CSX SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

CSX Bundle

CSX navigates a complex industry, boasting significant operational strengths and a robust infrastructure network. However, understanding the nuances of its competitive landscape and potential regulatory hurdles is crucial for informed decision-making.

Want the full story behind CSX's strengths, risks, and growth drivers? Purchase the complete SWOT analysis to gain access to a professionally written, fully editable report designed to support planning, pitches, and research.

Strengths

CSX boasts an extensive rail network spanning 21,000 route miles across the Eastern United States. This vast infrastructure connects 70% of the U.S. population and provides crucial access to major ports and industrial hubs. In 2023, CSX moved approximately 1.6 million carloads of merchandise, highlighting its significant reach and operational capacity.

CSX's strength lies in its diverse commodity portfolio, transporting everything from coal and agricultural products to chemicals, automotive parts, and intermodal containers. This broad reach across various industries significantly reduces its reliance on any single market, creating a more resilient revenue structure.

In 2024, while the coal segment faced headwinds, CSX reported growth in other key areas, such as chemicals and intermodal. This diversification proved crucial, with agricultural products also showing steady performance, contributing to a balanced financial outlook and mitigating the impact of sector-specific downturns.

CSX's advanced intermodal and logistics solutions are a significant strength, offering customers integrated rail and truck transportation for efficient end-to-end supply chain management. This positions CSX to benefit from the increasing preference for multimodal freight. For instance, in the first quarter of 2024, CSX reported a 3% increase in intermodal revenue, reaching $578 million, underscoring the market's positive reception to these services.

Commitment to Operational Efficiency and PSR

CSX's dedication to operational efficiency, particularly through Precision Scheduled Railroading (PSR), is a significant strength. This approach focuses on optimizing train schedules and asset utilization, leading to a more fluid and reliable network. For instance, CSX reported a substantial improvement in its operating ratio, reaching 57.1% in the first quarter of 2024, a testament to their efficiency drive.

The implementation of PSR has demonstrably boosted network fluidity and service reliability. This translates to better on-time performance for customers and a more predictable supply chain. CSX's commitment to disciplined operations is expected to continue driving incremental operating margin improvements, a key factor in its competitive positioning.

- Focus on PSR: Optimizes network flow and asset utilization.

- Improved Fluidity: Enhances service reliability and customer experience.

- Labor Productivity: PSR contributes to greater efficiency in workforce deployment.

- Margin Potential: Disciplined operations support incremental operating margin growth.

Leadership in Sustainability and Environmental Initiatives

CSX stands out for its robust leadership in sustainability, earning recognition as the most fuel-efficient U.S.-based Class I railroad. This commitment is backed by concrete actions, including setting ambitious science-based targets for reducing greenhouse gas emissions. The company is actively investing in cutting-edge technologies, such as hydrogen-powered locomotives, to further its environmental goals and appeal to environmentally conscious stakeholders.

CSX's extensive network, covering 21,000 miles across the Eastern U.S., connects a significant portion of the population and key industrial areas, facilitating efficient freight movement. Its diverse commodity mix, including agricultural products and chemicals, provides financial stability by reducing dependence on any single sector.

The company's commitment to Precision Scheduled Railroading (PSR) drives operational efficiency, leading to improved service reliability and a strong operating ratio. For instance, CSX reported an operating ratio of 57.1% in Q1 2024, reflecting its success in optimizing operations and enhancing labor productivity.

CSX's leadership in sustainability, recognized by its fuel efficiency and investment in green technologies like hydrogen-powered locomotives, appeals to environmentally conscious investors and stakeholders. This focus on eco-friendly practices is becoming increasingly important in the transportation sector.

| Strength | Description | Supporting Data (2024/2025) |

| Extensive Network | Vast rail infrastructure across the Eastern U.S. | 21,000 route miles, serving 70% of the U.S. population. |

| Diversified Commodities | Broad range of transported goods reduces market reliance. | Growth in chemicals and intermodal in Q1 2024, alongside steady agricultural performance. |

| Operational Efficiency (PSR) | Optimized schedules and asset utilization. | Operating ratio of 57.1% in Q1 2024; improved network fluidity and service reliability. |

| Intermodal Solutions | Integrated rail and truck services for supply chain management. | 3% increase in intermodal revenue to $578 million in Q1 2024. |

| Sustainability Leadership | Most fuel-efficient U.S. Class I railroad with green tech investments. | Setting science-based emission reduction targets; exploring hydrogen-powered locomotives. |

What is included in the product

Analyzes CSX’s competitive position through key internal and external factors, detailing its strengths, weaknesses, opportunities, and threats.

Identifies critical CSX vulnerabilities and market threats, enabling proactive risk mitigation and strategic adjustments for smoother operations.

Weaknesses

CSX's financial performance faces headwinds from a significant drop in coal volumes, a trend that has been impacting the company for some time. For instance, in the first quarter of 2024, CSX reported a substantial decrease in coal revenue, directly tied to lower export prices and reduced demand.

This ongoing decline in coal shipments, a historically strong revenue generator for CSX, continues to exert downward pressure on overall carloads. The shift in the global energy landscape away from coal is a persistent challenge, directly affecting a key segment of CSX's business.

CSX's financial performance shows a clear sensitivity to fuel surcharge fluctuations. For instance, in the first quarter of 2024, a decrease in fuel surcharges contributed to a year-over-year revenue decline, even as operating expenses were managed. This dynamic means that while lower fuel costs can reduce operational spending, they simultaneously shrink revenue generated from these surcharges, leading to revenue instability.

CSX's financial health is closely tied to the overall economic climate, and recent performance has shown this vulnerability. For instance, in the first quarter of 2024, CSX reported a 7% year-over-year decline in revenue, largely attributed to softer demand in key industrial sectors like chemicals and automotive, which are sensitive to economic fluctuations.

Broader economic uncertainties, such as the potential for slower consumer spending and ongoing challenges within the manufacturing industry, directly impact freight volumes. This can lead to reduced demand for CSX's rail transportation services, affecting their top-line growth and profitability.

Operational Constraints from Infrastructure Projects

CSX is currently navigating operational hurdles stemming from significant, ongoing infrastructure projects. While these investments promise long-term network enhancements, they have created temporary constraints and reduced efficiency, notably impacting first-quarter 2025 performance. These large-scale developments can impede capacity and service levels during their implementation phases.

The impact of these infrastructure upgrades is evident in recent operational metrics, with network speed and car velocity experiencing a temporary slowdown. For instance, in Q1 2025, average train speed saw a slight decrease compared to the previous year, directly attributable to work zones and rerouting necessitated by these projects. This has, in turn, affected the company's ability to fully leverage its network capacity during this transitional period.

- Network Constraints: Ongoing infrastructure projects are temporarily limiting network capacity and efficiency.

- Q1 2025 Impact: Operational challenges from these projects negatively affected first-quarter 2025 financial results.

- Efficiency Reduction: Large-scale developments can lead to temporary declines in operational efficiency and service reliability.

Goodwill Impairment Charges

CSX recorded a significant pre-tax, non-cash goodwill impairment charge in the fourth quarter of 2024. This charge, amounting to $1.4 billion, signals a downward revision in the perceived value of past acquisitions or other intangible assets. While not an immediate cash outflow, it suggests that the company is reassessing the performance of these investments in light of current market conditions and future outlook.

This impairment can reflect a variety of factors, including slower-than-expected integration of acquired businesses, changes in the competitive landscape, or a general economic slowdown impacting the industries CSX serves. For investors, it raises questions about the strategic decisions behind those acquisitions and the accuracy of initial valuations.

The implications of such a charge include:

- Reduced Net Income: The impairment directly lowers reported net income for the period it is recognized.

- Impact on Equity: While non-cash, it reduces total assets and therefore equity on the balance sheet.

- Investor Scrutiny: It often leads to increased scrutiny of management's capital allocation and acquisition strategies.

- Potential for Future Write-downs: If underlying issues persist, further impairments could follow.

CSX's reliance on coal, a declining energy source, presents a significant weakness, as evidenced by a substantial drop in coal revenue in Q1 2024 due to lower export prices and demand. This trend continues to exert downward pressure on overall carloads, impacting a historically strong revenue segment.

The company's financial performance is also sensitive to fluctuations in fuel surcharges. In Q1 2024, a decrease in these surcharges contributed to a year-over-year revenue decline, demonstrating how changes in fuel costs can negatively affect top-line results even when operating expenses are managed.

Broader economic uncertainties and slower demand in key industrial sectors like chemicals and automotive, as seen in the 7% revenue decline in Q1 2024, highlight CSX's vulnerability to economic downturns. This sensitivity directly impacts freight volumes and profitability.

CSX incurred a substantial $1.4 billion pre-tax, non-cash goodwill impairment charge in Q4 2024. This charge indicates a reassessment of the value of past acquisitions, potentially signaling integration challenges or overestimations of initial valuations, and negatively impacts reported net income and equity.

Preview the Actual Deliverable

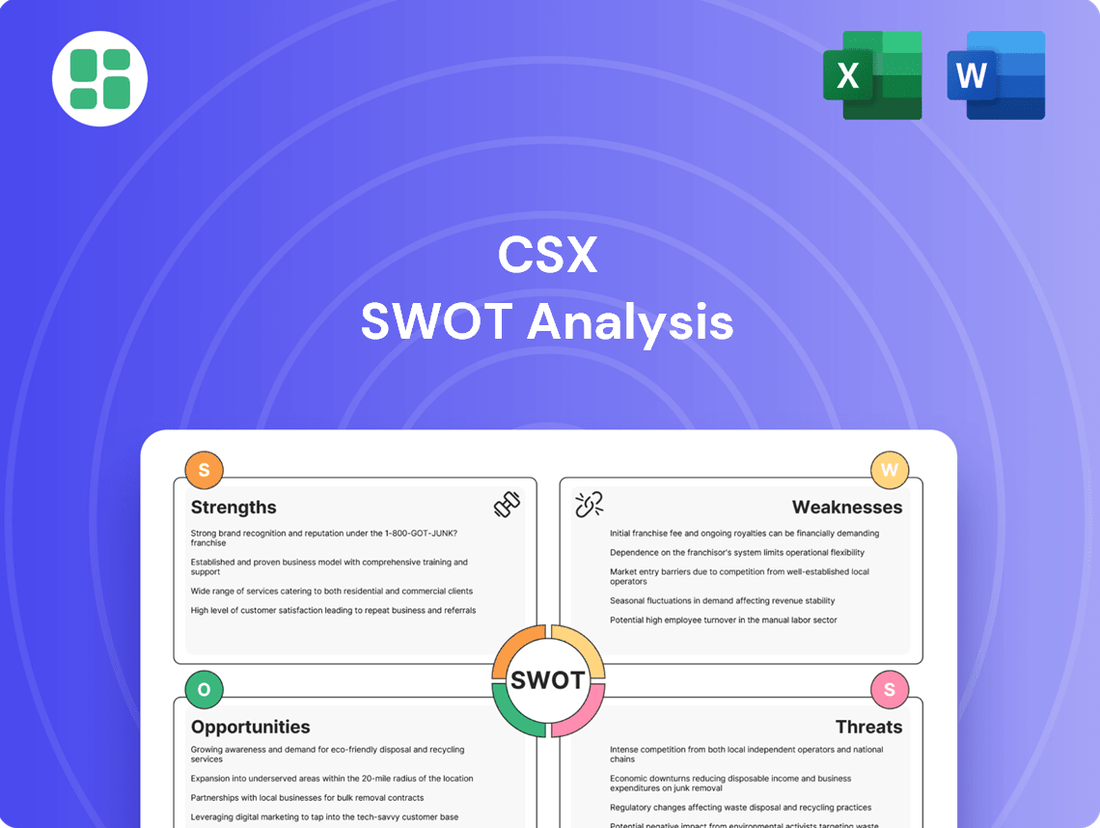

CSX SWOT Analysis

This is the actual CSX SWOT analysis document you’ll receive upon purchase—no surprises, just professional quality and actionable insights.

The preview below is taken directly from the full CSX SWOT report you'll get. Purchase unlocks the entire in-depth version, providing a comprehensive strategic overview.

This is a real excerpt from the complete CSX SWOT analysis. Once purchased, you’ll receive the full, editable version ready for your strategic planning.

Opportunities

The intermodal freight market is experiencing robust growth, with projections indicating a significant expansion driven by the surge in global trade and the ever-increasing demand from e-commerce. This trend is a substantial opportunity for companies like CSX that already have a strong footing in providing these combined rail and truck transportation solutions.

CSX's established intermodal network and services position it advantageously to capture a larger share of this expanding market. For instance, in the first quarter of 2024, CSX reported a 3% increase in its intermodal revenue, signaling its ability to leverage this growing demand effectively.

The shift towards onshoring and nearshoring manufacturing, particularly from China to Mexico, is a significant opportunity for CSX. This trend is projected to bolster North American production, directly benefiting U.S. rail freight volumes as supply chains become more localized.

As companies reconfigure their supply chains to be closer to U.S. consumers, CSX stands to gain from increased intermodal and domestic freight movements. For instance, Mexico's manufacturing output, a key beneficiary of nearshoring, saw its industrial production index increase by 3.2% year-over-year in April 2024, indicating growing activity that can translate to rail demand.

The escalating global emphasis on environmental, social, and governance (ESG) principles is a powerful tailwind for rail. As companies across sectors, including manufacturing and retail, set ambitious carbon reduction targets, the inherent efficiency of rail freight becomes a critical enabler. In 2023, CSX reported a 10% improvement in fuel efficiency compared to 2019, underscoring its commitment to sustainable operations and positioning it favorably to capture demand from environmentally conscious shippers.

Advancements in Rail Technology and Digitalization

CSX can capitalize on the wave of technological innovation sweeping through the rail sector. The integration of AI and robotics promises to streamline operations, from automated yard management to enhanced safety protocols. For instance, predictive maintenance, powered by real-time data analytics, can significantly reduce downtime and associated costs, a critical factor in maintaining competitive edge. In 2023, CSX reported a capital expenditure of $3.1 billion, with a portion allocated to technology upgrades aimed at improving efficiency and service delivery.

Digitalization offers CSX the chance to provide customers with superior visibility and control over their shipments. Real-time tracking, coupled with advanced data platforms, allows for more accurate ETAs and proactive issue resolution. This enhanced transparency can foster stronger customer relationships and open doors to offering value-added digital services. By leveraging these advancements, CSX can position itself as a leader in a more connected and responsive supply chain ecosystem.

- Enhanced Efficiency: AI-driven route optimization and automated processes can lead to faster transit times and reduced operational costs.

- Predictive Maintenance: Utilizing sensors and data analytics to anticipate equipment failures can minimize service disruptions and maintenance expenses.

- Improved Customer Service: Real-time tracking and digital platforms provide customers with greater transparency and control over their logistics.

- New Service Offerings: Advanced digital capabilities can enable CSX to develop and offer more sophisticated, data-driven logistics solutions.

Strategic Infrastructure Modernization and Expansion

CSX's commitment to modernizing its infrastructure, exemplified by the significant investment in the Howard Street Tunnel project, unlocks crucial operational enhancements. This upgrade, expected to be completed in 2024, will facilitate double-stack intermodal service, directly boosting network capacity and efficiency.

These strategic infrastructure improvements are designed to increase the velocity of freight movement across the network. For instance, by enabling larger, more efficient trains, CSX can handle greater volumes of goods, translating into improved service for customers and a stronger competitive position.

The ongoing expansion and modernization efforts are key to capturing future growth opportunities. As of early 2024, CSX has continued to allocate substantial capital to these initiatives, anticipating a return through increased market share and operational cost savings.

The benefits of this strategic focus are tangible:

- Enhanced Network Capacity: Enabling double-stack trains significantly increases the volume of goods that can be transported on key routes.

- Improved Operational Efficiency: Modernized infrastructure leads to faster transit times and reduced handling costs per unit.

- Future Growth Potential: The upgraded network better positions CSX to capitalize on increasing demand for efficient and reliable freight transportation.

- Competitive Advantage: Investments in infrastructure differentiate CSX by offering superior service capabilities to its customers.

The growing emphasis on ESG principles presents a significant opportunity for CSX, as rail freight is inherently more fuel-efficient than trucking. By highlighting its sustainability efforts, such as the reported 10% improvement in fuel efficiency by 2023 compared to 2019, CSX can attract environmentally conscious shippers. This aligns with corporate goals for carbon reduction and positions CSX as a preferred logistics partner in a greener economy.

Technological advancements, including AI and predictive maintenance, offer CSX a chance to boost efficiency and reduce costs. The company's 2023 capital expenditure of $3.1 billion, with a portion dedicated to technology upgrades, underscores this commitment. These innovations can lead to faster transit times and fewer service disruptions, enhancing customer satisfaction and competitive positioning.

Infrastructure upgrades, like the Howard Street Tunnel project nearing completion in 2024, are crucial for expanding network capacity and improving operational velocity. This project's ability to accommodate double-stack intermodal service directly increases the volume of goods CSX can efficiently move, strengthening its service offering and market competitiveness.

| Opportunity Area | Description | Supporting Data/Impact |

|---|---|---|

| ESG Alignment | Capitalizing on the demand for sustainable logistics solutions. | CSX reported a 10% improvement in fuel efficiency (2023 vs. 2019), appealing to ESG-focused clients. |

| Technological Integration | Leveraging AI and data analytics for operational enhancements. | $3.1 billion capital expenditure in 2023 included technology upgrades for efficiency. |

| Infrastructure Modernization | Increasing network capacity and efficiency through strategic upgrades. | Howard Street Tunnel project (completion 2024) enables double-stack service, boosting volume. |

| Nearshoring/Reshoring | Benefiting from the trend of localized manufacturing and supply chains. | Mexico's industrial production index rose 3.2% YoY in April 2024, indicating increased activity. |

Threats

The U.S. railroad industry, including CSX, is bracing for potential economic headwinds in 2025. Shifts in economic policy, trade dynamics, and consumer spending patterns introduce significant uncertainty. A notable slowdown in consumer demand or a contraction in manufacturing could directly translate to lower freight volumes for CSX, impacting its revenue streams and overall profitability.

CSX navigates a challenging landscape with significant competition from other freight transportation methods. Trucking, for instance, provides a compelling alternative, especially for shorter hauls and time-critical shipments, due to its inherent flexibility and direct, door-to-door service capabilities. This flexibility can often outweigh the cost efficiencies of rail for certain types of cargo.

The trucking industry's agility in adapting to customer needs and its ability to reach virtually any location directly present a constant competitive pressure. In 2024, the trucking sector continued to see robust demand, with freight volumes remaining strong, directly impacting the market share available to rail carriers like CSX. For example, intermodal truck-rail traffic, while growing, still faces competition from dedicated long-haul trucking services that can offer faster transit times for certain goods.

Potential shifts in federal administration, particularly with the 2024 US Presidential election, introduce uncertainty regarding future trade policies, such as tariffs, and taxation. These changes could directly impact CSX's operating costs and revenue streams, as seen with past tariff adjustments affecting supply chains.

Evolving regulatory frameworks, especially concerning environmental standards and transportation safety, present ongoing challenges. CSX must continuously adapt to these regulations, which can involve significant compliance costs and capital expenditures, potentially impacting profitability.

Aging Infrastructure and Climate Change Impacts

A substantial portion of CSX's rail network, like much of the nation's, is aging. This presents ongoing challenges for maintenance and upgrades. For instance, in 2024, CSX continued its significant capital expenditures focused on network improvements and resilience, with a notable portion allocated to track and bridge maintenance.

Climate change exacerbates these infrastructure vulnerabilities. More frequent and intense weather events, such as hurricanes and severe flooding, pose a direct threat to rail operations. These events can cause significant disruptions, leading to costly repairs and requiring substantial, continuous investment in making the infrastructure more resilient. For example, extreme weather events in late 2024 and early 2025 led to temporary service suspensions in certain regions, highlighting the need for ongoing adaptation strategies.

The need for consistent investment in infrastructure resilience is paramount. CSX's 2024 capital plan included substantial outlays for projects aimed at mitigating the impacts of extreme weather, such as upgrading drainage systems and reinforcing track beds in flood-prone areas. This ongoing commitment reflects the growing necessity to address these environmental threats proactively.

- Aging Infrastructure: A significant percentage of the U.S. rail network, including CSX's, requires ongoing modernization and maintenance.

- Climate Change Amplification: Increased frequency and severity of extreme weather events like hurricanes and floods directly threaten rail operations and asset integrity.

- Operational Disruptions: Weather-related events can lead to service interruptions, impacting delivery times and customer satisfaction.

- Capital Investment Needs: Substantial and continuous investment is required for infrastructure repairs, upgrades, and resilience projects to counter climate impacts.

Labor Relations and Workforce Challenges

The rail sector, including CSX, faces the persistent threat of labor shortages and wage inflation. These factors can significantly escalate operational expenses, directly impacting profitability. For instance, in 2024, the industry continued to grapple with attracting and retaining skilled labor, a trend that persisted from previous years, leading to increased compensation demands.

While CSX has made strides in employee engagement, ongoing labor negotiations and the overall availability of a qualified workforce remain critical. These elements directly influence operational efficiency and the reliability of service delivery to customers. The potential for work stoppages or disruptions due to labor disputes adds another layer of risk.

- Labor Shortages: Persistent difficulty in recruiting and retaining qualified personnel, particularly in specialized roles like engineers and conductors.

- Wage Inflation: Increased labor costs driven by union negotiations and the competitive market for skilled workers, impacting operating margins.

- Operational Disruptions: The risk of service interruptions due to strikes, slowdowns, or other labor-related actions, affecting supply chain reliability.

- Employee Engagement: While efforts are underway, maintaining high levels of employee morale and productivity amidst challenging labor conditions is an ongoing concern.

CSX faces significant threats from economic downturns and shifts in consumer spending, which directly reduce freight volumes. Competition from trucking, especially for shorter hauls, remains a constant challenge, with trucking's flexibility often preferred for time-sensitive goods. Potential changes in trade policies and taxation following the 2024 US Presidential election introduce uncertainty regarding operating costs and revenue. Evolving environmental and safety regulations necessitate ongoing, costly compliance efforts.

SWOT Analysis Data Sources

This CSX SWOT analysis is built upon a robust foundation of publicly available financial reports, comprehensive industry analyses, and expert commentary from reputable sources, ensuring a well-rounded and informed perspective.