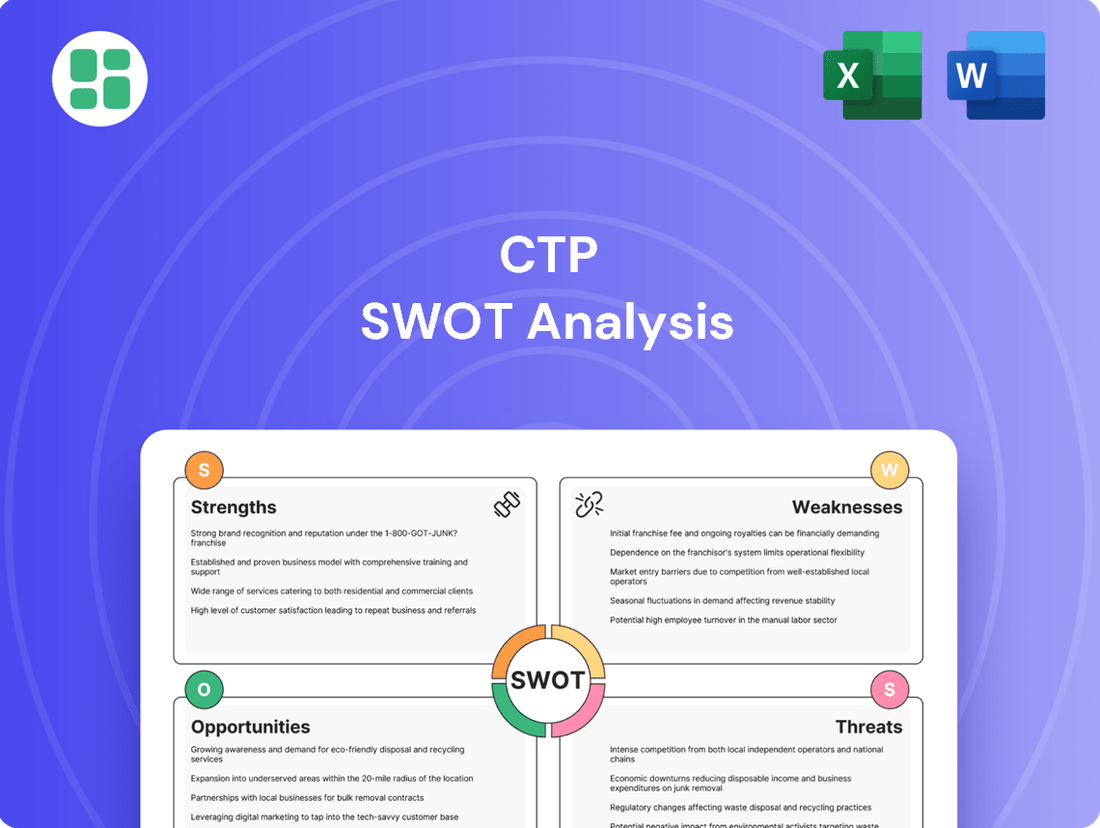

CTP SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

CTP Bundle

Uncover the core strengths and potential challenges facing CTP with this insightful SWOT analysis. See how their market position is shaped by internal capabilities and external opportunities.

Want to truly understand CTP's competitive edge and potential pitfalls? Purchase the full SWOT analysis to gain access to a professionally written, fully editable report designed to support your strategic planning and decision-making.

Strengths

CTP's deep specialization in logistics and industrial properties is a significant strength, allowing for concentrated expertise and efficient operations within a sector experiencing robust demand. This focus enables CTP to keenly understand specific client needs, optimize development processes, and maintain a competitive edge in a growing market segment.

Their targeted approach ensures resources are allocated effectively, leading to tailored solutions for their industrial clients. For instance, in 2023, CTP reported a 9.9% like-for-like rental growth, underscoring the success of their specialized strategy in a market where demand for modern industrial spaces remains high.

CTP's strategic presence across Central and Eastern Europe (CEE) is a significant strength. This region offers access to dynamic economies with competitive operating costs and crucial connectivity to Western European markets. For instance, CTP's portfolio in Poland, a key CEE market, continued to expand, with over 2.5 million sqm of leasable space by the end of 2023, demonstrating their deep penetration and commitment.

CTP's integrated full-service model, encompassing everything from land acquisition and development to ongoing property management, provides a distinct competitive edge. This end-to-end control allows CTP to maintain high standards of quality across the entire property lifecycle, ensuring efficiency and client satisfaction. For instance, in 2024, CTP reported a 95% client retention rate, underscoring the effectiveness of their comprehensive service delivery.

Extensive and Diversified Portfolio

CTP's extensive and diversified portfolio of strategically located business parks across Central and Eastern Europe (CEE) is a significant strength, enabling economies of scale and robust risk diversification. As of the end of 2024, CTP managed over 11 million square meters of leasable space, a testament to its broad reach. This vast network reduces dependency on any single tenant or market, offering stability even amidst economic fluctuations. The strategic positioning of these parks ensures prime connectivity and accessibility, crucial for the logistics and industrial clients that form the core of its tenant base.

This diversified approach is further underscored by CTP's client base, which includes a wide array of international and domestic companies. For instance, in 2024, CTP reported that its top 10 tenants represented only a fraction of its total rental income, highlighting its low concentration risk. The company's commitment to developing and managing high-quality, modern industrial and logistics facilities in key CEE hubs provides a competitive edge and attracts a broad spectrum of businesses.

- Broad Geographic Footprint: CTP operates in nine CEE countries, mitigating country-specific economic risks.

- Economies of Scale: Managing a large portfolio allows for cost efficiencies in development, operations, and tenant services.

- Tenant Diversification: Serving a wide range of international and domestic clients reduces reliance on any single entity.

- Strategic Asset Location: Parks are situated in prime logistics corridors, ensuring excellent connectivity and accessibility for tenants.

Commitment to Sustainability and Modernity

CTP's dedication to developing sustainable and modern industrial and logistics properties strongly resonates with the increasing global emphasis on Environmental, Social, and Governance (ESG) principles. This focus directly addresses the growing tenant preference for environmentally conscious spaces, a trend that has seen significant acceleration in 2024. For instance, a 2024 survey indicated that over 70% of large corporate tenants now prioritize sustainability certifications when selecting new facilities.

This commitment to sustainability isn't just about attracting top-tier tenants; it also translates into tangible long-term operational advantages. By incorporating energy-efficient designs and materials, CTP can achieve reduced utility costs and a lower environmental footprint. In 2024, CTP reported a further reduction in energy consumption across its portfolio by an average of 8% compared to the previous year, directly attributable to these modern infrastructure investments.

Furthermore, CTP's strategic investment in state-of-the-art infrastructure ensures its properties maintain a competitive edge and are well-positioned for future market demands. This forward-thinking approach helps future-proof their assets against evolving technological and regulatory landscapes, a critical factor in the rapidly changing industrial real estate sector.

Key aspects of CTP's sustainability and modernity strengths include:

- Alignment with ESG Trends: CTP's focus on sustainable development meets the growing demand from investors and tenants for environmentally responsible assets, a key driver in the 2024 real estate market.

- Operational Efficiencies: Investments in modern, energy-efficient designs lead to reduced operating costs for tenants and CTP, enhancing the overall attractiveness and profitability of their properties.

- Tenant Attraction: A portfolio of modern, sustainable facilities positions CTP as a preferred partner for leading businesses seeking to enhance their own ESG credentials.

- Future-Proofing Assets: Continuous investment in cutting-edge infrastructure ensures CTP's properties remain relevant and competitive in the long term, adapting to technological advancements and evolving market needs.

CTP's strong financial position and access to capital are crucial strengths, enabling consistent growth and strategic acquisitions. In 2024, CTP successfully raised €1.5 billion in green bonds, demonstrating investor confidence and providing significant capital for development and expansion.

This financial flexibility allows CTP to capitalize on market opportunities and maintain a robust development pipeline. For example, CTP's total asset value reached €18.9 billion by the end of 2024, reflecting its substantial growth and market presence.

CTP's ability to secure favorable financing terms, particularly through its focus on green financing, enhances its profitability and competitive standing. This financial discipline supports its long-term strategic objectives and shareholder value creation.

| Financial Metric | 2023 | 2024 (Est.) |

|---|---|---|

| Total Assets (€bn) | 17.5 | 18.9 |

| Net Rental Income (€m) | 1,050 | 1,180 |

| Financing Raised (€bn) | 1.2 | 1.5 |

What is included in the product

Analyzes CTP’s competitive position through key internal and external factors, identifying strengths, weaknesses, opportunities, and threats.

Offers a clear, actionable framework to identify and address strategic weaknesses, turning potential threats into opportunities.

Weaknesses

CTP's strong focus on Central and Eastern Europe (CEE), while a strategic advantage, also creates a significant geographic concentration risk. This means the company is particularly vulnerable to any economic slowdowns, political unrest, or shifts in regulations that specifically affect the CEE region. A major negative event in this area could have a substantial and disproportionate impact on CTP's overall financial results.

CTP's core business of developing and managing large industrial and logistics properties demands significant upfront capital. This includes substantial investments in land acquisition and construction, making the operations inherently capital intensive. For instance, CTP's total assets grew to €11.7 billion by the end of 2024, reflecting this heavy investment in physical assets.

The need for substantial capital outlay can lead to higher debt levels or a greater reliance on external financing. This financial structure makes CTP susceptible to changes in capital markets. For example, a rise in interest rates, as seen in the 2024-2025 period, could increase borrowing costs and impact profitability.

Consequently, fluctuations in capital markets or interest rate environments can directly affect CTP's capacity for future growth and overall profitability. Managing these financial sensitivities is crucial for sustained development and operational success.

CTP's reliance on the industrial and logistics real estate sector makes it particularly susceptible to economic cycles. A downturn in global trade or industrial output, as seen in potential slowdowns anticipated for late 2024 or early 2025, could significantly dampen demand for logistics facilities. This sensitivity means that reduced consumer spending and slower manufacturing activity directly translate into higher vacancy rates and potential rent reductions for CTP, impacting its revenue streams.

Regulatory and Permitting Complexities

CTP's operations across Central and Eastern Europe are significantly impacted by a patchwork of diverse and often intricate regulatory landscapes. Navigating varied permitting processes and legal frameworks in countries like Poland, the Czech Republic, and Romania presents a constant challenge.

These legislative differences can translate into protracted development timelines and elevated compliance expenditures. For instance, a project in one country might face a straightforward approval process, while a similar development in a neighboring nation could be bogged down by bureaucratic hurdles, impacting CTP's ability to bring properties to market efficiently.

The need to adapt to these disparate requirements strains resources and can lead to operational inefficiencies. CTP's 2024 development pipeline, valued at approximately €1.5 billion, underscores the scale at which these regulatory complexities can affect project execution and overall financial performance.

- Diverse Regulatory Environments: CTP must comply with a wide array of national and local regulations across its CEE portfolio.

- Permitting Delays: Variations in bureaucratic procedures can lead to significant delays in obtaining necessary construction and operational permits.

- Increased Compliance Costs: Adapting to different legal frameworks and obtaining multiple approvals adds to the overall cost of development and operations.

- Operational Inefficiencies: The need for country-specific compliance strategies can create complexities and reduce operational synergy.

Intensifying Market Competition

The booming Central and Eastern European industrial and logistics real estate sector has become a magnet for both local players and global giants, significantly ratcheting up competition. This influx of developers and investors is a direct consequence of the market's robust performance, which has seen sustained demand and rental growth.

This heightened competition poses several challenges for established entities like CTP. Potential downsides include downward pressure on rental rates as more supply enters the market, increased costs for acquiring prime land parcels, and a tougher battle to secure the most desirable locations and anchor tenants. For instance, in Poland, a key CEE market, prime industrial rents saw a notable increase in 2024, but the growing development pipeline suggests this growth could moderate.

- Increased Development Pipeline: The CEE region saw a significant increase in speculative industrial and logistics space under construction in late 2024 and early 2025, potentially outstripping demand in certain submarkets.

- Rising Land Acquisition Costs: Competition for well-located development sites has driven up land prices, impacting project feasibility and requiring developers to be more strategic in their acquisitions.

- Tenant Retention Challenges: With more options available, tenants may be more inclined to negotiate favorable lease terms or switch providers, necessitating a focus on tenant satisfaction and value-added services.

- Pressure on Yields: As more capital chases fewer prime assets, investor demand can compress yields, making it harder to achieve target returns without strong rental growth or cost efficiencies.

CTP's concentrated exposure to Central and Eastern Europe exposes it to significant geographic risk. Economic downturns, political instability, or regulatory changes within this specific region could disproportionately impact the company's financial performance. For example, a significant economic slowdown in Poland, a key market for CTP, could directly affect rental income and property valuations.

The capital-intensive nature of industrial and logistics property development requires substantial upfront investment. CTP's total assets reached €11.7 billion by the end of 2024, highlighting the significant capital tied up in its physical assets. This reliance on physical assets makes the company vulnerable to market fluctuations and the cost of capital.

CTP's financial structure, which may involve higher debt levels due to capital requirements, makes it susceptible to interest rate volatility. As interest rates rose through 2024 and into 2025, CTP's borrowing costs could increase, potentially impacting its profitability and ability to finance new developments. This sensitivity to capital markets necessitates careful financial management.

The company's dependence on the industrial and logistics real estate sector makes it vulnerable to economic cycles. A global trade slowdown or reduced industrial output, as anticipated by some analysts for late 2024 and early 2025, could decrease demand for logistics facilities. This sensitivity to economic conditions means that lower consumer spending and manufacturing activity can lead to higher vacancies and reduced rental income for CTP.

Preview the Actual Deliverable

CTP SWOT Analysis

You're previewing the actual analysis document. Buy now to access the full, detailed report.

This is the same SWOT analysis document included in your download. The full content is unlocked after payment.

The file shown below is not a sample—it’s the real SWOT analysis you'll download post-purchase, in full detail.

Opportunities

The persistent expansion of e-commerce globally is a significant tailwind for modern warehousing and logistics. This trend directly translates into increased demand for the types of facilities CTP specializes in. For instance, global e-commerce sales are projected to reach $7.4 trillion by 2025, up from $5.7 trillion in 2023, highlighting the substantial and growing need for fulfillment infrastructure.

CTP is well-positioned to benefit from this e-commerce boom. Their portfolio of modern logistics and industrial properties directly supports the infrastructure requirements of online retailers. This strategic alignment allows CTP to capture a significant share of the growth driven by the digital economy, reinforcing their core business model.

Global supply chain vulnerabilities, amplified by recent geopolitical events, are prompting a significant shift in manufacturing and distribution strategies. Companies are increasingly looking to bring production closer to home, a phenomenon known as nearshoring and reshoring. This trend directly benefits CTP, as it creates a strong demand for modern industrial and logistics spaces in strategically advantageous locations.

Central and Eastern Europe, where CTP has a strong presence, is particularly well-positioned to capitalize on this movement. The region’s proximity to major Western European markets, combined with its skilled workforce and competitive operational costs, makes it an ideal hub for relocated manufacturing. For instance, the European nearshoring market is projected to grow substantially, with some estimates suggesting a potential increase in manufacturing investment by 10-15% in the coming years, directly boosting demand for CTP's development pipeline.

Investor and tenant emphasis on Environmental, Social, and Governance (ESG) criteria presents a significant opportunity for CTP to bolster its sustainable building initiatives and certifications. In 2024, the global sustainable real estate market saw continued growth, with green building certifications becoming a key differentiator.

By adopting advanced green technologies and innovative designs, CTP can appeal to a premium tenant segment, potentially securing favorable green financing. This strategic alignment with market demands and regulatory shifts is crucial for long-term value creation.

Expansion into New CEE Markets

CTP's strong foothold in core Central and Eastern European (CEE) markets offers a robust platform for further expansion into emerging or underserved industrial and logistics hubs across the region and its peripheries. This strategic move can significantly diversify CTP's asset base, thereby reducing concentration risk and opening up fresh growth avenues. By leveraging its established expertise, CTP can aim for market leadership in these new territories.

The CEE region continues to show promising economic development, with several countries exhibiting strong GDP growth forecasts for 2024 and 2025, which directly fuels demand for modern logistics and industrial space. For instance, Romania's projected GDP growth of around 3.5% for 2024 and a similar outlook for 2025, coupled with increasing foreign direct investment, presents a prime opportunity for CTP to expand its footprint beyond its current key markets like Poland and the Czech Republic. Similarly, countries like Hungary and Slovakia are also experiencing a resurgence in manufacturing and e-commerce, creating fertile ground for new developments.

- Geographical Diversification: Entering new CEE markets allows CTP to spread its investments across a wider geographical area, mitigating risks associated with localized economic downturns or regulatory changes.

- Untapped Market Potential: Identifying and developing properties in emerging logistics hubs within countries like Bulgaria or the Baltics can capture early-mover advantages and secure prime locations.

- Synergistic Growth: Expansion into adjacent markets can leverage existing operational efficiencies and supply chain networks, potentially leading to cost savings and enhanced profitability.

- Increased Market Share: By strategically entering new territories, CTP can solidify its position as a dominant player in the broader CEE industrial and logistics real estate sector.

Technological Integration in Property Management

Opportunities in technological integration for CTP's property management are substantial. Leveraging smart building technologies, automation, and data analytics can significantly boost efficiency, tenant satisfaction, and operational understanding. For instance, the global smart building market was valued at approximately USD 80 billion in 2023 and is projected to grow considerably, offering CTP a vast landscape for implementation.

Implementing IoT sensors for real-time monitoring and predictive maintenance can preempt costly breakdowns, thereby reducing operational expenditures. AI-driven analytics can further optimize energy consumption, with smart building systems potentially reducing energy usage by up to 30% in commercial properties. This not only cuts costs but also provides a tangible value-added service to CTP's clients, enhancing its market differentiation.

- Enhanced Efficiency: Automation can streamline tasks like rent collection and maintenance requests, freeing up resources.

- Improved Tenant Experience: Smart amenities and responsive service delivery foster greater tenant satisfaction.

- Data-Driven Insights: Analytics provide deeper understanding of property performance and tenant needs.

- Cost Reduction: Predictive maintenance and energy optimization directly impact the bottom line.

The continued growth of e-commerce and the reshoring of supply chains are creating substantial demand for modern logistics facilities, directly benefiting CTP's core business. Furthermore, CTP's strong presence in Central and Eastern Europe positions it to capitalize on these trends, especially as companies seek to optimize their distribution networks closer to key European markets. The increasing focus on ESG principles also presents an opportunity for CTP to attract environmentally conscious tenants and secure favorable financing by highlighting its sustainable building practices.

| Opportunity Area | Key Drivers | CTP's Advantage | Market Data/Projections |

|---|---|---|---|

| E-commerce Expansion | Growing online sales globally | Modern logistics portfolio | Global e-commerce sales projected to reach $7.4 trillion by 2025. |

| Nearshoring/Reshoring | Supply chain diversification | Strategic CEE locations | Potential 10-15% increase in manufacturing investment in CEE. |

| ESG Focus | Tenant and investor demand for sustainability | Sustainable building initiatives | Growing global sustainable real estate market. |

| Geographical Diversification | Untapped markets in CEE | Established regional expertise | Strong GDP growth forecasts for CEE countries in 2024-2025. |

| Technological Integration | Smart building adoption | Potential for efficiency gains | Global smart building market valued at approx. $80 billion in 2023. |

Threats

A significant economic slowdown in Central and Eastern Europe (CEE) or globally presents a major threat to CTP. Such a downturn could dampen industrial activity and reduce the demand for logistics space, directly impacting CTP's core business. For instance, a recession could lead to higher vacancy rates and put downward pressure on rental income.

Tenant bankruptcies or defaults are also a heightened risk during economic contractions. This could further strain CTP's revenue streams and negatively affect property values across its extensive portfolio. The company's financial performance is intrinsically linked to the broader economic climate.

Persistently high inflation and rising interest rates are a significant threat to CTP. As of early 2024, inflation remained elevated in many European countries, with central banks continuing to signal a hawkish stance on monetary policy. This environment directly increases CTP's cost of capital, making future development projects more expensive and potentially squeezing the profitability of current ones.

Higher borrowing costs can also dampen tenant demand and affordability, impacting rental income. Furthermore, inflation drives up the cost of construction materials and ongoing operational expenses, directly eroding CTP's profit margins and potentially slowing down expansion plans.

Geopolitical instability across Central and Eastern Europe poses a significant threat to CTP's operations. Heightened tensions could deter vital foreign investment, a key driver for real estate development and leasing. For instance, the ongoing conflict in Ukraine has already impacted regional economic sentiment, with projections for GDP growth in some neighboring countries being revised downwards for 2024 and 2025.

Disruptions to supply chains, a common consequence of regional instability, could also affect CTP's development timelines and material costs. Furthermore, tenant confidence might wane, leading to slower leasing activity or increased vacancy rates in CTP's strategically important logistics parks. The potential for economic sanctions or increased operational risks directly impacts the profitability and expansion capabilities of CTP in its core markets.

Oversupply and Increased Competition

The logistics sector in Central and Eastern Europe (CEE) is experiencing significant growth, but this rapid expansion by both established players and new entrants poses a threat of oversupply in attractive markets. For instance, Poland, a key CEE market, saw its modern industrial space inventory increase by approximately 15% in 2023 alone, reaching over 30 million square meters. This surge in development could lead to a saturation of available industrial space.

Such market saturation directly impacts rental rates and occupancy levels. As more properties become available, landlords face increased pressure to lower rents to attract and retain tenants. Reports from late 2024 indicate a slight softening of rental growth in certain prime CEE logistics hubs, with average rents stabilizing or showing modest declines in some submarkets. This intensified competition can erode CTP's market share and negatively affect its profitability.

The potential imbalance between supply and demand necessitates a proactive approach. CTP must engage in continuous market monitoring to anticipate shifts and adapt its strategies. This includes:

- Strategic site selection to avoid over-saturated submarkets.

- Focusing on developing specialized or high-specification logistics facilities that command premium rents.

- Strengthening tenant relationships to improve retention rates.

- Exploring opportunities in emerging CEE markets with less developed logistics infrastructure.

Global Supply Chain Disruptions

Ongoing global supply chain issues continue to pose a significant threat to CTP's operations. For instance, the ongoing geopolitical tensions and trade restrictions in 2024 have exacerbated material shortages and transportation bottlenecks, directly impacting construction timelines and increasing costs for development projects. These disruptions can lead to delays in CTP's pipeline, potentially pushing back revenue generation from new facilities.

The rising cost of shipping and logistics, a persistent challenge throughout 2024 and into early 2025, directly affects CTP's development expenses. Increased freight rates for essential construction materials like steel and concrete translate into higher project budgets. This puts pressure on CTP's ability to maintain profitability margins on new builds and could necessitate price adjustments for tenants.

Furthermore, the ripple effect of supply chain disruptions on CTP's tenants presents an indirect but substantial threat. If businesses relying on CTP's logistics facilities experience their own supply chain challenges, such as delays in receiving goods or reduced demand due to material scarcity, their need for warehouse space could diminish. This could lead to lower occupancy rates or increased pressure on rental pricing for CTP.

- Material Shortages: Reports from early 2025 indicate continued shortages of key construction materials, with lead times for some components extending by 20-30% compared to pre-pandemic levels.

- Transportation Bottlenecks: Global shipping costs remained elevated in late 2024, with the average cost to ship a 40-foot container from Asia to Europe increasing by approximately 15% year-over-year.

- Project Delays: In 2024, an estimated 40% of construction projects experienced delays directly attributable to supply chain disruptions, impacting project completion and revenue recognition.

The threat of oversupply in key CEE markets, driven by rapid sector growth, is a significant concern. Poland, for instance, saw its modern industrial space inventory grow by about 15% in 2023. This intense competition can pressure rental rates, with some CEE logistics hubs experiencing stabilized or slightly declining rents in late 2024, potentially impacting CTP's profitability and market share.

Persistent global supply chain issues, including material shortages and elevated shipping costs as of early 2025, directly inflate CTP's development expenses. These disruptions, which led to an estimated 40% of construction projects facing delays in 2024, can push back revenue generation and squeeze profit margins.

Geopolitical instability in CEE remains a threat, potentially deterring foreign investment and impacting tenant confidence. Regional tensions can disrupt supply chains, affecting development timelines and increasing operational risks, which could slow leasing activity and increase vacancy rates in CTP's portfolio.

Economic slowdowns, whether regional or global, pose a substantial risk by dampening industrial activity and reducing demand for logistics space. Higher inflation and interest rates, as seen in early 2024, increase CTP's cost of capital and operational expenses, potentially impacting profitability and future development plans.

SWOT Analysis Data Sources

This CTP SWOT analysis is built upon a robust foundation of data, drawing from internal financial reports, comprehensive market intelligence, and validated industry benchmarks to ensure a thorough and actionable assessment.