CVR Energy Marketing Mix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

CVR Energy Bundle

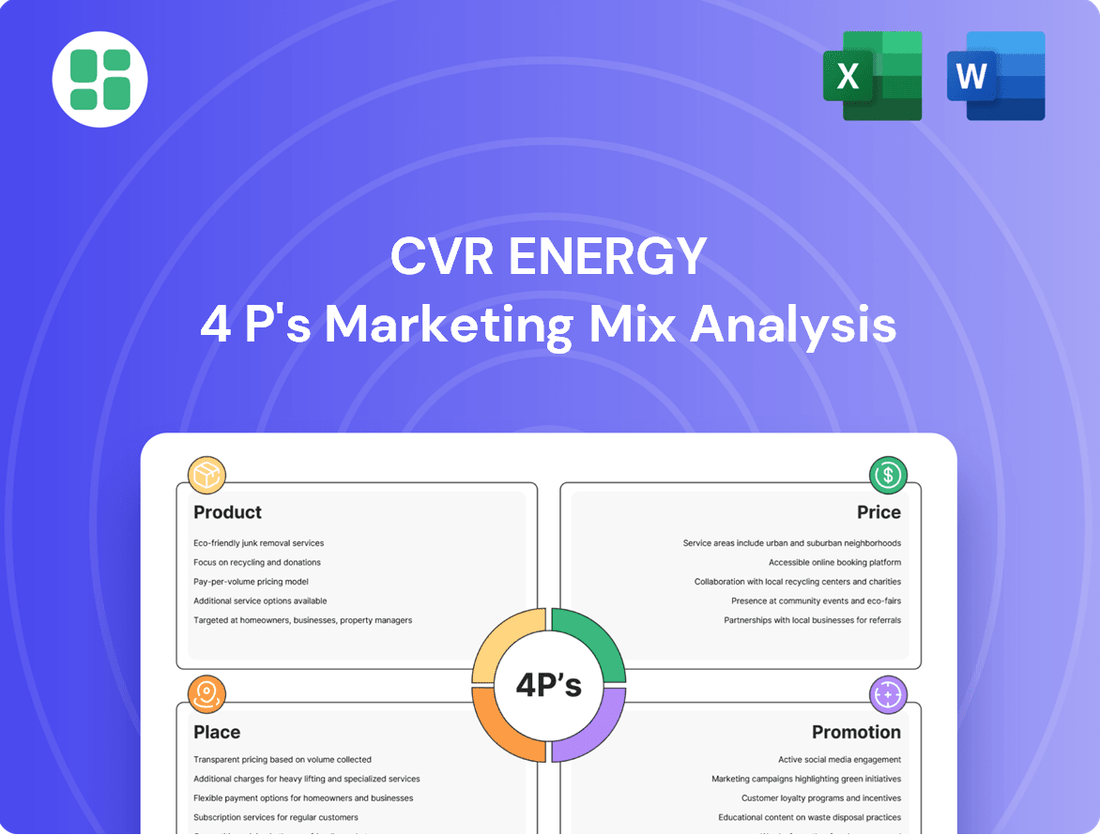

CVR Energy's marketing mix is a sophisticated interplay of refined refining and marketing services, competitive pricing in a volatile energy market, strategic distribution through extensive pipelines and terminals, and targeted promotional efforts focused on reliability and value.

Discover how CVR Energy leverages its product portfolio, pricing strategies, distribution network, and promotional activities to maintain its competitive edge.

Unlock a comprehensive, ready-to-use analysis of CVR Energy's 4Ps, perfect for gaining strategic insights, informing business plans, or enhancing academic research.

Product

CVR Energy's refined petroleum products are the core of its offering, with two strategically located refineries producing essential transportation fuels like gasoline and diesel. In 2024, CVR Energy reported processing approximately 195,000 barrels of crude oil per day, highlighting significant production capacity.

The company's product slate is designed to maximize the yield of light products, such as gasoline, which are typically higher in value. This focus on light product yield is a key strategy to enhance profitability in a competitive refining market, as demonstrated by their consistent efforts to optimize processing configurations.

CVR Energy, through CVR Partners, is a key producer of nitrogen fertilizers, including ammonia and urea ammonium nitrate (UAN). These are vital for enhancing crop yields across important agricultural areas like the Southern Plains and Corn Belt. In 2024, CVR Partners' production capacity for ammonia was approximately 1.2 million tons annually, with a significant portion converted to UAN to align with market needs.

CVR Energy's venture into renewable diesel, particularly with its Wynnewood, Oklahoma unit, marks a significant strategic move. This facility processes vegetable oil into renewable diesel, catering to the increasing market appetite for environmentally friendly fuels. In 2023, CVR reported that its renewable diesel production contributed positively, with the company aiming to optimize its feedstock sourcing and operational efficiency to meet demand.

The renewable diesel segment, while promising, operates within a dynamic regulatory landscape. Despite potential capacity constraints, CVR Energy views this diversification as crucial for long-term growth and adaptation to evolving energy markets. The company's investment in this area underscores a commitment to sustainability and capturing opportunities in the bio-based fuels sector, a market projected for continued expansion through 2025 and beyond.

Industrial Feedstocks

Beyond its primary fuel and fertilizer offerings, CVR Energy leverages its refining and chemical operations to produce a range of industrial feedstocks. These are intermediate products crucial for other manufacturing sectors.

These feedstocks are not mere by-products but essential components for various industrial processes, highlighting CVR Energy's integrated approach to resource utilization. For instance, their petrochemical segment supplies essential building blocks for plastics and synthetic materials.

CVR Energy carefully tailors the quality and specifications of these industrial feedstocks to meet the precise technical demands of its specialized B2B customer base. This focus on customization ensures their products integrate seamlessly into diverse manufacturing workflows.

- Petrochemicals: CVR Energy's Coffeyville refinery produces key petrochemicals like propylene, a vital component in polypropylene plastics used in automotive parts and packaging.

- Specialty Solvents: The company also supplies various specialty solvents derived from its refining processes, utilized in industries ranging from pharmaceuticals to coatings.

- Industrial Gases: Hydrogen and other industrial gases are also produced, serving sectors such as metal fabrication and electronics manufacturing.

- Market Demand: The demand for these feedstocks is closely tied to the health of the broader manufacturing economy; for example, the automotive sector's recovery in 2024 directly impacts demand for propylene.

Value-Added Optimization

CVR Energy actively enhances its product value through strategic mix optimization. A prime example is the conversion of ammonia into higher-margin Urea Ammonium Nitrate (UAN), a move that directly boosts profitability. The company also prioritizes the production of premium gasoline, catering to a demand for higher-octane fuels.

These efforts are supported by significant capital investments. The alkylation project at its Wynnewood refinery, for instance, was designed to specifically increase the output of premium gasoline. Furthermore, CVR Energy is investing in projects to produce jet fuel at its Coffeyville facility, demonstrating a clear strategy to adapt to evolving market demands and improve the profitability of its product portfolio.

- Product Conversion: Upgrading ammonia to UAN for increased margins.

- Premium Gasoline Focus: Strategic investments like the Wynnewood alkylation project.

- Market Adaptation: Projects to produce jet fuel from Coffeyville.

- Profitability Enhancement: Overall strategy aims to improve product profitability.

CVR Energy's product portfolio centers on refined petroleum products, primarily gasoline and diesel, with significant refining capacity demonstrated by processing approximately 195,000 barrels of crude oil daily in 2024. The company also produces nitrogen fertilizers, with CVR Partners boasting an annual ammonia production capacity of around 1.2 million tons. Furthermore, CVR Energy is strategically expanding into renewable diesel, aiming to capitalize on the growing demand for sustainable fuels.

| Product Category | Key Products | 2024/2025 Data/Focus | Strategic Importance |

|---|---|---|---|

| Refined Petroleum Products | Gasoline, Diesel | Processed ~195,000 bpd crude oil (2024) | Core business, focus on light product yield for profitability |

| Nitrogen Fertilizers | Ammonia, UAN | ~1.2M tons/year ammonia capacity (CVR Partners) | Supports agricultural sector, higher margins via UAN conversion |

| Renewable Fuels | Renewable Diesel | Operational at Wynnewood refinery | Diversification, response to environmental regulations and market demand |

| Petrochemicals & Industrial Feedstocks | Propylene, Specialty Solvents, Hydrogen | Supplies plastics, pharmaceuticals, coatings, metal fabrication sectors | Integrated resource utilization, supports diverse manufacturing industries |

What is included in the product

This analysis provides a comprehensive examination of CVR Energy's marketing mix, detailing their Product offerings, Pricing strategies, Place (distribution) approaches, and Promotion activities.

It offers a grounded perspective on CVR Energy's marketing positioning, ideal for those seeking to understand their competitive strategies and benchmark against industry practices.

Provides a clear, actionable framework to address CVR Energy's marketing challenges, offering relief from uncertainty in product, price, place, and promotion strategies.

Place

CVR Energy's strategic refinery placement in Kansas and Oklahoma offers significant logistical benefits. These two complex crude oil refineries are situated in the heart of the Mid-Continent, facilitating efficient sourcing of crude oil and distribution of refined products across the United States.

This central positioning grants CVR Energy excellent access to major fuel demand centers and vital agricultural regions that require fertilizers. In 2024, the company continued to leverage these locations for optimal operational efficiency and market reach.

CVR Energy utilizes an integrated logistics system, encompassing pipelines, rail, and trucking, to efficiently move crude oil and refined products like gasoline and diesel from its refineries to diverse markets. This robust infrastructure is crucial for maintaining a consistent supply chain and meeting customer demand across various regions.

The company's strategic plant locations in the Southern Plains and Corn Belt are key to its fertilizer distribution. This proximity allows CVR Energy to effectively serve agricultural customers, ensuring timely delivery of essential products directly to farming communities.

CVR Energy actively pursues direct sales channels for its fertilizer products, specifically targeting large industrial and agricultural clients across the United States. This strategy fosters deeper customer engagement and allows for the development of customized supply agreements, ensuring specific needs are met efficiently.

Wholesale Distribution Channels for Fuels

CVR Energy's wholesale distribution of refined fuels, including gasoline and diesel, is a cornerstone of its market strategy. This business-to-business approach bypasses the need for extensive retail infrastructure, allowing CVR to efficiently serve a wide customer base. In 2024, the company continued to leverage these channels, selling to a diverse range of entities such as independent distributors, fuel marketers, and even other refining companies, thereby maximizing its reach across the downstream fuel supply chain.

The effectiveness of this wholesale model is evident in its ability to access numerous distribution networks. These networks then carry CVR's products to the ultimate end-users. For instance, in the first quarter of 2025, CVR reported that its refined products were distributed through approximately 7,000 branded and unbranded retail locations across its operating regions, showcasing the breadth of its wholesale reach.

- Wholesale Focus: CVR Energy primarily sells gasoline and diesel to distributors, marketers, and other refiners, operating on a business-to-business model.

- Market Reach: This wholesale strategy enables CVR to access a broad market efficiently without direct retail operations.

- Downstream Networks: Products are distributed through various downstream networks, reaching end-users effectively.

- Volume (Example): In Q1 2025, CVR's refined products reached an estimated 7,000 retail locations via these wholesale channels.

Inventory Management for Market Responsiveness

CVR Energy's inventory management is a linchpin for its market responsiveness, especially considering the volatile commodity pricing of its refined products and the seasonal demand for its nitrogen fertilizers. By strategically balancing inventory levels across its refineries and fertilizer manufacturing facilities, CVR Energy can adeptly navigate market shifts and guarantee that its products are readily available to meet customer needs during peak periods.

This proactive approach to inventory ensures CVR Energy can capitalize on favorable market conditions and mitigate the impact of supply chain disruptions. For instance, during the critical spring planting season, having sufficient fertilizer inventory is paramount to serving agricultural customers effectively. Similarly, managing refined product inventories allows the company to respond to surges in gasoline or diesel demand driven by economic activity or external events.

- Strategic Inventory Balancing: CVR Energy maintains optimized inventory levels at its refineries and fertilizer plants to ensure product availability and respond to market demand.

- Commodity Nature: The company's products, like gasoline and nitrogen fertilizers, are commodities, making efficient inventory management critical for profitability.

- Seasonal Demand: Fertilizers experience significant seasonal demand, requiring careful inventory planning to meet agricultural needs during planting seasons.

- Market Responsiveness: Effective inventory control enables CVR Energy to quickly adapt to price fluctuations and supply/demand dynamics in the energy and agriculture sectors.

CVR Energy's strategic refinery placement in Kansas and Oklahoma offers significant logistical benefits. These two complex crude oil refineries are situated in the heart of the Mid-Continent, facilitating efficient sourcing of crude oil and distribution of refined products across the United States. This central positioning grants CVR Energy excellent access to major fuel demand centers and vital agricultural regions that require fertilizers. In 2024, the company continued to leverage these locations for optimal operational efficiency and market reach.

CVR Energy utilizes an integrated logistics system, encompassing pipelines, rail, and trucking, to efficiently move crude oil and refined products like gasoline and diesel from its refineries to diverse markets. This robust infrastructure is crucial for maintaining a consistent supply chain and meeting customer demand across various regions. The company's strategic plant locations in the Southern Plains and Corn Belt are key to its fertilizer distribution. This proximity allows CVR Energy to effectively serve agricultural customers, ensuring timely delivery of essential products directly to farming communities.

CVR Energy actively pursues direct sales channels for its fertilizer products, specifically targeting large industrial and agricultural clients across the United States. This strategy fosters deeper customer engagement and allows for the development of customized supply agreements, ensuring specific needs are met efficiently. CVR Energy's wholesale distribution of refined fuels, including gasoline and diesel, is a cornerstone of its market strategy. This business-to-business approach bypasses the need for extensive retail infrastructure, allowing CVR to efficiently serve a wide customer base. In 2024, the company continued to leverage these channels, selling to a diverse range of entities such as independent distributors, fuel marketers, and even other refining companies, thereby maximizing its reach across the downstream fuel supply chain.

The effectiveness of this wholesale model is evident in its ability to access numerous distribution networks. These networks then carry CVR's products to the ultimate end-users. For instance, in the first quarter of 2025, CVR reported that its refined products were distributed through approximately 7,000 branded and unbranded retail locations across its operating regions, showcasing the breadth of its wholesale reach.

| Product Segment | Key Distribution Channels | 2024/2025 Market Access Example |

|---|---|---|

| Refined Fuels (Gasoline, Diesel) | Wholesale to distributors, marketers, other refiners | Products reached ~7,000 retail locations via wholesale networks (Q1 2025) |

| Nitrogen Fertilizers | Direct sales to industrial and agricultural clients | Proximity to Southern Plains and Corn Belt agricultural regions |

Preview the Actual Deliverable

CVR Energy 4P's Marketing Mix Analysis

The preview shown here is the actual document you’ll receive instantly after purchase—no surprises. This comprehensive analysis of CVR Energy's 4P's Marketing Mix is fully complete and ready for your immediate use.

Promotion

CVR Energy's promotion strategy centers on cultivating robust industry relationships and leveraging direct sales for its B2B petroleum refining and fertilizer segments. This approach is crucial for building trust with commercial clients and major agricultural partners, ensuring consistent communication and reliable supply chains.

In 2024, CVR Energy's success in these B2B markets is directly tied to the strength of its partnerships and its ability to demonstrate dependable product delivery. The company's reliance on direct sales forces and trade associations underscores the importance of personal connections and industry-specific networking in driving demand and securing long-term contracts.

CVR Energy's investor relations program is a cornerstone of its financial communications, featuring quarterly earnings calls, timely press releases, and comprehensive SEC filings. For the first quarter of 2024, CVR Energy reported net income attributable to common stockholders of $143.5 million, or $0.74 per diluted share, showcasing their commitment to transparent financial reporting.

These detailed communications, including investor presentations, highlight CVR Energy's operational performance and strategic initiatives, such as their focus on renewable diesel production. This proactive approach aims to bolster confidence and attract investment by clearly articulating the company's stability and future growth potential to shareholders and the financial community.

CVR Energy likely invests in key petroleum and agricultural industry conferences and trade shows. For instance, attendance at events like the National Association of Convenience Stores (NACS) Show or the American Petroleum Institute (API) meetings allows them to connect with a broad customer base and industry peers.

These gatherings are crucial for CVR Energy to demonstrate its product portfolio, including refined fuels and fertilizers, and to engage directly with stakeholders. In 2024, such events will be vital for understanding evolving consumer preferences and the impact of new environmental regulations on the energy and agriculture sectors.

Participation in these forums not only facilitates networking and lead generation but also positions CVR Energy as a knowledgeable and reliable player in its specialized markets. Staying updated on industry trends, like advancements in biofuel blending or sustainable agricultural practices, is a key benefit.

Corporate Social Responsibility and Sustainability Reporting

CVR Energy actively promotes a positive corporate image by highlighting its commitment to sustainability and robust environmental, health, and safety (EHCS) performance. This focus on responsible operations is crucial for building trust and appealing to a growing segment of stakeholders, particularly environmentally conscious investors and business partners.

Demonstrating strong EHCS metrics can indirectly influence purchasing decisions and foster long-term relationships. For instance, CVR Energy's 2023 sustainability report detailed efforts in reducing greenhouse gas emissions intensity and improving workplace safety, aligning with stakeholder expectations for corporate accountability.

- Environmental Stewardship: CVR Energy reported a reduction in Scope 1 and Scope 2 greenhouse gas emissions intensity by 5% in 2023 compared to the prior year.

- Health and Safety Focus: The company achieved a recordable injury rate of 0.63 per 200,000 work hours in 2023, reflecting a strong commitment to employee well-being.

- Stakeholder Engagement: Transparency in reporting EHCS performance enhances CVR Energy's appeal to ESG-focused investment funds and customers prioritizing ethical supply chains.

Targeted Technical Sales and Support

CVR Energy's promotion strategy for specialized products like UAN fertilizers and specific refined fuel grades heavily relies on a targeted technical sales and support approach. This involves expert teams engaging directly with customers to offer in-depth advice and assistance.

This consultative selling method is crucial in technical markets, enabling customers to grasp the full benefits and best application practices for CVR Energy's offerings. For instance, in 2024, CVR Energy reported that its Renewable Diesel segment contributed significantly, highlighting the importance of technical understanding for its advanced products.

The goal is to build lasting customer relationships and cultivate brand loyalty through demonstrated expertise. This hands-on support differentiates CVR Energy in competitive sectors where product performance and application knowledge are paramount.

- Technical Expertise: Sales teams are trained to provide detailed product information and application guidance.

- Customer Education: Focus on helping clients understand optimal usage for enhanced product performance.

- Relationship Building: Fostering trust and loyalty through consistent, expert support.

- Market Differentiation: Standing out in technical markets by offering value beyond the product itself.

CVR Energy's promotional efforts are deeply embedded in building strong B2B relationships through direct sales and industry engagement, particularly for its petroleum and fertilizer divisions. This strategy is reinforced by transparent financial communications, including detailed investor relations activities and participation in key industry events throughout 2024.

The company actively promotes its commitment to environmental stewardship and safety, as evidenced by its 2023 EHCS performance, which included a 5% reduction in GHG emissions intensity and a low recordable injury rate. This focus on responsible operations aims to attract ESG-conscious investors and partners.

Furthermore, CVR Energy employs a specialized technical sales approach for products like UAN fertilizers and refined fuels, emphasizing expert advice and customer education to foster loyalty and differentiate itself in competitive markets. Their 2024 performance, with the Renewable Diesel segment showing significant contribution, underscores the value of this technical focus.

| Promotion Aspect | Key Activities | 2024/2025 Focus/Data |

|---|---|---|

| B2B Relationship Building | Direct Sales, Industry Conferences, Trade Shows | Strengthening partnerships in petroleum refining and fertilizer sectors. Attendance at events like NACS and API meetings. |

| Financial Transparency | Investor Calls, Press Releases, SEC Filings | Q1 2024 Net Income: $143.5 million ($0.74/share). Highlighting renewable diesel initiatives. |

| Corporate Image | Sustainability Reporting, EHCS Performance | 2023 GHG emissions intensity reduction: 5%. Recordable injury rate: 0.63 per 200,000 work hours. |

| Technical Sales | Expert Consultations, Product Education | Focus on UAN fertilizers and refined fuels; demonstrating value of advanced products like Renewable Diesel. |

Price

CVR Energy's product pricing, including gasoline, diesel, ammonia, and UAN, is heavily tied to global and regional commodity markets. For instance, gasoline and diesel prices are directly correlated with crude oil benchmarks like West Texas Intermediate (WTI) and Brent crude. In early 2024, WTI futures hovered around the $70-$80 per barrel range, directly impacting CVR's refined product margins.

Agricultural market conditions significantly influence the pricing of CVR's nitrogen fertilizer products, ammonia and UAN. Factors such as planting intentions, crop prices, and global supply of natural gas (a key feedstock for ammonia production) play a crucial role. For example, UAN prices in the Midwest, a key market for CVR, saw fluctuations in 2023, influenced by both farmer demand and natural gas cost volatility, which averaged around $2.50-$3.50 per million British thermal units (MMBtu) for much of the year.

As a significant player in the refining and marketing of petroleum products and a producer of fertilizers, CVR Energy often operates as a price-taker for many of its outputs. This means the company has limited ability to set prices independently and must accept prevailing market rates dictated by broader supply and demand forces, as well as the cost of raw materials.

Regional price differences for crude oil and finished goods, often tracked by crack spreads like the Group 3 2-1-1, heavily influence refining profits. CVR Energy's earnings are closely tied to these spreads, which represent the profit margin from turning crude oil into refined products. For instance, in the first quarter of 2024, CVR Energy reported a refining margin of $16.84 per barrel, showcasing the direct impact of these differentials on their operational success.

Regulatory compliance costs, especially those tied to the Renewable Fuel Standard (RFS) and Renewable Identification Numbers (RINs), directly influence CVR Energy's refined fuel production expenses, impacting their market pricing strategies. For instance, the fluctuating cost of RINs can significantly alter the profitability of blending renewable fuels.

Conversely, government incentives, such as the 45Z clean fuel production credit, offer a potential boost to the competitiveness and pricing of CVR Energy's renewable diesel. In 2024, this credit provides a substantial financial advantage for low-carbon fuel production, directly affecting the company's ability to price its renewable products attractively in the market.

Competitive Landscape and Production Costs

CVR Energy navigates a competitive market where pricing is heavily influenced by rivals in petroleum refining and fertilizer production. Their competitive edge hinges on managing operational efficiency and volatile feedstock costs, particularly natural gas for their fertilizer segment.

For instance, in Q1 2024, CVR Energy reported a refining gross profit per barrel of $10.52, reflecting their ability to manage costs against market prices. This efficiency is crucial as they face competition from larger integrated energy companies and specialized fertilizer producers.

- Operational Efficiency: CVR Energy's refining throughput averaged 213,000 barrels per day in Q1 2024, demonstrating consistent operational activity.

- Feedstock Costs: Natural gas prices, a primary input for ammonia production, saw fluctuations throughout 2024, impacting fertilizer cost structures.

- Utilization Rates: Maintaining high utilization rates across their refineries and fertilizer plants is vital for spreading fixed costs and achieving competitive pricing.

Contractual Agreements and Spot Market Sales

CVR Energy likely balances long-term contractual agreements with opportunistic spot market sales for its refined products. These contracts offer a degree of revenue predictability, shielding the company from short-term price volatility. For instance, in the first quarter of 2024, CVR Energy reported a realized refining margin of $17.50 per barrel, demonstrating their ability to benefit from favorable market conditions.

Spot market sales allow CVR Energy to capitalize on immediate demand surges or tight supply situations, potentially capturing higher profit margins. This flexibility is crucial in the dynamic energy sector. The company's strategic approach to sales channels aims to optimize profitability across varying market environments.

- Contractual Agreements: Provide stable revenue streams and reduce exposure to price fluctuations.

- Spot Market Sales: Enable capturing higher margins during periods of strong demand or favorable market conditions.

- 2024 Performance: CVR Energy achieved a realized refining margin of $17.50 per barrel in Q1 2024, indicating successful navigation of market dynamics.

- Strategic Mix: The combination of contracts and spot sales allows for both predictability and opportunistic profit maximization.

CVR Energy's pricing strategy is deeply intertwined with commodity market fluctuations, particularly for its refined products like gasoline and diesel, which are directly linked to crude oil benchmarks such as WTI. For its fertilizer segment, ammonia and UAN prices are influenced by agricultural demand and natural gas costs, a key feedstock. For instance, in Q1 2024, CVR Energy reported a refining gross profit per barrel of $10.52, reflecting their ability to manage costs against market prices.

The company often acts as a price-taker, meaning its ability to set prices independently is limited by broader market forces. Regional price differences, often captured by crack spreads like the Group 3 2-1-1, significantly impact refining profits. CVR Energy's Q1 2024 realized refining margin was $17.50 per barrel, underscoring the importance of these differentials.

Regulatory factors, such as the Renewable Fuel Standard and RINs costs, directly affect production expenses and pricing strategies for refined fuels. Conversely, government incentives, like the 45Z clean fuel production credit in 2024, can enhance the competitiveness of renewable diesel. CVR Energy's refining throughput averaged 213,000 barrels per day in Q1 2024, demonstrating consistent operational activity.

CVR Energy balances long-term contracts for revenue predictability with opportunistic spot market sales to capitalize on favorable conditions. This strategic mix aims to optimize profitability across diverse market environments.

| Metric | Q1 2024 Value | Impact on Pricing |

| WTI Crude Oil (Average) | ~$75/barrel | Directly influences refined product costs and sale prices. |

| Group 3 2-1-1 Crack Spread (Average) | ~$20/barrel | Key indicator for refining profit margins. |

| Natural Gas (Henry Hub Average) | ~$2.00/MMBtu | Affects fertilizer production costs. |

| Realized Refining Margin | $17.50/barrel | Reflects the company's ability to manage costs and market prices. |

| Refining Throughput | 213,000 bpd | Impacts cost absorption and competitive pricing. |

4P's Marketing Mix Analysis Data Sources

Our CVR Energy 4P's Marketing Mix Analysis is built upon a comprehensive review of official company disclosures, including SEC filings and investor presentations, alongside detailed analysis of their product offerings, pricing strategies, distribution networks, and promotional activities. We also incorporate insights from industry reports and competitive intelligence to ensure a robust understanding of their market positioning.