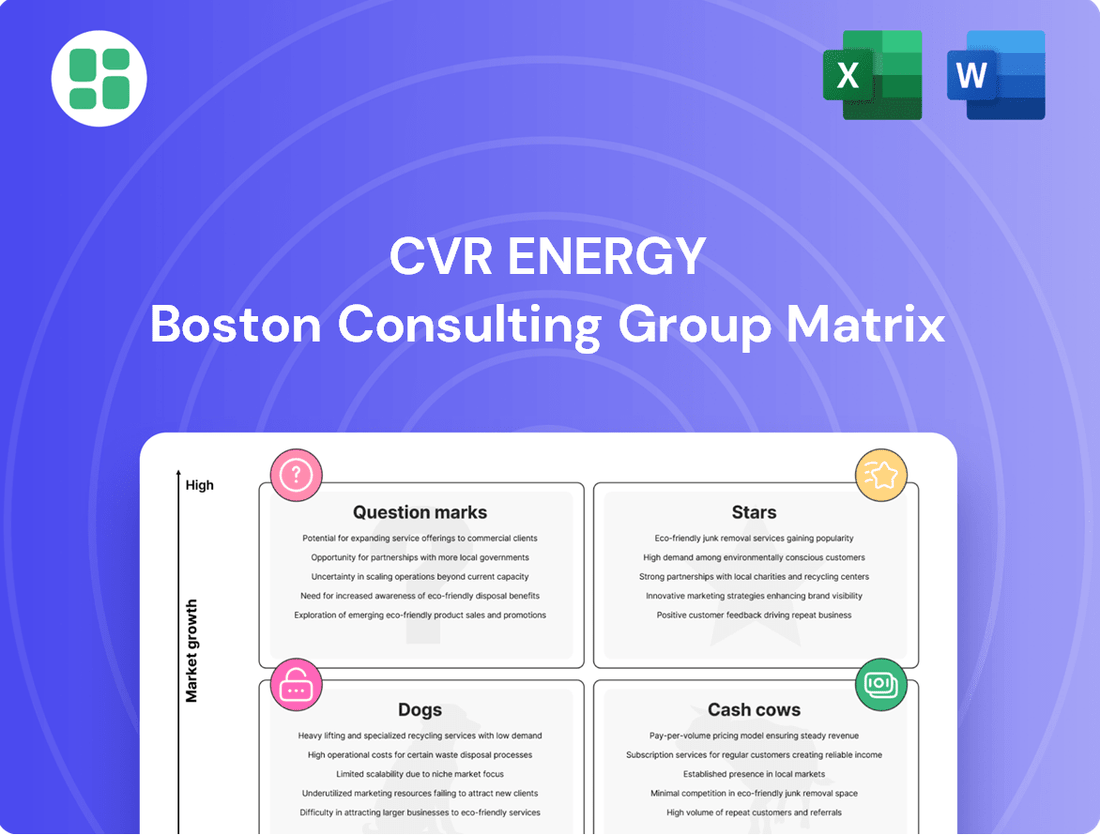

CVR Energy's BCG Matrix analysis identifies key business units as Stars, Cash Cows, Question Marks, or Dogs, guiding strategic decisions.

The CVR Energy BCG Matrix provides a clear, one-page overview of each business unit's strategic position, alleviating the pain of complex portfolio analysis.

Cash Cows

CVR Partners, CVR Energy's nitrogen fertilizer arm, is a clear Cash Cow. In Q2 2025, this segment delivered a robust $67 million in EBITDA and $39 million in net income, marking impressive year-over-year increases of 24% and 49% respectively.

The global nitrogen fertilizer market is a significant growth area, projected to expand at a 6.7% compound annual growth rate from 2024 to 2025, and further to 7.2% through 2029. This sustained demand, fueled by increasing global population and agricultural requirements, provides a stable and profitable environment for CVR's operations.

CVR's operational efficiency, highlighted by its 91% ammonia utilization rate in Q2 2025 and 96% for the first six months of the year, along with a strategic shift to higher-margin UAN production, solidifies its position as a strong cash generator within the industry.

CVR Energy's established petroleum refining operations, focusing on gasoline and diesel, are clear Cash Cows. These two complex refineries are vital suppliers to the U.S. market, consistently generating significant revenue. For instance, the petroleum segment brought in $1.48 billion in revenue during the first quarter of 2025, underscoring its robust performance.

The demand for gasoline and diesel in the U.S. remains stable, mirroring recent historical averages in key regions like the Mid-Continent. This consistent demand, coupled with CVR Energy's strong market share in these essential fuel products, ensures a reliable and substantial cash flow, even in a mature industry.

CVR Energy's refineries in Kansas and Oklahoma are positioned in the crucial Mid-Continent region, enabling efficient service to diverse U.S. markets. This prime location bolsters their market share for refined products and significantly cuts down on logistical expenses.

While the broader U.S. refinery capacity expansion exerts some pressure on profit margins, CVR's established access to export markets and robust domestic trade routes help to maintain its profitability. For example, in the first quarter of 2024, CVR Energy reported a net income of $142 million, demonstrating the resilience of its strategically located assets.

Reliable Production Capacity and Utilization Rates

CVR Energy's nitrogen fertilizer facilities demonstrated remarkable operational efficiency, achieving a combined ammonia production rate of 91% during the second quarter of 2025. This high utilization rate directly supports the cash cow status of this segment, as it reflects consistent and reliable output. CVR Partners' strategic emphasis on safe, dependable operations and robust free cash flow generation further solidifies its position as a mature, high-earning business unit within the company's portfolio.

The petroleum segment also contributed significantly to this operational strength. Coffeyville refinery returned to full operating rates in July 2025, a testament to its efficient management and production capabilities. With no further planned turnarounds scheduled until 2027, this ensures sustained and predictable output, reinforcing the cash cow characteristics of CVR Energy's core refining operations.

- Ammonia Production Rate: 91% in Q2 2025

- Petroleum Segment Operations: Full operating rates resumed at Coffeyville in July 2025

- Future Turnarounds: None planned until 2027 for Coffeyville

- Strategic Focus: Safe, reliable operations and free cash flow generation

Integrated Feedstock Advantage (Petroleum Coke for Fertilizer)

CVR Partners' Coffeyville plant leverages petroleum coke, a byproduct from CVR Energy's refining operations, as a key feedstock for its fertilizer production. This integrated model offers a significant cost advantage and ensures supply stability, bolstering the fertilizer segment's profitability and cash generation.

This strategic synergy between refining and fertilizer operations is a cornerstone of CVR Energy's robust cash flow. For instance, in the first quarter of 2024, CVR Energy reported total revenue of $1.73 billion, with its refining segment contributing $1.49 billion. The fertilizer segment, while smaller, benefits immensely from the consistent and cost-effective supply of petroleum coke, enhancing its competitive positioning.

- Integrated Feedstock: Petroleum coke from CVR Energy's refining operations is used by CVR Partners for fertilizer production.

- Cost Advantage: This integration provides a lower feedstock cost compared to competitors relying on external sourcing.

- Supply Stability: The direct link to refining operations ensures a reliable and consistent supply of petroleum coke.

- Profitability Driver: Enhanced profitability and strong cash flow generation are key benefits of this synergistic relationship.

CVR Energy's nitrogen fertilizer arm, CVR Partners, is a prime example of a cash cow. Its Q2 2025 performance, with $67 million in EBITDA and $39 million in net income, showcases consistent profitability. The segment benefits from a high ammonia utilization rate of 91% in Q2 2025, a testament to its operational efficiency and stable cash generation.

The petroleum refining segment also firmly fits the cash cow profile. With refineries strategically located in the Mid-Continent, CVR Energy serves vital U.S. markets for gasoline and diesel. The segment's revenue of $1.48 billion in Q1 2025 highlights its substantial contribution to the company's overall cash flow. The Coffeyville refinery's return to full operating rates in July 2025, with no further turnarounds until 2027, ensures predictable and sustained output.

| Segment | Key Metric | Value (Q2 2025/Q1 2025) | Significance |

| Nitrogen Fertilizer (CVR Partners) | EBITDA | $67 million | Strong cash generation |

| Nitrogen Fertilizer (CVR Partners) | Ammonia Utilization Rate | 91% | Operational efficiency |

| Petroleum Refining | Revenue | $1.48 billion (Q1 2025) | Stable market demand |

| Petroleum Refining | Coffeyville Operations | Full operating rates resumed July 2025 | Sustained output |

Delivered as Shown

CVR Energy BCG Matrix

The CVR Energy BCG Matrix preview you are viewing is the exact, fully formatted document you will receive immediately after purchase. This comprehensive analysis, detailing CVR Energy's business units within the BCG framework, is ready for your strategic planning without any watermarks or demo content. You can confidently use this preview as a direct representation of the high-quality, actionable report that will be yours to download and implement.

Dogs

The Wynnewood renewable diesel unit faced challenges, with throughput dropping to 11.7 million gallons in Q2 2024 from 17.8 million gallons in Q2 2023. This decline was influenced by planned maintenance turnarounds and a fire incident.

Despite a Q1 2025 performance uptick, the segment has historically struggled, operating below breakeven even after accounting for regulatory incentives. In Q2 2025, this resulted in an adjusted EBITDA loss of $4 million.

CVR Energy has halted additional sustainable aviation fuel (SAF) development, awaiting clearer government subsidy frameworks. This strategic pause underscores the unit's reliance on external support for consistent profitability.

CVR Energy's legacy refining segments, particularly those with low margins, are positioned as dogs in the BCG matrix. The overall refining margin plummeted to $2.21 per barrel in Q2 2025 from $10.94 per barrel in Q2 2024, largely due to adverse mark-to-market adjustments on Renewable Fuel Standards (RFS) obligations.

Despite a slight uptick in adjusted margins, the segment reported a substantial net loss of $137 million and an EBITDA loss of $84 million in Q2 2025. This financial performance highlights segments within petroleum refining that are highly susceptible to RIN price fluctuations and lack distinct competitive strengths, leading to poor profitability and limited market expansion opportunities.

CVR Energy's divestiture of its 50% stake in the Midway Pipeline, LLC in December 2024 for roughly $90 million highlights a strategic move concerning non-core assets. This transaction, which resulted in a gain for the company, indicates that the pipeline was likely not a primary contributor to CVR Energy's long-term strategic objectives or growth trajectory.

Assets like the Midway Pipeline, once divested, typically represent a company's 'Dogs' in a BCG Matrix analysis. This classification stems from their limited contribution to current market share and minimal potential for future growth, often making them candidates for sale or discontinuation to focus resources on more promising ventures.

Segments Highly Reliant on Fading Tax Credits/Subsidies

The profitability of CVR Energy's renewable diesel segment has been significantly impacted by the expiration of key government tax credits, such as the blenders tax credit. This reliance on subsidies makes the segment vulnerable to policy shifts.

CVR Energy's strategic pause on further Sustainable Aviation Fuel (SAF) investments underscores this dependence, as the company awaits clearer signals on government support. Without sustained and favorable policy, this segment faces challenges in achieving consistent profitability.

- Renewable Diesel Profitability: Heavily influenced by expired tax credits like the blenders tax credit.

- SAF Investment Pause: Reflects vulnerability to government subsidy clarity.

- Policy Dependence: Operations may struggle without consistent, favorable government support.

Older or Less Efficient Refinery Units

CVR Energy operates sophisticated refineries, but the overall U.S. refining sector contends with new global capacity and the potential shuttering of older, less efficient facilities. If specific CVR refining units lag in efficiency or necessitate substantial capital investment without securing a dominant market position, they might be categorized as question marks within a BCG matrix framework. The company's planned alkylation unit upgrade demonstrates a forward-thinking approach to managing such assets.

CVR Energy's legacy refining segments, particularly those with lower margins, are classified as Dogs in the BCG matrix. The overall refining margin dropped significantly to $2.21 per barrel in Q2 2025 from $10.94 per barrel in Q2 2024, largely due to adverse mark-to-market adjustments on Renewable Fuel Standards obligations. This segment reported a substantial net loss of $137 million and an EBITDA loss of $84 million in Q2 2025, indicating poor profitability and limited growth potential.

| Segment | Q2 2024 Margin ($/barrel) | Q2 2025 Margin ($/barrel) | Q2 2025 Net Loss ($M) | Q2 2025 EBITDA Loss ($M) |

|---|---|---|---|---|

| Legacy Refining | 10.94 | 2.21 | 137 | 84 |

Question Marks

CVR Energy is exploring the conversion of its renewable diesel unit to SAF production, alongside a potential larger SAF project at Coffeyville. This positions SAF as a 'Question Mark' within their strategic portfolio due to its high-growth potential driven by decarbonization efforts in aviation.

The SAF market is experiencing significant expansion, with projections indicating continued robust growth. However, CVR's current market share in SAF is minimal, and the substantial capital investment required for SAF production, coupled with reliance on government incentives, introduces considerable uncertainty.

While CVR Energy is heavily invested in renewable diesel and sustainable aviation fuel (SAF), the advanced biofuels landscape is buzzing with innovation. Companies are exploring everything from algae-based fuels to cellulosic ethanol, representing a dynamic and potentially high-growth market. For CVR, venturing into these less established areas would mean entering new territories with unproven market share but significant upside. For example, the U.S. Department of Energy's Bioenergy Technologies Office has been supporting research into advanced biofuels, with projects aiming to reduce production costs and improve feedstock yields.

CVR Energy's potential investment in Carbon Capture and Storage (CCS) for its fertilizer plants aligns with the growing demand for blue ammonia, a product of CCS. The U.S. tax incentives for blue ammonia specifically signal this opportunity.

CCS is experiencing rapid expansion, fueled by global climate targets and increasing regulatory mandates. This positions CCS as a high-growth sector.

Given CVR's current limited involvement in CCS, it fits the profile of a Question Mark. Successful development and scaling of CCS technology could propel CVR into a Star position within this emerging market.

Diversification into New Energy Transition Technologies

CVR Energy, as it navigates the evolving energy landscape, may look to diversify into emerging sectors like green hydrogen production or other industrial decarbonization solutions. These represent new frontiers for the company, offering substantial growth prospects but also demanding considerable upfront investment to establish a market presence. This strategic exploration aligns with the characteristics of a Question Mark in the BCG Matrix, signifying high potential but uncertain outcomes.

- New Market Entry: CVR Energy's potential ventures into areas like hydrogen production or carbon capture technologies would place them in nascent markets with limited existing share.

- High Growth Potential: The global push for decarbonization is expected to drive significant demand for these new energy transition technologies in the coming years.

- Significant Investment Required: Developing and scaling up these technologies necessitates substantial capital outlay for research, development, and infrastructure.

- Uncertainty of Success: As these are emerging markets, the long-term viability and competitive landscape for CVR Energy's participation remain uncertain, characteristic of a Question Mark.

Optimizing Refinery Flexibility for Future Fuel Blends

CVR Energy's capacity to pivot refinery operations between traditional hydrocarbons and renewable fuels, as emphasized by its CEO, positions this operational flexibility as a potential Question Mark. This adaptability isn't a direct product but a crucial capability. It allows CVR to swiftly seize opportunities in nascent fuel markets or low-carbon product sectors should market demands or regulatory landscapes change abruptly.

The strategic advantage lies in CVR's ability to reconfigure its assets, potentially reducing downtime and capital expenditure compared to building entirely new facilities for renewable production. This flexibility could prove invaluable in navigating the evolving energy transition, allowing the company to respond to shifts in demand for biofuels like renewable diesel or sustainable aviation fuel (SAF). For instance, if government mandates for renewable fuel content increase significantly, CVR's existing infrastructure could be a key differentiator.

- Strategic Flexibility: CVR's ability to switch refinery units between hydrocarbon and renewable fuel production is a key strategic asset.

- Market Responsiveness: This adaptability enables quick capture of market share in emerging fuel blends and low-carbon products.

- Uncertainty Factor: Its success as a Question Mark depends on future market dynamics and CVR's agility in capitalizing on them.

- Potential Growth Driver: This operational capability could become a significant competitive advantage if the transition to alternative fuels accelerates.

CVR Energy's potential expansion into Sustainable Aviation Fuel (SAF) and Carbon Capture and Storage (CCS) represent significant growth opportunities, but also carry inherent risks. These ventures are classified as Question Marks because they require substantial investment and their future market share and profitability are uncertain.

The SAF market is projected to grow substantially, driven by environmental regulations and airline commitments. However, CVR's current limited presence and the high capital costs associated with SAF production make it a Question Mark. For example, the International Air Transport Association (IATA) aims for a 10% SAF usage by 2030.

Similarly, the demand for blue ammonia, produced via CCS, is increasing due to decarbonization efforts in agriculture and industry. While CVR's exploration of CCS for its fertilizer plants positions it to capitalize on this, the technology's widespread adoption and CVR's success in scaling it remain uncertain, classifying it as a Question Mark.

CVR Energy's strategic flexibility to shift refinery operations between traditional fuels and renewables also functions as a Question Mark. This adaptability offers potential to capture emerging markets, but its ultimate impact depends on future energy transition dynamics and CVR's execution.

BCG Matrix Data Sources

Our CVR Energy BCG Matrix is informed by comprehensive financial filings, detailed industry research reports, and up-to-date market growth data to provide an accurate strategic overview.