CTP PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

CTP Bundle

Unlock the critical external factors shaping CTP's destiny. Our comprehensive PESTLE analysis dives deep into the political, economic, social, technological, legal, and environmental forces at play. Equip yourself with actionable intelligence to anticipate challenges and seize opportunities. Download the full PESTLE analysis now and gain the strategic clarity you need to propel CTP forward.

Political factors

CTP's operational certainty hinges on the political stability within its key Central and Eastern European markets. For instance, Poland, a significant market for CTP, has maintained a relatively stable political landscape, fostering a conducive environment for foreign direct investment. This stability is vital for CTP's long-term development projects, which often span many years and require predictable regulatory frameworks.

Consistent government policies are paramount for CTP's investment strategy. In 2024, many CEE nations continued to emphasize policies that attract foreign capital and protect property rights, crucial for real estate developers like CTP. For example, Hungary's commitment to streamlined permitting processes for industrial parks has been a positive factor for CTP's expansion there.

However, potential shifts in political leadership or policy direction present a risk. A change in government in Romania, for example, could lead to a review of existing property development regulations or tax incentives, potentially impacting CTP's planned investments and operational costs. Such uncertainties require CTP to maintain robust risk management strategies.

European Union policies significantly shape CTP's operational landscape, particularly given its strong presence in EU member states and closely aligned countries. For instance, the EU's commitment to a single market and the facilitation of cross-border trade, as evidenced by initiatives aimed at reducing trade barriers, directly impact CTP's logistics and supply chain efficiency. These policies can unlock new market opportunities or streamline existing operations.

Regional development funds allocated by the EU can also play a crucial role in CTP's expansion strategies. In 2024, the EU continued to invest heavily in infrastructure projects across Central and Eastern Europe, with billions earmarked for transportation networks. CTP can leverage these investments to improve its logistical capabilities and reach new customer bases.

Furthermore, the ongoing harmonization of legal and regulatory frameworks across the EU, a core tenet of integration, simplifies CTP's cross-country operations. This reduces compliance complexities and allows for more seamless management of its diverse portfolio of properties and services throughout the region.

International trade agreements and geopolitical shifts significantly shape demand for logistics and industrial properties, directly impacting CTP's market. For instance, the ongoing adjustments to post-Brexit trade flows in the UK and the EU continue to influence supply chain strategies, potentially increasing the need for strategically located warehousing.

Disruptions like trade wars or regional conflicts can impede the movement of goods, directly affecting occupancy and rental income for CTP's portfolio. The conflict in Ukraine, for example, has led to rerouted shipping and increased transportation costs across Eastern Europe, a key region for CTP's operations, necessitating careful risk assessment.

CTP's strategic planning must actively monitor geopolitical tensions across Europe, particularly in Eastern and Central European markets. Understanding how these tensions might affect client operations and their demand for industrial space is crucial for maintaining strong occupancy rates and rental yields, especially as global trade patterns evolve.

Foreign Investment Regulations

Foreign investment regulations significantly impact CTP's capacity to secure land and undertake property development across Central and Eastern European (CEE) markets. Changes in these policies, including shifts in investment incentives, can directly affect CTP's strategic growth plans and its ability to execute new projects.

Favorable foreign direct investment (FDI) policies are crucial as they attract multinational corporations, thereby boosting the demand for CTP's industrial and logistics real estate solutions. For instance, in 2024, several CEE countries continued to refine their FDI frameworks to attract capital, with some offering enhanced tax breaks or streamlined approval processes for large-scale developments.

- 2024 FDI inflows to CEE countries saw a moderate increase, driven by sectors like manufacturing and logistics.

- Specific CEE nations are actively promoting FDI through targeted incentives, potentially lowering acquisition costs for developers like CTP.

- Regulatory stability and predictability regarding foreign ownership and land acquisition are key determinants for CTP's investment decisions.

Infrastructure Development Policies

Governments globally are showing a strong commitment to upgrading transportation networks. For instance, the European Union's Connecting Europe Facility (CEF) program has allocated significant funding towards TEN-T (Trans-European Transport Network) projects, aiming to improve rail, road, and waterway connectivity. This directly benefits companies like CTP, which operate business parks, by making their locations more accessible to clients and suppliers. Such investments can lower logistics costs and boost operational efficiency for tenants.

Public-private partnerships (PPPs) are increasingly being utilized to finance and manage large-scale infrastructure development. In 2024, many countries are actively seeking private sector involvement in road and rail upgrades. These collaborations can accelerate project timelines and bring private sector expertise to bear, ultimately enhancing the overall quality and reach of transport infrastructure. For CTP, this means improved accessibility to their parks and a more attractive proposition for businesses relying on efficient logistics.

The strategic development of new logistical hubs and corridors presents significant growth avenues. For example, initiatives like the Belt and Road Initiative, while broad, have spurred development in key transit regions, creating new opportunities for industrial and logistics parks. Governments investing in these corridors can unlock new markets and improve supply chain resilience. CTP can leverage these developments by strategically acquiring or developing land in proximity to these new logistical arteries, positioning itself to capitalize on increased demand.

Key infrastructure investment trends for 2024-2025 include:

- Increased government spending on high-speed rail networks across Europe and Asia.

- Focus on port modernization and expansion to handle growing global trade volumes, with significant investments planned in major Asian and European ports.

- Expansion of digital infrastructure, including 5G networks and smart city technologies, which are becoming integral to modern logistics and business park operations.

- Government incentives for green infrastructure projects, such as electric vehicle charging networks and sustainable transport solutions, aligning with CTP's focus on ESG principles.

Political stability and consistent government policies are crucial for CTP's long-term development projects, especially in its key Central and Eastern European markets. In 2024, many CEE nations continued to focus on attracting foreign capital and protecting property rights, with Hungary, for example, streamlining permitting processes for industrial parks. However, potential shifts in government or policy direction in countries like Romania could introduce regulatory uncertainties, necessitating robust risk management for CTP.

European Union policies significantly influence CTP's operations, particularly through the facilitation of cross-border trade and the allocation of regional development funds for infrastructure projects. The EU's ongoing harmonization of legal and regulatory frameworks across member states simplifies CTP's cross-country management and compliance efforts.

Geopolitical shifts and international trade agreements impact demand for industrial properties, affecting CTP's market. For instance, evolving post-Brexit trade flows continue to shape supply chain strategies, potentially increasing the need for strategically located warehousing. The conflict in Ukraine has already rerouted shipping and increased transportation costs across Eastern Europe, a key region for CTP.

Foreign investment regulations are vital for CTP's land acquisition and development plans. In 2024, several CEE countries refined their FDI frameworks, offering enhanced tax breaks and streamlined approval processes to attract capital, which directly boosts demand for CTP's real estate solutions.

| Factor | Impact on CTP | 2024/2025 Data/Trend |

|---|---|---|

| Political Stability | Ensures predictable regulatory environment for long-term projects. | CEE markets generally stable, fostering FDI; Poland remains a key market with consistent policies. |

| Government Policies | Attracts foreign capital and protects property rights, crucial for development. | Hungary's streamlined permitting and CEE nations' FDI incentives are positive. |

| EU Policies | Facilitates cross-border trade, streamlines operations, and provides development funds. | EU's TEN-T program invests billions in infrastructure, enhancing logistics connectivity. |

| Geopolitical Shifts | Influences supply chain strategies and demand for industrial space. | Ukraine conflict rerouted shipping, increasing costs; post-Brexit trade flows affect warehousing demand. |

| FDI Regulations | Affects land acquisition and development capacity. | CEE countries refining FDI frameworks with tax breaks and faster approvals in 2024. |

What is included in the product

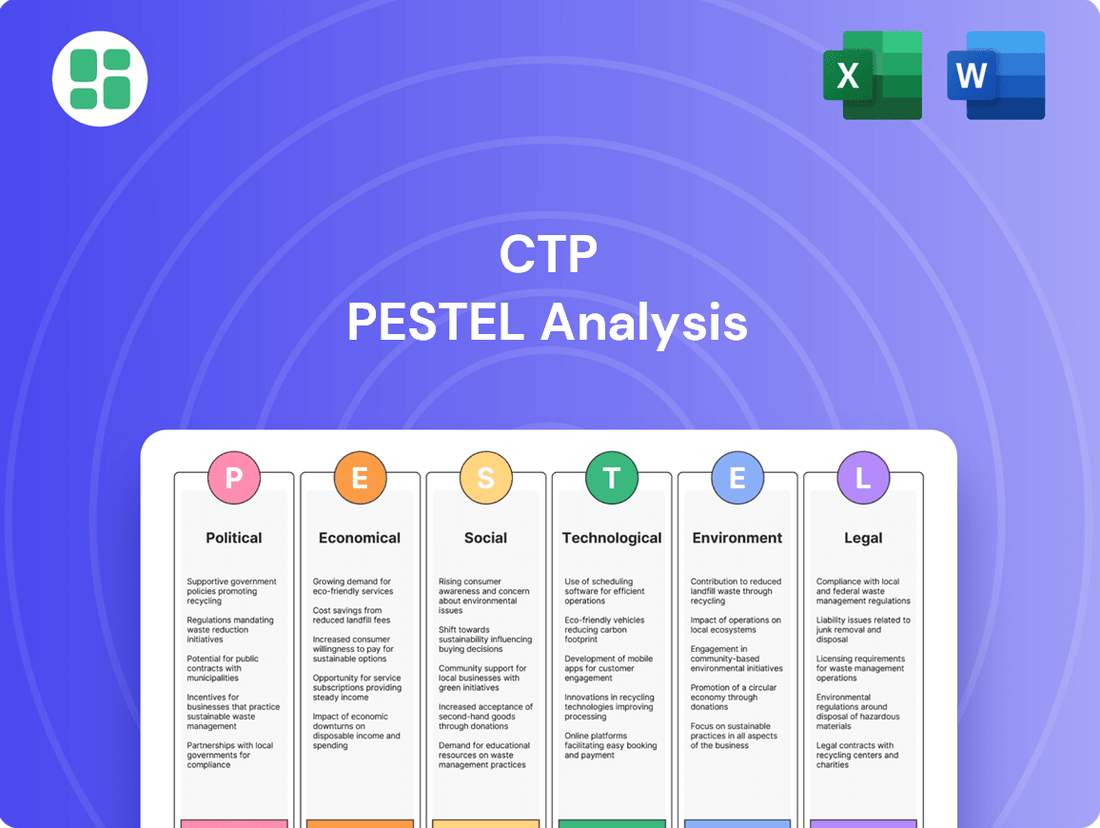

The CTP PESTLE Analysis systematically examines the Political, Economic, Social, Technological, Environmental, and Legal forces impacting the CTP, providing a comprehensive understanding of the external landscape.

The CTP PESTLE Analysis provides a clear, actionable framework that helps mitigate the confusion and overwhelm often associated with complex external environmental scans.

Economic factors

Central and Eastern European (CEE) economies are showing resilience, with projected GDP growth of around 2.5% to 3.5% for 2024 and a similar outlook for 2025, according to recent IMF and World Bank forecasts. This steady economic expansion directly fuels demand for industrial and logistics properties, as increased manufacturing output and cross-border trade necessitate greater warehousing and distribution capacity. For CTP, this translates into a stronger market for their logistics parks.

Economic stability within the CEE region is a crucial factor for CTP's success. Lower inflation rates, projected to moderate further in 2024-2025, and stable employment figures reduce business uncertainty, encouraging companies to invest in expanding their operational footprints. This stability makes the CEE region an attractive destination for foreign direct investment, further bolstering the demand for modern logistics infrastructure that CTP provides.

High inflation and rising interest rates present significant challenges for CTP. For instance, in early 2024, inflation in key European markets remained elevated, contributing to increased construction material and labor costs. This directly impacts CTP's development pipeline, potentially increasing project expenses by 5-10% compared to previous years.

The current interest rate environment, with central banks like the ECB maintaining higher rates through late 2024 and into 2025, escalates CTP's cost of capital. This makes financing new acquisitions and development projects more expensive, potentially reducing profit margins on new ventures. For example, a 1% increase in interest rates could add millions to the annual financing costs for a large portfolio.

Conversely, a stable or declining interest rate environment, anticipated by some analysts for late 2025, would offer CTP greater financial predictability. This stability is crucial for accurately assessing the feasibility of long-term projects and managing rental income against financing obligations, allowing for more confident strategic planning.

The relentless growth of e-commerce in Europe, projected to reach €1.5 trillion by the end of 2024, fuels an insatiable demand for advanced logistics and distribution centers. This surge necessitates sophisticated supply chain infrastructure to meet consumer expectations for rapid delivery.

Geopolitical shifts and a focus on supply chain resilience are prompting a move towards re-shoring and near-shoring manufacturing and distribution within Europe. This trend is creating significant demand for industrial properties situated closer to key consumer markets.

CTP is strategically positioned to capitalize on these trends, with its portfolio of modern logistics parks located in prime European hubs. For instance, CTP's presence in Poland, a key near-shoring destination, saw occupancy rates exceeding 95% in its industrial parks throughout 2024.

Foreign Direct Investment (FDI) Inflows

Sustained foreign direct investment into Central and Eastern European (CEE) countries is a critical driver for CTP's property demand, particularly in manufacturing and logistics. FDI signals economic growth and directly translates into a need for modern industrial and warehouse spaces, which CTP specializes in. For instance, in 2023, FDI inflows into CEE countries remained robust, with Poland attracting significant investment in its automotive and technology sectors, boosting demand for CTP's facilities there.

CTP's success is intrinsically linked to its capacity to attract and cater to these international investors. The company's established presence and high-quality offerings provide a competitive edge in securing these crucial tenants. For example, CTP's portfolio in Romania saw increased interest from German manufacturing firms in early 2024, seeking to expand their production capabilities within the EU.

- Poland's FDI in 2023: Significant inflows, particularly into manufacturing and technology, indicating strong demand for industrial space.

- CTP's Competitive Advantage: Ability to serve international clients with high-quality industrial and logistics properties.

- Romanian Market in Early 2024: Increased interest from German manufacturers seeking to expand operations.

Labor Market Dynamics and Costs

The availability and cost of labor in Central and Eastern European (CEE) countries significantly shape operational expenses for CTP's clients. This directly impacts their decisions to invest and, consequently, the demand for CTP's industrial and logistics properties. A region boasting a skilled and affordable workforce is a magnet for manufacturing and logistics companies looking to optimize their supply chains.

Wage inflation and potential labor shortages are critical considerations for CTP. For instance, while Poland's unemployment rate remained low at around 3.0% in early 2024, wage growth has been a persistent factor. Similarly, Romania experienced average gross monthly wages increasing by approximately 10-12% year-on-year in late 2023 and early 2024. These trends can affect the competitiveness of certain CEE locations, necessitating CTP's careful analysis during site selection to ensure continued client interest and operational viability.

- Skilled Workforce Attraction: Regions with readily available skilled labor, such as Poland and the Czech Republic, continue to attract advanced manufacturing and R&D operations, boosting demand for modern industrial spaces.

- Wage Growth Impact: Average wage increases in countries like Hungary and Slovakia, potentially exceeding 8-10% annually in 2024, influence the overall cost-competitiveness for businesses operating in these markets.

- Labor Shortages: In sectors facing specific skill gaps, such as specialized logistics or advanced manufacturing technicians, potential labor shortages can deter investment, prompting CTP to assess local talent pools and infrastructure.

- Operational Cost Sensitivity: Clients in labor-intensive industries closely monitor labor cost trends; a significant uptick in wages can shift their investment focus to alternative locations within or outside the CEE region.

The economic landscape of Central and Eastern Europe (CEE) presents a mixed but generally positive outlook for CTP. While GDP growth is projected to remain steady around 2.5% to 3.5% for 2024 and 2025, indicating continued demand for logistics and industrial properties, businesses are navigating persistent inflation and higher interest rates. These factors increase operational costs and financing expenses, influencing investment decisions and the overall cost-competitiveness of CEE locations.

| Economic Factor | 2024 Projection/Observation | 2025 Outlook | Impact on CTP | Supporting Data/Example |

|---|---|---|---|---|

| GDP Growth (CEE) | 2.5% - 3.5% | Similar to 2024 | Fuels demand for logistics properties due to increased trade and manufacturing. | IMF and World Bank forecasts |

| Inflation | Moderating but remains a concern | Further moderation expected | Increases construction and operational costs for CTP and its clients. | Elevated in key European markets in early 2024 |

| Interest Rates | Higher, maintained by central banks | Potential for stabilization or slight decline later in the year | Escalates cost of capital, impacting project financing and margins. | ECB rates remained elevated through late 2024 |

| E-commerce Growth | Continued strong growth | Projected to continue | Drives demand for advanced distribution centers. | European e-commerce market to reach €1.5 trillion by end of 2024 |

| Foreign Direct Investment (FDI) | Robust inflows into CEE | Expected to remain strong | Signals economic growth and boosts demand for industrial spaces. | Poland attracted significant FDI in 2023 for manufacturing and technology |

Preview Before You Purchase

CTP PESTLE Analysis

The CTP PESTLE Analysis preview you see is the exact document you’ll receive after purchase—fully formatted and ready to use.

This is a real screenshot of the product you’re buying—delivered exactly as shown, no surprises.

The content and structure shown in the preview is the same document you’ll download after payment, providing a comprehensive overview of the political, economic, social, technological, legal, and environmental factors impacting your CTP.

Sociological factors

Central and Eastern Europe (CEE) continues to see significant urbanization, with major cities experiencing population growth. This trend directly fuels demand for strategically placed logistics and distribution hubs, bringing them closer to the dense consumer bases in these urban centers. For instance, Warsaw's population is projected to reach 3.1 million by 2030, highlighting the increasing need for efficient last-mile solutions.

Demographic shifts also play a crucial role. An aging population in many CEE countries, like Poland where the median age is around 43 years, can affect the availability of a younger, more mobile workforce essential for logistics operations. Conversely, migration patterns, both internal and external, can reshape labor pools, requiring CTP to adapt its location strategies to access necessary talent.

Consumers' increasing comfort with online shopping is a significant driver for CTP. This shift directly translates into a greater demand for advanced logistics facilities. As e-commerce continues its upward trajectory across Central and Eastern Europe (CEE), the need for modern warehouses, efficient fulfillment centers, and well-connected distribution hubs escalates.

CTP's strategic positioning in logistics properties allows it to capitalize on these evolving consumer purchasing habits. For instance, in 2024, e-commerce sales in CEE were projected to reach over €120 billion, a substantial increase from previous years, underscoring the growing reliance on robust supply chains.

The availability of a skilled workforce is paramount for CTP's operations and its tenants. In 2024, many European countries, including those where CTP operates, are experiencing persistent labor shortages in logistics and warehousing. For instance, Germany's logistics sector reported a deficit of around 60,000 qualified drivers in early 2024, a figure that impacts operational efficiency across the board.

A lack of specialized skills, such as in automation technology for modern warehouses or property management expertise, can further strain operations and increase costs. CTP may need to strategically select locations with robust labor pools or invest in training programs. In Poland, for example, where CTP has a significant presence, there's a growing demand for skilled warehouse workers, with some regions seeing wage increases of up to 15% year-on-year for these roles as of Q1 2024 due to high demand.

Quality of Life and Employee Well-being

The quality of life in areas surrounding CTP's business parks significantly impacts their appeal to potential tenants. Access to amenities like green spaces, recreational facilities, and convenient transportation options contributes to employee satisfaction. For instance, CTPark Prague East benefits from its proximity to Prague's extensive public transport network and nearby natural areas, enhancing its attractiveness.

Companies are placing a growing emphasis on employee well-being, making the work environment a key factor in talent acquisition and retention. This trend means that industrial park developers like CTP must consider aspects beyond just the physical infrastructure. A 2024 survey indicated that over 70% of employees consider the work environment and amenities when evaluating job offers.

CTP's commitment to developing modern, sustainable business parks aligns with this growing demand for enhanced employee well-being. Their parks often feature amenities such as on-site services, fitness areas, and ample green spaces. This focus on creating a holistic and positive work environment can be a significant differentiator for CTP in attracting and retaining high-caliber tenants.

- Employee Well-being as a Priority: A 2024 study by Deloitte revealed that 65% of companies are increasing their investment in employee well-being programs, directly impacting real estate decisions.

- Green Spaces and Amenities: CTPark Bucharest West, for example, includes extensive green areas and planned amenities, reflecting a trend where companies seek locations that support a healthy work-life balance for their staff.

- Talent Attraction: Companies located in business parks with superior quality of life offerings report a 15% higher employee retention rate, according to a 2025 industry analysis.

- Sustainability and Health: CTP's focus on BREEAM certification for its parks, with many achieving ‘Very Good’ or ‘Excellent’ ratings, signals a commitment to healthier indoor environments, which is increasingly valued by tenants.

Sustainability Awareness and Corporate Social Responsibility

Societal awareness regarding sustainability and corporate social responsibility is profoundly reshaping business landscapes. Consumers and business partners alike are increasingly prioritizing environmental, social, and governance (ESG) principles in their decision-making. This trend directly impacts how companies like CTP select their operational strategies and choose their collaborations.

Tenants, in particular, are demonstrating a clear preference for properties that reflect their own ESG commitments. This translates into a growing demand for green buildings and developers who actively engage in responsible practices. For example, in 2024, a significant percentage of commercial real estate investors indicated that ESG factors were a primary consideration in their investment decisions, a figure projected to climb further by 2025.

CTP's strategic focus on developing sustainable and modern facilities is therefore highly advantageous. This commitment not only aligns with evolving societal expectations but also directly addresses the growing corporate responsibility mandates faced by their tenants. By offering environmentally conscious infrastructure, CTP is well-positioned to attract and retain clients who value these principles.

- Growing Tenant Demand: By 2025, it's estimated that over 70% of large corporations will have publicly stated ESG targets, driving demand for compliant real estate.

- Green Building Certification: Properties with certifications like BREEAM or LEED are seeing higher occupancy rates and rental premiums.

- Investor Focus: ESG-focused real estate funds attracted record inflows in 2024, signaling a strong market preference for sustainable assets.

- Reputational Advantage: Companies demonstrating strong CSR are perceived more favorably, enhancing brand loyalty and market position.

Societal shifts towards valuing employee well-being are influencing corporate real estate decisions, with companies increasingly seeking locations that offer a high quality of life. This includes access to amenities, green spaces, and convenient transportation, as demonstrated by CTPark Prague East's integration with Prague's public transport. A 2024 Deloitte study found 65% of companies are increasing investment in employee well-being programs, directly impacting property choices.

The growing emphasis on corporate social responsibility (CSR) and sustainability is also a key sociological factor. Tenants are prioritizing partners and properties that align with their ESG targets, driving demand for green buildings and developers with strong environmental credentials. By 2025, over 70% of large corporations are expected to have public ESG targets, making sustainable infrastructure a critical differentiator for CTP.

The increasing comfort with online shopping across Central and Eastern Europe is a significant driver for CTP's logistics business. This e-commerce growth, projected to exceed €120 billion in CEE in 2024, directly fuels the need for modern warehousing and efficient distribution networks. CTP's strategically located properties are well-positioned to meet this escalating demand for advanced logistics facilities.

| Sociological Factor | Impact on CTP | Supporting Data (2024/2025) |

|---|---|---|

| Urbanization & Population Growth | Increased demand for urban logistics hubs | Warsaw population projected to reach 3.1 million by 2030 |

| Employee Well-being Focus | Need for amenity-rich, high-quality work environments | 65% of companies increasing investment in well-being (Deloitte 2024) |

| E-commerce Growth | Escalating demand for modern warehousing and fulfillment centers | CEE e-commerce sales projected over €120 billion in 2024 |

| ESG Prioritization | Tenant preference for sustainable and responsible properties | 70% of large corporations to have public ESG targets by 2025 |

Technological factors

The logistics sector is rapidly embracing automation and robotics, a trend that significantly shapes warehouse design. CTP needs to ensure its properties can support these advanced systems, requiring features like increased clear heights for automated storage and retrieval systems (AS/RS), reinforced floors to handle heavy robotic loads, and robust power infrastructure. For instance, the global warehouse robotics market was valued at approximately $7.1 billion in 2023 and is projected to reach $18.5 billion by 2030, indicating a strong demand for suitable facilities.

The integration of IoT and smart building technologies is significantly boosting operational efficiency and tenant experience in CTP's portfolio. For instance, smart sensors can monitor occupancy and environmental conditions, enabling dynamic adjustments to lighting and HVAC systems, leading to an estimated 15-20% reduction in energy consumption for comparable properties in 2024.

Predictive maintenance, powered by IoT data, allows CTP to anticipate equipment failures, minimizing downtime and associated costs. This proactive approach can reduce unexpected maintenance expenses by up to 30% in managed facilities, ensuring business continuity for tenants.

Furthermore, these advanced systems enhance building security through real-time monitoring and access control, providing a safer environment. CTP's adoption of these innovations positions them to offer superior, data-driven property management, attracting and retaining tenants seeking modern, efficient workspaces.

Data analytics offers CTP significant advantages, providing deep insights into property performance, tenant preferences, and evolving market dynamics. By leveraging this data, CTP can make more strategic decisions, such as optimizing rental pricing or identifying underperforming assets. For instance, in 2024, real estate firms increasingly adopted AI-driven analytics to forecast occupancy rates, with some reporting a 10-15% improvement in leasing efficiency.

Predictive maintenance, fueled by data from sensors and historical records, allows CTP to anticipate and address potential issues before they escalate. This proactive approach minimizes unexpected disruptions and reduces costly emergency repairs, benefiting both CTP and its tenants. Early adopters of predictive maintenance in the commercial real estate sector have seen operational cost reductions of up to 20% in building management.

These technological advancements collectively boost the attractiveness and operational efficiency of CTP's real estate portfolio. By ensuring properties are well-maintained and responsive to market demands, CTP can enhance tenant satisfaction and potentially command higher rental yields, contributing to a stronger financial performance in the competitive 2024-2025 market.

Advanced Construction Techniques and Materials

Innovations in construction are rapidly reshaping the industry. Modular construction, for instance, saw significant growth, with the global modular construction market projected to reach over $200 billion by 2027, according to some industry forecasts. This approach allows for faster project completion and reduced on-site waste, directly impacting cost-efficiency and sustainability.

3D printing in construction is another area gaining traction, enabling complex designs and potentially lowering material costs. While still emerging, pilot projects have demonstrated its capability to build structures significantly faster than traditional methods. The adoption of advanced materials, such as self-healing concrete or recycled composites, also contributes to more durable and environmentally friendly developments.

For CTP, embracing these technological advancements offers a distinct competitive advantage. For example, by integrating modular building techniques, CTP could potentially reduce construction timelines by up to 30-50% on certain projects, as reported in industry case studies. This speed, combined with enhanced sustainability through new materials, positions CTP to deliver superior business spaces more effectively in the 2024-2025 period.

Key technological factors impacting CTP include:

- Modular Construction: Offers faster build times and reduced on-site labor needs. Global market growth is robust, indicating increasing industry adoption.

- 3D Printing: Enables complex architectural designs and potential material cost savings, though widespread commercial application is still developing.

- Sustainable Materials: Innovations like low-carbon concrete and recycled building components improve environmental footprints and long-term durability.

- Digitalization: Building Information Modeling (BIM) and AI-driven project management enhance efficiency, reduce errors, and improve collaboration across development phases.

Digitalization of Property Management

The ongoing digitalization of property management is fundamentally reshaping how real estate portfolios are operated. For CTP, this means leveraging digital platforms to streamline tenant communication, automate lease management, and enhance facility services. This shift not only boosts operational efficiency but also significantly improves the overall tenant experience, a critical factor in today's competitive market.

By implementing robust digital solutions, CTP can achieve greater transparency and responsiveness across its vast property holdings. For instance, integrated property management software can provide real-time data on maintenance requests, lease renewals, and occupancy rates, allowing for quicker decision-making and proactive problem-solving. This technological advancement is crucial for CTP to maintain its position as a provider of comprehensive, full-service real estate solutions.

The market for proptech (property technology) solutions is experiencing significant growth, with investments projected to reach substantial figures. For example, global proptech investment reached over $30 billion in 2023, indicating a strong industry trend towards digital transformation. CTP's adoption of these technologies aligns with this trend, enabling:

- Enhanced Tenant Engagement: Digital portals for rent payments, maintenance requests, and community updates improve tenant satisfaction.

- Streamlined Operations: Automation of administrative tasks like lease administration and financial reporting frees up resources.

- Data-Driven Insights: Real-time analytics on property performance allow for optimized asset management and strategic planning.

Technological advancements are fundamentally altering the logistics and real estate sectors, necessitating strategic adaptation by CTP. Automation and robotics are transforming warehouse operations, requiring facilities with higher clear heights and reinforced floors to support systems like AS/RS. The global warehouse robotics market, valued at approximately $7.1 billion in 2023, is expected to reach $18.5 billion by 2030, highlighting the demand for technologically advanced logistics spaces.

IoT and smart building technologies are enhancing operational efficiency and tenant experience, with smart sensors potentially reducing energy consumption by 15-20% in 2024. Predictive maintenance, driven by IoT data, can cut unexpected maintenance costs by up to 30%, ensuring business continuity. Data analytics, increasingly powered by AI, is improving leasing efficiency by 10-15% for real estate firms in 2024, enabling more strategic property management decisions.

Innovations in construction, such as modular building and 3D printing, are also key technological factors. Modular construction, projected to exceed $200 billion by 2027, can reduce project timelines by 30-50%. The adoption of advanced materials and digital tools like BIM further contributes to efficiency and sustainability in development projects.

The digitalization of property management, driven by a growing proptech market that saw over $30 billion in investments in 2023, streamlines operations and enhances tenant engagement. This digital transformation allows for better data-driven insights, leading to optimized asset management and strategic planning for CTP.

| Technology Area | Key Advancement | Impact on CTP | Market Data/Projection |

|---|---|---|---|

| Automation & Robotics | Automated Storage and Retrieval Systems (AS/RS) | Requires higher clear heights, reinforced floors, robust power infrastructure. | Global warehouse robotics market: $7.1B (2023) to $18.5B (2030). |

| IoT & Smart Buildings | Sensors for occupancy, environmental monitoring | Reduces energy consumption (15-20% potential), enhances tenant experience, enables predictive maintenance. | Predictive maintenance can reduce unexpected costs by up to 30%. |

| Data Analytics | AI-driven forecasting and performance analysis | Improves leasing efficiency (10-15% reported), informs strategic asset management. | Real estate firms increasingly adopting AI for occupancy rate forecasting. |

| Construction Technology | Modular construction, 3D printing, advanced materials | Faster build times (30-50% reduction potential for modular), reduced waste, enhanced durability. | Modular construction market projected to exceed $200B by 2027. |

| Digitalization | Proptech solutions, digital property management platforms | Streamlines operations, enhances tenant engagement, provides real-time data insights. | Global proptech investment exceeded $30B in 2023. |

Legal factors

CTP's expansion hinges on meticulous adherence to varied zoning, land use, and building regulations across Central and Eastern Europe. These legal frameworks directly influence project viability, site selection, and construction timelines, requiring expert navigation.

For instance, in Poland, recent updates to the spatial planning law aim to streamline development processes, but localized interpretations still demand careful attention. Similarly, Romania's evolving building codes, particularly concerning seismic resilience, necessitate robust design adaptations, impacting construction costs and schedules.

Efficiently managing these diverse legal requirements is paramount for CTP to maintain its development momentum and ensure project success within the CEE region.

CTP's operations are heavily influenced by environmental protection laws, requiring strict adherence to regulations concerning emissions, waste management, and biodiversity to secure necessary permits for new developments. Compliance with local and EU environmental directives, such as the Industrial Emissions Directive and the Water Framework Directive, directly impacts site selection, construction techniques, and ongoing operational procedures.

The environmental permitting process itself can be a significant hurdle, often proving lengthy and complex. For instance, in 2024, the average time to obtain environmental permits for large infrastructure projects across the EU saw an increase, with some countries reporting delays of over 18 months, impacting project timelines and initial investment costs.

The legal frameworks governing commercial leases and contractual agreements across Central and Eastern European (CEE) countries significantly influence CTP's revenue and tenant interactions. For instance, variations in landlord-tenant laws, such as notice periods for lease termination or rules around rent adjustments, can directly affect CTP's income predictability. In 2024, CTP reported that its rental income was a primary driver of its financial performance, underscoring the importance of these legal structures.

Navigating diverse contract enforcement and dispute resolution mechanisms across CEE markets is essential for CTP's extensive client portfolio. A 2025 report highlighted that efficient legal systems can reduce the time and cost associated with resolving contractual disagreements, which is critical for maintaining positive tenant relationships and minimizing operational disruptions. CTP's reliance on long-term leases means that the stability and fairness of these legal processes are paramount.

Therefore, CTP's commitment to robust legal counsel is indispensable for the meticulous drafting and execution of sound lease agreements. This ensures compliance with local regulations and mitigates potential risks, safeguarding CTP's assets and operational integrity. In 2024, CTP's legal department played a key role in finalizing several major development projects, with lease agreements forming the bedrock of their financial viability.

Labor Laws and Employment Regulations

Labor laws in the Central and Eastern European (CEE) countries where CTP operates significantly impact both its direct workforce and, indirectly, the operational expenses and practices of its tenants. For instance, minimum wage adjustments in countries like Poland, a key market for CTP, directly affect labor costs for businesses operating within CTP's industrial parks. As of early 2024, Poland's minimum wage stands at PLN 4,242 gross per month, with further increases planned for July 2024 to PLN 4,300 gross. This influences the overall cost-competitiveness of manufacturing and logistics operations in the region.

Regulations governing working conditions, such as maximum working hours and health and safety standards, also play a crucial role. These regulations can affect the operational efficiency and attractiveness of specific CEE locations for industrial tenants. CTP, therefore, must maintain rigorous compliance with all national labor legislation across its portfolio to ensure fair employment practices and to support its tenants in doing the same.

- Minimum Wage Impact: CTP's tenants in Poland face a gross minimum wage of PLN 4,242 in the first half of 2024, rising to PLN 4,300 in the second half, directly impacting their labor expenditure.

- Working Condition Standards: Adherence to strict working hour limits and safety regulations in CEE countries influences tenant operational models and the overall appeal of industrial sites.

- Compliance Burden: CTP is responsible for ensuring its own operations and indirectly supporting tenant compliance with diverse national labor laws across its CEE footprint.

Property Acquisition and Ownership Laws

Laws governing land acquisition, property registration, and the extent to which foreign entities can own real estate differ significantly across Central and Eastern European (CEE) countries. This variability directly influences CTP's capacity to grow its land portfolio. For instance, while some CEE nations have streamlined processes for foreign investors, others impose stricter limitations or require specific legal structures for property acquisition.

Changes in property taxation, such as adjustments to capital gains tax or property holding taxes, can impact CTP's profitability and the overall valuation of its assets. Furthermore, the risk of expropriation or changes in eminent domain laws, though generally low in stable CEE markets, remains a legal consideration that can affect long-term investment strategies and asset security. CTP's business model, heavily reliant on acquiring and developing land, necessitates a deep and current understanding of these evolving legal frameworks.

- Varying Foreign Ownership Restrictions: Some CEE countries, like Poland and the Czech Republic, have relatively open policies, while others may have more complex requirements for non-EU buyers or specific land types.

- Property Registration Efficiency: The time and cost associated with registering property ownership can range from a few weeks in some jurisdictions to several months in others, impacting project timelines.

- Tax Law Volatility: For example, changes in corporate tax rates or specific property-related levies introduced in 2024 or anticipated for 2025 in key CEE markets could alter CTP's net returns.

- Expropriation Risk Assessment: While not a frequent occurrence, understanding the legal recourse and compensation mechanisms in case of government land acquisition is crucial for risk management.

Legal frameworks governing competition and anti-trust practices across CEE nations are critical for CTP's market positioning and expansion strategies. For instance, adherence to merger control regulations is essential for any potential acquisitions or significant partnerships. In 2024, several CEE countries intensified their scrutiny of market concentration in the logistics and real estate sectors, potentially impacting CTP's growth avenues.

Intellectual property rights protection is also a key legal consideration, particularly as CTP increasingly leverages technology and innovative building solutions. Ensuring robust IP protection safeguards CTP's proprietary designs and operational advancements from infringement. The legal landscape surrounding data privacy, especially with the implementation of GDPR and its national adaptations, directly influences how CTP manages tenant data and internal operations, with significant penalties for non-compliance.

CTP's ability to secure and enforce contracts, including construction agreements and service contracts, is fundamental to its operational efficiency and financial stability. Variations in contract law and dispute resolution mechanisms across CEE markets necessitate careful legal drafting and proactive risk management to ensure timely project delivery and reliable income streams.

Environmental factors

Climate change is increasingly impacting CTP's real estate portfolio through more frequent and severe extreme weather events. For instance, the European Environment Agency reported that the economic damage from weather and climate-related disasters in Europe reached €50.9 billion in 2023 alone, a significant increase from previous years. This directly translates to physical risks like flooding in low-lying areas, heatwaves impacting building efficiency and occupant comfort, and severe storms causing structural damage to CTP's properties.

To mitigate these risks, CTP needs to embed climate resilience into its design and construction phases, ensuring new developments can withstand anticipated environmental stresses. This might involve elevated building foundations, advanced cooling systems, and robust roofing materials. Furthermore, a review of insurance strategies is critical to ensure adequate coverage for potential damages and to maintain business continuity for tenants, especially in regions identified as high-risk by climate projection models.

CTP's commitment to green building certifications like BREEAM and LEED is increasingly vital as demand for sustainable properties surges. By aligning with these international standards, CTP not only showcases its dedication to environmental stewardship but also boosts property value and satisfies the growing ESG mandates from tenants and investors. These certifications directly impact choices in materials, energy consumption, and how sites are managed.

Focusing on energy efficiency in building design and operations, alongside the integration of renewable energy sources like solar panels, is crucial for reducing operational costs and environmental footprint. CTP's commitment to sustainable and modern facilities includes minimizing energy consumption and exploring on-site renewable energy generation for its parks.

This strategic approach aligns with both environmental goals and financial savings, as seen in the growing global investment in renewables. For instance, global renewable energy capacity additions reached a record 510 gigawatts (GW) in 2023, a 50% increase from 2022, according to the International Energy Agency (IEA). This trend highlights the increasing economic viability and regulatory push towards cleaner energy solutions.

Waste Management and Circular Economy Principles

Effective waste management is paramount for CTP's developments, aligning with stringent environmental regulations and fostering a sustainable operational model. This includes proactive strategies for waste reduction, recycling, and reuse throughout the construction and operational phases. For instance, in 2024, the European Union reported that construction and demolition waste accounted for approximately 37% of total waste generated, highlighting the significance of CTP's commitment to minimizing this impact.

Adopting circular economy principles offers a pathway to significantly reduce resource consumption and waste generation. CTP can achieve this by prioritizing the selection of durable, recyclable, and reusable materials in its building designs and construction methods. By 2025, the demand for sustainable building materials is projected to grow, with the global green building materials market expected to reach over $400 billion, underscoring the market advantage of such a strategy.

- Waste Reduction Targets: Implementing specific, measurable targets for waste diversion from landfills across all CTP projects in 2024-2025.

- Circular Material Sourcing: Prioritizing suppliers who offer materials with high recycled content or are designed for disassembly and reuse, a trend gaining traction in the 2025 construction landscape.

- Operational Waste Streams: Developing comprehensive plans for managing operational waste within CTP's parks, aiming for increased recycling rates by 15% by the end of 2025.

- Life Cycle Assessment: Integrating life cycle assessments for key building components to inform material selection and minimize environmental footprint, a practice becoming standard in forward-thinking development.

Biodiversity and Land Stewardship

CTP's extensive development activities inherently interact with local ecosystems, underscoring the critical importance of biodiversity preservation and responsible land stewardship. This focus is not merely about compliance but about fostering sustainable growth. For instance, in 2024, CTP committed to enhancing biodiversity across its portfolio, with specific targets for increasing green cover at new developments.

Minimizing ecological disruption and protecting natural habitats are key components of CTP's environmental strategy. By integrating green spaces and employing sensitive development practices within its business parks, CTP aims to mitigate negative environmental impacts. This approach can significantly enhance the overall appeal and long-term value of its properties for tenants and the surrounding communities.

- Site Selection: CTP prioritizes locations that minimize disruption to sensitive ecosystems, often favoring brownfield sites or areas with lower ecological value.

- Habitat Protection: Development plans include measures to protect existing natural habitats, such as establishing buffer zones around wetlands or woodlands.

- Green Infrastructure: The integration of green roofs, living walls, and native landscaping is a growing trend in CTP's new business park designs, contributing to urban biodiversity.

- Ecological Impact Assessments: Thorough assessments are conducted for all new projects to identify and address potential impacts on local flora and fauna.

Environmental factors present both risks and opportunities for CTP's real estate operations. Increased frequency of extreme weather events, as evidenced by the €50.9 billion in economic damage from weather and climate-related disasters in Europe in 2023, necessitates climate-resilient design and robust insurance strategies. Simultaneously, the growing demand for sustainable properties, driven by ESG mandates, positions CTP's focus on green certifications and energy efficiency as a key competitive advantage.

CTP's commitment to sustainability is further reinforced by the global surge in renewable energy capacity, which reached a record 510 GW in 2023. By integrating renewable sources and prioritizing energy efficiency, CTP can reduce operational costs and enhance its appeal to environmentally conscious tenants. The company's focus on waste reduction and circular economy principles, including the sourcing of materials with high recycled content, aligns with the significant portion of construction and demolition waste generated in the EU, approximately 37% in 2024.

Biodiversity preservation and responsible land stewardship are integral to CTP's development strategy, with a focus on minimizing ecological disruption. The integration of green infrastructure, such as green roofs and native landscaping, is becoming a standard practice in new park designs, contributing to urban biodiversity and enhancing property value. Thorough ecological impact assessments are crucial for new projects to address potential impacts on local flora and fauna.

| Environmental Factor | Impact on CTP | Key Data/Trend (2023-2025) | Strategic Response |

| Extreme Weather Events | Physical damage, increased insurance costs | European economic damage from weather events: €50.9 billion (2023) | Climate-resilient design, enhanced insurance coverage |

| Demand for Sustainable Properties | Increased property value, tenant attraction | Global green building materials market projected to exceed $400 billion by 2025 | BREEAM/LEED certifications, energy efficiency, renewable energy integration |

| Renewable Energy Transition | Operational cost savings, reduced carbon footprint | Global renewable energy capacity additions: 510 GW (2023), a 50% increase from 2022 | On-site solar panel installation, energy-efficient building operations |

| Waste Management & Circularity | Regulatory compliance, resource efficiency | Construction and demolition waste: ~37% of total EU waste (2024) | Waste reduction targets, circular material sourcing, operational waste management plans |

| Biodiversity & Ecosystems | Ecological impact, community relations | CTP commitment to enhancing biodiversity across portfolio (2024) | Prioritizing brownfield sites, habitat protection, green infrastructure integration |

PESTLE Analysis Data Sources

Our PESTLE analysis is meticulously constructed using a blend of official government publications, reputable industry research firms, and leading economic databases. This ensures that every insight into political, economic, social, technological, legal, and environmental factors is grounded in verifiable and current information.