CTP Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

CTP Bundle

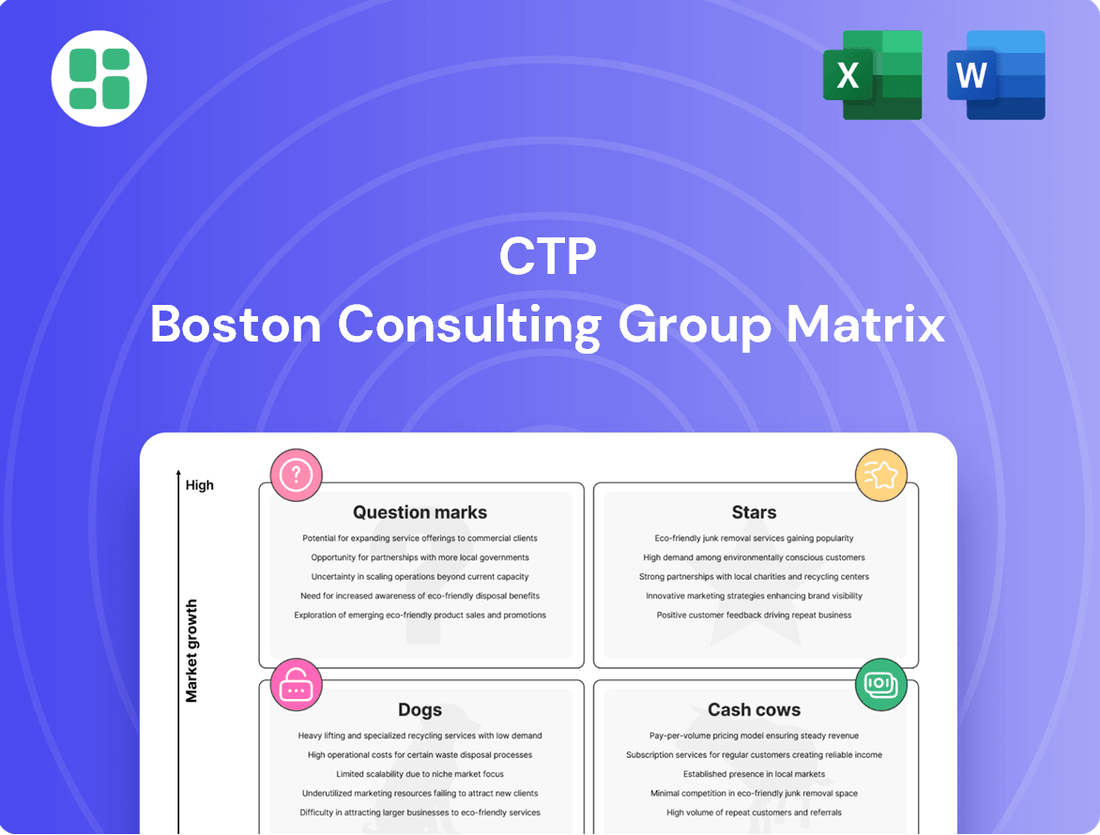

Uncover the strategic positioning of this company's product portfolio with our insightful BCG Matrix preview. See how its offerings stack up as Stars, Cash Cows, Dogs, or Question Marks, and begin to understand the dynamics at play. Purchase the full BCG Matrix for a comprehensive breakdown of each quadrant, data-driven recommendations, and actionable strategies to optimize your investment decisions and product roadmap.

Stars

CTP's High-Growth Development Pipeline is a key driver of its market position. As of late 2024 and projected into mid-2025, the company has an impressive 1.8 to 2.0 million square meters of projects actively under construction, showcasing significant organic expansion in sought-after Central and Eastern European markets.

This rapid development translates into strong financial performance, with new projects consistently delivering a Yield on Cost (YoC) of around 10.3%. This high YoC underscores the profitability and efficiency of CTP's development strategy.

Furthermore, the success of these developments is largely assured by exceptionally high pre-letting rates, typically between 92% and 100% upon completion. This robust occupancy ensures swift and effective monetization of newly completed assets, reinforcing the pipeline's strength.

CTP is strategically expanding its presence in key European markets, focusing on Poland and Germany to capture growing market share. This move is directly influenced by significant secular trends like nearshoring and the robust growth of e-commerce across the continent.

The company is capitalizing on these powerful macroeconomic tailwinds, aiming to establish a stronger foothold in burgeoning industrial and logistics sectors. For instance, CTP's investment in Poland, a country experiencing significant industrial growth, aligns perfectly with the nearshoring trend as companies seek to diversify supply chains closer to Western European markets.

In 2024, CTP reported strong leasing activity, with a substantial portion of new leases signed in Poland and Germany, underscoring the success of its expansion strategy in these regions. The company's focus on modern, sustainable logistics facilities is particularly attractive to businesses benefiting from the e-commerce boom.

CTP's dedication to BREEAM-certified buildings and the integration of photovoltaic (PV) systems on its properties is a significant driver of its competitive edge. This strategic focus directly caters to the escalating tenant demand for sustainable and energy-efficient industrial spaces.

By prioritizing green energy solutions, CTP not only meets current market needs but also anticipates future trends in environmentally conscious real estate. This commitment is reflected in their ongoing development projects, many of which are designed to achieve high BREEAM ratings, ensuring operational efficiency and reduced environmental impact.

For instance, CTP has been actively expanding its portfolio of modern, sustainable facilities, with a notable increase in the installation of PV systems across its industrial parks. This proactive approach allows them to attract and retain premium tenants who value sustainability, thereby solidifying their market position. In 2024, CTP continued its robust expansion, with a significant portion of its new developments incorporating advanced sustainability features, including solar energy generation capabilities, further enhancing its appeal to environmentally conscious clients.

Accelerated Leasing and Rental Growth

CTP has demonstrated exceptional leasing performance, a key indicator for its position within the BCG matrix. The company secured 2.1 million square meters of leases throughout 2024, showcasing strong market penetration and tenant acquisition. This momentum continued into the first half of 2025, with an additional 1.0 million square meters leased, underscoring sustained demand for CTP's industrial and logistics properties.

This substantial leasing volume is further bolstered by an upward trend in rental income. Average monthly rents on new leases have seen a consistent increase, reflecting CTP's capacity to command premium pricing in its core markets. This dual growth in leasing activity and rental rates positions CTP favorably, indicating a healthy and expanding business segment.

- Accelerated Leasing: 2.1 million sqm leased in 2024 and 1.0 million sqm in H1 2025.

- Robust Demand: Significant leasing volumes indicate strong tenant interest.

- Rising Rental Income: Average monthly rents on new leases are increasing.

- Value Capture: CTP effectively leverages market growth to enhance revenue.

Ambitious Portfolio Growth Targets

CTP's growth aspirations are truly ambitious, targeting a doubling of its property portfolio to 20 million square meters of Gross Lettable Area (GLA) by 2030. This aggressive expansion is underpinned by a clear financial objective: to achieve an annualized rental income of €1 billion by 2027.

This strategic vision highlights CTP's confidence in the sustained high growth trajectory of the Central and Eastern European (CEE) logistics market. The company's substantial landbank, exceeding 26 million square meters, provides a solid foundation to execute these significant expansion plans.

- Portfolio Target: 20 million sqm GLA by 2030.

- Rental Income Target: €1 billion annualized by 2027.

- Market Belief: Strong conviction in CEE logistics market's high growth potential.

- Landbank Support: Over 26 million sqm of land available for expansion.

Stars in the BCG Matrix represent businesses or products with high market share in a high-growth industry. CTP's logistics and industrial property development in Central and Eastern Europe aligns with this classification. The company's substantial development pipeline, strong leasing activity, and increasing rental income all point to its star status.

CTP's commitment to sustainability, exemplified by its BREEAM-certified buildings and PV systems, further enhances its appeal in a growing market segment. The company's ambitious growth targets, aiming to double its portfolio by 2030, underscore its belief in the continued high growth of the CEE logistics sector.

The company's performance in 2024 and H1 2025, with significant leasing volumes and rising rental income, solidifies its position as a market leader in a high-growth environment. This strong market penetration and revenue growth are characteristic of a Star in the BCG framework.

CTP's strategic focus on Poland and Germany, driven by secular trends like nearshoring and e-commerce, positions it to capitalize on ongoing market expansion. This strategic foresight, coupled with strong execution, reinforces its Star status.

| Metric | 2024 Performance | H1 2025 Projection/Performance | Significance |

|---|---|---|---|

| Development Pipeline (sqm) | 1.8 - 2.0 million | Continued expansion | High growth potential |

| Leasing Activity (sqm) | 2.1 million | 1.0 million | Strong market demand |

| Rental Income Growth | Increasing average rents | Upward trend | Value capture |

| Sustainability Features | Increased PV installations, BREEAM focus | Ongoing integration | Competitive advantage |

What is included in the product

The CTP BCG Matrix analyzes product portfolios by market share and growth, guiding investment decisions.

A clear visual representation of your portfolio, simplifying complex strategic decisions.

Cash Cows

CTP's dominance in Central and Eastern European (CEE) markets, particularly in the Czech Republic, Romania, Hungary, and Slovakia, positions it as a true Cash Cow. The company commands an average market share of approximately 28% in these core territories, solidifying its status as the leading owner and developer.

This established leadership extends to Serbia and Bulgaria, further reinforcing CTP's strong foothold across key CEE nations. Such a commanding presence in mature markets guarantees a consistent and reliable flow of income for the company.

CTP's properties consistently achieve a high occupancy rate, reaching 93% across its portfolio. This strong occupancy, coupled with a tenant retention rate between 85% and 95%, underscores the enduring appeal and stability of its assets, directly translating into reliable rental income streams.

The company's ability to retain tenants is further bolstered by its long-standing relationships with over 1,500 diverse clients. This extensive client base provides a significant buffer against market fluctuations, reinforcing CTP's position as a cash cow within the BCG matrix.

CTP's established properties are a significant source of stable and increasing rental income, highlighting its position as a Cash Cow. In the first half of 2025, Gross Rental Income saw a robust 14.4% increase, building on a strong 16.1% growth for the full year 2024.

This consistent revenue expansion is a direct result of effective lease management, including indexation adjustments and favorable renegotiations on expiring contracts. By June 2025, CTP's annualised rental income had climbed to an impressive €757 million, underscoring the predictable and substantial cash flow generated by its mature portfolio.

Conservative Valuations and Asset Appreciation

CTP's portfolio demonstrates conservative valuation yields, with its existing assets experiencing positive revaluations. This indicates that CTP's mature properties are appropriately valued and contribute substantially to the Gross Asset Value (GAV) without requiring significant capital investment for further expansion.

The portfolio's like-for-like revaluation saw a healthy increase of 4% in the first half of 2025. This upward trend in asset values suggests strong underlying performance and effective asset management within CTP's established holdings.

- Conservative Valuation Yields: CTP's established properties are valued prudently, ensuring stability and predictable returns.

- Positive Asset Revaluations: Standing assets are appreciating, enhancing the company's overall Gross Asset Value (GAV).

- H1 2025 Revaluation Growth: A 4% like-for-like revaluation increase highlights the strength of the existing portfolio.

- Capital Efficiency: Mature assets contribute significantly to GAV without demanding excessive capital for growth.

Diversified and Resilient Tenant Base

CTP's strength lies in its remarkably diverse and stable tenant roster, a key characteristic of its cash cow properties. With over 1,500 international clients, the company has built a robust portfolio where no single tenant represents more than a mere 2.5% of its total annual rental income. This broad base significantly de-risks the income stream.

This tenant diversification spans critical sectors like manufacturing, booming e-commerce, and the resilient automotive industry. Such cross-industry exposure means that even if one sector experiences a downturn, CTP's overall rental revenue remains largely unaffected, ensuring consistent cash flow generation from these assets.

- Diversified Tenant Base: Over 1,500 international clients.

- Low Tenant Concentration: No single tenant exceeds 2.5% of annual rent.

- Industry Spread: Clients across manufacturing, e-commerce, automotive, and more.

- Stable Income: Minimizes risk and ensures reliable cash generation.

CTP's established properties are a significant source of stable and increasing rental income, highlighting its position as a Cash Cow. In the first half of 2025, Gross Rental Income saw a robust 14.4% increase, building on a strong 16.1% growth for the full year 2024. By June 2025, CTP's annualised rental income had climbed to an impressive €757 million, underscoring the predictable and substantial cash flow generated by its mature portfolio.

CTP's portfolio demonstrates conservative valuation yields, with its existing assets experiencing positive revaluations. The portfolio's like-for-like revaluation saw a healthy increase of 4% in the first half of 2025. This upward trend in asset values suggests strong underlying performance and effective asset management within CTP's established holdings.

CTP's strength lies in its remarkably diverse and stable tenant roster, a key characteristic of its cash cow properties. With over 1,500 international clients, the company has built a robust portfolio where no single tenant represents more than a mere 2.5% of its total annual rental income. This broad base significantly de-risks the income stream.

| Metric | H1 2025 | FY 2024 | Significance |

|---|---|---|---|

| Gross Rental Income Growth | 14.4% | 16.1% | Consistent and growing revenue from mature assets. |

| Annualised Rental Income | €757 million | N/A | Substantial and predictable cash flow generation. |

| Like-for-Like Revaluation Growth | 4% | N/A | Indicates strong underlying asset performance. |

| Tenant Retention Rate | 85%-95% | N/A | High client stickiness and stable income. |

| Tenant Diversification | <2.5% per tenant | N/A | Minimizes risk and ensures income stability. |

What You’re Viewing Is Included

CTP BCG Matrix

The CTP BCG Matrix preview you're currently viewing is the exact, fully formatted document you will receive immediately after purchase. This means no watermarks, no demo content, and no hidden surprises – just a professionally designed and analysis-ready strategic tool ready for your immediate use.

Dogs

Certain older properties, like those from the former Deutsche Industrie REIT portfolio acquired by CTP, could be classified as underperforming assets. These might exhibit low growth potential and a smaller market share compared to CTP's newer, high-quality parks.

These older assets may necessitate significant capital investment for modernization or repositioning. Their alignment with CTP's strategic focus on sustainable, premium industrial parks might also be questionable, potentially dragging down overall performance.

The financial contribution from these underperforming assets could be minimal, or even negative, once ongoing maintenance and necessary upgrade expenses are accounted for. For instance, if a property requires €5 million in upgrades and generates only €1 million annually, it represents a net drain.

Properties situated in stagnant sub-markets, often older industrial zones or areas with declining local economies, can represent a challenge within CTP's portfolio. Even in a generally expanding region, these specific locations may suffer from reduced demand or an oversupply of commercial space.

Assets in these areas might experience lower occupancy rates and downward pressure on rental income, leading to a small market share and minimal potential for growth. For instance, in the European logistics market, while overall demand for modern warehousing grew by approximately 5% in 2024, certain secondary locations saw occupancy rates dip below 80% due to an influx of new supply without corresponding tenant demand.

Such properties require a thorough assessment to determine the best course of action, which could involve strategic divestment to free up capital or significant investment in repositioning to attract new tenants or adapt to changing market needs.

Assets with persistent vacancy challenges within a portfolio, akin to Dogs in the BCG matrix, represent properties or smaller groupings that consistently underperform in occupancy, even when the broader market is robust. These might be individual buildings or specific segments that face issues like suboptimal locations, aging infrastructure, or require excessive resources for marketing, thereby immobilizing capital and hindering cash flow generation. In 2024, the U.S. office vacancy rate reached 19.6% by Q3, a figure that highlights how specific submarkets or older buildings within this sector can become persistent challenges.

Non-Core, Non-Strategic Holdings

Non-core, non-strategic holdings within CTP's portfolio represent assets that do not align with the company's primary strategy of developing and managing large, integrated business parks. These might include smaller, standalone properties or those geographically isolated from existing or planned CTParks. For instance, a small industrial unit acquired as part of a larger portfolio purchase that lacks the scale or location to be developed into a full-service business park would fall into this category.

These assets often stem from past acquisitions where not all properties fit the current strategic direction. They may have limited potential for expansion or integration into CTP's core network, offering little synergistic benefit. Identifying and managing these non-core assets is crucial for optimizing capital allocation and focusing resources on high-growth, strategic opportunities. As of the first half of 2024, CTP continued its active portfolio management, divesting non-core assets to strengthen its focus on its flagship CTPark network.

- Non-Strategic Fit Properties that do not align with CTP's focus on large, integrated business parks.

- Limited Growth Potential Assets with restricted opportunities for expansion or integration into the core network.

- Acquisition Remnants Properties acquired that do not offer synergistic benefits or competitive advantage.

- Capital Optimization Divesting these assets allows for reinvestment in core, high-return strategic projects.

Investments with Low Return on Capital

Investments with low return on capital, if they consistently yield significantly less than CTP's average of over 10% on cost for new developments, can be categorized as Dogs within the BCG matrix framework. These are assets where the capital invested isn't generating adequate profits or contributing to market expansion.

Such underperforming assets, potentially including older land holdings or initial development projects, tie up valuable capital without commensurate returns.

- Underperforming Assets: Investments failing to meet or exceed the benchmark of over 10% return on capital.

- Capital Reallocation: Potential candidates for divestiture to free up capital for more lucrative opportunities.

- Market Share Stagnation: Assets not contributing to growth or competitive positioning.

Dogs in CTP's portfolio are assets with low market share and low growth potential, often requiring significant capital without generating substantial returns. These can include older properties or those in stagnant sub-markets, similar to how the U.S. office sector saw a 19.6% vacancy rate by Q3 2024 in certain areas. Divesting these non-core assets, which may stem from past acquisitions, allows CTP to reallocate capital towards its high-growth, strategic CTPark network, aiming for returns exceeding its benchmark of over 10% on capital for new developments.

| Asset Characteristic | BCG Matrix Classification | CTP Portfolio Example | Potential Action | 2024 Market Context | |

|---|---|---|---|---|---|

| Low Market Share, Low Growth | Dog | Older industrial properties, non-core holdings | Divestment or significant repositioning | Stagnant sub-market demand, declining occupancy in older buildings | |

| Low Return on Capital | Dog | Underperforming land holdings, initial projects with poor yields | Capital reallocation to higher-yield opportunities | New developments targeting >10% return on cost |

Question Marks

New geographic market entries for CTP, beyond its established presence in Central and Eastern Europe and current Western European operations in Germany, Austria, and the Netherlands, represent a strategic move into territories with anticipated high growth potential. These ventures require significant upfront capital and dedicated strategic planning to build market share.

In 2024, CTP's expansion efforts focused on identifying and securing land for development in these nascent markets. For instance, preliminary land acquisitions in countries like France and Italy are underway, signaling a commitment to these new regions. These moves are driven by CTP's ongoing analysis of European industrial and logistics real estate demand, which showed a robust 7% year-on-year growth in leasing activity across key Western European markets in the first half of 2024.

CTP is actively investigating emerging niche property types, such as data centers, as potential avenues for future growth. These represent high-potential markets where CTP's current market penetration is minimal, aligning with the characteristics of Question Marks in the CTP BCG Matrix.

Developing expertise and infrastructure for these specialized assets will demand substantial investment. The inherent uncertainty surrounding their market adoption and profitability places them firmly in the Question Mark category, requiring careful evaluation and strategic decision-making.

Early-stage developments in new CTParks represent CTP's investment in future growth engines. While a smaller portion of CTP's total construction, typically 9-16% in H1 2024 and 2025, is allocated to these nascent parks, they hold significant potential, with some projected to exceed 100,000 sqm of Gross Leasable Area (GLA).

These new locations are strategically chosen for their high-growth potential, but CTP's market share is initially minimal. This necessitates substantial investment to establish a dominant presence and transform these emerging parks into future Stars within CTP's portfolio.

Large-Scale Brownfield Redevelopment Projects

Large-scale brownfield redevelopment projects, like the 830,000 sqm downtown Dusseldorf initiative, embody significant investment potential, offering high growth prospects post-transformation. These ventures, however, come with elevated initial risks and demand substantial capital for site remediation and subsequent development.

In their undeveloped state, these projects often hold a low market share, aligning them with the characteristics of a question mark within the CTP BCG Matrix. This strategic positioning necessitates careful consideration of investment, balancing the potential for future growth against the inherent risks and costs.

- High Growth Potential: Successful transformation can unlock substantial economic value and create new urban centers.

- Significant Capital Outlay: Remediation, infrastructure, and construction require considerable upfront investment.

- Elevated Initial Risks: Uncertainties in environmental cleanup, regulatory approvals, and market absorption are common.

- Low Current Market Share: The undeveloped nature of brownfield sites means minimal current contribution to market share.

Scalable Renewable Energy Initiatives

CTP's expansion of photovoltaic systems across its portfolio, aiming for a 15% Yield on Cost, positions these initiatives as question marks within the CTP BCG Matrix. This strategic move taps into the burgeoning renewable energy sector, a market experiencing significant growth and investor interest. For context, the global renewable energy market was valued at approximately $1.3 trillion in 2023 and is projected to grow substantially in the coming years, driven by climate change concerns and supportive government policies.

While these photovoltaic projects enhance CTP's sustainability profile and offer a new revenue stream, CTP's current market share as an energy provider is negligible. This makes its position in the high-growth energy production sector uncertain. CTP is effectively a new entrant in this competitive landscape, where established players already hold significant market dominance.

- High Growth Potential: The renewable energy sector is experiencing rapid expansion, offering significant opportunities for new market entrants.

- Low Market Share: CTP's current presence in the energy provision market is minimal, indicating a low share of the overall market.

- Investment Required: Significant capital investment is necessary to scale these photovoltaic initiatives and compete effectively.

- Uncertain Future Returns: The long-term success and market position of CTP in renewable energy generation remain to be seen, classifying them as question marks.

Question Marks in CTP's portfolio represent investments in areas with high growth potential but currently low market share. These ventures, such as new geographic market entries and emerging property types like data centers, require substantial capital and strategic focus to gain traction. CTP's 2024 activities included preliminary land acquisitions in France and Italy, signaling a commitment to these nascent markets, which are expected to drive future growth.

The expansion of photovoltaic systems across CTP's properties also falls into this category. While the renewable energy sector offers significant growth, CTP's current market share as an energy provider is negligible, necessitating considerable investment to compete. These initiatives, alongside early-stage developments in new CTParks, are CTP's bets on future growth engines, with a portion of capital allocated to these nascent parks, some projected to exceed 100,000 sqm of GLA.

Large brownfield redevelopment projects, like the 830,000 sqm Dusseldorf initiative, also embody question mark characteristics. These offer high growth prospects post-transformation but come with elevated initial risks and substantial capital requirements for site remediation and development, coupled with low current market share in their undeveloped state.

| Initiative | Growth Potential | Current Market Share | Investment Required | Risk Level |

|---|---|---|---|---|

| New Geographic Markets (e.g., France, Italy) | High | Low | Significant | Moderate to High |

| Emerging Property Types (e.g., Data Centers) | High | Minimal | Substantial | High |

| New CTParks Development | High | Low | Moderate | Moderate |

| Brownfield Redevelopment (e.g., Dusseldorf) | High | Low | Very High | High |

| Photovoltaic System Expansion | High | Negligible | Significant | Moderate |

BCG Matrix Data Sources

Our BCG Matrix leverages comprehensive data from financial statements, market research reports, and industry growth forecasts to provide a clear strategic overview.