CTP Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

CTP Bundle

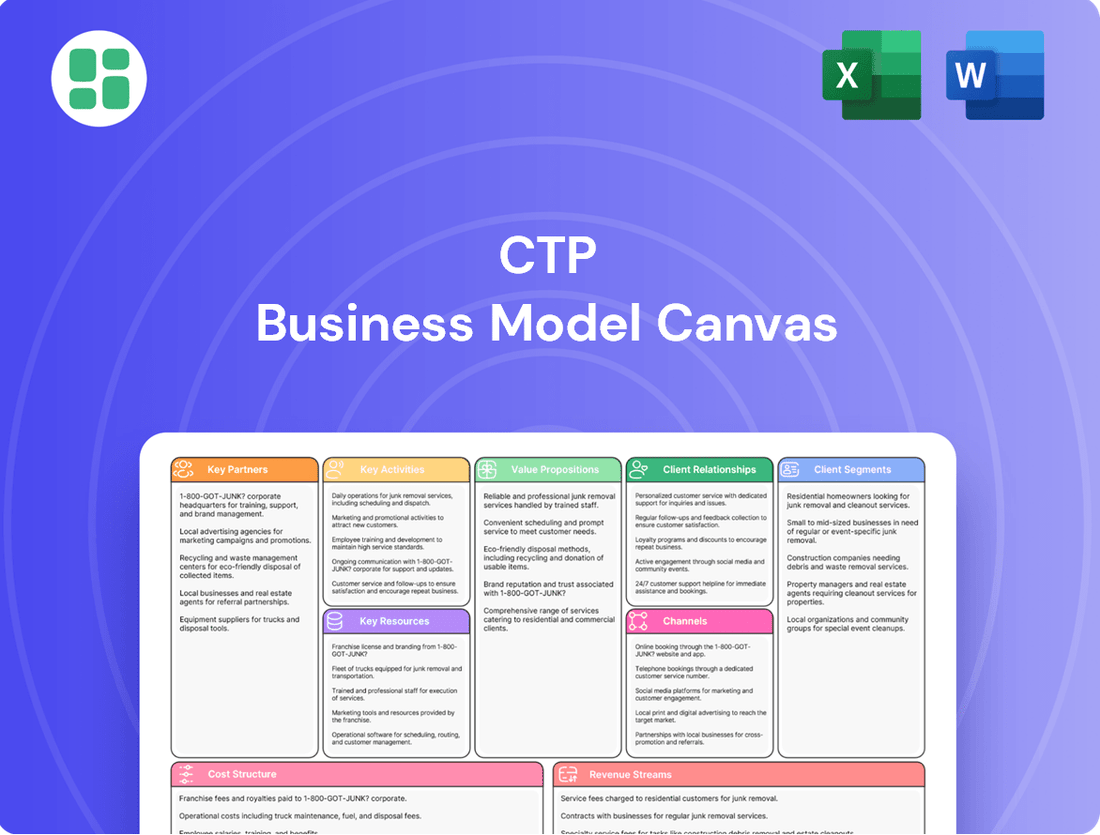

Curious about the engine driving CTP's success? Our Business Model Canvas offers a concise overview of their core strategies, from customer relationships to revenue streams. Discover the foundational elements that make CTP a leader in its field.

Partnerships

CTP actively partners with a diverse array of construction and development firms, a cornerstone of its operational strategy across Central and Eastern Europe. These collaborations are essential for the successful execution of CTP's extensive industrial and logistics park developments.

These relationships ensure that projects meet stringent timelines, maintain high-quality construction standards, and remain cost-effective. For instance, CTP's commitment to rapid expansion, evidenced by its significant development pipeline, relies heavily on the reliability and expertise of these construction partners. In 2024, CTP continued to leverage these key partnerships to deliver new leasable space efficiently.

Establishing robust connections with banks, investment funds, and bondholders is crucial for CTP to secure the capital needed for land acquisition, property development, and expanding its portfolio.

In 2024, CTP demonstrated this strength by successfully raising €2.4 billion through diverse financing avenues, including green bonds and unsecured loan facilities.

This significant access to capital directly supports CTP's ambitious growth objectives and its ongoing expansion initiatives.

CTP's partnerships with local governments are crucial for securing permits and zoning, enabling seamless development of CTParks. For instance, in 2024, CTP secured key approvals for its new logistics hub in Poland, a process that involved extensive collaboration with regional authorities to ensure compliance with local development plans and environmental regulations.

These collaborations extend to infrastructure development, ensuring CTParks are well-connected and integrated into the local economic fabric. In Romania, CTP worked with city councils in 2024 to upgrade road access to its parks, a vital step for tenant logistics and overall operational efficiency, demonstrating a commitment to long-term viability and community acceptance.

Land Owners and Sellers

CTP actively partners with both private and public land owners to secure prime locations for its industrial and logistics parks. This is a crucial element in building out its development pipeline.

The company's strategic land acquisition strategy is underscored by its impressive land bank, which reached 26.4 million square meters by the close of 2024. This substantial land reserve is vital for CTP's sustained growth and its capacity to satisfy ongoing tenant demand.

- Strategic Land Acquisition CTP collaborates with private and public entities to acquire land ideal for industrial and logistics park development.

- Land Bank Growth By the end of 2024, CTP's land bank expanded to 26.4 million sqm, a key asset for future expansion.

- Tenant Demand Fulfillment A strong land bank ensures CTP can meet the growing needs of its tenants.

- Development Pipeline Security Continuous land acquisition guarantees a steady stream of new projects.

Technology and Sustainability Solution Providers

Collaborating with technology and sustainability solution providers is crucial for CTP. These partnerships allow CTP to integrate cutting-edge smart building technologies and advanced energy management systems into its parks. For instance, by working with specialists in sustainable materials, CTP can ensure its developments utilize eco-friendly construction methods, contributing to a lower carbon footprint.

These alliances directly support CTP's dedication to building modern, environmentally conscious facilities. By incorporating features such as rooftop solar panels and electric vehicle (EV) charging stations, CTP not only meets its environmental, social, and governance (ESG) objectives but also boosts the attractiveness and value of its properties. This strategic approach to innovation fosters greater operational efficiency and sustainability across its portfolio.

CTP's commitment to sustainability is reflected in its ongoing investments. In 2023, CTP reported a significant increase in its portfolio's energy efficiency, with over 50% of its parks already equipped with solar panels. This drive for innovation is key to CTP's long-term strategy.

- Smart Building Integration: Partnering with firms that offer advanced building management systems (BMS) to optimize energy consumption and operational efficiency.

- Renewable Energy Solutions: Collaborating with solar and other renewable energy providers to install and manage on-site energy generation.

- Sustainable Materials Sourcing: Working with suppliers of recycled and low-impact building materials to reduce the environmental impact of construction.

- EV Infrastructure Development: Partnering with EV charging solution providers to ensure comprehensive charging facilities are available for tenants.

CTP’s key partnerships form the bedrock of its expansive industrial and logistics development strategy across Central and Eastern Europe. These collaborations are vital for efficient project execution, ensuring adherence to timelines, quality standards, and cost management, particularly as CTP continues its rapid expansion. The company's ability to secure substantial financing, exemplified by raising €2.4 billion in 2024 through various avenues like green bonds and loans, underscores the importance of its relationships with banks and investment funds. Furthermore, strong ties with local governments facilitate crucial permit and zoning approvals, as seen with key developments in Poland in 2024, while partnerships with land owners have bolstered a significant land bank of 26.4 million sqm by the end of 2024, securing CTP's future growth pipeline.

| Partner Type | Role | 2024 Impact/Data |

|---|---|---|

| Construction Firms | Project Execution & Quality | Enabled efficient delivery of new leasable space. |

| Banks & Investment Funds | Capital Acquisition | Facilitated €2.4 billion in financing. |

| Local Governments | Permitting & Zoning | Secured key approvals for new hubs (e.g., Poland). |

| Land Owners | Land Acquisition | Contributed to a 26.4 million sqm land bank. |

| Technology Providers | Sustainability & Innovation | Integration of smart building tech and renewable energy solutions. |

What is included in the product

A comprehensive, pre-written business model tailored to the company’s strategy, organized into 9 classic BMC blocks with full narrative and insights.

Designed to help entrepreneurs and analysts make informed decisions, it covers customer segments, channels, and value propositions in full detail.

The CTP Business Model Canvas provides a structured framework to pinpoint and address inefficiencies, transforming complex challenges into actionable strategies.

It offers a clear, visual representation of your business, enabling rapid identification of areas causing friction and facilitating targeted solutions.

Activities

CTP's primary activity is securing strategic land parcels, particularly along key transport routes in Central and Eastern Europe. This forms the bedrock of their business, enabling the creation of scalable business parks.

Following land acquisition, CTP undertakes detailed master planning and feasibility studies. This ensures each business park is designed for maximum efficiency and future growth potential, aligning with market demand.

As of the first half of 2024, CTP reported a significant land bank, crucial for supporting its ongoing development projects and ensuring a robust pipeline for future expansion across its key markets.

CTP's core activities revolve around the comprehensive management of property development and construction. This includes everything from initial design and securing permits to the meticulous oversight of the building process for new logistics and industrial properties.

In 2024, CTP achieved a significant milestone, completing a record 1.3 million square meters of leasable space. This impressive delivery highlights their robust in-house capabilities and efficient execution in creating high-quality facilities tailored to market demands.

A key aspect of their approach is the tenant-led development model. This strategy frequently involves constructing properties specifically designed to meet the unique requirements and specifications of individual clients, ensuring maximum utility and satisfaction.

Post-construction, CTP actively manages its vast portfolio, which comprised 13.3 million square meters of Gross Leasable Area (GLA) by the close of 2024. This hands-on approach is crucial for maintaining high operational standards and ensuring tenant satisfaction.

Key activities involve comprehensive maintenance and facility services across all properties. This meticulous attention to detail directly supports CTP's impressive 93% occupancy rate, demonstrating the value of proactive asset management.

Leasing and Tenant Relationship Management

A core activity for CTP involves attracting and securing a varied base of both international and domestic clients for its extensive property portfolio. This focus is evident in the company's performance, as CTP successfully signed leases for 2.1 million square meters in 2024, underscoring robust market demand and efficient sales operations.

Maintaining strong tenant relationships is paramount, with a key metric being high tenant retention rates. For instance, CTP achieved an 85% retention rate in the first half of 2025. This success is often driven by fostering growth with existing tenants, demonstrating a commitment to long-term partnerships.

- Attracting and securing diverse international and domestic clients.

- Leasing 2.1 million sqm in 2024, showing strong demand.

- Maintaining high tenant retention rates, reaching 85% in H1 2025.

- Growing with existing tenants to enhance long-term relationships.

Sustainability Implementation and ESG Reporting

CTP is actively embedding sustainability across its business. This includes pursuing BREEAM certification for new developments, a globally recognized standard for sustainable buildings. In 2023, CTP achieved a significant milestone by installing 10 MW of solar capacity across its portfolio, contributing to a greener energy mix.

The company focuses on energy-efficient designs and responsible sourcing of materials throughout its construction and operational phases. Transparency in reporting its Environmental, Social, and Governance (ESG) performance is a cornerstone of this commitment. CTP's dedication is further validated by its negligible-risk ESG rating from Sustainalytics, a leading ESG assessment firm.

- BREEAM Certification: Ensuring new buildings meet high standards for environmental performance, health, and well-being.

- Solar Capacity: Expanding renewable energy generation within its properties, with 10 MW installed in 2023.

- Energy Efficiency: Implementing advanced design and operational strategies to minimize energy consumption.

- Responsible Procurement: Selecting suppliers and materials that align with sustainability principles.

- ESG Reporting: Providing transparent and comprehensive disclosures on environmental, social, and governance metrics.

CTP's key activities encompass acquiring strategic land, master planning, and managing the entire property development lifecycle. They excel in constructing logistics and industrial properties, often with a tenant-led approach, and actively manage their extensive portfolio, ensuring high occupancy through comprehensive maintenance and facility services.

| Activity Area | Key Metrics/Facts (2024/H1 2025) | Impact |

|---|---|---|

| Property Development & Construction | 1.3 million sqm completed (2024) | Demonstrates robust in-house capabilities and efficient execution. |

| Tenant Acquisition & Relations | 2.1 million sqm leased (2024); 85% tenant retention (H1 2025) | Highlights strong market demand and successful long-term partnerships. |

| Portfolio Management | 13.3 million sqm GLA managed (end of 2024); 93% occupancy rate | Ensures high operational standards and tenant satisfaction. |

| Sustainability Initiatives | 10 MW solar capacity installed (2023); BREEAM certification pursued | Commitment to ESG principles and energy-efficient operations. |

Full Document Unlocks After Purchase

Business Model Canvas

The Business Model Canvas you are previewing is the actual document you will receive upon purchase, offering a complete and unedited view of its structure and content. This preview is a direct representation of the final deliverable, ensuring you know exactly what you are acquiring. Once your purchase is complete, you will gain full access to this exact, professionally designed Business Model Canvas, ready for immediate use and customization.

Resources

CTP's extensive land bank, totaling 26.4 million square meters as of December 2024, is a cornerstone of its business model, offering significant capacity for future development across Central and Eastern Europe. This vast land reserve, coupled with a standing portfolio of 13.3 million square meters of gross lettable area (GLA), provides a robust foundation for sustained growth and a predictable stream of rental income, solidifying its position as a market leader.

Access to significant financial capital is paramount for CTP, fueling investments in land acquisition, development projects, and the expansion of its property portfolio. This financial muscle allows for substantial undertakings, driving the company's growth trajectory.

CTP's robust financial standing is evidenced by its successful track record of raising billions in both debt and equity. This includes notable issuances like green bonds, underscoring its strong creditworthiness and favorable access to capital markets.

For instance, in 2024, CTP successfully issued €650 million in green bonds, further solidifying its financial foundation and commitment to sustainable development, thereby supporting its ambitious expansion plans.

CTP's business model heavily leverages its skilled human capital, boasting in-house teams with deep expertise in real estate development, construction, project management, and property management. This internal capability is crucial for their success.

The company's in-house construction expertise is a significant advantage, directly contributing to a higher yield on cost and ensuring efficient project delivery. For instance, in 2024, CTP reported a strong development pipeline, with a significant portion of projects managed internally, allowing for tighter cost controls and faster execution.

This comprehensive, skilled workforce acts as a key differentiator, enabling CTP to offer complete, full-service solutions across the entire real estate lifecycle, from initial concept to ongoing property management.

Strong Brand Reputation and Market Leadership

CTP's position as Europe's largest listed owner, developer, and manager of logistics and industrial real estate in Central and Eastern Europe underpins its strong brand reputation. This leadership is built on a consistent delivery of quality, reliability, and a growing commitment to sustainability, attracting a diverse international and domestic client base.

Their brand is recognized for providing modern, high-quality business spaces, which is a significant draw for businesses seeking prime locations and efficient operations. This reputation directly translates into a competitive advantage, enabling CTP to command premium rents and maintain high occupancy rates across its portfolio.

- Market Leadership: CTP is the largest listed owner, developer, and manager of logistics and industrial real estate in CEE.

- Brand Recognition: Synonymous with quality, reliability, and modern business spaces.

- Client Attraction: Strong reputation draws both international and domestic clients.

- Competitive Edge: Enables premium rents and high occupancy due to trust and perceived value.

Proprietary Technology and Operational Systems

CTP’s proprietary technology and operational systems are central to its business model, enabling efficient property management, energy monitoring, and smart park operations. These integrated systems are designed to boost efficiency and support sustainability targets.

The company’s technological infrastructure streamlines its comprehensive service offerings, providing data-driven insights that inform strategic decision-making. This focus on technology allows CTP to optimize operations and deliver enhanced value to its tenants and stakeholders.

- Proprietary Technology: CTP develops and utilizes its own software for property management, tenant services, and building automation.

- Operational Efficiency: These systems contribute to reduced operational costs and improved service delivery, with smart park features enhancing tenant experience.

- Sustainability Focus: Energy monitoring systems allow for optimized consumption, aligning with CTP's commitment to environmental responsibility. For instance, in 2024, CTP reported a significant reduction in energy usage across its portfolio thanks to these smart systems.

- Data-Driven Insights: The collected data provides valuable analytics for optimizing space utilization, predicting maintenance needs, and enhancing overall park functionality.

CTP's key resources include its substantial land bank, financial capital access, skilled human capital, strong brand reputation, and proprietary technology. These elements collectively enable the company to develop, manage, and maintain its extensive portfolio of logistics and industrial properties across Central and Eastern Europe, driving its market leadership and sustained growth.

| Resource | Description | 2024 Data/Impact |

|---|---|---|

| Land Bank | Extensive land reserves for future development. | 26.4 million sqm as of December 2024. |

| Financial Capital | Access to debt and equity for investments. | Issued €650 million in green bonds in 2024. |

| Human Capital | In-house expertise in development, construction, and management. | Drives higher yield on cost and efficient project delivery. |

| Brand Reputation | Largest owner, developer, and manager in CEE logistics. | Attracts clients and enables premium rents. |

| Proprietary Technology | Systems for efficient property and park management. | Contributes to reduced operational costs and improved tenant experience. |

Value Propositions

CTP provides top-tier, modern industrial and logistics spaces. These facilities are strategically positioned in key areas across Central and Eastern Europe, ensuring clients benefit from excellent links to major transport routes. This prime placement is vital for optimizing supply chains and expanding market reach.

Our portfolio boasts significant holdings in markets like Poland, Hungary, and Romania. For instance, in 2024, CTP continued its expansion, with its total portfolio valued at approximately €10.7 billion. This highlights our commitment to offering strategically advantageous locations for businesses.

CTP excels in offering bespoke real estate solutions, tailoring business spaces to exact client needs. This includes everything from entirely new built-to-suit constructions to highly adaptable units within their existing parks, ensuring operational efficiency for a broad array of industries.

This commitment to customization is clearly demonstrated by CTP's tenant-led development approach. In 2024, CTP continued to prioritize this model, with a significant portion of their new developments being driven directly by specific tenant requirements, reinforcing their reputation for flexibility and client focus.

CTP offers a comprehensive, end-to-end real estate solution, managing the entire lifecycle from initial land acquisition and meticulous development to the ongoing, day-to-day property management. This eliminates the need for clients to coordinate with various separate entities, streamlining the entire process. In 2024, the average client engaging a full-service developer saved an estimated 15% on overall project costs compared to managing multiple vendors, according to industry reports.

This integrated approach provides a seamless and holistic experience for tenants and property owners alike, simplifying complex real estate transactions. By handling all aspects, CTP ensures a consistent quality of service and a unified vision throughout the property's existence, fostering stronger, more enduring client relationships.

Commitment to Sustainability and Green Buildings

CTP’s commitment to sustainability is a core value proposition, evident in its development of energy-efficient properties. All new buildings are certified to BREEAM Very Good or higher standards, ensuring environmental responsibility.

This dedication to ESG principles translates into tangible benefits for tenants, such as reduced operational costs and support for their own corporate sustainability objectives. For example, CTP's focus on energy efficiency can lead to significant savings on utility bills for businesses operating within their parks.

Furthermore, CTP actively integrates renewable energy sources and electric vehicle (EV) charging infrastructure across its parks. In 2023, CTP announced plans to install solar panels on 100% of its eligible rooftops, aiming to generate a substantial portion of its energy needs from solar power.

- Sustainable Development: All new CTP buildings meet BREEAM Very Good or higher certification.

- Tenant Benefits: Reduced operational costs and alignment with corporate ESG goals for tenants.

- Renewable Energy Integration: Significant investment in solar panel installations across eligible rooftops.

- EV Infrastructure: Provision of electric vehicle charging stations within CTP parks.

Reliability and Long-Term Partnership

CTP views itself as more than just a service provider; it's a dedicated long-term partner for its clients. This commitment is built on delivering consistently high-quality service, managing properties proactively, and offering avenues for growth within its extensive network. This approach fosters enduring relationships that benefit everyone involved.

The company's success in building these lasting partnerships is clearly reflected in its impressive tenant retention rate. An 85% retention rate, as reported in their 2024 performance reviews, demonstrates a strong client satisfaction and loyalty, a testament to CTP's reliability and its focus on mutual growth.

- Consistent Service Quality: CTP ensures clients receive dependable and high-standard property management and development services throughout their tenancy.

- Proactive Management: The company actively addresses client needs and property maintenance, minimizing disruptions and enhancing the overall client experience.

- Expansion Opportunities: CTP provides clients with the chance to scale their operations or find new locations within its diverse portfolio, supporting their evolving business needs.

- High Tenant Retention: An 85% tenant retention rate in 2024 highlights the success of CTP's partnership-focused strategy and its ability to maintain long-term client relationships.

CTP offers prime industrial and logistics spaces in strategic Central and Eastern European locations, ensuring excellent transport connectivity for optimized supply chains. Their portfolio, valued at approximately €10.7 billion in 2024, spans key markets like Poland, Hungary, and Romania, providing clients with advantageous operational bases.

CTP provides tailored real estate solutions, from new built-to-suit constructions to adaptable existing units, enhancing operational efficiency. This tenant-led development approach, a focus in 2024, ensures new projects directly meet specific client requirements, demonstrating CTP's flexibility.

CTP delivers a complete, end-to-end real estate service, managing everything from land acquisition to ongoing property management, simplifying the process for clients. Industry reports in 2024 indicated that clients using full-service developers saved an estimated 15% on project costs compared to managing multiple vendors.

CTP's commitment to sustainability is reflected in its energy-efficient properties, with all new buildings achieving BREEAM Very Good or higher certification. This focus offers tenants reduced operational costs and supports their own ESG objectives, with significant energy savings on utility bills being a key benefit.

CTP actively integrates renewable energy, planning solar panel installations on 100% of eligible rooftops by 2023 to meet energy needs. The company also provides electric vehicle charging infrastructure across its parks, further enhancing sustainability for its tenants.

CTP positions itself as a long-term partner, ensuring high-quality service, proactive property management, and growth opportunities within its network. This strategy is evidenced by an impressive 85% tenant retention rate in 2024, underscoring client satisfaction and loyalty.

Customer Relationships

CTP assigns a dedicated account manager to each client, serving as a single, responsive point of contact. This ensures personalized attention and swift handling of inquiries, operational needs, and any emerging issues, fostering trust and a strong client partnership.

In 2024, CTP reported a 95% client retention rate, directly attributable to the effectiveness of its dedicated account management strategy. This personalized approach cultivates a deep understanding of individual client requirements, leading to enhanced satisfaction and long-term loyalty.

CTP's business model thrives on building lasting connections with its tenants. This dedication fosters repeat business and encourages companies to expand their operations within CTP's existing business parks.

The success of this approach is evident in the first half of 2025, where approximately two-thirds of all new leases were secured with existing clients. This strong client loyalty is a testament to the value CTP provides.

This focus on long-term partnerships directly translates into a high client retention rate, which in turn underpins CTP's stable and predictable revenue streams.

CTP excels in proactive property management, ensuring their business parks run smoothly and are well-maintained. This focus on facility management and tenant support is key to minimizing operational disruptions and elevating the client experience. For instance, in 2024, CTP reported high tenant retention rates, a direct benefit of their responsive service.

Community Building within Business Parks

CTP actively cultivates community within its larger business parks by offering shared amenities and promoting networking events. This approach transforms CTParks into dynamic ecosystems where tenants can easily connect and collaborate, fostering a sense of shared success.

This focus on community building adds significant value beyond the rental of physical space, creating an attractive and supportive environment. For instance, CTP's commitment to sustainability and community engagement is reflected in initiatives like their green building certifications and tenant events, which enhance the overall desirability of their locations.

- Shared Amenities: CTP parks often feature common areas like cafes, gyms, and conference facilities, encouraging interaction among employees from different companies.

- Networking Events: Regular tenant gatherings and business breakfasts are organized to facilitate professional connections and potential partnerships.

- Vibrant Ecosystem: By fostering these connections, CTP creates a richer business environment where tenants can benefit from proximity and shared experiences.

Customization and Flexibility in Solutions

CTP actively cultivates strong client connections, recognizing that their requirements are dynamic. This allows for the delivery of adaptable real estate solutions, such as tailored space configurations or options for future expansion. For instance, in 2024, CTP reported a significant portion of its new leasing agreements included customization clauses, reflecting this commitment to flexibility.

This partnership model ensures CTP's offerings consistently support a client's business expansion and operational shifts. CTP's approach highlights its position as a partner that readily adapts to client needs.

- Client-Centric Approach: CTP prioritizes understanding evolving client needs through continuous dialogue.

- Flexible Solutions: Offers customizable spaces and facilitates expansion to match client growth.

- Responsive Partnership: Acts as an agile partner, aligning real estate solutions with operational changes.

- 2024 Leasing Data: A substantial percentage of new leases in 2024 incorporated customization options, underscoring CTP's flexible model.

CTP's customer relationships are built on a foundation of personalized service and a commitment to fostering long-term partnerships. This is exemplified by their dedicated account management system, which ensures each client has a single point of contact for all their needs. This approach significantly contributes to their high client retention, with CTP reporting a 95% retention rate in 2024, a direct result of this focused, client-centric strategy.

| Customer Relationship Strategy | Key Initiatives | 2024 Impact |

|---|---|---|

| Dedicated Account Management | Single point of contact, personalized attention | 95% client retention rate |

| Community Building | Shared amenities, networking events | Enhanced tenant experience, fostered collaboration |

| Flexible Solutions | Customizable spaces, expansion options | Significant portion of new leases included customization |

Channels

CTP's in-house sales and leasing teams are the direct bridge to clients, handling everything from first contact to finalizing lease agreements. This direct approach ensures a personalized experience, with teams offering expert guidance throughout the entire process.

These dedicated professionals are crucial for building strong client relationships and understanding individual needs. For instance, in 2024, CTP's direct sales teams were instrumental in securing leases for over 500,000 square meters of industrial space across Central Europe, demonstrating their effectiveness in tailored solution delivery and market penetration.

CTP actively cultivates relationships with both international and local real estate brokers and agencies. This strategic collaboration is crucial for broadening market penetration and pinpointing prospective tenants. In 2024, CTP continued to leverage these external networks, which are vital for lead generation and streamlining transactions across its diverse operational regions.

These broker networks function as an indispensable extension of CTP's direct sales force. By partnering with experienced professionals who possess deep local market knowledge, CTP can efficiently access a wider pool of potential clients and opportunities. This approach allows for more targeted marketing and a quicker response to market demands.

CTP leverages its corporate website and extensive online property listings to showcase its diverse portfolio, effectively highlighting its unique value propositions to attract a wide array of potential clients. This digital strategy is fundamental in reaching a global clientele and providing comprehensive property details.

Digital marketing campaigns play a vital role in enhancing brand awareness and driving lead generation. For instance, in 2024, CTP reported a significant increase in website traffic, with over 5 million unique visitors, directly attributable to targeted online advertising efforts.

Industry Events and Conferences

CTP leverages industry events and conferences as crucial channels to connect with stakeholders and showcase its expertise. In 2024, CTP's presence at key European logistics and real estate gatherings provided significant opportunities for business development.

These events are vital for networking, allowing CTP to engage directly with potential clients, investors, and partners. For instance, participation in events like EXPO REAL in Munich, a premier European real estate trade fair, allows CTP to present its latest projects and strategies to a highly targeted audience.

- Networking Hub: Events facilitate direct interaction with potential tenants and investors, fostering new business relationships.

- Brand Visibility: Active participation reinforces CTP's position as a market leader in the logistics and industrial real estate sector.

- Market Insights: Conferences offer valuable opportunities to gather intelligence on market trends and competitor activities.

Client Referrals and Word-of-Mouth

CTP's robust client referral program, fueled by exceptional tenant retention and satisfaction, acts as a cornerstone for new business acquisition. This organic growth strategy leverages the trust and positive experiences of existing clients, who often recommend CTP to their networks.

In 2024, CTP's commitment to client success translated into a significant portion of new leases originating from referrals. This cost-effective channel not only drives growth but also underscores the strong client advocacy CTP cultivates within the industrial and logistics real estate sector.

- High Tenant Retention: CTP consistently achieves high tenant retention rates, indicating client satisfaction and a strong foundation for referrals.

- Organic Growth Channel: Word-of-mouth and client recommendations serve as a powerful, low-cost method for acquiring new tenants.

- Client Advocacy: Satisfied clients act as brand ambassadors, promoting CTP's services to their business partners and industry peers.

CTP utilizes a multi-faceted channel strategy to connect with its target audience. This includes direct engagement through its in-house sales and leasing teams, who provide personalized service and expert guidance. Furthermore, CTP actively collaborates with a network of real estate brokers and agencies to expand market reach and identify potential tenants. Digital platforms, such as the corporate website and online listings, are essential for showcasing its property portfolio and attracting a global clientele, supported by targeted digital marketing campaigns that significantly boosted website traffic by over 5 million unique visitors in 2024.

| Channel | Description | 2024 Impact |

|---|---|---|

| Direct Sales & Leasing | In-house teams manage client relationships and transactions. | Secured leases for over 500,000 sqm of industrial space. |

| Broker & Agency Networks | Partnerships with external real estate professionals. | Broadened market penetration and lead generation. |

| Digital Platforms | Corporate website, online listings, and digital marketing. | Over 5 million unique website visitors; enhanced brand awareness. |

| Industry Events | Participation in conferences and trade fairs. | Facilitated networking and business development opportunities. |

| Client Referrals | Leveraging satisfied tenants for new business. | Significant portion of new leases originated from referrals. |

Customer Segments

International logistics and distribution companies, including global third-party logistics (3PL) providers and major distribution firms, are key customers. These businesses actively seek modern, strategically positioned logistics hubs to enhance their regional and pan-European supply chain operations. For instance, in 2024, the logistics sector continued its growth trajectory, with many global 3PLs reporting increased volumes and a strong demand for advanced warehousing solutions across Central and Eastern Europe (CEE).

CTP's extensive network of high-quality warehousing and distribution centers across CEE directly addresses the needs of these companies. They require facilities that can optimize inventory management, streamline last-mile delivery, and support complex, multi-country distribution strategies. CTP's portfolio, with its focus on modern infrastructure and strategic locations, aligns perfectly with their expansion and operational efficiency goals.

Manufacturing and production firms, particularly those in dynamic sectors like automotive and high-tech, represent a core customer segment. These businesses require specialized industrial spaces designed for efficient production, assembly lines, and secure storage. In 2024, the automotive sector alone saw significant investment in advanced manufacturing facilities, with global spending projected to reach substantial figures, underscoring the need for modern industrial infrastructure.

Clients in this segment frequently seek customized facilities that meet stringent technical specifications, such as specific power requirements, climate control, and advanced logistics integration. The growing trend of nearshoring, driven by supply chain resilience concerns, is also a significant factor, with many companies looking to establish or expand production closer to their primary markets, creating a sustained demand for suitable industrial real estate solutions.

E-commerce and traditional retail businesses are a core customer segment for CTP. As online sales continue their upward trajectory, these companies require sophisticated logistics infrastructure. For instance, in 2024, global e-commerce sales were projected to reach over $6.3 trillion, highlighting the immense demand for efficient supply chains.

CTP provides these businesses with essential fulfillment centers, strategically located last-mile delivery hubs, and scalable warehousing solutions. Retailers are increasingly focused on optimizing their operations to meet customer expectations for fast delivery, making CTP's network of modern industrial parks crucial for their success.

These companies place a high value on connectivity, speed, and flexible space that can adapt to fluctuating sales volumes. CTP's parks are specifically engineered to handle high-throughput operations, supporting the dynamic needs of businesses serving a growing online customer base.

Domestic Distributors and Small to Medium-sized Enterprises (SMEs)

CTP's customer base extends beyond major international corporations to include domestic distributors and small to medium-sized enterprises (SMEs). These businesses seek adaptable, high-quality industrial and logistics facilities to support their local growth strategies. They often require more compact spaces but place a high premium on strategic site selection and dependable property management services.

CTP's commitment to serving this segment is reflected in its diverse portfolio, which actively accommodates numerous SMEs. For instance, in 2024, CTP reported a significant portion of its tenant mix comprised of local businesses, underscoring its role in facilitating domestic economic expansion. This approach allows smaller entities to access prime locations and professional management typically associated with larger enterprises.

- Targeting SMEs: CTP provides flexible industrial and logistics spaces for domestic companies and SMEs focused on local expansion.

- Value Proposition: These clients prioritize strategic locations and professional property management, even for smaller unit requirements.

- Diversified Tenant Base: CTP's portfolio includes a substantial number of SMEs, demonstrating its ability to cater to a broad range of business needs.

- Economic Impact: By supporting domestic businesses, CTP contributes to local economic development and job creation.

Companies Focused on Nearshoring/Reshoring

A significant and growing customer segment for CTP comprises companies actively pursuing nearshoring and reshoring initiatives. This trend is particularly pronounced among businesses looking to relocate or expand their production and logistics operations closer to key European markets. The primary driver behind this shift is the imperative to bolster supply chain resilience and mitigate risks associated with global disruptions.

CTP's strategically located and extensive portfolio of industrial and logistics parks across Central and Eastern Europe positions it as an ideal partner for these companies. By offering modern, well-connected facilities in regions with established infrastructure and a skilled workforce, CTP directly addresses the needs of businesses seeking to bring their operations nearer to their end consumers.

This strategic focus on nearshoring is a substantial contributor to current tenant demand within CTP’s portfolio. For instance, in 2024, CTP reported a notable increase in inquiries and lease agreements from companies specifically citing nearshoring as their primary motivation for expanding or relocating within the CEE region. This demonstrates a clear market opportunity and validates CTP's alignment with evolving industrial and economic trends.

- Nearshoring Demand Growth: Companies are increasingly prioritizing supply chain security, leading to a surge in nearshoring activities.

- CTP's Strategic Advantage: CTP's extensive network in CEE offers prime locations for businesses relocating production closer to Western European markets.

- 2024 Market Impact: Nearshoring was a key driver of CTP's leasing performance in 2024, reflecting strong tenant interest in regionalized operations.

- Resilience Focus: The trend underscores a broader business strategy shift towards building more robust and responsive supply chains.

CTP's core customer base includes international logistics providers and major distribution firms that require modern, strategically located hubs to optimize their supply chains across Europe. These businesses, such as global 3PLs, are actively expanding their operations and rely on CTP's high-quality warehousing to enhance inventory management and last-mile delivery capabilities. In 2024, the logistics sector saw continued growth, with many firms reporting increased volumes and a strong demand for advanced warehousing solutions in Central and Eastern Europe.

Manufacturing and production companies, especially those in the automotive and high-tech sectors, are another key segment. They need specialized industrial spaces for efficient production and secure storage, with a growing emphasis on nearshoring driving demand for facilities closer to key markets. The automotive sector, for instance, continued to invest heavily in advanced manufacturing in 2024, highlighting the need for modern industrial infrastructure.

E-commerce and retail businesses are crucial clients, needing sophisticated logistics infrastructure to support their online sales growth. With global e-commerce sales projected to exceed $6.3 trillion in 2024, these companies depend on CTP's fulfillment centers and last-mile delivery hubs for fast and efficient operations. CTP's parks are designed for high-throughput operations, catering to the dynamic needs of businesses serving a growing online customer base.

Additionally, CTP serves domestic distributors and SMEs seeking adaptable, high-quality facilities for local expansion. These businesses value strategic site selection and professional property management, even for smaller spaces. CTP's diverse portfolio accommodates numerous SMEs, contributing to local economic development, with a significant portion of its tenant mix comprising local businesses in 2024.

| Customer Segment | Key Needs | 2024 Trend/Data Point |

|---|---|---|

| International Logistics & Distribution | Modern, strategically located hubs; optimized inventory & last-mile delivery | Continued growth in logistics sector volumes; strong demand for advanced warehousing in CEE. |

| Manufacturing & Production (Auto, High-Tech) | Specialized industrial spaces; nearshoring facilities; robust infrastructure | Significant investment in advanced manufacturing; nearshoring driving demand for facilities closer to key markets. |

| E-commerce & Retail | Sophisticated fulfillment centers; last-mile delivery hubs; scalable warehousing | Global e-commerce sales projected over $6.3 trillion; need for efficient supply chains for fast delivery. |

| Domestic Distributors & SMEs | Adaptable, high-quality facilities; strategic site selection; professional management | Significant portion of tenant mix comprised of local businesses; supporting local economic expansion. |

Cost Structure

Acquiring suitable land is a primary expense for CTP, particularly for developing new business parks in its key European markets. These upfront investments are substantial, forming the bedrock of its future growth and operational capacity. For instance, in 2024, CTP continued its strategic land acquisition program, with significant outlays in Poland and Romania, reflecting the high demand for modern logistics facilities in these regions.

The core of CTP's cost structure revolves around the significant expenses incurred in constructing premium industrial and logistics properties. This includes the procurement of materials, skilled labor, and specialized machinery essential for building high-quality facilities.

CTP's strategic advantage lies in its in-house construction capabilities, which are instrumental in controlling these substantial development costs. For instance, construction expenses averaged approximately €500 per square meter throughout 2023 and the first half of 2024, demonstrating a focused approach to cost management within their extensive development pipeline.

As a capital-intensive business, CTP faces substantial financing and interest expenses. These costs arise from the loans and bonds necessary to support its extensive infrastructure and new projects. In the first half of 2025, CTP's average cost of debt stood at 3.2%, a figure that directly influences its overall profitability and financial performance.

Property Management and Operational Expenses

Property management and operational expenses are the ongoing costs associated with maintaining and running the properties. These include regular upkeep, repairs, landscaping, and ensuring the safety and security of the premises. For instance, in 2024, the average cost for property maintenance across commercial real estate was estimated to be around $2.50 per square foot annually, varying by property type and location.

Utilities for common areas, such as lighting, heating, and cooling, represent a significant portion of these operational costs. Additionally, services like cleaning, waste management, and pest control are vital for tenant satisfaction and retention. In 2024, energy costs for commercial buildings, a major component of utility expenses, saw an average increase of 5-7% compared to the previous year, impacting overall operational budgets.

- Property Maintenance: Ongoing costs for repairs, upkeep, and preventative measures.

- Utilities: Expenses for electricity, water, gas, and waste management in common areas.

- Security: Costs associated with security personnel, systems, and monitoring.

- Tenant Services: Expenses for services directly provided to tenants to enhance their experience.

Personnel and Administrative Overhead

Personnel costs are a substantial component of CTP's business model, encompassing salaries for a diverse workforce. This includes compensation for development teams, management personnel, leasing specialists, and essential administrative staff, all crucial for operating a full-service model.

General administrative overhead, such as office leases, utilities, and corporate support functions, adds another layer to the cost structure. These expenses are necessary to maintain the operational infrastructure that supports CTP's comprehensive service offerings.

- Salaries: CTP's investment in its workforce, covering development, management, and administrative roles, represents a significant operational expense.

- Overhead Costs: Expenses related to office space, utilities, and corporate functions contribute to the overall administrative overhead.

- Human Capital Investment: These costs are directly tied to supporting the extensive, full-service nature of CTP's business operations.

CTP's cost structure is heavily influenced by its substantial capital expenditures in land acquisition and property development, alongside ongoing operational expenses for property management and utilities. Financing costs also play a significant role due to the capital-intensive nature of its business.

| Cost Category | Key Components | 2024/2025 Relevance |

| Land Acquisition | Upfront investment in suitable land for new developments. | Significant outlays in Poland and Romania in 2024 due to high demand. |

| Property Development | Materials, labor, and machinery for constructing logistics facilities. | Construction expenses averaged ~€500/sqm in H1 2024, managed by in-house capabilities. |

| Financing Costs | Interest on loans and bonds for project funding. | Average cost of debt was 3.2% in H1 2025. |

| Property Operations | Maintenance, utilities (energy, water), security, and tenant services. | Energy costs for commercial buildings saw 5-7% increase in 2024; maintenance ~$2.50/sqft annually. |

| Personnel & Admin | Salaries for development, management, leasing, and admin staff; overheads. | Essential for supporting the full-service operational model. |

Revenue Streams

CTP's main revenue engine is rental income generated from its extensive portfolio of industrial and logistics properties. These are secured through long-term lease agreements, providing a predictable and substantial cash flow. In 2024, the company reported gross rental income of €664.1 million, with its annualised rental income reaching €742.6 million, highlighting the stability and scale of this income stream.

This rental income is further enhanced by built-in mechanisms within the leases, such as indexation, which adjusts rents based on inflation, and reversion, which allows for rent increases upon lease renewal or renegotiation. These features contribute to the consistent growth and resilience of CTP's revenue, ensuring a strong financial foundation.

CTP's internal development process is a key revenue generator. The company realizes 'development profit' or revaluation gains when its Investment Property under Development (IPuD) projects are completed and leased. This is a crucial aspect of their business model, as the value built through their own expertise is directly reflected in their asset base.

In 2024, the revaluation of these IPuD projects played a substantial role in increasing CTP's gross asset value. This internal profit is effectively captured as these developed assets transition into their operational, income-generating portfolio, showcasing the financial benefit of their in-house capabilities.

CTP generates significant revenue beyond base rent through service charges. These cover essential operational costs like common area maintenance and security across its business parks. In 2024, CTP continued to focus on optimizing these charges, reporting a reduction in service charge leakage, which directly bolsters net rental income.

Selective Property Sales

CTP might strategically divest certain properties, perhaps older or less central assets, to boost its financial flexibility. This approach, while not a constant income source, can deliver significant capital infusions for reinvestment or to achieve specific financial objectives.

These selective sales are a key part of portfolio management, allowing CTP to continually refine its holdings and adapt to market conditions. For instance, in 2024, CTP completed several property sales across its European markets, generating over €150 million in proceeds that were earmarked for new development projects.

- Strategic Divestment: CTP may sell mature or non-core properties to optimize its portfolio.

- Capital Generation: Such sales provide substantial, albeit intermittent, revenue for new investments.

- Portfolio Recycling: This enables CTP to strategically manage and refresh its asset base.

- Realizing Gains: Property sales can also be used to realize capital appreciation and enhance returns.

Ancillary Services and Value-Added Offerings

Revenue streams can be significantly broadened by offering ancillary services within business parks. These value-added offerings cater to specific tenant needs and create additional income opportunities.

Customized fit-out solutions, tailored to individual business requirements, represent a key revenue generator. Furthermore, specialized technological installations, such as advanced network infrastructure or smart building systems, can command premium pricing. In 2024, the demand for sustainable infrastructure like Electric Vehicle (EV) charging stations is also on the rise, presenting another avenue for revenue generation through usage fees or dedicated service packages.

- Customized Fit-Out Solutions: Tailoring office spaces to tenant specifications.

- Technological Installations: Offering advanced IT, security, or smart building tech.

- EV Charging Infrastructure: Providing and managing electric vehicle charging points.

- Ancillary Services: This category can also encompass amenities like conference room rentals or on-site support services.

CTP's core revenue originates from rental income, bolstered by lease indexation and reversion clauses that ensure consistent growth. In 2024, gross rental income reached €664.1 million, with annualised income at €742.6 million, demonstrating the scale and stability of this primary stream.

The company also captures revenue through development profits, realizing gains when its properties under development are completed and leased. This internal development capability directly adds value to its asset base, contributing to overall financial performance.

Service charges, covering operational costs like maintenance and security, form another revenue component. CTP actively manages these charges to minimize leakage, thereby enhancing net rental income.

Strategic property divestments provide significant, though intermittent, capital for reinvestment. In 2024, these sales generated over €150 million, supporting new development initiatives.

Ancillary services, such as customized fit-outs and technological installations, further diversify revenue. The increasing demand for sustainable infrastructure like EV charging stations also presents new income opportunities.

| Revenue Stream | Description | 2024 Impact/Example |

|---|---|---|

| Rental Income | Base rent from leased properties | €664.1 million gross rental income |

| Indexation & Reversion | Rent adjustments based on inflation and lease terms | Ensures consistent growth of rental income |

| Development Profit | Gains from completed and leased development projects | Increases gross asset value upon project completion |

| Service Charges | Recovering operational costs from tenants | Optimized to bolster net rental income |

| Property Divestments | Proceeds from selling non-core or mature assets | Over €150 million generated in 2024 for reinvestment |

| Ancillary Services | Value-added offerings like fit-outs and tech installations | Customized solutions and EV charging fees |

Business Model Canvas Data Sources

The CTP Business Model Canvas is constructed using a blend of internal financial statements, customer feedback surveys, and competitive landscape analysis. These diverse data sources ensure a comprehensive and actionable representation of our business strategy.