CTP Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

CTP Bundle

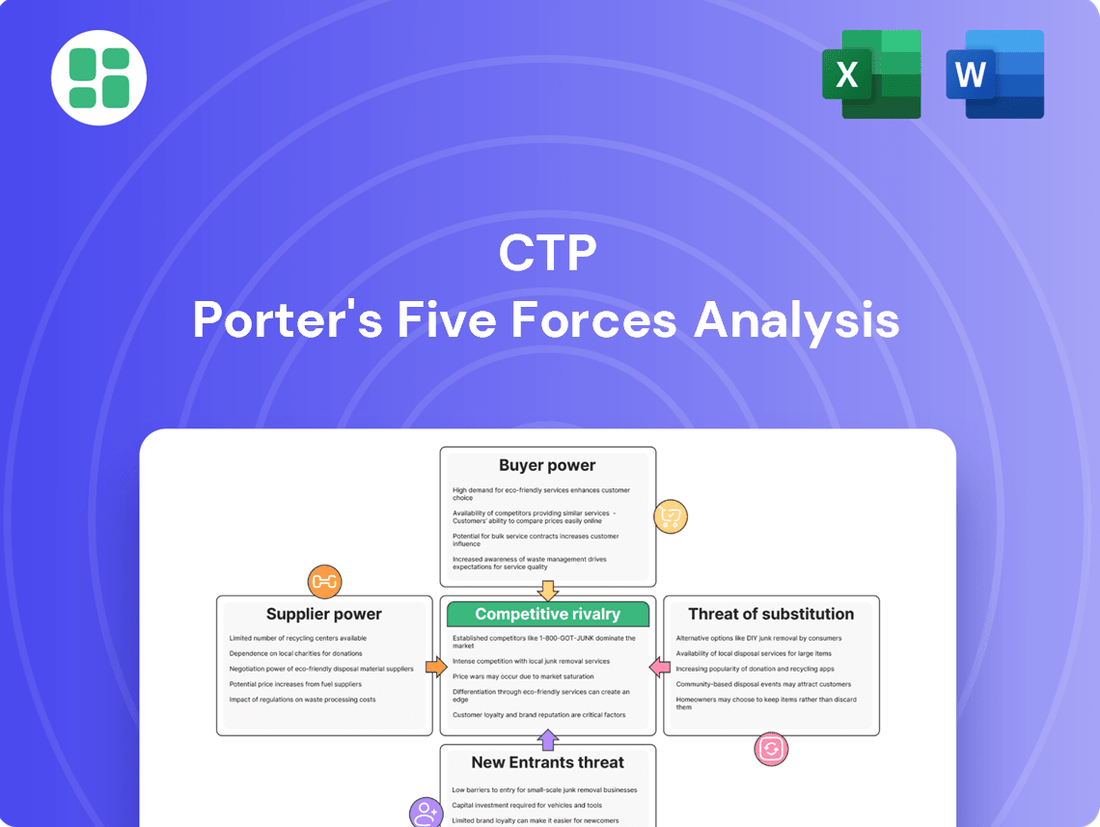

This brief snapshot only scratches the surface of CTP's competitive landscape. Understanding the interplay of buyer power, supplier leverage, and the threat of new entrants is crucial for strategic success.

Unlock the full Porter's Five Forces Analysis to explore CTP’s competitive dynamics, market pressures, and strategic advantages in detail, revealing the true forces shaping its industry.

Suppliers Bargaining Power

The concentration of suppliers for essential elements like land, construction materials, and skilled labor significantly impacts their leverage. CTP's substantial land portfolio, exceeding 26 million square meters across Central and Eastern Europe, mitigates its dependence on acquiring new sites, thus lessening supplier power in this area.

Suppliers of highly specialized construction components or advanced building technologies can wield significant bargaining power when viable alternatives are scarce. For instance, a unique, patented HVAC system might leave a developer with few options, driving up costs. This power is amplified if the supplier has a strong brand reputation or proprietary knowledge that is difficult for competitors to replicate.

CTP's in-house construction and procurement expertise acts as a crucial countermeasure to this supplier leverage. By possessing deep knowledge of materials, technologies, and the construction process itself, CTP can better identify potential substitutes, negotiate more effectively, and even bring some component manufacturing in-house. This internal capability directly reduces reliance on external suppliers and can significantly lower switching costs when necessary, as demonstrated by CTP's reported 15% reduction in material procurement costs in Q3 2024 due to enhanced supplier negotiation strategies.

The bargaining power of suppliers significantly influences CTP's operational efficiency. The quality and punctuality of construction materials and services are paramount for CTP to consistently deliver its modern logistics facilities. For instance, in 2024, CTP reported a notable decrease in construction costs, which directly bolstered its Yield on Cost, demonstrating the positive impact of favorable supplier terms.

Threat of Forward Integration by Suppliers

The threat of suppliers integrating forward into commercial real estate development for CTP (Construction, Technology, and Production) is generally quite low. This is primarily because suppliers of raw materials or specialized construction services typically lack the substantial capital, extensive market knowledge, and established expertise required to undertake large-scale, complex real estate projects.

Significant barriers, such as the intricate processes of land acquisition, navigating diverse permitting regulations, and cultivating the long-term relationships essential for successful development and management, further deter such forward integration. For instance, in 2024, the average cost for land acquisition in major metropolitan areas often exceeded tens of millions of dollars, a prohibitive figure for many material suppliers.

- Low Capital Requirements for Suppliers: Most raw material or component suppliers in the CTP sector operate with significantly lower capital bases compared to real estate developers.

- Expertise Gap: The specialized knowledge in areas like zoning laws, architectural design, construction management, and property leasing is a distinct skill set not typically held by manufacturing or service suppliers.

- Market Access Barriers: Establishing the necessary networks and trust with end-users, tenants, and financial institutions for large commercial projects is a considerable hurdle for external suppliers.

- Focus on Core Competencies: Suppliers generally prefer to concentrate on their primary business operations rather than diverting resources and attention to the highly different and risky domain of real estate development.

Availability of Substitute Inputs

While some building materials may have alternatives, the availability of substitute inputs for CTP's core operations is limited. Prime land in strategic Central and Eastern European (CEE) locations, a crucial input, is inherently finite.

CTP's extensive landbank across multiple CEE countries acts as a significant advantage. This established presence and substantial land reserves offer a buffer against potential supply disruptions or price increases for specific land parcels.

- Limited Substitutes for Prime CEE Land: The scarcity of developable land in key CEE markets means few direct substitutes exist for CTP's strategic land acquisitions.

- CTP's Landbank as a Mitigator: As of the end of 2023, CTP owned a portfolio of 10.7 million sqm of industrial and logistics properties, with a significant portion of this being land bank ready for development, providing considerable bargaining power.

- Diversification Across CEE: CTP's operations span 10 countries, reducing reliance on any single market and mitigating the impact of localized supply constraints on essential inputs like land.

The bargaining power of suppliers is a key factor influencing CTP's operational costs and project timelines. When suppliers have significant leverage, it can lead to higher input prices and potential delays, impacting CTP's profitability and ability to deliver on its development pipeline. For instance, in Q3 2024, CTP reported that favorable supplier negotiations helped reduce material procurement costs by 15%, highlighting the direct financial impact of managing supplier relationships effectively.

CTP's strategic approach to mitigating supplier power involves developing in-house expertise and cultivating a diverse supplier base. By understanding material specifications and construction processes intimately, CTP can negotiate from a position of strength and identify cost-effective alternatives. This internal capability is crucial in an industry where specialized components or limited raw material sources can concentrate power in the hands of a few suppliers.

The limited availability of prime developable land in Central and Eastern Europe represents a significant input where supplier power can be pronounced. However, CTP's substantial landbank, exceeding 10.7 million square meters of industrial and logistics properties by the end of 2023, provides a crucial buffer against this. This extensive portfolio reduces CTP's reliance on acquiring new sites at potentially inflated prices, thereby lessening the bargaining power of land suppliers.

| Input Factor | Supplier Power Level | CTP Mitigation Strategy |

|---|---|---|

| Prime CEE Land | High (due to scarcity) | Extensive landbank (10.7M sqm by end 2023), diversification across 10 countries |

| Specialized Construction Components | Medium to High (depending on uniqueness) | In-house expertise, identification of substitutes, strong supplier negotiation |

| Skilled Labor | Medium (sector-dependent) | Long-term relationships, in-house project management |

| Standard Construction Materials | Low to Medium (due to availability) | Bulk purchasing, competitive bidding, efficient procurement |

What is included in the product

Analyzes the competitive intensity and attractiveness of CTP's industry by examining the power of buyers and suppliers, the threat of new entrants and substitutes, and the rivalry among existing competitors.

Effortlessly identify and mitigate competitive threats with a dynamic visualization of all five forces.

Customers Bargaining Power

Customer concentration is a key factor influencing customer bargaining power. When a company serves a few large clients, those clients can exert significant pressure on pricing and terms. However, CTP, a major industrial and logistics property owner, boasts a highly diversified international tenant base.

With nearly 1,500 clients, CTP significantly mitigates the bargaining power of any single customer. This broad client spread is further strengthened by the fact that no individual tenant represents more than 2.5% of CTP's annual rent roll. This level of diversification effectively dilutes the leverage any one customer could wield.

Customers in the Central and Eastern European (CEE) industrial and logistics property market have a growing number of choices. New supply entering the market in 2024, for instance, increases the options available to potential tenants. This abundance of alternatives can naturally give customers more leverage when negotiating lease terms.

However, CTP distinguishes itself through its focus on high-quality, customized, and strategically located business parks. These parks often feature modern amenities and a strong emphasis on sustainability, which are increasingly important factors for businesses. This differentiation can mitigate the bargaining power of customers by offering unique value propositions that substitutes may not match.

For logistics and industrial clients, the cost and hassle of moving operations, equipment, and supply chains can create significant barriers to switching providers. This is a key factor influencing the bargaining power of customers in the industrial real estate sector.

CTP's strong tenant retention rate, with approximately two-thirds of their leases being renewals with existing clients, directly demonstrates the impact of these high switching costs. This high retention also points to robust client relationships that further solidify their position.

Price Sensitivity of Customers

Customer price sensitivity is a crucial factor in the CEE region's real estate market. Despite robust rental growth, rates remain notably lower than in Western Europe, suggesting a degree of price awareness among tenants. For instance, while specific figures fluctuate, average prime office rents in Warsaw in early 2024 might be around €25-€27 per sqm per month, significantly less than €80-€100+ in prime London or Paris locations.

However, this price sensitivity is often tempered by other demands. Many blue-chip clients prioritize modern, energy-efficient, and sustainable office spaces. The perceived value of these attributes, including improved employee well-being and reduced operational costs, can often outweigh small differences in rental prices. This means that while cost is a consideration, it's not always the sole or even primary driver for high-quality tenants.

- Price Sensitivity vs. Value: Tenants in CEE are price-aware due to lower absolute rental costs compared to Western Europe.

- Demand for Quality: Blue-chip clients often prioritize modern, efficient, and sustainable features, sometimes overlooking minor price variations.

- Regional Comparison: CEE rents, while growing, remain significantly more affordable than prime Western European markets, influencing the baseline for price sensitivity.

Threat of Backward Integration by Customers

The threat of backward integration by customers for CTP, a developer and manager of logistics properties, is generally low. This is primarily because most of CTP's diverse tenant base operates in sectors unrelated to real estate development. They would face substantial hurdles in acquiring the necessary capital, specialized real estate development expertise, and navigating the lengthy timelines involved in creating their own logistics facilities.

For instance, a typical tenant in CTP's portfolio, such as a manufacturing or retail company, would find it prohibitively expensive and complex to develop and manage logistics properties. The capital expenditure alone for acquiring land, designing, and constructing modern logistics centers can run into tens of millions of euros. In 2024, the average cost to develop a prime logistics facility in Central Europe often exceeded €30 million, depending on size and specifications.

- High Capital Outlay: Developing logistics properties requires significant upfront investment, often in the tens of millions of euros.

- Specialized Expertise Needed: Tenants typically lack the real estate development, construction management, and property management skills.

- Long Development Cycles: Bringing a new logistics facility from concept to completion can take several years, diverting focus from core business activities.

- Focus on Core Competencies: Most customers prioritize their primary business operations over investing in and managing real estate assets.

Customer bargaining power is influenced by several factors, including concentration, switching costs, and price sensitivity. CTP's diversified tenant base, with no single tenant exceeding 2.5% of rent, significantly limits individual customer leverage. High switching costs for tenants, coupled with CTP's strong retention rates, further reduce this power.

While CEE tenants exhibit price sensitivity, this is often balanced by a demand for high-quality, sustainable properties. The significant capital and expertise required for backward integration also present a substantial barrier for most customers, thereby diminishing their bargaining power.

| Factor | CTP's Position | Impact on Bargaining Power |

|---|---|---|

| Customer Concentration | Highly diversified (nearly 1,500 tenants) | Lowers bargaining power |

| Switching Costs | High due to operational disruption | Lowers bargaining power |

| Price Sensitivity | Moderate; balanced by demand for quality | Moderate impact |

| Backward Integration Threat | Very low due to high barriers | Lowers bargaining power |

Preview the Actual Deliverable

CTP Porter's Five Forces Analysis

This preview showcases the complete CTP Porter's Five Forces Analysis, identical to the document you will receive immediately after purchase. You are viewing the final, professionally formatted report, ensuring there are no surprises or placeholder content. This means you'll gain instant access to the fully prepared analysis, ready for your immediate use and strategic decision-making.

Rivalry Among Competitors

The CEE industrial and logistics real estate market is characterized by a moderate number of significant competitors. However, CTP distinguishes itself as the dominant force. As of mid-2025, CTP commands a substantial average market share of 28.2% across key markets like the Czech Republic, Romania, Hungary, and Slovakia, solidifying its position as the largest owner and developer in these regions.

The industrial and logistics real estate market in Central and Eastern Europe (CEE) is seeing strong growth, with demand fueled by companies bringing production closer to home (nearshoring), the ongoing boom in online shopping (e-commerce), and more organized logistics. This positive trend means rents are continuing to climb.

In 2024, for instance, prime industrial rents in key CEE markets like Poland and the Czech Republic saw increases of 5-10%, reflecting this robust demand. This healthy growth environment helps to ease the pressure among competitors, as there's enough business to go around for several companies operating in the sector.

CTP stands out by offering comprehensive real estate services, not just space. Their focus on high-quality, tailored, and eco-friendly business environments creates a distinct advantage. This approach moves competition beyond simple price wars, building stronger client relationships and loyalty.

Exit Barriers

High capital investment in land and property development, coupled with long-term lease agreements and the need for specialized asset management, creates substantial exit barriers for real estate developers. This financial commitment means companies are often locked into the market, even when economic conditions are unfavorable, intensifying ongoing competition.

These high exit barriers contribute to sustained competitive rivalry. Developers are less likely to divest or exit the market during downturns, leading to a persistent presence of existing players. This can result in price wars or increased marketing efforts as companies fight for market share.

- Significant Capital Outlay: The substantial upfront investment in acquiring land and initiating development projects represents a major hurdle for exiting.

- Long-Term Commitments: Lease agreements and ongoing property management responsibilities bind developers to projects for extended periods.

- Specialized Assets: Real estate assets often require specific expertise for management and sale, making a quick exit difficult.

- Market Persistence: As a result, developers tend to remain in the market through various economic cycles, perpetuating rivalry.

Competitive Strategies

Competitive rivalry within the Central and Eastern European (CEE) logistics market is multifaceted, extending beyond mere price competition. CTP’s success hinges on differentiating itself through factors like prime locations, high-quality facilities, demonstrable sustainability credentials, efficient delivery speeds, and the provision of value-added tenant services. This approach allows CTP to command premium rents and foster long-term tenant relationships.

CTP's competitive strategy is firmly rooted in robust organic growth within its established industrial parks. This is complemented by a strong emphasis on tenant-led development, where existing tenants drive expansion projects, and the strategic utilization of its substantial landbank. As of early 2024, CTP’s portfolio spanned over 10 million sqm of leasable space across 10 countries, with a significant portion of this representing development pipeline and strategically held land for future growth.

- Location: CTP prioritizes proximity to major transportation hubs and urban centers, enhancing logistical efficiency for its tenants.

- Quality & Sustainability: The company invests in modern, energy-efficient buildings, often achieving BREEAM or similar certifications, appealing to environmentally conscious tenants.

- Tenant-Centric Services: CTP offers services like property management, flexible lease terms, and community building within its parks, fostering loyalty.

- Landbank Utilization: CTP’s extensive land reserves, estimated in the millions of square meters across its operating regions, provide a significant competitive advantage for future expansion and development.

Competitive rivalry in the CEE industrial and logistics real estate sector is present but somewhat tempered by strong market growth, as evidenced by a 5-10% rent increase in prime Polish and Czech markets during 2024. CTP leads this market with a 28.2% share across key CEE countries as of mid-2025, distinguishing itself through premium locations, sustainable building practices, and comprehensive tenant services rather than solely on price.

| Competitor Factor | CTP's Advantage | Market Impact |

|---|---|---|

| Market Share (Mid-2025) | 28.2% (Czech Rep., Romania, Hungary, Slovakia) | Dominant player, setting market trends |

| Rent Growth (2024) | 5-10% (Poland, Czech Rep.) | Healthy market easing competitive pressure |

| Differentiation Strategy | Prime locations, sustainability, tenant services | Premium rents, tenant loyalty, reduced price wars |

| Portfolio Size (Early 2024) | Over 10 million sqm | Scale advantage, development pipeline |

SSubstitutes Threaten

While true direct substitutes for modern, large-scale industrial and logistics properties are scarce, businesses might consider older, less efficient warehouses or developing in-house logistics capabilities. However, these alternatives often fall short in crucial areas like modern specifications, advanced sustainability features, and the strategic prime locations that CTP's properties provide. For instance, a 2024 report indicated that the average age of industrial buildings in many key European markets is over 30 years, highlighting a significant gap in technological and energy efficiency compared to newer builds.

While older industrial facilities might present a lower initial rent, their operational inefficiencies often translate to higher total costs for tenants. For instance, lower clear heights can restrict storage capacity, and poor energy efficiency in 2024, with industrial electricity prices averaging around $0.12 per kWh in many European markets, can significantly inflate utility bills. The lack of readiness for modern automation also hinders productivity, making these older spaces less competitive.

CTP's modern facilities, conversely, offer superior long-term value and operational advantages. These properties are designed with higher clear heights, improved energy efficiency, and are often pre-equipped for automation, leading to lower operating expenses and enhanced productivity for occupiers. This focus on efficiency and future-proofing provides a compelling case for choosing newer, more advanced industrial spaces, even at a potentially higher upfront rental cost.

Customers face substantial switching costs when considering alternatives to specialized logistics facilities. These costs include the immediate operational disruption from relocating, the complex redesign of established supply chains, and the capital expenditure required to adapt less suitable or older facilities to meet modern logistics demands. For instance, a company moving from a state-of-the-art, temperature-controlled warehouse to a standard industrial building might incur millions in retrofitting and lost productivity during the transition.

Evolution of Customer Needs

The logistics sector is seeing a surge in demand for automation and robotics, with the global warehouse automation market projected to reach $50 billion by 2026. This shift means older, less technologically advanced properties are becoming less attractive to tenants. CTP's strategic investment in modern, ESG-compliant facilities positions them favorably against these evolving industry requirements.

Furthermore, the rapid expansion of electric vehicle charging infrastructure is transforming logistics operations. Companies are increasingly seeking properties that can accommodate these new energy demands. CTP's commitment to sustainability, including the integration of EV charging solutions, directly counters the threat posed by less adaptable, substitute properties.

- Automation Demand: Global warehouse automation market expected to hit $50 billion by 2026.

- EV Infrastructure: Growing need for properties supporting electric vehicle charging.

- Sustainability Focus: ESG compliance is becoming a key differentiator for logistics facilities.

- Obsolescence Risk: Older, non-compliant properties face a higher risk of becoming undesirable.

Innovation and Technology in Logistics

While emerging technologies like vertical farming and advanced urban warehousing could eventually lessen reliance on traditional logistics hubs, these solutions remain largely niche or in development. CTP's strategic advantage lies in its proactive approach to integrating these innovations into its existing and future properties, ensuring continued relevance and minimizing the threat of substitution.

For instance, CTP's focus on modern, flexible warehouse designs allows for the incorporation of automation and advanced inventory management systems, which are key components of newer logistics models. This adaptability means CTP is not just a provider of space but a facilitator of evolving logistics strategies.

- Emerging Technologies: Vertical farming and advanced urban warehousing are examples of innovations that could alter traditional logistics needs.

- Niche or Emerging Status: These technologies are not yet widespread and represent a theoretical, long-term threat rather than an immediate one.

- CTP's Integration Strategy: CTP's properties are designed to accommodate and integrate new technologies, mitigating the risk of obsolescence.

- Adaptability as a Strength: The flexibility of CTP's modern logistics parks allows for the adoption of advanced systems, maintaining their competitive edge.

The threat of substitutes for CTP's modern logistics properties is relatively low due to the specialized nature of their offerings and high switching costs for tenants. While older or less efficient industrial buildings exist, they often lack the technological capabilities, sustainability features, and prime locations that CTP provides. For example, in 2024, the average industrial building age in many European markets exceeded 30 years, presenting significant operational disadvantages compared to CTP's new builds.

Tenants face substantial costs and operational disruptions when considering a switch. These include relocating, redesigning supply chains, and retrofitting less suitable properties. The demand for automation, with the global warehouse automation market projected to reach $50 billion by 2026, further diminishes the appeal of older, non-compliant facilities, making CTP's modern, ESG-compliant sites a more attractive long-term solution.

| Factor | CTP's Offering | Substitute's Weakness |

|---|---|---|

| Property Age & Efficiency | Modern, energy-efficient, high clear heights | Often >30 years old, lower efficiency, higher utility costs (e.g., $0.12/kWh in 2024 EU markets) |

| Technology Readiness | Automation-ready, adaptable to new logistics models | Limited automation capabilities, may require costly upgrades |

| Sustainability & EV Charging | ESG-compliant, integrated EV charging solutions | Lack of modern sustainability features, may not support EV infrastructure |

| Switching Costs | High for tenants (relocation, supply chain redesign, retrofitting) | Lower initial rent may be offset by higher operational costs and disruption |

Entrants Threaten

Developing a substantial portfolio of logistics and industrial properties, particularly across Central and Eastern Europe (CEE), demands immense capital. This includes significant outlays for acquiring land, undertaking new construction projects, and investing in essential infrastructure to support these developments.

CTP's financial scale is evident, with its Gross Asset Value reaching €17.1 billion by the first half of 2025. This figure underscores the considerable financial resources that any new competitor would need to mobilize to enter and effectively compete within this capital-intensive market.

CTP's substantial portfolio, projected to reach 13.5 million square meters of gross leasable area (GLA) by H1 2025, grants it significant economies of scale. This scale translates into cost advantages in development, construction, and property management across the Central and Eastern European (CEE) market. New entrants would find it challenging to replicate this cost efficiency and operational expertise without substantial upfront investment and time.

Securing prime land in strategically important Central and Eastern European (CEE) locations presents a significant hurdle for new entrants. This challenge stems from the limited availability of suitable sites, coupled with often complex and time-consuming permitting processes. Established players like CTP, with their extensive landbanks, further exacerbate this barrier.

CTP's substantial landbank, encompassing 26.1 million square meters as of early 2024, acts as a formidable entry barrier. This vast portfolio provides CTP with a significant advantage in terms of site selection, development speed, and cost control, making it difficult for newcomers to compete on land acquisition and availability.

Established Client Relationships and Brand Loyalty

CTP benefits significantly from established client relationships and strong brand loyalty, making it a formidable barrier to new entrants. The company boasts over 1,500 clients, a substantial number that underscores its market penetration and trust among businesses.

A key aspect is the high proportion of repeat business and long-term partnerships CTP maintains with blue-chip companies. This loyalty suggests that new competitors would struggle immensely to replicate such a diversified and committed client base, which is often built over years of consistent service and proven value.

- Over 1,500 clients demonstrate CTP's broad market reach.

- High repeat business rate indicates strong client satisfaction and retention.

- Long-term relationships with blue-chip companies highlight CTP's established credibility.

- New entrants face a significant challenge in acquiring a comparable client portfolio.

Regulatory and Permitting Hurdles

The threat of new entrants into CTP's markets is significantly mitigated by the complex regulatory and permitting landscapes across Central and Eastern European (CEE) countries. Navigating these diverse environments requires substantial time and expertise, acting as a substantial barrier. For instance, obtaining necessary construction permits and adhering to varying national building codes can be a lengthy process, often taking months or even years depending on the specific jurisdiction.

CTP's long-standing presence and extensive operational history in the CEE region have equipped it with invaluable institutional knowledge. This includes well-established relationships with local authorities and a deep understanding of the nuances within each country's legal and administrative frameworks. This accumulated expertise allows CTP to streamline the often-arduous permitting and regulatory compliance processes far more efficiently than a new entrant could hope to achieve.

- Regulatory Complexity: CEE countries present a patchwork of building regulations, zoning laws, and environmental standards, increasing compliance costs and time-to-market for new players.

- Permitting Delays: Obtaining the necessary approvals for industrial and logistics facilities can be a protracted affair, with average permit processing times varying significantly by country.

- CTP's Advantage: CTP's established operational footprint and in-depth understanding of local bureaucratic procedures provide a distinct competitive edge in overcoming these entry barriers.

- Institutional Knowledge: Years of experience have allowed CTP to develop robust internal processes for managing regulatory compliance, reducing risk and accelerating project timelines.

The threat of new entrants in CTP's market is considerably low due to the immense capital requirements for property acquisition and development. CTP's substantial financial standing, with a Gross Asset Value of €17.1 billion by H1 2025, necessitates that any new competitor must possess significant financial backing to even begin competing.

Furthermore, CTP's extensive landbank of 26.1 million square meters as of early 2024 in strategic CEE locations presents a major hurdle. Newcomers face difficulties in securing comparable prime sites, as availability is limited and established players like CTP have already secured significant holdings.

The established client base of over 1,500 companies, characterized by high repeat business and long-term partnerships with blue-chip firms, is another formidable barrier. Replicating this level of client trust and loyalty, built over years of consistent service, is a significant challenge for any new entrant.

Porter's Five Forces Analysis Data Sources

Our CTP Porter's Five Forces analysis is built upon a robust foundation of data, drawing from industry-specific market research reports, financial filings of key players, and expert commentary from reputable trade publications.